- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Shilajit Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Shilajit Market Size, Share & Trends Report]()

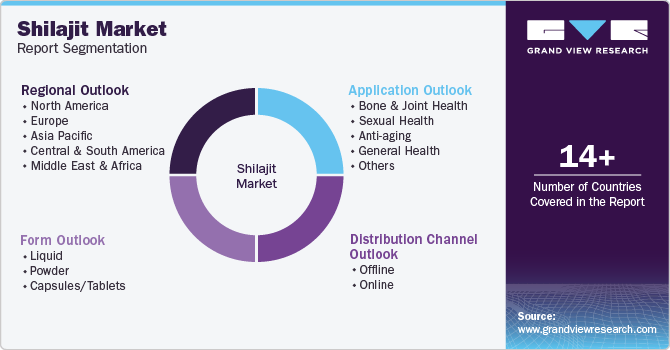

Shilajit Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Liquid, Powder), By Application (Bone & Joint Health, Sexual Health), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-436-6

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Shilajit Market Summary

The global shilajit market size was estimated at USD 191.1 million in 2024 and is expected to reach USD 320.1 million by 2030, growing at a CAGR of 9.0% from 2025 to 2030. Shilajit is a natural substance that oozes from sedimentary rocks in specific regions around the world.

Key Market Trends & Insights

- The shilajit market in North America captured a revenue share of over 19.18% in 2023.

- The shilajit market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030.

- By form, the liquid segment accounted for a revenue share of 61.15% in 2023.

- By application, sexual health segment accounted for a revenue share of 29.18% in 2023.

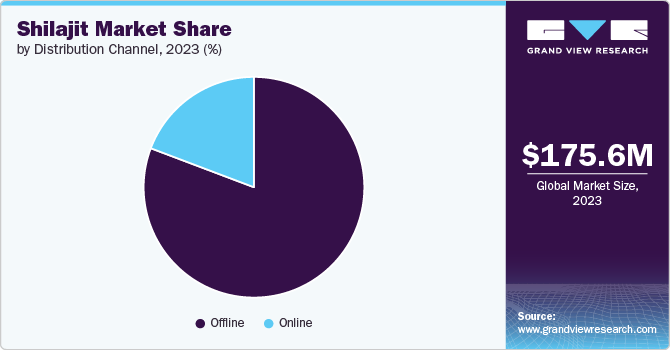

- By distribution channel, the offline segment accounted for a revenue share of 80.75% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 191.1 Million

- 2030 Projected Market Size: USD 320.1 Million

- CAGR (2025-2030): 9.0%

- North America: Largest market in 2023

Shilajit is renowned for its powerful antioxidant and anti-inflammatory properties. The market has grown steadily, fueled by increasing consumer interest in natural and traditional health remedies. Shilajit, a mineral-rich substance traditionally used in Ayurvedic medicine, is gaining popularity due to its wide range of health benefits, including boosting energy, supporting cognitive function, enhancing physical performance, and promoting healthy aging.

As consumers become more health-conscious and increasingly wary of synthetic products, the demand for natural and organic supplements has surged. Shilajit fits well into this trend with its natural composition and long-standing use in traditional medicine. The global shift towards wellness and preventive healthcare is a major driving factor. Consumers are increasingly looking for products that treat ailments and promote overall well-being, leading to higher demand for shilajit. The increasing penetration of e-commerce platforms has made Shilajit products more accessible to consumers worldwide. This has been particularly evident during events like Amazon Prime Day, where brands have launched new shilajit products to reach a broader audience.

Companies are introducing shilajit products and other beneficial ingredients like gold dust, fulvic acid, and herbal extracts to enhance their potency and appeal. Manufacturers focus on producing high-purity shilajit with minimal processing, ensuring products are free from fillers and additives. This emphasis on quality is crucial to meet consumer expectations and regulatory standards. Moreover, introducing convenient delivery formats, such as capsules, powders, and liquid tinctures, broadens consumer acceptance. Manufacturers are becoming prevalent in tailoring products for specific demographics, including athletes and older adults.

The market is set for sustained growth, driven by innovations in product formulations, campaigns, collaboration activities, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market. New entrants are also emerging, further intensifying competition in the market. Startups focusing on sustainable sourcing and eco-friendly packaging are gaining attention and appealing to environmentally conscious consumers.

