- Home

- »

- Green Building Materials

- »

-

Shotcrete Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Shotcrete Market Size, Share & Trends Report]()

Shotcrete Market (2024 - 2030) Size, Share & Trends Analysis Report By Process (Wet Mix, Dry Mix), By Application (Repair Works, Underground Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-244-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shotcrete Market Size & Trends

The global shotcrete market size was estimated at USD 8.25 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. The market is expected to be driven by the growing infrastructural development projects around developing economies such as India, China, and Mexico. These projects include bridge rehabilitation, road construction, slope stabilization, and tunneling.

Shotcrete is used for stabilization, support, and lining in mining and tunnel construction. Thus, the growth of mining industry along with the underground construction projects are a few of the significant driving factors of the industry. Moreover, use of shotcrete leads to improved structural performance, reduced labor costs, and faster construction of tunnels and other mining projects.

The high investment cost for factory setup and equipment including pumps, mixing systems, and spraying machines may deter small manufacturers from entering the market, thereby hampering the overall growth of the market. In addition, application of shotcrete requires skilled operators to handle equipment and materials. The shortage of laborers in countries like the U.S. can pose a challenge for the industry.

Market Concentration & Characteristics

The market growth stage is medium, and pace of growth is accelerating. The industry is characterized by a high degree of innovation as many manufacturers have developed advanced shotcrete formulations to enhance the mechanical properties of the process. For instance, companies like BASF SE, Sika AG, and GCP offer fiber-reinforced shotcrete solutions that are more resistant to shrinkage, impact, and cracking compared to standard concrete solutions.

The level of mergers and acquisitions activities was recorded to be medium over the last decade as many shotcrete companies seek to expand their Process portfolio, and global presence, and capitalize on growth opportunities. Furthermore, few companies have acquired raw material suppliers to gain more control over their supply chain activities.

The industry is subject to high impact of safety regulations and standards as they establish minimum quality and performance standards. The manufacturers are obliged to comply with the regulations to ensure the durability, strength, and reliability of the structural components made using shotcrete.

There are various substitutes available of the product such as pre-cast concrete, traditional concrete, sprayed mortar, or fiber-reinforced plaster. Moreover, there are several factors to consider while choosing the material for any construction project, for instance, the site conditions, cost-effectiveness, project requirements, and construction method.

The market serves a diverse range of end users across various industries such as mining, tunneling, commercial & industrial construction, energy, and utility. Therefore, the end use concentration is high in the market. Understanding the specific needs of end users along with providing efficient services to the clients are a few of the major factors for the shotcrete manufacturers.

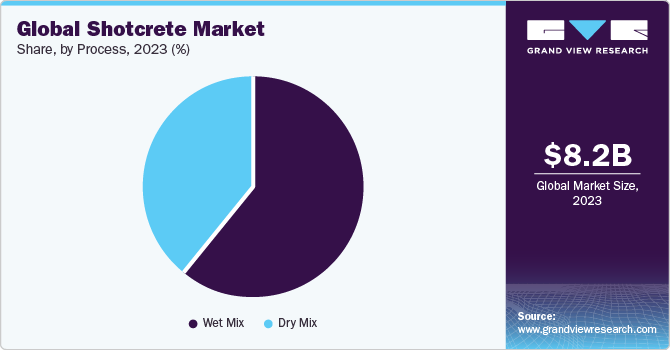

Process Insights

Based on process, the wet mix process segment led the market with the largest revenue share of 61.3% in 2023. The demand for wet mixed shotcrete is likely to be driven by their increasing utilization in applications such as underground mining operations, excavated rock surfaces, slope stabilization, structural repairs, and rehabilitation.

Furthermore, wet mix process is a rapid and efficient method for lining underground structures, controlling groundwater ingress in civil engineering projects, and creating stable openings in tunnels. The growing use of wet mix process is expected to boost the process growth over the forecast period.

The dry mix segment is projected to grow at a significant CAGR from 2024 to 2030, owing to its primary use in swimming pool construction and repairs & restoration of deteriorated concrete structures such as dams, tunnels, bridges, and buildings. In addition, dry mixed shotcrete is used for artistic and decorative rockworks, sculptures, and architecture further propelling the process demand.

