- Home

- »

- Agrochemicals & Fertilizers

- »

-

Rodenticides Market Size & Share, Industry Report, 2033GVR Report cover

![Rodenticides Market Size, Share & Trends Report]()

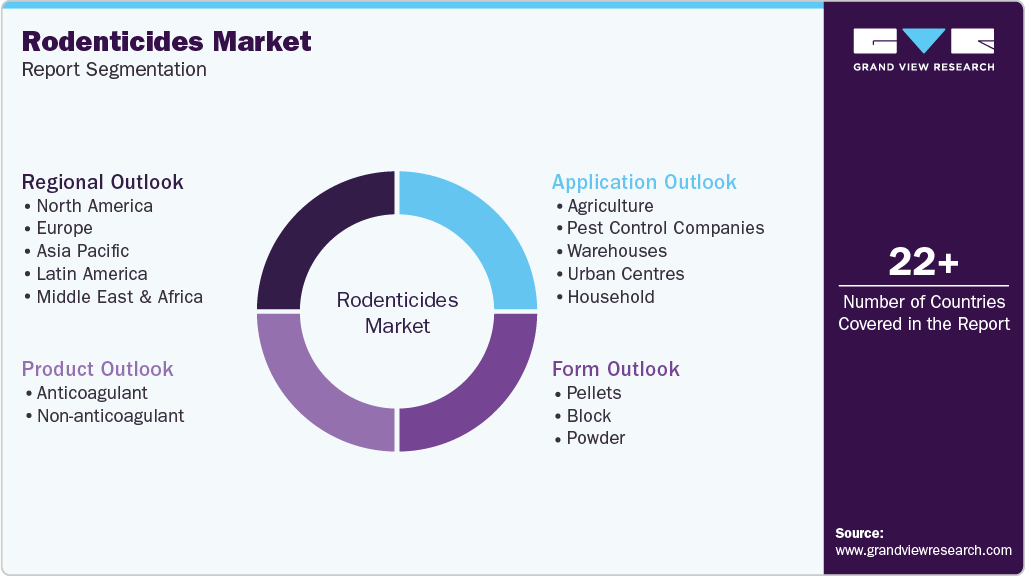

Rodenticides Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Anticoagulant, Non-anticoagulant), By Form (Pellets, Block, Powder), By Application (Agriculture, Pest Control Companies), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-499-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rodenticides Market Summary

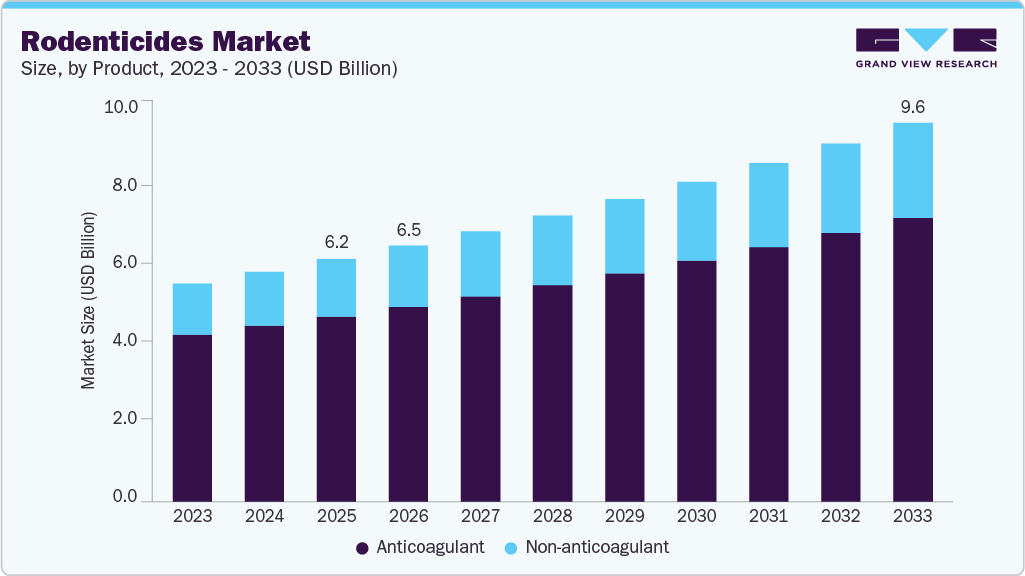

The global rodenticides market size was estimated at USD 6,179.1 million in 2025 and is expected to reach USD 9,645.9 million by 2033, growing at a CAGR of 5.7% from 2026 to 2033. Increasing incidences of rodent infestations in residential, commercial, and agricultural settings are driving market growth.

