- Home

- »

- Specialty Polymers

- »

-

Smart Packaging Market Size, Share & Trends Report, 2030GVR Report cover

![Smart Packaging Market Size, Share & Trends Report]()

Smart Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Modified Atmosphere Packaging (MAP), Active Packaging, Intelligent Packaging), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-267-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Packaging Market Summary

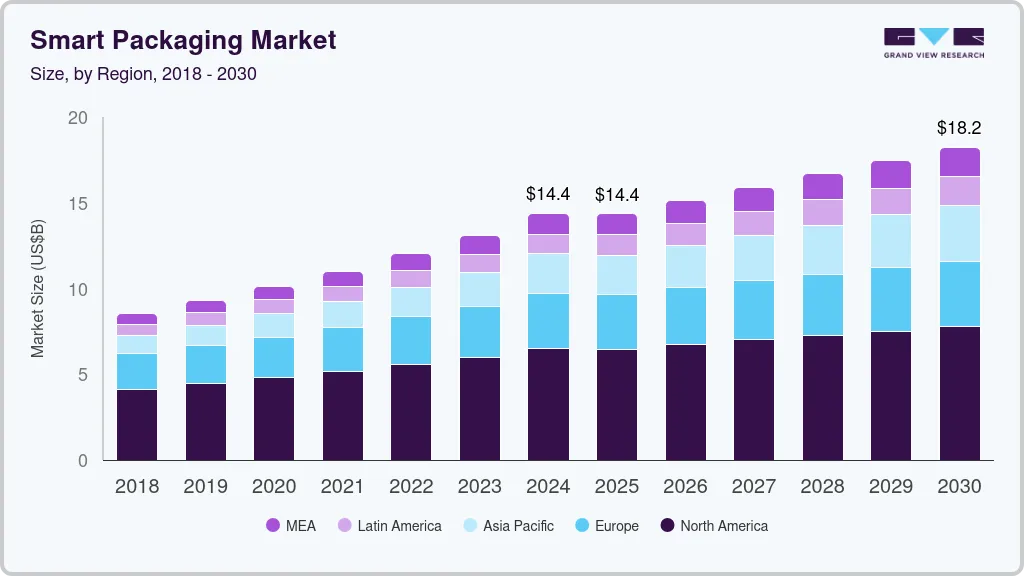

The global smart packaging market size was valued at USD 28.5 million in 2023 and is projected to reach USD 43.3 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. The smart packing market is expected to grow rapidly owing to the growing demand from food and pharma industries as these industries require advanced features like tamper-evident seals, and temperature monitoring.

Key Market Trends & Insights

- North America smart packaging market accounted for the largest revenue share of 42.0% in 2023.

- The U.S. smart packaging market accounted for the largest market revenue share in North America.

- Based on technology, the active packaging accounted for the largest revenue share of 70.4% in 2023.

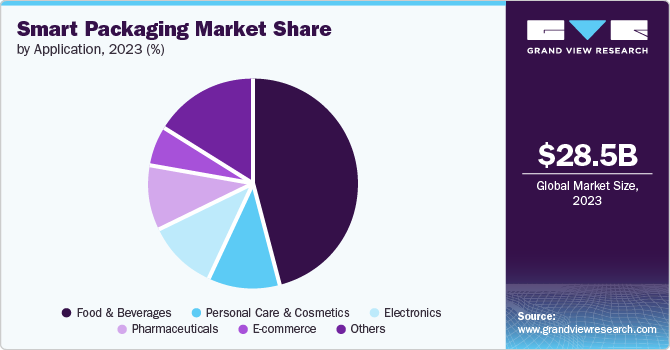

- Based on application, the food & beverages accounted for a revenue share of 45.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 28.5 Billion

- 2030 Projected Market Size: USD 43.3 Billion

- CAGR (2024-2030): 6.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The expansion of e-commerce necessitates innovative packaging solutions for tracking and monitoring products during transit, thereby minimizing damage and enhancing customer experience. It provides information regarding the origin, authenticity, and environmental impact of products with the help of QR codes and RFID tags. Smart packaging refers to a particular type of sensor-based packaging system that is utilized for a variety of commodities, including pharmaceuticals, food and other industries. Smart packaging technology enhances consumer and product safety while simultaneously enhancing product quality, shelf life, and freshness monitoring.

