Amino Acids Market Size, Share & Trends Analysis Report By Type, By Source (Plant-based, Animal Based, Chemical Synthesis) By Grade, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-453-6

- Number of Report Pages: 177

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Amino Acids Market Size & Trends

The global amino acids market size was valued at USD 27.2 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.5% from 2024 to 2030. This is attributable to increased consumer spending capacity and growing awareness among individuals regarding healthy lifestyle and preventive care. Amino acids are used in health supplements to reduce muscle pain, fatigue, and lower the risk associated with cardiovascular diseases. They are also gaining popularity in nutritional sports supplements. Many athletes prefer consuming product-based supplements in the form of tablets, powders, and drinks for muscle growth. Nutraceutical products are segmented into functional beverages, functional food, and dietary supplements.

In the animal feed industry, the market is used as bioactive supplements as they offer several health benefits to animals. They are also used as critical ingredients in pet food products and veterinary supplements to enhance food digestibility and thereby strengthen the immune system. Feed-grade are in demand as their consumption improves activities & health of animals and offers better joint mobility. Animal feed industry is expected to witness a high demand for feed-grade product owing to increasing aging-pet population, unique dietary requirements, and specialized diets. The growing adoption of pets in households across several countries is expected to drive the demand for pet food, in turn, driving the demand for market in the pet food industry.

Amino Acids Market Size, Share & Growth Insights:

- Amino acids market size is estimated at USD 29.4 billion in 2024.

- The market size is expected to grow at a CAGR of 8.5% from 2024 to 2030.

- Asia Pacific accounted for the largest market share of 46.4% in 2023.

Raw materials used for amino acids production including soybean oilseeds, wheat, and corn have been witnessing price volatility over the past few years. This trend is expected to continue over the forecast period owing to increasing consumption of raw materials for other food production, resulting in limited supply for market production. Short-term factors such as increasing energy prices are among the other hurdles leading to shortage of raw materials for product production. In developing economies, manufacturers are often forced to create product from low-quality alternative ingredients such as cassava or sorghum. Such alternative ingredients are less digestible compared to corn and soybean.

Market Concentration & Characteristics

Amino acids are anticipated to witness high demand from food and dietary supplement manufacturers with the increased consumer spending capacity and growing awareness among individuals regarding healthy lifestyle and preventive care. Amino acids are used in health supplements to reduce muscle pain and fatigue, as well as to lower the risk associated with cardiovascular diseases. They are also gaining popularity in nutritional sports supplements.

Many athletes prefer consuming amino acid-based supplements in the form of tablets, powders, and drinks for muscle growth. Nutraceutical products are segmented into functional beverages, functional food, and dietary supplements. The key factor driving the growth of the nutraceuticals industry is the increased spending on organic and healthy food products. This is expected to increase the consumption of amino acids in the nutraceuticals industry.

Key regions such as North America and Asia Pacific have witnessed an upsurge in healthcare spending. In 2023, North America is projected to record the highest healthcare spending as compared to other regions owing to the burgeoning aging population and prevalence of several diseases in the region. Furthermore, the growing aging population, expansion of the nutraceutical & pharmaceutical industry, and technological & clinical advancements. Increasing consumption of pharmaceutical and nutraceutical products in developed economies is anticipated to surge the demand for amino acids over the forecast period.

Source Insights

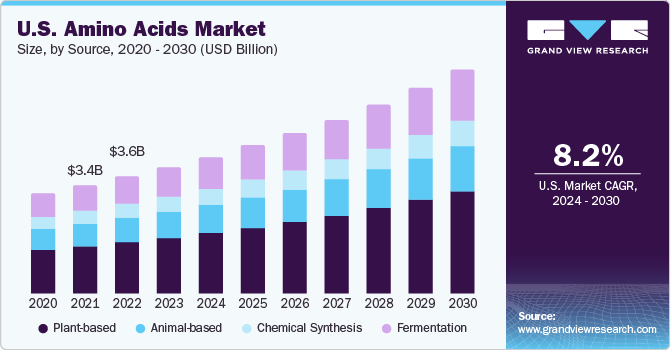

Plant based source dominated the market with a revenue share of 43.9% in 2023. This is attributed to the growing consumer awareness regarding natural and organic products that is expected to drive the worldwide production and consumption of plant-based. In addition, the augmented social awareness related to animal slaughter is expected to positively impact the demand for plant-derived. However, the production of plant-based products is limited owing to the lack of production technology and high capital cost required.

Animals are the primary sources for the extraction of amino acids. Animal meat including pork, beef, and chicken along with other by-products such as muscle, skin, gut, blood, and placenta of fish. Animal by-products can be sourced from slaughterhouses, meat processors, and aquaculture farms. Key players involved in meat processing include JBS S.A., Tyson Foods, Inc., and Smithfield Foods. The rising meat consumption across the globe has driven its production. This, in turn, is likely to boost market growth in the coming years.

Type Insights

Non-essential type segment dominated market with a revenue share of 52.5% in 2023. This is attributed to the fact that non-essential amino acids are commonly used in animal feed to provide a balanced product profile for the animal. Animal nutritionists formulate diets to meet the animal's nutrient requirements, including their protein needs. Amino acids are the building blocks of proteins, so it is essential to provide a balanced mix of both essential and non-essential in the animal's diet. This helps to ensure optimal growth, development, and health.