Application Insights

Based on application, the underground construction segment held the market with the largest revenue share of over 35% in 2023. Shotcrete is widely used in underground construction owing to its efficiency, effective performance, strength, and versatility. It offers ground reinforcement, lining solutions, and structural support in challenging geological conditions.

Furthermore, shotcrete is employed in shaft sinking projects to stabilize shaft walls and prevent ground collapse during the construction and operation of shafts. Along with that, it is used in various underground excavations such as drifts, galleries, and caverns to reduce the risk of instability during construction or mining activities.

The slope & surface protection segment is expected to grow at a significant CAGR during the forecast period, as shotcrete is being used for reinforcing and stabilizing man-made and natural slopes from landslides, erosion, and other environmental hazards. In addition, shotcrete barriers absorb and dissipate the energy of falling rocks, reducing the potential damage to infrastructure and buildings below slopes.

Repair works segment also accounted for a major revenue share of the market in 2023 due to extensive use of shotcrete for repairing concrete structures, pipelines, stormwater drainage systems, and marine systems. Shotcrete is a durable, cost-effective, and rapid solution for restoring damaged structures across various sectors.

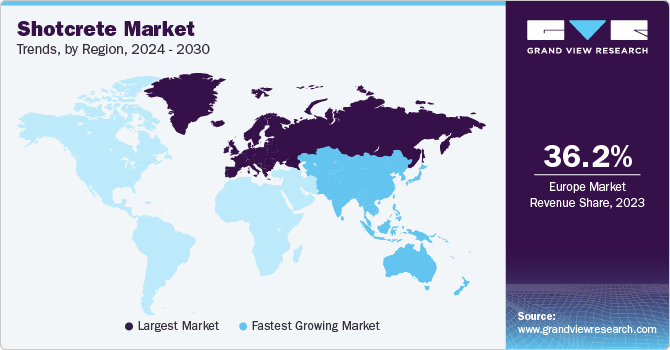

Regional Insights

The shotcrete market in North America is expected to witness at the significant CAGR over the forecast period, owing to rising investments in modernizing transportation systems, enhancing public amenities, and growing emphasis on environmental stability.

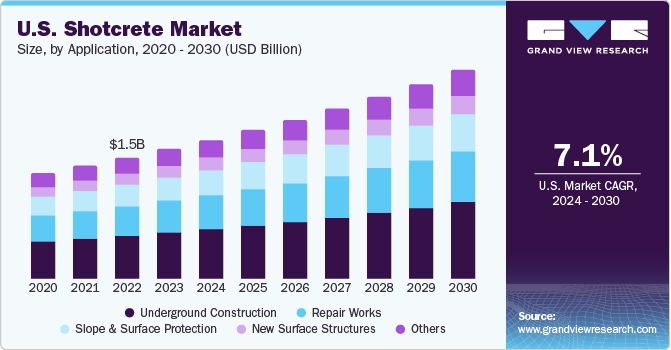

U.S. Shotcrete Market Trends

The U.S. shotcrete market is expected to grow at the fastest CAGR of 7.1% from 2024 to 2030. This growth is attributed to the U.S. government’s focus on infrastructural modernization and renewal projects.

The shotcrete market in Canada accounted with the revenue share of 19.4% in 2023, due to various factors such as mining and resource extraction, construction industry growth, and adoption of technological advancement related to shotcrete.

Europe Shotcrete Market Trends

Europe dominated the shotcrete market with the revenue share of 36.2% in 2023, owing to substantial investment in urban infrastructural development projects. The region’s robust use of shotcrete in underground construction, slope stabilization, and surface protection is expected to further boost the process demand over the forecast period. Moreover, Europe is a hub for technological innovation and research in construction industry. European companies invest in R&D initiatives to develop advanced shotcrete materials, thereby boosting the process demand.

The Germany shotcrete market is expected to grow at the fastest CAGR of 6.5% from 2024 to 2030, due to its growing population and significant infrastructural investment plans by the German government. The country’s strong economic growth coupled with rise in construction modernization projects over the forecast period is expected to drive the market growth in Germany.

Asia Pacific Shotcrete Market Trends

The shotcrete market in Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030, owing to growing infrastructural development projects in China, India, and Japan. Further, rising mining industry in Australia provides an opportunity for process manufacturers to capitalize on the demand for shotcrete.

The China shotcrete market accounted for a major revenue share in Asia Pacific region for the year 2023. Construction projects, for instance, Belt and Road Initiative (BRI) which is expected to be completed by 2049 are driving the process demand.

