- Home

- »

- Electronic Devices

- »

-

Smart Speaker Market Size, Share And Growth Report, 2030GVR Report cover

![Smart Speaker Market Size, Share & Trends Report]()

Smart Speaker Market (2023 - 2030) Size, Share & Trends Analysis Report By Virtual Personal Assistant (Amazon Alexa, Google Assistant, Apple Siri), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-614-1

- Number of Report Pages: 82

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Speaker Market Summary

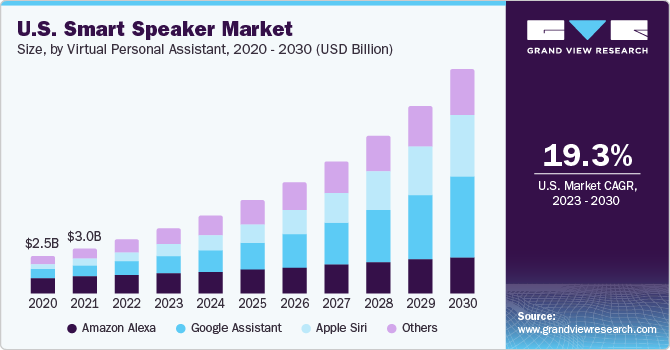

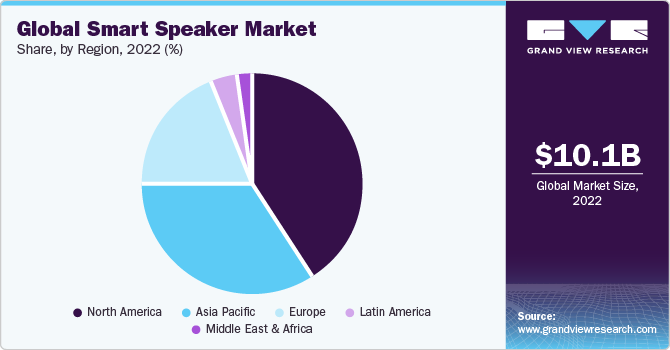

The global smart speaker market size was valued at USD 10.06 billion in 2022 and is projected to reach USD 50.19 billion by 2030, growing at a CAGR of 22.2% from 2023 to 2030. Increasing the adoption of smart home technology and the presence of smart home devices enables people to shift their preferences toward smart speakers.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 41.0% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 26.1% during the forecast period.

- Based on virtual personal assistant, the Amazon Alexa segment accounted for the largest revenue share of 36.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 10.06 Billion

- 2030 Projected Market Size: USD 50.19 Billion

- CAGR (2023-2030): 22.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The capability of these products to operate using voice commands is driving their adoption. Controlling the entire home from any corner of the house using voice commands attracts consumers toward these products, subsequently driving the market. Voice assistants such as Alexa and Google Home are gaining popularity among consumers. Alexa held the largest market share in 2012, followed by Google. Furthermore, Google introduced its smart speaker, Google Home, primarily in Asian countries such as India and Japan, and is expected to witness significant growth over the forecast period.

Consumers tend to prefer cost-efficient products that offer multiple advanced features. Amazon Alexa gained massive consumer traction due to its promotional techniques at a Whole Foods store and Alexa-centric advertisements on both online and television commercials. Additionally, Amazon reduced its product pricing to gain a competitive edge in the market.

Automation of domestic tasks and increasing demand for human-to-machine interaction is anticipated to boost the market's growth over the forecast years. According to stats published by voicebot.ai in April 2020, close to 88 million adults in the U.S. had installed smart speakers. It is due to the multi-purpose usability of these speakers and because they can be used to listen to music, receive sports and entertainment updates, and control smart home devices, among others.

Virtual Personal Assistant Insights

The Amazon Alexa segment accounted for the largest revenue share of 36.6% in 2022. Its adoption is rapidly increasing among U.S. consumers due to its first-mover advantage. This adoption is expected to increase over the next few years owing to Alexa's multiple smart home integrations and Amazon's strategy to offer its voice assistant to various emerging players in the market.

Google's assistant is anticipated to exhibit significant growth over the forecast period to emerge as the leading VPA segment. The use of Google Home voice assistant in Asia is expected to increase rapidly, with Google launching its products in Asian countries such as India and Japan. Currently, the China market is marked by the presence of other pioneers such as Alibaba, Xiaomi, and JD.com.

The Apple Siri segment is expected to grow at the fastest CAGR of 31.2% during the forecast period. Apple has a strong brand loyalty among its customers, meaning many who own Apple products will likely choose a HomePod or HomePod mini over a speaker from another manufacturer. Siri's voice recognition has improved significantly in recent years, making it more accurate and reliable. It has made it more appealing to users, who are now more likely to use Siri to control their smart speakers. The HomePod and HomePod mini are known for superior sound quality. It makes them a popular choice for people who want to use their smart speakers for listening to music or podcasts..

Regional Insights

North America dominated the market and accounted for the largest revenue share of 41.0% in 2022, owing to the growing demand for Internet-of-Things (IoT)-enabled services and wireless devices. The increasing consumer inclination toward convenience goods in North America has fueled the region’s growth. This region is also one of the early adopters of this technology. The willingness of consumers to use and accept new technologies has encouraged manufacturers to develop advanced and new products thus far.