The applications of intelligent packaging extend beyond the realm of food and beverage. Pharmaceuticals, medical devices, and consumer electronics are among the industries that are actively seeking advanced packaging solutions. This increases the scope of target market and potential customer base. Consumers are increasingly concerned with product quality, origin, and environmental impacts. Smart packaging features address these concerns and foster trust and brand loyalty. There exists an opportunity for innovation in materials, functionalities, and integration with emerging technologies such as the internet of things (IoT)

The growing emphasis on sustainability is creating a demand for eco-friendly packaging solutions. Intelligent packaging can incorporate biodegradable materials and reduce waste, thus aligning with the present environmental consciousness. As discussed earlier, smart packaging provides businesses with benefits that translate into increased profits. By offering solutions that minimize waste, improve efficiency, and enhance brand value, may position as a valuable partner to various industries.

Technology Insights &Trends

Active packaging accounted for the largest market revenue share of 70.4% in 2023 and is expected to register the fastest CAGR of 6.0% during the forecast period. The adoption of active packaging solutions is driven by increasing concern of consumers about the safety and freshness of their food. Active packaging addresses these concerns by including features like oxygen scavengers, antimicrobial coatings, and moisture control inserts. These attributes have a direct impact on the product's shelf life, mitigate spoilage, and minimize the likelihood of foodborne illness. Stringent regulations regarding food safety and a growing awareness of food waste. Governments and organizations are promoting practices to reduce food waste throughout the supply chain. Active packaging assists achieve this goal by keeping food fresh for longer.

Active packaging offers a variety of functionalities applicable to various food and beverage products. Active packaging offers customized solutions to extend shelf life and maintain quality of perishable fruits, vegetables, meats, cheeses and others.

Application Insights & Trends

Food & beverages accounted for a share of 45.5% in 2023. Food and beverage industries are subject to strict regulations regarding food safety and traceability. Smart packaging with features like RFID tags and QR codes help ensure compliance by providing detailed information about product origin, processing, and transport conditions. This information is critical in identifying and managing potential foodborne illness outbreaks. Additionally Food and beverages, particularly fresh produce, meat, and dairy, possess a high degree of perishability. They require packaging that is able to maintain freshness, quality, and safety throughout the supply chain. Smart packaging solutions with features such as oxygen absorbers, time-temperature indicators, and freshness monitoring can greatly address these concerns.

Pharmaceuticals is expected to register the fastest CAGR during the forecast period. The growth of smart packaging in the pharmaceutical sector is driven by the need for improved safety, improved compliance, efficient logistics, and robust anti-counterfeiting measures. Regulations are enforcing stricter guidelines for drug traceability, counterfeit prevention, and patient safety. Smart packaging features such as RFID tags are used to track and trace pharmaceuticals throughout the supply chain, ensuring their authenticity and preventing counterfeiting. Tamper-evident seals are used for safeguarding product integrity. The use of serialization for assigning unique identifiers to each product package facilitates enhanced tracking and allows for targeted recalls in the event of necessity.

Regional Insights

North America smart packaging market accounted for the largest market revenue share of 42.0% in 2023. The surge in e-commerce activities has significantly influenced the smart packaging market in North America. With more consumers opting for online shopping, there is an increased need for secure and efficient packaging solutions that can withstand transportation challenges while ensuring product integrity upon delivery. Smart packaging technologies such as tamper-evident seals and temperature-controlled packs are becoming essential to meet these demands.

U.S. Smart Packaging Market Trends

The U.S. smart packaging market accounted for the largest market revenue share in North America. Consumers' demand for convenience and personalized experiences in the U.S. proliferates the market. As consumers seek more interactive and tailored experiences, brands leverage smart packaging solutions to engage with their audience. Coca-Cola's "Share a Coke" campaign featured personalized labels that can be scanned via a mobile app for customized content and social media integration. This approach enhances consumer engagement and drives brand loyalty through innovative packaging solutions.

Europe Smart Packaging Market Trends

Europe smart packaging market was identified as a lucrative region in 2023. The European Union has proactively established regulations to promote smart packaging solutions that enhance food safety and traceability. The EU’s General Food Law Regulation emphasizes the importance of food safety throughout the supply chain, encouraging manufacturers to adopt smart packaging technologies that can monitor temperature, humidity, and other conditions critical to maintaining product integrity. The European Commission’s Circular Economy Action Plan aims to make all packaging recyclable by 2030, further driving investment in smart packaging technologies.

