- Home

- »

- Network Security

- »

-

Security As A Service Market Size, Industry Report, 2033GVR Report cover

![Security As A Service Market Size, Share & Trends Report]()

Security As A Service Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment Mode (Public Cloud, Hybrid Cloud), By Organization Size, By Security Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-670-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Security As A Service Market Summary

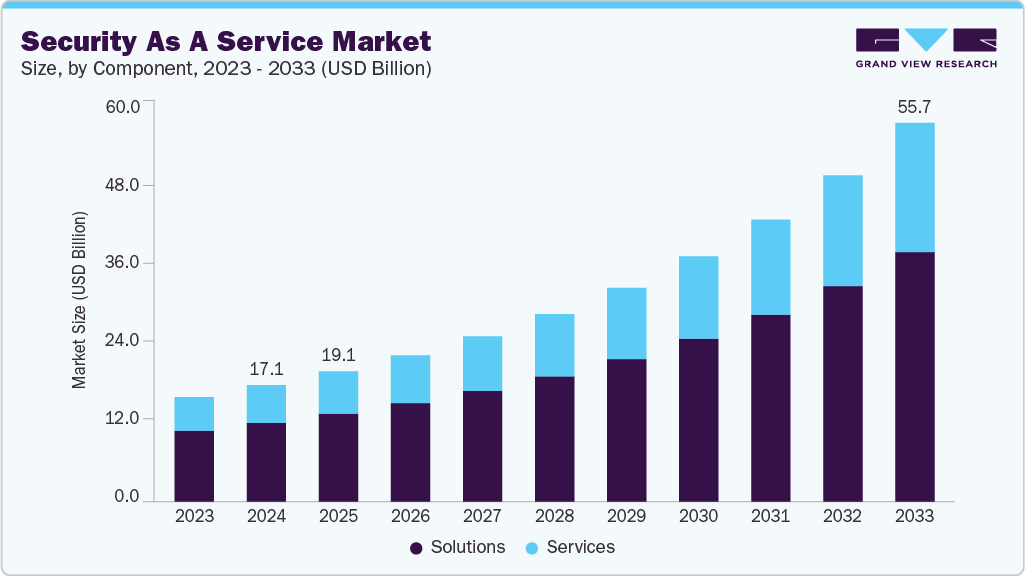

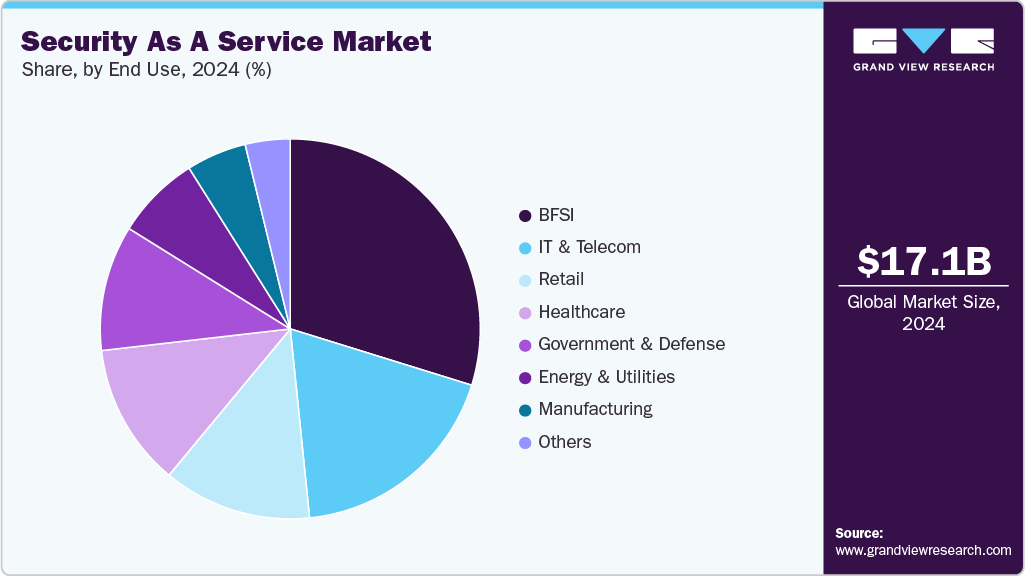

The global security as a service market size was estimated at USD 17.12 billion in 2024 and is projected to reach USD 55.71 billion by 2033, growing at a CAGR of 14.3% from 2025 to 2033. The growth is driven by the convergence of cloud-native technologies, AI-driven threat detection, and zero-trust architectures.

