- Home

- »

- Medical Devices

- »

-

Smart Healthcare Market Size, Share, Industry Report, 2030GVR Report cover

![Smart Healthcare Market Size, Share & Trends Report]()

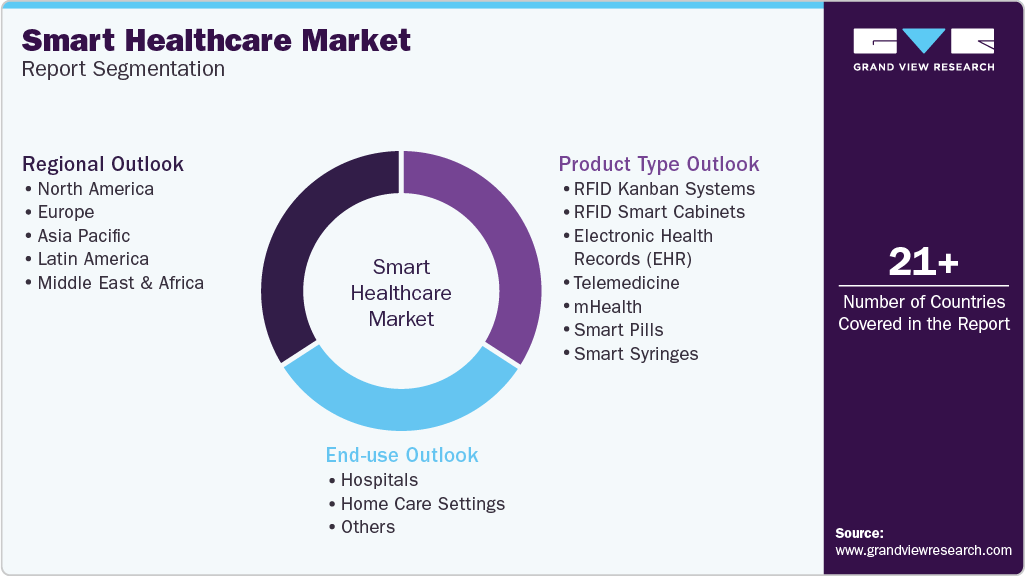

Smart Healthcare Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (RFID Kanban Systems, RFID Smart Cabinets, Electronic Health Records, Telemedicine, mHealth, Smart Pills, Smart Syringes), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-407-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Healthcare Market Summary

