- Home

- »

- Advanced Interior Materials

- »

-

Semiconductor Manufacturing Equipment Market Report 2033GVR Report cover

![Semiconductor Manufacturing Equipment Market Size, Share & Trends Report]()

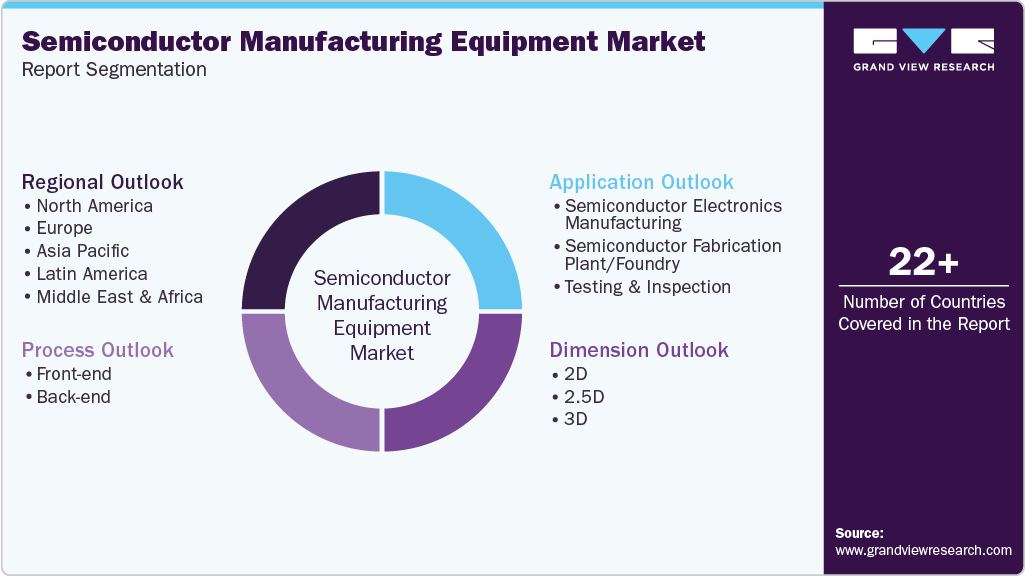

Semiconductor Manufacturing Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Process (Front-end, Back-end), By Dimension (2D, 2.5D, 3D), By Application (Semiconductor Electronics Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-067-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Semiconductor Manufacturing Equipment Market Summary

