- Home

- »

- Next Generation Technologies

- »

-

Satellite Antenna Market Size, Share & Trends Report, 2030GVR Report cover

![Satellite Antenna Market Size, Share & Trends Report]()

Satellite Antenna Market (2024 - 2030) Size, Share & Trends Analysis Report By Platform (Land, Space, Maritime, Airborne), By Frequency (L Band, S Band, C Band), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-382-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Satellite Antenna Market Summary

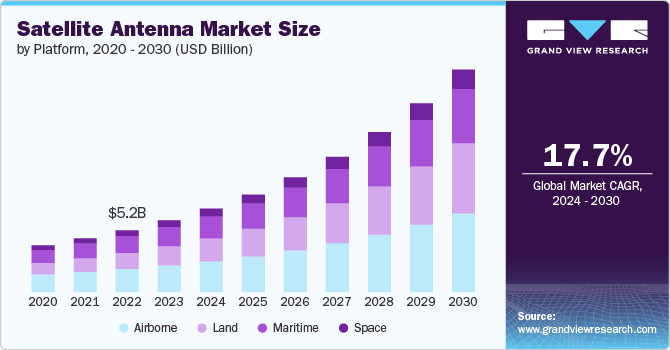

The global satellite antenna market size was estimated at USD 5.97 billion in 2023 and is projected to reach USD 18.6 billion by 2030, growing at a CAGR of 17.7% from 2024 to 2030. The increasing demand for satellite-based communication services and a growing need for reliable and high-speed connectivity across maritime, aviation, defense, telecommunications, and disaster management sectors is driving the market expansion.

Key Market Trends & Insights

- The North America region accounted for the highest revenue share of 39.93% in 2023.

- The satellite antenna market in the U.S. is projected to grow at a CAGR of 16.7% from 2024 to 2030.

- By platform, the land segment accounted for the largest market share of 26.87% in 2023.

- By frequency, the Ka-band segment is anticipated to grow fastest from 2024 to 2030.

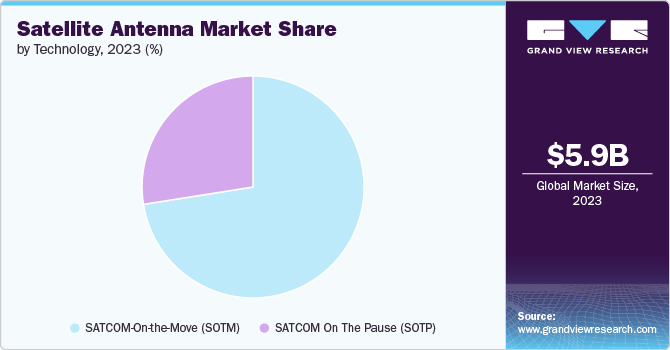

- By technology, the SATCOM-On-the-Move (SOTM) segment registered the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.97 Billion

- 2030 Projected Market Size: USD 18.6 Billion

- CAGR (2024-2030): 17.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Satellite antennas are crucial in providing internet services to remote and underserved areas where traditional broadband infrastructure is lacking. As a result, the demand for advanced satellite antenna systems capable of delivering high-speed connectivity is expected to fuel market growth in the coming years. Airlines are equipping their aircraft with satellite antenna systems to provide in-flight Wi-Fi for passengers, while the maritime industry is adopting compact satellite antennas for onboard communications and operations. Sectors such as coaches, trains, emergency services, and logistics present valuable opportunities for mobile satellite antennas. These antennas enable internet access and communication solutions for users on the move, thereby accelerating the popularity and adoption of satellite antennas in these sectors.

Furthermore, the ongoing technological advancements in satellite design and deployment are accelerating the market growth. Innovations such as high-throughput satellites (HTS), low earth orbit (LEO) constellations, and reusable launch vehicles have enhanced the efficiency and cost-effectiveness of satellite communications have led to improved data transmission rates, lower latency and increased coverage areas, driving the adoption of satellite antennas for various applications, including telecommunications, broadcasting, and defense.

Moreover, the development of ultra-compact satellite antennas designed to operate with high-throughput satellites is creating opportunities for market expansion. These antennas support advanced ground combat vehicles with high-speed data transmission capabilities, enabling beyond-line-of-sight applications for voice, video, and data communications. This trend is expected to fuel the market growth further.

