- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Silt Curtain Market Size, Share, Global Industry Report, 2025GVR Report cover

![Silt Curtain Market Size, Share & Trends Report]()

Silt Curtain Market (2019 - 2025) Size, Share & Trends Analysis Report By Product (Type I, Type II, Type III), By Application, By Region (North America, Europe, Asia Pacific, CSA, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-246-4

- Number of Report Pages: 112

- Format: PDF

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silt Curtain Market Summary

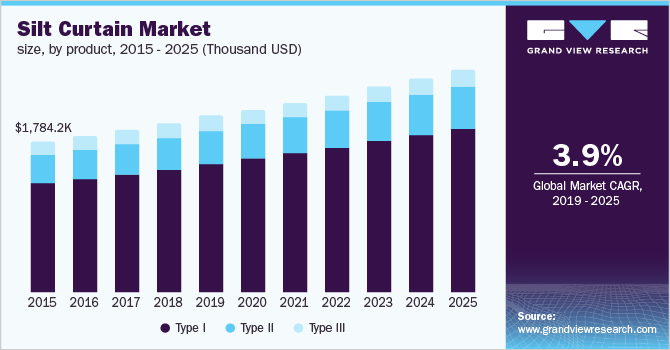

The global silt curtain market size to be valued at USD 7.2 million by 2018 and is projected to reach USD 9.4 million by 2025, growing at a CAGR of 3.9% from 2019 to 2025. Increasing awareness regarding environmental degradation due to construction activities along the seashore is anticipated to have a positive impact on market growth.

Key Market Trends & Insights

- North America is estimated to reach USD 2.8 million by 2025.

- By application, the erosion control application segment is estimated to reach 824.7 thousand USD by 2025.

- By product, type II silt curtains segment is estimated to reach USD 1.7 million by 2025.

Market Size & Forecast

- 2018 Market Size: USD 7.2 Million

- 2025 Projected Market Size: USD 9.4 Million

- CAGR (2019-2025): 4.8%

- North America: Largest market in 2018

Silt curtains are installed in a wide range of construction projects undertaken majorly within the vicinity of water bodies to prevent the flow of silt and sediments in the waterways, thereby helping avoid the contamination of water bodies. Furthermore, the product is used along the shorelines to avoid loosening of the soil and prevent it from being washed away from the bank or shore into the waterbody. Rapid growth in the U.S. marine construction industry and the product’s ability to reduce clogging by separating soil and sediments from water during construction activities are anticipated to augment the product demand in the country. Furthermore, rising government investments to upgrade old infrastructures such as bridges, docks, and dams are expected to complement market growth.

The governments of various developed economies such as the U.S. and Germany have mandated the use of silt curtains in construction activities near water bodies, which is anticipated to have a positive impact on market growth. Furthermore, increasing government policies pertaining to oil spills in Russia is expected to boost product demand.

Silt curtains are used in dredging, bridge construction, dam construction, as well as for preventing construction debris runoff into the water bodies. Furthermore, rising awareness about water conservation and maintaining water quality is anticipated to boost product demand in the aforementioned applications. In addition, various governments are making it mandatory to use silt curtains during construction activities to safeguard the ecosystem.

However, lack of awareness regarding the difference between silt fence, geotextiles, and silt curtains is anticipated to restrain the product demand in the emerging economies such as India, Brazil, South Africa, Mexico, and Argentina. The presence of limited companies providing the entire silt curtains assembly is projected to restrain the market growth.

Silt Curtain Market Trends

The market is expected to grow as consumers are becoming aware of the environment deterioration caused by construction near water sources. Furthermore, the growing demand to limit water pollution is expected to boost the demand for silt curtains in the forecast period. The majority of new projects near water bodies have these curtains built in order to avoid silts and sediments from flowing into the water and polluting the water bodies. Furthermore, silt curtain is gaining traction as it reduces soil loosening along shorelines, which is expected to increase the demand.

