- Home

- »

- Petrochemicals

- »

-

Silicone Surfactants Market Size, Industry Report, 2030GVR Report cover

![Silicone Surfactants Market Size, Share & Trends Report]()

Silicone Surfactants Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Application, By End Use (Personal Care, Construction, Textile, Paints & Coatings, Agriculture, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-006-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicone Surfactants Market Summary

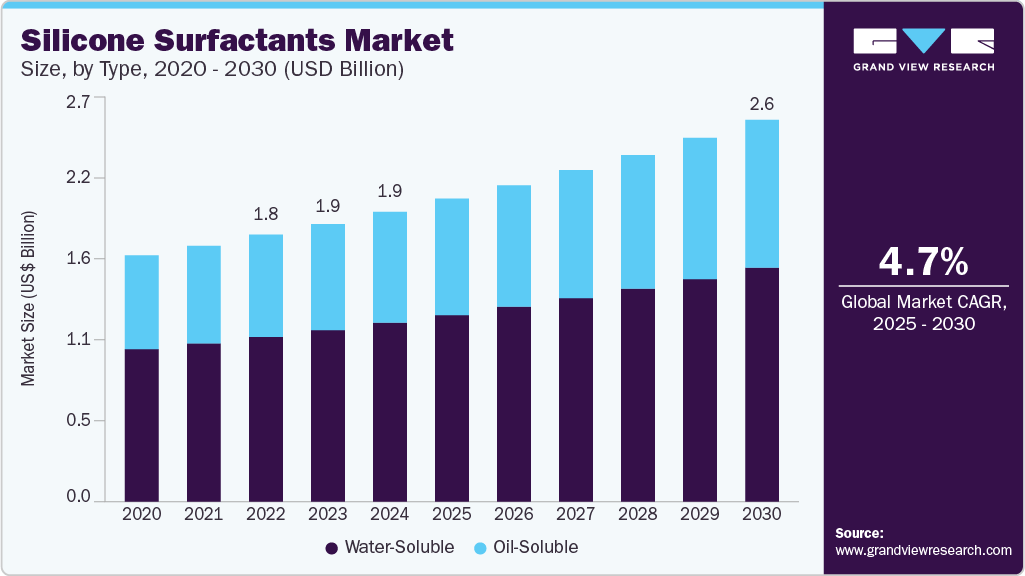

The global silicone surfactants market size was estimated at USD 1.98 billion in 2024 and is projected to reach USD 2.60 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. The silicone surfactants industry encompasses a range of specialty surface-active agents derived from silicone compounds, offering superior emulsification, spreading, and wetting capabilities across various industrial applications.

Key Market Trends & Insights

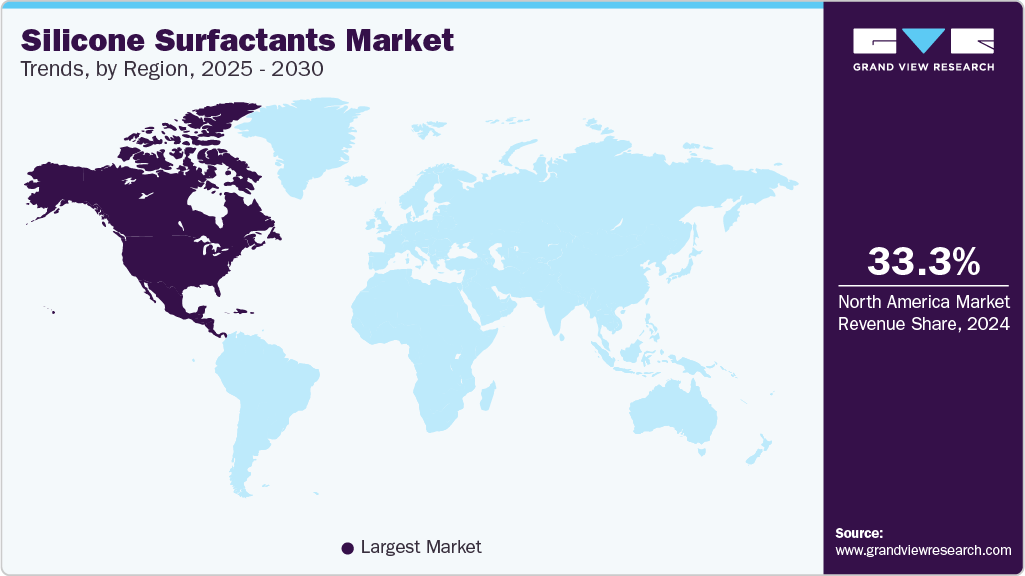

- North America accounted for the largest revenue share of 33.3% in 2024.