Companies are employing a variety of strategies to enhance their market presence and capitalize on growth opportunities. They are securing contracts and forming partnerships. For instance, in June 2023, Airbus and Oerlikon signed a €3.8 million contract focused on the industrial additive manufacturing of satellite components, specifically antenna clusters for communication satellites.These antennas will be utilized in satellites that transmit and receive signals in the K-band frequency, which is essential for modern communication systems. Such strategies by key players are expected to boost market growth in the coming years.

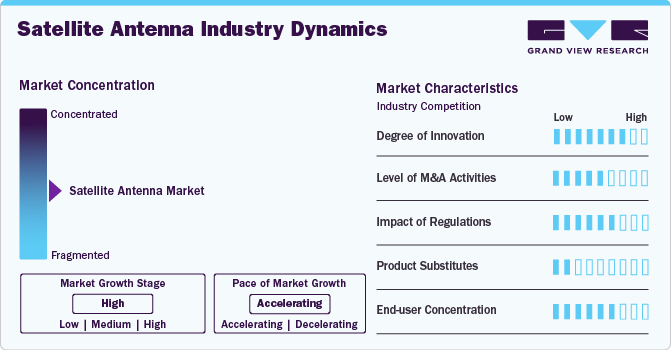

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by advancements in technology and increasing demand for enhanced communication capabilities. Companies invest heavily in research and development to introduce new products and improve existing ones, focusing on miniaturization, higher bandwidth, and enhanced signal quality. Innovations in materials, design, and manufacturing processes have led to more efficient and cost-effective antennas catering to a wide range of commercial and military applications.

The market's level of mergers and acquisitions is expected to be moderate. Companies in this sector engage in M&A activities to expand their product portfolio, acquire new technologies, and strengthen their competitive positions.This trend also reflects the industry's dynamic nature, where consolidation helps reduce competition and drive growth through combined resources and capabilities.

The impact of regulations on the market is expected to be moderate to high. Governments and international bodies, such as the Federal Communications Commission (FCC) and the International Telecommunication Union (ITU), set stringent standards and guidelines for satellite communications, including frequency allocations, licensing, and operational safety. Compliance with these regulations is crucial for market players to operate legally and avoid penalties.

The competition from product substitutes in the market is expected to be low. Terrestrial communication technologies, such as fiber optics and cellular networks, can serve as alternatives, particularly in urban and suburban areas. However, these alternatives often fall short in remote or underdeveloped regions where satellite communication is indispensable.

The market's end-user concentration is moderate to high. Satellite antennas have seen widespread adoption across various industries, including telecommunications companies, defense and military organizations, maritime and aviation industries, and remote sensing and earth observation services. This diversity in end-user concentration helps stabilize the market, as demand is not overly reliant on a single sector.

Platform Insights

The land segment accounted for the largest market share of 26.87% in 2023. The increasing demand for high-speed internet in urban and rural areas and the need for resilient communication infrastructure are driving significant investment in land-based satellite antennas. Furthermore, the rise of smart cities and the expansion of IoT networks are expected to drive segmental growth.

The airborne segment is expected to witness a significant CAGR of over 16.9% from 2024 to 2030, driven by the growing demand for advanced communication systems in aviation. This includes satellite antennas for commercial airlines, military aircraft, and unmanned aerial vehicles (UAVs). Furthermore, the increasing trend of in-flight connectivity for passengers, providing internet access, and live television is driving the segmental growth.

Frequency Insights

The Ku-band registered the largest share in the market in 2023, owing to its widespread adoption, particularly for direct-to-home (DTH) television services, and its well-established infrastructure. Its frequency range of 12-18 GHz offers reliable and high-quality communication, making it a preferred choice for broadcasting, maritime, and aeronautical services.Ku-band's cost-effectiveness and operational flexibility, including its resilience to weather conditions compared to higher frequency bands, is expected to fuel segmental growth.

The Ka-band segment is anticipated to grow fastest from 2024 to 2030. Its superior bandwidth and the rising demand for high-throughput satellites (HTS) drive the segmental growth. Operating in the 26.5-40 GHz frequency range, the Ka-band supports high-data-rate applications like broadband internet and HD video streaming. Technological advancements, such as phased array and electronically steerable antennas, enhance its performance and affordability.

Technology Insights

The SATCOM-On-the-Move (SOTM) segment registered the largest revenue share in 2023. This growth can be attributed to its essential role in providing continuous, high-speed communication for mobile platforms. SOTM systems are indispensable for military and defense operations, enabling real-time data transmission and communication for vehicles, aircraft, and ships. The commercial sector also benefits from SOTM, with applications in logistics, transportation, and media broadcasting, where constant connectivity is crucial.The ability to maintain seamless communication while in motion makes SOTM a critical component of modern communication infrastructure.