Key Market Trends & Insights

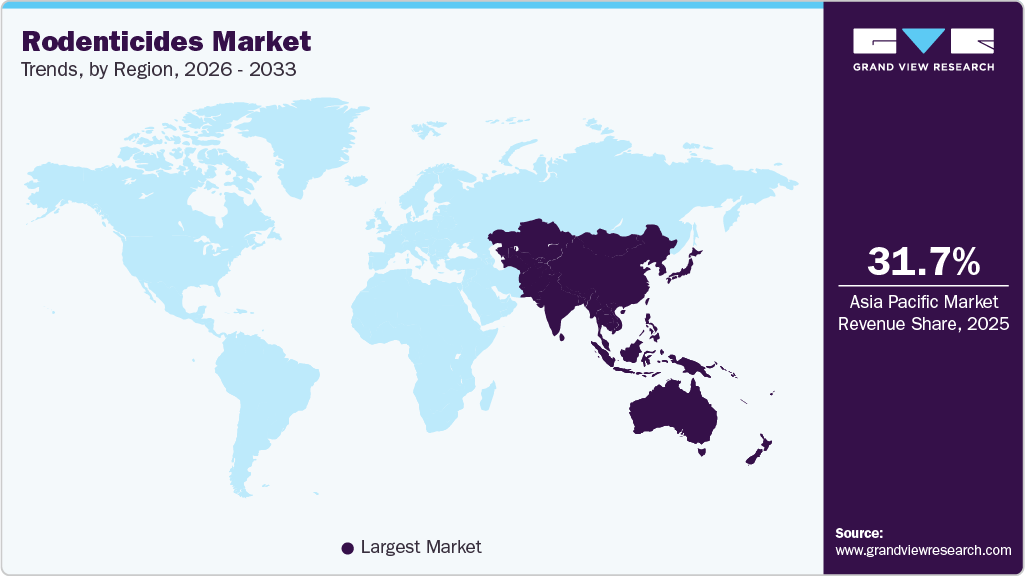

- Asia Pacific dominated the rodenticides market with the largest revenue share of 31.7% in 2025.

- The rodenticides market in China is witnessing strong growth.

- By product, the anticoagulants segment accounted for a dominant revenue share of 76.2% in 2025 and is expected to witness steady growth during the forecast period.

- By form, the block segment accounted for a dominant revenue share of 45.8% in 2025.

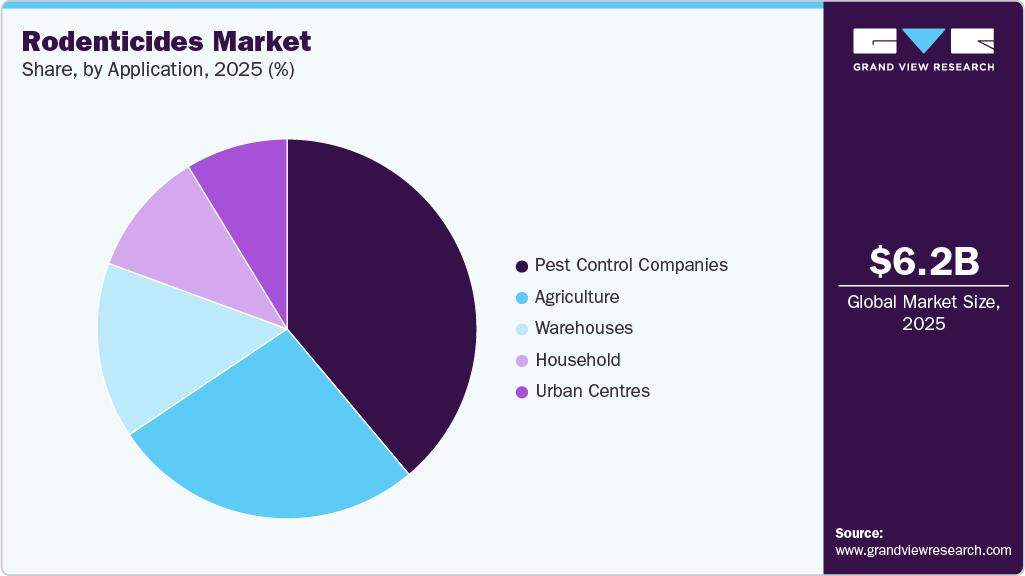

- By application, the pest control companies segment held the largest revenue share of 38.9% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6,179.1 Million

