- Home

- »

- Medical Devices

- »

-

Restorative Dentistry Market Size And Share Report, 2030GVR Report cover

![Restorative Dentistry Market Size, Share & Trends Report]()

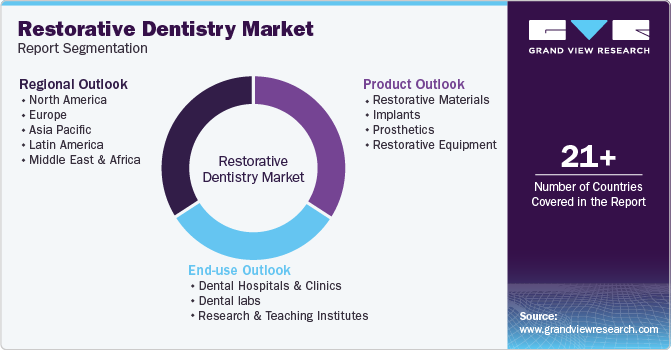

Restorative Dentistry Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Restorative Materials, Implants, Prosthetics), By End-use (Dental Hospitals & Clinics, Dental Labs, Research & Teaching Institutes), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-058-3

- Number of Report Pages: 209

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Restorative Dentistry Market Summary

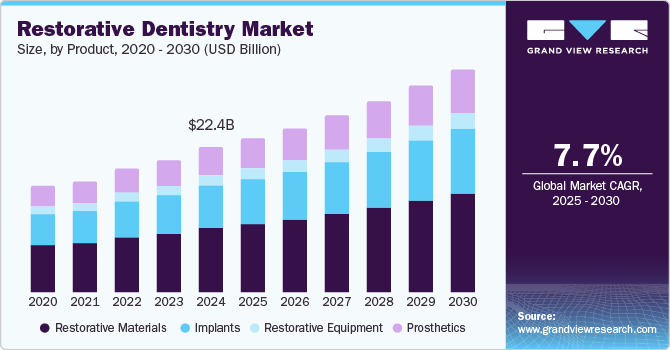

The global restorative dentistry market size was estimated at USD 22.4 billion in 2024 and is projected to reach USD 34.8 billion by 2030, growing at a CAGR of 7.7% from 2025 to 2030. Increasing dental issues, such as tooth decay, periodontal diseases, and tooth loss, due to aging populations and poor oral hygiene, are expected to boost the demand for restorative treatments.

Key Market Trends & Insights

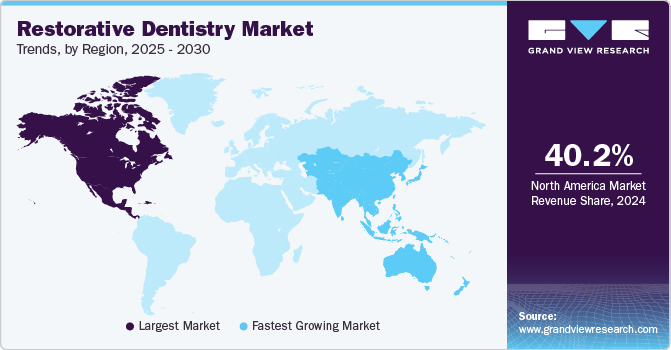

- The North America restorative dentistry market dominated in 2024, accounting for a revenue share of 40.2%.

- The U.S. restorative dentistry market is primarily regulated by the Food and Drug Administration (FDA).

- In terms of product, restorative material accounted for the highest market share of around 43.9% in 2024.

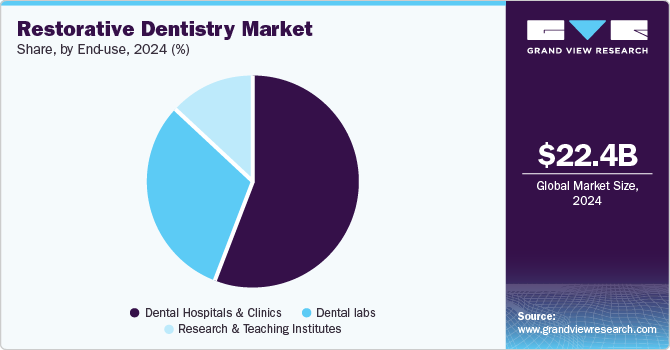

- In terms of end-use, dental hospitals and clinics accounted for the highest market share of around 56.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22.4 Billion

