- Home

- »

- Communication Services

- »

-

Same Day Delivery Market Size And Share Report, 2030GVR Report cover

![Same Day Delivery Market Size, Share & Trends Report]()

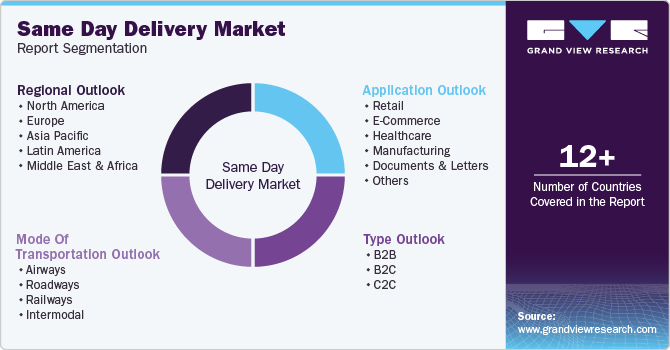

Same Day Delivery Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (B2B, B2C, C2C), By Mode Of Transportation (Airways, Roadways, Railways), By Application (E-Commerce, Retail, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-497-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Same Day Delivery Market Summary

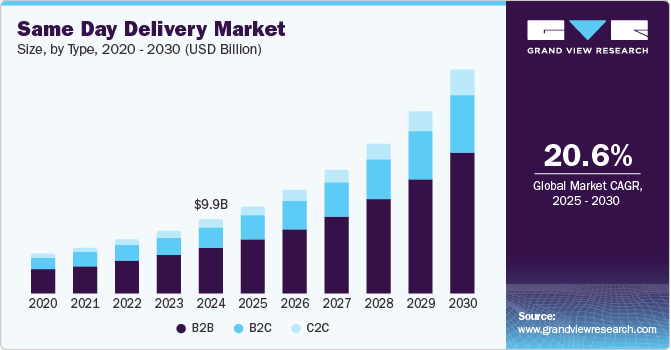

The global same day delivery market size was estimated at USD 9.90 billion in 2024 and is projected to reach USD 29.82 billion by 2030, growing at a CAGR of 20.6% from 2025 to 2030. With the rise in e-commerce, customers have increasingly become accustomed to quick and convenient delivery options, pushing companies to offer same-day delivery services to stay competitive.

Key Market Trends & Insights

- The North American same-day delivery market held a dominant share of 38.6% in 2024.

- The U.S. same-day delivery market dominated the North American market in 2024.

- By type, the B2B segment dominated the market with a 61.5% share in 2024.

- By mode of transportation, airways dominated the market with a 63.5% share in 2024.

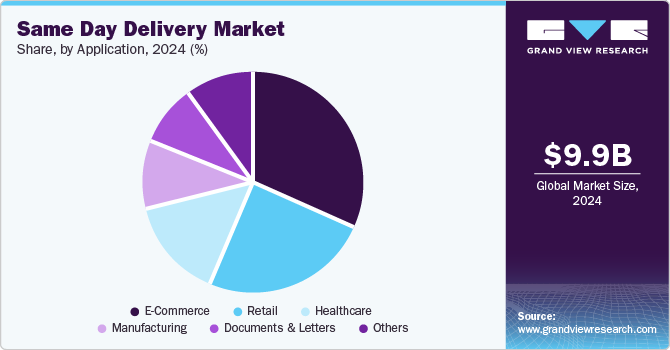

- By application, e-commerce accounted for the dominant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.90 Billion

- 2030 Projected Market Size: USD 29.82 Billion

- CAGR (2025-2030): 20.6%

- North American: Largest market in 2024

This trend is particularly evident in urban areas where the density of population and the availability of advanced logistics infrastructure make it feasible to implement such services.

Technological advancements in logistics technology, such as real-time tracking systems, automated warehouses, and advanced route optimization algorithms, have significantly improved the efficiency and reliability of same-day delivery services. Additionally, the adoption of drones and autonomous vehicles for delivery purposes has further enhanced the speed and cost-effectiveness of these services.

