- Home

- »

- Homecare & Decor

- »

-

Rope Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Rope Market Size, Share & Trends Report]()

Rope Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Synthetic, Steel Wire), By End Users (Industrial, Commercial, Residential), By Region (North America, Europe, Asia Pacific, Central & South America (CSA),Middle East & Africa (MEA)), And Segment Forecasts

- Report ID: GVR-4-68038-630-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rope Market Summary

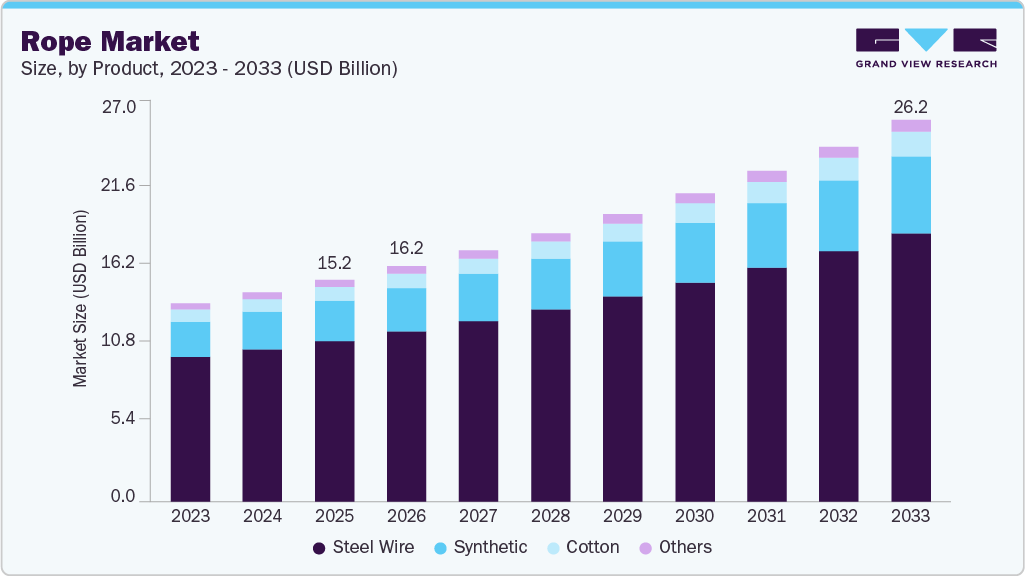

The global rope market size was valued at USD 15.20 billion in 2025 and is expected to reach USD 26.22 billion by 2033, growing at a CAGR of 7.2% from 2026 to 2033. The global market growth is primarily driven by the increasing demand for ropes for residential and commercial purposes, such as weighing loads and materials. With the rising population, the demand for residential housing units is expected to grow exponentially. Consequently, the demand for wire and synthetic rope is expected to increase.

