- Home

- »

- Consumer F&B

- »

-

Rice Protein Market Size And Share, Industry Report, 2030GVR Report cover

![Rice Protein Market Size, Share & Trends Report]()

Rice Protein Market (2024 - 2030) Size, Share & Trends Analysis Report By Segregation (Organic Rice Protein, Processed Rice Protein), By Product, By Source, By Application, By Organic Rice Protein Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-454-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rice Protein Market Size & Trends

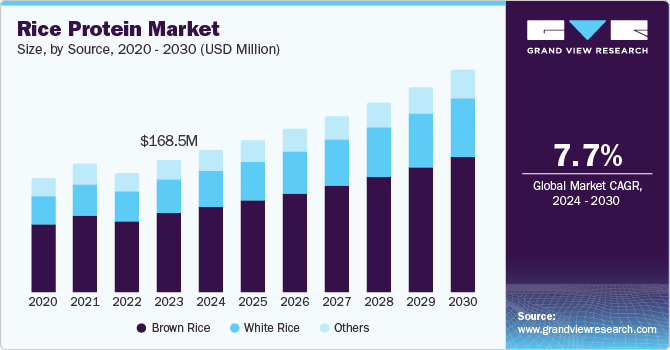

The global rice protein market size was valued at USD 168.5 million in 2023 and is expected to expand at a CAGR of 7.7% from 2024 to 2030. Rising consumer preference for plant-based diets is fueled by increasing awareness of the health benefits of plant-based proteins, such as improved digestion and reduced risk of chronic diseases. The growing vegan and vegetarian population worldwide significantly contributes to the demand for rice protein as a sustainable and ethical protein source.

The food and beverage industry is increasingly incorporating rice protein into various products, including snacks, beverages, and dietary supplements, to cater to health-conscious consumers. Innovations in food technology and the development of new rice protein-based products are also propelling market growth. The rising fitness and wellness trend has spurred demand for protein supplements, with rice protein being favored for its high digestibility and balanced amino acid profile. The environmental benefits of rice protein production, which requires less water and land than animal-based proteins, also appeal to eco-conscious consumers.

The increasing prevalence of food allergies and intolerances, particularly to dairy and soy proteins has led consumers to seek hypoallergenic protein alternatives, with rice protein emerging as a popular choice due to its low allergenic potential. Additionally, supportive government policies and initiatives promoting sustainable agriculture and plant-based diets further encourage the adoption of rice protein. The expanding application of rice protein in the cosmetics and personal care industry, used for its moisturizing and anti-aging properties, is another significant driver of market growth.

Segregation Insights

The organic rice protein segment accounted for the largest revenue share of 56.8% in 2023. This dominance can be attributed to the growing consumer preference for organic products, which are perceived as healthier and more environmentally friendly. Organic rice protein is free from synthetic pesticides and fertilizers, aligning with the clean-label trend and the increasing demand for natural and minimally processed ingredients. Additionally, the higher nutritional value and better taste profile of organic rice protein than conventional options make it a preferred choice among health-conscious consumers and manufacturers.

The processed rice protein segment is projected to grow at the fastest CAGR over the forecast period. This growth is driven by the increasing demand for high-quality, functional protein ingredients in various applications, including food and beverages, dietary supplements, and animal feed. Processed rice protein offers enhanced solubility, improved texture, and better flavor profiles, making it an attractive ingredient for manufacturers aiming to meet the evolving consumer preferences for nutritious and palatable products. Additionally, advancements in processing technologies enable rice protein production with higher purity and functionality, further boosting its adoption across different industries.

Product Insights

Rice protein isolates accounted for the largest revenue share in 2023. This can be attributed to their high protein content and superior functional properties, such as excellent solubility and emulsification, making them highly desirable for various applications. These isolates are extensively used in the food and beverage industry, particularly in protein bars, shakes, and other nutritional products, due to their ability to provide a complete amino acid profile. Additionally, the growing demand for clean-label and allergen-free protein sources has further propelled the popularity of rice protein isolates.

Rice protein concentrates are expected to grow at the fastest with a CAGR of 8.1% over the forecast period. Rice protein concentrates are increasingly being incorporated into various food products, such as baked goods, cereals, and snacks, due to their ability to enhance protein content without significantly altering taste or texture. Additionally, the rising demand for plant-based protein supplements among fitness enthusiasts and health-conscious consumers further boosts the market for rice protein concentrates. The versatility and affordability of these concentrates make them an attractive option for manufacturers looking to meet the growing consumer demand for high-protein, plant-based products.

