- Home

- »

- Consumer F&B

- »

-

Seaweed Snacks Market Size, Share, Industry Report, 2030GVR Report cover

![Seaweed Snacks Market Size, Share & Trends Report]()

Seaweed Snacks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Strips & Chips, Flakes, Bars, Others), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-315-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Seaweed Snacks Market Summary

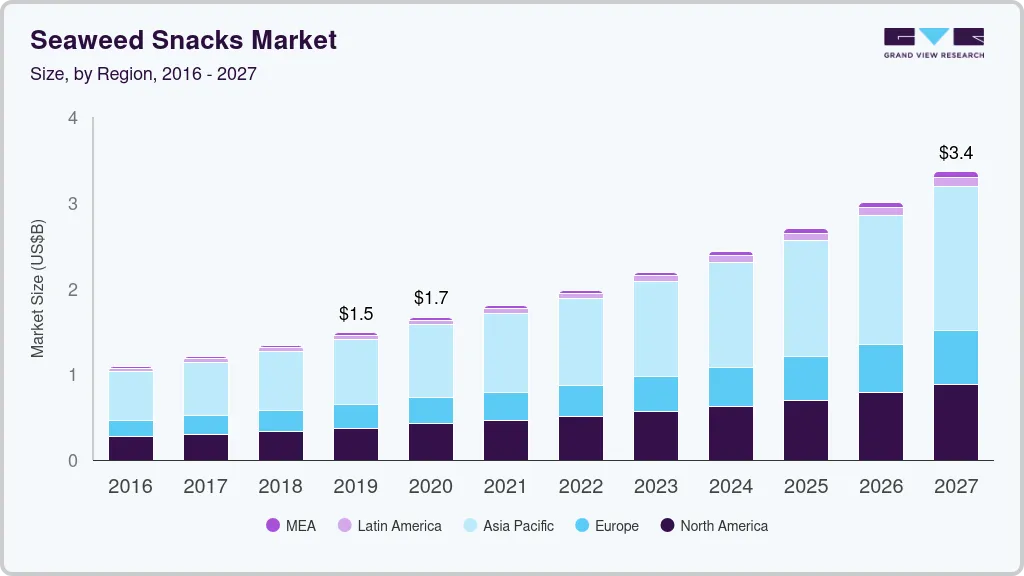

The global seaweed snacks market size was estimated at USD 2.43 billion in 2024 and is projected to reach USD 4.66 billion by 2030, growing at a CAGR of 11.6% from 2025 to 2030. The increasing popularity of nutrient-rich snacking products due to the steadily expanding health-conscious demographic has led to the launch of several innovative food items, with seaweed being considered a highly beneficial ingredient.

Key Market Trends & Insights

- The Asia Pacific seaweed snacks market accounted for the largest revenue share of 50.6% globally in 2024.

- China accounted for a leading revenue share in the regional market in 2024.

- By product, the strips & chips segment accounted for the largest revenue share of 53.2% in the global market in 2024.

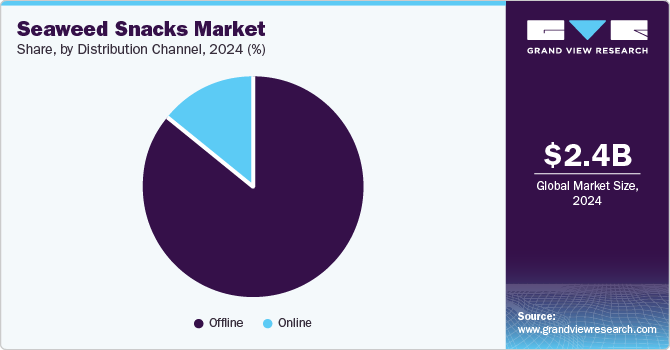

- By distribution channel, the offline segment accounted for a dominant market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.43 Billion

- 2030 Projected Market Size: USD 4.66 Billion

- CAGR (2025-2030): 11.6%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Additionally, as more consumers adopt plant-based diets, seaweed snacks have emerged as a preferred choice due to their nutritional content and versatility. The rising vegan population presents another notable avenue for manufacturers of seaweed snacks, as these products are naturally sourced and considered healthier and cleaner.

