- Home

- »

- Next Generation Technologies

- »

-

Software As A Service Market Size, Industry Report, 2030GVR Report cover

![Software As A Service Market Size, Share & Trends Report]()

Software As A Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Application, By Enterprise Size, By Deployment, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-940-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Software As A Service Market Summary

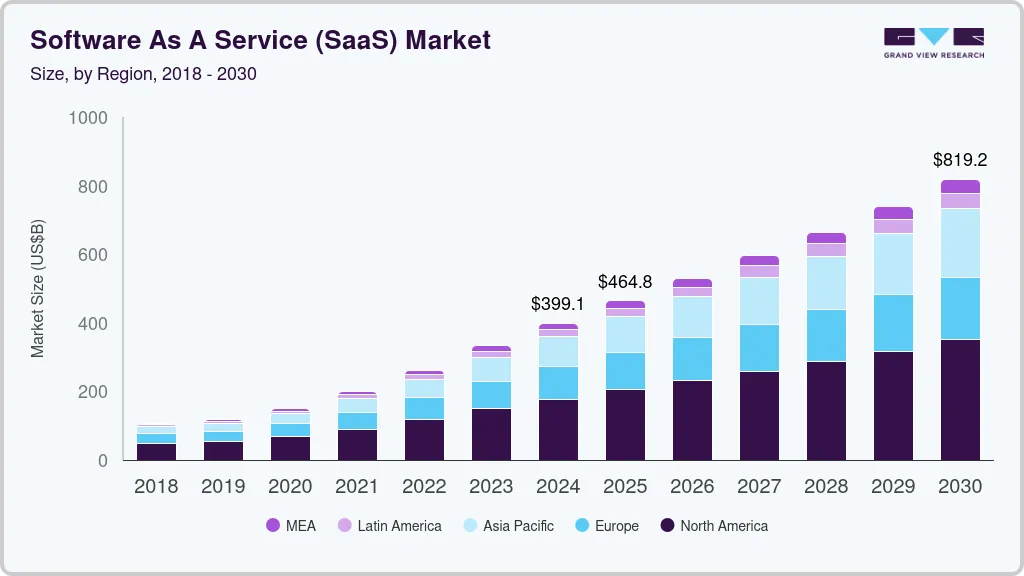

The global software as a service market size was estimated at USD 399.10 billion in 2024 and is projected to reach USD 819.23 billion by 2030, growing at a CAGR of 12.0% from 2025 to 2030. Rising adoption of public cloud services across enterprises is one of the major factors that propel the market growth.

Key Market Trends & Insights

- North America software as a service market dominated with a revenue share of over 43% in 2024.

- The U.S. software as a service market is expected to grow at a significant CAGR from 2025 to 2030.

- Based on component, the software segment led the market in 2024, accounting for over 84% share of the global revenue.

- Based on application, the customer relationship management (CRM) segment accounted for the largest revenue share in 2024.

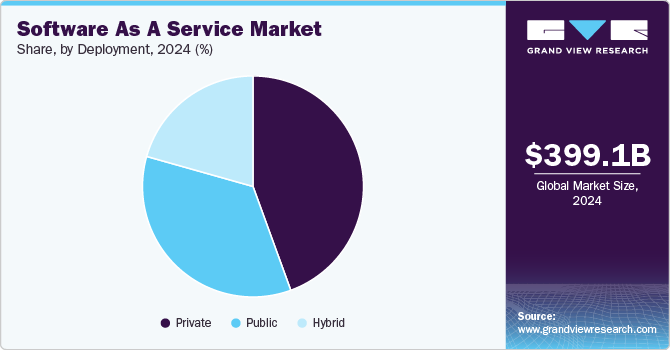

- Based on deployment, the private cloud segment accounted for the largest revenue share of the SaaS industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 399.10 Billion

- 2030 Projected Market Size: USD 819.23 Billion

- CAGR (2025-2030): 12.0%

- North America: Largest Market in 2024

The growing shift of enterprises towards software as a service (SaaS) from an on-premises model owing to high cost of on-premises software deployment is further projected to propel the market growth. However, concerns related to data privacy and security related to public cloud is projected to hinder market growth. Significant increase in the adoption of emails, instant messaging applications, and video calls encourages demand for smart devices among end-users and is projected to contribute to the growth of SaaS industry. Furthermore, adoption of CRM SaaS solutions continues to rise as businesses seek to reduce their IT costs and improve scalability. Customization and configuration of CRM SaaS solutions are becoming easier and more accessible, allowing businesses to tailor their CRM systems to their specific needs, such as security.