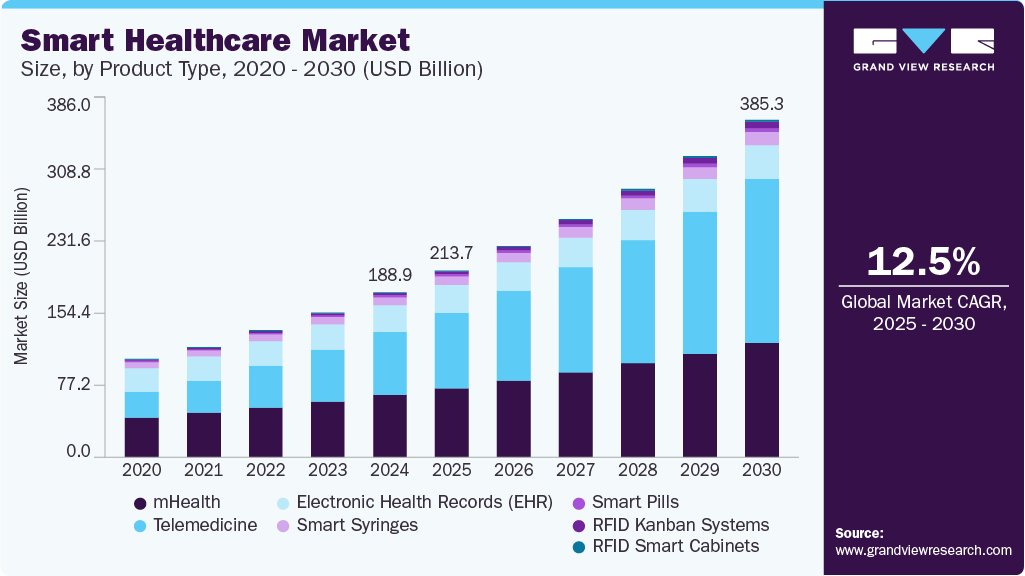

The global smart healthcare market size was estimated at USD 188.86 billion in 2024 and is projected to reach USD 385.28 billion by 2030, growing at a CAGR of 12.51% from 2025 to 2030. This growth is attributed to the technological advancements, rising healthcare costs, and the increasing demand for efficient, patient-centric care delivery.

Key Market Trends & Insights

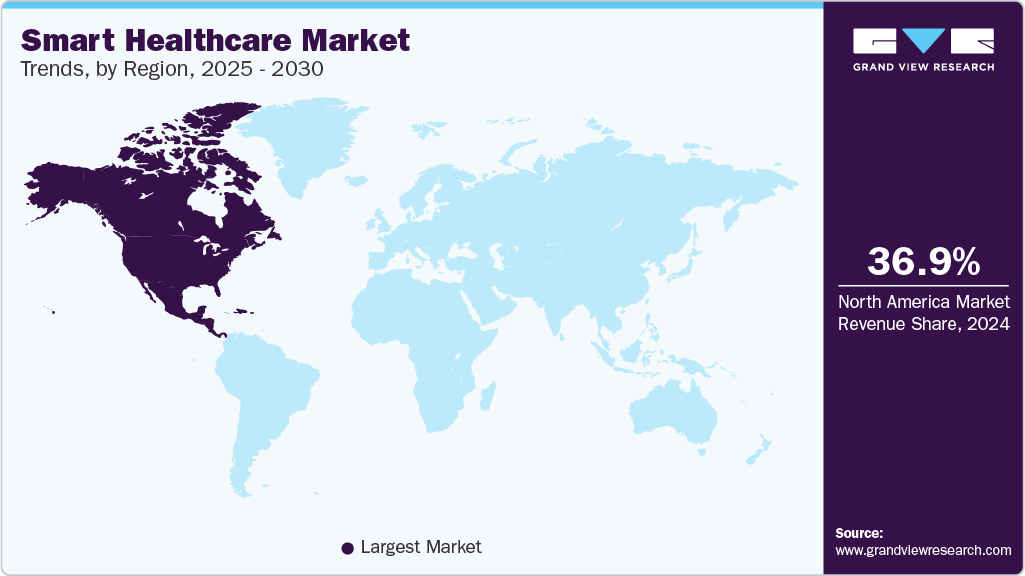

- The North America market dominated the global industry and accounted for a revenue share of over 36.85% in 2024.

- The smart healthcare industry in the U.S. is characterized by rapid innovation and a focus on patient-centered care.

- By product type, the telemedicine segment held the largest revenue share of 38.56% in 2024.