Key Market Trends & Insights

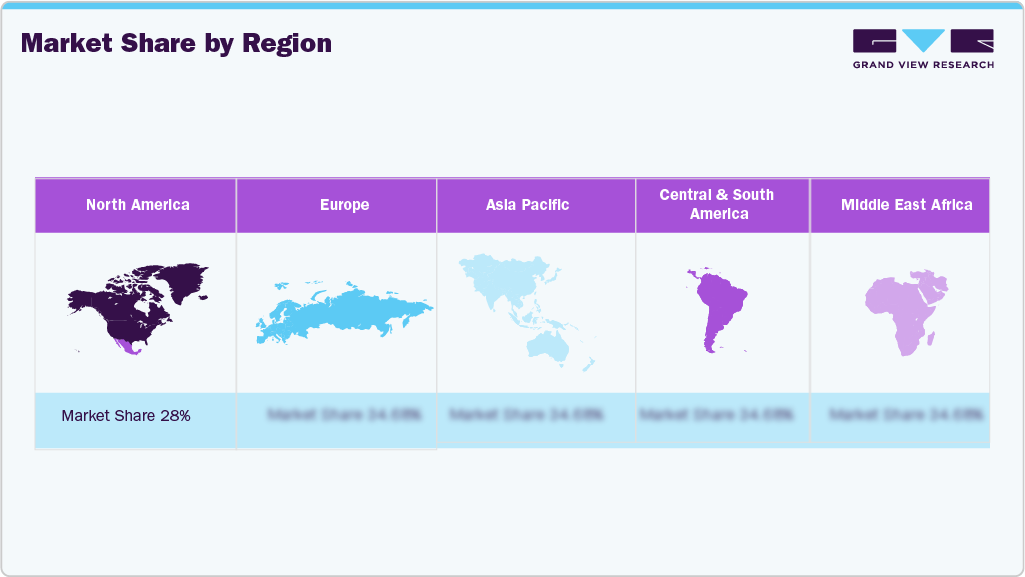

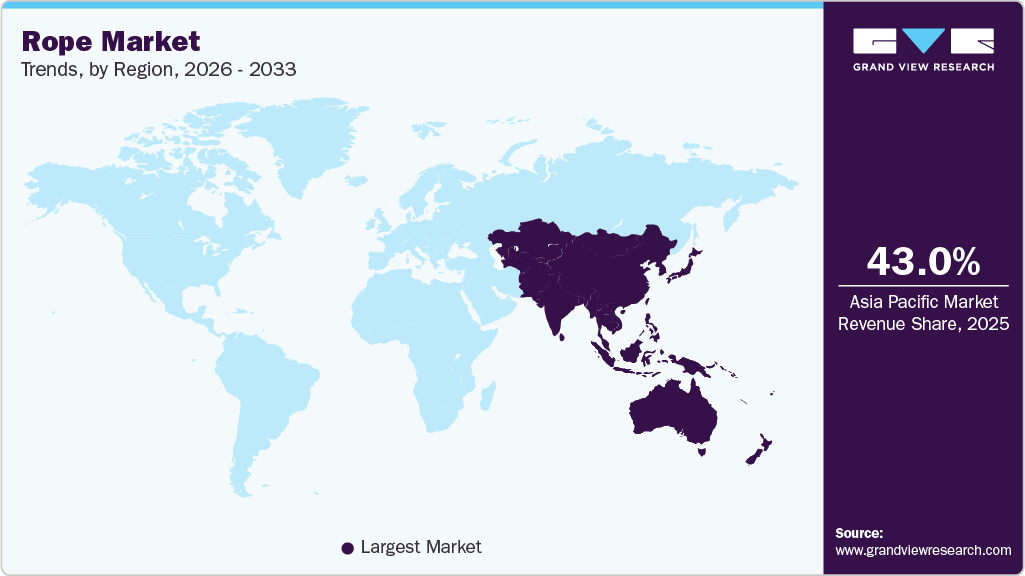

- By region, Asia Pacific led the market with a share of 43.8% in 2025.

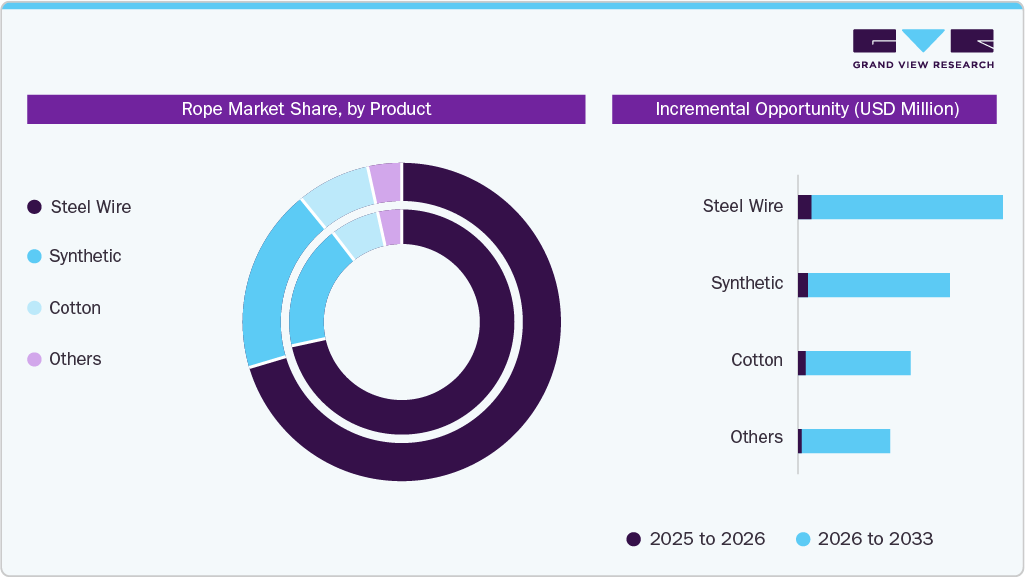

- By product, steel wire led the market and accounted for a share of 72.6% in 2025.