- Europe is estimated to grow at the fastest CAGR in the silicone surfactants industry over the forecast period.

- Asia Pacific silicone surfactants industry held a significant revenue share in 2024.

- Based on type, the water-soluble segment dominated the market with a revenue share of 61.7% in 2024.

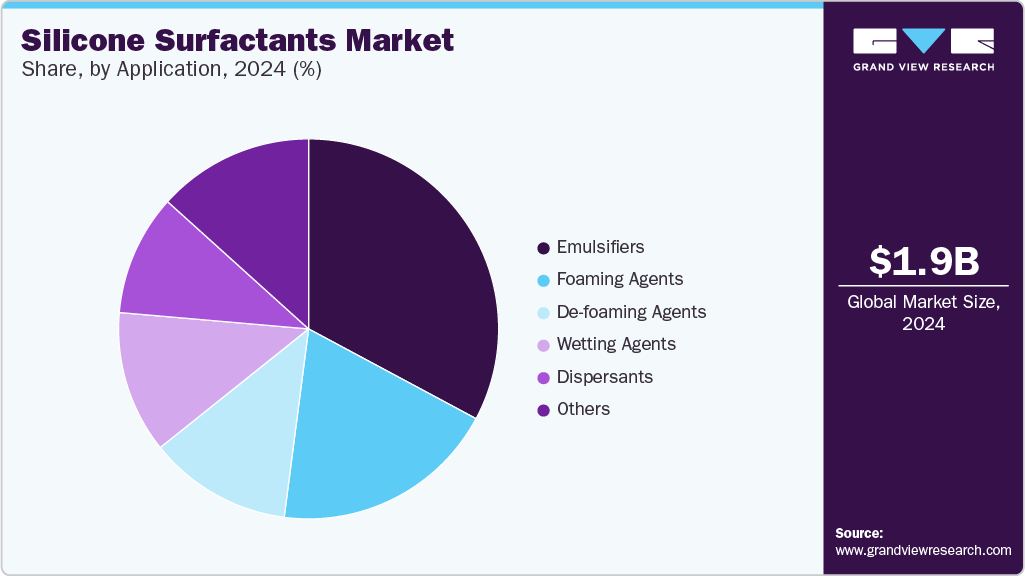

- In terms of application, the emulsifiers segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.98 Billion

- 2030 Projected Market Size: USD 2.60 Billion

- CAGR (2025-2030): 4.7%

- North America: Largest market in 2024

- Europe: Fastest growing market

Market growth is primarily driven by increasing demand from the personal care sector, where these surfactants enhance formulation aesthetics, stability, and performance in skincare and haircare products. Additionally, the increasing use of silicone surfactants as agricultural adjuvants to improve the efficacy and distribution of crop protection chemicals is contributing to market expansion. The construction and automotive industries are also key growth drivers, owing to rising consumption in polyurethane foam production for insulation and cushioning. Furthermore, ongoing innovation in silicone-based chemistry and a growing shift toward high-performance, multifunctional surfactants are expected to support long-term market development.

Growth in cosmetics and personal care manufacturing has surged the product demand from grooming, skincare, and hair care formulation applications. Natural products are a major trend in the cosmetics and personal care industry. The demand for cosmetics and personal care products made from natural ingredients has increased due to improvements in lifestyle, rising per capita income, and greater awareness of natural products. Moreover, natural surfactants in cosmetics and personal care products augment the performance of the formulations.

The growing emphasis on sustainability presents a compelling opportunity for silicone surfactant manufacturers to invest in bio-based and eco-friendly formulations. With increasing regulatory scrutiny and rising consumer awareness, especially in personal care and agriculture, demand for biodegradable and non-toxic ingredients is accelerating. According to a 2025 survey by the National Sanitation Foundation (NSF), 74% of consumers prioritize organic ingredients in personal care products, and 45% are willing to pay a premium for certified organic options. Companies leveraging green chemistry and sustainable sourcing strategies stand to gain a competitive edge by aligning with these evolving market expectations. This shift supports compliance and brand differentiation and unlocks new revenue streams in high-growth, sustainability-driven segments.