The usage of essential amino acids is growing steadily across the world owing to surging demand for dietary supplements and sports nutrition products, increasing number of patients suffering from chronic diseases, aging population, and rising awareness among consumers about the benefits of essential amino acids.

Amino acids are essential for muscle growth and recovery. Hence, they are widely used in sports nutrition products such as protein powders, bars, and shakes. Moreover, the growing trend of veganism and vegetarianism worldwide has led to the development of plant-based market. This, in turn, is leading to the growth of essential amino acids segment of the market worldwide.

Grade Insights

The pharma grade dominated the market with a revenue share of 39.0% in 2023. This is attributed to the fact that pharmaceutical-grade amino acids are among the most premium and high-cost grades of these acids. They are manufactured while adhering to strict quality control standards to ensure their purity and safety. These product play a crucial role in various biological processes within the human body, including protein synthesizing, cell signaling, and neurotransmitter manufacturing.

Feed-grade amino acids are added to animal diets to supplement and balance their profile. These supplements ensure that animals receive the required number of for their proper growth, development, and reproduction, as well as for their overall health. Feed-grade are manufactured through a rigorous process involving hydrolysis or fermentation of plant or animal protein sources. This process breaks down complex proteins into constituent amino acids leading to their easy bioavailability and digestibility. These acids are then carefully processed and purified to meet the high-quality standards required for animal feed.

Food-grade amino acids are crucial for the food industry as they add protein content and functional and nutritional value to various products. Some products, such as glutamic acid, are known for enhancing the taste and flavor of food. They are often used as flavor enhancers in processed food, such as snacks. These acids are the building blocks of proteins and play a crucial role in the growth, repair, and maintenance of body tissues.

End-use Insights

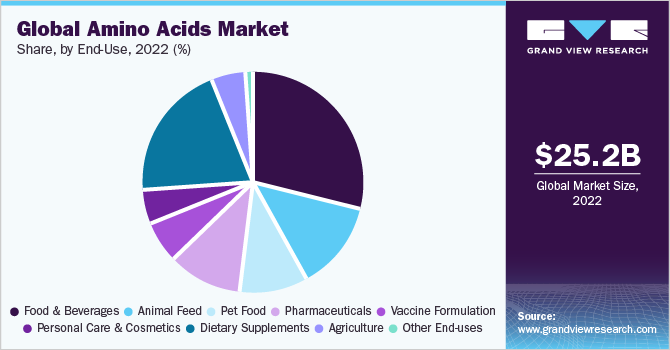

Food & beverage application dominated the market with a revenue share of 29.0% in 2023. Amino acids are used to increase the nutritive value of food products. Products such as lysine and methionine are used in bread and soy products, respectively. Increased demand for functional and nutritional food products is anticipated to drive the segment over the forecast period. Amino acids are widely used in nutraceutical industry as a dietary supplement for the treatment of muscle fatigue, muscle soreness as well as to maintain cardiovascular health.

Amino acids play a crucial role in pet food formulations as they provide essential nutrients to support the health and growth of pets, as well as to ensure their overall wellbeing. These building blocks of proteins are necessary for ensuring the proper physiological functions of animals, making them a fundamental component in the development of a balanced and nutritious pet diet.

In pharmaceutical applications, markets play a vital role in the prevention of various diseases such as the treatment of brain metabolism and neurotransmission imbalances, liver disease, burn, sepsis, and urine disease. Among different amino acids, glutamic acid is used widely used as an antiulcer drug, as well as gastrointestinal medicine has recently gained attention also. Besides arginine is also gaining popularity owing to its fast and effecting recovering property post-surgery.

Amino acids are the building blocks of proteins. They play an essential role in the formulation of vaccines, which are designed to trigger an immune response in the body to prepare its immune system to fight against specific pathogens. These acids are used in vaccine formulations for developing antigens, which are the molecules that are to be recognized and responded to by the immune system.

Regional Insights

Asia Pacific dominated the market with a highest revenue share of 46.4% in 2023. Asia Pacific is expected to be the fastest-growing market for amino acids during the forecast period owing to increasing overall consumer spending, growing adoption of a healthy lifestyle by the masses, and flourishing end-use industries such as nutraceutical, pharmaceutical, personal care, and cosmetics. Increasing production in the region and surging exports of feed additives from key countries such as Japan and China are anticipated to contribute to the market growth.

China Amino Acids Market

Rising pork consumption in China is expected to drive the market growth in the country. Growing health concerns and rising individual medical expenditure are expected to fuel the demand for dietary supplements in China, which, in turn, is expected to augment the demand for product. The shift in trend toward ready-to-drink (RTD) beverages is projected to positively influence the demand for aspartame, in turn, augmenting the consumption of product in the form of aspartic acids in the region over the forecast period.

India Amino Acids Market

In India, amino acids are used for manufacturing nutritional supplements used in the pharmaceutical sector, as well as in several beauty products. Amino acids mainly sourced from plant-based materials are preferred in the country owing to religious sentiments. Amino acids are majorly used in nutraceutical applications in the form of dietary supplements to boost the immune system and as an alternative cure for some medical issues. Increasing awareness among consumers regarding health, an imbalanced diet, stress at workplaces, and foreign lifestyle has triggered the demand for dietary supplements in the region, which is further projected to augment the market growth.