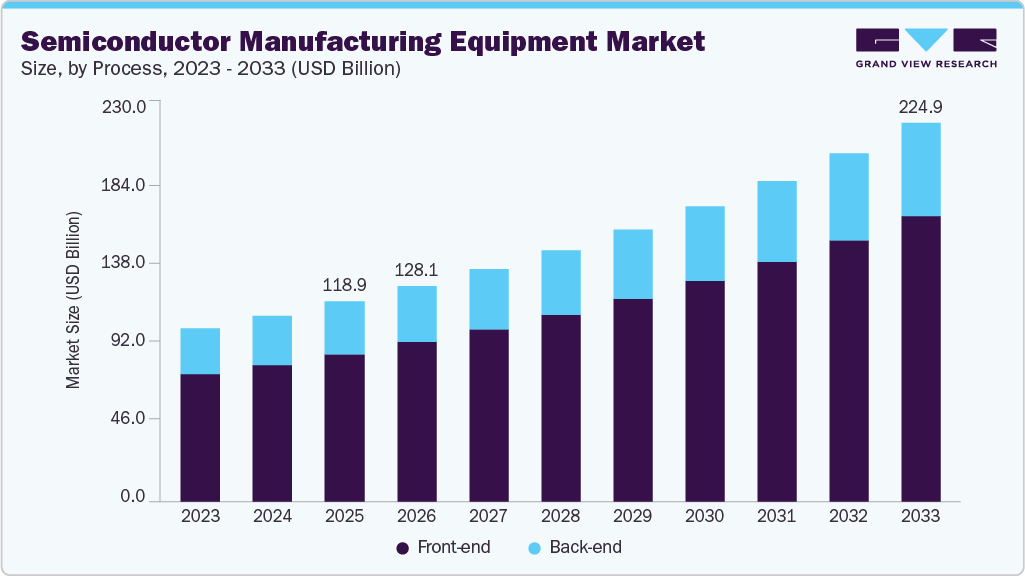

The global semiconductor manufacturing equipment market size was valued at USD 118.88 billion in 2025 and is projected to reach USD 224.93 billion by 2033, growing at a CAGR of 8.4% from 2026 to 2033. Escalating adoption of electronic products as part of a daily lifestyle and for professional purposes is expected to increase the demand for semiconductors over the forecast period and support the growth of the semiconductor manufacturing equipment.

Key Market Trends & Insights

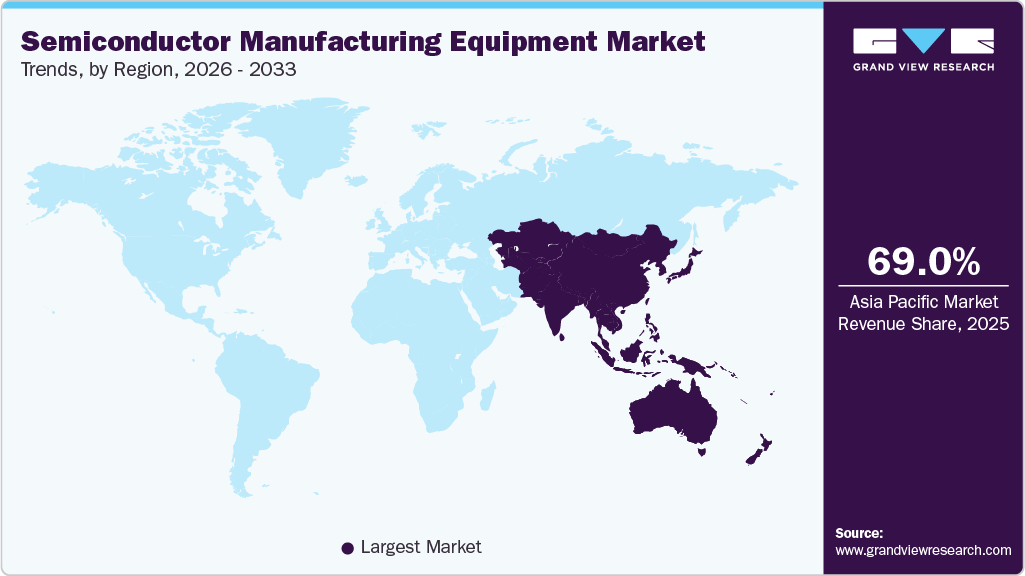

- Asia Pacific dominated the semiconductor manufacturing equipment industry with the largest revenue share of 69.0% in 2025.

- The semiconductor manufacturing equipment industry in the U.S. is expected to grow at a substantial CAGR of 6.5% from 2026 to 2033.

- By process, the front-end segment is expected to grow at a considerable CAGR of 8.6% from 2026 to 2033 in terms of revenue.

- By dimension, the 3D segment is expected to grow at a considerable CAGR of 10.7% from 2026 to 2033 in terms of revenue.

- By application, the semiconductor fabrication plant/foundry segment is expected to grow at a considerable CAGR of 9.2% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 118.88 Billion

- 2033 Projected Market Size: USD 224.93 Billion

- CAGR (2026-2033): 8.4%

- Asia Pacific: Largest market in 2025

Moreover, growth of the semiconductor manufacturing equipment industry is supported by the evolution of cloud technology, development of 5G networks, and rising demand for connected vehicles. These advancements require increasingly complex and powerful semiconductor components, driving investment in cutting-edge fabrication technologies. In addition, the expansion of AI and IoT applications continues to fuel demand for high-performance chips, further boosting the need for advanced manufacturing equipment.