- 2030 Projected Market Size: USD 34.8 Billion

- CAGR (2025-2030): 7.7%

- North America: Largest market in 2024

Advancements in dental materials & technologies, such as CAD/CAM systems and 3D printing, enhance treatment accuracy & efficiency. In addition, rising awareness of dental health, growing cosmetic dentistry trends, and the expansion of dental tourism in emerging markets contribute to the market's expansion. According to the World Health Organization (WHO), as of May 2020, more than 42,48,389 COVID-19 cases were reported. This has negatively affected the restorative dentistry market during the lockdown phase. Due to the outbreak of COVID-19, dentists avoided going to the clinic for practice, opting instead for prescribing antibiotics and consultations remotely. Dental clinics remained closed because dentists would have become potential disease carriers and posed a high risk for nosocomial infections. The risk is primarily due to dental interventions that include the generation of aerosols and the handling of sharps.

The increasing prevalence of dental caries across the globe is expected to boost the demand for dental treatments. As per statistics from The Global Burden of Disease Study 2019, dental diseases have affected 3.5 billion people with caries of permanent teeth. It is estimated that 520 million children suffer from caries of primary teeth, and 2 billion people suffer from caries of permanent teeth. Thus, the growing prevalence of dental disorders is anticipated to boost the restorative dentistry market.

Regular dental checkups may drive the demand for dental procedures. As per statistics from the Centers for Disease Control and Prevention, over USD 45 billion in the U.S. productivity is lost each year due to untreated dental diseases, and approximately 34 million school hours are lost each year due to unplanned dental care. The routine checkups mainly include root canals, crowns, dental fillings, maxillofacial procedures, and bonding treatments. Thus, regular dental checkups are anticipated to boost the restorative dentistry market. Various initiatives by major key market players such as product launches, mergers, and acquisitions are anticipated to boost the market.

Product Insights

Restorative material accounted for the highest market share of around 43.9% in 2024. The rapid growth of the segment is attributed to the increasing prominence of aesthetics, which results in cosmetic dentistry procedures. In addition, many tooth repairs drive the adoption of biomaterials in dentistry and the widespread use of these materials in fabricating dental restorations. Furthermore, new technologies in the equipment have increased the precision and the quality of the restoration. These factors are anticipated to propel the segment's growth.

Restorative material is further sub-segmented into direct restorative materials, indirect restorative materials, biomaterials, bonding agents/adhesives, and impression materials. Amalgam is a direct material that has various benefits in restorative dentistry. Amalgam is durable, affordable, and a safe material used to restore molars and premolars. Amalgam can be used by individuals of all ages in stress-bearing areas of the mouth. The amalgam protects against spillage during trituration, prevents mercury contact with skin, and does not discard scrap amalgam into waste containers. The benefits of amalgam have increased its usage demand, contributing toward market revenue.

Technological advancements in implants and placement procedures for implants contribute to the rapid growth of the implants segment. For instance, in June 2024, BioHorizons, a dental implant company, launched the Tapered Pro Conical, which features a deep conical connection. This new implant enhances the Tapered Pro design by incorporating a tapered body and threaded structure to ensure improved stability. Recent innovations, including the development of biocompatible materials, improved implant designs, and enhanced surgical techniques, further enhance implants' success rates and longevity. For instance, in February 2024, ZimVie Inc. announced the introduction of the TSX Implant in Japan. Designed for immediate extraction protocols, these implants provide reliable placement and primary stability in both soft and dense bone.

End-use Insights

Dental hospitals and clinics accounted for the highest market share of around 56.2% in 2024. The market's growth is anticipated due to the increasing number of hospitals and dental clinics in regions such as Asia Pacific and Europe. The increasing enrollment in dental courses is also driving the growth of this segment. For instance, as per the NCBI in 2019, 2.7 lakh dentists are registered with the Dental Council of India (DCI). The growing presence of dental hospitals and clinics, including a high number of freshly passed out dental students per year, are likely to boost this segment.

A key factor contributing to this expansion is the rising number of practicing dentists globally, which is improving patient access to dental services. According to the American Dental Association, the number of professionally active dentists in the U.S. increased from 59.73 per 100,000 residents in 2011 to 60.84 in 2021, reflecting a 1.9% growth. The Bureau of Labor Statistics also projects that dentist employment will grow by 5% between 2023 and 2033, which is on par with the average growth rate across all occupations. As a result, the Dental Hospitals and Clinics segment is expected to continue expanding significantly in the coming years.

