- Home

- »

- Automotive & Transportation

- »

-

Skid Steer Loaders Market Size, Share, Growth Report, 2030GVR Report cover

![Skid Steer Loaders Market Size, Share & Trends Report]()

Skid Steer Loaders Market (2024 - 2030) Size, Share & Trends Analysis Report By Rated Operating Capacity (ROC) (Upto 1,250 lbs, 1,251 to 2,200 lbs, More than 2,200 lbs), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-084-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Skid Steer Loaders Market Summary

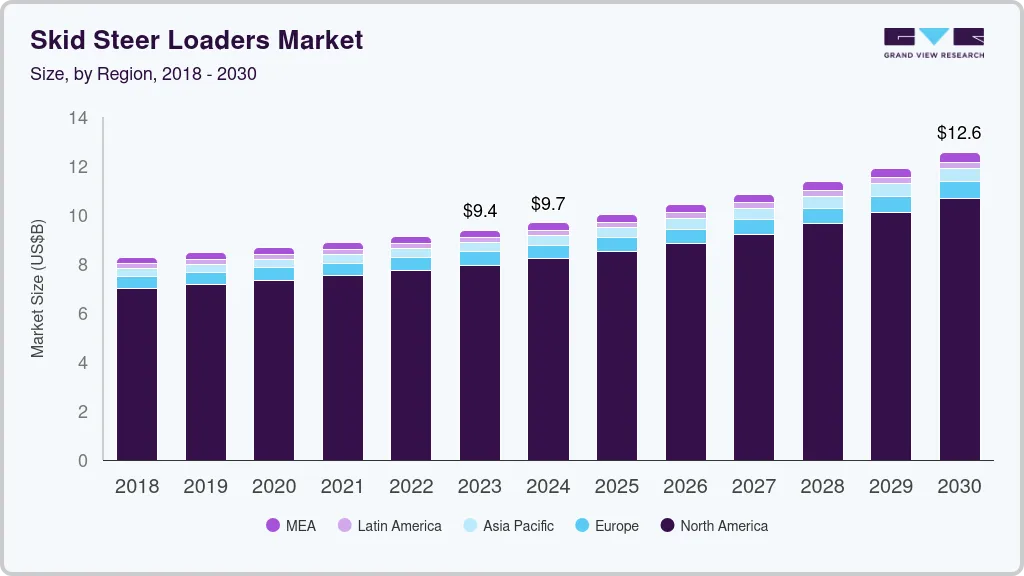

The global skid steer loaders market size was estimated at USD 9.4 billion in 2023 and is projected to reach USD 12.56 billion by 2030, growing at a CAGR of 4.4% from 2024 to 2030. As urbanization accelerates, particularly in emerging economies, there is a rise in construction activities, including residential, commercial, and public infrastructure projects..

Key Market Trends & Insights

- The North America skid steer loaders market accounted for the largest market revenue share of 84.7% in 2023.

- The U.S. skid steer loaders market dominated the North America market in 2023.

- By Rated Operating Capacity (ROC), the more than 2,200 Ibs dominated the market and accounted for a share of 55.6% in 2023.

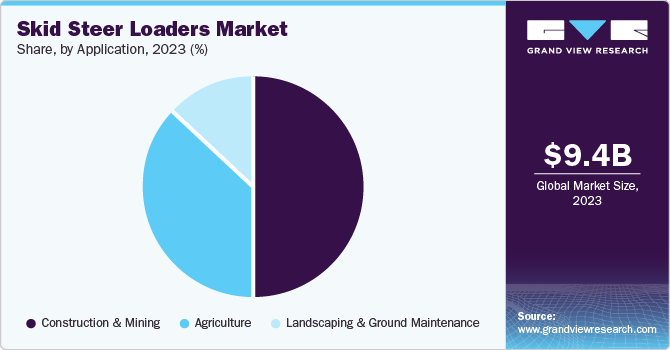

- By application, the Construction & mining accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.4 Billion

- 2030 Projected Market Size: USD 12.56 Billion

- CAGR (2024-2030): 4.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Skid steer loaders are favored for their versatility and compact size, allowing them to operate efficiently in tight spaces where larger machinery cannot fit. This adaptability makes them essential for excavation, grading, and material handling tasks, thereby driving their adoption across various construction sites. Technological advancements in skid steer loader design and functionality also contribute to market growth. For instance, in April 2023, Bobcat launched a Machine IQ telematics system to enhance its equipment's operational efficiency and productivity. This advanced system gives customers real-time data and insights into their machinery's performance, allowing for better decision-making and maintenance planning.Innovations such as telematics integration enable operators to monitor machine performance in real time, enhancing operational efficiency and reducing downtime. Additionally, improvements in hydraulic systems and control mechanisms have made these machines more accessible while increasing their lifting capacities and speed. The introduction of electric models aligns with sustainability trends by offering lower emissions and reduced operating costs, appealing to environmentally conscious consumers.