Similarly, the rising demand for bridge and dam repair and maintenance and the increased use of such curtains in the marine sector is expected to provide numerous potential opportunities for the silt curtain market in the forecast period. However, various products for the same application are available in the market as the use of other silt barriers such as silt walls, silt fences, and other turbidity barriers is expected to restrain market growth in the projected period. Moreover, product demand is projected to be constrained in developing markets such as Argentina, South Africa, India, Mexico, and Brazil due to a lack of knowledge of the differences between geotextiles, silt fences, and silt curtains.

Product Insights

Silt curtains majorly consist of a series of continuous flotation elements along the top with a fabric skirt or screen hanging beneath the floats. Increased construction activities along the water bodies and rising awareness regarding the prevention of water pollution are anticipated to augment market growth.

Type I silt curtains, also referred to as type I turbidity curtains, are floating barriers designed to regulate or control runoff and various sediments, especially in calm water bodies. The product segment is estimated to witness growth at a CAGR of 4.2%, in terms of volume, from 2019 to 2025 owing to its increasing application in small ponds, roadside construction projects, and calm water lakes.

Type II silt curtains segment is estimated to reach USD 1.7 million by 2025 on account of their ability to contain turbidity and silt in various moving water applications. In addition, increasing penetration of these products in multiple applications such as dredging projects, pile driving, DOT roadwork & construction projects, shoreline construction, riprap installation, and remediation projects is likely to impact the segment growth positively.

Type III turbidity curtains are designed to have combined strength of high-strength fabric along with heavy-duty tension members (below and above the floatation as well as beneath the curtains), stress plates at the bottom corners of the skirt, and fabric reinforcement. The aforementioned abilities of the product aid in controlling sediment and silt during marine construction activities in turbulent water bodies, thereby driving market growth.

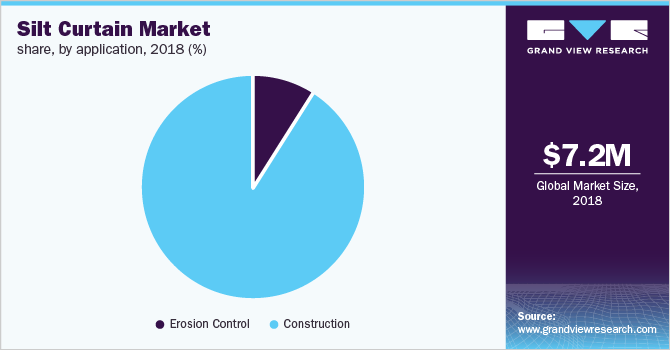

Application Insights

The erosion control application segment is estimated to reach 824.7 thousand USD by 2025; however, product penetration is currently limited to areas where other sediment and erosion control techniques cannot be used. Furthermore, environmental awareness regarding vegetation growth through product installation is likely to complement market growth.

Rising awareness and favorable government regulations related to erosion control are anticipated to drive the product demand in developing economies in Asia Pacific and Latin America. In addition, the ability of the product to control soil erosion helps maintain the composition of riverbank areas by trapping silt and sediments.

The application of the product in construction activities is expected to witness growth at a CAGR of 3.9%, in terms of revenue, from 2019 to 2025. This growth can be attributed to its penetration in various construction activities such as in the repair and construction of rock wall, jetty & bridges, civil works in or adjoining waterways, marine or coastal dredging, and for sediment pond management.

The major function of these products is to contain suspended sediments and silt around one to two meters from the surface of the water, resulting in the settling of suspended particles that are primarily caused due to ongoing construction activities. This, in turn, results in controlling any further dispersion and reducing the environmental impact of construction activities, thereby, complementing the product demand in construction applications.

Regional Insights

North America is estimated to reach USD 2.8 million by 2025 on account of the occurrence of natural disasters such as hurricanes and storms in the past few years. Rising penetration of silt curtains in restoring the structures affected by these disasters is expected to complement market growth in the region.