The SATCOM On the Pause (SOTP) segment is expected to grow at a significant CAGR from 2024 to 2030, owing to its increasing applications in various fields that require reliable communication in stationary positions. SOTP systems are particularly vital for military operations, emergency response, and remote field research where temporary, high-bandwidth satellite communications are needed in locations without established infrastructure. The growing prevalence of natural disasters and humanitarian crises drives demand for portable and deployable SATCOM solutions, ensuring connectivity in critical situations.

Regional Insights

The North America region accounted for the highest revenue share of 39.93% in 2023. This dominance is driven by advancements in satellite technology, such as the development of high-throughput satellites (HTS) and phased array antennas, which enhance the performance and capabilities of satellite communication systems. Furthermore, the popularity of satellite TV services in North America contributes to the demand for satellite antennas as consumers seek access to a wide range of channels and content.

U.S. Satellite Antenna Market Trends

The satellite antenna market in the U.S. is projected to grow at a CAGR of 16.7% from 2024 to 2030. A trend towards miniaturization, making satellite antennas more compact and lightweight, is driving the market growth. This is particularly beneficial for applications in mobile communications and IoT devices.

Europe Satellite Antenna Market Trends

The satellite antenna market in Europe is anticipated to grow at a CAGR of 16.3% from 2024 to 2030.This growth is driven by the strong aerospace industry's demand for reliable satellite communication solutions for aircraft connectivity and navigation systems. Satellite antennas play a vital role in ensuring seamless data transmission for aviation applications within the region, driving market growth.

The UK satellite antenna market is anticipated to grow at the fastest CAGR from 2024 to 2030 in the European market. The UK is experiencing a growing demand for high-speed internet services, especially in rural areas where traditional broadband infrastructure may be lacking. Satellite antennas are crucial in providing reliable internet connectivity to these underserved regions.

The satellite antenna market in Germany is expected to grow lucratively from 2024 to 2030. Germany’s push towards expanding 5G networks requires robust infrastructure, including satellite antennas, to ensure widespread coverage and high-speed connectivity. This trend is fueling the demand for advanced satellite antenna solutions.

The France satellite antenna market is projected to grow at a significant CAGR from 2024 to 2030. France’s active participation in space exploration programs necessitates advanced satellite communication capabilities, including sophisticated antenna systems. The country’s focus on space research drives investments in cutting-edge satellite antenna technologies.

Asia Pacific Satellite Antenna Market Trends

The satellite antenna market in the Asia Pacific region is expected to grow at the fastest CAGR of over 20% from 2024 to 2030. Rapid urbanization and increasing demand for high-speed internet connectivity in both urban and rural areas are driving the market growth in the region. Satellite antennas are needed to bridge the digital divide and provide reliable communication services.

China satellite antenna market is projected to grow at a significant CAGR from 2024 to 2030.China has been investing heavily in space technology and satellite communication infrastructure, and the Chinese government’s support for the development of satellite technology is a significant driver of this growth.

The satellite antenna market in Japan is expected to grow lucratively CAGR from 2024 to 2030.Japan’s advanced telecommunications infrastructure and high-speed connectivity requirements drive the adoption of cutting-edge satellite antenna solutions to meet the growing demand for data-intensive applications.

India satellite antenna market is expected to grow at an impressive CAGR from 2024 to 2030. Satellite antennas play a crucial role in providing connectivity to remote and underserved areas in India. The focus on improving rural connectivity through satellite technology is fueling the market growth in India.

Middle East & Africa Satellite Antenna Market Trends

The satellite antenna market in the Middle East and Africa is expected to grow at a CAGR of over 16% from 2024 to 2030, driven by increasing demand for satellite communication services, technological advancements, government investments, expansion of 5G networks, IoT/M2M proliferation, market liberalization, and rising demand for mobility solutions.

Saudi Arabia satellite antenna market is anticipated to grow significantly from 2024 to 2030. Saudi Arabia's defense sector relies heavily on satellite communication for secure and reliable data transmission. Satellite antennas are integral to military operations, surveillance activities, and national security initiatives, driving the country's demand for advanced antenna solutions.

Key Satellite Antenna Company Insights

Some of the key players operating in the market include Honeywell International, Inc. and Siemens AG.

-

L3Harris Technologies is a leading global aerospace and defense technology company that provides various solutions, including tactical communications, geospatial systems, air traffic management, avionics, and electronic warfare.The company also provides advanced satellite communication systems supporting military and commercial applications. Its SATCOM solutions include terminals, modems, and antennas that enable secure and reliable communication for various platforms, including ground stations, aircraft, and maritime vessels.

