- Home

- »

- Clothing, Footwear & Accessories

- »

-

Shoe Insoles Market Size And Share, Industry Report, 2033GVR Report cover

![Shoe Insoles Market Size, Share & Trends Report]()

Shoe Insoles Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Casual, Athletic, Orthotics), By Material (Foam, Gel, Rubber, Plastic, Carbon Fiber, Polyurethane), By End Use, By Price, By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-956-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Shoe Insoles Market Summary

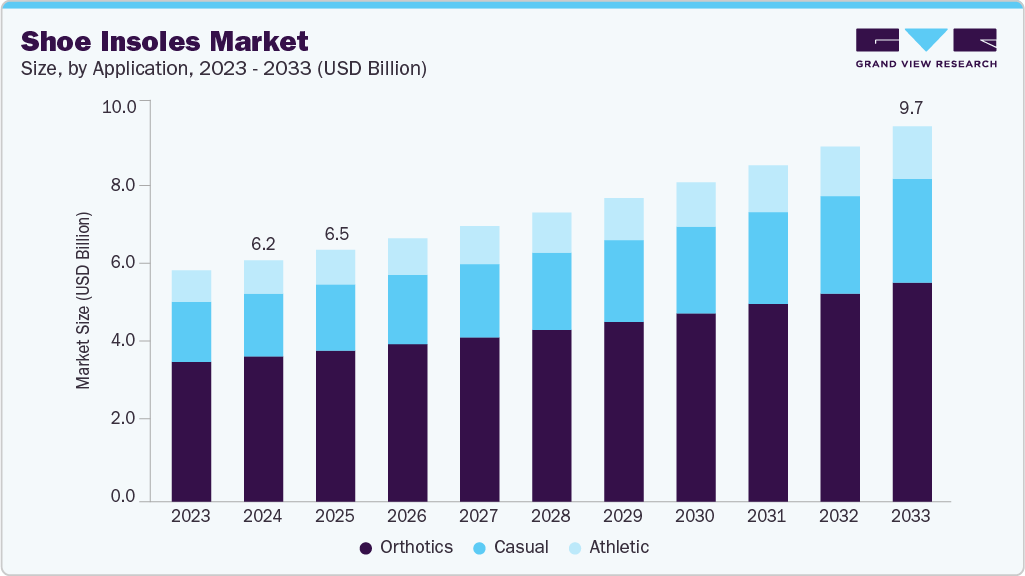

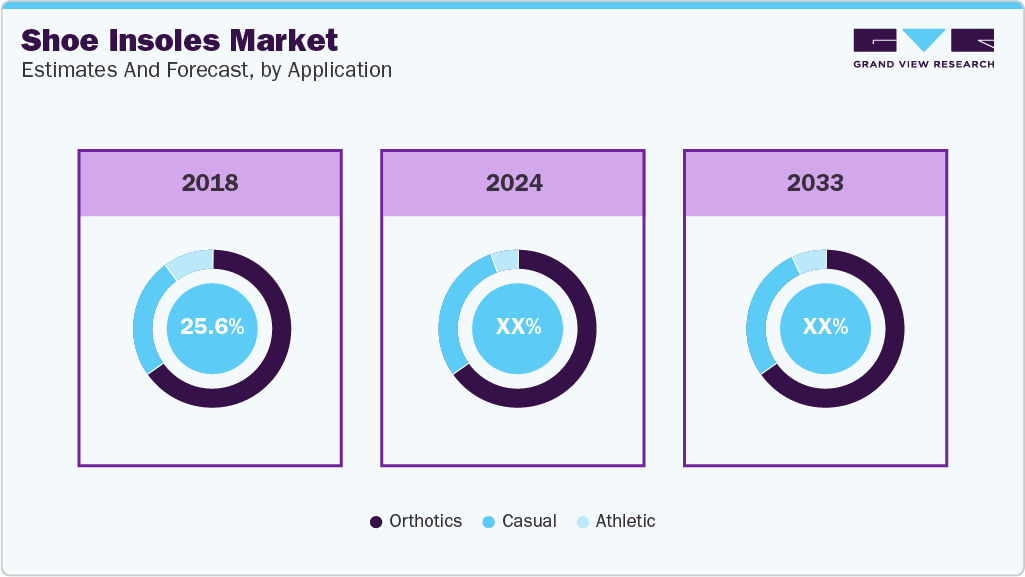

The global shoe insoles market size was estimated at USD 6.22 billion in 2024 and is projected to reach USD 9.69 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The increase in sports and athletic activities has fueled the market for shoe insoles.