- 2033 Projected Market Size: USD 9,645.9 Million

- CAGR (2026-2033): 5.7%

- Asia Pacific: Largest market in 2025

Rising awareness about health risks associated with rodents, stringent government regulations on food safety and hygiene, growing adoption of eco-friendly and low-toxicity rodent control solutions, and continuous innovation in bait formulations and delivery systems are contributing to the market’s steady expansion.

Rodenticides are chemical or biological formulations designed to control rodent populations, valued for their effectiveness, safety, and targeted action against pest species. Rodenticides are applied across various settings, including residential, commercial, agricultural, and municipal environments, and are increasingly recognized as essential tools for pest management and public health protection. The rising demand for rodenticides is driven by increasing incidences of rodent infestations, growing emphasis on food safety and hygiene, and the need for effective, low-toxicity control solutions, alongside advancements in bait formulations and delivery systems that enhance efficacy and ease of use.

The increasing awareness of environmental sustainability and public health safety is supporting the adoption of eco-friendly rodenticides globally. Rising concerns related to rodent-borne diseases, food contamination, and regulatory restrictions on highly toxic chemical rodenticides continue to encourage the shift toward safer, more effective products, further strengthening demand for rodenticides across residential, commercial, and agricultural markets.

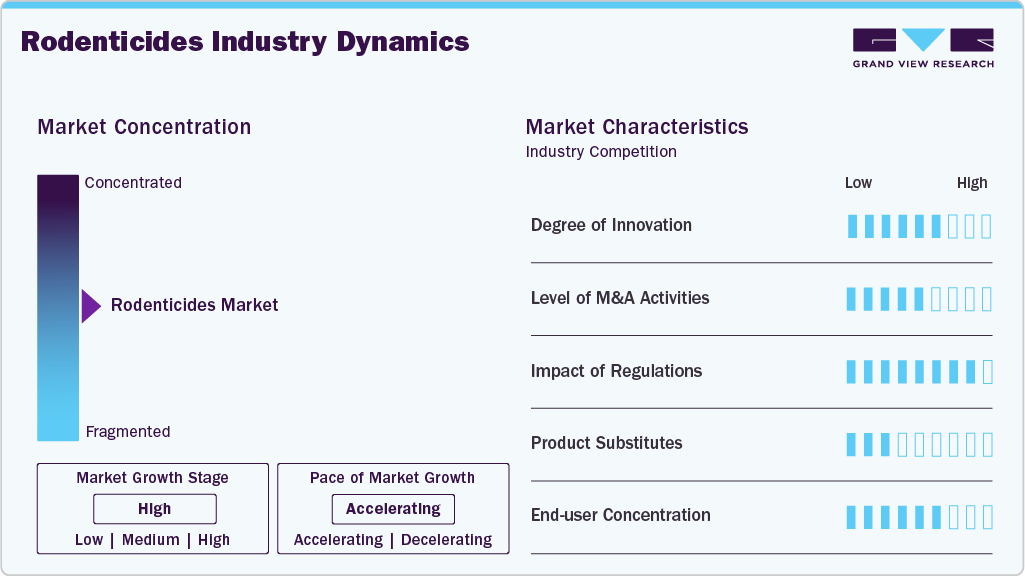

Market Concentration & Characteristics

The industry is moderately fragmented, with a mix of multinational companies and regional manufacturers shaping the competitive landscape. These players leverage established distribution networks, robust R&D capabilities, and diversified rodent control product portfolios. Key participants are increasingly focusing on expanding their product pipelines, investing in bait formulation improvements and delivery system innovations, and strengthening regulatory compliance and field validation efforts to enhance their competitive positioning in the global industry.

