- Home

- »

- Plastics, Polymers & Resins

- »

-

Reusable Corrugated Plastic Boxes Market Report, 2030GVR Report cover

![Reusable Corrugated Plastic Boxes Market Size, Share & Trends Report]()

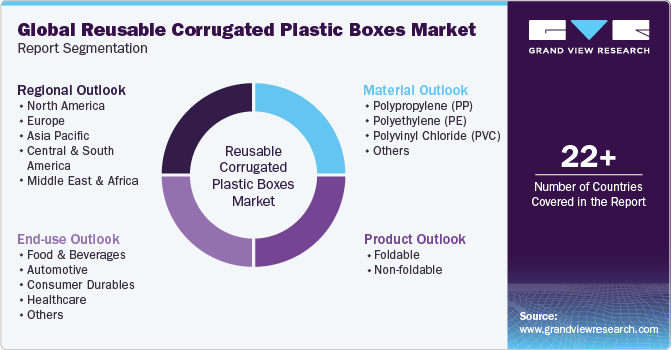

Reusable Corrugated Plastic Boxes Market (2023 - 2030) Size, Share & Trends Analysis Report By Material (Polypropylene, Polyethylene), By Product (Foldable, Non-foldable), By End-use (Food & Beverages, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-149-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global reusable corrugated plastic boxes market size was estimated at USD 7.74 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. The market is witnessing rapid growth owing to the expansion of food & beverage, automotive, healthcare, e-commerce, and logistics industries. The exponential rise in online shopping has revolutionized the retail landscape, necessitating efficient and sustainable packaging solutions to meet the demands of this booming e-commerce industry. Reusable corrugated plastic boxes have emerged as a sustainable packaging solution owing to their durability, recyclability, and sustainability.

Furthermore, as e-commerce companies increasingly seek eco-friendly packaging solutions to reduce their carbon footprint and enhance their supply chain efficiency, reusable corrugated plastic boxes emerge as a sustainable, cost-effective, and viable option, seamlessly integrating into the rapidly evolving landscape of online retail. Hence, extensive incorporation of the product in the e-commerce industry is expected to drive the demand for reusable corrugated plastic boxes during the forecast period.

The growing food and beverages industry is a significant driver for the increasing demand for reusable corrugated plastic boxes. The increasing consumer preferences for efficient, hygienic, and sustainable packaging solutions are positively impacting the reusable corrugated plastic boxes industry. In February 2021, Walmart and IFCO SYSTEMS (IFCO) revealed a long-term business collaboration. This partnership aims to enhance Walmart's utilization of IFCO reusable plastic containers (RPCs) and designate IFCO as the exclusive RPC packaging supplier for specific fresh vegetables and fruits distributed in the U.S.

Reusable corrugated plastic boxes provide a sturdy and protective environment for transporting and safeguarding them against damage during the transit of perishable goods. Moreover, these boxes are easily cleaned and sanitized, ensuring the highest standards of hygiene for food products. Additionally, the ability to reuse these boxes multiple times reduces packaging costs for businesses while minimizing waste. Hence, the advantages offered by reusable corrugated plastic boxes are slated to escalate the adoption of the product in the food & beverage industry over the forecast period.

The pharmaceutical and healthcare industry relies heavily on stringent standards of cleanliness and sterility, choosing packaging materials crucial in ensuring the integrity and safety of medical supplies, pharmaceuticals, and laboratory equipment. Reusable corrugated plastic boxes have emerged as a preferred solution in this sector due to their exceptional cleanliness and ability to maintain a sterile environment. These boxes are easily cleaned, disinfected, and sanitized, fulfilling the industry's strict hygiene requirements.

Reusable corrugated plastic boxes are resistant to moisture, preventing the growth of bacteria and fungi, which is particularly vital for transporting sensitive medical equipment and pharmaceuticals. Furthermore, their sturdy construction provides excellent protection against physical damage during transit, ensuring that delicate instruments and medications reach their destinations in perfect condition. Hence, this outlook is anticipated to stimulate the demand for reusable corrugated plastic boxes in the pharmaceutical and healthcare sectors in the coming years.

The initial investment in reusable corrugated plastic boxes can be higher compared to traditional single-use packaging solutions. However, their long-term cost savings significantly outweigh the initial expenditure due to their durability and ability to withstand multiple uses. This cost-effectiveness attracts businesses looking to reduce their overall packaging expenses, thus benefitting the reusable corrugated plastic boxes industry growth.