Seaweed (sea vegetables) are algae that grow in seas and are found in various colors, including red, green, brown, and black. The ingredient is highly versatile and is utilized in various culinary preparations globally, including soups and stews, sushi rolls, supplements, salads, and smoothies. Seaweed is a rich source of iodine, which is crucial for thyroid function, as this mineral produces hormones that regulate metabolism, growth, and development. The product is also known to contain varying amounts of vitamins A, C, E, and K, as well as minerals such as zinc, sodium, calcium, and magnesium. Some forms of seaweed, such as chlorella and spirulina, contain all nine essential amino acids, while it is also considered a good source of vitamin B12 and omega-3 fats. Manufacturers are aiming to launch several variants in their snacking portfolio that attract a wider demographic, boosting product sales in the seaweed snacks industry.

As awareness regarding environmental issues rises among the worldwide population, consumers are moving towards sustainable food alternatives. Seaweed snacks are generally marketed as clean-label and eco-friendly products, appealing to eco-conscious consumers who prefer snacks with minimal processing and natural ingredients. Moreover, the frequent introduction of diverse flavors and innovative product formats, such as chips, bars, and seasonings, has increased product awareness and popularity among a broader audience, aiding the substantial expansion of the seaweed snacks industry. Sushi’s growing popularity and availability in Western countries also contribute to market growth. In recent years, sushi rolls made with seaweed roll-ups have gained traction as a notable snacking item.

Companies are also focusing on utilizing innovative packaging materials and processes to boost product sales. For instance, in November 2023, Neste and Mitsui Chemicals and the latter’s subsidiary Prime Polymer announced a collaboration to provide sustainable packaging solutions for CO-OP, a Japanese Consumers Co-operative Union (JCCU) brand. As per the deal, fossil-based packaging materials for CO-OP’s seaweed snacks were replaced with bio-based alternatives. The companies further stated that they would extend the implementation of this sustainable packaging to other product categories in the near future. This packaging is the first-ever solution made using renewable plastics through the mass balancing approach that received the Japanese Eco Mark certification.

Product Insights

The strips & chips segment accounted for the largest revenue share of 53.2% in the global market in 2024, owing to the extensive popularity and sales of seaweed strips and chips. These products are perceived as healthier alternatives to traditional chips due to their low-calorie content and high nutritional value, including vitamins, minerals, antioxidants, and fiber. Seaweed chips provide a crispy texture that mimics their conventional alternatives while being lighter and healthier. Moreover, they are being made available in a wider range of flavors, such as wasabi, sesame, teriyaki, barbecue, and fusion flavors, including chili lime and truffle. These factors have helped boost segment demand in the seaweed snacks industry.

Meanwhile, the bars segment is anticipated to grow at the highest CAGR during the forecast period. Increasing sales of nutritious snack bars offers a significant opportunity for companies to introduce products in this category. Seaweed bars are a rapidly emerging product segment in the functional snack category, combining the nutritional benefits of seaweed with ingredients such as nuts, seeds, grains, and dried fruits. Companies are using innovative promotion strategies and social media channels to boost their sales, while several new brands have also emerged that aim to benefit from the nutritional properties of seaweed. For instance, in July 2024, the Phytabar brand was launched, which is a vegan chocolate nutrition bar made by two university students from Massachusetts, the U.S. The product includes Wakame seaweed, 85% cacao chocolate, dates, almonds, stevia & monk fruit, and a vegan protein blend.

Distribution Channel Insights

The offline segment accounted for a dominant revenue share in the global market in 2024, aided by the substantial sales of seaweed snacks through specialty stores, supermarkets & hypermarkets, and grocery outlets. With the awareness regarding these products still growing among consumers, larger chains such as Walmart and Tesco have increased their presence across aisles to improve product visibility. They are also strategically placed near checkout counters to increase the chances of impulse purchases, which can drive repeated sales. Brands also leverage strategies such as free sample testing, promotions, and price reductions during health awareness months to drive sales of seaweed snacks.