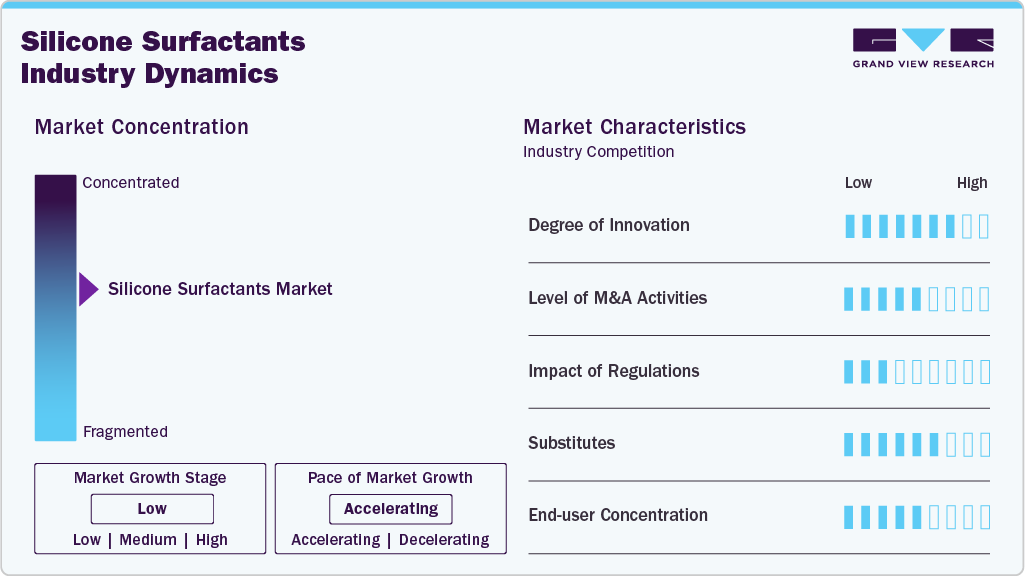

Market Concentration & Characteristics

The global silicone surfactants industry exhibits moderate growth, with leading companies such as Dow, Momentive, Elkem ASA, Evonik Industries AG, and Shin-Etsu Chemical Co., Ltd. collectively accounting for major market share. These key players maintain a competitive edge through robust R&D capabilities, diverse product portfolios, and well-established distribution networks. Market growth is primarily driven by increasing demand across personal care, construction, agriculture, and industrial sectors, fueled by a rising preference for high-performance, low-Volatile Organic Compounds (VOC), and sustainable surfactant solutions.

In addition to these market leaders, companies like Innospec, AB Specialty Silicones, Siltech Corporation, and Supreme Silicones are strengthening their presence through innovation in bio-based formulations and strategic regional expansion. For instance, on June 6, 2023, Evonik Industries AG launched TEGO Rad 2550, a radically cross-linkable defoaming and slip additive for radiation-curing inks and coatings. This low-viscosity, clear liquid is engineered to reduce both static and dynamic surface tension in UV- and LED-cured systems, while enhancing scratch resistance and enabling hydrophobic surface formation, underscoring Evonik’s commitment to delivering high-performance solutions for advanced coatings applications.

The silicone surfactants industry is increasingly shaped by evolving regulatory standards and a increased focus on innovation and R&D. Market players are prioritizing the development of eco-friendly, biodegradable formulations to comply with environmental regulations and address growing consumer demand for sustainable products. Efforts include the advancement of green silicone surfactants aligned with global sustainability objectives. Moreover, R&D initiatives are expanding into emerging applications such as solar energy and lithium-ion batteries, reflecting a broader shift toward high-efficiency and environmentally responsible technologies.