Key Market Trends & Insights

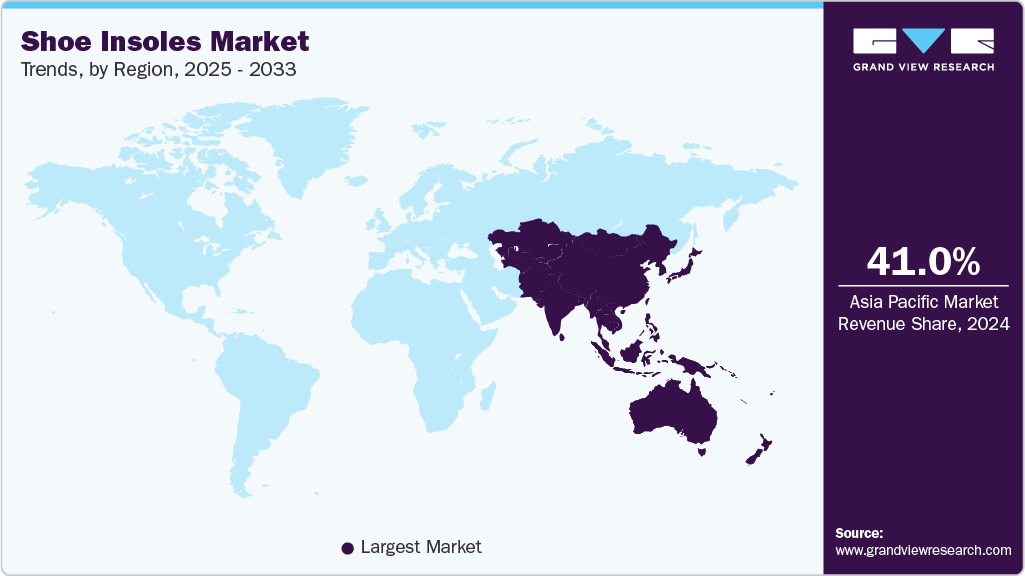

- Asia Pacific dominated the global shoe insoles industry in 2024 with a revenue share of 41.0%.

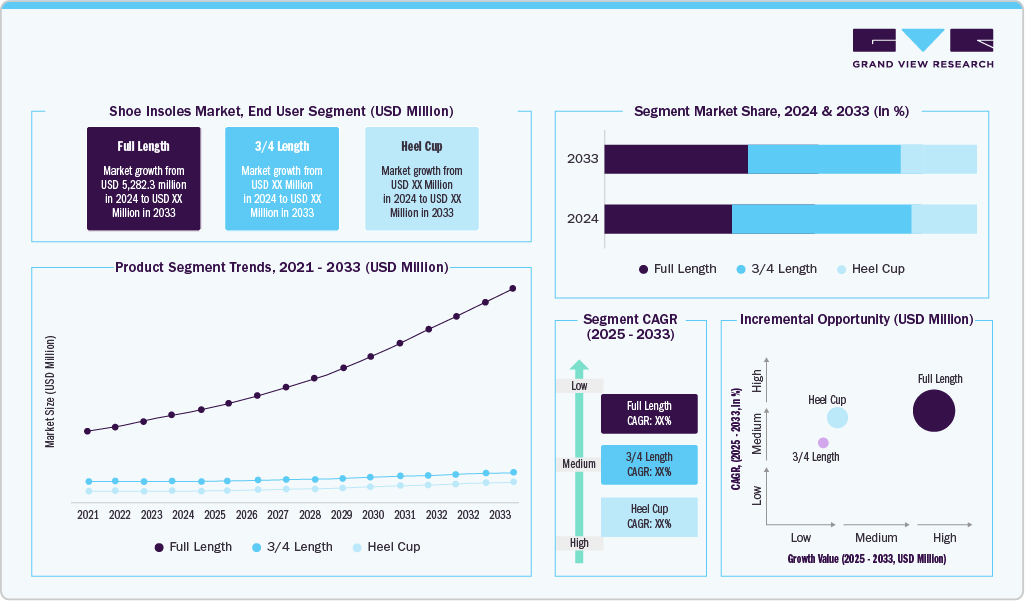

- Based on type, the full length segment accounted for 84.9% share of the global shoe insoles industry in 2024.

- By application, the orthotics segment dominated the global market for shoe insoles and accounted for a share of 60.2% in 2024.

- Based on material, the carbon fiber segment is expected to grow at a significant CAGR of 6.2% from 2025 to 2033.

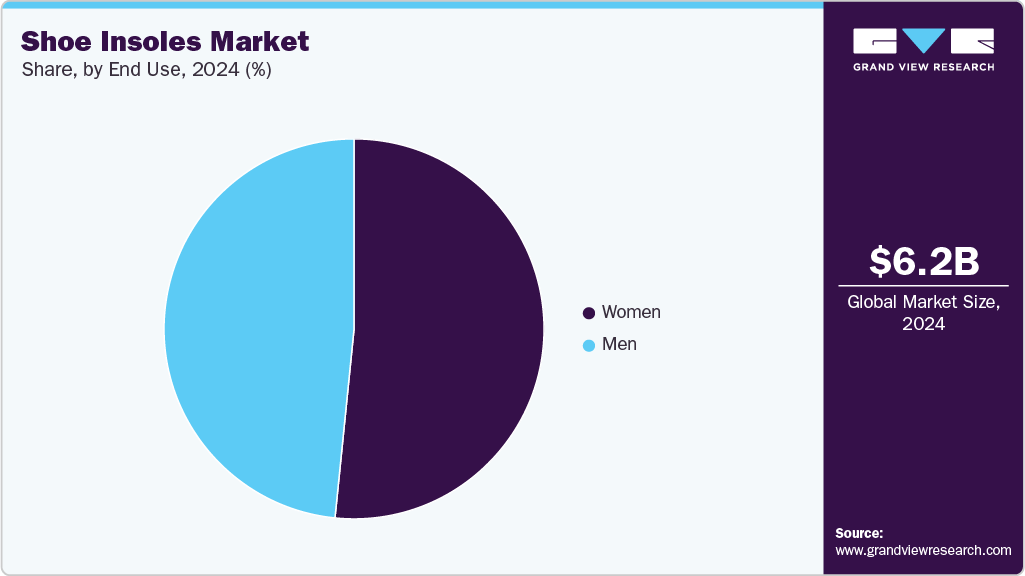

- By end use, the women segment spearheaded the market and accounted for a revenue share of over 50% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.22 Billion