Europe is the second-largest compound feed producer globally, with Germany and France being the major producing countries. Poultry feed accounts for a major share of the region’s compound feed market, representing approximately one-third of the total compound feed market. Key companies operating in the market have diversified businesses and broader product portfolios for animal feed. Rising production and consumption of animal feed are expected to drive growth for market in the region over the forecast period

Key Amino Acids Company Insights

Key companies are adopting several growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In Dec 2023, Fenglihui Anjiachun, a novel biostimulant containing sugar alcohol and amino acids from the renowned US brand Brandt, has been introduced to the Chinese market and is now available through distribution by Beijing Xinhefeng Agricultural Materials

-

In July 2023, according toresearch & development by University of California, A novel synergistic approach combines synthetic photochemistry and biocatalysis to generate non-canonical amino acids

Key Amino Acids Companies:

- Adisseo

- ADM

- Ajinomoto Co., Inc.

- AMINO GmbH

- Bill Barr & Company

- BI Nutraceuticals

- Blue Star Corp.

- CJ CheilJedang Corp.

- DAESANG

- DSM

- Donboo Amino Acid Co., Ltd.

- Evonik Industries AG

- Fermentis Life Sciences

- Global Bio-chem Technology Group Company Limited

- IRIS BIOTECH GmbH

- KYOWA HAKKO BIO CO., LTD.

- Novus International

- PACIFIC RAINBOW INTERNATIONAL, INC.

- Sichuan Tongsheng Amino Acid Co., Ltd.

- Taiwan Amino Acid Co., Ltd.

- Sigma-Aldrich

- Wacker Chemie AG

- Wuxi Jinghai Amino Acid Co., Ltd.

- Wuhan Grand Hoyo Co., Ltd.

- Hebei Huayang Group Co., Ltd.

Amino Acids Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 29.4 billion |

|

Revenue forecast in 2030 |

USD 48.3 billion |

|

Growth rate |

CAGR of 8.5% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, Source, Grade, End-Use, Region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Russia; Italy; Spain; Turkey; Netherland; China; India; Japan; South Korea; Indonesia; Thailand, Brazil; Argentina, South Africa, Saudi Arabia |

|

Key companies profiled |

Adisseo; ADM; Ajinomoto Co., Inc.; AMINO GmbH; Bill Barr & Company; BI Nutraceuticals; Blue Star Corp.; CJ CheilJedang Corp.; DAESANG; DSM; Donboo Amino Acid Co., Ltd.; Evonik Industries AG; Fermentis Life Sciences; Global Bio-chem Technology Group Company Limited; IRIS BIOTECH GmbH; KYOWA HAKKO BIO CO., LTD.; Novus International; PACIFIC RAINBOW INTERNATIONAL, INC.; Sichuan Tongsheng Amino Acid Co., Ltd.; Taiwan Amino Acid Co., Ltd.; Sigma-Aldrich; Wacker Chemie AG; Wuxi Jinghai Amino Acid Co., Ltd.; Wuhan Grand Hoyo Co., Ltd.; Hebei Huayang Group Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Amino Acids Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global amino acid market report based on type, source, grade, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Essential

-

Histidine

-

Isoleucine

-

Leucine

-

Lysine

-

Methionine

-

Phenylalanine

-

Threonine

-

Tryptophan

-

Valine

-

-

Non-essential

-

Alanine

-

Arginine

-

Asparagine

-

Aspartic Acid

-

Cysteine

-

Glutamic Acid

-

Glutamine

-

Glycine

-

Proline

-

Serine

-

Tyrosine

-

Ornithine

-

Citrulline

-

Creatine

-

Selenocysteine

-

Taurine

-

Others

-

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plant-based

-

Animal-based

-

Chemical Synthesis

-

Fermentation

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Grade

-

Feed Grade

-

Pharma Grade

-

Other Grades

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Bakery

-

Dairy

-

Confectionery

-

Convenience Foods

-

Functional Beverages

-

Meat Processing

-

Infant Formulation

-

Others

-

-

Animal Feed

-

Swine

-

Poultry

-

Cattle

-

Others

-

-

Pet Food

-

Pharmaceuticals

-

Vaccine Formulation

-

Personal Care & Cosmetics

-

Dietary Supplements

-

Agriculture

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Russia

-

Italy

-

Spain

-

Turkey

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the amino acid market include Ajinomoto Co., Inc. Bill Barr & Company, Wacker Chemie AG, Evonik Industries AG, Kyowa Hakko Bio Co., Ltd., and AMINO GmbH.

b. Key factors that are driving the amino acid market growth include increasing demand from food, pharmaceutical, and nutraceutical industries. Amino acids are extensively used as an active ingredient in the animal feed industry to improve feed quality and animal health by enhancing feed efficiency,

b. The global amino acids market size was estimated at USD 27.22 billion in 2023 and is expected to reach USD 29.44 billion in 2024.

b. The global amino acids market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 48.3 billion by 2030.

b. Food & beverages end-use accounted for the largest revenue share of 29.0% in 2023. This is attributable to the rising usage of amino acids as flavor enhancers, preservatives, and nutrition enhancers.