The UK smart packaging market is expected to grow significantly in the coming years. As the UK government implements stricter regulations regarding labeling accuracy, traceability, and safety standards across various industries, including pharmaceuticals and food & beverage companies, they are compelled to adopt smarter packaging solutions that facilitate compliance with these regulations. The Medicines and Healthcare Products Regulatory Agency (MHRA) has emphasized the importance of traceability in pharmaceutical products; thus, many pharmaceutical companies are turning to serialization technologies embedded within their packaging systems to meet these requirements effectively.

Asia Pacific Smart Packaging Market Trends

Asia Pacific smart packaging market is anticipated to register the fastest CAGR over the forecast period. As more people move to cities and have greater purchasing power, there's a rising preference for convenience, quality, and enhanced product experiences. Smart packaging, which includes features such as QR codes, NFC, and sensors, aligns perfectly with these preferences by offering better product tracking, improved safety, and enhanced consumer engagement.

Japan smart packaging market is expected to grow rapidly in the coming years. The country is renowned for its high product safety and quality expectations, particularly in the food, pharmaceutical, and cosmetics sectors. Smart packaging solutions, which offer tamper-evidence, real-time monitoring, and freshness indicators, help companies meet these stringent requirements. By ensuring that products remain safe, fresh, and authentic throughout the supply chain, smart packaging addresses both regulatory compliance and consumer trust, alluring the Japanese market.

Key Smart Packaging Company Insights

Some of the key companies in the smart packaging market include Sealed Air Corporation, Multisorb Technologies, Amcor PLC, Ball corporation and others. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

International Paper Company offers services such as applying RFID labels, printing serialized barcodes, and integrating QR codes or data matrix into graphics. These functionalities are classified under the "intelligent packaging" category and aim to enhance product traceability, enhance supply chain efficiency, and provide fundamental consumer engagement.

Key Smart Packaging Companies:

The following are the leading companies in the smart packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Sealed Air Corporation

- Multisorb Technologies

- Amcor PLC

- Ball corporation

- Huhtamaki OYJ

- Stora Enso

- Avery Dennison Corporation

- Zebra TechnologiesCorporation

- 3M Company

- International Paper Company

- Timestrip PLC

- Sysco Corporation

- Paksense Incorporated

- M & G USA Corporation

- BASF SE

Recent Developments

-

In September 2023, Jus de Fruits Caraïbes and Tetra Pak partnered to build an interactive connected experience in packaging. The connected experience aims at increasing awareness related to sustainability and helping customers to understand the recycling of beverage cartons.

-

In April 2022, Sealed Air launched its digital packaging brand, Prismiq, offering solutions for smart packaging, digital printing and design services.

Smart Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.2 million

Revenue forecast in 2030

USD 43.3 million

Growth rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Argentina, KSA, UAE, South Africa

Key companies profiled

Sealed Air Corporation; Multisorb Technologies; Amcor PLC; Ball corporation; Huhtamaki OYJ; Stora Enso; Avery Dennison Corporation; Zebra Technologies Corporation;3M Company; International Paper Company; Timestrip PLC; Sysco Corporation; Paksense Incorporated; M & G USA Corporation; BASF SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

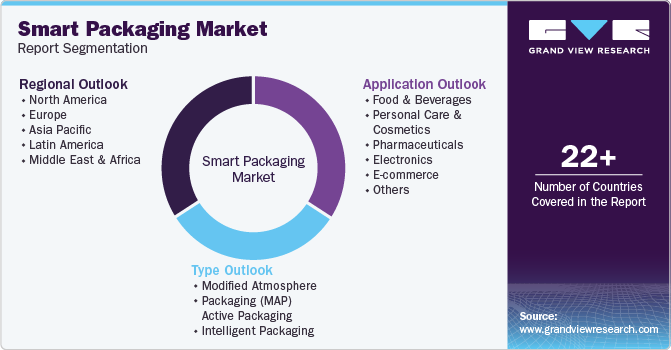

Global Smart Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart packaging market report based on technology, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Modified Atmosphere Packaging (MAP)

-

Active Packaging

-

Gas Scavengers

-

Corrosion Control Packaging

-

Moisture Control Packaging

-

-

Intelligent Packaging

-

Time temperature indicator

-

Gas Indicator

-

Thermochromic Ink

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Electronics

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.