- 2033 Projected Market Size: USD 9.69 Billion

- CAGR (2024-2030): 5.1%

- Asia Pacific: Largest market in 2024

This impact has increased consumer demand for customized insoles that improve performance and comfort and help reduce the risk of injury. The growing prevalence of diabetes is also expected to drive the demand for diabetic-friendly shoe insoles. Consumers are increasingly seeking insoles that offer both support and style, and with the convenience of online shopping, they have access to a wide range of options to cater to their specific needs and preferences.

People of all ages participate in various sports, from leisure cycling and running to team sports and endurance events. This has significantly driven the demand for sports footwear as it provides various advantages including injury prevention, shock absorption, stability, and support. Moreover, key players operating in the market are also launching new sports footwear that incorporates such advantages. For instance, in January 2023, ASICS launched new running shoes GEL-NIMBUS 25 consisting GEL technology with enhanced shock absorption. In addition, consumers are investing in specialized insoles with performance-enhancing features, such as support, stability, and cushioning.

People with medical conditions that affect the legs or feet-diabetes, ulcers, and arthritis-are the major end users of specialized insoles, as they provide ample support and comfort. In diabetic patients, high blood sugar can cause damage to the body, including nerves and blood vessels. This makes them more prone to developing peripheral neuropathy, which causes numbness and pain in the hands and feet. Specialized shoe insoles are designed to help reduce the risk of foot injury by promoting healthy blood circulation, mobility, and support. According to data published by the International Diabetes Federation in 2021, an estimated 537 million adults between the ages of 20 and 79 were living with diabetes globally. This number is estimated to reach 643 million by 2030 and 783 million by 2045. The growing prevalence of diabetes is expected to drive the demand for shoe insoles.

Smart insoles and wearable technology are key technology trends in the insoles market. The development of smart insoles has resulted from the integration of sensors and electronics into shoe insoles. These insoles can monitor a number of parameters, including temperature, pressure distribution, step count, and gait analysis. Smart insole data can be used for health-related analysis, performance improvement, and monitoring of physical activity. For laboratory research as well as to monitor foot pressure in everyday life situations, a variety of insole systems that are sensitive to pressure but not shear have previously been created. Tekscan, Inc. and XSENSOR Technology Corporation are two major manufacturers of these systems among others.

Furthermore, advancements in materials science, biotechnology, and manufacturing processes have led to innovative insole technologies. Responsive foams, gel-based materials, and 3D printing techniques are examples of how technology improves insole performance and customization. Manufacturers that invest in research and development to incorporate these technologies can gain a competitive advantage.

Moreover, the rise of e-commerce and direct-to-consumer sales channels presents opportunities for insole manufacturers to reach a wider audience without relying solely on traditional retail distribution. Creating a strong online presence and leveraging digital marketing can help manufacturers tap into new markets.

