- Home

- »

- Clinical Diagnostics

- »

-

Skin Cancer Diagnostics Market Size, Industry Report, 2033GVR Report cover

![Skin Cancer Diagnostics Market Size, Share & Trends Report]()

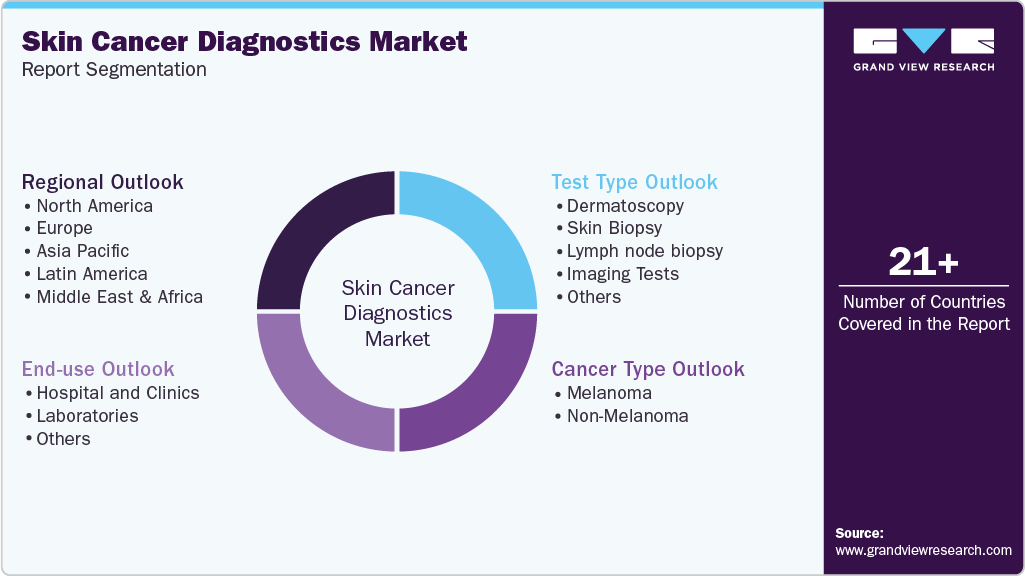

Skin Cancer Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Cancer Type (Melanoma, Non-Melanoma), By Test Type (Dermatoscopy, Skin Biopsy, Lymph Node Biopsy, Imaging Tests) By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-322-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Skin Cancer Diagnostics Market Summary

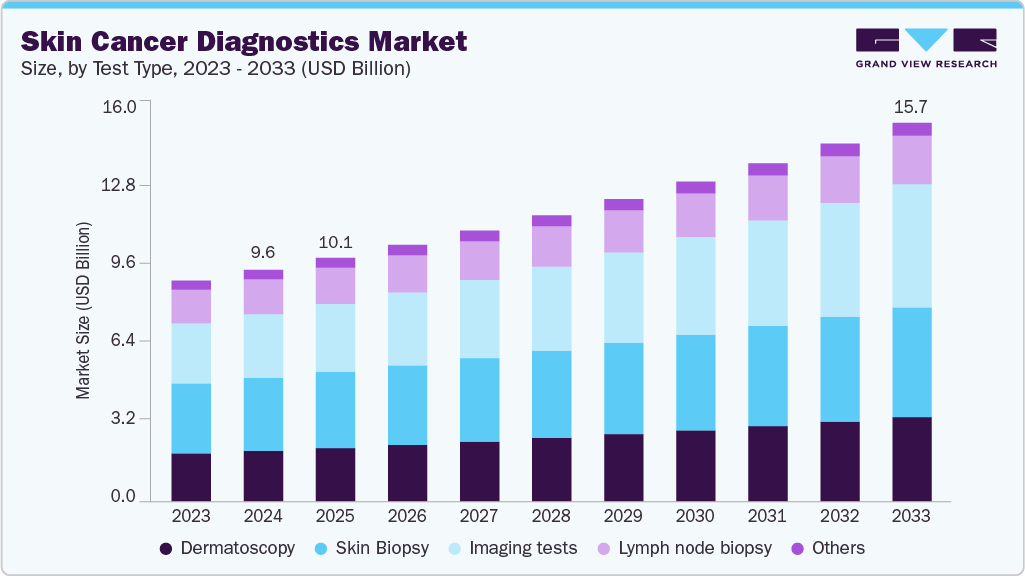

The global skin cancer diagnostics market size was estimated at USD 9.58 billion in 2024 and is projected to reach USD 15.67 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The integration of artificial intelligence, technological advancements, and patient preference for non-invasive diagnostics drives the growth.