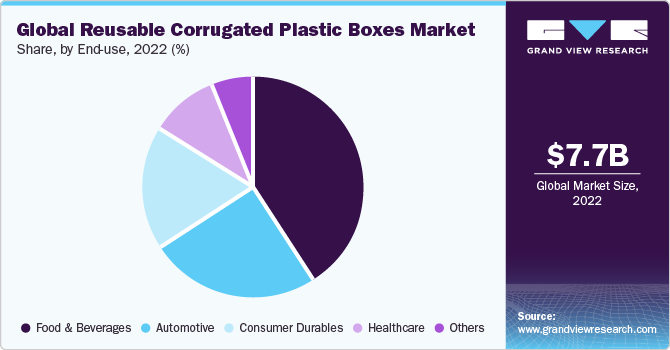

End-use Insights

Based on end-use, the market is segmented into food & beverages, automotive, consumer durables, healthcare, and others. The food & beverages segment accounted for the largest revenue share of 41.2 % in 2022 and is expected to grow at the fastest CAGR of 6.2% during the forecast period. The food and beverage industry is focused on sustainability and reducing environmental impact. Reusable corrugated plastic boxes align with these goals by minimizing waste generation. Compared to single-use packaging, they contribute to a significant reduction in packaging waste and promote a circular economy.

The automotive segment is expected to grow steadily during the forecast period. Corrugated plastic boxes provide excellent protection for automotive parts and products. They are resistant to moisture, ensuring that the automotive part remains safe and unaffected by external factors during transportation and storage. This helps maintain product quality and reduces the risk of damage.

Product Insights

Based on product, the market is bifurcated into foldable and non-foldable reusable corrugated plastic boxes. The foldable segment accounted for the largest revenue share of 69.0 % in 2022 and is expected to grow at the fastest CAGR of 5.9% during the forecast period. These boxes can be folded when not in use, significantly reducing their volume. This feature allows for efficient storage and transportation, as multiple folded boxes can be stacked together, optimizing space utilization. They provide cost savings in terms of storage, transportation, and packaging materials. Their ability to be collapsed and reused reduces the need for additional packaging supplies and lowers overall logistics costs.

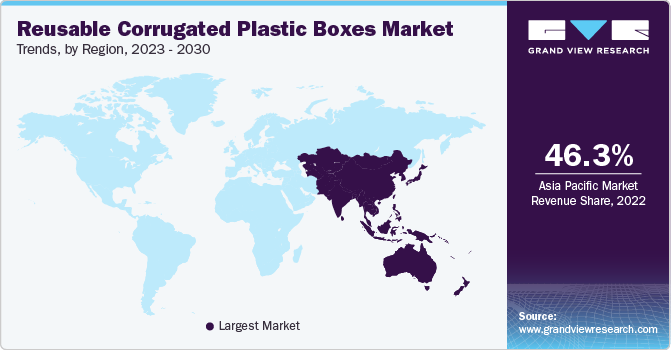

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 46.3% in 2022, and is expected to grow at the fastest CAGR of 6.21% during the forecast period. The region has potential developing and emerging countries such as India, China, Indonesia, Malaysia, Sri Lanka, and Thailand. These countries are witnessing major growth in the food & beverage and automotive industries due to which the reusable corrugated plastic boxes industry is also expected to grow over the forecast period.

In Europe, the growing demand for sustainable packaging solutions, driven by consumer awareness and preferences for environment-friendly products is expected to fuel the demand for reusable corrugated plastic boxes during the forecast period. Businesses in the food and beverage industry are responding to this demand by opting for reusable corrugated plastic boxes to meet consumer expectations, thus driving the market growth.

In North America, key players operating in the reusable corrugated plastic boxes sector are undertaking different strategies such as product launches, mergers, joint ventures, acquisitions, and geographical expansion. For instance, in December 2021, ReusePac launched polypropylene (PP) corrugated boxes which are reusable, lightweight, low-priced, and collapsible. These boxes are manufactured without any welds and glues. These strategic initiatives are expected to stimulate market growth in the region.