Key Market Trends & Insights

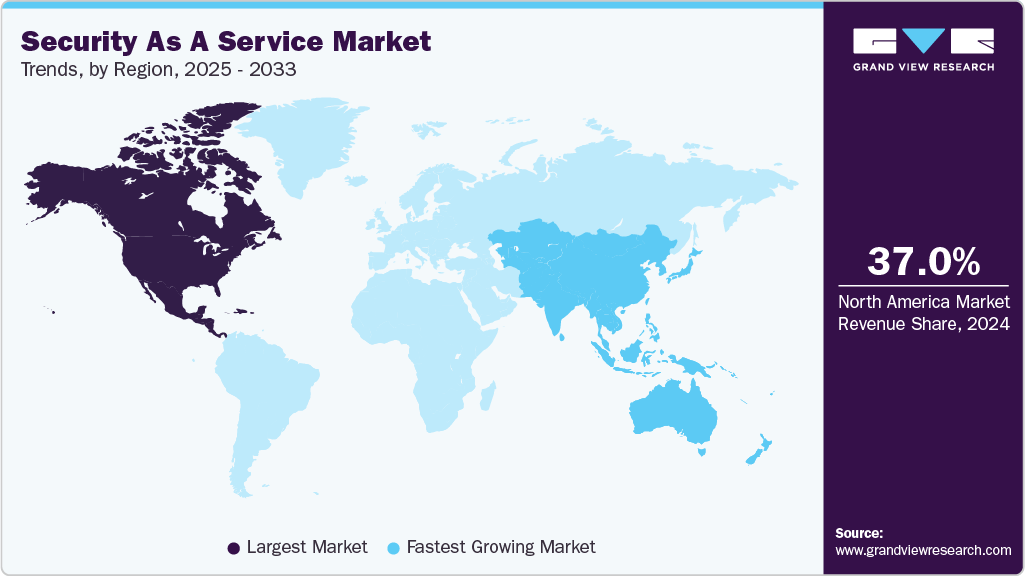

- North America held a 37.0% revenue share of the global security as a service market in 2024.

- The U.S security as a service (SECaaS) market is experiencing rapid growth.

- By component, the solutions segment held the largest revenue share of 67.7% in 2024.

- By deployment mode, the public cloud segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.12 Billion

- 2033 Projected Market Size: USD 55.71 Billion

- CAGR (2025-2033): 14.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enterprises are increasingly shifting from traditional on-premises cybersecurity models to subscription-based, scalable SECaaS offerings that support real-time risk analytics, multi-factor authentication, and automated response capabilities. This cloud-first transition is accelerating as organizations face mounting cyber threats across hybrid work environments and distributed IT infrastructures. For instance, in April 2024, Microsoft expanded its Defender suite to offer integrated SIEM and XDR capabilities as-a-service, enabling customers to unify endpoint, email, and identity protection across multi-cloud ecosystems.

Additionally, key drivers include the growing sophistication of ransomware attacks, rising regulatory scrutiny around data protection (GDPR and HIPAA), and the need to secure expanding digital attack surfaces. Organizations across BFSI, healthcare, and retail are increasingly relying on SECaaS to manage security operations at scale while avoiding the capital expense of in-house infrastructure. Moreover, the integration of AI and machine learning is further optimizing threat detection accuracy and reducing incident response time. For instance, in May 2024, Palo Alto Networks launched an AI-based SECaaS platform that provides predictive threat modeling and autonomous remediation workflows, helping IT teams proactively mitigate vulnerabilities before they escalate.