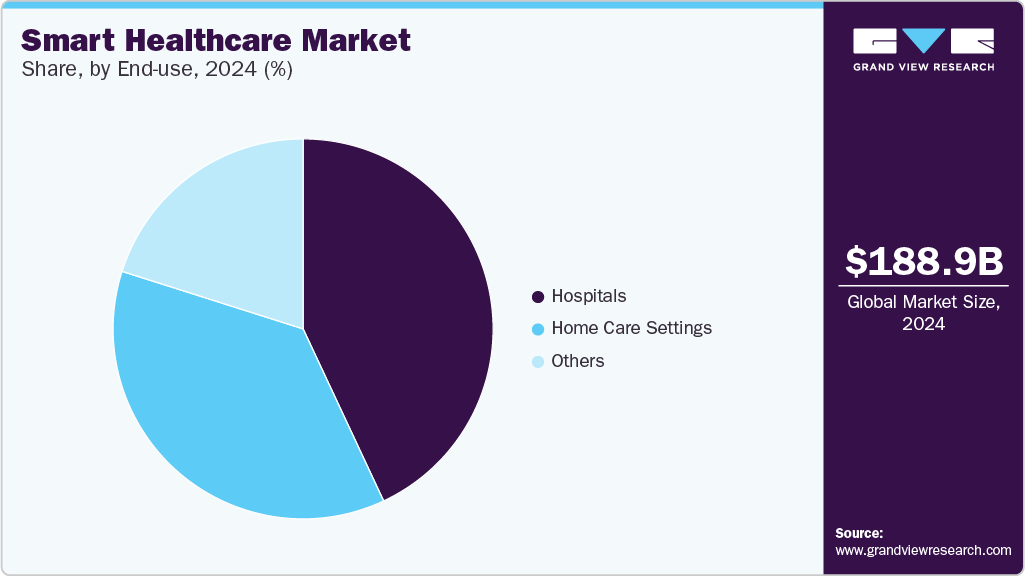

- By end-use, the hospitals segment held the largest revenue share of the smart healthcare industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 188.86 Billion

- 2030 Projected Market Size: USD 385.28 Billion

- CAGR (2025-2030): 12.51%

- North America: Largest market in 2024

Innovations across product categories, such as RFID Kanban systems and smart cabinets, are enhancing hospital inventory and supply chain management, reducing errors and wastage. Electronic Health Records (EHRs), especially web-based platforms, are seeing widespread adoption due to their scalability and interoperability, facilitating seamless data sharing and clinical decision-making. Moreover, rising internet penetration significantly drives the telemedicine segment. According to a 2023 report by DemandSage, approximately 82.2% of the U.S. population owned smartphones, which serve as key platforms for accessing mHealth applications. These devices accounted for 70% of the country’s digital media consumption time, highlighting their central role in everyday digital engagement.

Advancements in telecommunications and integrated medical technologies, such as AI diagnostics, IoT-enabled wearables, and remote monitoring, are revolutionizing telemedicine. These innovations enhance real-time care, improve chronic disease management, and support proactive interventions. Cloud-based EMRs and AI-driven triage tools further streamline operations and improve patient outcomes, making telemedicine a scalable, cost-effective solution for rising healthcare demands. For instance, in May 2024, Apollo Telehealth, in partnership with the Government of Manipur, inaugurated a telemedicine-driven Primary Health Centre (PHC) in Borobeka. This initiative addresses the healthcare challenges faced by communities in conflict-affected and remote areas of Manipur.

Moreover, the demand for mHealth is rising as digital health services gain traction, particularly in remote patient monitoring. Increasing awareness among individuals about the benefits of mHealth solutions, along with supportive government initiatives promoting digital healthcare access, is expected to further accelerate market growth. Moreover, the growing use of smartphones across all age groups, especially among teenagers and adults, is playing a key role in expanding the reach of mHealth technologies. According to The Mobile Economy 2023 report, smartphone penetration stood at 76% in 2022 and is projected to rise to 92% by 2030, indicating a strong foundation for the continued adoption of mobile-based healthcare platforms.

Furthermore, supportive government programs are projected to bode well for the growth of the market for smart healthcare. For instance, the Ayushman Bharat Digital Mission in India aims to create an integrated digital health infrastructure, digitally linking practitioners and patients and promoting structured healthcare nationwide. In addition, the European Union's EU4Health program, launched in 2021, allocates USD 5.78 billion (Euro 5.1 billion) to strengthen healthcare systems and improve access to services. These programs demonstrate a global commitment to enhancing healthcare through digital transformation.

Rising participation from the market players is expected to drive the growth of the smart healthcare industry. For instance, in May 2025, MediBuddy, a digital healthcare platform in India, joined forces with Japanese electronics company ELECOM to bring cutting-edge smart health IoT devices to the Indian market. This strategic collaboration aligns with MediBuddy’s mission to provide quality healthcare access to a billion people by advancing innovation in preventive healthcare. In the initial rollout, ELECOM’s smart devices will be integrated into MediBuddy’s healthcare ecosystem, enhancing the reach and effectiveness of digital health solutions across the country.