-

Honeywell International, Inc. provides advanced SATCOM systems for aircraft, offering connectivity solutions that enhance flight operations and passenger experience. Honeywell's antennas are integral to its JetWave system, which delivers high-speed, global in-flight Wi-Fi connectivity. These antennas support various applications, including cockpit communications, passenger internet, and operational data exchanges, underscoring Honeywell's commitment to innovation in airborne satellite communication technologies.

Thales Group and Visat Inc. are some of the emerging market participants in the market.

-

Thales Groupis a global technology leader in the aerospace, defense, transportation, and security markets. The company offers a range of high-performance SATCOM solutions. Thales's antennas are designed for various applications, including aviation, maritime, and ground-based communications. The company's products are renowned for their reliability, advanced technology, and capability to support critical communication needs in defense and commercial sectors.

-

Visat, Inc. is a global communications company that provides high-speed satellite broadband services and secure networking systems covering military and commercial markets. The company's satellite antennas are integral to its residential, business, and in-flight connectivity services, delivering reliable and fast internet access to remote and underserved areas. Viasat's innovations in satellite technology, including its high-capacity ViaSat-3 satellite constellation, are driving advancements in the market

Key Satellite Antenna Companies:

The following are the leading companies in the satellite antenna market. These companies collectively hold the largest market share and dictate industry trends.

- L3Harris Technologies

- Honeywell International Inc.

- Thales Group

- Viasat, Inc.

- Hughes Network Systems

- Kymeta Corporation

- Cobham

- Airbus

- ALL.SPACE Networks Limited

- C-COM Satellite Systems Inc.

Recent Developments

-

In July 2024, Cobham SATCOM unveiled its new flagship Sea Tel TVRO antenna, designed to provide enhanced connectivity for maritime vessels. The antenna features advanced technology and aims to improve communication capabilities for ships at sea. This innovation represents a significant advancement in maritime satellite communication systems.

-

In May 2024, Airbus successfully delivered the first active antenna for the SpainSat NG I satellite. This milestone marks a significant step in developing the SpainSat NG I program, which aims to enhance secure satellite communications for Spanish defense and security forces. The active antenna is a crucial component that will enable advanced communication capabilities for the satellite, ensuring reliable and secure connectivity.

-

In February 2024, L3Harris Technologies, Inc. demonstrated a digital phased array antenna system designed to enhance satellite communication capabilities. The system was showcased during a live demonstration at the company’s Palm Bay, Florida facility. This technology aims to improve the efficiency and flexibility of satellite communications by enabling high-speed data transfer and enhanced connectivity.

Satellite Antenna Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.96 billion

Revenue forecast in 2030

USD 18.6 billion

Growth rate

CAGR of 17.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Deployment

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform,technology, frequency, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

L3Harris Technologies, Inc.; Honeywell International Inc.; Thales Group; Viasat, Inc.; Hughes Network Systems; Kymeta Corporation; Cobham; Airbus; ALL.SPACE Networks Limited; C-COM Satellite Systems Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Satellite Antenna Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global satellite antenna market report based on platform, technology, frequency, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Land

-

Space

-

Maritime

-

Airborne

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

SATCOM-On-the-Move (SOTM)

-

SATCOM On the Pause (SOTP)

-

-

Frequency Outlook (Revenue, USD Million, 2018 - 2030)

-

L Band

-

S-band

-

C-band

-

X-band

-

Ku-band

-

Ka-band

-

Q band

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global satellite antenna market size was estimated at USD 5.97 billion in 2023 and is expected to reach USD 6.96 billion in 2024.

b. The global satellite antenna market is expected to grow at a compound annual growth rate of 17.7% from 2024 to 2030 to reach USD 18.6 billion by 2030.

b. The satellite antenna market in North America accounted for a significant revenue share of over 39.33% in 2023. This dominance is driven by the advancements in satellite technology, such as the development of high-throughput satellites (HTS) and phased array antennas, enhancing the performance and capabilities of satellite communication systems.

b. Some key players operating in the satellite antenna market include L3Harris Technologies, Honeywell International Inc., Thales Group, Viasat, Inc., Hughes Network Systems, Kymeta Corporation, Cobham, Airbus, ALL.SPACE Networks Limited, C-COM Satellite Systems Inc.

b. Key factors that are driving satellite antenna market growth include increasing demand for satellite-based communication services, growing need for reliable and high-speed connectivity across sectors and the ongoing technological advancements in satellite design and deployment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.