Type Insights

The water-soluble segment dominated the market with a revenue share of 61.7% in 2024, owing to the growing utilization of the product in the agriculture industry in the formulation of fertilizers, which is anticipated to boost the growth of water-soluble surfactants. In addition, the increasing demand for water-soluble solutions in agriculture, cosmetics and personal care, food & beverage, textiles, and home care sectors is further driving the growth of the segment. For instance, in 2024, Shin-Etsu Chemical introduced the KRW-6000 Series, the first water-based, fast-curing silicone resin that eliminates the need for emulsifiers. This innovation enables VOC-free formulations and lowers greenhouse gas emissions, making it a sustainable, high-performance solution for the paints and coatings industry.

The oil-soluble segment is expected to register the fastest growth during the forecast period. The penetration of oil-soluble type in the drilling fluids is growing due to its potential to improve viscosity. The drilling fluid sector is highly dependent on the oil-soluble surfactants as it allows high surface tension and high stability. Additionally, oil-soluble silicone surfactants are gaining traction due to their superior emulsification properties in formulations requiring enhanced spreadability and moisture retention. The growing adoption of oil-soluble silicone surfactants in specialized personal care and cosmetic formulations, particularly in long-wear and water-resistant products, is a key factor propelling segment growth. Demand is also supported by rising consumer preference for high-performance formulations in skincare and haircare, contributing positively to the segment's expansion.

Application Insights

The emulsifiers segment dominated the market in 2024. This can be attributed to the increasing use of silicone surfactants in cosmetics and personal care, and home care products formulation, such as lotions, shampoo, hand wash, soaps, and detergents. Emulsifiers are used to alleviate polyurethane foam, hence, the growth of PU foam is anticipated to trigger the growth of the emulsifiers segment.

The foaming agents segment is projected to witness the fastest growth within the silicone surfactants market, driven by rising demand across personal care, household, and industrial cleaning applications. These surfactants enhance foam stability and texture, making them essential in shampoos, facial cleansers, and detergents. Growing consumer preference for high-foaming, sensory-rich formulations is further accelerating segment adoption. Additionally, innovations in mild, skin-friendly foaming agents are contributing to expanded usage across sensitive skin and baby care products.

The wetting agent segment is expected to grow notably during the forecast period. The penetration of wetting agents in the agriculture industry is growing due to their potential to improve crop quality and growth. They are also used to increase the volume and efficiency of crop production. The agriculture industry is highly dependent on the wetting agent as it allows water to spread evenly on the surface and for better penetration.

Also, the demand for dispersants is growing as they provide stability, protection from harmful UV rays, and coating strength. It helps in improving the workability of the fluid. Due to such properties, it is widely used in the paint and coatings industry, which is anticipated to drive the market. In addition, the emulsifying and foaming properties of silicone surfactants have resulted in an increasing demand for these surfactants globally.

Additionally, BYK-3481, a 100% active silicone surfactant developed by BYK, is specifically engineered for aqueous systems, offering superior substrate wetting through substantial surface tension reduction. This surfactant delivers a combination of excellent defoaming efficiency, anti-cratering performance, and enhanced leveling characteristics. Its formulation is particularly effective in clearcoat applications, where uniform surface finish and defect prevention are critical. Owing to its multifunctional profile, BYK-3481 is widely adopted in high-performance coatings, aligning with industry trends toward advanced, waterborne formulations.

End Use Insights

The personal care segment dominated the market in 2024. The rising utilization of silicone surfactants in the formulation of personal care products is a key growth driver for the market, owing to their role as effective foaming and emulsifying agents that enhance product performance and user experience. Additionally, silicone surfactants are widely adopted in the paints and coatings industry, where they improve application properties such as dispersion, spreadability, and retention, thereby increasing their appeal across high-growth sectors including construction, automotive, and wood finishing.

The paints & coatings segment is expected to grow at the fastest CAGR during the forecast period. Silicone surfactants play a significant role in the paints and coatings industry, offering key performance enhancements such as improved spreadability, leveling, and pigment dispersion. These surfactants help reduce surface tension, resulting in smoother finishes, better substrate wetting, and enhanced durability of the final coating. Their ability to improve water repellency and resistance to environmental factors makes them especially valuable in automotive, construction, and wood coatings. As demand for high-performance, eco-friendly coatings continues to grow in these sectors, the adoption of silicone surfactants is expected to rise steadily.

Beyond these, silicone surfactants are gaining traction in textiles, agriculture, and construction, particularly in emerging economies. In agriculture, the use of bio-based silicone surfactants with water-based sprays supports improved wetting, emulsification, and spreading, aligning with sustainability goals. The ongoing industrialization and rising investments across Asia Pacific are expected to significantly boost product demand across these diverse applications.