Leading players in the global rodenticides industry are adopting a mix of capacity expansion, product innovation, strategic collaborations, and sustainability-focused initiatives to strengthen their market presence. Companies involved in rodenticide development, formulation, and commercialization are investing in advanced bait formulations, delivery system technologies, and next-generation low-toxicity products to improve efficacy, safety, and target specificity. To address rising demand across Asia Pacific and Latin America, several market participants are expanding manufacturing capabilities, strengthening regional distribution networks, and supporting public awareness campaigns and field demonstration programs to accelerate product adoption.

Product Insights

The anticoagulants segment accounted for a dominant revenue share of 76.2% in 2025 and is expected to witness steady growth during the forecast period. Demand for anticoagulant rodenticides is driven by their high efficacy in controlling a wide range of rodent species, prolonged residual activity, and ease of application in residential, commercial, and agricultural settings. Anticoagulant rodenticides offer targeted control of rodent populations, helping prevent property damage, contamination, and disease transmission, supporting their strong adoption across various end-use sectors. Rising emphasis on food safety, public health, and integrated pest management practices is further boosting the use of anticoagulants globally. In addition, non-anticoagulant rodenticides, including acute toxicants, cholecalciferol-based formulations, and natural or botanical products, are increasingly applied in sensitive environments where low-toxicity or rapid action is preferred, addressing diverse rodent control requirements.

Anticoagulant rodenticides are valued for their ability to deliver consistent results, reduce rodent infestations effectively, and provide long-term protection with minimal intervention. Continuous advancements in bait formulations, palatability enhancement, and safer delivery mechanisms, along with expanding adoption in commercial, municipal, and agricultural pest control programs, are expected to drive sustained growth of the anticoagulants segment over the forecast period, while non-anticoagulant products complement control strategies in specialized applications.

Form Insights

The block segment accounted for a dominant revenue share of 45.8% in 2025 and is expected to witness steady growth during the forecast period. Demand in this segment is driven by the ease of deployment, long-lasting efficacy, and suitability for both indoor and outdoor rodent control applications. Blocks provide a convenient and effective solution for households, commercial facilities, warehouses, urban centers, and agricultural areas. In addition, other rodenticide forms, including pellets and powders, are increasingly used to address specific infestation challenges, provide flexible application methods, and enhance targeting of rodent populations.

Rodenticides in different forms are valued for their ability to deliver effective population control, reduce contamination risks, and ensure safe usage in diverse environments. Continuous improvements in formulation, palatability, and delivery mechanisms, along with growing awareness of safe rodent control practices, are expected to drive sustained growth of the block segment, while pellets and powders complement overall market expansion across residential, commercial, and agricultural applications.

Application Insights

The pest control companies segment accounted for a dominant revenue share of 38.9% in 2025 and is expected to witness steady growth during the forecast period. Demand in this segment is driven by the increasing reliance of commercial and residential clients on professional pest management services, rising awareness of rodent-borne diseases, and the need for effective, safe, and targeted rodent control solutions. Pest control companies provide expertise in deploying rodenticides across diverse environments, ensuring compliance with safety regulations and optimized application methods. In addition, other application segments, including agriculture, warehouses, urban centers, and households, are increasingly adopting rodenticides to protect crops, stored products, infrastructure, and living spaces, addressing diverse rodent infestation challenges.

Rodenticides are valued across these applications for their ability to deliver effective population control, reduce contamination risks, and safeguard human and animal health. Continuous improvements in bait formulation, delivery systems, and low-toxicity products, along with growing professionalization of pest management services and awareness campaigns, are expected to drive sustained growth in the pest control segment, while agricultural, household, warehouse, and urban applications complement overall market expansion.

The household segment is expected to emerge as one of the fastest-growing applications in the rodenticides market, registering a CAGR of 7.2% from 2026 to 2033. Growth is driven by increasing awareness of rodent-borne diseases, rising incidences of infestations in residential areas, and growing adoption of safe and easy-to-use rodent control solutions by homeowners. Household rodenticides, including low-toxicity baits, traps, and eco-friendly formulations, are increasingly preferred due to their effectiveness, ease of application, and minimal risk to humans and pets.

Rising focus on food safety, hygiene, and integrated pest management practices is further accelerating the use of rodenticides in household settings, particularly in urban and peri-urban areas. Continuous advancements in product formulations, delivery mechanisms, and safety features, along with educational campaigns on proper application, are expected to support the strong growth of the household segment over the forecast period, complementing steady demand from agriculture, warehouses, urban centers, and professional pest control services.