Mobile devices are now capable of running more sophisticated software applications, increasing demand for SaaS solutions that can be accessed from any device with an internet connection. Modern tablets and smartphones are equipped with relatively powerful embedded processors, which allow processing on the device itself. This processing power is used for various applications, from running complex software applications and games to processing high-resolution images and videos and executing artificial intelligence and machine learning algorithms. Since 2020, COVID-19 has sped up the development of distant online labor, creating enormous digital needs across multiple horizontal SaaS sectors, including education, retail e-commerce, online supply chain management, office automation, and electronic contracts.

Enterprise users prioritize updating solutions that help them provide better customer service. For instance, ERP providers in e-commerce retail assist businesses in developing member management systems; marketing SaaS providers assist businesses in conducting online marketing and reaching customers remotely through traffic platforms; and catering SaaS vendors assist offline restaurants in developing ordering systems using mini-programs to realize contactless ordering. Among the key attributes of SaaS technology are flexibility, scalability, reliability, and agility. Software as a service (SaaS) helps businesses with their IT infrastructure costs in various ways. It is the main factor driving firms to embrace SaaS apps more frequently. Businesses are investing increasingly in mobile SaaS and app-based solutions as smartphones become an essential part of people's lives, allowing for simple access to information whenever and wherever. Users can synchronize, update, and manage documents using smartphones and app-based SaaS.

Component Insights

The software segment led the market in 2024, accounting for over 84% share of the global revenue. This high share is driven by increasing adoption across industries, fueled by its scalability, cost efficiency, and rapid deployment capabilities. Businesses turned to SaaS solutions for critical functions such as CRM, ERP, and HRM, leveraging their ability to integrate seamlessly with existing systems. The rise in remote work and digital transformation initiatives also amplified the demand for collaborative and cloud-based tools. Additionally, continuous advancements in AI, machine learning, and analytics embedded within SaaS products enhanced their appeal by delivering actionable insights and automation.

The services segment is predicted to foresee significant growth in the coming years.This growth is driven by the increasing reliance on professional and managed services to optimize SaaS deployment and maximize return on investment. Organizations sought specialized expertise for implementation, customization, and integration of SaaS platforms with existing infrastructures. The growing complexity of SaaS ecosystems also boosted demand for ongoing support, training, and consultancy services to ensure seamless operation. Additionally, businesses prioritized cybersecurity and compliance services to address regulatory requirements and safeguard sensitive data.

Application Insights

The customer relationship management (CRM) segment accounted for the largest revenue share in 2024. CRM solutions offer advanced capabilities such as AI-powered analytics, personalized marketing automation, and seamless omnichannel communication, enabling organizations to enhance customer experiences and loyalty. The rise in e-commerce and digital-first strategies further amplified CRM adoption as companies sought to manage large volumes of customer data efficiently. Additionally, integrations with other business applications, such as ERP and HRM systems, improved workflow efficiency and provide comprehensive insights.

The content, collaboration & communication segment is predicted to foresee significant growth in the coming years. SaaS platforms offering real-time collaboration tools, cloud-based document management, and video conferencing solutions became essential for maintaining productivity and connectivity. Organizations embraced these tools to streamline workflows, enhance employee engagement, and enable cross-border collaboration. Additionally, the integration of AI-powered features, such as automated transcription, task management, and analytics, further boosted efficiency and adoption. The scalability and user-friendly interfaces of these platforms catered to businesses of all sizes, establishing their critical role in modern digital workplaces.

Deployment Insights

The private cloud segment accounted for the largest revenue share of the SaaS industry in 2024. Combining the deployment of SaaS applications at the network's edge with a private cloud infrastructure can provide organizations with greater control and security over their data while improving performance and reducing latency. Additionally, organizations can maintain greater control over their data by using a private cloud infrastructure, ensuring compliance with regulatory requirements, and mitigating risk of data breaches. Overall, combining edge computing with private cloud can provide a powerful platform for delivering SaaS applications that meet the needs of modern businesses.

The hybrid cloud segment is predicted to foresee significant growth in the forecast period. Increasing demand for industry-specific SaaS applications, such as those tailored to healthcare, finance, and education, is driven by need for specialized features and compliance with specific industry regulations. Organizations in these industries seek SaaS solutions customized to their unique needs and requirements, such as hybrid cloud.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share in 2024.SaaS solutions offer large enterprises several benefits, including cost-effectiveness, scalability, and flexibility. A trend seen in large enterprises is adopting multi-cloud and hybrid-cloud strategies, driven by the need to manage complex distributed application environments that span multiple geographies, data centers, and cloud providers. Another trend observed among large enterprises is the adoption of platform-as-a-service (PaaS) solutions. PaaS solutions provide a higher level of abstraction than SaaS solutions, allowing enterprises to focus on application development and deployment rather than managing the underlying infrastructure. It can help large enterprises to accelerate their time-to-market, reduce development costs, and improve agility and innovation.