“The partnership with MediBuddy is a crucial step towards realising our Healthcare Business Division’s vision of delivering medical and healthcare services. Lifestyle-related diseases have become a significant social issue in India, with experts emphasizing the importance of early prevention and management from a medical perspective. In this initiative, we plan to provide a system for seamlessly managing users’ health data, utilising our IoT technology, including Wi-Fi-enabled and Bluetooth-equipped weight and body composition scales.”

-Dr Kota Hada, CEO Healthcare Division, Elecom

Smart healthcare adoption increased during the pandemic situation, and this adoption rate is further projected to grow in the post-COVID-19 scenario. Consequently, many businesses are expanding their products and services; for instance, in November 2020, Vera Smart Health invested around USD 20 billion to expand its services into home-based tests and diagnostics, remote health services, medication delivery, virtual care, and nutrition consultation services. Therefore, substantial demand for smart healthcare products is anticipated due to the COVID-19 emergency.

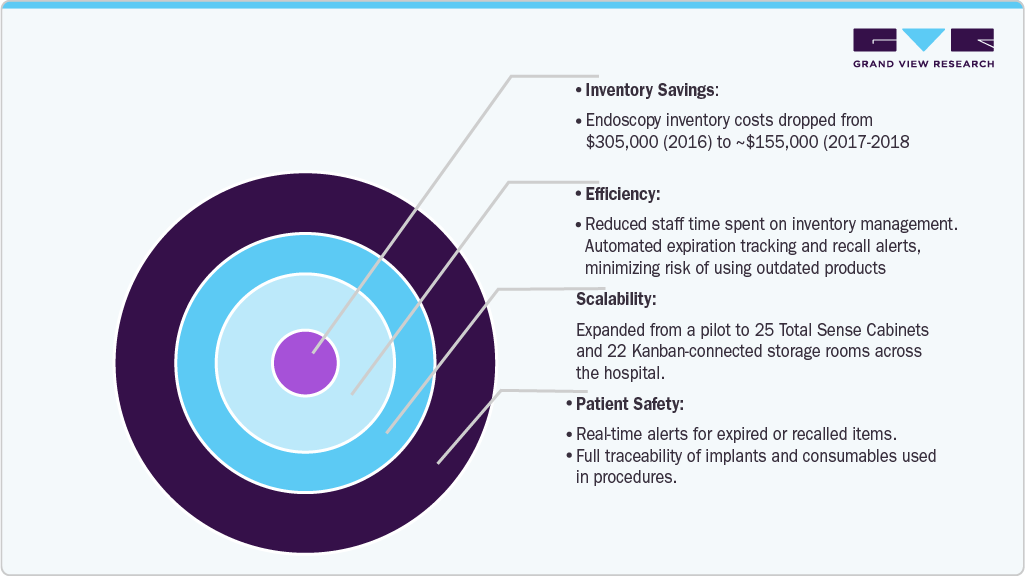

Case Study: Total Sense implemented Stock Box Kanban RFID systems and Smart Cabinet in New York Presbyterian Hospital

Background:

New York-Presbyterian Queens (a 519-bed hospital) implemented IDENTI Medical’s Total Sense Smart Cabinet and Stock Box Kanban RFID systems to automate and optimize inventory management for medical devices (like stents, catheters, and implants) and consumables in its interventional radiology unit.

Challenge:

-

The hospital struggled with excess inventory, expired stock, and manual inventory management, leading to inefficiency, waste, and risk to patient safety.

-

Manual tracking made it difficult to know what was used, by whom, and when, complicating billing and regulatory compliance.

Solution:

-

Total Sense Smart Cabinets: Secure, RFID-enabled cabinets that track high-value and time-sensitive items. Staff access items using RFID badges, and the system logs every removal/return automatically.