Increased dredging activities in France for the repair and maintenance of waterways are anticipated to augment the demand for silt curtains over the forecast period. The rising number of renovation projects by Voies navigables de France (VNF) under the waterway modernization plan including the replacement of 29 manually operated dams on Aisne and Meuse rivers by automated water-inflated dams is expected to drive the market growth in the country.

Construction activities pertaining to the exploration of oil & gas is one of the major application areas for the market in Argentina. A stable government coupled with steady GDP growth is expected to augment exploration and production activities in the country. This, in turn, is projected to positively influence product penetration in the oil and gas industry over the forecast period for the prevention of water contamination caused by oil spills in the country.

The sanction and commencement of infrastructural development projects in developing economies such as China, Australia, India, and New Zealand are expected to drive the demand for construction materials. Silt curtains are estimated to witness a CAGR of 4.1% from 2019 to 2025, in terms of revenue, in Asia Pacific owing to their use in construction projects along the riverside and lakeside as well as in the maintenance and repair works of dams and bridges.

Key Companies & Market Share Insights

The Companies are majorly focusing on research & development activities to improve the product quality and durability to serve various application requirements as well as alleviate the threat of new entrants.

Furthermore, for individual projects, these companies are engaged in the manufacturing of customized products depending on government regulations, project duration, and the condition of the operating water body. In addition, primary key players offer additional services such as fabrication, distribution, design support, and project management as per customer requirements. For instance, Nilex Inc. offers innovative solutions to overcome the challenges related to resource, civil, and environmental construction projects. The company is engaged in providing new avenues to aid its clients in new product development as well as exploring new business ideas.

Recent Developments

-

In February 2022, Riverbend Consolidated Mining Corp. (RCMC) built an additional 13 settling ponds, with their operator, Arc Nickel Resources Inc. They have started construction on two giant dams and deployed silt curtains in important Davao Oriental locations to prevent silt from reaching the sea.

-

In September 2020, the action plan for the ecological development of Country Garden Forest City was released, which established the ecological development purpose and clearly specified the goals and targets of eco-city management, development, and operation in phases. Forest city relentlessly invested in the development such as the installation of a double-layer silt barrier during reclamation work and seagrass conservation.

Some of the prominent players in the silt curtain market include:

-

ACME Environmental

-

Nilex Inc.

-

ABASCO LLC

-

GEI Works

-

Elastec

Silt Curtain Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 8.4 million

Revenue forecast in 2025

USD 9.4 million

Growth Rate

CAGR of 3.9% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Volume in thousand square meters, revenue in thousand USD and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; Russia; Spain; U.K.; China; India; Japan; South Korea; Australia; Argentina; Brazil; South Africa; United Arab Emirates

Key companies profiled

ACME Environmental; Nilex Inc.; ABASCO LLC; GEI Works; Elastec

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silt Curtain Market SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global silt curtain market on the basis of product, application, and region:

-

Product Outlook (Volume, Thousand Square Meters; Revenue, Thousand USD, 2014 - 2025)

-

Type I

-

Type II

-

Type III

-

-

Application Outlook (Volume, Thousand Square Meters; Revenue, Thousand USD, 2014 - 2025)

-

Erosion control

-

Construction

-

-

Regional Outlook (Volume, Thousand Square Meters; Revenue, Thousand USD, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Russia

-

Spain

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

United Arab Emirates

-

-

Frequently Asked Questions About This Report

b. The global silt curtain market size was estimated at USD 7.8 million in 2019 and is expected to reach USD 8.4 million in 2020.

b. The global silt curtain market is expected to grow at a compounded annual growth rate of 3.9% from 2019 to 2025 to reach USD 9.4 million in 2025.

b. Asia Pacific dominated the silt curtain market with a share of 39.6% in 2019. The sanction and commencement of infrastructural development projects in developing economies such as China, Australia, India, and New Zealand are expected to drive the demand.

b. Some key players operating in the silt curtain market include ACME Environmental, Nilex Inc., ABASCO LLC, GEI Works, and Elastec.

b. Key factors driving the silt curtain market growth include increasing awareness regarding environment degradation due to construction activities along the seashore

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.