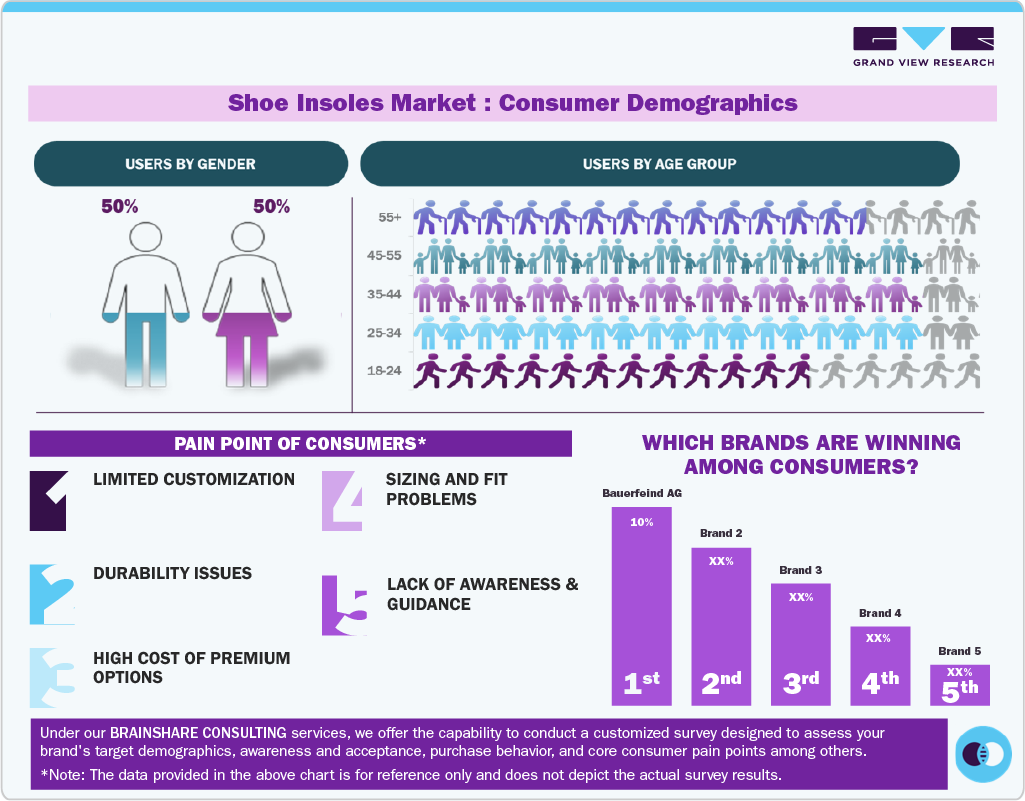

Consumer Insights

The market for shoe insoles is primarily driven by rising awareness of foot health, comfort, and performance enhancement. Increasing incidences of foot disorders such as plantar fasciitis, flat feet, and heel pain have encouraged consumers to invest in medical and mass-market supportive insoles. Athletes and fitness enthusiasts also represent a strong consumer segment, seeking insoles that improve shock absorption, reduce fatigue, and enhance overall performance. In addition, working professionals, especially those required to stand for long hours, increasingly adopt insoles for daily comfort. Growing preference for customized and orthotic insoles highlights the rising focus on personalized solutions.

Consumers are also interested in innovative materials and advanced designs that provide durability, breathability, and lightweight comfort. Eco-conscious buyers are influencing the market by demanding sustainable and recyclable insole options, encouraging manufacturers to explore biodegradable foams and natural fibers. Online retail and e-commerce platforms are reshaping purchasing patterns, as consumers value the convenience of product comparison and home delivery. Price sensitivity remains a factor, with budget-conscious consumers opting for generic insoles while premium buyers invest in advanced orthopedic solutions. Consumer insights reflect health, lifestyle, sustainability, and convenience-driven purchasing behavior.

Application Insights

Orthotic insoles dominated the market with a share of 60.2% in 2024. Increasing consumer awareness regarding the benefits of custom orthotics is driving the growth of this segment. Custom orthotics offer added cushioning, support, and pressure redistribution, making them particularly beneficial for individuals with arthritis or those required to stand for extended periods at work. Orthotics insoles are also widely used to prevent pressure ulcers and foot abnormalities related to diabetes, contributing to sustained segment growth over time.

The use of orthotics helps correct such imbalances, enhance alignment, and reduce stress on the joints. By providing extra support and cushioning, orthotics offer protection against impacts and aid in injury prevention. Their widespread adoption is attributed to their numerous benefits to foot health and overall well-being, catering to active individuals and those seeking relief from foot-related issues.

Casual insoles market is projected to grow at a CAGR of 5.8% over the forecast period, driven by rising consumer demand for everyday comfort and foot support. Increasing awareness of foot health and the availability of lightweight, breathable, and cost-effective insoles is boosting adoption among urban populations. Casual insoles such as sneakers, loafers, and flats are widely used in daily footwear, making them a high-volume product category. In addition, growing fashion trends and a preference for versatile footwear further contribute to the steady expansion of this market segment.

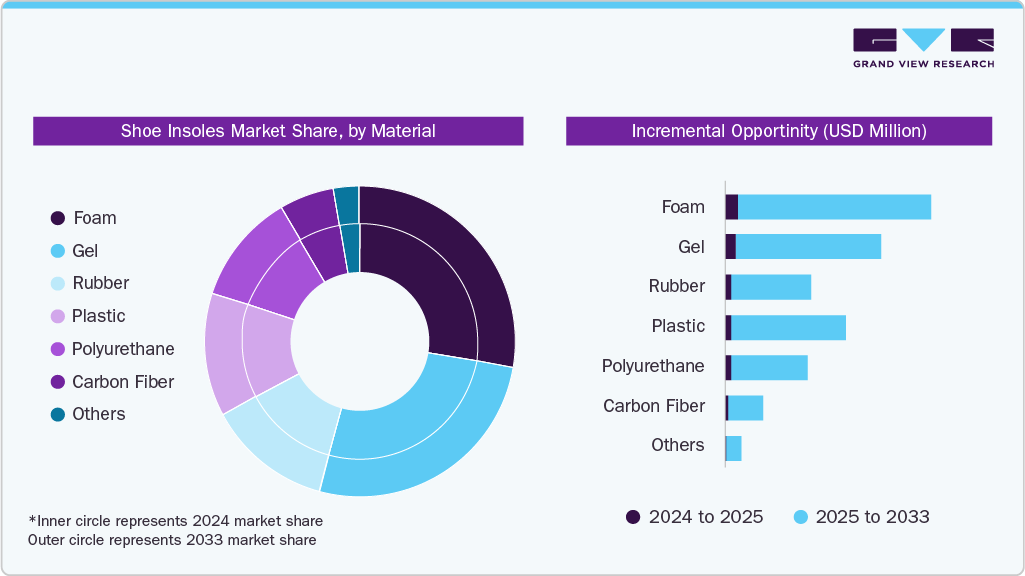

Material Insights

Foam-based insoles dominated the global market with a share of 34.4% in 2024. Foam insoles crafted from high-density polyurethane are favored by many due to their ability to provide exceptional support and pressure relief. The chemical properties of the foam also offer potential medical benefits for foot comfort. Moreover, the foam's density imparts bounce and comfort to the footwear.