Form Insights

The liquid segment accounted for a revenue share of 61.15% in 2023. Resin shilajit is the most traditional and unprocessed form, often directly extracted and minimally processed. This appeals to consumers seeking an authentic, natural product that resembles the form used in ancient Ayurvedic practices. Resin shilajit in semi-liquid form is known for its high bioavailability, meaning the body easily and efficiently absorbs it. This results in faster and more noticeable effects, a significant factor for consumers seeking immediate benefits, such as enhanced energy or cognitive function. This kind of shilajit is sometimes used in skincare and topical applications, adding to its versatility and broadening its appeal in the market.

Capsules/tablets is expected to grow at a CAGR of 9.4% from 2024 to 2030. Capsules and tablets are among the most convenient forms of supplementation, requiring no preparation and easily fitting into daily routines. As consumers increasingly seek simplicity in their health regimens, the demand for shilajit in capsule or tablet form is rising. The capsules/tablets segment has seen significant innovation, with companies introducing various formulations, such as those combined with other beneficial ingredients like Ashwagandha or Turmeric. These new products cater to diverse consumer needs, further driving growth.

Application Insights

Sexual health accounted for a revenue share of 29.18% in 2023. Shilajit has been used for centuries in traditional Ayurvedic medicine as a potent aphrodisiac and remedy for sexual dysfunction. Its long-standing reputation as a natural enhancer of sexual health drives its demand in this segment. Modern scientific studies have supported some of the traditional claims, showing that shilajit may help increase testosterone levels, improve sperm quality, and enhance overall sexual performance. This scientific backing has bolstered consumer confidence in shilajit as an effective supplement for sexual health.

The bone & joint health segment is expected to grow at a CAGR of 9.3% from 2024 to 2030. shilajit is rich in minerals like calcium, magnesium, and fulvic acid, which support bone density and joint health. As awareness of these benefits grows, more consumers are turning to shilajit as a natural way to maintain and improve their musculoskeletal health. The global population is aging, and with age comes an increased prevalence of bone and joint issues such as osteoarthritis, rheumatoid arthritis, and osteoporosis. This demographic trend drives demand for supplements supporting bone and joint health, making Shilajit an attractive option. Many middle-aged and older adults increasingly focus on preventive health measures to maintain mobility and quality of life as they age. With its potential to strengthen bones and joints, Shilajit aligns well with this preventive health focus.

Distribution Channel Insights

The sales of shilajit through offline channel accounted for a revenue share of 80.75% in 2023. Offline channels often provide access to pharmacists, health advisors, or store staff who can offer personalized recommendations based on individual health needs. This expert guidance is particularly important for first-time buyers of Shilajit or those with specific health concerns. In many regions, particularly in countries where traditional medicine is prevalent, consumers prefer buying supplements like Shilajit from local herbal stores or Ayurveda shops. These traditional markets play a significant role in the distribution of Shilajit. Moreover, in rural areas or developing countries, internet access and e-commerce infrastructure are limited, making offline channels the primary mode of purchase for supplements like Shilajit.

The sales of shilajit through online is expected to grow at a CAGR of 9.6% from 2024 to 2030. The global increase in internet penetration, particularly in emerging markets, is driving more consumers online, where they have access to a broader range of products, including Shilajit. This trend is accelerating the shift from traditional retail to e-commerce. Online stores are open 24/7, allowing consumers to shop anytime that suits them. This flexibility particularly appeals to busy professionals and others who may not have the time to visit physical stores during regular business hours. The online sites typically provide extensive product descriptions, customer reviews, and ratings, helping consumers make informed decisions. This transparency builds consumer confidence and drives online sales.

Regional Insights

The shilajit market in North America captured a revenue share of over 19.18% in 2023. The growing awareness of the potential health benefits of natural supplements is a significant factor driving the market in North America. Consumers are increasingly looking for natural products that boost energy, support cognitive function, and promote overall wellness. The availability of Shilajit products through online platforms such as Amazon and other health-focused e-commerce sites has made it easier for North American consumers to access these products. This has also facilitated market expansion and allowed for targeted marketing efforts. Manufacturers are introducing various forms of Shilajit, including capsules, powders, and liquid extracts, to cater to different consumer preferences. This diversification has helped broaden the appeal of Shilajit across different demographic groups.

U.S. Shilajit Market Trends

The shilajit market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030. The U.S. market is shifting strongly towards preventive health and wellness, with consumers increasingly seeking natural and organic supplements. Shilajit fits well into this trend, offering a natural alternative to synthetic supplements. The U.S. supplement market is highly competitive, with Shilajit facing competition from a variety of other natural supplements. Brands need to differentiate their products through unique formulations, quality assurance, and effective marketing strategies.