Additionally, the proliferation of IoT, mobile devices, and remote access points is driving adoption of cloud-delivered security across SMEs and large enterprises alike. Vendors are enhancing their offerings with centralized policy management, real-time dashboards, and compliance reporting tools tailored for sector-specific requirements. For instance, in May 2022, Zscaler partnered with Siemens to deliver industrial-grade secure access services to critical infrastructure operators using edge-based micro segmentation. Consequently, as cyber threats continue to evolve, Security as a Service allows organizations to strengthen their resilience with enhanced agility and cost-efficiency, enhancing its role as a foundational pillar of modern cybersecurity strategies.

Component Insights

The solutions segment accounted for the largest revenue share of 67.7% in 2024, owing to the rising demand for integrated, cloud-native security tools that address complex threat landscapes. Enterprises prioritize modular solutions such as identity and access management (IAM), endpoint protection, SIEM, DLP, and secure email gateways to fortify security across distributed networks, hybrid cloud environments, and remote workforces.

Additionally, these solutions provide real-time threat detection, automated response, and centralized visibility capabilities that are critical as organizations face more frequent and sophisticated cyberattacks. Moreover, the growing adoption of zero-trust security models, regulatory compliance mandates, and the need for scalable protection across multi-cloud ecosystems have further reinforced demand for solution-based offerings. For instance, in May 2025, Microsoft announced the public preview of its unified security operations platform, combining Defender XDR and Sentinel SIEM into a single as-a-service solution, enabling users to streamline identity, endpoint, and email security across cloud platforms. Therefore, the growing demand to enhance solution performance with AI, behavioral analytics, and seamless integration features is contributing significantly to driving the growth of the solutions segment within the security as a service market.

The services segment is anticipated to be the fastest-growing segment during the forecast period, driven by rising enterprise demand for outsourced cybersecurity expertise. Managed and professional services are becoming essential as organizations adopt hybrid work models and multi-cloud infrastructures, requiring 24/7 threat monitoring, incident response, compliance support, and security architecture optimization.

Additionally, these services offer cost-effective access to expert teams and advanced tools without the need to maintain internal Security Operations Centers (SOCs). For instance, in July 2023, NTT DATA launched a global Security Management Outsourcing Service (MDR), offering end-to-end threat detection, incident response, and zero-trust-based remediation. Aimed at scaling from 100 to 500 security staff and generating ¥200 billion annual revenue by FY 2026, the initiative highlights the growing reliance on managed services for resilient and scalable cyber defense. Subsequently, the growing need to enhance service offerings with AI-driven threat analytics, automation, and sector-specific compliance solutions is contributing substantially to driving the demand for the services segment during the forecast period.

Deployment Mode Insights

The public cloud segment accounted for the largest revenue share in 2024 due to the growing enterprise preference for scalable, on-demand security solutions that align with cloud-first and digital transformation strategies. Additionally, public cloud deployments enable rapid provisioning, seamless integration with existing cloud workloads, and centralized threat management across global operations, ideal for businesses with distributed infrastructures. For instance, in November 2022, HCLTech launched its Cloud Security Service for AWS, a fully managed offering designed to help enterprises secure their AWS environments through real-time threat detection, vulnerability management, and compliance automation. By leveraging the flexibility and global reach of AWS’s public cloud infrastructure, HCLTech’s solution reflects the growing trend of vendors aligning SECaaS offerings with hyperscaler platforms to address evolving security and performance requirements. Therefore, the aforementioned factors are contributing notably to spurring the growth of the public cloud segment in the global security as a service market.

The hybrid cloud segment is projected to be the fastest-growing segment over the forecast period due to increasing enterprise demand for security platforms that bridge on‑premises, private, and public cloud environments, offering unified policy enforcement, consistent data protection, and regulatory compliance across diverse infrastructures. As organizations embark on digital transformation, they require flexible architectures that safeguard sensitive workloads in private clouds while leveraging public cloud agility for scalable applications.