Table of Contents

Chapter 1. Amino Acids Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Amino Acids Market: Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Amino Acid Market: Variables, Trends & Scope

3.1. Global Amino Acid Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Outlook

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. Amino Acid Market: Type Outlook Estimates & Forecasts

4.1. Amino Acid Market: Type Movement Analysis, 2023 & 2030

4.2. Essential

4.2.1. Essential amino acid market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.2.2. Histidine

4.2.2.1. Histidine market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.2.3. Isoleucine

4.2.3.1. Isoleucine market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.2.4. Leucine

4.2.4.1. Leucine market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.2.5. Lysine

4.2.5.1. Lysine market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.2.6. Methionine

4.2.6.1. Methionine market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.2.7. Phenylalanine

4.2.7.1. Phenylalanine market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.2.8. Threonine

4.2.8.1. Threonine market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.2.9. Tryptophan

4.2.9.1. Tryptophan market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.2.10. Valine

4.2.10.1. Valine market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.3. Non-Essential

4.3.1. Non-Essential amino acid market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.2. Alanine

4.3.2.1. Alanine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.3. Arginine

4.3.3.1. Arginine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.4. Asparagine

4.3.4.1. Asparagine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.5. Aspartic Acid

4.3.5.1. Aspartic market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.6. Cysteine

4.3.6.1. Cysteine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.7. Glutamic Acid

4.3.7.1. Glutamic market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.8. Glutamine

4.3.8.1. Glutamine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.9. Glycine

4.3.9.1. Glycine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.10. Proline

4.3.10.1. Proline market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.11. Serine

4.3.11.1. Serine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.12. Tyrosine

4.3.12.1. Tyrosine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.13. Ornithine

4.3.13.1. Ornithine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.14. Citrulline

4.3.14.1. Citrulline market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.15. Creatine

4.3.15.1. Creatine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.16. Selenocysteine

4.3.16.1. Selenocysteine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.17. Taurine

4.3.17.1. Taurine market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3.18. Other Non-Essential Amino Acids

4.3.18.1. Other non-essential market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 5. Amino Acid Market: Source Outlook Estimates & Forecasts

5.1. Amino Acid Market: Source Movement Analysis, 2023 & 2030

5.2. Plant Based

5.2.1. Plant-based amino acid market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.3. Animal Based

5.3.1. Animal-based amino acid market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.4. Chemical Synthesis

5.4.1. Chemical Synthesis based amino acid market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.5. Fermentation

5.5.1. Fermentation based amino acid market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 6. Amino Acid Market: Grade Outlook Estimates & Forecasts

6.1. Amino Acid Market: Grade Movement Analysis, 2023 & 2030

6.2. Food Grade

6.2.1. Food Grade amino acid market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3. Feed Grade

6.3.1. Feed Grade amino acid market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4. Pharma Grade

6.4.1. Pharma Grade amino acid market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5. Other Grades

6.5.1. Other Grades amino acid market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 7. Amino Acid Market: End-Use Outlook Estimates & Forecasts

