- Home

- »

- Advanced Interior Materials

- »

-

Rifles Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Rifles Market Size, Share & Trends Report]()

Rifles Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Assault Rifles, Light Machine Guns, Designated Marksman Rifles, General-Purpose Machine Guns), By Firing Type, By Region, And By Segment Forecasts

- Report ID: GVR-4-68040-477-3

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rifles Market Size & Trends

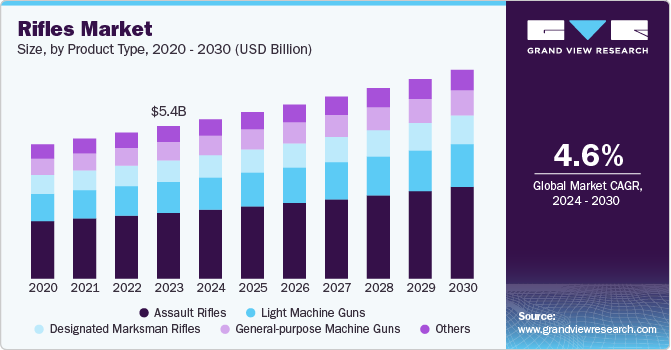

The global rifles market size was estimated at USD 5.44 billion in 2023 and is projected to grow at a CAGR of 4.6% from 2024 to 2030. This growth is attributed to the increasing defense expenditures globally, particularly in countries like the U.S., China, and India, which is driving the demand for advanced rifles for military personnel. Furthermore, modernization efforts and the acquisition of new firearms for national security contribute significantly to market growth. In addition, innovations in rifle design, such as lighter materials, enhanced accuracy, and integration with advanced optics and electronics, are creating new demand. Smart rifles, which feature improved targeting systems and digital enhancements, are gaining popularity, thereby contributing to overall market growth.

Civilian demand for rifles, driven by recreational shooting, hunting, and personal defense, is a key market driver, particularly in regions with relaxed gun ownership laws like the U.S., Canada, and parts of Europe. In addition to this, increasing interest in competitive shooting sports globally is boosting rifle sales. Events like target shooting and skeet shooting, along with the rise of shooting sports leagues, are creating consistent demand for specialized rifles.

Rising geopolitical tensions and cross-border conflicts in regions like the Middle East, Eastern Europe, and the Asia Pacific are driving countries to arm their military forces with more advanced rifles, leading to increased procurement by governments. Moreover, specialized military units, law enforcement agencies, and security forces require highly customized rifles. Manufacturers can target these niche markets by developing precision rifles, sniper rifles, and tactical weaponry.

Advanced rifles require cutting-edge technology and high-quality materials, which increases manufacturing costs. These higher costs can reduce profit margins or lead to higher prices, limiting the market to premium buyers such as military forces or affluent civilians. Furthermore, trade restrictions and export controls imposed by governments can limit the market's growth potential. For instance, bans on the export of firearms to certain countries can reduce market opportunities for manufacturers.

Strict government regulations on firearms ownership, particularly in countries like Australia, Japan, and several European nations, limit civilian access to rifles and restrict overall market growth. Compliance with varying legal frameworks can also increase production costs for manufacturers. However, there is a significant opportunity for rifle manufacturers to innovate by developing lighter, more ergonomic designs, improving rifle accuracy, and integrating smart technologies. Rifles with modular designs or customizable components offer additional market potential as consumers and military personnel seek tailored solutions.

Product Type Insights

The market is segmented into assault rifles, light machine guns, designated marksman rifles, and general-purpose machine guns. Amongst these, the assault rifles segment led the market with the largest revenue share of 43.2% in 2023, on account of their wide use by military forces worldwide due to their versatility, lightweight design, and adaptability in a variety of combat situations. Furthermore, this product is lightweight and capable of both semi-automatic and fully automatic fires that use intermediate cartridges, thereby offering a balance of range, firepower, and maneuverability. These rifles are also preferred in high-risk operations due to their firepower, accuracy, and adaptability to different combat scenarios.