-

Stock Box Kanban System: RFID-enabled solution for consumables. When supplies reach a reorder point, the system triggers an automated replenishment request.

-

Integration:

The IDENTIPlatform AI cloud software integrates inventory data with the hospital’s EHR/ERP systems, supporting automated billing and accurate patient records.

Results & Benefits: The hospital has deployed 25 Total Sense Cabinets to manage high-value inventory and track implants, while 22 core storage rooms are currently integrated with the Kanban system.

Key Takeaways:

-

Digital transformation of inventory management with RFID and AI.

-

Improved operational efficiency, cost savings, and patient safety.

-

Seamless integration with hospital EHR/ERP for accurate billing and traceability.

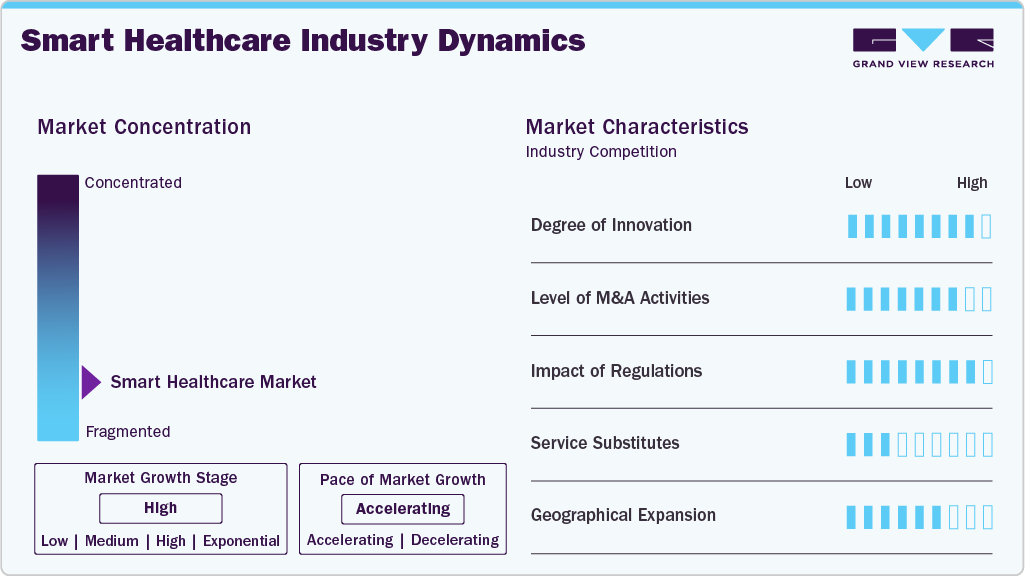

Market Concentration & Characteristics

The smart healthcare market demonstrates a high degree of innovation, driven by advancements in telemedicine, EHR, and mHealth applications. Telemedicine providers are enhancing virtual care capabilities to improve patient-doctor interactions remotely. For instance, in October 2024, AMD Global Telemedicine collaborated with Carefluence, a provider of interoperability solutions, to strengthen AMD’s telehealth services and ensure seamless continuity of care. This collaboration improves clinical workflows and supports better patient outcomes, which are core objectives of the market.

“By incorporating their cutting-edge interoperability expertise, we are not just expanding our product offerings but significantly enhancing the capabilities of our existing solutions. This strategic partnership aligns with our commitment to innovation and excellence in telehealth, ensuring that our clients have access to the most advanced and effective tools available.”

- Tim Steffl, President of AMD Global Telemedicine

Mergers and acquisitions (M&A) continue to shape the smart healthcare industry dynamics, with companies adopting strategic partnerships to expand their market position. For instance, Google, Inc. bought Sound Life Science Services in October 2022. Sound Life Science Services is a small start-up from the University of Washington that created an app to monitor breathing. Google's acquisition has helped them enhance their application by integrating with Sound Life Science's breathing app.