Key Market Trends & Insights

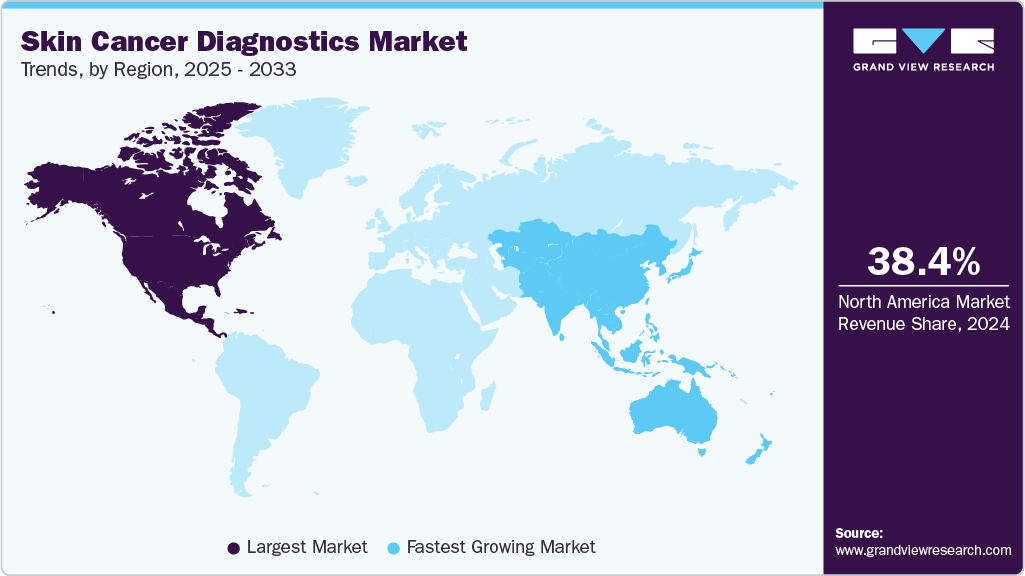

- The North America skin cancer diagnostics market accounted for a 38.39% revenue share in 2024.

- The skin cancer diagnostics industry in the U.S. is expected to grow over the forecast period.

- By cancer type, the nonmelanoma segment held the largest market share of 74.8% in 2024.

- By test, the skin biopsy segment accounted for a revenue share of 31.47% in 2024.