Furthermore, competitive pressures within the retail and e-commerce sectors have driven the growth of the same-day delivery market. Companies have constantly sought ways to differentiate themselves from their competitors, and offering same-day delivery has become a key strategy to attract and retain customers. Major players in the industry, such as Amazon, FedEx, and UPS, have invested heavily in their logistics networks to provide faster delivery options and gain a competitive edge.

Moreover, the rise in the number of crowdsourced delivery models has contributed to the expansion of the same-day delivery market. Platforms, including UberEats and DoorDash, have leveraged their extensive networks of drivers to offer same-day delivery services for a wide range of products, from food to retail goods. This model has increased the availability of same-day delivery services and reduced businesses' operational costs.

Type Insights

The B2B segment dominated the market with a 61.5% share in 2024. The market growth can be credited to the increased demand for rapid and reliable delivery services among businesses. Companies across various industries, such as manufacturing, healthcare, and retail, require timely delivery of critical supplies and components to maintain their operations and meet customer expectations. In addition, businesses have increasingly relied on online platforms to procure goods and services, leading to the growing need for fast and efficient delivery options. This trend is particularly evident in electronics, pharmaceuticals, and automotive sectors, where timely delivery of parts and products is crucial for maintaining supply chain continuity.

The C2C (customer-to-customer) segment is expected to boost over the forecast period with the increasing popularity of online marketplaces and peer-to-peer platforms such as eBay, Craigslist, and Facebook Marketplace. These platforms facilitate direct transactions between individuals, creating a demand for fast and reliable delivery services to ensure timely exchanges of goods. Additionally, innovations such as real-time tracking, automated dispatch systems, and advanced route optimization algorithms have streamlined the delivery process, making it easier for individuals to send and receive packages quickly. Moreover, integrating mobile apps and digital payment systems has simplified the logistics of arranging same-day deliveries between consumers.

Mode Of Transportation Insights

Airways dominated the market with a 63.5% share in 2024 owing to the increasing demand for rapid and reliable delivery services across various industries, including healthcare, e-commerce, and manufacturing. The ability of air transport to cover long distances quickly makes it an ideal choice for urgent deliveries, such as medical supplies, high-value electronics, and perishable goods. Moreover, the expansion of global trade and e-commerce has fueled the demand for airways in same day delivery. Air transport provides a crucial link in the supply chain, ensuring that products can be delivered to international destinations within the same day. This is particularly important for companies that rely on just-in-time inventory systems and need to minimize downtime.

Railways are expected to grow over the forecast period. Rail transport is one of the most energy-efficient and environmentally friendly modes of transportation, producing significantly lower carbon emissions than road and air transport. Additionally, technological advancements in rail infrastructure and logistics have enhanced the efficiency and reliability of these services via rail. Innovations such as high-speed trains, automated cargo handling systems, and advanced tracking technologies have streamlined operations, enabling faster and more reliable deliveries.

Application Insights

E-commerce accounted for the dominant market share in 2024. The proliferation of online shopping platforms and the increasing penetration of the internet and smartphones have primarily contributed to the growth. Consumers have increasingly grown accustomed to quick and convenient delivery options, leading to heightened expectations for same-day delivery services. In addition, urbanization and rising disposable incomes in emerging regions have fueled the demand for these services as consumers seek convenient and time-saving solutions for their shopping needs. This has created a favorable environment for the growth of same day delivery services, particularly in densely populated urban areas where the logistics infrastructure is well-developed.

Documents and letters are expected to emerge as the fastest-growing segment with a CAGR of 22.3% over the forecast period, owing to the rising need for time-sensitive communications. Businesses and individuals often require the rapid delivery of important documents, such as legal papers, contracts, and financial statements, to meet tight deadlines and ensure smooth operations. Same-day delivery services provide a reliable solution for these urgent needs, ensuring critical documents promptly reach their destinations.

Regional Insights

The North American same-day delivery market held a dominant share of 38.6% in 2024 owing to the continued expansion of e-commerce. Consumers have increasingly expected faster delivery times, and retailers have leveraged same-day delivery services to meet customer demands and stay competitive. In addition, the increased adoption of online grocery shopping, particularly following the pandemic, has fueled the need for these services.