The SMEs segment is anticipated to exhibit the fastest CAGR over the forecast period. On-demand consumption model of SaaS has revolutionized the IT landscape, with small and medium enterprises rapidly adopting SaaS over the past few years. Cost-effectiveness, accessibility, and scalability of SaaS have made it an attractive option for SMEs that have smaller budgets and cannot afford the initial capital outlay and ongoing service and maintenance costs of traditional IT infrastructure. By adopting SaaS, SMEs can access powerful software applications and services that would otherwise have been beyond their reach. It can help them to compete more effectively with larger businesses, increase productivity, and drive growth.

Industry Insights

The BFSI segment accounted for the largest revenue share of the Software as a Services (SaaS) industry in 2024. SaaS solutions offer scalable platforms for core functions such as customer relationship management, risk assessment, fraud detection, and regulatory compliance. Advanced analytics and AI-powered tools enabled real-time decision-making and personalized financial services. The rise of digital banking and fintech further boosted demand for SaaS platforms to streamline processes and manage large volumes of transactional data. Additionally, heightened security features within SaaS offerings addressed industry concerns over data protection, making them a preferred choice for modernizing BFSI operations.

The education segment is estimated to grow significantly over the forecast period. Learning management systems (LMS) software is becoming increasingly popular in the education sector, enabling teachers to deliver online and hybrid learning experiences. SaaS solution providers like Canva and Blackboard, Inc. provide secure and reliable LMS services, helping to improve educational outcomes and reduce administrative burdens. Student information systems (SIS) software is essential for managing student data, such as grades and attendance records. Education analytics software is becoming increasingly important in the education sector, enabling teachers and administrators to analyze student data and identify trends.

Regional Insights

North America software as a service market dominated with a revenue share of over 43% in 2024. The U.S. is positively contributing to the growth of market revenue. The presence of well-established market players is one of the driving factors for market growth. Moreover, developed IT infrastructure increases easy deployment of cloud-based virtual services in the region, further contributing to a significant share in the global SaaS market. Moreover, significant expenditure on cloud infrastructure and availability of many secured internet servers further contributed to the highest market share.

U.S. Software As A Service Market Trends

The U.S. software as a service market is expected to grow at a significant CAGR from 2025 to 2030, driven by its robust technology infrastructure and innovation ecosystem. The widespread adoption of cloud computing across industries and the presence of leading SaaS providers like Salesforce, Microsoft, and Google bolstered market growth. High investment in R&D and advanced technologies, including AI and machine learning, fueled the development of cutting-edge SaaS solutions. Additionally, the rise in remote work and digital transformation initiatives further increased demand for SaaS tools in sectors like BFSI, healthcare, and retail.

Europe Software As A Service Market Trends

The SaaS industry in the Europe region is expected to witness significant growth over the forecast period. The region's robust regulatory frameworks, including GDPR, emphasized data security and privacy, encouraging businesses to adopt compliant SaaS solutions. Growing demand for remote work tools and cloud-based services fueled the adoption of collaboration, CRM, and ERP platforms. Additionally, government initiatives supporting digital innovation and cloud infrastructure development further accelerated growth.

Asia Pacific Software As A Service Market Trends

The Asia Pacific software as a service market is anticipated to register the highest CAGR over the forecast period. The region’s growing internet penetration, expanding mobile user base, and increasing investments in IT infrastructure fueled SaaS adoption across industries like e-commerce, BFSI, and healthcare. Governments in countries like India and China supported digital transformation through initiatives promoting cloud technologies. Additionally, the rise of remote work and demand for cost-effective, scalable solutions spurred the adoption of collaboration, CRM, and ERP tools.

Key Software As A Service Company Insights

Some key players in the Software as a Service (SaaS) industry, such as Adobe Inc., Salesforce, Inc., IBM Corporation, and Microsoft. Companies operating in the market are implementing a variety of strategic initiatives, such as forming partnerships, pursuing mergers and acquisitions, fostering collaborations, and developing innovative products and technologies. This proactive approach not only enhances their market presence but also enables them to respond effectively to the evolving demands of security and compliance. By leveraging these strategies, these industry leaders are well-positioned to capitalize on growth opportunities, drive innovation, and maintain a robust competitive advantage in the rapidly evolving SaaS landscape.

-

Adobe Inc. is renowned for its innovative solutions in digital media, content creation, and customer experience management. The company pioneered the shift to a subscription-based model through its Adobe Creative Cloud, offering tools like Photoshop, Illustrator, and Premiere Pro. These platforms empower professionals and businesses to create, edit, and manage digital content seamlessly. By integrating AI and machine learning through Adobe Sensei, the company delivers enhanced personalization and automation capabilities. Its SaaS offerings are widely adopted across industries such as advertising, media, and e-commerce, driving customer engagement and operational efficiency.