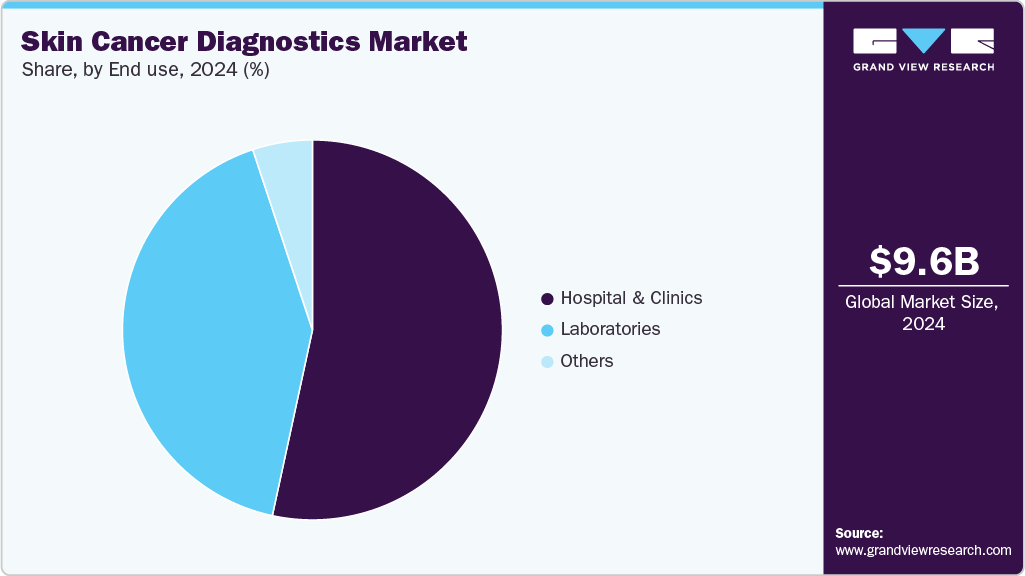

- By end user, hospitals and clinics led the skin cancer diagnostics market with a share of 53.39% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.58 Billion

- 2033 Projected Market Size: USD 15.67 Billion

- CAGR (2025-2033): 5.7%

- North America: Largest market in 2024

Furthermore, increased awareness about skin cancer, advancements in AI-based diagnostic tools, and initiatives promoting early detection, rising incidence, particularly in sun-exposed regions, are expected to drive the market growth. For instance, according to the American Cancer Society, invasive melanoma accounts for only 1% of all skin cancer cases, and in 2024, an estimated 100,640 new cases of invasive and 99,700 cases of in situ melanoma were diagnosed in the U.S. Partnerships between healthcare providers and tech companies further support this growth by enhancing accessibility and accuracy of diagnoses.

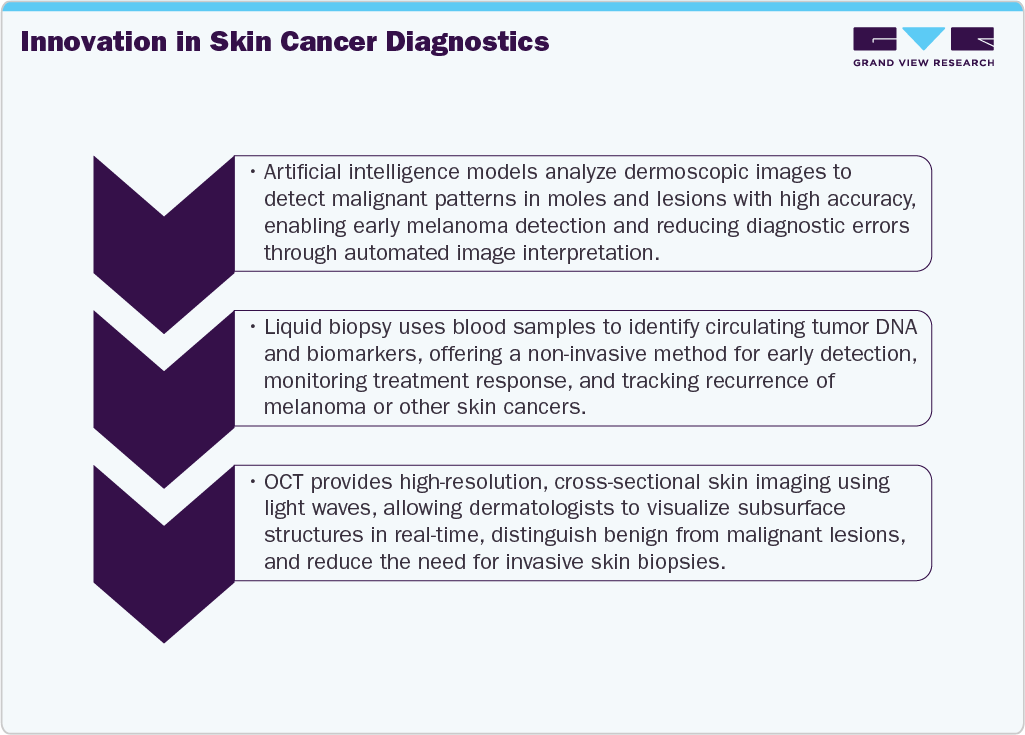

Furthermore, advanced technologies such as AI-enabled product approvals are driving the growth of the market. For instance, in January 2024, the FDA approved the first AI-powered skin cancer diagnostic tool, namely the DermaSensor device. Further, DermaSensor provides quantitative, point-of-testing identification for skin cancer, including melanoma, squamous cell carcinoma, and basal cell carcinoma. Also, the DermaSensor device uses artificial intelligence (AI)-powered spectroscopy in order to identify cellular and subcellular characteristics of lesions.