In addition, foam insoles are known for their lightweight nature, making them an attractive choice for individuals seeking lightweight and breathable shoe insole options. This is especially important for athletes, fitness enthusiasts, and people who spend extended periods on their feet.

Carbon fiber-based insoles market is projected to register the fastest CAGR of 6.2% over the forecast period, driven by excellent arch support and stability, which helps in relieving foot fatigue and discomfort. Further, carbon fiber insoles offer superior shock absorption and energy return capabilities, enhancing overall athletic performance and reducing the impact on joints during physical activities. Athletes and active individuals, in particular, seek footwear that can provide better support and minimize the risk of injuries, making carbon fiber insoles an attractive choice.

Price Insights

Economy price range insoles dominated the market in 2024, primarily due to it's affordability and broad consumer appeal. These budget-friendly insoles cater to price-conscious shoppers and those seeking basic foot support without the need for premium features. Manufacturers benefit from economies of scale through mass production, allowing them to keep costs low and offer competitive prices. Retailers also prioritize this price range, further increasing its visibility and accessibility to consumers. While higher-priced insoles offer advanced features, the economy range fulfills basic needs, making it the preferred choice for many consumers.

The medium price range shoe insoles are expected to witness the fastest CAGR over the forecast period. This is due to the increasing demand for insoles that offer a good balance of affordability and quality. Medium-priced insoles are typically made with natural materials and are more durable than economy insoles. They can provide good arch support and comfort, and they may also have additional features, such as shock absorption or moisture-wicking.

Type Insights

Full length insoles dominated the market with a share of 84.9% in 2024. An increasing number of people opt for these shoe insoles for better arch support. Insoles help support and stabilize the foot, reducing stress on the feet, ankles, knees, and back. Therefore, consumers are increasingly opting for full length shoe insoles for added comfort. Furthermore, since many women are believed to wear high heels and fashionable footwear for an extended period, they have started to opt for insoles for added comfort and cushioning for their feet.

The ¾ length shoe insoles are expected to observe a CAGR of 4.8% over the forecast period. The rise of athleisure and casual footwear trends has further fueled the demand for these shoe insoles. Consumers are increasingly looking for ways to enhance the comfort of their favorite casual shoes, from sneakers to loafers, without compromising on style. Shoe insoles that cater to these casual styles and fit seamlessly into various footwear have become increasingly popular. Moreover, the convenience and affordability of casual shoe insoles are contributing to their demand.

End Use Insights

Women emerged as the dominant consumers in the market with a share of 51.6% in 2024 due to their prioritization of foot health and comfort, coupled with diverse shoe preferences. Their active lifestyles, fashion-conscious choices, and growing demand for customization options further drove their prominence. Online shopping convenience, wellness trends, and tailored insole solutions also contributed to women's significant presence in the market, a trend that is likely to continue over the forecast period.

Men are projected to register the fastest CAGR of 5.4% over the forecast period. The rising prevalence of foot problems, such as plantar fasciitis, flat feet, and various types of foot pain, has led an increasing number of men to opt for specialized shoe insoles that can provide targeted support and relief for specific foot conditions. Advancements in technology and material science have fueled the development of innovative and customizable insole solutions catering to individual foot shapes and arch types. This personalization aspect has attracted many men looking for tailored and comfortable insoles that fit their unique foot profiles. Fashion and style also play a key role in driving the market for men's shoe insoles.

Regional Insights

North America shoe insoles industry is expected to witness a robust CAGR of 5.2% from 2025 to 2033. North America shows mature, value-added demand, led by high foot-health awareness, widespread athletic participation, and large populations working long-standing shifts. Consumers prioritize cushioning, arch support, and pain-relief solutions for plantar fasciitis and flat feet. Orthotic prescriptions and OTC upgrades coexist, with pharmacies, specialty sports retailers, and Amazon/Walmart shaping routes to market. Innovation centers on gel, EVA, TPU blends, and antimicrobial, moisture-wicking liners. Private-label insoles gain share on price, while premium brands defend with biomechanical validation, endurance testing, and fit guarantees. Customization, 3D scanning, and sustainability messaging underpin repeat purchases.

U.S. Shoe Insoles Market Trends

The shoe insoles industry in the U.S. accounted for the largest revenue share of 81.6% in the North American region in 2024. The U.S. market benefits from strong podiatry access, HSA/FSA spending, and high e-commerce penetration. Segments include performance athletes, nurses and service workers, and aging consumers addressing pronation and heel pain. DTC brands use quizzes, virtual arch profiling, and generous return policies to reduce choice friction. Marketing emphasizes shock absorption, energy return, and odor control. Regulation is light for comfort insoles, while medical-grade devices require evidence and coding, creating barriers that protect higher-margin offerings.