For instance, in February 2025, AlgoSec launched its Horizon platform, an application-centric security management solution designed for hybrid environments, delivering AI-driven visibility, automated policy controls, and risk remediation. This development reflects the growing focus among SECaaS providers on supporting hybrid deployments with intelligent orchestration and comprehensive protection, making the hybrid cloud model the fastest-growing segment within the market.

By Organization Size

The large enterprises segment accounted for the largest revenue share in 2024 due to their expansive digital operations, stringent regulatory obligations, and heightened exposure to sophisticated cyber threats, which demand enterprise-grade SECaaS solutions. Additionally, these organizations operate across multiple regions, handling vast volumes of sensitive data, thus necessitating advanced offerings such as identity and access management, SIEM, endpoint protection, and zero-trust architectures.

For example, in March 2025, Bell Canada introduced a sovereign-cloud SECaaS platform designed specifically for large-scale enterprises and public sector organizations. Hosted entirely within Canadian data centers, the service ensures data residency, offers AI-powered SIEM-driven threat detection, and provides 24/7 monitoring by the Bell Business Enterprise Cyber Intelligence Centre. Therefore, the above-mentioned factors are contributing significantly in spurring the growth of the large enterprises segment in the global security as a service market.

The SME segment is expected to be the fastest-growing segment in the coming years as small and medium-sized businesses increasingly adopt accessible, cost-effective security platforms to combat escalating cyber threats amid resource constraints. SME face thousands of cyberattacks annually yet lack in-house expertise and infrastructure, making subscription-based SECaaS offerings particularly appealing. In October 2023, Arete introduced Cloud Security offering targeting SMBs, equipped with managed detection and response across email, cloud endpoints, mobile devices, and more, backed by a global Security Operations Center and proprietary threat intelligence data to reduce risk and business interruptions.

This allows SMEs to focus on core business operations while maintaining strong security postures, making security as a service a practical and strategic solution for their evolving needs. In conclusion, the increasing demand for security services in small and medium organizations with AI-driven analytics, MDR services, and sector-specific compliance features is projected to drive the market share during the forecast period.

Security Type Insights

The network security segment accounted for the largest revenue share in 2024 because it serves as the frontline defense for distributed endpoints, cloud environments, and remote access. Additionally, the surge in hybrid work, multi-cloud deployments, and increasingly sophisticated cyber threats is driving rapid adoption of cloud-delivered firewalls, intrusion detection/prevention systems (IDS/IPS), Secure Access Service Edge (SASE), and secure network gateways.

Moreover, the growing trend towards the integration of AI-based analytics to streamline threat detection and reporting is further driving the growth of the network security segment. In November 2024, Zyxel Networks introduced SecuPilot, an AI-powered assistant within its SecuReporter Cloud Analytics Service. It allows IT teams to analyze and correlate network security data through natural-language queries and receive actionable insights in real time. Subsequently, the ability of network security to reduce analysis time and enable faster response is contributing notably to spurring market growth during the forecast period.

The cloud security segment is expected to register the fastest growth during the forecast period, driven by the expansion of multi-cloud and SaaS adoption, which exposes organizations to security risks, and the growing need for holistic and proactive protection of workloads and data in the cloud. These threats, including misconfigurations, runtime vulnerabilities, and API abuse, require continuous monitoring, automated response, and advanced analytics.

Additionally, the growing regulatory focus on data privacy and the increasing frequency of cloud-targeted attacks are further accelerating the adoption of cloud-native security platforms across industries. For instance, in June 2025, Tamnoon launched Managed Cloud Detection & Response (CDR) service alongside Tami. This AI-powered cloud SecOps agent contextualizes alerts and orchestrates runtime remediation across CNAPP platforms like Wiz, GuardDuty, CrowdStrike, and Orca. By combining machine learning with human validation, Tamnoon’s offering empowers organizations to reduce cloud security alert fatigue and speed up incident resolution. Consequently, the growing adoption of cloud security, owing to its benefits, is contributing notably to spurring the growth of the segment.