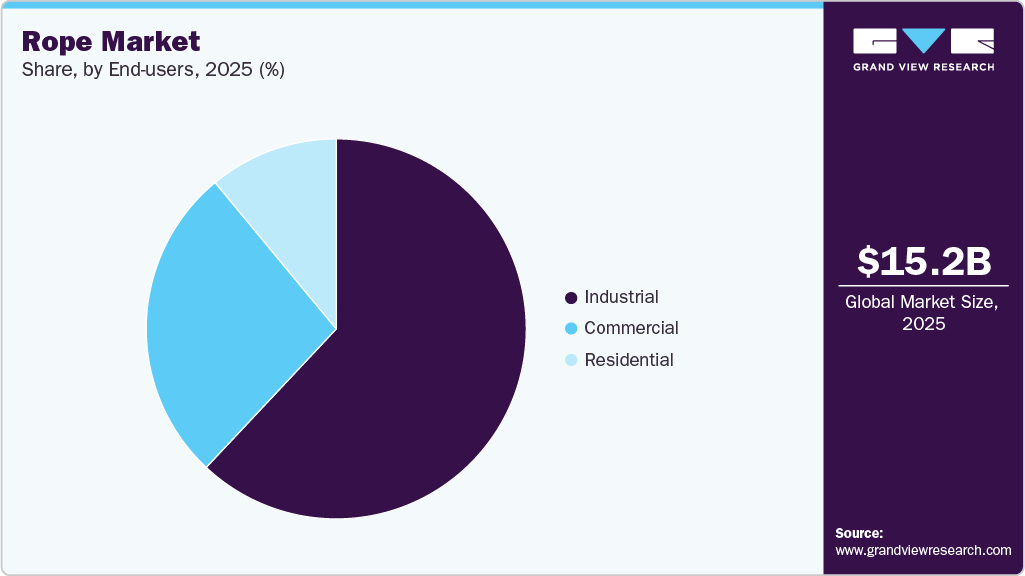

- By end users, the industrial sector led the market and accounted for a share of 61.5% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 15.20 Billion

- 2033 Projected Market Size: USD 26.22 Billion

- CAGR (2026-2033): 7.2%

The increased spending on construction and mining equipment is driving the global market's growth. Key rope manufacturers are heavily investing in advanced manufacturing technologies and materials to stay ahead of the competition. For instance, Teufelberger, one of the leading rope manufacturing companies, is heavily investing in the development of its ropes. The company is conducting intensive research to transform its rope portfolio to include rope robots, 3D printers, and automation. It is also modifying its product line to meet highly specific requirements while serving as a universal element for transferring tensile forces.

Additionally, the increased demand from various sectors, including industrial & crane, mining, transportation, and marine & fisheries, is driving the rope industry to expand steadily. However, severe limitations, such as high prices, frequent preventive maintenance, and normal wear and tear, are limiting market growth. Additionally, due to international trade and tariffs, the prices of raw materials required for rope manufacturing will also increase, subsequently pushing up rope prices worldwide. This is expected to limit the demand for ropes among price-sensitive end-users and low-budget residential and industrial sites.

Apart from this, major product innovations and launches by key players are expected to create brand awareness and help them expand their consumer reach. Key players in the global market are making significant efforts to replace conventional raw materials with cutting-edge alternatives that are both economical and have no adverse environmental impacts during the manufacturing process.

Product Insights

Steel wire dominated the product category, accounting for a share of 72.6% in 2025. A steel wire rope is frequently used in the construction, mining, oil and gas, and marine industries. It is made up of wires, strands, and a core made of steel and fiber. Steel wire ropes are created by twisting the wires, which are typically made up of stainless steel and high-carbon steel. The rope's function is to support and safeguard the external strands for effective functionality. Steel wire rope has a higher strength-to-weight ratio, which is an important factor for various applications, especially in the marine and fishing sectors.

The synthetic segment is expected to grow at a CAGR of 8.5% from 2026 to 2033. Synthetic ropes are made from man-made textile fibers that have been chemically infused and are used as a substitute for natural fibers. Moreover, due to characteristics like high strength-to-weight ratio, bend fatigue durability, and strong spooling capabilities, the synthetic rope is also seeing increased use in cranes. Synthetic ropes have the extra benefit of being lighter than steel cables, which makes them a popular product in cranes and other maritime industry applications.

End Users Insights

The industrial segment dominated the market with a share of 61.5% in 2025. Ropes are widely used in various industries, including construction, maritime and fishing, oil and gas, and mining, due to their lightweight nature, reduced downtime preparation, simple handling, and non-requiring re-lubing properties. Moreover, synthetic ropes are one of the most often used forms of rope in the nautical and fishing industries. These ropes are available in a variety of shapes and colors, offering excellent insulating capacity, chemical resistance, absorption prevention, and environmental resistance. The increased usage of rope for industrial applications is likely to favor market growth.