Modern machine learning techniques rely on extensive datasets to identify patterns useful for classification, with diagnostic imaging being a particularly promising area for AI research. Moreover, skin cancer detection, in particular, is an attractive test type for AI due to the subjective nature of clinical and dermoscopic image interpretation. Also, AI-assisted diagnosis offers advantages such as improved access to specialist expertise, which is often scarce in many regions, leading to long waiting times for specialist appointments. There is growing optimism that AI-based systems could offer greater consistency and higher accuracy than human experts.

In dermatology, AI is applied across diverse tools for detection, including total body photography (TBP) and dermoscopy. Market-approved AI-powered software for dermatologists, such as MoleAnalyzer Pro (FotoFinder ATMB) and DEXI (Vectra WB360), is typically integrated with specialized hardware. These apps have undergone testing in retrospective and prospective trials, demonstrating their effectiveness. Moreover, AI has been applied to other noninvasive diagnostic techniques, such as Reflectance Confocal Microscopy (RCM) and Optical Coherence Tomography (OCT), reducing the number of unnecessary biopsies in skin cancer referral centers.

Moreover, dermato-oncology has made significant advances in noninvasive diagnostic tools such as dermoscopy, ultrasonography, confocal microscopy, and optical coherence tomography. These tools are critical for early detection of melanoma and non-melanoma skin cancers (NMSC), which are becoming more common. The Skin Cancer Institute uses a novel device called Reflectance Confocal Microscopy (RCM) to provide non-invasive skin imaging. This technology allows doctors to diagnose many types of cancer quickly and safely, without the need for a biopsy. Furthermore, RCM enables physicians to monitor treatment responses, making it an invaluable tool in the management of cancer patients.