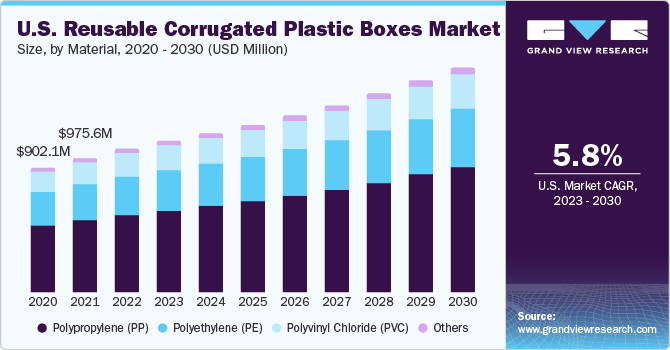

Material Insights

Based on material, the market is segmented into polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), and others. The polypropylene (PP) segment accounted for the largest revenue share of 54.2 % in 2022 and is expected to grow at the fastest CAGR of 6.0% during the forecast period. The material offers exceptional fatigue resistance and elasticity, establishing a strong reputation for its toughness and durability. Additionally, it possesses waterproof properties and exhibits high resistance to moisture absorption, further enhancing its value as a packaging material. These attributes contribute to the material's packaging advantages which drive the demand for the product.

Polyethylene (PE) exhibits good resistance to chemicals, making it suitable for packaging applications where contact with certain substances is expected, such as pharmaceuticals or chemicals. Moreover, polyethylene is widely recyclable, which aligns with the growing focus on sustainability and environmental responsibility. The ability to recycle polyethylene contributes to reducing waste and promoting a circular economy.

Key Companies & Market Share Insights

Major players operating in the reusable corrugated plastic boxes industry are investing in cutting-edge technologies that can boost the production capacity of reusable corrugated plastic boxes. For instance, in June 2023, MDI invested about USD 3.2 million in advanced machinery that can produce five million sheets of plastic material every year. These sheets are used to manufacture boxes, trays, and totes.

Key Reusable Corrugated Plastic Boxes Companies:

- MDI

- Logimarkt

- ORBIS Corporation

- Flex Container

- KISHOR PLASTIC

- Shri Ekvira MFGR and Coats Pvt. Ltd

- Technology Container Corp.

- Kiva Container

- New-Tech Packaging

- CoolSeal USA

- Suzhou Huiyuan Plastic Products Co., Ltd

- Coroplast

- Qingdao Tianfule Plastic Co., Ltd.

- Shandong Corruone New Material Co., Ltd.

- Primex Plastics Corporation

- American Containers, Inc.

- ReusePac

- YF Packaging

- Daiichigosei Co., Ltd.

Reusable Corrugated Plastic Boxes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.16 billion

Revenue forecast in 2030

USD 12.01 billion

Growth rate

CAGR of 5.6 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in units, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Material, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

MDI; Logimarkt; ORBIS Corporation; Flex Container; KISHOR PLASTIC; Shri Ekvira MFGR and Coats Pvt. Ltd.; Technology Container Corp.; Kiva Container; New-Tech Packaging; CoolSeal USA; Suzhou Huiyuan Plastic Products Co., Ltd.; Coroplast; Qingdao Tianfule Plastic Co., Ltd.; Shandong Corruone New Material Co., Ltd.; Primex Plastics Corporation; American Containers, Inc.; ReusePac; YF Packaging; Daiichigosei Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reusable Corrugated Plastic Boxes Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reusable corrugated plastic boxes market report based on material, product, end-use, and region:

-

Material Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Polyvinyl Chloride (PVC)

-

Others

-

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Foldable

-

Non-foldable

-

-

End-use Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Automotive

-

Consumer Durables

-

Healthcare

-

Others

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global reusable corrugated plastic boxes market was estimated at around USD 7.74 billion in the year 2022 and is expected to reach around USD 8.16 billion in 2023.

b. The global reusable corrugated plastic boxes market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach around USD 12.01 billion by 2030.

b. Food & beverage emerged as a dominating application with a value share of around 41.0% in the year 2022 owing to the expanding food and beverage industries. Besides, the emergence of online grocery stores is fueling the demand for reusable corrugated plastic boxes.

b. The key market player in the reusable corrugated plastic boxes market includes MDI, Logimarkt, ORBIS Corporation, Flex Container, KISHOR PLASTIC, Shri Ekvira MFGR and Coats Pvt. Ltd, Technology Container Corp., Kiva Container, New-Tech Packaging, CoolSeal USA, Suzhou Huiyuan Plastic Products Co., Ltd, Coroplast, Qingdao Tianfule Plastic Co.,Ltd., Shandong Corruone New Material Co., Ltd., Primex Plastics Corporation, American Containers, Inc., ReusePac, YF Packaging, Daiichigosei Co., Ltd.

b. Expanding end-use industries such as food & beverage, healthcare, and automotive and the rising e-commerce industry is expected to drive the demand for reusable corrugated plastic boxes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.