The shotcrete market in India is projected to grow at fastest CAGR of 7.8% over the forecast period. This growth is attributed to the growing population and increasing demand for urban amenities such as high-rise buildings, commercial complexes, and metro rail projects.

Middle East & Africa Shotcrete Market Trends

The shotcrete market in Middle East & Africa has witnessed high process demand as countries like Saudi Arabia, Qatar, and UAE are investing heavily in large-scale infrastructure projects such as urban development, high-rise buildings, transportation networks, and utilities.

The Saudi Arabia shotcrete market is growing primarily due to presence of a wide variety of natural resources including oil, minerals, and gas which drives the quarrying and mining operations in the country, thereby driving the process demand.

Central & South America Shotcrete Market Trends

The shotcrete market in Central & South America is projected to grow at the fastest CAGR over the forecast period, owing to the construction industry growth, rise in wastewater management projects, and increasing natural disaster mitigation efforts.

The Brazil shotcrete market is projected to grow at the fastest CAGR during the forecast period, due to the rapid growth of construction projects in the country. Monte Dam exemplifies the demand for shotcrete in large-scale infrastructural projects.

Key Shotcrete Company Insights

Some of the key players operating in market are Sika AG, BASF SE, Cemex, S.A.B. de C.V., GCP Applied Technologies, and Lafargeholcim Ltd.:

-

Sika AG specializes in chemical processes for construction industry such as concrete admixtures, waterproofing systems, roofing membranes, adhesives, sealants, and industrial flooring systems

-

BASF SE operates in various segments including building materials, chemicals, industrial solutions, nutrition & care, agricultural solutions, and surface technologies. BASF is known for its research & development activities to develop technologically advanced processes to address construction, agricultural, and personal care challenges

U.S. Concrete Inc., Mapei S.P.A., and Normet Group are some of the emerging participants in global market.

-

U.S. Concrete Inc. specializes in producing and supplying ready-mix concrete, shotcrete, along with other construction materials. The company operates in major metropolitan areas across the U.S. including New York City, San Francisco Bay, Dallas/Fort Worth, Washington D.C., and Houston

-

Mapei S.P.A. is an Italian company that is engaged in Procession of chemicals and materials for construction industry such as flooring process, concrete additives, sealants, and adhesives. The company serves residential, commercial, infrastructure, and industrial projects

Key Shotcrete Companies:

The following are the leading companies in the shotcrete market. These companies collectively hold the largest market share and dictate industry trends- Sika AG

- Grupo ACS

- BASF SE

- Heidelbergcement

- Cemex S.A.B. De C.V.

- GCP Applied Technologies

- U.S. Concrete Inc

- Lafargeholcim Ltd.

- Mapei S.P.A.

- Normet Group

Recent Development

-

In December 2023, Sika AG announced the Procession line for concrete admixture Sigunit in Luxembourg. The new Procession line will be used for transporting shotcrete accelerators more efficiently for major infrastructure projects such as the Second Gotthard Road Tunnel, in Switzerland and other significant tunnel projects in neighboring countries including Germany and Austria

Shotcrete Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.92 billion

Revenue forecast in 2030

USD 15.49 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

Sika AG; Grupo ACS; BASF SE; Heidelbergcement; Cemex S.A.B. De C.V.; GCP Applied Technologies; U.S. Concrete Inc; Lafargeholcim Ltd.; Mapei S.P.A.; Normet Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shotcrete Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the shotcrete market report based on process, application, and region:

-

Process Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wet Mix

-

Dry Mix

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Repair Works

-

Underground Construction

-

Slope & Surface Protection

-

New Surface Structures

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global shotcrete market size was estimated at USD 8.25 billion in 2023 and is expected to reach USD 8.92 billion in 2024.

b. The global shotcrete market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 15.49 billion by 2030.

b. Wet mix shotcrete led the market and accounted for over 61.3% share of the revenue in 2023, owing to its applications in construction, mining, and infrastructural projects.

b. Some of the key players operating in the shotcrete market include Sika AG, Grupo ACS, BASF SE, Heidelbergcement, Cemex S.A.B. De C.V., and Normet Group.

b. The key factors that are driving the global shotcrete market include utilizing shotcrete in underground construction, slope & surface protection, and new surface structures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.