Europe Shilajit Market Trends

The shilajit market in Europe is expected to grow at a CAGR of 8.8% from 2024 to 2030. There is a rising awareness of Ayurvedic medicine and its natural remedies in Europe. As a core component of Ayurveda, Shilajit is gaining recognition for its purported benefits in enhancing energy, cognitive function, and overall wellness. European consumers are increasingly seeking supplements with clean labels, meaning products that are natural, organic, and free from synthetic additives. Shilajit, being a natural substance, aligns well with this preference. European consumers tend to trust products with quality certifications such as organic certification, GMP (Good Manufacturing Practice), and ISO standards. Shilajit products that carry these certifications are more likely to gain consumer trust and market share.

Asia Pacific Shilajit Market Trends

The shilajit market in Asia Pacific is expected to witness a CAGR of 9.3% from 2024 to 2030. Shilajit has a long history of use in Ayurvedic medicine, particularly in India and Nepal. This cultural familiarity has made it easier for Shilajit to gain acceptance in these markets, where it is widely recognized for its health benefits. There is a growing trend across the Asia Pacific region toward preventive health and wellness. Consumers increasingly seek natural products that enhance overall health, boost immunity, and prevent diseases. With its antioxidant and anti-inflammatory properties, Shilajit is well-positioned to benefit from this trend. Countries like Indonesia, Vietnam, and Thailand represent untapped potential for the market. As consumer awareness grows, these markets are expected to see increased demand for natural health supplements like Shilajit.

Key Shilajit Company Insights

The market is characterized by dynamic competitive dynamics shaped by product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, reinforcing their leadership in international markets that embrace shilajit.

Key Shilajit Companies:

The following are the leading companies in the shilajit market. These companies collectively hold the largest market share and dictate industry trends.

- Undersun Biomedtech Corp.

- VISTERRA

- Botanic Healthcare

- Alpspure Lifesciences

- HERBOIL CHEM

- Shaanxi Huachen Biotech

- Mufan Biology

- Xi’an Changyue Biological Technology

- Blisque Inc.

- CYMBIOTIKA LLC

Recent Developments

-

In July 2022, Dabur India Ltd. unveiled the expansion of its trusted healthcare and energizer brand, Dabur Shilajit, with the introduction of 'Dabur Himalayan Shilajit' during Amazon.in's Prime Day event. This innovative product is a natural health booster to improve well-being and promote healthy aging. Dabur Himalayan Shilajit is entirely pure and devoid of any fillers or additives. It functions as a natural revitalizer, containing over 80% Fulvic Acid, which provides exceptional antioxidant benefits by blocking free radical formation and lowering oxidative stress.

-

In August 2021, Upakarma Ayurveda unveiled its latest offering: Shilajit Resin with Gold Dust. This unique formulation combines the natural potency of pure Shilajit with the luxurious touch of gold elements, specifically Swarna (Gold) Vang and Vark. The product results from thorough research and development, providing consumers with a lavish experience of gold-infused Shilajit in its rich resin form.

Shilajit Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 208 million

Revenue forecast in 2030

USD 320.1 million

Growth rate

CAGR of 9.0% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Thailand; Malaysia; Brazil; South Africa

Key companies profiled

Undersun Biomedtech Corp.; VISTERRA; Botanic Healthcare; Alpspure Lifesciences; HERBOIL CHEM; Shaanxi Huachen Biotech; Mufan Biology; Xi’an Changyue Biological Technology; Blisque Inc.; CYMBIOTIKA LLC

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Shilajit Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shilajit market report based on form, application, distribution channel, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Capsules/Tablets

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Sexual Health

-

Anti-aging

-

General Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shilajit market size was estimated at USD 175.6 million in 2023 and is expected to reach USD 191.0 billion in 2024.

b. The global shilajit market is expected to grow at a compounded growth rate of 9.0% from 2024 to 2030 to reach USD 320.1 million by 2030

b. The liquid segment accounted for the largest share of the global revenue in 2023. Resin shilajit is the most traditional and unprocessed form of shilajit, often directly extracted and minimally processed.

b. Some key players operating in the shilajit market are Undersun Biomedtech Corp., VISTERRA, Botanic Healthcare, Alpsure Lifesciences, Herboil Chem, and others

b. The global shilajit market has been witnessing steady growth, fueled by increasing consumer interest in natural and traditional health remedies. Shilajit, a mineral-rich substance traditionally used in Ayurvedic medicine, is gaining popularity due to its wide range of health benefits, including boosting energy, supporting cognitive function, enhancing physical performance, and promoting healthy aging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.