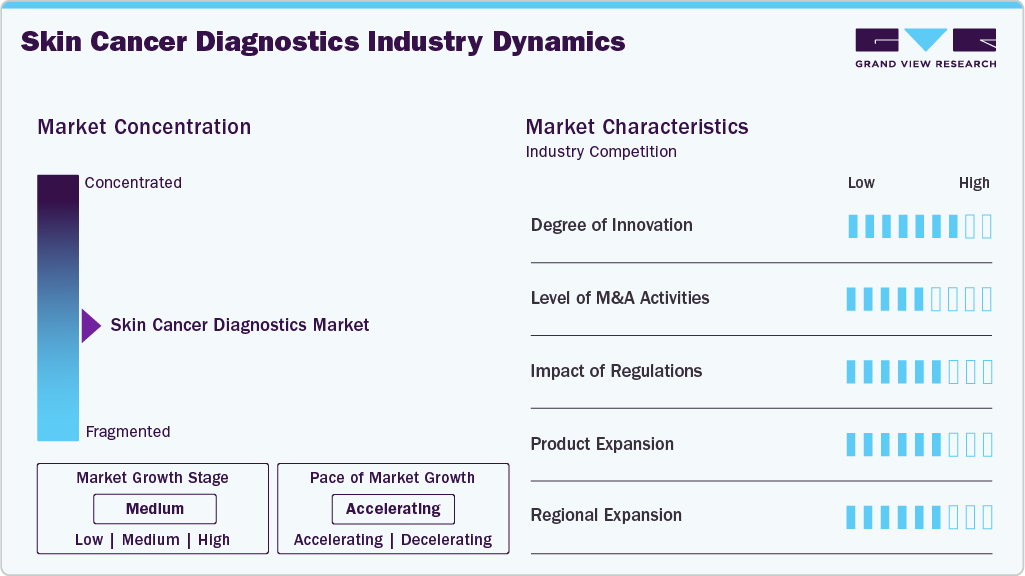

Market Concentration & Characteristics

The skin cancer diagnostics field exhibits a high degree of innovation, integrating advanced technologies such as artificial intelligence and machine learning to enhance accuracy and early detection. For instance, in June 2024, Korean digital health company LifeSemantics received the first approval for an AI-powered solution for skin cancer diagnosis in South Korea. Four months after its application, the Ministry of Food and Drug Safety granted regulatory clearance for canofyMD SCAI. Moreover, the Doctor Answer 2.0 project developed mobile AI technology, which has gathered 30 hospitals and 19 technology companies to advance their medical AI development. These cutting-edge techniques, such as digital dermoscopy, molecular diagnostics, and non-invasive imaging methods, are transforming patient care.

The skin cancer diagnostics market has seen a high level of merger and acquisition activity, with companies seeking to expand their product portfolios and geographic presence. For instance, in May 2024, FotoFinder Systems, a global skin imaging solution provider, acquired DermLite, a renowned handheld dermatoscope supplier, marking a significant advancement in dermoscopy. This strategic merger is EMZ Partners’ first investment in the U.S. and a testament to its industry-leading innovations.

Regulations significantly impact the skin cancer diagnostics industry by ensuring the accuracy and reliability of measurements and tests. The U.S. FDA expanded and finalized 510(k) registration routes for the safety and performance of medical devices. Based on the abbreviated form of 510(k), the expansion was drafted in 2018. The improved market approval pathway is focused on analyzing & assessing performance issues and device safety by demonstrating substantial equivalence.

Product substitutes are limited in the skin cancer diagnostics market. There are no true substitutes for biopsy, which remains the gold standard for definitive diagnosis. Despite the advancements in non-invasive imaging and molecular techniques, biopsies provide unparalleled accuracy in identifying malignancies, making them an irreplaceable component of effective skin cancer diagnosis and treatment planning.

Skin cancer diagnostics has a high concentration of end users, primarily dermatologists, oncologists, and specialized skin cancer clinics. These professionals rely heavily on diagnostic tools such as dermoscopy, biopsies, and advanced imaging techniques to accurately diagnose and manage cancer, resulting in targeted treatment and better patient outcomes. Their expertise is critical for early detection and intervention.

Cancer Type Insights

The nonmelanoma segment held the largest market share of 74.8% in 2024. The rising incidence of NMSC represents a significant market driver for novel technologies in screening and diagnosis. Basal Cell Carcinoma (BCC) and Squamous Cell Carcinoma (SCC), which constitute 70% and 25% of NMSC cases, respectively, are the most prevalent forms of skin cancer, comprising 90% of all malignant skin tumors. Studies indicate a continued increase in NMSC cases until at least 2040, highlighting the urgent need for reliable screening tools.

In addition, deep learning, a form of AI, shows promise in image analysis and is particularly attractive for NMSC diagnosis. As NMSC cases increase globally, there is a growing demand for early detection tools. Deep learning has emerged as a valuable decision-support tool in medicine, offering significant potential in image analysis, a critical aspect of dermatology diagnoses. Dermatology heavily relies on visual diagnoses, making deep learning’s image analysis capabilities highly relevant for diagnosing skin cancer. With the widespread availability of smartphones equipped with powerful cameras, deep learning technology can also be leveraged for remote skin cancer screening test types. Current data indicate that deep learning technology for detecting and diagnosing cancer offers sensitivity & specificity comparable to trained dermatologists. While there is ongoing work to increase the clinical use of AI-based tools, the positive attitude of patients and physicians toward these technologies suggests that deep learning could be effectively integrated as a clinical decision-making tool.

Melanoma is the fastest-growing segment in the skin cancer market, due to several key factors, including rising global incidence of melanoma cases, driven by increased exposure to ultraviolet (UV) radiation, and public awareness, which has increased demand for better diagnostic and therapeutic options. Melanoma is the most lethal type of skin cancer, necessitating the development of novel treatments such as immunotherapies and targeted therapies that improve survival rates while posing fewer risks.