Light machine guns are portable machine guns, typically used by a single soldier, that provide sustained automatic fire to suppress enemy forces. They often have a higher rate of fire and greater ammunition capacity compared to assault rifles. LMGs play a crucial role in providing suppressive fire in modern infantry squads. The ability to deliver continuous fire while remaining mobile makes LMGs indispensable in tactical operations. Furthermore, their lightweight design, coupled with high firepower, is driving their adoption by specialized military units across the globe. In addition to this, LMGs are also gaining popularity among paramilitary forces and elite law enforcement units for counter-terrorism and crowd-control operations. Their ability to deliver high volumes of suppressive fire is crucial in situations involving armed conflict or riot control.

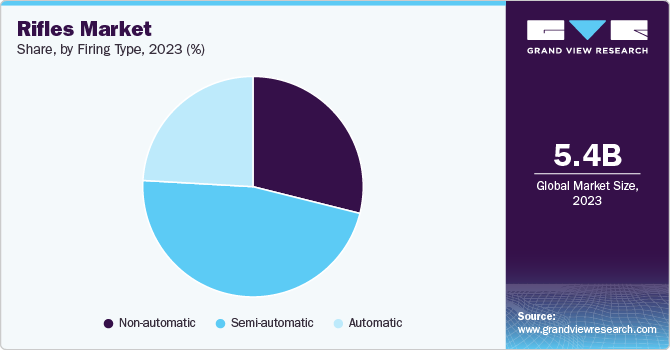

Firing Type Insights

Based on firing type, the semi-automatic rifles segment led the market with the largest revenue share of 47.0% in 2023 and is further expected to grow at a significant CAGR over the forecast period. The market is segmented into non-automatic, semi-automatic, and automatic. Global demand for non-automatic, semi-automatic, and automatic firing rifles has been growing significantly due to several factors, including increased military and law enforcement procurement, rising interest in civilian ownership, advancements in firearm technology, and geopolitical tensions. Semi-automatic rifles are increasingly being used by military and law enforcement forces worldwide for their tactical versatility. These rifles are suitable for a range of applications, from general infantry use to Special Forces operations, providing soldiers and officers with the ability to engage multiple targets quickly.

Automatic rifles, often referred to as fully automatic or select-fire rifles, are capable of continuous fire as long as the trigger is held down. They are primarily used in military contexts where sustained firepower is critical in combat. The primary driver of automatic rifle demand is military modernization programs around the world.Continuous advancements in automatic rifle technology, including improved reliability, lighter materials, and better recoil control, have made these weapons more effective in modern warfare. Furthermore, manufacturers are developing rifles with enhanced durability, ergonomics, and modular designs, which appeal to both military and law enforcement buyers.

Regional Insights

The rifles market in North America is expected to grow at a significant CAGR during the forecast period, driven by both civilian and military demand. Ongoing technological advancements in rifle design, including modularity, lightweight materials, improved optics, and customization options, are attracting both civilian and military buyers. Furthermore, the popularity of hunting, target shooting, and competitive sports like 3-gun competitions, particularly in the U.S. and Canada, continues to drive demand for rifles in North America.

U.S. Rifles Market Trends

The rifle market in the U.S. is anticipated to grow at a significant CAGR over the forecast period, driven by a robust civilian firearms culture, significant military and law enforcement demand, and strong hunting and sporting traditions. Furthermore, The U.S. military is continuously upgrading its inventory with modern rifles, which is resulting in market growth.

Europe Rifles Market Trends

Europe dominated the rifles market with the largest revenue share of 70.34% in 2023. Europe's market is well-established, driven by military procurement, rising civilian interest, and sporting traditions. Hunting and sporting traditions in countries like Germany, Sweden, and Finland continue to support the demand for non-automatic and semi-automatic rifles. While European countries have stringent gun laws, hunting and sports shooting remain popular, contributing to stable demand in the civilian sector.