Asia Pacific is expected to grow at the fastest CAGR of 26.1% during the forecast period. Smart speakers are becoming more versatile and capable of supporting multiple languages and providing localized content. It makes them more attractive to consumers in the Asia Pacific region, where diverse languages and cultures exist.

Key Companies & Market Share Insights

Key players in the smart speakers market include Amazon, Google, Apple, and Xiaomi. These key players are focused on upgrading existing versions of their products, investing in technological advancements, and entering into collaborations to establish their market presence.

In December 2021, Google launched a new smart speaker called the Nest Audio. The Nest Audio speaker has two features that adjust the speaker's sound to the environment and what the user is listening to. The Media EQ feature automatically tunes the speaker's sound based on the content the user is listening to, while the Ambient IQ feature adjusts the volume of Assistant, podcasts, news, and audiobooks based on the background noise in your environment. Nest Audio can also be connected to other Nest or Google Home devices to create a multi-room audio system.

Key Smart Speaker Companies:

- Apple, Inc.

- Amazon.com, Inc.

- Bose Corporation

- Baidu, Inc

- Google LLC

- HARMAN International

- Sonos, Inc.

- ULTIMATE EARS

- Sony Corporation

- Panasonic Holdings Corporation

- Xiaomi

Recent Developments

-

In June 2023, Amazon introduced the Echo Pop smart speaker. The Amazon Echo Pop is a smart speaker that uses Amazon's AZ2 Neural Edge processor. It supports voice commands in English, Hindi, and Hinglish, allowing users to play music, operate smart lights and plugs, set alarms, check cricket scores, and create reminders. Users can also connect the Echo Pop with Bluetooth to play music from their phone or computer. The Echo Pop also contains a microphone on/off button and can examine and delete voice recordings. The user can control privacy settings and specify when Alexa should listen.

-

In May 2023, Google announced the launch of an upgrade for the second-generation Nest Hub, making it the third gadget to run the company's in-house Fuchsia OS. The project aims to develop an open-source operating system for smart home devices.

-

In April 2023, Google announced an update for its Assistant software. This update aims to change how the Assistant responds to commands; the user can command the Assistant to turn off the lights without verbal confirmation.

-

In February 2023, Amazon announced that Indian users could choose between a male and female voice for Alexa. The added feature is that Indian users can now choose a male voice for Alexa over the existing female voice. It is a significant development, giving users more flexibility and choice in interacting with Alexa.

-

In January 2023, Apple introduced the second-generation HomePod, a powerful smart speaker with groundbreaking sound and intelligence. The HomePod supports immersive Spatial Audio tracks and powerful computational audio for a game-changing listening experience. It also lets users use Siri to establish smart home automation, receive notifications of smoke or carbon monoxide alarms, and check the temperature and humidity in a space, all while remaining hands-free.

-

In July 2022, Xiaomi introduced the Smart Speaker with IR control. It can be a remote control for suitable home equipment such as air conditioners, as the Xiaomi Smart Speaker supports Google Assistant. It is capable of controlling smart gadgets around the house via voice assistance. The Mi Home app houses all of these controls.

-

In October 2020, Apple unveiled a new smart speaker called the HomePod mini. It is small but powerful, with impressive sound quality and the intelligence of Siri. HomePod mini is easy to use and control, making it a convenient addition to any home.

Smart Speaker Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.30 billion

Revenue forecast in 2030

USD 50.19 billion

Growth rate

CAGR of 22.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Virtual personal assistant, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Apple, Inc.; Amazon, Inc.; Bose Corporation; Baidu, Inc; Google LLC; HARMAN International; Sonos, Inc.; ULTIMATE EARS; Sony Corporation; Panasonic Holdings Corporation; Xiaomi

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Speaker Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart speaker market report based on virtual personal assistant, and region:

-

Virtual Personal Assistant Outlook (Revenue, USD Million, 2017 - 2030)

-

Amazon Alexa

-

Google Assistant

-

Apple Siri

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart speaker market size was estimated at USD 10.06 billion in 2022 and is expected to reach USD 12.30 billion in 2023.

b. The global smart speaker market is expected to grow at a compound annual growth rate of 22.2% from 2023 to 2030 to reach USD 50.19 billion by 2030.

b. North America dominated the smart speaker market with a share of 41.0% in 2022. This is attributable to the growing demand for Internet-of-Things (IoT)-enabled services and wireless devices. The increasing consumer inclination toward convenience goods in North America has fueled the region’s growth.

b. The key players operating in the smart speakers market include Apple, Inc., Amazon.com, Inc., Bose Corporation, Baidu, Inc., Google LLC, HARMAN International, Sonos, Inc., ULTIMATE EARS, SONY Corporation, Panasonic Holdings Corporation, and Xiaomi.

b. Increasing the adoption of smart home technology and the presence of smart home devices enables people to shift their preferences toward smart speakers. The capability of these products to operate using voice commands is driving their adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.