Test Type Insights

The skin biopsy segment led the skin cancer diagnostics industry with a revenue share of 31.47% in 2024. Skin biopsy is a fundamental diagnostic procedure in dermatology, with various methods available for different situations. Further, the launch of skin biopsy tests is driving the growth of the market. In October 2025, CND Life Sciences (US) received FDA breakthrough device designation for its skin biopsy-based Syn-One Test. CND introduced the Syn-One Test as a laboratory-developed test (LDT) in late 2019. Since then, neurologists and other clinicians have prescribed it to nearly 50,000 patients across all 50 states and in a wide range of clinical settings, including community practices, academic medical centers, and large health systems.

The imaging tests segment is expected to grow at the fastest CAGR during the forecast period. Emerging optical imaging modalities, including Reflectance Confocal Microscopy (RCM), Optical Coherence Tomography (OCT), Magnetic Resonance Imaging (MRI), Near-infrared (NIR) bioimaging, and Positron Emission Tomography (PET), offer noninvasive imaging data that can aid in the early detection of cutaneous tumors & assist in surgical planning. These modalities are valuable for observing dynamic processes, such as blood flow, immune cell activation, and tumor energy metabolism, which are relevant for disease progression.

End User Insights

Hospitals and clinics led the skin cancer diagnostics market with a share of 53.39% in 2024. In addition, it is expected to be the fastest-growing segment over the forecast period. Its growth can be attributed to the increasing incidence, advancements in diagnostic technologies, and rising awareness about early detection. The integration of AI and teledermatology in hospitals can further enhance diagnostic accuracy & accessibility, boosting the demand for hospital-based skin cancer diagnostic services. For instance, in July 2025, West Middlesex University Hospital launched autonomous AI technology in order to speed up life-saving skin cancer checks. DERM, the only artificial intelligence medical device approved to make clinical decisions in cancer care, analyzes magnified skin lesions using advanced dermoscopic imaging. It performs admirably, detecting skin cancer with 97% efficacy and ruling out melanoma with 99.96% accuracy, comparable to dermatologist performance.

In May 2023, the UK NHS planned to accelerate the expansion of teledermatology, which involves taking high-resolution images of skin lesions for faster diagnosis and treatment of skin cancer. Also, this technology uses a small lens attached to a phone camera (dermatoscope), which allows dermatologists to double the number of patients. Teledermatology, currently used in about 15% of trusts offering dermatology services, was expected to be available in all areas by July 2023. It would also be expanded to GP practices, aiding people in rural areas and reducing the need for specialist appointments. More than 600,000 people were referred for skin cancer checks last year, a 9% increase from the previous year.

Teledermatology is being used more often in community diagnostic centers by NHS trusts in an effort to shorten wait times. There is no need for an in-person appointment when patients are referred straight to a nearby diagnostic center. Additionally, AI-powered magnifying lenses are being tested to rapidly and precisely evaluate lesions. Because of this technology, about 10,000 pointless in-person appointments have been avoided. Additionally, it has made it possible for certain hospitals to identify and treat practically all patients with skin cancer within two months of a general practitioner referral. It is anticipated that the NHS's focus on technologically driven improvements in cancer diagnosis and treatment will greatly enhance patient outcomes while lessening the burden on healthcare resources.

Regional Insights

The North America skin cancer diagnostics market accounted for a 38.39% revenue share in 2024. Skin cancer is the most prevalent form of cancer in the U.S.; approximately one in five U.S. individuals is expected to suffer from skin cancer in their lifetime. An estimated 9,500 individuals in the U.S. receive a diagnosis daily. NMSC, including BCC and SCC, affects over 3 million U.S. citizens annually. In addition, strategic initiatives undertaken by key market players can offer lucrative opportunities for market growth over the forecast period. For instance, in May 2024, Epredia, a subsidiary of PHC Holdings Corporation, partnered with NovaScan, Inc. in order to sign a letter of intent for an exclusive commercial distribution agreement in the U.S. for MarginScan. The MarginScan medical device is designed to aid physicians in the real-time detection of NMSC, as these companies drive innovation and provide a wide range of products to meet market demand.

