- Home

- »

- Homecare & Decor

- »

-

Residential Bathroom Cabinets Market Size Report, 2030GVR Report cover

![Residential Bathroom Cabinets Market Size, Share & Trends Report]()

Residential Bathroom Cabinets Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (With Mirror, Without Mirror), By Material (Wood, Metal), By Product (Single Door, Multi-door), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-262-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global residential bathroom cabinets market size was estimated at USD 72.98 billion in 2023 and is projected to grow at a CAGR of 9.3% from 2024 to 2030. The increasing trend of bathroom remodeling and home restoration activities across major economies such as China, the U.S., and Japan is expected to elevate the demand for bathroom cabinets in the coming years. According to statistics published by U.S. Houzz Inc. in 2022, more than 3 in 5 homeowners (62%) preferred home system upgrades, most frequently with bathroom enhancements.

The growth rate observed across various nations in the home furnishing and fittings sector is expected to have a favorable effect on market growth. According to the 2023 State of Home Spending report, across all categories of home spending-improvement, maintenance, and emergencies-the total average expenditure in 2023 amounted to USD 13,667, spread across an average of 11.1 projects. This reflects a notable 6% increase compared to 2022.

The growing trend of bathroom renovation for improved aesthetics and functionality is evident, with substantial growth observed in this sector. According to the 2023 U.S. Houzz Bathroom Trends Study, there has been a robust increase in national median spending for primary bathroom projects, surging by nearly 50% as compared to the previous year to reach USD 13,500. This data depicts the growing inclination among homeowners to invest in upgrading their bathrooms, aiming to enhance both the visual appeal and practicality of these essential spaces within their homes.

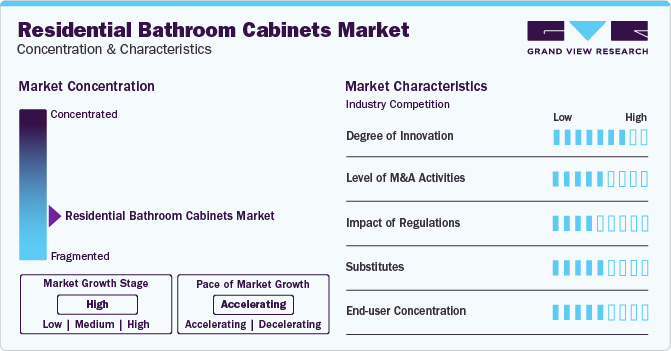

Market Concentration & Characteristics

The market shows moderate innovation, with trends focused on smart storage solutions, eco-friendly materials, and customizable designs to meet diverse consumer preferences. However, the market is also influenced by traditional designs and materials, limiting the pace of innovation compared to other sectors.

Regulations play a pivotal role in the market, ensuring product safety, sustainability, and compliance with building codes. They drive innovation, influencing material choices, design trends, and manufacturing processes to meet stringent standards, ultimately shaping the market's evolution towards more efficient and environmentally friendly solutions.

The market faces moderate availability of substitutes, with options including standalone storage units, custom-built solutions, and alternative storage furniture. However, the unique design, functionality, and integration of bathroom cabinets often make them the preferred choice, limiting the impact of substitutes.

End-user concentration in the market refers to the focus on the preferences, needs, and behavior of individual homeowners or residents who purchase these cabinets. This concentration influences product design, features, and marketing strategies tailored to meet diverse consumer demands and trends in home aesthetics and functionality.

Type Insights

Based on type, the without mirror segment led the market with a revenue share of 55.27% in 2023. Many homeowners prefer to customize their bathroom spaces, and cabinets without mirrors allow for greater flexibility in choosing separate mirrors that suit their style and requirements. Homeowners may prioritize storage over integrated mirrors, especially in smaller bathrooms where maximizing cabinet space is crucial for organizing toiletries, linens, and other essentials. Therefore, the demand for bathroom cabinets without mirrors is likely to grow.

With mirror segment is expected to grow at the fastest CAGR of about 9.7% during the forecast period. The demand for technologically advanced and well-designed bathroom furniture is projected to drive the demand for innovative bathroom cabinets with mirrors, and manufacturers will continue to focus on blending practicality with design to cater to the evolving preferences of consumers. The need for practical and organized bathroom spaces will drive for residential bathroom cabinets with mirrors due to their dual functionality, especially with consumers who have limited countertop space.

