- Home

- »

- Petrochemicals

- »

-

Residual Solvents Market Size & Share, Industry Report 2030GVR Report cover

![Residual Solvents Market Size, Share & Trends Report]()

Residual Solvents Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Class 1, Class 2, Class 3), By Application (Pharmaceutical, Food & Beverage, Industrial, Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-547-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Residual Solvents Market Size & Trends

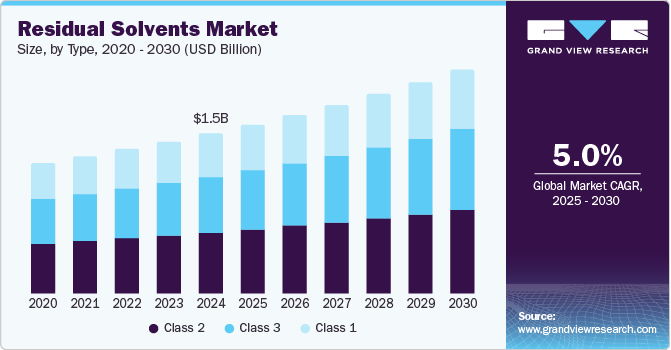

The global residual solvents market size was estimated at USD 1.49 billion in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. There is a growing awareness among consumers about product safety and an increasing demand for high-quality products. The pharmaceutical sector, which represents a significant portion of the market, requires thorough testing of residual solvents due to the critical nature of its products.

Pharmaceutical manufacturing involves solvents in drug formulation, synthesis, and purification processes. The increasing production of active pharmaceutical ingredients (APIs), biologics, and generics drives the need for solvent testing to ensure drug safety and efficacy. Additionally, the expansion of the biotechnology sector necessitates high-purity solvents with minimal residual content.

The food processing industry extensively uses solvents for extraction, purification, and flavor enhancement. Stringent food safety norms from agencies such as the Food Safety and Standards Authority of India (FSSAI), FDA, and EFSA drive the demand for residual solvent testing to prevent contamination and ensure consumer safety.

Drivers, Opportunities & Restraints

Consumers are becoming increasingly aware of product safety, particularly in industries such as food & beverages, cosmetics, and personal care. This has led to higher quality standards, encouraging manufacturers to conduct rigorous solvent residue testing to meet Good Manufacturing Practices (GMP) and other safety certifications. The development of gas chromatography (GC), headspace gas chromatography (HS-GC), and mass spectrometry (GC-MS) has improved the accuracy and efficiency of residual solvent analysis. Innovations in automated and real-time monitoring systems enhance detection capabilities, leading to increased adoption across industries.

The residual solvents industry faces significant restraints, primarily due to the high costs associated with advanced analytical technologies such as gas chromatography (GC) and mass spectrometry (GC-MS), which limit adoption among small and mid-sized enterprises. Additionally, strict regulatory compliance imposes challenges for manufacturers, requiring continuous monitoring, documentation, and validation processes, which can be time-consuming and resource-intensive. The lack of standardized testing procedures across different regions also creates inconsistencies, making global compliance complex.

The market presents significant opportunities driven by technological advancements in analytical testing methods, such as real-time monitoring and automation in gas chromatography (GC) and mass spectrometry (GC-MS), enhancing accuracy and efficiency. The increasing demand for pharmaceuticals, biologics, and high-purity specialty chemicals is creating a growing need for stringent solvent testing to meet regulatory requirements. Additionally, the expansion of food safety regulations and quality assurance in cosmetics and personal care products is encouraging manufacturers to invest in improved residual solvent analysis.

Type Insights

The class 2 segment accounted for the largest revenue share of 38.9% in 2024 and is expected to continue to dominate the industry over the forecast period. This is due to its widespread use in pharmaceuticals, food processing, and cosmetics, where moderate toxicity solvents require strict regulation and monitoring. These solvents, including methanol, toluene, and dichloromethane, are commonly used in manufacturing but must be controlled within permissible limits to ensure safety.