-

Salesforce, Inc. is known for its pioneering role in cloud-based CRM. The company provides businesses with tools to manage sales, service, marketing, and analytics through its flagship Salesforce Customer 360 platform. These solutions enable organizations to streamline customer interactions, optimize workflows, and drive data-driven decision-making. Salesforce has expanded its portfolio with offerings like Tableau for analytics, Slack for team collaboration, and MuleSoft for integration, addressing diverse business needs. Its innovative use of AI, branded as Einstein AI, powers predictive analytics and personalized customer experiences. The company serves a wide array of industries, including retail, healthcare, and finance, helping businesses of all sizes enhance their customer engagement.

Key Software As A Service Companies:

The following are the leading companies in the software as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- Microsoft

- Alibaba Cloud International

- IBM Corporation

- Google LLC

- Salesforce, Inc.

- Oracle

- SAP SE

- Rackspace Technology, Inc.

- VMware Inc.

- IONOS Cloud Inc.

- Cisco Systems, Inc.

- Atlassian

- ServiceNow

Recent Developments

-

In December 2024, TeraRecon, a provider in advanced image processing, is launching a SaaS cloud platform that integrates its Intuition Advanced Visualization, Eureka Clinical AI, and CARAai into a unified solution. This platform enables healthcare organizations to configure and deploy AI-enabled workflows consistently across enterprise and network levels, ensuring broader accessibility to clinical tools and streamlined operations regardless of location.

-

In November 2024, AppOmni, a SaaS security provider, partnered with Cisco Systems, Inc.'s Security Service Edge (SSE) to deliver a comprehensive zero-trust solution for SaaS applications. This collaboration extends security from endpoints to SaaS platforms, offering enhanced visibility, monitoring, and protection of configurations and user behaviors. The partnership focuses on safeguarding the cloud-based SaaS ecosystem by enabling the adoption of zero-trust principles and ensuring strong data security in the dynamic SaaS environment.

-

In July 2024, Temenos Headquarters SA announced a partnership with Tech Mahindra Limited, a global leader in technology consulting and digital solutions. The collaboration will enable Tech Mahindra to provide a core banking solution on Temenos SaaS, tailored specifically for Electronic Money Institutions (EMIs) in the U.K. and Europe. By leveraging Temenos’ composable banking architecture and Tech Mahindra’s expertise, EMIs will gain advantages such as accelerated time-to-market, reduced operational costs, and a scalable framework. Additionally, they will have access to over 100 curated fintech partners from the Temenos Exchange, empowering them to offer innovative, customized, and differentiated services to their customers.

Software As A Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 464.76 billion

Revenue forecast in 2030

USD 819.23 billion

Growth rate

CAGR of 12.0% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, deployment, enterprise size, industry, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Adobe Inc., Microsoft, Alibaba Cloud International, IBM Corporation, Google LLC, Salesforce, Inc., Oracle, SAP SE, Rackspace Technology, Inc., VMware Inc., IONOS Cloud Inc., Cisco Systems, Inc., Atlassian, ServiceNow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Software As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global software as a service market report based on component, application, deployment, enterprise size, industry, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Customer Relationship Management (CRM)

-

Enterprise Resource planning (ERP)

-

Human Capital Management

-

Content, Collaboration & Communication

-

BI & Analytics

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail And Consumer Goods

-

Healthcare

-

Education

-

Manufacturing

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global software as a service market size was estimated at USD 399.10 billion in 2024 and is expected to reach USD 464.76 billion in 2025.

b. The global software as a service market is expected to grow at a compound annual growth rate of 12.0% from 2025 to 2030 to reach USD 819.23 billion by 2030.

b. North America dominated the software as a service (SaaS) market with a share of 44.4% in 2024. This is attributable to the developed IT infrastructure which increases the easy deployment of cloud-based virtual services and the significant expenditure on the cloud infrastructure coupled with the availability of high number of secured internet servers.

b. Some key players operating in the SaaS market include Adobe Inc., Microsoft, Alibaba Cloud International, IBM Corporation, Google LLC, Salesforce, Inc., Oracle, SAP SE, Rackspace Technology, Inc., VMware Inc., IONOS Cloud Inc., Cisco Systems, Inc., Atlassian, ServiceNow

b. Key factors that are driving the SaaS market growth include the rising adoption of public cloud services across enterprises and the growing shift of enterprises towards SaaS from an on-premises model owing to the high cost of the on-premises software deployment across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.