U.S. Same Day Delivery Market Trends

The U.S. same-day delivery market dominated the North American market in 2024. The primary market driver is the continued rise of online shopping across various sectors, including fashion, electronics, groceries, and pharmaceuticals. Consumer demand for convenience and instant gratification has pushed businesses to offer same-day delivery services as a standard option. Retailers have adopted omnichannel strategies, blending physical stores and online sales. Services including buy-online-pickup-in-store (BOPIS) and curbside pickup have been complemented by same day delivery options, helping retailers offer more flexible and faster delivery solutions.

Europe Same Day Delivery Market Trends

The Europe same day delivery market accounted for a 25.1% share in 2024 owing to the rapid growth of the e-commerce sector. Consumers have increasingly preferred shopping online for a wide range of products, including clothing, electronics, and groceries, with expectations of fast delivery. In addition, logistics and supply chain management innovations, such as automated warehouses, AI-driven route optimization, and real-time tracking, have enabled faster and more efficient delivery services. These technologies allow retailers and logistics providers to streamline operations and reduce delivery times.

Asia Pacific Same Day Delivery Market Trends

The Asia Pacific (APAC) same day delivery services market registered a 23.1% share in 2024 due to the continued growth of e-commerce across of e-commerce across the APAC region, particularly in emerging countries such as China, India, Japan, and Southeast Asia. Increasing internet penetration, smartphone usage, and online shopping have significantly boosted demand for fast delivery options.

The same day delivery market in China dominated the APAC market in 2024. The country’s e-commerce market is one of the largest and fastest-growing markets, led by giants including Alibaba, JD.com, and Pinduoduo. Moreover, the shift to online grocery shopping and food delivery services has significantly increased the demand for these services. Platforms such as JD Fresh and Ele. I offer quick delivery for fresh produce, prepared meals, and other perishable goods, making same-day delivery essential in this sector.

Key Same Day Delivery Company Insights

The market is consolidated owing to the presence of well-established companies operating globally. Key market participants include Deutsche Post AG, Dropoff, FedEX, and others. Companies have mainly focused on mergers, acquisitions, and joint ventures or collaborations to hold a competitive position in the market. Moreover, the players operating in the market have focused on enhancing their market presence by adopting various growth strategies.

-

Dropoff is a leading provider of same-day delivery and courier services that offers a range of logistics solutions tailored to various industries, including healthcare, retail, and industrial sectors. Dropoff’s services are distinguished by real-time tracking, image confirmations, and a high on-time delivery rate, ensuring that packages are delivered safely and promptly.

Key Same Day Deliver Companies:

The following are the leading companies in the same day deliver market. These companies collectively hold the largest market share and dictate industry trends.

- Deutsche Post AG

- Dropoff

- FedEx

- Aramex

- Jet Delivery, Inc.

- Power Link Expedite

- United Parcel Service of America, Inc.

- USACouriers

- XPO, Inc.

Recent Developments

-

In January 2024, Flipkart announced that it would roll out same-day delivery services for products without extra cost from February 2024. The facility will be available initially in 20 Indian cities, including Bengaluru, Chennai, Mumbai, Delhi, Vijayawada and Coimbatore, Siliguri.

-

In April 2023, Ecom Express Limited introduced new services, namely Same Day Delivery+ (SDD+), Next Day Delivery (NDD), and Same Day Delivery (SDD), and are designed to meet the increasing demands of e-commerce businesses in India. The company aims to enhance customer experience.

Same Day Delivery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.69 billion

Revenue forecast in 2030

USD 29.82 billion

Growth Rate

CAGR of 20.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mode of transportation, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Deutsche Post AG; Dropoff; FedEx; Aramex; Jet Delivery, Inc.; Power Link Expedite; United Parcel Service of America, Inc.; USACouriers; XPO, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Same Day Delivery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global same day delivery market report based on type, mode of transportation, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

B2B

-

B2C

-

C2C

-

-

Mode Of Transportation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Airways

-

Roadways

-

Railways

-

Intermodal

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

E-Commerce

-

Healthcare

-

Manufacturing

-

Documents & Letters

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.