Europe Shoe Insoles Market Trends

Europe shoe insoles industry is expected to witness a steady growth rate of 4.6% over the forecast period from 2025 to 2033, supported by rising health awareness and increasing demand for comfort-oriented footwear. Growing foot-related issues, such as plantar fasciitis and flat feet, drive consumers toward corrective and preventive insoles. Moreover, the presence of established footwear brands and innovative insole manufacturers in the region is boosting product availability. Advancements in materials and expanding online retail channels are further strengthening market adoption across Europe.

The shoe insoles industry in Germany accounted for the largest revenue share of 28.2% in the European region in 2024. Germany is a high-specification market where engineering credibility, foot-pressure analytics, and orthopedic tradition shape purchasing. Health insurers sometimes support custom orthotics, strengthening clinical channels. Consumers value durability, breathability, and temperature regulation for year-round use. Continuous R&D investments in biomechanical design further improve performance, while premium positioning ensures strong consumer loyalty. Specialty retailers and Sanitätshaus networks offer foot scans and try-before-buy services, creating stickiness. Outdoor activity (hiking, trekking) and industrial labor needs primarily drive the shock-absorption and anti-fatigue features. Sustainability is a differentiator: cork-latex composites, recycled EVA, and local manufacturing appeal.

Asia Pacific Shoe Insoles Market Trends

Asia Pacific shoe insoles industry held the largest revenue share of 41.0% in 2024 and is expected to retain its dominance over the forecast period. The growth is propelled by urbanization, rising sports participation, and increasing diabetes diagnoses and musculoskeletal issues. Consumers favor lightweight, breathable insoles for humid climates and slimmer profiles for fashion footwear. Japan and South Korea prioritize tech-forward, antibacterial materials; Australia emphasizes podiatry and running. Emerging SEA markets amplify online discovery via marketplaces and social commerce. Price sensitivity is high, but willingness to trade up exists for visible comfort gains. Meanwhile, localization, Asian sizing, lower-volume lasts, and multilingual guidance have improved conversion, while cross-border e-commerce expands the reach of global brands, intensifying competition with agile local labels.

China shoe insoles industry emerged as a dominant market in Asia Pacific with a revenue share of 29.3% in 2024. China’s market is scale-driven and digitally led, with Tmall, JD, and Douyin powering awareness, education, and rapid trials. Key use cases include daily commuter comfort, sports performance, and back-to-school comfort for students. Consumers scrutinize ratings, KOL reviews, and short-video demos highlighting shock absorption and arch support. Success depends on clear sizing, slim designs for fashion sneakers, and odor-control technologies. Domestic brands compete on value and speed, while international labels position themselves on biomechanical science and material quality. Singles’ Day promotions, bundling with footwear, and smart insoles/pedometer tie-ins stimulate repeat purchases.

Central & South America Shoe Insoles Market Trends

The shoe insoles industry in Central & South America is expected to grow at a CAGR of 4.2% over the projected period. The region exhibits underpenetrated but rising demand, aided by expanding modern retail, improving e-commerce logistics, and growing foot health awareness among workers and runners. Affordability is critical; mid-priced EVA and gel inserts dominate, while premium orthotics remain niche in major cities. Heat and humidity spur interest in ventilation and antimicrobial features. Local manufacturing helps offset currency volatility and import costs. Pharmacists and specialty footwear stores act as educators, simplifying choice. Brands that offer clear size trimming guides, durability claims, and installment payments gain share. Social media and soccer/running sponsorships build trust.

Brazil shoe insoles industry accounted for a revenue share of 32.4% in Central & South America region in 2024. This growth is attributed to strong sports culture, large service-sector employment, and fashion-sneaker adoption. Consumers look for cushioning that withstands daily commuting and standing. Retail is omnichannel: pharmacies, multi-brand footwear chains, and marketplaces like Mercado Livre. Price tiers must balance inflation pressures with perceived quality; combo packs and loyalty discounts resonate. Climate considerations elevate breathable meshes and moisture-wicking covers. Local brands win with accessible pricing and broad size runs, while international players differentiate through clinical validation and athlete endorsements. Regulatory compliance and Portuguese-language education reduce returns and increase repeat purchases.

Middle East & Africa Shoe Insoles Market Trends

The Middle East & Africa shoe insoles industry is expected to grow at a CAGR of 5.0% over the forecast period. The region is showcasing diverse demand patterns, with Gulf markets leaning toward premium products emphasizing comfort, odor control, and brand reputation. In contrast, North and Sub-Saharan markets remain primarily price-driven. Extended working hours in retail, hospitality, and construction industries are driving the adoption of anti-fatigue insoles, whereas the hot climate increases the need for breathable and antimicrobial features. Distribution largely depends on pharmacies, hypermarkets, and cross-border e-commerce; however, limited in-store guidance makes simple claims and clear sizing crucial. Import costs and fragmented regulations restrict assortment breadth, but successful market strategies focus on durability and affordability. At the same time, premium niches are gaining momentum through expatriate communities, sports clubs, and medical referrals in urban centers.