As environmental regulations become stricter globally, manufacturers invest heavily in developing electric models that produce fewer emissions than traditional diesel-powered machines. Electric skid steer loaders offer lower operating costs and quieter operation, making them suitable for urban environments where noise pollution is a concern. For instance, in January 2022, Bobcat launched all-electric compact loaders, the T7X and S7X, marking a significant advancement in sustainable construction equipment. These models are designed to provide zero emissions during operation, aligning with the growing demand for environmentally friendly machinery in the construction and landscaping industries. The increasing awareness of environmental issues among consumers further fuels the demand for these eco-friendly alternatives, contributing positively to market growth.

Rated Operating Capacity (ROC) Insights

More than 2,200 Ibs dominated the market and accounted for a share of 55.6% in 2023. Skid steer loaders with higher ROC are crucial for handling heavier loads and performing a wide range of tasks, such as digging, grading, and lifting, which are essential in large-scale construction and earthmoving projects. Governments and private enterprises worldwide invest heavily in infrastructure projects, including road construction, urban development, and utility installation. Skid steer loaders with an ROC exceeding 2,200 lbs are particularly suited for these tasks due to their ability to handle large volumes of material and operate in diverse environmental conditions. This increased focus on infrastructure development directly contributes to the rising demand for high-capacity skid steer loaders.

1,251 to 2,200 Ibs is expected to grow at significant CAGR during the forecast period.There is an increasing demand for versatile and compact machinery in various industries, such as construction, agriculture, and landscaping. These industries require equipment that can maneuver easily in tight spaces while delivering substantial lifting capacity. The 1,251 to 2,200 lbs ROC range offers an ideal balance between power and size, making it suitable for various applications, including material handling, excavation, and site preparation.

Application Insights

Construction & mining accounted for the largest market revenue share in 2023. Due to the complexity and scale of modern construction projects, the need for efficient and adaptable equipment is paramount in the construction and mining sector. Skid steer loaders are highly valued for their ability to perform various tasks, such as digging, grading, and lifting, with precision. Their compact size and agility make them ideal for navigating tight spaces and challenging job sites, further driving their adoption in both residential and commercial construction projects.

Landscaping & ground maintenance is expected to grow significantly over the forecast period. Increasing demand for aesthetic and functional outdoor spaces and the versatility of skid steer loaders proliferates the market demand. In residential and commercial landscaping projects, efficient and versatile equipment is critical to managing various tasks such as grading, digging, and material transport. Skid steer loaders, with their ability to easily switch attachments and operate in diverse conditions, provide landscapers with the tools needed to handle intricate and large-scale projects efficiently.

Regional Insights

North America skid steer loaders market accounted for the largest market revenue share of 84.7% in 2023. As urbanization accelerates and infrastructure projects expand in the region, construction companies seek machinery that can operate efficiently in confined spaces while delivering high performance. Skid steer loaders are particularly favored for their maneuverability, allowing them to navigate tight job sites effectively. Additionally, technological advancements have led to the development of more efficient engines and hydraulic systems, enhancing productivity and reducing operational costs. The growing trend towards automation in construction further propels the adoption of skid steer loaders with advanced features such as telematics and remote control capabilities.

U.S. Skid Steer Loaders Market Trends

The U.S. skid steer loaders market dominated the North America market in 2023. In cities such as New York and Los Angeles, ongoing urban redevelopment projects and infrastructure upgrades, such as subway expansions and highway renovations, necessitate using versatile and efficient equipment. Skid steer loaders are ideal for such projects due to their ability to navigate tight spaces and perform various tasks. This adaptability makes them indispensable for urban construction and infrastructure maintenance, thus boosting market demand.