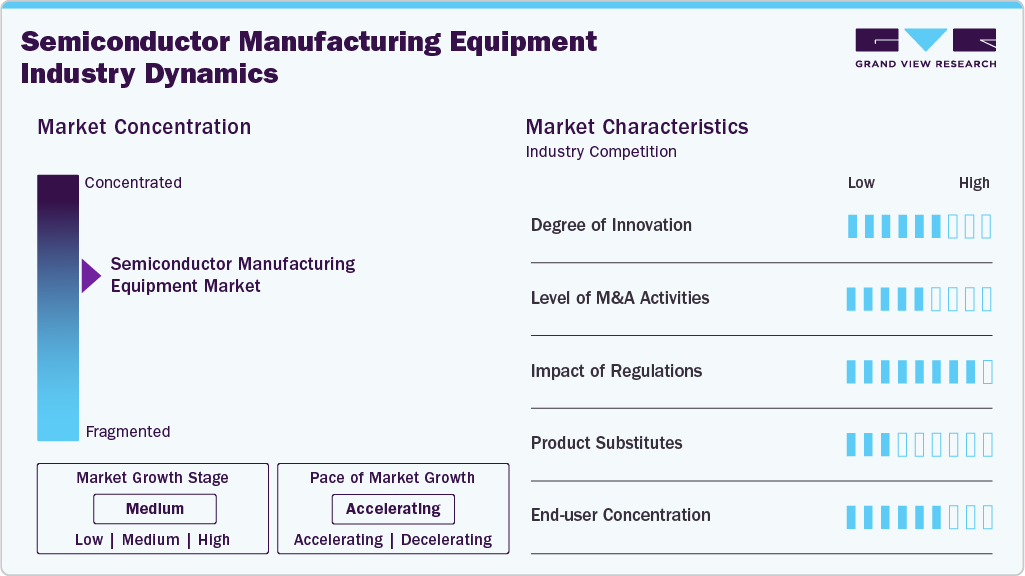

Market Concentration & Characteristics

The global semiconductor manufacturing equipment industry is moderately to highly consolidated, dominated by a few major players which command a significant share of the global market. These companies operate alongside a network of specialized equipment providers and component suppliers, many of which serve niche roles in the broader semiconductor value chain. The market is characterized by high barriers to entry, driven by the complexity of technology, capital intensity, and the need for extensive R&D investment.

Innovation in semiconductor manufacturing equipment is rapid, driven by the push for smaller nodes, higher performance, and greater energy efficiency. Toolmakers invest heavily in R&D to introduce advanced lithography, precision metrology, and smarter process controls. This steady stream of breakthroughs keeps the competitive bar high. As a result, technology leadership remains a core differentiator in the market.

Regulatory pressures from organizations such as the EU, EPA, and local environmental authorities are significantly shaping the market, with a strong focus on monitoring harmful emissions, air quality, and compliance with safety standards. Companies must comply with these regulations to stay competitive, as governments around the world introduce stricter measures to mitigate pollution and protect public health. With industries becoming more conscious of their environmental impact, the demand for eco-friendly gas detection technologies that support regulatory compliance is increasing, particularly in sectors such as manufacturing, healthcare, and energy.

End user demand is concentrated among a small group of major foundries and IDMs that dominate global chip production. Their large-scale capital spending cycles often set the pace for equipment orders. As these players focus on advanced nodes and higher wafer output, tool suppliers must align closely with their roadmaps. This concentration makes customer relationships strategic and highly competitive.

Drivers, Opportunities & Restraints

Growth is driven by rising demand for advanced chips used in AI, 5G, automotive electronics, and data centers. Continuous node migration requires more sophisticated tools, boosting spending across lithography, etch, deposition, and metrology. Governments are also funding new fabs to strengthen domestic supply chains. Together, these forces keep equipment orders on an upward trajectory.