The class 3 segment is expected to grow at the fastest CAGR during the forecast period. This is due to its high usage and low toxicity profile, making these solvents less strictly regulated compared to Class 1 and 2. Common solvents such as ethanol, acetone, and acetic acid are widely used in pharmaceuticals, food, and cosmetics with higher permissible limits, leading to increased demand for monitoring solutions.

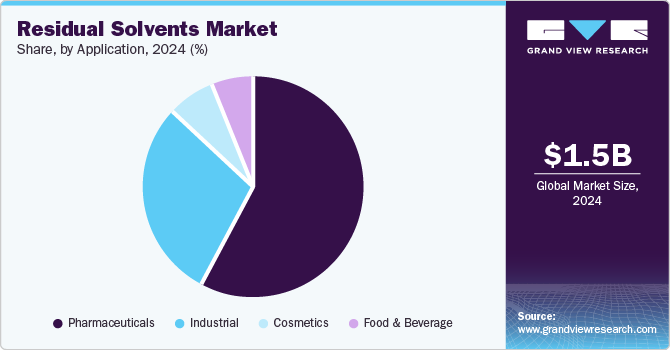

Application Insights

The pharmaceutical segment dominated the market with a share of 58.3% in 2024, during the forecast period. This is due to the extensive use of solvents in drug formulation, synthesis, and purification processes. Strict regulatory standards set by ICH, FDA, and EMA mandate rigorous residual solvent testing to ensure drug safety and compliance, driving demand for advanced analytical techniques like gas chromatography (GC) and mass spectrometry (GC-MS). The rising production of active pharmaceutical ingredients (APIs), generics, and biologics further fuels the need for solvent analysis. Additionally, the global expansion of the pharmaceutical and biotechnology industries continues to strengthen market growth in this segment.

The cosmetics segment is expected to grow at the fastest CAGR over the forecast period, due to the widespread use of solvents in formulations such as perfumes, skincare, and hair care products. Regulatory bodies like the FDA and EU Cosmetics Regulation impose strict limits on residual solvents to ensure consumer safety, driving demand for advanced testing solutions. The rising consumer preference for high-quality, non-toxic, and organic cosmetics further increases the need for solvent analysis.

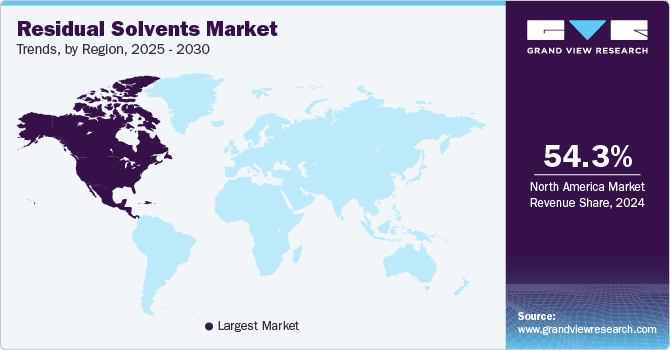

Regional Insights

The North America residual solvents industry dominated with revenue share of 54.3% in 2024.. The region is expected to grow due to strict regulatory frameworks enforced by the FDA, USP, and ICH guidelines, ensuring high safety standards in pharmaceuticals, food, and cosmetics. The region's well-established pharmaceutical and biotechnology industries, along with advancements in analytical technologies like gas chromatography (GC) and mass spectrometry (GC-MS), drive market growth. Additionally, increasing consumer awareness and demand for high-purity products further boost the need for stringent solvent testing.

U.S.Residual Solvents Market Trends

The U.S. dominates the residual solvents industry due to its stringent FDA regulations, advanced pharmaceutical sector, and strong presence of analytical technology providers. The growing demand for high-quality drug formulations, food safety, and clean-label cosmetics further drives market expansion.

Asia Pacific Residual Solvents Market Trends

The Asia Pacific residual solvents industry is driven by rapid industrialization, expanding pharmaceutical and food industries, and strengthening regulatory frameworks in countries like China, India, and Japan. Increasing investments in drug manufacturing, biotechnology, and quality control technologies further fuel market growth.

Europe Residual Solvents Market Trends

The Europe residual solvents industry growth is driven by strict regulatory standards set by the EMA and ICH, ensuring high-quality pharmaceuticals, food, and cosmetics. The region's strong pharmaceutical industry, advanced analytical technologies, and growing focus on sustainable manufacturing further support market growth.