Regional Insights

Asia Pacific rodenticides market dominated with a revenue share of 31.7% in 2025, driven by increasing incidences of rodent infestations in residential, commercial, and agricultural settings and growing awareness of safe and effective rodent control solutions. Rising concerns over food safety, property damage, and rodent-borne diseases, coupled with expanding urbanization and infrastructure development, are encouraging the adoption of rodenticides across households, warehouses, urban centers, and agricultural areas. Strong pest management activity, supportive government initiatives, and improving access to professional pest control services and low-toxicity rodenticide products across India, China, Japan, and Southeast Asia are expected to sustain regional growth.

China Rodenticides Market Trends

The rodenticides market in China is witnessing strong growth, driven by increasing incidences of rodent infestations in agricultural, residential, and commercial settings and rising awareness of safe and effective rodent control solutions. As stakeholders focus on protecting crops, stored products, and infrastructure while minimizing health risks, demand for rodenticides is increasing across households, warehouses, urban centers, and agricultural areas. Expansion of domestic manufacturing capabilities, improved distribution networks, and continued product innovation in anticoagulant and non-anticoagulant formulations are further supporting market growth, positioning China as a key contributor to the Asia Pacific rodenticides market.

Europe Rodenticides Market Trends

The rodenticides market in Europe is witnessing steady growth with a share of 27.7% in 2025, driven by strong regulatory support for public health, food safety, and integrated pest management practices. Commercial, residential, and agricultural stakeholders across Germany, France, the UK, and other European countries are increasingly adopting rodenticides to comply with stringent regulations on rodent control, prevent property and crop damage, and reduce health risks associated with rodent infestations. The market is further supported by rising awareness of hygiene, contamination prevention, and safe, low-toxicity pest management solutions, alongside government initiatives promoting sustainable and effective rodent control practices.

Growing emphasis on environmentally safe and human-friendly rodent control is encouraging manufacturers to innovate with advanced anticoagulant and non-anticoagulant formulations, as well as safer bait and delivery systems. Additionally, the expansion of professional pest control services, improvements in distribution infrastructure, and rising adoption across households, warehouses, urban centers, and agricultural settings are strengthening Europe’s position as a key regional market for rodenticides, contributing significantly to overall global growth.

Germany rodenticides market is growing steadily, driven by increasing awareness of rodent-borne diseases, food safety, and effective pest management solutions. Rodenticides are widely used across households, commercial facilities, warehouses, urban centers, and agricultural areas to control rodent populations and prevent property and crop damage. Rising emphasis on integrated pest management, hygiene, and environmentally safe rodent control is encouraging manufacturers to innovate with advanced anticoagulant and non-anticoagulant formulations, as well as improved bait delivery systems. Expansion of production facilities, distribution networks, and application technologies is further supporting market growth.

North America Rodenticides Market Trends

The rodenticides market in North America is witnessing steady growth with a share of 26.1% in 2025, fueled by increasing awareness of rodent-borne diseases, food safety, and effective pest management solutions. Rodenticides are increasingly applied across households, commercial facilities, warehouses, urban centers, and agricultural areas to prevent property damage, contamination, and infrastructure losses. Growing emphasis on integrated pest management practices, hygiene, and safe, low-toxicity rodent control, coupled with supportive regulations, is driving product innovation and supporting market expansion across the United States, Canada, and Mexico.

The rodenticides market in the U.S. is growing steadily, driven by increasing awareness of rodent infestations, food safety, and effective pest management solutions. Rodenticides are widely applied across households, commercial facilities, warehouses, urban centers, and agricultural areas to prevent property damage, contamination, and infrastructure losses. Rising demand for integrated pest management practices, hygiene, and safe, low-toxicity rodent control is encouraging product innovation. Expansion of production facilities, distribution networks, and product availability across commercial and retail channels is further supporting market growth.

Latin America Rodenticides Market Trends

The rodenticides market in Latin America is witnessing steady growth, driven by increasing incidences of rodent infestations in residential, commercial, and agricultural settings. Rodenticides are increasingly used across households, warehouses, urban centers, and agricultural areas to prevent property damage, contamination, and crop losses. Rising awareness of integrated pest management practices, hygiene, and safe, low-toxicity rodent control, along with growing demand for food safety and effective pest management solutions, is encouraging manufacturers to innovate and expand production capabilities across Brazil and other key markets.