South Africa shoe insoles industry accounted for a revenue share of 12.6% in the Middle East & Africa region in 2024. Growth in the country is primarily driven by key factors such as occupational foot strain, the expansion of running communities, and rising awareness of diabetes-related foot care. Retail distribution is split across pharmacies, footwear chains, and online marketplaces, with last-mile delivery reliability showing improvement but remaining uneven. Consumers are prioritizing strong cushioning, heel stabilization, and odor control at affordable price, while proper education on sizing, trimming, and in-shoe fit helps reduce product returns. Local assembly and the use of region-specific materials, such as breathable covers and high-wear foams, support cost management. Moreover, partnerships with occupational health programs, sports events, and flexible installment options are creating opportunities to drive higher volumes and strengthen brand loyalty in the market.

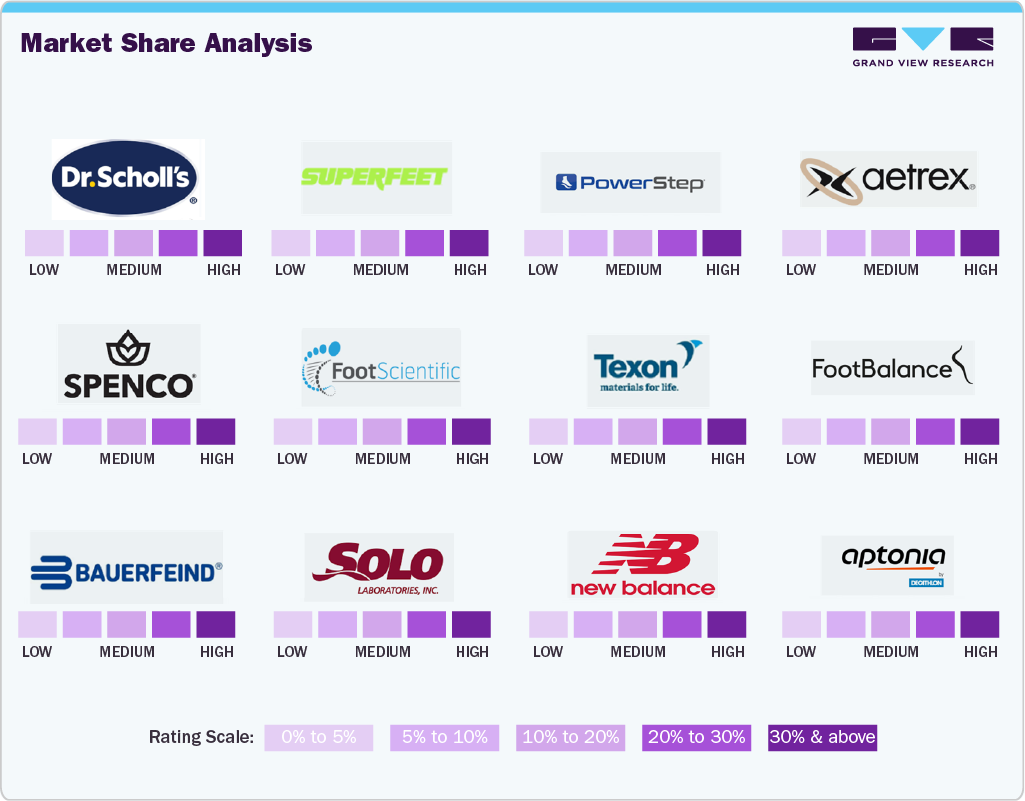

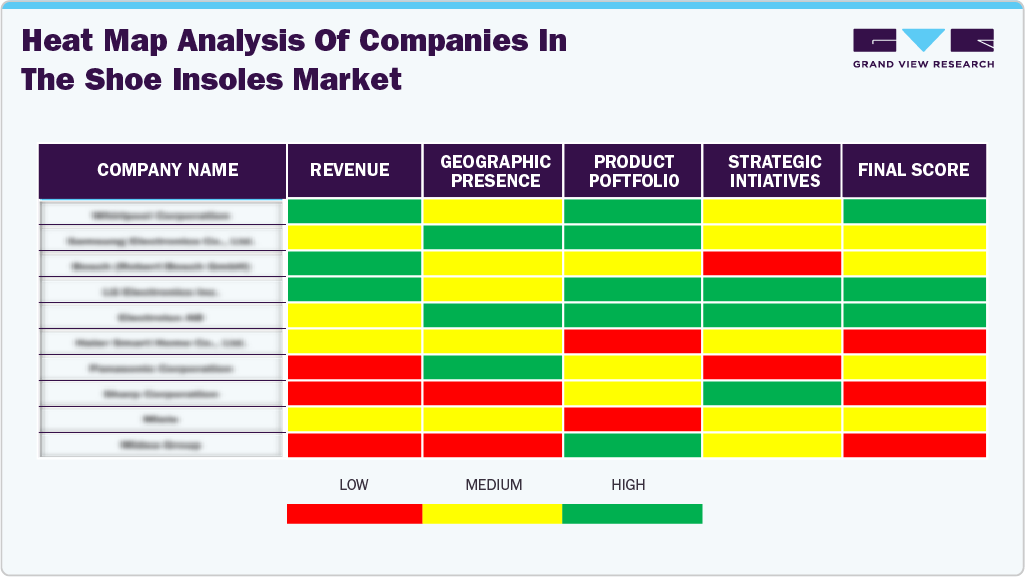

Key Shoe Insoles Company Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others.