Regulations in the market significantly impact the adoption and growth of new technologies. Strict data privacy laws, such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in Europe, influence the design and deployment of healthcare technologies. For instance, compliance with HIPAA is crucial for telemedicine platforms, which must ensure patient data confidentiality. The high level of regulatory oversight encourages innovation in secure systems and creates barriers to entry for new players.

The global smart healthcare market is expanding rapidly, driven by its ability to enhance accessibility, reduce costs, and improve health outcomes. This momentum is being propelled by major industry players entering emerging markets and the rise of local startups. Companies are scaling their operations by setting up new facilities in different regions and pursuing mergers or acquisitions to strengthen their presence. For instance, Telefonica Tech’s acquisition of Incremental, a company specializing in digital transformation and data analytics, enabled both firms to broaden their capabilities and expand their Microsoft technology offerings across the UK.

Product Type Insights

The telemedicine segment held the largest revenue share of 38.56% in 2024. This growth is attributed to the increasing demand for remote healthcare services, especially post-pandemic. Key drivers include the need for convenient, accessible healthcare, growing adoption of digital health solutions, and advancements in communication technologies. Telemedicine enables virtual consultations, monitoring, and follow-ups, improving healthcare access for patients in remote areas. For instance, in March 2025, Airtel Business and Fortis Healthcare partnered to introduce a Smart Clinics solution powered by Airtel's 5G network, enhancing telemedicine access in urban and rural regions. The Smart Clinics initiative aims to transform telemedicine by offering real-time consultations, integrating connected medical devices, and ensuring secure health data management.

The RFID Kanban Systems segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by the need for real-time inventory tracking, reduction in stock-outs and overstocking, and improved medication expiration management. The increasing demand for lean inventory practices and enhanced operational efficiency continues to drive the adoption of RFID Kanban systems in healthcare settings. For instance, in August 2023, BlueBin and Avatek partnered to introduce an advanced Kanban system that integrates RFID and voice technology. This collaboration introduces enhanced automation and real-time inventory management capabilities, key benefits of RFID-enabled Kanban systems widely used in healthcare for efficient hospital inventory and supply chain management.

End-use Insights

The hospitals segment held the largest revenue share of the smart healthcare industry in 2024, due to the increasing demand for advanced technologies to improve patient care, operational efficiency, and cost reduction. The healthcare industry is experiencing a digital transformation with advancements, enhancing patient care, hospital management, and security. According to an article published in March 2025, with 79% of healthcare organizations investing in rising cybersecurity threats, hospitals must embrace Smart Hospital technologies to remain resilient.

The home care settings segment is expected to grow at the fastest CAGR in the market, driven by an aging population, increased chronic disease prevalence, and a preference for in-home care. Technologies such as remote patient monitoring and telehealth services enable continuous care and early intervention, reducing hospital readmissions. Innovations enhance patient outcomes and alleviate healthcare system burdens, making home care a central focus in modern healthcare delivery.

Regional Insights

North America smart healthcare market dominated the global industry and accounted for a revenue share of over 36.85% in 2024. The market's growth can be attributed to favorable government policies supporting digital health deployment, accessible infrastructure, and high digital literacy. For instance, in November 2024, the Alliance for Smart Healthcare Excellence was formed to promote the development of smart hospitals by integrating advanced technologies and practices. As an independent nonprofit organization, the Alliance promotes adopting and utilizing advanced innovative healthcare technologies, processes, and practices specifically within hospitals.

U.S. Smart Healthcare Market Trends

The smart healthcare industry in the U.S. is characterized by rapid innovation and a focus on patient-centered care. The adoption of mobile health applications and the implementation of RFID systems for inventory management are notable trends. Regulatory support, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act, has facilitated the widespread use of electronic health records (EHRs) and telehealth services.

Asia Pacific Smart Healthcare Market Trends

The Asia Pacific smart healthcare industry is growing due to technological advancements and rising demand for improved healthcare services. Expanding healthcare infrastructure and investments in health tech startups drove the market's growth. For instance, in December 2024, Mobile-health Network Solutions (MNDR) launched ManaSocial. This healthcare engagement platform allows users, professionals, and organizations to connect, share insights, and support one another on health-related topics. ManaSocial enhances MNDR's telemedicine platform by integrating telehealth services, enabling users to access remote consultations and healthcare support within a connected ecosystem.