U.S. Skin Cancer Diagnostics Market Trends

The skin cancer diagnostics industry in the U.S. is expected to grow over the forecast period, due to the increasing prevalence of skin cancer. In the U.S., skin cancer is the most prevalent form of cancer, with approximately one in five Americans expected to develop it during their lifetime. In June 2025, the American Academy of Dermatology reported that each day, an estimated 9,500 individuals in the U.S. receive a skin cancer diagnosis. Nonmelanoma Skin Cancer (NMSC), including Basal Cell Carcinoma (BCC) and Squamous Cell Carcinoma (SCC), affects over 3 million Americans annually.

Europe Skin Cancer Diagnostics Market Trends

The Europe skin cancer diagnostics industry was identified as a lucrative region. The market in the EU-27 countries is expected to observe continued growth due to the increasing incidence of melanoma. Several key players operate in this market, offering a range of diagnostic tests and services. For example, Roche Diagnostics provides the cobas 4800 BRAF V600 Mutation Test, which is used to detect mutations in the BRAF gene, commonly found in melanoma. Another example is Siemens Healthineers, which offers the ADVIA Centaur BRAF V600 Mutation Test for the detection of BRAF mutations.

The skin cancer diagnostics market in the UK is expected to grow over the forecast period. Skin cancer cases in the UK have surged to record levels, with approximately 17,500 cases diagnosed annually. Projections suggest that these numbers could rise by about 50% over the next two decades. In 2024, to address this growing concern, innovative research led by Dr. David Bajek, in collaboration with the University and NHS Tayside, aims to reduce the need for biopsy surgeries to detect and treat the disease. The National Health Service (NHS) in the UK is backing this effort by funding nine trusts to pilot Skin Analytics' AI device for detecting cancerous lesions.

The Germany skin cancer diagnostics market is expected to grow over the forecast period due to the increasing launch of advanced diagnostic techniques. For instance, in February 2025, Lohmann & Rauscher (L&R) acquired OnlineDoctor AG, the first acquisition of a start-up in digital health. In Germany, OnlineDoctor leads the teledermatology market. The business provides dermatologists in private practice with digital diagnoses for skin issues, including skin cancer. The purchase is a component of L&R's expansion plan, which emphasizes digitalization, including AI and M&A.

Asia Pacific Skin Cancer Diagnostics Market Trends

Asia Pacific is anticipated to witness the fastest growth in the skin cancer diagnostics industry, driven by increasing awareness, rising incidences due to environmental factors like UV exposure, and advancements in diagnostic technologies. Growing healthcare expenditure and improved access to medical facilities also contribute to market growth, along with government initiatives promoting early detection and treatment of skin cancer.

The China skin cancer diagnostics market is expected to grow steadily over the forecast period, owing to increased investments in healthcare R&D and the introduction of novel diagnostic technologies. The government's emphasis on improving medical infrastructure and early disease detection accelerates market growth. Furthermore, the introduction of innovative diagnostic tools has sped up growth. For instance, in May 2023, F. Hoffmann-La Roche (Switzerland) launched its anti-PRAME antibody in China for the melanoma diagnosis.

The skin cancer diagnostics market in Japan is significantly growing during the forecast period, due to the country's well-established and technologically advanced healthcare system. Japan's strong emphasis on early disease detection, combined with widespread access to medical services, contributes to the growing demand for precise and efficient diagnostic solutions. Furthermore, increasing awareness and the adoption of advanced diagnostic technologies are driving market growth. Ongoing research initiatives and collaborations between domestic and international healthcare companies are also expected to drive innovation and improve diagnostic capabilities in the country.

Latin America Skin Cancer Diagnostics Market Trends

The Latin America skin cancer diagnostics industry was identified as a lucrative region in this industry. Technological advancements in the region are anticipated to fuel market growth. Moreover, the Brazil market is expected to grow over the forecast period due to the increasing cancer prevalence. Skin cancer is the most common type of cancer, accounting for 25% of all cancer cases in the country.