Regional Insights

North America accounted for the largest revenue share of 33.3% in 2024. The market is driven by rising demand for high-performance and environmentally sustainable surfactant technologies. Key application sectors, including personal care, paints and coatings, and agriculture, are increasingly adopting silicone surfactants due to their superior functional properties and environmental compatibility. The region benefits from stringent regulatory standards that promote the use of low-VOC and bio-based ingredients, encouraging innovation in green chemistry. Additionally, strong consumer awareness and preference for eco-friendly formulations are accelerating product uptake. The presence of a mature industrial ecosystem, along with sustained investment in research and development, continues to reinforce North America’s leadership in adopting advanced material technologies.

U.S. Silicone Surfactants Market Trends

The U.S. dominated the regional silicone surfactants market in 2024. This expansion is largely attributed to increasing demand from key industries such as personal care, agriculture, and paints and coatings, where silicone surfactants offer enhanced functionality and sustainability. Regulatory support for low-VOC and bio-based solutions is fostering greater adoption across applications. Furthermore, a growing consumer inclination toward eco-friendly and premium product formulations is reinforcing demand, particularly in skincare and cosmetics. The presence of a mature industrial base and ongoing investments in research and development continue to drive innovation and competitive advancement within the market.

Europe Silicone Surfactants Market Trends

Europe is estimated to grow at the fastest CAGR in the silicone surfactants industry over the forecast period, driven by increasing demand across the personal care, construction, and agriculture sectors. Leading economies such as Germany, France, and the UK are at the forefront of adoption, supported by a strong consumer shift toward sustainable and high-performance formulations. Stringent environmental regulations in the region are compelling manufacturers to innovate low-emission and eco-friendly surfactant solutions. Backed by a mature industrial infrastructure and sustained R&D investments, Europe remains a hub for advanced silicone surfactant applications.

Germany is emerging as one of the key markets for silicone surfactants in the region, and it is projected to expand at the fastest CAGR during the forecast period. This growth is primarily supported by the country’s strong industrial base, particularly in the personal care, automotive, and construction sectors, which are significant consumers of high-performance surfactants. Additionally, Germany’s stringent environmental regulations are accelerating the shift toward sustainable and low-VOC chemical formulations, prompting increased adoption of silicone-based surfactants. Continuous investments in R&D and innovation, coupled with a focus on green chemistry, further reinforce Germany’s position as a key driver in the regional market landscape.

Asia Pacific Silicone Surfactants Market Trends

Asia Pacific silicone surfactants industry held a significant revenue share in 2024. This is attributed to the region’s rapid industrialization, expanding construction activities, and increasing consumption of personal care and agricultural products, particularly in China, India, and Southeast Asia. Additionally, favorable government policies supporting domestic manufacturing and sustainable chemical production have strengthened regional demand. Strategic capacity expansions by key manufacturers further reinforce Asia Pacific’s position as a manufacturing and consumption hub for silicone surfactants.

Key Silicone Surfactants Company Insights

Some of the key companies in the silicone surfactants industry include Dow,Momentive, and others. Companies dominate the market with their continuous focus on manufacturing innovative products. Organizations have been tactically implementing product launch, mergers and acquisitions, and other strategies to gain a competitive advantage.

-

Dow is actively expanding its silicone surfactant portfolio, particularly in personal care, agriculture, and polyurethane foam applications. The company focuses on sustainable innovation, offering high-performance, eco-friendly solutions tailored to evolving customer needs.

-

Momentive emphasizes specialty silicone technologies, including advanced surfactants for coatings, personal care, and industrial applications. The company invests in R&D and strategic partnerships to deliver customized, performance-driven solutions that align with global sustainability goals.

Key Silicone Surfactants Companies:

The following are the leading companies in the silicone surfactants market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Innospec

- Momentive

- Elkem ASA

- Shin-Etsu Chemical Co., Ltd.