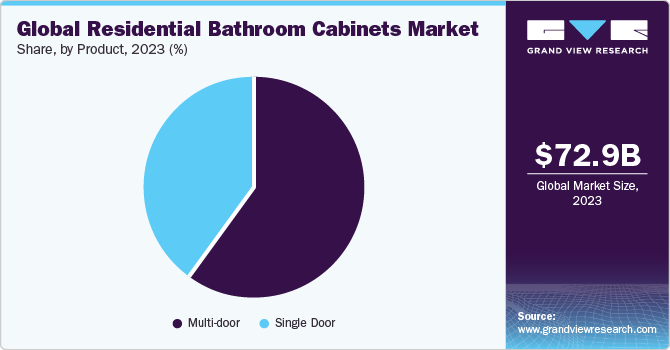

Product Insights

The multi-door segment led the market with the largest revenue share of 60.14% in 2023. The demand for multi-door bathroom cabinets is likely to be high among individuals who value organization, style, and practicality in their living spaces. Durable materials, ample storage capacity, and added features such as the magnetic strip and lock closure in multi-door cabinets cater to the diverse needs of users looking to streamline their daily routines and keep their bathroom essentials neatly organized and easily accessible. In response to this demand, Vanitibox offers a two-door bathroom cabinet in its portfolio. This cabinet is an ergonomically crafted storage solution for consumers looking to enhance the organization in their bathroom space. It is made from durable and rust-free Stainless Steel 304 and offers specific slots for various toiletries and personal care items.

The single door segment is anticipated to grow at the fastest CAGR of about 10.0% over the forecast period. These are extremely popular among consumers owing to their design and features. The demand for such cabinets is driven by a combination of practical storage solutions and space optimization.U.S.-based bathroom fittings and luxury sanitaryware manufacturer Kohler Co. offers the Maxstow Mirror Cabinet, which is a storage cabinet for bathrooms with silver-coated glass mirror doors. The staggered shelving inside the cabinet ensures efficient use of space, accommodating tall and short items without wasting any room. With the added advantage of easy installation, these single-door cabinets are a popular choice, maximizing storage while minimizing countertop clutter in bathrooms.

Material Insights

Based on material, the wood segment led the market with the largest revenue share of 57.78% in 2023. Alternative materials and construction methods, such as plywood, engineered wood, and water-resistant finishes, have gained popularity for bathroom cabinets, balancing aesthetics, and durability in humid conditions. Despite the challenges, the demand for cabinets with a wooden appearance in bathrooms remains steady, and the industry has responded with innovative solutions to address moisture-related concerns.

The metal segment is anticipated to grow at the fastest CAGR of about 9.1% during the forecast period. The contemporary and sleek appearance of metallic finishes aligns with modern design trends. Homeowners seeking a minimalist, industrial, or contemporary look in their bathrooms will likely prefer metallic cabinets. Metal, especially stainless steel, is known for its durability and resistance to corrosion, making it one of the practical choices for bathroom environments prone to high humidity and moisture. Furthermore, the demand for long-term usage and low-maintenance requirements among homeowners will drive the demand for metallic cabinets.

Regional Insights

North America residential bathroom cabinets market captured a revenue share of 25.98% in 2023. The demand for these products in North America is on the rise, fueled by a surge in home renovation projects over the past three years. According to the Joint Center for Housing Studies (JCHS) at Harvard University, spending on home improvement projects has seen significant growth, increasing from USD 328 billion in 2019 to USD 472 billion in 2022, with an estimated USD 485 billion spending projected for 2024.

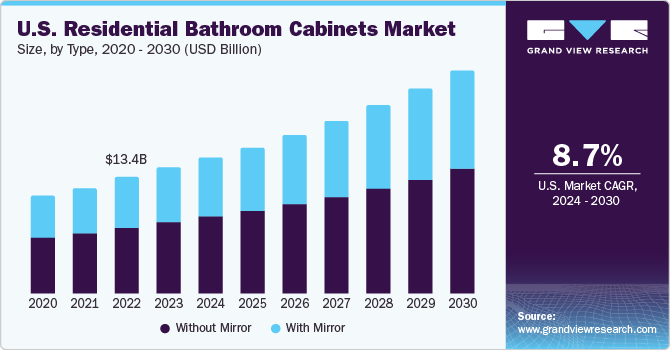

U.S. Residential Bathroom Cabinets Market Trends

The residential bathroom cabinets market in the U.S. accounted for a revenue share of 76.25% of North America in 2023. The desire to increase home value has been a significant driver of the demand for residential bathroom cabinets. According to the NAR, renovated bathrooms are considered a major selling point for potential buyers, with 73% of homeowners believing that bathroom renovations will positively impact the value of their home, as stated in the Bath Tune-Up blog. This offers homeowners a strong financial incentive to pursue bathroom remodels. As a result, there has been a surge in demand for residential bathroom cabinets as homeowners seek to create modern, stylish, and functional spaces that enhance the overall value of their homes.