The commercial segment is estimated to grow with a CAGR of 8.0% over the forecast period. Commercial uses of ropes include camping, rock climbing, agriculture, adventure sports, logistics, and other applications. Ropes are a job site necessity that can be used for bundling, holding, and securing. In some cases, they can also be used for fall protection applications. The different types of rope used for commercial uses include nylon, polyester, hemp, and polypropylene.

Regional Insights

North America Rope Market Trends

The North American rope market is projected to grow at a CAGR of 7.4% from 2026 to 2033. Increased infrastructure development, including large-scale construction projects such as highway and bridge upgrades, fuels the demand for high-strength ropes used in lifting and securing heavy loads. Additionally, the rise in outdoor activities such as climbing, boating, and fishing, along with the expansion of the marine and leisure industries, contributes to the need for specialized ropes. The shift toward synthetic materials, which offer superior strength-to-weight ratios and better abrasion resistance, is further driving market growth.

Europe Rope Market Trends

The European rope market is projected to grow at a CAGR of 8.7% from 2026 to 2033. Increased demand for synthetic ropes is expected to result from the growth of the marine and fishing industries across European countries. Moreover, the growth in the construction industry is driving the demand for steel wire and synthetic rope. In the marine and offshore sectors, including shipping, fishing, and wind‑farm operations in the North Sea region, ropes made of advanced synthetic fibres (lighter, corrosion‑resistant) are increasingly preferred over traditional materials.

Asia Pacific Rope Market Trends

The Asia Pacific dominated the rope market, accounting for a 43.8% share in 2025. Rapidly expanding commercial and residential construction activities accelerate the need for waterproof and durable ropes that are lightweight and high-strength. The increasing infrastructural needs in emerging economies, such as India and China, are driving demand for synthetic ropes. At the same time, the marine/offshore sector (shipping, fishing, oil & gas) is growing, and manufacturers are shifting from traditional fibres and steel wires to high‐performance synthetics (lighter weight, higher strength, better corrosion resistance) which are especially suited to harsh environments.

Central & South America Rope Market Trends

The Central & South American rope market is projected to grow at a CAGR of 3.5% from 2026 to 2033. The rope market in Central & South America is gaining momentum due to surging infrastructure and construction activities, including the expansion of ports, bridges, and housing, which drive demand for lifting, rigging, and anchoring solutions. At the same time, the region's mining, oil & gas, and marine sectors are expanding, for example, deep-water oil fields and shipping growth in Brazil, which is boosting demand for steel wire and specialty ropes. Moreover, there is a shift toward synthetic and high‑performance rope materials, offering longer life, better performance, and compliance with rising safety standards, further accelerating uptake in industrial and marine applications.

Middle East & Africa America Rope Market Trends

The Middle East & Africa rope market is projected to grow at a CAGR of 5.9% from 2026 to 2033. The region's large-scale infrastructure and construction projects are fueling demand for various types of ropes used in lifting, rigging, and hoisting. Additionally, the booming energy sector, particularly in oil and gas and offshore platforms, is driving the need for heavy-duty ropes used in mooring, load securement, and drilling operations. Furthermore, advancements in rope materials, such as lighter, stronger synthetic fibers and high-performance steel varieties, are making ropes more suitable for the harsh desert and marine environments typical in the region. These factors, combined with ongoing industrialization and technological innovation, are contributing to the rise of the rope market in the Middle East and Africa.