7.1. Amino Acid Market: End-Use Movement Analysis, 2023 & 2030

7.2. Food & Beverage

7.2.1. Amino acid market estimates and forecast, in food & beverage 2018 - 2030 (USD Million) (Kilotons)

7.2.2. Bakery

7.2.2.1. Amino acid market estimates and forecast, in bakery 2018 - 2030 (USD Million) (Kilotons)

7.2.3. Dairy

7.2.3.1. Amino acid market estimates and forecast, in dairy 2018 - 2030 (USD Million) (Kilotons)

7.2.4. Confectionery

7.2.4.1. Amino acid market estimates and forecast, in confectionery 2018 - 2030 (USD Million) (Kilotons)

7.2.5. Convenience Food

7.2.5.1. Amino acid market estimates and forecast, in convenience food 2018 - 2030 (USD Million) (Kilotons)

7.2.6. Functional beverages

7.2.6.1. Amino acid market estimates and forecast, in functional beverages 2018 - 2030 (USD Million) (Kilotons)

7.2.7. Meat processing

7.2.7.1. Amino acid market estimates and forecast, in meat processing 2018 - 2030 (USD Million) (Kilotons)

7.2.8. Infant Formula

7.2.8.1. Amino acid market estimates and forecast, in infant formula 2018 - 2030 (USD Million) (Kilotons)

7.2.9. Others

7.2.9.1. Amino acid market estimates and forecast, in Others 2018 - 2030 (USD Million) (Kilotons)

7.3. Animal Feed

7.3.1. Amino acid market estimates and forecast, in animal feed 2018 - 2030 (USD Million) (Kilotons)

7.3.2. Swine

7.3.2.1. Amino acid market estimates and forecast, for swine 2018 - 2030 (USD Million) (Kilotons)

7.3.3. Poultry

7.3.3.1. Amino acid market estimates and forecast, for poultry 2018 - 2030 (USD Million) (Kilotons)

7.3.4. Cattle

7.3.4.1. Amino acid market estimates and forecast, for cattle 2018 - 2030 (USD Million) (Kilotons)

7.3.5. Others

7.3.5.1. Amino acid market estimates and forecast, in others 2018 - 2030 (USD Million) (Kilotons)

7.4. Pet Food

7.4.1. Amino acid market estimates and forecast, in pet food 2018 - 2030 (USD Million) (Kilotons)

7.5. Pharmaceuticals

7.5.1. Amino acid market estimates and forecast, in Pharmaceuticals 2018 - 2030 (USD Million) (Kilotons)

7.6. Vaccine Formulation

7.6.1. Amino acid market estimates and forecast, in vaccine formulation 2018 - 2030 (USD Million) (Kilotons)

7.7. Personal Care & Cosmetics

7.7.1. Amino acid market estimates and forecast, in personal care & cosmetics 2018 - 2030 (USD Million) (Kilotons)

7.8. Dietary Supplement

7.8.1. Amino acid market estimates and forecast, in dietary supplement 2018 - 2030 (USD Million) (Kilotons)

7.9. Agriculture

7.9.1. Amino acid market estimates and forecast, in agriculture 2018 - 2030 (USD Million) (Kilotons)

7.10. Other End-Uses

7.10.1. Amino acid market estimates and forecast, in other end-uses 2018 - 2030 (USD Million) (Kilotons)

Chapter 8. Amino Acid Market Regional Outlook Estimates & Forecasts

8.1. Regional Snapshot

8.2. Amino Acid Market: Regional Movement Analysis, 2023 & 2030

8.3. North America

8.3.1. North America Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.2. North America Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.3.3. North America Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.3.4. North America Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.3.5. North America Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.6. U.S.

8.3.6.1. U.S. Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.2. U.S. Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.3. U.S. Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.4. U.S. Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.5. U.S. Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.3.7. Canada

8.3.7.1. Canada Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.2. Canada Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.3. Canada Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.4. Canada Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.5. Canada Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.3.8. Mexico

8.3.8.1. Mexico Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.8.2. Mexico Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.3.8.3. Mexico Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.3.8.4. Mexico Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.3.8.5. Mexico Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4. Europe

8.4.1. Europe Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.2. Europe Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.3. Europe Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.4.4. Europe Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.5. Europe Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.6. Germany

8.4.6.1. Germany Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.2. Germany Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.3. Germany Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.4. Germany Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.5. Germany Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.7. France

8.4.7.1. France Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.2. France Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.3. France Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.4. France Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.5. France Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.8. UK

8.4.8.1. UK Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.2. UK Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.3. UK Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.4. UK Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.5. UK Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.9. Russia

8.4.9.1. Russia Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.2. Russia Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.3. Russia Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.4. Russia Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.5. Russia Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.10. Italy

8.4.10.1. Italy Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.2. Italy Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.3. Italy Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.4. Italy Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.5. Italy Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.11. Spain

8.4.11.1. Spain Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.11.2. Spain Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.11.3. Spain Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.4.11.4. Spain Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.11.5. Spain Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.12. Turkey

8.4.12.1. Turkey Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.12.2. Turkey Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.12.3. Turkey Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.4.12.4. Turkey Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.12.5. Turkey Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.13. Netherlands

8.4.13.1. Netherlands Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.13.2. Netherlands Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.13.3. Netherlands Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.4.13.4. Netherlands Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.13.5. Netherlands Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5. Asia Pacific

8.5.1. Asia Pacific Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.2. Asia Pacific Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.3. Asia Pacific Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.5.4. Asia Pacific Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.5. Asia Pacific Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.6. China

8.5.6.1. China Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.2. China Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.3. China Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.4. China Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.5. China Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.7. South Korea

8.5.7.1. South Korea Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.2. South Korea Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.3. South Korea Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.4. South Korea Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.5. South Korea Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.8. Japan

8.5.8.1. Japan Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.2. Japan Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.3. Japan Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.4. Japan Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.5. Japan Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.9. India

8.5.9.1. India Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.2. India Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.3. India Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.4. India Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.5. India Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.10. Indonesia

8.5.10.1. Indonesia Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.2. Indonesia Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.3. Indonesia Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.4. Indonesia Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.5. Indonesia Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.11. Thailand

8.5.11.1. Thailand Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.11.2. Thailand Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.11.3. Thailand Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.5.11.4. Thailand Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.11.5. Thailand Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.6. Central & South America

8.6.1. Central & South America Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.6.2. Central & South America Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.6.3. Central & South America Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.6.4. Central & South America Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.6.5. Central & South America Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.6.6. Brazil

8.6.6.1. Brazil Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.6.6.2. Brazil Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.6.6.3. Brazil Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.6.6.4. Brazil Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.6.6.5. Brazil Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.6.7. Argentina

8.6.7.1. Argentina Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.6.7.2. Argentina Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.6.7.3. Argentina Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.6.7.4. Argentina Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.6.7.5. Argentina Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.7. Middle East & Africa

8.7.1. Middle East & Africa Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.7.2. Middle East & Africa Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.7.3. Middle East & Africa Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.7.4. Middle East & Africa Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.7.5. Middle East & Africa Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.7.6. South Africa

8.7.6.1. South Africa Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.7.6.2. South Africa Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.7.6.3. South Africa Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.7.6.4. South Africa Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.7.6.5. South Africa Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.7.7. Saudi Arabia

8.7.7.1. Saudi Arabia Amino Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.7.7.2. Saudi Arabia Amino Acid Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.7.7.3. Saudi Arabia Amino Acid Market estimates and forecast, by source, 2018 - 2030 (USD Million) (Kilotons)

8.7.7.4. Saudi Arabia Amino Acid Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.7.7.5. Saudi Arabia Amino Acid Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company Categorization