Opportunities are widening as emerging regions invest in new fabrication ecosystems and mature-node capacity expands for IoT, power devices, and consumer electronics. Advances in heterogeneous integration and advanced packaging are opening fresh tool requirements. Localizing supply chains is creating space for new equipment suppliers in select segments. These trends enable companies to tap into high-growth niches.

Market growth faces restraints from high capital costs and complex technology development cycles that limit participation to a few capable players. Export controls and geopolitical tensions can delay projects or restrict access to advanced tools. Supply-chain bottlenecks add further pressure on timelines. These challenges often slow the pace of expansion despite strong underlying demand.

Process Insights

The front-end process led the market and accounted for 73.8% of the semiconductor manufacturing equipment revenue share in 2025. This dominance is attributed to the increasing complexity and performance requirements of advanced semiconductors used in applications such as GPUs, CPUs, IoT devices, and high-performance computing (HPC). The front-end segment covers critical stages including wafer fabrication, lithography, etching, and deposition, where precision and technological advancement are paramount.

The back-end segment is expected to grow at a significant CAGR of 7.6% from 2026 to 2033 in terms of revenue. The back-end segment is projected to witness notable growth through 2033, driven by increasing demand for advanced packaging, 3D stacking, and heterogeneous integration. As chipmakers aims to improve yield, reduce costs, and shrink form factors, back-end processes such as assembly, test, and burn-in are evolving rapidly. Innovations in chiplet architecture, fan-out wafer-level packaging (FOWLP), and system-in-package (SiP) are prompting new investments in specialized back-end equipment.

Dimension Insights

The 2.5D segment dominated the market and accounted for 38.9% of overall revenue share in 2025 driven by its ability to enhance performance while maintaining a compact form factor. This technology enables high-bandwidth interconnects between multiple semiconductor dies on a single interposer, making it ideal for applications such as AI, high-performance computing, and data centers. As traditional 2D scaling reaches its limits, 2.5D packaging offers a cost-effective solution by supporting chiplet-based architectures that combine specialized chips into one package, boosting efficiency and reducing manufacturing complexity.

The 3D segment is projected to grow at a rapid CAGR of 10.7% from 2026 to 2033 in terms of revenue. The 3D segment is gaining significant traction in the market, driven by its ability to stack multiple layers of semiconductor dies, enabling higher performance, greater functionality, and reduced space requirements. This technology allows for faster data transfer and better power efficiency, making it ideal for applications in high-performance computing, AI, and data centers.