Middle East & Africa Rodenticides Market Trends

The rodenticides market in the Middle East & Africa is growing steadily, supported by increasing awareness of rodent-borne diseases, food safety, and effective pest management solutions. Rodenticides are increasingly applied across households, commercial facilities, warehouses, urban centers, and agricultural areas to prevent property damage, contamination, and crop losses. Growing emphasis on integrated pest management practices, hygiene, and safe, low-toxicity rodent control is driving product innovation. Expansion of production facilities and distribution networks across key markets, including the UAE, Saudi Arabia, and South Africa, further supports market growth.

Key Rodenticide Company Insights

Key players operating in the rodenticides market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Key players, such as BASF SE., Bayer AG., and Rentokil Initial plc., are dominating the market.

BASF SE

- BASF SE is emerging as a key player in the global rodenticides market, focusing on the development, formulation, and commercialization of high-quality anticoagulant and non-anticoagulant rodent control solutions. The company leverages its extensive R&D capabilities, technological expertise, and global production infrastructure to deliver innovative and effective rodenticides across households, commercial facilities, warehouses, urban centers, and agricultural areas. BASF SE’s commitment to safe and sustainable pest management, regulatory compliance, and product innovation supports its growing presence in both domestic and international rodenticide markets.

Key Rodenticides Companies:

The following are the leading companies in the rodenticides market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Rentokil Initial plc

- Neogen Corporation

- UPL Ltd

- Ecolab Inc

- Bell Laboratories Inc

- Anticimex

- Syngenta AG

- JT Eaton and Co.

Recent Developments

- In April 2023, Target Specialty Products announced the launch of CITO Paste, a fast-acting and easy-to-use commercial rodenticide paste. Formulated with brodifacoum, the product provides rapid and effective control of rodent populations in both internal and external settings. Designed for use with bait stations and applicators, CITO Paste enhances convenience and efficacy for pest management professionals. Innovations like this drive market growth by improving application efficiency, expanding adoption among commercial users, and meeting the demand for highly effective rodent control solutions.

Rodenticides Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6,522.0 million

Revenue forecast in 2033

USD 9,645.9 million

Growth rate

CAGR of 5.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

BASF SE; Bayer AG; Rentokil Initial plc; Neogen Corporation; UPL Ltd; Ecolab Inc; Bell Laboratories Inc; Anticimex; Syngenta AG; JT Eaton and Co

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rodenticides Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global rodenticides market report based on product, form, application and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Anticoagulant

-

Non-anticoagulant

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Pellets

-

Block

-

Powder

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Agriculture

-

Pest control companies

-

Warehouses

-

Urban centres

-

Household

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rodenticides market size was estimated at USD 6,179.1 million in 2025 and is expected to reach USD 6,522.0 million in 2026.

b. The global rodenticides market is expected to grow at a compound annual growth rate of 5.7% from 2026 to 2033 to reach USD 9,645.9 million by 2033.

b. The anticoagulant segment dominated the global rodenticides market by product in 2025 with market share of 76.2%, accounting for a significant share of overall consumption, driven by its proven efficacy, broad-spectrum control, and widespread acceptance across professional and household applications. Anticoagulant rodenticides are widely used across residential areas, commercial facilities, warehouses, and agricultural settings to effectively manage rodent populations and reduce risks related to contamination and property damage. Key advantages such as delayed action, high palatability, and effectiveness against multiple rodent species continue to strengthen the market position of anticoagulant rodenticides globally.

b. Some of the key players operating in the market include BASF SE, Bayer AG, Rentokil Initial plc, Neogen Corporation, UPL Ltd, Ecolab Inc, Bell Laboratories Inc, Anticimex, Syngenta AG, and JT Eaton and Co.

b. The global rodenticides market is primarily driven by rising demand from residential, commercial, agricultural, and municipal sectors, supported by increasing awareness of effective rodent control and public health protection. Growing concerns related to food safety, infrastructure damage, and rodent-borne diseases, along with continuous product innovation and expanding use of anticoagulant and non-anticoagulant formulations, are accelerating market growth. The application of rodenticides across households, warehouses, urban centers, and agricultural areas, driven by demand for effective, safe, and targeted rodent control solutions, continues to support steady global market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.