Middle East and Africa Skin Cancer Diagnostics Market Trends

The Middle East and Africa (MEA) is witnessing steady growth due to several factors such as increasing incidence of skin cancer, rising awareness about early detection, advancements in diagnostic technologies, and growing initiatives for skin cancer prevention & control. The market for skin cancer diagnostics in South Arabia is influenced by various factors, including technological advancements, increasing awareness, and the rapidly aging population. The field of dermatology and oncology has witnessed significant technological advancements in diagnostic tools and techniques for detecting skin cancer at early stages.

Key Skin Cancer Diagnostics Company Insights

Key players operating in the market are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced technology and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

DermTech, Castle Biosciences, and SkinVision are some of the emerging market participants in the skin cancer diagnostics market. These companies focus on achieving funding support from government bodies and healthcare organizations, aided by novel product launches to capitalize on untapped avenues.

Key Skin Cancer Diagnostics Companies:

The following are the leading companies in the skin cancer diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Castle Bioscience

- DermTech

- bioMérieux Inc.

- FOUNDATION MEDICINE, INC.

- DermaSensor, Inc.

- F Hoffmann-La Roche Ltd

- NeoGenomics Laboratories

- Quest Diagnostics Incorporated.

- SkylineDx

- Abbott

Recent Developments

-

In July 2025, Castle Biosciences, Inc. (Nasdaq: CSTL), a company dedicated to advancing health through innovative diagnostic tests, announced that its DecisionDx-Melanoma assay received Breakthrough Device designation from the U.S. Food and Drug Administration (FDA). The DecisionDx-Melanoma gene expression profile (GEP) test delivers personalized insights to support risk-based clinical management for patients with stage I-III cutaneous melanoma.

-

In October 2025, DermaSensor secured USD 16 million in order to scale AI-powered skin cancer detection in primary care. This latest round of financing includes the majority of existing investors, as well as new institutional investors such as Pier 70 Ventures, Kern Venture Group, GenHenn Capital, and an undisclosed strategic investor. This additional $16 million in capital raises the total investment in the company to USD 43 million.

-

In February 2024, Quest Diagnostics launched MelaNodal Predict, a highly advanced predictive gene expression test to help personalize treatment decisions for patients with melanoma, the deadliest form of skin cancer and one of the most common cancers in the U.S.

-

In January 2024, DermaSensor Inc. received FDA clearance for its noninvasive skin cancer assessment system, which uses artificial intelligence to detect common skin cancers, such as melanoma, basal cell carcinoma, and SCC. The wireless, handheld device provides instant, objective results using an FDA-approved algorithm, allowing physicians to evaluate suspicious lesions without invasive procedures.

-

In January 2024, SkylineDx, a diagnostics technology developer, received European Patent No. 3827101, a significant advancement in cancer diagnostics and personalized treatment. The patent outlines novel methods for categorizing and managing patients with primary cutaneous melanoma, using gene expression signature levels.

Skin Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.07 billion

Revenue forecast in 2033

USD 15.67 billion

Growth rate

CAGR of 5.7% from 2025 - 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 - 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cancer type, test type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Castle Bioscience; DermTech; bioMérieux, Inc.; FOUNDATION MEDICINE, INC.; DermaSensor, Inc.; F. Hoffmann-La Roche Ltd; NeoGenomics Laboratories; Quest Diagnostics Incorporated.; SkylineDx, Abbott

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Skin Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global skin cancer diagnostics market report based on cancer type, test type, end use, and region:

-

Cancer Type Outlook (Revenue, USD Million; 2021 - 2033)

-

Melanoma

-

Non-Melanoma

-

-

Test Type Outlook (Revenue, USD Million; 2021 - 2033)

-

Dermatoscopy

-

Skin Biopsy

-

Lymph node biopsy

-

Imaging Tests

-

Others

-

-

End Use Outlook (Revenue, USD Million; 2021 - 2033)

-

Hospital and Clinics

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.