Asia Pacific Residential Bathroom Cabinets Market Trends

The residential bathroom cabinets market in Asia Pacific held the largest revenue share of 35.79% in 2023. The market is expected to grow at a substantial CAGR during the forecast period, due to various regional and international market players offering a range of products, such as pedestals, freestanding, and under-mounted sinks and cabinets. According to data released by the United Nations Environment Program (UNEP) in 2021, construction in the Asia Pacific is booming, and by 2040, the region will be home to nearly half of all new construction in the world.

Middle East & Africa Residential Bathroom Cabinets Market Trends

The residential bathroom cabinets market in Middle East & Africa is expected to grow at the fastest CAGR of about 9.7% in the forecast period. The booming real estate sector in cities like Dubai, Abu Dhabi, Riyadh, and Nairobi has led to a surge in residential construction projects, driving the demand for residential bathroom cabinets as developers aim to offer modern and well-appointed living spaces to attract buyers and tenants. Recent statistics from the Dubai Statistics Center reveal a 3.6% growth in the city's real estate sector and a 1.9% growth in the construction sector during the first half of 2023.

Key Residential Bathroom Cabinets Company Insights

The global residential bathroom cabinets industry is highly competitive, marked by the presence of numerous small-scale regional companies as well as multinational players such as Duravit AG, Nilkamal, Geberit AG, Roca Sanitario S.A.U., and HiB Ltd. among others.

Key Residential Bathroom Cabinets Companies:

The following are the leading companies in the residential bathroom cabinets market. These companies collectively hold the largest market share and dictate industry trends.

- Duravit AG

- Nilkamal

- Geberit AG

- Roca Sanitario S.A.U.

- HiB Ltd.

- Roper Rhodes

- LAUFEN Bathrooms AG

- FAB Glass and Mirror

- W. Schneider+Co AG

- EMCO Group

Recent Developments

-

In February 2024, HiB Ltd. forged a strategic partnership with Futureproof, a well-known sustainability platform. This collaboration underscored HiB's dedication to advancing its sustainable initiatives and making a lasting positive impact on the environment and society

-

In December 2023, Roca Sanitario S.A.U. announced that it had been awarded a Gold Medal from EcoVadis, a renowned provider of business sustainability ratings, positioning it among the top 3% globally. EcoVadis assesses business sustainability based on international standards, such as the International Labor Organization (ILO) conventions, the Ten Principles of the United Nations Global Compact, the ISO 26000 standard, and Global Reporting Initiative (GRI) standards

-

In November 2023, Duravit AG inaugurated its first global B2C retail concept in Singapore. The showroom offers a range of premium sanitaryware and furniture to customers of all levels. It allows consumers to visit and explore its latest product lines, receive consultations from its team of experts, and make purchases across various lines and price levels

Residential Bathroom Cabinets Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 79.10 billion

Revenue forecast in 2030

USD 134.60 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; China; India; Japan; Australia; Brazil; South Africa

Key companies profiled

Duravit AG; Nilkamal; Geberit AG; Roca Sanitario S.A.U.; HiB Ltd.; Roper Rhodes; LAUFEN Bathrooms AG; FAB Glass and Mirror; W. Schneider+Co AG; EMCO Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Residential Bathroom Cabinets Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global residential bathroom cabinets market report based on type, material, product, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

With Mirror

-

Without Mirror

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Metal

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Door

-

Multi-door

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global residential bathroom cabinets market size was estimated at USD 72.98 billion in 2023 and is expected to reach USD 79.10 billion in 2024.

b. The global residential bathroom cabinets market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 134.60 billion by 2030.

b. Asia Pacific dominated the residential bathroom cabinets market with a share of around 35% in 2023.This is due to its growing levels of disposable income, presence of small and medium scale manufacturers, rise in demand for luxury bathroom fittings, and growing e-commerce channel.

b. Some key players operating in the residential bathroom cabinets market include Duravit AG, Nilkamal, Geberit AG, Roca Sanitario S.A.U., HiB Ltd., Roper Rhodes, LAUFEN Bathrooms AG, FAB Glass and Mirror, W. Schneider+Co AG, EMCO Group.

b. Key factors that are driving the residential bathroom cabinets market growth include technological integration in cabinets, increasing home renovation trends, rise in spending on home remodeling projects, growing trend of bathroom renovation for better aesthetics and functionality, growing real estate industry, and expanding income levels globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.