Latin America Residual Solvents Market Trends

The Latin America residual solvents industry is growing due to expanding pharmaceutical and food industries, along with increasing regulatory enforcement in countries like Brazil and Mexico. Rising consumer awareness and demand for high-quality, safe products further drive market adoption.

Middle East & Africa Residual Solvents Market Trends

The Middle East & Africa residual solvents industry is expanding due to growing pharmaceutical manufacturing, increasing food safety regulations, and rising investments in quality control technologies. Countries like Saudi Arabia, the UAE, and South Africa are strengthening regulatory frameworks to ensure compliance with international standards. Additionally, the region’s focus on expanding healthcare infrastructure and industrial growth is driving demand for residual solvent testing.

Key Residual Solvents Company Insights

Some of the key players operating in the market include Agilent Technology and Thermo Fisher Scientific.

-

Agilent Technologies Inc. is a significant global analytical instrumentation company specializing in life sciences, diagnostics, and chemical analysis. Headquartered in California, U.S., Agilent provides cutting-edge solutions in gas and liquid chromatography, mass spectrometry, and spectroscopy for industries such as pharmaceuticals, biotechnology, food safety, and environmental testing. The company is known for its high-precision laboratory equipment, software, and consumables, helping businesses comply with regulatory standards. The company has a global presence.

-

Shimadzu Corporation is a Japanese multinational company specializing in analytical instruments, medical equipment, and industrial machinery. The company provides advanced solutions in chromatography, mass spectrometry, spectroscopy, and material testing for industries such as pharmaceuticals, food safety, environmental monitoring, and healthcare. With a strong focus on innovation and precision technology, Shimadzu is recognized for its high-performance laboratory instruments that ensure quality control and regulatory compliance. The company continues to expand its global footprint, driving advancements in scientific research and industrial applications.

Key Residual Solvents Companies:

The following are the leading companies in the residual solvents market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technology

- Shimadzu

- PerkinElmer

- Thermo Fisher Scientific

- Bruker

- Techcomp

- LECO

- Fuli Instruments

- Beifenruili

Recent Developments

-

In March 2023, The United States Pharmacopeia (USP) has revised Chapter <467> "Residual Solvents" to align with the updated ICH guideline Q3C (R8) on impurities. This revision introduces two Class 2 solvents, cyclopentyl methyl ether and tertiary butyl alcohol, and one Class 3 solvent, 2-methyltetrahydrofuran, necessitating updates to related sections and appendices.

Residual Solvents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.57 billion

Revenue forecast in 2030

USD 2.00 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Agilent Technology; Tazzetti S.P.A.; PerkinElmer; Thermo Fisher Scientific; Bruker; Techcomp; LECO; Fuli Instruments; Shimadzu; Beifenruili

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Residual Solvents Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global residual solvents market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Class 1

-

Class 2

-

Class 3

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Pharmaceuticals

-

Food & Beverage

-

Cosmetics

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global residual solvents market size was estimated at USD 1.49 billion in 2024 and is expected to reach USD 1.57 billion in 2025.

b. The global residual solvents market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach USD 2.00 billion by 2030.

b. North America dominated the residual solvents market, with a share of 54.3% in 2024. This is attributed to growing consumer awareness about product safety and an increasing demand for high-quality products. The pharmaceutical sector, which represents a significant portion of the market, requires thorough testing of residual solvents due to the critical nature of its products.

b. Some key players operating in the residual solvents market include Agilent Technology, Tazzetti S.P.A., PerkinElmer, Thermo Fisher Scientific, Bruker, Techcomp, LECO, Fuli Instruments, Shimadzu, and Beifenruili.

b. Key factors driving market growth include pharmaceutical manufacturing, which involves solvents in drug formulation, synthesis, and purification processes. The increasing production of active pharmaceutical ingredients (APIs), biologics, and generics drives the need for solvent testing to ensure drug safety and efficacy. Additionally, the expansion of the biotechnology sector necessitates high-purity solvents with minimal residual content.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.