Regional Insights

The North America restorative dentistry market dominated in 2024, accounting for a revenue share of 40.2%. The rising incidents of dental caries and periodontal diseases among the population are driving the restorative dentistry market in North America. According to the Centers for Disease Control and Prevention (CDC), in May 2024, more than half of children aged between 6 and 8 had cavities in their primary teeth. Similarly, an estimated 57.0% of the adolescents aged 12 to 19 years had cavities in their permanent teeth.

U.S. Restorative Dentistry Market Trends

The U.S. restorative dentistry market is primarily regulated by the Food and Drug Administration (FDA). The FDA ensures that dental devices, including restorative materials, meet safety and efficacy standards before marketing. The FDA categorizes these devices into different classes based on their associated risks, with Class I devices being subject to the least regulatory control and Class III devices requiring premarket approval due to their higher risk.

Asia Pacific Restorative Dentistry Market Trends

Asia Pacificrestorative dentistry market growth is driven by rising dental tourism and increased awareness of oral health. Countries such as India, South Korea, and Thailand have emerged as popular destinations for dental procedures due to their competitive pricing and high-quality care. Similarly, technological advancements in dental materials and techniques have also played a crucial role in expanding the restorative dentistry market in Asia Pacific.

The restorative dentistry market in Japan is experiencing significant growth driven by demographic shifts, government initiatives, and research initiatives aimed at developing advanced restorative dentistry solutions. A key factor contributing to this expansion is the country's ageing population, which has increased the prevalence of dental issues such as tooth decay, gum disease, and tooth loss.

The Australia restorative dentistry market is driven by favourable government and other organization’s initiatives to increase awareness about the importance of oral health in the country. For instance, the Dental Health Week (DHW), organized annually in the country, highlights the link between oral health and overall well-being. The campaign encourages regular dental visits and good oral hygiene practices to promote dental health. Such initiatives significantly increase dental awareness among various demographic groups, increasing the demand for restorative dentistry in the country.

South Korea restorative dentistry market, with one of the fastest ageing populations, led to an increased prevalence of dental issues such as tooth loss and decay. As the demographic landscape shifts, more elderly individuals seek restorative procedures such as dental implants and crowns to maintain their oral health and improve their quality of life. Data from Statistics Korea, released in March 2023, forecasts that the population of South Koreans aged 65 and older will exceed 10 million by 2024, marking a 5.4% increase from 2023. This is further supported by the rising awareness of oral health, as South Koreans increasingly recognize the importance of aesthetics in their dental care.

Europe Restorative Dentistry Market Trends

As dental education initiatives have increased, patients are more informed about the importance of maintaining their dental health, leading to a higher demand for restorative procedures such as crowns, fillings, and bridges. Additionally, effective policies by various private and public organizations in the country are raising awareness about dental care in the region. For instance, The Platform for Better Oral Health in Europe carries out population-based preventative strategies, such as water fluoridation programs in countries such as Ireland and the UK and fluoridated milk initiatives targeting children in Bulgaria and the UK, enhancing overall dental health outcomes.

The high prevalence of dental diseases and conditions among the population, which has increased awareness regarding dental health, is a major factor driving the growth of the UK restorative dentistry market. The 2021 Adult Oral Health Survey in England revealed that most adults reported having a functional dentition, with a significant proportion having received restorative treatments such as fillings and crowns.

The restorative dentistry market in Germany has experienced significant growth driven by technological advancements in restorative dentistry, increasing efforts by the government and other organizations to improve oral health in the country, and a rising focus on R&D in restorative dentistry. Moreover, several organizations are funding research initiatives to improve restorative materials used in dentistry, further contributing to the market growth.

Latin America Restorative Dentistry Market Trends

The restorative dentistry market in Latin America is driven by the region's developing healthcare infrastructure, increasing access to dental care for a larger population, and growing oral health awareness. Several organizations and healthcare professionals are taking significant steps to increase dental care access for underserved population groups in the region.

Brazil restorative dentistry market, with one of the most developed healthcare infrastructures in Latin America, is one of the biggest dental care markets in the region. Brazil has witnessed significant growth in its restorative dentistry market owing to increasing access to dental care and various advanced restoration products, which improve patient outcomes from dental restoration procedures.

MEA Restorative Dentistry Market Trends

The restorative dentistry market in the Middle East and Africa (MEA) is experiencing significant growth owing to the high prevalence of oral health issues, which has increased awareness regarding the importance of dental care among the population and the increasing efforts by various organizations and government to increase the awareness and access of oral health in the region.