End Use Insights

The BFSI segment accounted for the largest revenue share of over 29.0% in 2024 due to its high exposure to cyber threats, strict regulatory compliance requirements, and the critical importance of safeguarding sensitive financial and customer data. Financial institutions, including banks, insurers, and investment firms, are prime targets for cyberattacks such as phishing, ransomware, and advanced persistent threats, necessitating the adoption of robust, real-time security as a service solution.

Additionally, the industry's need for continuous monitoring, secure access management, data encryption, and regulatory reporting drives significant investment in cloud-native security platforms. Moreover, the rapid digital transformation of BFSI through mobile banking, online payments, and fintech integration further expands the threat surface, making security solutions essential for operational resilience and customer trust.

The healthcare segment is projected to register the fastest growth during the forecast period due to rising cybersecurity risks associated with digital health transformations, such as HIPAA compliance, telemedicine proliferation, and the digitization of patient records. Healthcare providers rely on cloud, IoT devices, and electronic health systems, making them vulnerable to ransomware, data breaches, and operational disruptions. This drives the demand for SECaaS offerings that ensure 24/7 protection, privacy, and regulatory compliance. For instance, in August 2022, Happiest Minds Technologies launched end-to-end security services for healthcare, tailored to the sector’s unique needs. The offering includes advanced threat detection, compliance support (HIPAA, HITRUST), secure EHR access, and real-time network monitoring. Therefore, the growing demand for security solutions in the healthcare sector, owing to the above-mentioned factors, is contributing notably in spurring the security as a service market size.

Regional Insights

North America security as a service market accounted for the largest revenue share of 37.0% in 2024, fueled by the region’s stringent data protection regulations such as HIPAA, GLBA, and CCPA, rapid cloud migration across industries, and the presence of major players offering advanced threat detection and zero-trust frameworks. The United States is witnessing a surge in high-profile ransomware and nation-state attacks targeting BFSI, healthcare, and government sectors, prompting organizations to adopt SECaaS solutions with integrated SIEM, MDR, and endpoint protection capabilities.

Additionally, the demand for sovereign cloud-based security offerings is growing amid rising concerns over data sovereignty and federal cybersecurity mandates. Moreover, North American enterprises are also leveraging AI-powered SECaaS tools for real-time analytics, insider threat detection, and compliance automation, reflecting a mature cybersecurity landscape that prioritizes both resilience and regulatory alignment.

U.S. Security As A Service Market Trends

The U.S security as a service (SECaaS) market is experiencing rapid growth driven by a sharp rise in ransomware attacks, evolving regulatory mandates such as NIST 800-53, CMMC, and the Executive Order on Improving the Nation’s Cybersecurity, and widespread cloud adoption across sectors. Enterprises are increasingly transitioning to zero-trust architectures and integrating AI-powered threat analytics and identity management into their SECaaS frameworks to address sophisticated, multi-vector threats.

In addition, the growing emphasis on data sovereignty and secure federal cloud workloads is also accelerating demand for government-grade SECaaS platforms. For instance, Amazon Web Services announced the launch of its second “Secret” cloud region in the U.S., scheduled for 2025, to support classified federal workloads and reinforce national cybersecurity infrastructure. Additionally, domestic vendors such as Zscaler, Palo Alto Networks, and CrowdStrike continue to lead the market with tailored offerings that support real-time threat detection, endpoint protection, and compliance-driven cloud security, reinforcing the U.S. as the most advanced and security-conscious national market in this domain.