Europe Skid Loaders Market Trends

Europe skid loaders market was identified as a lucrative region in 2023. The push towards sustainability and green building practices influences the market in the region. The European Union’s commitment to reducing carbon emissions and promoting sustainable construction practices has increased demand for environmentally friendly machinery. These machines offer reduced emissions and lower noise levels, making them suitable for use in urban areas with stringent environmental regulations.

Germany skid steer loaders market held a substantial market share in 2023. The German government’s commitment to infrastructure development, including housing initiatives and public works, has significantly increased the demand for construction equipment, including skid steer loaders. For instance, the “Housing Construction Program” initiated by the German government aims to build hundreds of thousands of new homes by 2025. This surge in construction activities necessitates versatile machinery like skid steer loaders that can efficiently perform various tasks such as excavation, grading, and material handling.

Asia Pacific Skid Loaders Market Trends

Asia Pacific skid steer loaders market is anticipated to register the fastest CAGR over the forecast period. Countries such as China and India are witnessing large-scale urbanization and infrastructure development, which drives the demand for versatile construction machinery. For instance, China’s Belt and Road Initiative (BRI) includes numerous infrastructure projects such as highways, bridges, and urban developments, where skid steer loaders are essential for excavation, grading, and material handling tasks. Similarly, India’s extensive urban renewal projects and Smart Cities Mission increase the need for efficient and adaptable construction equipment.

India skid steer loaders market is expected to grow rapidly in the coming years. With India's rapid urbanization and expansion of metropolitan areas, the demand for versatile and efficient construction machinery is on the rise. Major infrastructure projects such as the development of the Delhi-Mumbai Expressway and the expansion of Mumbai's Metro network have significantly increased the need for skid steer loaders.

Key Companies & Market Share Insights

Some of the key companies in the skid steer loaders market Bobcat, Caterpillar Inc., Deere & Company, CNH Industrial N.V., and others.

-

Bobcat provides a variety of skid steer loaders, offering multiple models with varying lifting capacities and features to meet a range of job site requirements. They also offer a wide range of accessories, such as buckets and augers, to brooms and trenchers, which improve the versatility and productivity of their skid steer loaders in different situations.

-

Caterpillar Inc. offers a diverse range of machinery designed to enhance productivity and efficiency on job sites. Among its extensive product lineup, skid steer loaders stand out as versatile and compact machines essential for various applications, including construction, landscaping, and agriculture. Caterpillar’s skid steer loaders are engineered with advanced technology and robust features that allow operators to easily perform tasks such as digging, grading, lifting, and material handling.

Key Skid Steer Loaders Companies:

The following are the leading companies in the skid steer loaders market. These companies collectively hold the largest market share and dictate industry trends.

- Bobcat

- Caterpillar Inc.

- Deere & Company

- CNH Industrial N.V.

- Komatsu Ltd.

- JCB Inc.

- Kubota Corporation

- Yanmar Co., Ltd.

- Volvo Construction Equipment

- Wacker Neuson Group

Recent Developments

-

In April 2024, Bobcat unveiled its innovative electric telehandler concept at the INTERMAT 2024, showcasing a significant step towards sustainable machinery in the construction industry. The electric telehandler is designed to meet the growing demand for environmentally responsible equipment, such as the skid steer loader, without compromising power or efficiency.

-

In October 2023, Caterpillar Inc. launched 255 and 265 loaders designed to enhance productivity and efficiency in various construction applications. These models feature advanced hydraulic systems and improved engine performance, making them suitable for high-power and maneuverability tasks.

Skid Steer Loaders Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.69 billion

Revenue forecast in 2030

USD 12.56 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Rated Operating Capacity (ROC), Application, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, and South Africa

Key companies profiled

Bobcat Company, Caterpillar Inc., Deere & Company, CNH Industrial N.V., Komatsu Ltd., JCB Inc., Kubota Corporation, Yanmar Co., Ltd., Volvo Construction Equipment, Wacker Neuson Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Skid Steer Loaders Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global skid steer loaders market report based on rated operating capacity (ROC), application, and region:

-

Rated Operating Capacity (ROC) Outlook (Revenue, USD Million, 2018 - 2030)

-

Upto 1,250 lbs

-

1,251 to 2,200 lbs

-

More than 2,200 lbs

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction & Mining

-

Landscaping & Ground Maintenance

-

Agriculture

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.