“Through the platform’s Communities of Care feature, we are expanding our reach, unlocking new revenue streams, and meeting the evolving needs of healthcare consumers. This launch strengthens MNDR’s ability to deliver value to patients, providers, and shareholders.”

- Dr. Rachel Teoh, co-founder of MNDR.

The smart healthcare market in Japan is shaped by its comprehensive universal health insurance system, which ensures broad access to medical services through a mix of public and private providers. The system emphasizes patient choice, affordability, and regulated medical fees, supporting various healthcare services, including preventive care, chronic disease management, and specialized treatments. Hospitals and clinics are integrated within a highly organized regional and national network, with a significant focus on efficiency and quality of care.

Europe Smart Healthcare Market Trends

The smart healthcare industry in Europe is expected to grow significantly, owing to the technological innovations, introduction of Digital health solutions, such as EHRs and telemedicine, is becoming widespread under the EU's Digital Health Strategy. In April 2025, a new EU project “i2X project,” was launched to connect the health data of 3 million citizens, advancing data interoperability across the region. This project aligns with the EU's Digital Health Strategy, aiming to enhance healthcare delivery and facilitate clinical research by improving the seamless exchange of health information.

The smart healthcare market in the UK is growing, due to the strong push toward digital transformation within the National Health Service (NHS), rising demand for remote patient monitoring, and the government's focus on preventive healthcare. Increasing adoption of technologies such as Electronic Health Records (EHRs), telemedicine platforms, and mobile health (mHealth) apps is enhancing care delivery and patient engagement. The aging population and the growing burden of chronic diseases are also contributing to the need for connected healthcare solutions. Additionally, favorable regulatory support, significant investments in health tech startups, and collaborations between public and private stakeholders are accelerating innovation and deployment of smart healthcare technologies across the country.

Latin America Smart Healthcare Market Trends

The smart healthcare industry in Latin America is experiencing significant growth, driven by advancements in various technologies to enhance healthcare delivery and efficiency. Mobile health (mHealth) applications are being utilized to monitor patient health metrics, facilitate communication between patients and providers, and promote wellness. In addition, the introduction of smart pills and syringes enhances medication adherence and precision in drug delivery. These developments reflect Latin America's integration of innovative technologies into its healthcare system to meet the needs of its diverse population and improve overall healthcare outcomes.

Middle East & Africa Smart Healthcare Market Trends

The smart healthcare industry in the Middle East & Africa (MEA) is set for rapid growth, driven by increased healthcare spending and a focus on advanced technologies. Investment in health tech startups and innovative infrastructure is expanding, while regulatory frameworks evolve to support telemedicine and digital records. In October 2024, the launch of The Global Health Network's MENA Regional Hub aims to strengthen health research across the region. This initiative addresses region-specific public health challenges and promotes the integration of advanced technologies, including digital health tools, contributing to the growth of the innovative healthcare ecosystem in the MEA region.

Key Smart Healthcare Company Insights

Players undertook various strategic initiatives such as mergers and acquisitions, product launches and partnerships, and collaborations to gain more penetration. For instance, in September 2021, MSF introduced free telemedicine helpline for COVID-19 patients in India.

Key Smart Healthcare Companies:

The following are the leading companies in the smart healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- AirStrip Technologies Inc.

- Veradigm LLC

- Apple Inc.

- AT&T Inc.

- BROOKS AUTOMATION

- Oracle (Cerner Corporation)

- Cisco

- GE Healthcare

- Medtronic

- Hurst Green Plastics Ltd.

- IBM

- Logi-Tag

- McKesson Corporation

- Olympus Corporation

- Pepperl&Fuchs Pvt. Ltd.