Source Insights

Brown rice accounted for the largest revenue share in 2023. This prominence is attributed to its comprehensive amino acid profile, hypoallergenic properties, and high digestibility, making it a preferred choice among health-conscious consumers and those with dietary restrictions. The increasing demand for plant-based protein sources, driven by the rising popularity of vegan and vegetarian diets, further bolstered the market for brown rice protein.

White rice is expected to grow at the fastest CAGR over the forecast period. Increasing popularity as a plant-based protein source and its hypoallergenic properties, which make it suitable for a wide range of dietary needs. The increasing consumer focus on health and wellness, along with the rising demand for vegan and vegetarian protein options, is playing a significant role in the growth of the white rice protein market. Furthermore, its wide range of uses in food and beverages, sports nutrition, and dietary supplements drives its market expansion.

Organic Rice Protein Application Insights

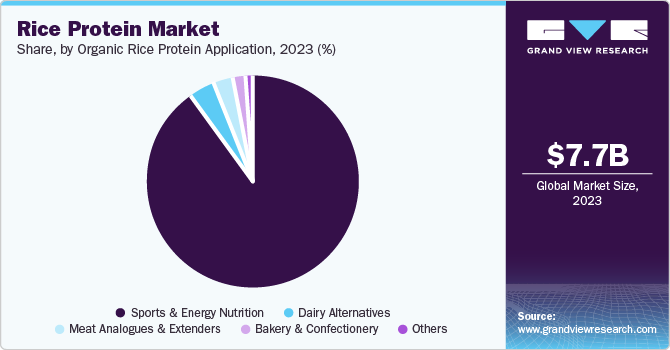

Sports & energy nutrition accounted for the largest revenue share in 2023. This dominance is attributed to the growing demand for high-quality, plant-based protein sources among athletes and fitness enthusiasts. Rice protein’s excellent amino acid profile, digestibility, and hypoallergenic properties make it a popular choice for sports nutrition products such as protein powders, bars, and recovery drinks. The increasing focus on health and wellness, coupled with the rising popularity of vegan and vegetarian diets, has further driven the adoption of rice protein in the sports and energy nutrition sector.

Meat analogues & extenders are expected to witness the fastest CAGR in the coming years due to the increasing consumer shift towards plant-based diets and the rising demand for meat substitutes. As more people become aware of the health and environmental benefits of reducing meat consumption, the demand for high-quality, plant-based protein sources like rice protein is surging.

Rice Protein Application Insights

Food and beverages accounted for the largest revenue share in 2023. The increasing consumer demand for plant-based and allergen-free protein sources. Rice protein’s versatility and nutritional benefits make it an ideal ingredient for a wide range of products, including protein bars, shakes, dairy alternatives, and baked goods. The growing trend towards health and wellness, along with the rising popularity of vegan and vegetarian diets, has further fueled the adoption of rice protein in the food and beverages industry.

The pharmaceuticals segment is projected to grow at the fastest CAGR over the forecast period. This rapid growth is driven by the increasing recognition of rice protein’s hypoallergenic properties and its comprehensive amino acid profile, making it an ideal ingredient for various pharmaceutical applications.

Regional Insights

North America rice protein market dominated the global market with a revenue share of 44.9% in 2023. Growing consumer awareness of health and wellness, coupled with a strong demand for plant-based and allergen-free protein sources. The increasing popularity of vegan and vegetarian diets, along with the widespread adoption of rice protein in various applications such as food and beverages, sports nutrition, and dietary supplements, has significantly contributed to the market’s growth in North America. Additionally, the presence of key market players and ongoing innovations in product development have further bolstered the region’s leading position.

U.S. Rice Protein Market Trends

The U.S. rice protein market is expected to witness a significant CAGR over the forecast period. This anticipated expansion is driven by increasing consumer awareness of the health benefits associated with plant-based proteins and a growing preference for allergen-free, vegan, and vegetarian dietary options. The versatility of rice protein in various applications, including food and beverages, sports nutrition, and dietary supplements, is further fueling its demand.

Europe Rice Protein Market Trends

Europe rice protein market was a lucrative region in 2023. The region’s strong emphasis on sustainable and ethical food production practices further supports the market’s growth. Additionally, the rising popularity of vegan and vegetarian diets, along with the versatile applications of rice protein in food and beverages, sports nutrition, and dietary supplements, contribute to Europe’s attractiveness in the rice protein market.