9.3. Company Ranking

9.4. Heat Map Analysis

9.5. Market Strategies

9.6. Vendor Landscape

9.6.1. List of raw material supplier, key manufacturers, and distributors

9.6.2. List of prospective end-users

9.7. Strategy Mapping

9.8. Company Profiles/Listing

9.8.1. Adisseo

9.8.1.1. Company Overview

9.8.1.2. Financial Performance

9.8.1.3. Product Benchmarking

9.8.2. ADM

9.8.2.1. Company Overview

9.8.2.2. Financial Performance

9.8.2.3. Product Benchmarking

9.8.3. Ajinomoto Co., Inc.

9.8.3.1. Company Overview

9.8.3.2. Financial Performance

9.8.3.3. Product Benchmarking

9.8.4. AMINO GmbH

9.8.4.1. Company Overview

9.8.4.2. Financial Performance

9.8.4.3. Product Benchmarking

9.8.5. Bill Barr & Company

9.8.5.1. Company Overview

9.8.5.2. Financial Performance

9.8.5.3. Product Benchmarking

9.8.6. BI Nutraceuticals

9.8.6.1. Company Overview

9.8.6.2. Financial Performance

9.8.6.3. Product Benchmarking

9.8.7. Blue Star Corp.

9.8.7.1. Company Overview

9.8.7.2. Financial Performance

9.8.7.3. Product Benchmarking

9.8.8. CJ CheilJedang Corp.

9.8.8.1. Company Overview

9.8.8.2. Financial Performance

9.8.8.3. Product Benchmarking

9.8.9. DAESANG

9.8.9.1. Company Overview

9.8.9.2. Financial Performance

9.8.9.3. Product Benchmarking

9.8.10. DSM

9.8.10.1. Company Overview

9.8.10.2. Financial Performance

9.8.10.3. Product Benchmarking

9.8.11. Donboo Amino Acid Co., Ltd.

9.8.11.1. Company Overview

9.8.11.2. Financial Performance

9.8.11.3. Product Benchmarking

9.8.12. Evonik Industries AG

9.8.12.1. Company Overview

9.8.12.2. Financial Performance

9.8.12.3. Product Benchmarking

9.8.13. Fermentis Life Sciences

9.8.13.1. Company Overview

9.8.13.2. Financial Performance

9.8.13.3. Product Benchmarking

9.8.14. Global Bio-chem Technology Group Company Limited

9.8.14.1. Company Overview

9.8.14.2. Financial Performance

9.8.14.3. Product Benchmarking

9.8.15. IRIS BIOTECH GmbH

9.8.15.1. Company Overview

9.8.15.2. Financial Performance

9.8.15.3. Product Benchmarking

9.8.16. KYOWA HAKKO BIO CO., LTD.

9.8.16.1. Company Overview

9.8.16.2. Financial Performance

9.8.16.3. Product Benchmarking

9.8.17. Novus International

9.8.17.1. Company Overview

9.8.17.2. Financial Performance

9.8.17.3. Product Benchmarking

9.8.18. PACIFIC RAINBOW INTERNATIONAL, INC.

9.8.18.1. Company Overview

9.8.18.2. Financial Performance

9.8.18.3. Product Benchmarking

9.8.19. Sichuan Tongsheng Amino Acid Co., Ltd.

9.8.19.1. Company Overview

9.8.19.2. Financial Performance

9.8.19.3. Product Benchmarking

9.8.20. Taiwan Amino Acid Co., Ltd.

9.8.20.1. Company Overview

9.8.20.2. Financial Performance

9.8.20.3. Product Benchmarking

9.8.21. Sigma-Aldrich

9.8.21.1. Company Overview

9.8.21.2. Financial Performance

9.8.21.3. Product Benchmarking

9.8.22. Wacker Chemie AG

9.8.22.1. Company Overview

9.8.22.2. Financial Performance

9.8.22.3. Product Benchmarking

9.8.23. Wuxi Jinghai Amino Acid Co., Ltd.

9.8.23.1. Company Overview

9.8.23.2. Financial Performance

9.8.23.3. Product Benchmarking

9.8.24. Wuhan Grand Hoyo Co., Ltd.

9.8.24.1. Company Overview

9.8.24.2. Financial Performance

9.8.24.3. Product Benchmarking

9.8.25. Hebei Huayang Group Co., Ltd.

9.8.25.1. Company Overview

9.8.25.2. Financial Performance

9.8.25.3. Product Benchmarking

List of Tables

Table 1. List of abbreviation

Table 2. Global Amino Acid market estimates and forecasts by type, 2018 - 2030 (Kilotons)

Table 3. Global Amino Acid market estimates and forecasts by type, 2018 - 2030 (USD Million)

Table 4. Global Amino Acid market estimates and forecasts by source, 2018 - 2030 (Kilotons)

Table 5. Global Amino Acid market estimates and forecasts by source, 2018 - 2030 (USD Million)

Table 6. Global Amino Acid market estimates and forecasts by grade, 2018 - 2030 (Kilotons)

Table 7. Global Amino Acid market estimates and forecasts by grade, 2018 - 2030 (USD Million)

Table 8. Global Amino Acid market estimates and forecasts by end-use, 2018 - 2030 (Kilotons)

Table 9. Global Amino Acid market estimates and forecasts by end-use, 2018 - 2030 (USD Million)

Table 10. Global Amino Acid market estimates and forecasts by region, 2018 - 2030 (Kilotons)