- Evonik Industries AG

- AB Specialty Silicones

- Supreme Silicones

- Siltech Corporation

Recent Developments

-

In April 2025, KCC Silicone launched SeraSense AG 21, a high-performance silicone fluid engineered to enhance makeup longevity and deliver a premium glossy finish. Leveraging a dual-function hydrophilic-hydrophobic profile, the formulation enables superior color vibrancy, extended wear, and a lightweight, non-tacky application experience. Positioned to support the accelerating demand for advanced cosmetic technologies, particularly within the K-beauty segment, SeraSense AG 21 reinforces KCC Silicone’s commitment to innovation and market-driven product development.

-

In March 2024, WACKER Chemie AG advanced its silicone capabilities with a USD 21.8 million investment in a new production facility at its Nünchritz site, Germany. Focused on one-component alkoxy silicone sealants for thermal insulation, the plant is set to begin operations in Q1 2025, supporting the company’s growth in sustainable construction solutions.

-

In March 2022, BASF launched Plantapon Soy, a sustainable, bio-based anionic surfactant derived from non-GMO soy protein and coconut oil. Designed for mild rinse-off applications, it is COSMOS-approved, vegan, and biodegradable, catering to the rising demand for natural ingredients in personal care products.

Silicone Surfactants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.06 billion

Revenue forecast in 2030

USD 2.60 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Tons, Revenue in USD thousand, and billion/million CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; South Korea; Southeast Asia; Brazil; Argentina; South Africa; Saudi Arabia;

Key companies profiled

DOW; Innospec; Momentive; Elkem ASA; Shin-Etsu Chemical Co., Ltd.; Evonik Industries AG; AB Specialty Silicones, AB Specialty Silicones; Siltech Corporation.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicone Surfactants Market Report Segmentation

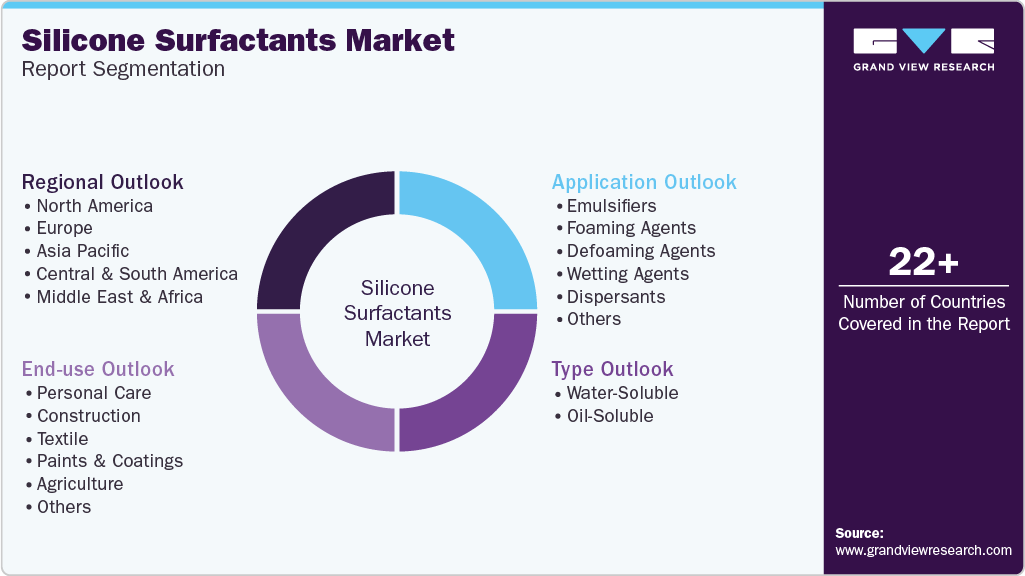

This report forecasts revenue growth at the global, regional, and country levels as well as provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the silicone surfactants industry report based on type, application, end use, and region:

-

Type Outlook (Revenue USD Thousand, Volume in Tons, 2018 - 2030)

-

Water-Soluble

-

Oil-Soluble

-

-

Application Outlook (Revenue USD Thousand, Volume in Tons, 2018 - 2030)

-

Emulsifiers

-

Foaming Agents

-

Defoaming Agents

-

Wetting Agents

-

Dispersants

-

Others

-

-

End Use Outlook (Revenue USD Thousand, Volume in Tons, 2018 - 2030)

-

Personal Care

-

Construction

-

Textile

-

Paints & Coatings

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue USD Thousand, Volume in Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.