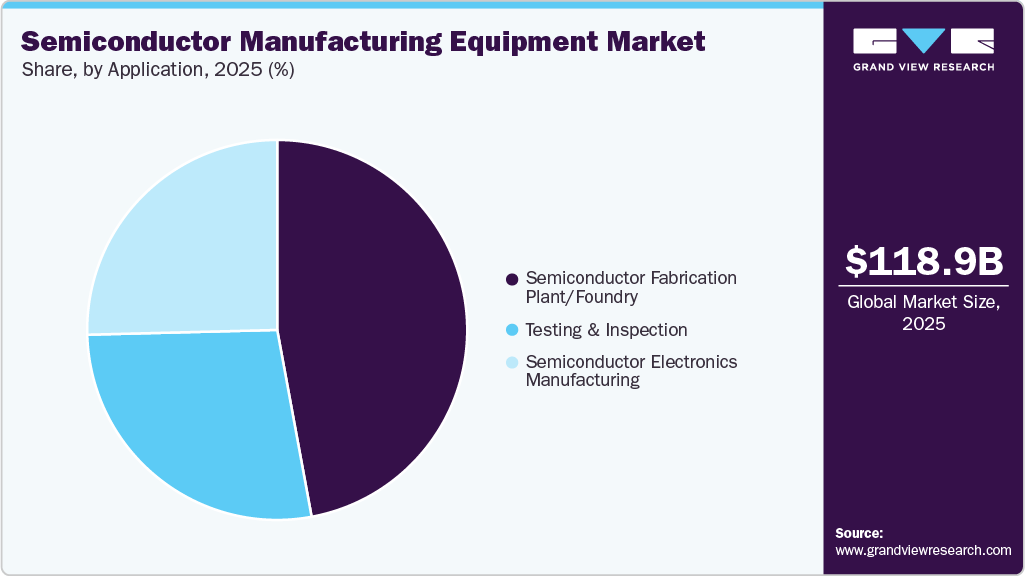

Application Insights

Based on application, the semiconductor fabrication plant/foundry segment led the market, accounting for a 47.1% revenue share in 2025. This growth is primarily driven by the expansion of industrial manufacturing throughout the forecast period. The increasing global population is driving higher demand for consumer electronics, including smartphones, laptops, wearables, and smart home products. As this demand rises, the need for advanced semiconductor manufacturing equipment is expected to grow significantly, further fueling the expansion of the semiconductor fabrication plant/foundry segment.

The semiconductor electronics manufacturing segment is projected to grow at a rapid CAGR of 7.8% from 2026 to 2033 in terms of revenue. The semiconductor electronics manufacturing sub-segment is projected to experience significant growth over the forecast period, driven by advancements in artificial intelligence (AI), high-bandwidth memory (HBM), and integrated circuit (IC) technologies. Investments in wafer fabrication equipment and advanced packaging technologies also support the segment’s persistent growth.

Regional Insights

The North America semiconductor manufacturing equipment industry is anticipated to grow at a CAGR of 6.6% over the forecast period, as large-scale fab construction and onshoring policies boost equipment demand. Incentives aimed at strengthening domestic chip manufacturing are driving investments in advanced logic fabs and R&D infrastructure. The presence of leading equipment suppliers also supports local ecosystem expansion. This combination is steadily lifting the region’s share of new tool installations.

U.S. Semiconductor Manufacturing Equipment Market Trends

The U.S. semiconductor manufacturing equipment industry dominated the North American region in 2025 due to major investments in advanced node fabs and strong federal incentives supporting domestic chip production. Leading foundries and IDMs are expanding capacity to reduce supply-chain risks and bring critical technologies onshore. The presence of top equipment suppliers further strengthens the country’s ecosystem. As a result, most regional tool demand is concentrated in the U.S.

Canada semiconductor manufacturing equipment industry is growing as it builds out its semiconductor value chain through research-driven initiatives and targeted incentives. The country is investing in compound semiconductors, photonics, and packaging technologies, which is gradually increasing its equipment needs. Collaboration between universities, startups, and global players is helping accelerate capability development. These efforts are positioning Canada as a rising participant in specialized segments of the market.

Asia Pacific Semiconductor Manufacturing Equipment Market Trends

Asia Pacific semiconductor manufacturing equipment industry led the global market and accounted for 69.0% share in 2025, due to its dense fabrication ecosystem, strong government incentives, and ongoing capacity expansion in countries such as Taiwan, South Korea, China, and Japan. Major foundries continue to invest in advanced nodes, which keeps demand for lithography, etch, and deposition tools high. The region also benefits from mature supply chains and skilled labor pools that support rapid scaling. Overall, it remains the core hub for both mature and cutting-edge semiconductor production.

China semiconductor manufacturing equipment dominated the Asia Pacific region in 2025 due to its aggressive fab expansion and strong government backing for domestic chip manufacturing. Large investments across memory, foundry, and mature-node production continue to drive sizeable equipment purchases. The rise of local toolmakers is also boosting procurement within the country. Altogether, these factors keep China at the center of regional equipment demand.

India semiconductor manufacturing equipment industry is growing as new semiconductor policies, incentives, and large-scale fabrication announcements propel the country into the global manufacturing landscape. Government programs are encouraging investments in fabs, ATMP units, and design-linked initiatives. Partnerships with global equipment suppliers are helping build early-stage technical capabilities. This momentum is steadily increasing India’s demand for both front-end and back-end equipment.