- SAMSUNG

- Siemens Healthcare Private Limited

- Solstice Medical LLC

- InnerSpace (Acquired by Solaire Medical)

- Böllhoff Group

- Adolf Würth GmbH & Co. KG

Recent Developments

-

In October 2024, AMD Global Telemedicine partnered with Carefluence, an innovator in interoperability solutions, to enhance AMD’s robust telehealth solutions, provide continuity of care, and enhance clinical outcomes.

-

In April 2024, MedStar Health, the hospital system based in Columbia, Maryland, announced its collaboration with the in-home care service DispatchHealth. This partnership aimed to deliver acute care services to individuals recently discharged from MedStar facilities in Washington, D.C.

-

In March 2024, RamSoft, a provider of cloud-based PACS /RIS radiology solutions, entered into a 5-year agreement with Premier Radiology Services to utilize RamSoft’s OmegaAI and PowerServer PACS platform across its network of more than 1,000 teleradiology locations.

-

In October 2023, Cedars-Sinai recently launched a mobile health application called Cedars-Sinai Connect app, which utilizes artificial intelligence technology to provide virtual care solutions for different clinical matters. This app enables patients to schedule primary care visits on the same day and offers 24/7 virtual access to medical specialists for urgent treatment.

-

In January 2023, Avery Dennison announced to launch of a new manufacturing unit in Mexico, which aims to expand the company’s production capacity in the country.

Smart Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 213.67 billion

Revenue forecast in 2030

USD 385.28 billion

Growth rate

CAGR of 12.51% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Sweden; Denmark; Norway; Asia Pacific; Japan; China; India; Australia; South Korea; Thailand; Latin America; Brazil; Argentina; Middle East & Africa; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AirStrip Technologies Inc.; Veradigm LLC; Apple Inc.; AT&T Inc.; BROOKS AUTOMATION; Oracle (Cerner Corporation); Cisco; GE Healthcare; Medtronic; Hurst Green Plastics Ltd.; IBM; Logi-Tag; McKesson Corporation; Olympus Corporation; Pepperl&Fuchs Pvt. Ltd.; SAMSUNG; Siemens Healthcare Private Limited; Solstice Medical LLC; InnerSpace (Acquired by Solaire Medical); Böllhoff Group; Adolf Würth GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Healthcare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart healthcare market report based on product type, end-use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

RFID Kanban Systems

-

RFID Smart Cabinets

-

Electronic Health Records (EHR)

-

Web-based EHR

-

Client-server Based EHR

-

-

Telemedicine

-

Hardware

-

Software

-

Others

-

-

mHealth

-

Monitoring Services

-

Diagnosis Services

-

Healthcare Systems Strengthening

-

Others

-

-

Smart Pills

-

Smart Syringes

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global smart healthcare market size was estimated at USD 188.86 billion in 2024 and is expected to reach USD 213.67 billion in 2025.

b. The global smart healthcare market is expected to grow at a compound annual growth rate of 12.51% from 2023 to 2030 to reach USD 385.28 billion by 2030.

b. North America dominated the smart healthcare market with a share of over 36.85% in 2024. The market's growth can be attributed to favorable government policies supporting digital health deployment, accessible infrastructure, and high digital literacy.

b. Some key players operating in the smart healthcare market include AirStrip Technologies Inc., Veradigm LLC, Apple Inc., AT&T Inc., BROOKS AUTOMATION, Oracle (Cerner Corporation), Cisco, GE Healthcare, Medtronic, Hurst Green Plastics Ltd., IBM, Logi-Tag, McKesson Corporation, Olympus Corporation, Pepperl&Fuchs Pvt. Ltd., SAMSUNG, Siemens Healthcare Private Limited, Solstice Medical LLC, InnerSpace (Acquired by Solaire Medical), Böllhoff Group, and Adolf Würth GmbH & Co. KG

b. Key factors that are driving the smart healthcare market growth include the rising adoption of mHealth, government initiatives to digitize healthcare, and the prevalence of chronic disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.