The UK rice protein market is expected to grow significantly over the forecast period. This anticipated expansion is driven by the increasing consumer shift towards plant-based diets and the rising demand for allergen-free protein sources. The growing awareness of health and wellness, coupled with the popularity of vegan and vegetarian lifestyles, is fueling the demand for rice protein in various applications such as food and beverages, sports nutrition, and dietary supplements.

Asia Pacific Rice Protein Market Trends

Asia Pacific rice protein market is expected grow at the fastest CAGR of 9.2% over the forecast period. Increasing consumer awareness about health and wellness is expected to drive market growth. The demand for dietary supplement segment, where rice protein is gaining popularity as an alternative to soy, pea, and milk proteins is projected to drive market expansion.

The Japan rice protein market is expected to grow significantly over the forecast period. The food and beverage industry in Japan is witnssing a shift towards healthier and more sustainable options, which is further boosting the demand for rice protein. Moreover, the cosmetic industry is contributing to this growth, as rice protein is being increasingly used in personal care products due to its beneficial properties for skin and hair health.

Key Rice Protein Company Insights

Some key companies in the rice protein market include Axiom Foods, Inc., RiceBran Technologies, Bioway Organic Group Limited, Golden Grain Group Limited, and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Axiom Foods, Inc. is a leading player in the rice protein market, renowned for its innovative and sustainable approach to plant-based protein production. It is one the world’s largest manufacturer and distributor of allergen-friendly, hexane-free, chemical free rice protein.

-

RiceBran Technologies is a prominent player in the rice protein market, specializing in the production of high-quality ingredients derived from rice bran and other ancient grains. It caters its products to several industries such as nutraceuticals, food, pet care, and others.

Key Rice Protein Companies:

The following are the leading companies in the rice protein market. These companies collectively hold the largest market share and dictate industry trends.

- Axiom Foods, Inc.

- RiceBran Technologies

- Bioway Organic Group Limited

- Golden Grain Group Limited

- Shafi Gluco Chem Pvt. Ltd.

- The Green Labs LLC

- Top Health Ingredients

- NutriBiotic

- Z-COMPANY

- BENEO

- AIDP

- Kerry Group plc.

- Sweet Additions

- Cambridge Commodities

View a comprehensive list of companies in the Rice Protein Market

Recent Developments

-

In January 2024, RiceBran Technologies announced the sale of its Golden Ridge rice mill in Wynne, Arkansas, for USD 2.15 million. This strategic move aimed to decrease the company's annual net loss by about USD 1.5 million based on third-quarter 2023 results.

-

In June 2023, Anhui Shunxin Shengyuan Biological Food, in collaboration with ZXChem USA, introduced HydroRice PA80, an innovative rice protein powder specifically designed for plant-based applications, particularly focusing on dairy replacement solutions. It is ideal for a wide range of products, including ready-to-drink powdered beverages, yogurt, cream cheese and ice cream.

-

In June 2022, Roquette, a prominent leader in plant-based ingredients, expanded its product line by introducing two rice protein variants. This development is a significant addition to its diverse portfolio, bringing a new botanical origin. The newly unveiled NUTRALYS rice protein aims to provide consumers with a nutritious, high-quality alternative protein source.

Rice Protein Market Report Scope

Report Attribute

Details

Revenue size in 2024

USD 180.3 million

Revenue forecast in 2030

USD 281.4 million

Growth Rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in tons, revenue in million, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Segregation, Product, Source, Application, Organic Rice Protein Application, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, Brazil, Argentina, South Africa, and Saudi Arabia

Key companies profiled

Axiom Foods, Inc.; RiceBran Technologies; Bioway Organic Group Limited; Golden Grain Group Limited; Shafi Gluco Chem Pvt. Ltd.; The Green Labs LLC; Top; Health Ingredients; NutriBiotic; Z-COMPANY; BENEO; AIDP; Kerry Group plc.; Sweet Additions; Cambridge Commodities

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rice Protein Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rice protein market report based on segregation, product, source, application, organic rice protein application, and region:

-

Segregation Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Organic Rice Protein

-

Processed Rice Protein

-

-

Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Brown Rice

-

White Rice

-

Others

-

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Rice Protein Isolates

-

Rice Protein Concentrates

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Food and Beverages

-

Pharmaceutical

-

Cosmetics

-

Animal feed

-

-

Organic Rice Protein Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Sports & Energy Nutrition

-

Bakery & Confectionery

-

Meat Analogues & Extenders

-

Dairy Alternatives

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.