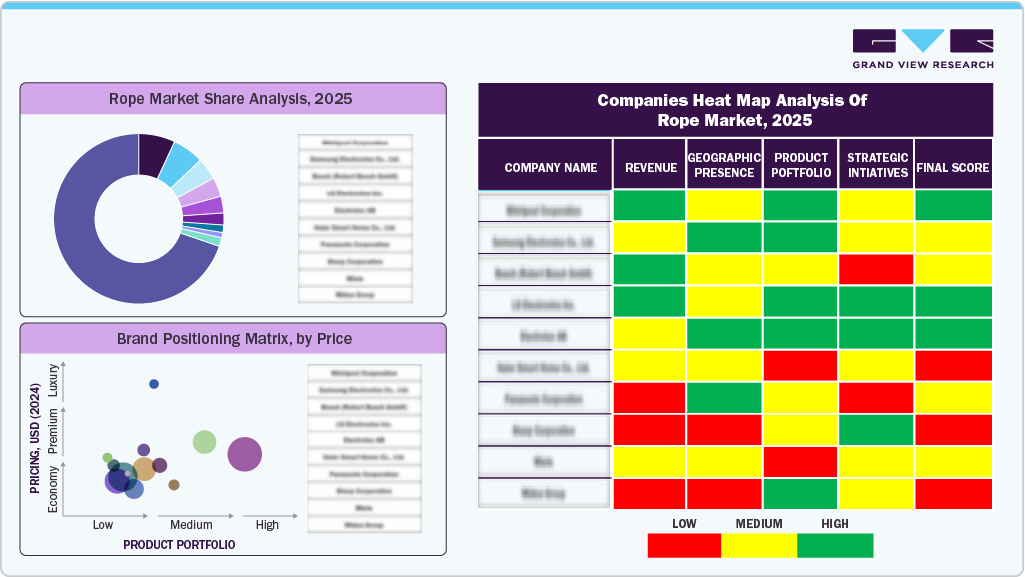

Key Rope Company Insights

The presence of a few established players and new entrants characterizes the market. Market players are focusing on marketing, product launches, and partnerships to compete effectively in this industry.

Key Rope Companies:

The following are the leading companies in the rope market. These companies collectively hold the largest market share and dictate industry trends.

- Bridon-Bekaert

- TEUFELBERGER

- WireCo WorldGroup, Inc.

- Yale Cordage

- Marlow Ropes

- MAGENTO, INC. (English Braids Ltd.)

- Cortland Limited

- Southern Ropes

- van Beelen Group BV

- DynamicaRopes

Rope Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 16.15 billion

Revenue forecast in 2033

USD 26.22 billion

Growth rate

CAGR of 7.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end users, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Bridon-Bekaert; TEUFELBERGER; WireCo, WorldGroup, Inc.; Yale Cordage; Marlow Ropes; MAGENTO, INC. (English Braids Ltd.); Cortland Limited; Southern Ropes; van Beelen Group BV; Dynamica Ropes

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Rope Market Report Segmentation

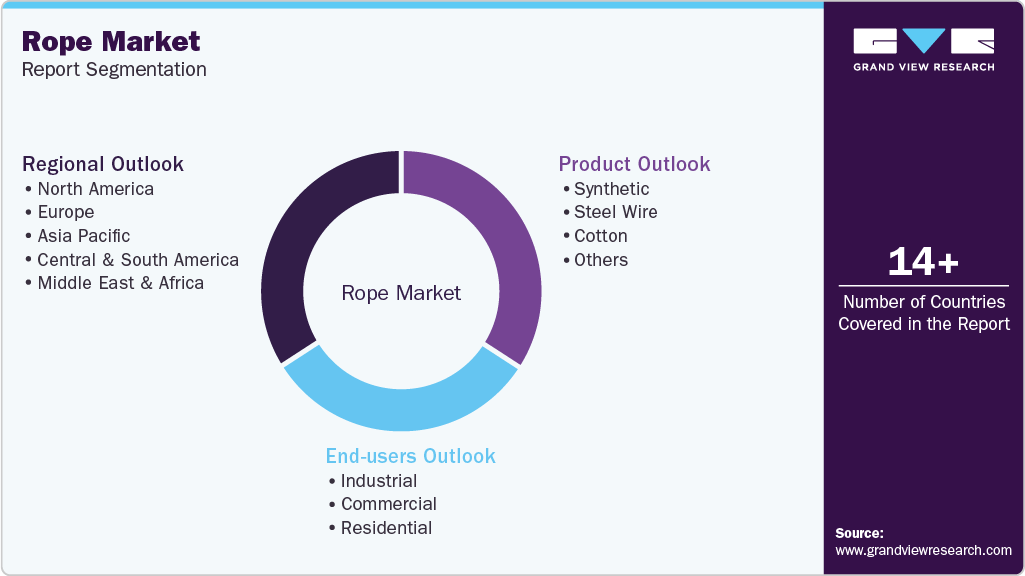

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the rope market on the basis of product, end users, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Synthetic

-

Steel Wire

-

Cotton

-

Others

-

-

End Users Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rope market was estimated at USD 15.20 billion in 2025 and is expected to reach USD 16.15 billion in 2026.

b. The global rope market is expected to grow at a compound annual growth rate of 7.2% from 2026 to 2033 to reach USD 26.22 billion by 2033.

b. Steel wire dominated the product category, accounting for a share of 72.6% in 2025

b. Some key players operating in the rope market include Bridon-Bekaert, TEUFELBERGER, WireCo WorldGroup, Inc., Yale Cordage, Marlow Ropes, MAGENTO, INC. (English Braids Ltd.), Cortland Limited, Southern Ropes, van Beelen Group BV, and Dynamica Ropes.

b. Key factors that are driving the rope market growth include the growing huge application of ropes across the industrial sector, enhanced material innovation amplifies the ability of the product to handle heavy materials in the industrial sector, thereby resulting in growing popularity of various types of ropes and expansion of the housing and commercial construction activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.