Key Shoe Insoles Companies:

The following are the leading companies in the shoe insoles market. These companies collectively hold the largest market share and dictate industry trends.

- Bauerfeind AG

- Foot Science International

- PowerStep

- SOLO Laboratories, Inc.

- Spenco Medical Corporation

- Superfeet Worldwide, Inc.

- Texon International Group

- FootBalance System Ltd.

- CURREX

- Sidas

- ENERTOR

- PROFOOT INC.

- Rehband

- YONEX Co., Ltd.

- Asics Corporation

- Aetrex Inc.

- Decathlon (Aptonia)

- Li Ning (China) Sports Goods Co., Ltd.

- Scholl’s Wellness Co.

- New Balance Athletics, Inc.

Recent Developments

-

In November 2024, Arris launched its first consumer brand, AURORRA, introducing USD 89 carbon-fiber insoles designed to fit any shoe. Previously focused on B2B, the company pivoted to B2C to capture higher margins and tap into markets like athletes, first responders, and long-shift workers.

-

In March 2023, Dr. Scholl's introduced a new product line featuring a foot file, foot mask, and insoles. The insoles help prevent pain resulting from joint stiffness and strain caused by weight gain, bad posture, uneven pressure, flat feet, or running on hard surfaces, among other reasons.

-

In October 2022, Superfeet Worldwide announced the introduction of two distinct categories of removable insoles specifically designed for snowboarders and skiers. These new insoles are tailor-made to cater to the needs of snowboarders and skiers, taking into account the unique demands of these winter sports. The specialized insoles come with Superfeet’s trademarked cushioning and foot stability characteristics, along with a thermal top cover for warmth and moisture wicking features.

-

In September 2022, Texon launched a new insole called Ecostrobe with 100% recycled content, specifically, recycled PET (polyethylene terephthalate). The insole is produced using a fusion-bonding technology that eliminates the need for chemicals or water during the manufacturing process. Moreover, the company claims that the production of Ecostrobe requires 50% less energy and it is 20% lighter.

Shoe Insoles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.50 billion

Revenue forecast in 2033

USD 9.69 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million units and CAGR from 2025 to 2033

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, end use, price, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Indonesia; Thailand; Brazil; UAE; South Africa

Key companies profiled

Bauerfeind AG; Foot Science International; PowerStep; SOLO Laboratories, Inc.; Spenco Medical Corporation; Superfeet Worldwide, Inc.; Texon International Group; FootBalance System Ltd.; CURREX; Sidas; ENERTOR; PROFOOT INC.; Rehband; YONEX Co., Ltd.; Asics Corporation; Aetrex Inc.; Decathlon (Aptonia); Li Ning (China) Sports Goods Co., Ltd.; Scholl’s Wellness Co.; New Balance Athletics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shoe Insoles Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global shoe insoles market report based on application, material, end use, price, and region:

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Casual

-

Athletic

-

Orthotics

-

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Foam

-

Gel

-

Rubber

-

Plastic

-

Carbon Fiber

-

Polyurethane

-

Others

-

-

End Use Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

-

Price Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Economy

-

Medium

-

Premium

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Full Length

-

3⁄4 Length

-

Heel Cup

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shoe insoles market size was estimated at USD 6.22 billion in 2024 and is projected to reach USD 9,687.0 million by 2033, growing at a CAGR of 5.1% from 2025 to 2033

b. The global shoe insoles market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 9.69 billion by 2033.

b. Asia Pacific shoe insoles market held the largest market share accounting for around 40.8% of global revenue in 2024 and is expected to retain its dominance over the forecast period. The significant rise in the elderly population and the heightened occurrence of diabetes, resulting in diabetic foot ulcers, are primary factors fueling market expansion within the region. Custom-made insoles are extensively used by individuals facing back pain, joint pain, and related issues, further boosting the demand

b. Some of the key market players in the Shoe insoles market are Bauerfeind AG; Foot Science International; PowerStep; SOLO Laboratories, Inc.; Spenco Medical Corporation; Superfeet Worldwide, Inc.; Texon International Group; FootBalance System Ltd.; CURREX; Sidas; ENERTOR; PROFOOT INC.; Rehband; YONEX Co., Ltd.; Asics Corporation; Aetrex Inc.; Decathlon (Aptonia); Li Ning (China) Sports Goods Co., Ltd.; Scholl’s Wellness Co.; New Balance Athletics, Inc, among others

b. The market for shoe insoles has been considerably impacted by the increase in sports and athletic activities, which has increased consumer demand for customized insoles that improve performance and comfort and help reduce the risk of injury. The growing prevalence of diabetes is also expected to drive the demand for diabetic-friendly shoe insoles. Consumers are increasingly seeking insoles that offer both support and style, and with the convenience of online shopping, they have access to a wide range of options to cater to their specific needs and preferences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.