The online segment, meanwhile, is expected to grow at the fastest CAGR during the forecast period. The increasing smartphone usage globally, the high rate of Internet adoption, and rising awareness regarding the nutritional benefits of seaweed snacks have led to the growing usage of online channels. Moreover, these platforms provide a cost-efficient way for start-ups and local brands to promote their products and nutritional value. The availability of substantial discounts, as well as same-day or next-day delivery options, have resulted in consumers preferring online platforms to purchase food items, enabling a strong segment expansion in the seaweed snacks industry.

Regional Insights

The Asia Pacific seaweed snacks market accounted for the largest revenue share of 50.6% globally in 2024. Substantial awareness regarding the ingredient and its continued usage in various regional food preparations have created a well-established market. Seaweed has been a dietary staple for centuries in countries such as Japan, South Korea, China, and Thailand and is commonly used in soups, rice dishes, and sushi. Products including nori sheets, flavored seaweed strips, and roasted seaweed are highly popular and integrated into everyday meals by regional consumers, generating a consistent demand for these snacking items.

China Seaweed Snacks Market Trends

China accounted for a leading revenue share in the regional market in 2024, aided by the increasing health awareness among Chinese consumers and a rapidly rising interest in natural and organic food products. Furthermore, the country is a significant producer of seaweed, with ‘The State of World Fisheries and Aquaculture 2022’ report stating that the country accounts for more than half of the global production volume. This has boosted the availability of seaweed as an ingredient for the fast-growing food & beverage sector. Moreover, rising disposable income levels and increasing urbanization have driven consumer willingness to spend more on premium snack offerings. Manufacturers are aiming to launch products in popular flavors such as spicy Sichuan, soy sauce, sesame, and barbecue, which are tailored to Chinese taste preferences.

Europe Seaweed Snacks Market Trends

Europe accounted for a substantial revenue share in the global market in 2024. Regional consumers are increasingly becoming aware of the various health benefits of seaweed, driving a strong demand for products incorporating this ingredient. The snacking sector is witnessing a noticeable demand for natural and organic offerings, which has compelled brands to introduce seaweed-based products in their portfolios. Seaweed snacks are rich in iodine, vitamins, antioxidants, and dietary fiber, making them an appealing option for health-conscious consumers. Furthermore, the rapidly expanding vegan and flexitarian demographic in Europe considers seaweed snacks as a sustainable and delicious plant-based alternative, aiding industry expansion. In September 2024, High Tide, a UK-based business, announced the imminent launch of High Tide Seaweed Snack Bars, made from sustainably sourced seaweed from a Welsh ocean farm. Such developments are expected to create further growth avenues for the regional industry.

North America Seaweed Snacks Market Trends

North America is expected to grow at the highest CAGR during the forecast period. Increasing health concerns among the regional population and rising awareness regarding functional ingredients have heightened the appeal of seaweed among food manufacturers. Moreover, several major retail chains such as Walmart, Kroger, and Whole Foods, along with the strong e-commerce sector, have led to widespread demand for seaweed snacks, particularly among younger consumers. Seaweed farming also has a low environmental impact, which is an important factor for snacking companies looking to drive sales among eco-conscious consumers in the U.S. and Canada.

The U.S. accounted for a dominant revenue share in the North American market for seaweed snacks in 2024. The presence of a substantial population suffering from lifestyle disorders such as diabetes and heart disease has compelled snack manufacturers to seek ingredients that can provide high nutritional value. Seaweed snacks align with the demand for functional foods that provide additional health benefits, such as gut health and thyroid support. Furthermore, the growing demographic of working professionals and their busy lifestyles have boosted the popularity of on-the-go snacks. Influencers and celebrities are also collaborating with notable brands to drive product awareness among the U.S. population, creating substantial sales opportunities.

Key Seaweed Snacks Company Insights

Some major companies involved in the global seaweed snacks industry include TAOKAENOI FOOD & MARKETING, gimme Seaweed, and Kimnori USA, among others.