Europe Security As A Service Market Trends

The Europe security as a service market is anticipated to register considerable growth from 2025 to 2033, driven by strict regulatory frameworks like GDPR and the NIS2 Directive, which mandate rigorous data protection, breach reporting, and cybersecurity standards. Additionally, rising enforcement actions and recent rulings by the Court of Justice of the European Union, such as recognizing loss of control over personal data as compensable harm, have heightened compliance pressures, prompting widespread adoption of SECaaS solutions offering encryption, SIEM, and real-time risk visibility. Moreover, the region’s acute cybersecurity skills shortage, with over 290,000 unfilled roles, has further accelerated demand for managed detection and response (MDR) and SOC-as-a-Service platforms that deliver 24/7 monitoring and AI-driven threat mitigation without relying on internal teams.

The UK security as a service market is witnessing strong momentum, driven by a surge in cyberattacks targeting critical infrastructure, increased cloud adoption across public and private sectors, and evolving regulatory mandates under frameworks like the UK GDPR and the National Cyber Strategy 2022. Additionally, British enterprises are rapidly shifting toward SECaaS models to comply with data residency requirements, secure remote workforces, and protect sensitive assets against ransomware, phishing, and advanced persistent threats. Moreover, the UK government’s investment in enhancing national cyber resilience, such as funding for the National Cyber Security Centre (NCSC) and initiatives encouraging SME cybersecurity adoption, is further catalyzing demand for scalable, subscription-based security solutions.

Germany security as a service market is gaining traction owing to the increased demand across solutions like network security, endpoint protection, cloud security, and SIEM. Key growth drivers include Germany's rigorous implementation of GDPR, the national IT Security Act, and a robust regulatory posture that prioritizes data sovereignty and encryption, compelling businesses to adopt cloud-based security models compliant with local standards. Moreover, Germany’s critical infrastructure, including manufacturing, healthcare, and public institutions, is frequently targets by advanced cyber threats, pushing demand for managed detection and response (MDR) and SOC-as-a-service platforms, especially given a continuing shortage of cybersecurity professionals.

Asia Pacific Security As A Service Market Trends

The Asia Pacific security as a service market is expected to register the fastest CAGR of 15.3% from 2025 to 2033, driven by the region’s rapid digital transformation, rising cybercrime incidents, and expanding regulatory frameworks across key economies. Countries like India, Japan, and Australia are adopting a security-as-a-service solution to support secure cloud migration, remote work enablement, and the protection of critical infrastructure.

Additionally, the deployment of 5G and IoT technologies is increasing the complexity of threat landscapes, prompting enterprises to invest in AI-powered security platforms that offer continuous monitoring and automated threat response. Moreover, the shortage of skilled cybersecurity professionals across the region is pushing organizations, especially SMEs, to rely on managed detection and response (MDR) and SOC-as-a-Service solutions.

Japan security as a service market is experiencing strong growth, driven by a rising frequency of targeted cyberattacks, increased cloud adoption across both private and public sectors, and a shift toward outsourcing cybersecurity operations. With the expansion of remote work and digital services, Japanese enterprises are adopting security solutions to address vulnerabilities in endpoint protection, identity access management, and cloud workload security.

Moreover, the country’s aging population and workforce constraints have also contributed to a reliance on managed security solutions that offer round-the-clock protection and compliance support without requiring large internal teams. Additionally, Japan’s focus on critical infrastructure protection, coupled with government-led cybersecurity initiatives and industry-specific guidelines, is pushing sectors like BFSI, healthcare, and manufacturing to embrace scalable, regulation-aligned SECaaS platforms.

China security as a service marketheld a substantial revenue share in 2024, driven by strong government regulation and an expanding managed security ecosystem. The Chinese government’s Cybersecurity Law of 2017, alongside ongoing initiatives from MIIT, mandates data localization, stringent network security standards, and regular risk assessments for critical sectors, compelling enterprises to adopt SECaaS providers capable of ensuring regulatory compliance. Furthermore, a significant shortage of cybersecurity talent has prompted both large corporations and SMEs to rely heavily on outsourced cloud-based and managed security services, including SIEM, DDoS mitigation, and endpoint protection.