Asia Pacific Rifles Market Trends

The rifles market in Asia Pacific is experiencing significant market growth, largely due to increased defense spending, rising security concerns, and a growing civilian interest in firearm sports. However, civilian gun ownership is heavily regulated in many Asia Pacific countries, and there is still a growing interest in firearms for sporting purposes, particularly in countries like Australia, New Zealand, and parts of Southeast Asia. Furthermore, competitive shooting events and hunting, though limited, are slowly contributing to the demand for rifles in the region.

Key Rifles Market Company Insights

Some of the key players operating in the market are Sig Sauer and FN Herstal:

-

Sig Sauer is headquartered in the U.S. and was founded in 1853. The company is a manufacturer of firearms, ammo, and accessories, including rifles serving military forces, law enforcement agencies, and civilian shooters. Its product portfolio includes pistols, rifles, and ammunition

-

FN Herstal, a Belgium-based company, was established in 1889 and is involved in the manufacturing of firearms. It is a subsidiary of Herstal Group and supplies firearms to military, law enforcement, and civilian markets across 100 countries. Furthermore, the product portfolio of the company includes a range of firearms, including assault rifles, machine guns, pistols, and sniper rifles, alongside advanced weapon systems and firearm accessories

CheyTac USA and Springfield, Inc. are some of the emerging participants in the market.

-

CheyTac USA is involved in the manufacturing of firearms, rifles, ammunition, and gear. With its product, the company serves the military and law enforcement sector

-

Springfield, Inc.,founded in 1974 and based in Geneseo, Illinois, is one of the most recognized American manufacturers of rifles and handguns. Furthermore, its rifles are sold under the following categories AR, Hellion, Model 2020, and M1A

Key Rifles Companies:

The following are the leading companies in the rifles market. These companies collectively hold the largest market share and dictate industry trends.

- Sig Sauer

- FN Herstal

- Smith & Wesson

- Heckler and Koch

- Sturm, Ruger & Co., Inc.

- Browning International S.A.

- O. F. Mossberg & Sons, Inc.

- CheyTac USA

- Barrett

- Springfield, Inc.

Recent Developments

-

In August 2024, Sig Sauer, a firearm company, sealed a deal with India to provide 73,000 SiG716 rifles. India is investing in new technology weapons as part of their ‘modernize the defense infrastructure’ initiative

Rifles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.68 billion

Revenue forecast in 2030

USD 7.45 billion

Growth Rate

CAGR of 4.6% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, firing type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Sig Sauer; FN Herstal; Smith & Wesson; Heckler and Koch; Sturm; Ruger & Co., Inc.; Browning International S.A.; O. F. Mossberg & Sons, Inc.; CheyTac USA, Barrett; Springfield, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rifles Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global rifles market report based on product type, firing type, and region:

-

Product Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Assault Rifles

-

Light Machine Guns

-

Designated Marksman Rifles

-

General-Purpose Machine Guns

-

Others

-

-

Firing Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Non-automatic

-

Semi-automatic

-

Automatic

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global rifles market size was estimated at USD 5.44 billion in 2023 and is expected to reach USD 5.94 billion in 2024.

b. The global rifles market is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2030 to reach USD 7.45 billion by 2030.

b. Assault rifles accounted for the largest revenue share of 43.2% of rifles market in 2023 on account of their wide use by military forces worldwide due to their versatility, lightweight design, and adaptability in a variety of combat situations.

b. Some key players operating in the rifles market include Sig Sauer, FN Herstal, Smith & Wesson, Heckler and Koch, Sturm, Ruger & Co., Inc., Browning International S.A., O. F. Mossberg & Sons, Inc., CheyTac USA, Barrett, Springfield, Inc.

b. The key factors that are driving the rifles market growth is attributed to the increasing defense expenditures globally, particularly in countries like the U.S., China, and India.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.