The restorative dentistry market in South Africa is witnessing significant growth driven by the rising awareness of oral health and advancements in dental technology. The increasing awareness among South Africans about maintaining good oral hygiene and aesthetics significantly increases the demand for restorative procedures such as fillings and implants.

The growth of the restorative dentistry market in Saudi Arabia can be attributed to the high prevalence of dental disorders, government initiatives to increase dental care access, and the adoption of advanced dental technology. According to the Ministry of Health of the Kingdom of Saudi Arabia, the prevalence of tooth decay in children aged 6 and 12 in the KSA has reached around 96% and 93.7%, respectively. As a result, there has been a surge in demand for restorative procedures such as fillings, crowns, bridges, and implants.

Key Restorative Dentistry Company Insights

The major market players are strengthened due to service quality and expertise in carrying out complicated restorative dentistry procedures. There are very few companies manufacturing transplant devices, and others offer topical products like gels, serums, and lotions. For instance, Dentsply Sirona established a new strategic business unit lab "Dentsply Sirona Lab" for its lab customers.

Key Restorative Dentistry Companies:

The following are the leading companies in the restorative dentistry market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Dentsply Sirona

- Danaher Corporation

- Mitsui Chemicals, Inc.

- Institut Straumann AG

- Zimmer Biomet Holdings, Inc.

- Septodont Holding

- Ivoclar Vivadent AG

- COLTENE Holding AG

- GC Corporation

Recent Developments

-

In July 2024, ZimVie officially announced that it has received clearance from the FDA for its GenTek Restorative Components, paving the way for their launch in the United States market. This development signifies a significant advancement in ZimVie’s offerings, as the GenTek line is designed to provide high-quality restorative solutions for dental professionals.

-

In September 2024, Dentsply Sirona introduces the Primescan 2, the first cloud-enabled intraoral scanner. The Primescan 2 features an entirely redesigned scanning interface with an updated workflow. Users can choose between "Status Scan" or "Restorative Scan," and three scan windows will open, allowing for efficient and seamless patient scanning.

Restorative Dentistry Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.0 billion

Revenue forecast in 2030

USD 34.8 billion

Growth rate

CAGR of 7.7% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Market representation

Revenue in USD million/billion and CAGR from 2025 to 2030

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; India; South Korea; Australia; Thailand; Japan; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M Company; Dentsply Sirona; Danaher Corporation; Septodont Holding; Ivoclar Vivadent AG; Coltene Holding Ag; GC Corporation; Mitsui Chemicals, Inc.; Institut Straumann AG; Zimmer Biomet Holdings, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Restorative Dentistry Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global restorative dentistry market report on the basis of procedure, therapy, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Restorative Materials

-

Direct Restorative Materials

-

Amalgam

-

Composites

-

Glass ionomer

-

Other Direct Restorative Materials

-

-

Indirect Restorative Materials

-

All-ceramic

-

Metal Ceramic

-

Metal Alloys

-

Other Indirect Restorative Materials

-

Biomaterials

-

Bonding Agents/ Adhesives

-

Impression Materials

-

Implants

-

Prosthetics

-

Restorative Equipment

-

CAD/CAM Systems

-

Handpieces

-

Rotary Instruments

-

Light Curing Equipment

-

Casting Equipment

-

Mixing Equipment

-

Articulating Equipment

-

Other Equipment

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dental Hospitals and Clinics

-

Dental labs

-

Research and Teaching Institutes

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global restorative dentistry market size was estimated at USD 22.4 billion in 2024 and is expected to reach USD 24.0 billion in 2025.

b. The global restorative dentistry market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2030 to reach USD 34.8 billion by 2030.

b. Europe dominated the restorative dentistry market with a share of over 39.4% in 2024. This is attributable to the high prevalence of oral diseases, the increasing number of dental practices and hospitals, the growing geriatric population, and the presence of several key market players.

b. Some key players operating in the restorative dentistry market include AO Kaspersky Lab; Broadcom; Check Point Software Technology Ltd.; Cisco Systems, Inc.; CrowdStrike; IBM Corporation; McAfee, Inc.; Microsoft; Palo Alto Networks, Inc.; Sophos.

b. Key factors that are driving the restorative dentistry market growth include the advent of digital dentistry, increasing demand for cosmetic dentistry and implants, and the growth of dental tourism.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.