-

TAOKAENOI FOOD & MARKETING is a Thailand-based manufacturer of fried, baked, and grilled seaweed and seaweed snacks. The company exports its seaweed to over 37 countries globally and is present in major markets such as the U.S., Canada, China, and European economies. It is well-known for its Roasted Seaweed Sheets, which are typically flavored with salt, sesame, or other spices and packaged in convenient snack-sized servings. TAOKAENOI further markets seaweed crisps as a healthier alternative to conventional chips and flavored snacks catering to regional preferences.

-

gimme Seaweed is a U.S.-based brand that specializes in producing organic seaweed snacks. The company offers a range of products, which includes Roasted Seaweed Snacks, Grab & Go Roasted Seaweed Snacks, Sushi Nori, and Big Sheets. These products are available in various popular flavors, including avocado oil, chili lime, olive oil, sea salt, teriyaki, Korean BBQ, wasabi, and toasted sesame. The company is heavily involved in sustainability initiatives, with its organic seaweed farms known to sequester carbon and improve water quality. Moreover, its Grab & Go product range was launched in 2022 without plastic trays, thus reducing the use of single-use plastics.

Key Seaweed Snacks Companies:

The following are the leading companies in the seaweed snacks market. These companies collectively hold the largest market share and dictate industry trends.

- TAOKAENOI FOOD & MARKETING PCL

- gimme Seaweed

- Frito-Lay North America, Inc.

- Annie Chun’s, Inc.

- Kimnori USA

- Wooltari USA, Inc.

- SeaSnax

- Ocean’s Halo

- BIBIGO, FROM CJ

- SINGHA CORPORATION CO., LTD.

Recent Developments

-

In October 2024, Gimme Seaweed announced the launch of a Korean BBQ flavor in the company’s roasted seaweed snacks portfolio, made available through both online (Amazon) and offline retail channels. The new product combines notable flavors of Korean BBQ, including gochujang, garlic, soy sauce, miso, and pepper. This is the ninth flavor in Gimme's range of roasted seaweed snacks, following Sea Salt & Avocado Oil, Sea Salt, Olive Oil, White Cheddar, Teriyaki, Wasabi, Sesame, and Chili Lime.

-

In October 2023, CJ CheilJedang announced the launch of its ‘bibigo Seaweed Snack’ across Asda and Ocado grocery chains in the UK, both through offline and online channels. This comes after the company introduced the product in the UK through a subsidiary in 2022. bibigo Seaweed Snacks are noted for their low cholesterol content and zero saturated fat, gluten, colorings, and additives. Dried seaweed is a major strategic product of the company, in addition to mandu, kimchi, chicken, K-sauce, processed rice, and rolls. CJ CheilJedang aims to expand its global footprint by further launching these offerings.

Seaweed Snacks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.70 billion

Revenue forecast in 2030

USD 4.66 billion

Growth Rate

CAGR of 11.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

TAOKAENOI FOOD & MARKETING PCL; gimme Seaweed; Frito-Lay North America, Inc.; Annie Chun’s, Inc.; Kimnori USA; Wooltari USA, Inc.; SeaSnax; Ocean’s Halo; BIBIGO, FROM CJ; SINGHA CORPORATION CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Seaweed Snacks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global seaweed snacks market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Strips & Chips

-

Flakes

-

Bars

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global seaweed snacks market size was estimated at USD 1.48 billion in 2019 and is expected to reach USD 1.66 billion in 2020.

b. The global seaweed snacks market is expected to grow at a compound annual growth rate of 10.8% from 2020 to 2027 to reach USD 3.36 billion by 2027.

b. Asia Pacific dominated the seaweed snacks market with a share of more than 50% in 2019. This is attributable to the availability of the product in different flavors and textures along with increasing popularity as a topping for kimbap or other Korean rice meals in the region.

b. Some key players operating in the seaweed snacks market include Taokaenoi Food & Marketing PCL, gimMe Health Foods Inc., Frito-Lay North America, Inc., Annie Chun’s, Inc., Kimnori U.S.A. Inc., KPOP Foods, SeaSnax, Ocean’s Halo, SEAWEED MARKET OÜ, and Singha Corporation.

b. Key factors that are driving the seaweed snacks market growth include growing demand for better-for-you food items, rising trend of “free-from†food products, and the rising inclination towards healthy food among consumers across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.