Table 11. Global Amino Acid market estimates and forecasts by region, 2018 - 2030 (USD Million)

Table 12. North America amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 13. North America amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 14. North America amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 15. North America amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 16. North America amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 17. North America amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 18. North America amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 19. North America amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 20. North America amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 21. U.S. amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 22. U.S. amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 23. U.S. amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 24. U.S. amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 25. U.S. amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 26. U.S. amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 27. U.S. amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 28. U.S. amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 29. U.S. amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 30. Canada amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 31. Canada amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 32. Canada amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 33. Canada amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 34. Canada amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 35. Canada amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 36. Canada amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 37. Canada amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 38. Canada amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 39. Mexico amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 40. Mexico amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 41. Mexico amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 42. Mexico amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 43. Mexico amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 44. Mexico amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 45. Mexico amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 46. Mexico amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 47. Mexico amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 48. Europe amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 49. Europe amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 50. Europe amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 51. Europe amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 52. Europe amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 53. Europe amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 54. Europe amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 55. Europe amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 56. Europe amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 57. Germany amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 58. Germany amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 59. Germany amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 60. Germany amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 61. Germany amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 62. Germany amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 63. Germany amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 64. Germany amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 65. Germany amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 66. UK amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 67. UK amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 68. UK amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 69. UK amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 70. UK amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 71. UK amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 72. UK amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 73. UK amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 74. UK amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 75. France amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 76. France amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 77. France amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 78. France amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 79. France amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 80. France amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 81. France amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 82. France amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 83. France amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 84. Italy amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 85. Italy amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 86. Italy amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 87. Italy amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 88. Italy amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 89. Italy amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 90. Italy amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 91. Italy amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 92. Italy amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 93. Spain amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 94. Spain amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 95. Spain amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 96. Spain amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 97. Spain amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 98. Spain amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 99. Spain amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 100. Spain amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 101. Spain amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 102. Russia amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 103. Russia amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 104. Russia amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 105. Russia amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 106. Russia amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 107. Russia amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 108. Russia amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 109. Russia amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 110. Russia amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 111. Turkey amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 112. Turkey amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 113. Turkey amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 114. Turkey amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 115. Turkey amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 116. Turkey amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 117. Turkey amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 118. Turkey amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 119. Turkey amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 120. Netherlands amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 121. Netherlands amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 122. Netherlands amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 123. Netherlands amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 124. Netherlands amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 125. Netherlands amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 126. Netherlands amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 127. Netherlands amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 128. Netherlands amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 129. Asia Pacific amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 130. Asia Pacific amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 131. Asia Pacific amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 132. Asia Pacific amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 133. Asia Pacific amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 134. Asia Pacific amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 135. Asia Pacific amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 136. Asia Pacific amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 137. Asia Pacific amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 138. China amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 139. China amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 140. China amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 141. China amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 142. China amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 143. China amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 144. China amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 145. China amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 146. China amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 147. Japan amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 148. Japan amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 149. Japan amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 150. Japan amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 151. Japan amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 152. Japan amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 153. Japan amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 154. Japan amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 155. Japan amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 156. India amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 157. India amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 158. India amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 159. India amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 160. India amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 161. India amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 162. India amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 163. India amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 164. India amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 165. South Korea amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 166. South Korea amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 167. South Korea amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 168. South Korea amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 169. South Korea amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 170. South Korea amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 171. South Korea amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 172. South Korea amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 173. South Korea amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 174. Indonesia amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 175. Indonesia amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 176. Indonesia amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 177. Indonesia amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 178. Indonesia amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 179. Indonesia amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 180. Indonesia amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 181. Indonesia amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 182. Indonesia amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 183. Thailand amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 184. Thailand amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 185. Thailand amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 186. Thailand amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 187. Thailand amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 188. Thailand amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 189. Thailand amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 190. Thailand amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 191. Thailand amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 192. Central & South America amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 193. Central & South America amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 194. Central & South America amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 195. Central & South America amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 196. Central & South America amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 197. Central & South America amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 198. Central & South America amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 199. Central & South America amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 200. Central & South America amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 201. Brazil amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 202. Brazil amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 203. Brazil amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 204. Brazil amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 205. Brazil amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 206. Brazil amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 207. Brazil amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 208. Brazil amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 209. Brazil amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 210. Argentina amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 211. Argentina amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 212. Argentina amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 213. Argentina amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 214. Argentina amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 215. Argentina amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 216. Argentina amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 217. Argentina amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 218. Argentina amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 219. Middle East & Africa amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 220. Middle East & Africa amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 221. Middle East & Africa amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 222. Middle East & Africa amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 223. Middle East & Africa amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 224. Middle East & Africa amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 225. Middle East & Africa amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 226. Middle East & Africa amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 227. Middle East & Africa amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 228. Saudi Arabia amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 229. Saudi Arabia amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 230. Saudi Arabia amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 231. Saudi Arabia amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 232. Saudi Arabia amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 233. Saudi Arabia amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 234. Saudi Arabia amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 235. Saudi Arabia amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 236. Saudi Arabia amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 237. South Africa amino acid market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 238. South Africa amino acid market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 239. South Africa amino acid market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 240. South Africa amino acid market estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 241. South Africa amino acid market estimates and forecasts, by source, 2018 - 2030 (Kilotons)