India security as a service market is gaining significant traction due to increasing cyber threats, accelerated cloud adoption, and a pronounced cybersecurity skills shortage, prompting organizations to outsource protection. For instance, in July 2024, Sysdig introduced a real‑time cloud security SaaS region based out of India, providing runtime threat detection for containers and cloud workloads hosted in local AWS data centers, an apt response to the country's expanding cloud ecosystem and real-time threat challenges.

Key Security As A Service Company Insights

Key players operating in the security as a service industry are IBM, Cisco Systems, Dell Technologies, Barracuda Networks, and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2025, Zscaler launched advanced AI-powered security innovations designed to enhance data protection, stop cyberattacks, and enable secure adoption of AI technologies at scale. Key features include AI-driven data security classification with granular sensitivity detection, enhanced generative AI protections to control and inspect AI prompts, AI-powered user-to-application segmentation to simplify security workflows, and AI-enabled network intelligence for improved reliability and threat detection.

-

In April 2025, Cisco and ServiceNow partnered to help enterprises securely adopt and scale AI-driven operations. The first integration, launched in H2 2025, combines Cisco AI Defense with ServiceNow SecOps to enable visibility into AI workloads, automated vulnerability assessment, real-time protection, incident response, and governance, all within a unified platform.

-

In November 2024, LTIMindtree partnered with Cisco by adopting Cisco Secure Access as its new Security Service Edge (SSE) solution to protect its 80,000 hybrid workforce with zero trust security and embedded AI. Together, they are delivering next-generation Secure Access Service Edge (SASE) solutions to LTIMindtree’s global clients, enabling seamless, secure hybrid work experiences with integrated cloud security and SD-WAN technologies.

Key Security As A Service Companies:

The following are the leading companies in the security as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Barracuda Networks

- Check Point Software Technologies

- Cisco Systems

- CrowdStrike

- Dell Technologies

- Fortinet

- IBM

- McAfee

- Palo Alto Networks

- Proofpoint

- Qualys

- Sophos

- Symantec

- Trend Micro

- Zscaler

Security As A Service Market Report Scope

Report Attribute

Details

Market size in 2025

USD 19.15 billion

Revenue forecast in 2033

USD 55.71 billion

Growth rate

CAGR of 14.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, organization Size, security type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

IBM; Cisco Systems; Dell Technologies; Barracuda Networks; Proofpoint; Sophos; Trend Micro; Zscaler; McAfee; Symantec; Qualys; Fortinet; Palo Alto Networks; Check Point Software Technologies; CrowdStrike

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Security As A Service Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global security as a service market report based on component, deployment mode, organization size, security type, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Identity and Access Management (IAM)

-

Data Loss Prevention (DLP)

-

Endpoint Protection

-

Secure Email Gateway

-

Security Information and Event Management (SIEM)

-

Intrusion Detection and Prevention Systems (IDPS)

-

Encryption

-

Others

-

-

Services

-

Managed Services

-

Professional Services

-

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Organization Size Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

Security Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Network Security

-

Endpoint Security

-

Email Security

-

Cloud Security

-

Web Security

-

Database Security

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Healthcare

-

Retail

-

Government & Defense

-

Energy & Utilities

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global security as a service market size was estimated at USD 17.12 billion in 2024 and is expected to reach USD 19.15 billion in 2025.

b. The global security as a service market is expected to grow at a compound annual growth rate of 14.3% from 2025 to 2033 to reach USD 55.71 billion by 2033.

b. The solutions segment dominated the multi-cloud networking market with a market share of 67.69% in 2024. The growth is attributed to the rising demand for integrated, cloud-native security tools that address complex threat landscapes.

b. Some key players operating in the market include IBM, Cisco Systems, Dell Technologies, Barracuda Networks, Proofpoint, Sophos, Trend Micro, Zscaler, McAfee, Symantec, Qualys, Fortinet, Palo Alto Networks, Check Point Software Technologies, CrowdStrike and Others.

b. Factors such as the convergence of cloud-native technologies, AI-driven threat detection, and zero-trust architectures plays a key role in accelerating the Security as a Service market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.