Europe Semiconductor Manufacturing Equipment Market Trends

Europe semiconductor manufacturing equipment industry is experiencing steady growth, with Germany leading the way due to its automotive industry’s increasing reliance on semiconductors. Investments in R&D and government efforts to boost semiconductor production within the region are expected to continue driving growth, although the pace may be slower compared to North America and Asia.

Germany semiconductor manufacturing equipment industry dominates the European market due to its strong industrial base, major investments in automotive and power semiconductor fabs, and supportive government funding. The country continues to attract leading chipmakers, expanding capacity for EVs and industrial applications. Its mature engineering ecosystem and supplier network also reinforces tool demand. As a result, Germany remains the key driver of equipment purchases in the region.

The semiconductor manufacturing equipment industry in the UK is growing as it strengthens its position in compound semiconductors, photonics, and advanced packaging technologies. Government-backed innovation programs and collaborations with research institutions are helping expand manufacturing capabilities. Rising interest from global players is further encouraging investments in niche, high-value segments. These developments are gradually increasing the UK’s need for specialized semiconductor equipment.

Latin America Semiconductor Manufacturing Equipment Market Trends

Latin America’s semiconductor manufacturing equipment industry is still in the early stages of growth but is showing promise due to increasing demand for consumer electronics and mobile devices. Countries like Brazil are focusing on developing local manufacturing capabilities, and while the region faces challenges like infrastructure and investment, growth is anticipated as the sector matures.

The semiconductor manufacturing equipment industry in Brazil is growing as it expands local electronics manufacturing and invests in strengthening its high-tech supply chain. Government incentives and public-private programs are encouraging companies to upgrade capabilities, including chip packaging and testing activities. Collaboration with global technology partners is also helping improve technical expertise. These efforts are slowly increasing Brazil’s demand for semiconductor manufacturing equipment.

Middle East & Africa Semiconductor Manufacturing Equipment Market Trends

The Middle East & Africa semiconductor manufacturing equipment industry is witnessing gradual growth, driven by technological advancements and rising demand for electronics in sectors like telecommunications and automotive. While the market is relatively small compared to other regions, investments in infrastructure and technology initiatives in countries like Israel and the UAE are fostering long-term growth prospects.

Israel semiconductor manufacturing equipment industry is growing owing to strong investment in advanced chip design, emerging fabrication projects, and expansion of local R&D capabilities. Government programs and global partnerships are encouraging companies to scale manufacturing-related activities. The country’s deep expertise in electronics and defense technologies supports greater adoption of specialized tools. These factors are steadily increasing Israel’s equipment demand within the region.

Key Semiconductor Manufacturing Equipment Company Insights

Some of the key players operating in the market include Applied Materials, Inc., and ASML, among others.

-

Applied Material, Inc. s is a prominent provider of semiconductor manufacturing equipment, specializing in materials and engineering solutions. The company offers a wide range of systems used in wafer fabrication, display, and solar industries. Applied Materials is known for its innovation in deposition, etching, and metrology technologies.

-

ASML is a key player in the semiconductor equipment manufacturing market, renowned for its advanced photolithography systems used in chip manufacturing. The company specializes in extreme ultraviolet (EUV) lithography, enabling the production of smaller and more powerful semiconductor devices. ASML is a critical supplier to leading semiconductor manufacturers worldwide.

Key Semiconductor Manufacturing Equipment Companies:

The following are the leading companies in the semiconductor manufacturing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Applied Materials Inc.

- Lam Research Corporation

- KLA Corporation

- ASML

- Tokyo Electron Limited

- Advantest Corporation

- SCREEN Semiconductor Solutions Co., Ltd.

- Cohu, Inc.

- ACM Research Inc.

- Nordson Corporation

- Tokyo Seimitsu Co., Ltd.