Table 242. South Africa amino acid market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 243. South Africa amino acid market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 244. South Africa amino acid market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 245. South Africa amino acid market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 246. Participants Overview

Table 247. Financial Performance

Table 248. Product Benchmarking

Table 249. Recent Development by Key Players & Its Impact

List of Figures

Fig 1. Market segmentation

Fig 2. Information procurement

Fig 3. Data Analysis Models

Fig 4. Market Formulation and Validation

Fig 5. Market snapshot

Fig 6. Segmental outlook- Type, Source, Grade, and End-Use

Fig 7. Competitive outlook

Fig 8. Amino acid market, 2018-2030 (USD Million) (Kilotons)

Fig 9. Value chain analysis

Fig 10. Market dynamics

Fig 11. Porter’s Analysis

Fig 12. PESTEL Analysis

Fig 13. Amino acid market, by type: Key takeaways

Fig 14. Amino acid market, by type: Market share, 2023 & 2030

Fig 15. Amino acid market, by source: Key takeaways

Fig 16. Amino acid market, by source: Market share, 2023 & 2030

Fig 17. Amino acid market, by grade: Key takeaways

Fig 18. Amino acid market, by grade: Market share, 2023 & 2030

Fig 19. Amino acid market, by end-use: Key takeaways

Fig 20. Amino acid market, by end-use: Market share, 2023 & 2030

Fig 21. Amino acid market, by region: Key takeaways

Fig 22. Amino acid market, by region: Market share, 2023 & 2030

Market Segmentation

- Amino Acid Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Essential

- Histidine

- Isoleucine

- Leucine

- Lysine

- Methionine

- Phenylalanine

- Threonine

- Tryptophan

- Valine

- Non-essential

- Alanine

- Arginine

- Asparagine

- Aspartic Acid

- Cysteine

- Glutamic Acid

- Glutamine

- Glycine

- Proline

- Serine

- Tyrosine

- Ornithine

- Citrulline

- Creatine

- Selenocysteine

- Taurine

- Others

- Essential

- Amino Acid Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Plant-based

- Animal-based

- Chemical Synthesis

- Fermentation

- Amino Acid Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Food Grade

- Feed Grade

- Pharma Grade

- Other Grades

- Amino Acid End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Food & Beverage

- Bakery

- Dairy

- Confectionery

- Convenience Foods

- Functional Beverages

- Meat Processing

- Infant Formulation

- Others

- Animal Feed

- Swine

- Poultry

- Cattle

- Others

- Pet Food

- Pharmaceuticals

- Vaccine Formulation

- Personal Care & Cosmetics

- Dietary Supplements

- Agriculture

- Other End-uses

- Food & Beverage

- Amino Acid Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Amino Acid Market, By Product

- Essential

- Histidine

- Isoleucine

- Leucine

- Lysine

- Methionine

- Phenylalanine

- Threonine

- Tryptophan

- Valine

- Non-essential

- Alanine

- Arginine

- Asparagine

- Aspartic Acid

- Cysteine

- Glutamic Acid

- Glutamine

- Glycine

- Proline

- Serine

- Tyrosine

- Ornithine

- Citrulline

- Creatine

- Selenocysteine

- Taurine

- Others

- Essential

- North America Amino Acid Market, By Source

- Plant-based

- Animal-based

- Chemical Synthesis

- Fermentation

- North America Amino Acid Market, By Grade

- Food Grade

- Feed Grade

- Pharma Grade

- Other Grades

- North America Amino Acid Market, By End-Use

- Food & Beverage

- Bakery

- Dairy

- Confectionery

- Convenience Foods

- Functional Beverages

- Meat Processing

- Infant Formulation

- Others

- Animal Feed

- Swine

- Poultry

- Cattle

- Others

- Pet Food

- Pharmaceuticals

- Vaccine Formulation

- Personal Care & Cosmetics

- Dietary Supplements

- Agriculture

- Other End-uses

- Food & Beverage

- U.S.

- U.S. Amino Acid Market, By Product

- Essential

- Histidine

- Isoleucine

- Leucine

- Lysine

- Methionine

- Phenylalanine

- Threonine

- Tryptophan

- Valine

- Non-essential

- Alanine

- Arginine

- Asparagine

- Aspartic Acid

- Cysteine

- Glutamic Acid

- Glutamine

- Glycine

- Proline

- Serine

- Tyrosine

- Ornithine

- Citrulline

- Creatine

- Selenocysteine

- Taurine

- Others

- Essential

- U.S. Amino Acid Market, By Source

- Plant-based

- Animal-based

- Chemical Synthesis

- Fermentation

- U.S. Amino Acid Market, By Grade

- Food Grade

- Feed Grade

- Pharma Grade

- Other Grades

- U.S. Amino Acid Market, By End-Use

- Food & Beverage

- Bakery

- Dairy

- Confectionery

- Convenience Foods

- Functional Beverages

- Meat Processing

- Infant Formulation

- Others

- Animal Feed

- Swine

- Poultry

- Cattle

- Others

- Pet Food

- Pharmaceuticals

- Vaccine Formulation

- Personal Care & Cosmetics

- Dietary Supplements

- Agriculture

- Other End-uses

- Food & Beverage