- EV Group (EVG)

- Modutek Corporation

- Dainippon Screen Group

- Ferrotec Holdings Corporation

Recent Developments

-

In June 2024, ASML announced its roadmap for the next-generation Hyper-NA EUV lithography machine, targeting a numerical aperture (NA) of 0.75 around 2030, which would enable semiconductor patterning down to about 0.2 nm (2 angstroms) scale, far beyond the current High-NA EUV systems with 0.55 NA. This advancement promises much finer transistor features and higher chip density, potentially extending Moore’s Law for another decade.

-

In December 2024, KLA Corporation updated IC substrate product portfolio enhancing advanced semiconductor packaging, focusing on improving connectivity. Key innovations like the Corus direct imaging platform, Serena lithography system, and Lumina inspection system with AI-based defect detection are designed to optimize yield and manufacturing efficiency. These solutions align with the back-end process, particularly in packaging and testing, by offering integrated technologies to meet evolving packaging demands such as smaller feature sizes and new materials.

Semiconductor Manufacturing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 128.06 billion

Revenue forecast in 2033

USD 224.93 billion

Growth rate

CAGR of 8.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments Covered

Process, dimension, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; Netherlands; China; Japan; India; South Korea; Taiwan; Malaysia; Brazil; South Africa; Israel

Key companies profiled

Applied Materials Inc.; Lam Research Corporation; KLA Corporation; ASML; Tokyo Electron Limited; Advantest Corporation; SCREEN Semiconductor Solutions Co., Ltd.; Cohu, Inc.; ACM Research Inc.; Nordson Corporation; Tokyo Seimitsu Co., Ltd.; EV Group (EVG); Modutek Corporation; Dainippon Screen Group; Ferrotec Holdings Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semiconductor Manufacturing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc has segmented the global semiconductor manufacturing equipment market report based on process, dimension, application, and region:

-

Process Outlook (Revenue, USD Billion, 2021 - 2033)

-

Front-end

-

Deposition

-

ALD (Atomic Layer Deposition)

-

CVD (Chemical Vapor Deposition)

-

Others

-

-

Lithography

-

DUV

-

EUV

-

-

Etch

-

Plasma Etch System

-

Gas Chemical Etch System

-

-

Cleaning

-

Single Wafer Cleaning System

-

Scrubber System

-

Single Wafer Cryokinetic Cleaning System

-

Batch Spray Cleaning System

-

Others

-

-

Testing

-

Multi-Cell Test System

-

Wafer/Dicing Frame Prober

-

Others

-

-

-

Back-end

-

Packaging

-

Testing

-

-

-

Dimension Outlook (Revenue, USD Billion, 2021 - 2033)

-

2D

-

2.5D

-

3D

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Semiconductor Electronics Manufacturing

-

Semiconductor Fabrication Plant/Foundry

-

Testing & Inspection

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Taiwan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Israel

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the semiconductor manufacturing equipment market with a revenue share of 69.0% in 2025, on account of major electronic product manufacturing companies operating in the region.

b. Some of the key players operating in the semiconductor manufacturing equipment market include Applied Materials Inc., Lam Research Corporation, KLA Corporation, ASML, Tokyo Electron Limited, Advantest Corporation, SCREEN Semiconductor Solutions Co., Ltd., Cohu, Inc., ACM Research Inc., Nordson Corporation, Tokyo Seimitsu Co., Ltd., EV Group (EVG), Modutek Corporation, Dainippon Screen Group, and Ferrotec Holdings Corporation.scope

b. Key factors driving the semiconductor manufacturing equipment market include rising demand for advanced chips in AI, 5G, and automotive applications, along with increasing investments in semiconductor fabrication and packaging technologies. Additionally, government incentives and the push for domestic chip production are accelerating market growth.

b. The global semiconductor manufacturing equipment market size was estimated at USD 118.88 billion in 2025 and is expected to reach USD 128.06 billion in 2026.

b. The global semiconductor manufacturing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.4% from 2026 to 2033 to reach USD 224.93 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.