- Home

- »

- Distribution & Utilities

- »

-

Recloser Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Recloser Market Size, Share & Trends Report]()

Recloser Market (2024 - 2030) Size, Share & Trends Analysis Report By Phase (Three-phase, Single-phase), By Control Type (Electronic, Hydraulic), By Insulation Medium, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-383-7

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recloser Market Summary

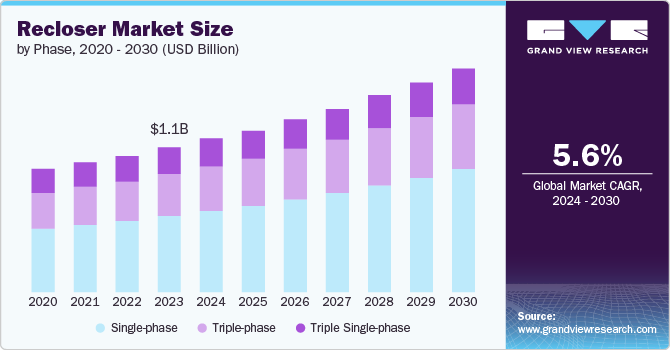

The global recloser market size was estimated at USD 1.13 billion in 2023 and is projected to reach USD 1.76 billion by 2030, growing at a CAGR of 5.6% from 2024 to 2030. This growth is attributed to the increasing demand for reliable and efficient power distribution systems.

Key Market Trends & Insights

- The North America recloser market accounted for the revenue share of 22.3% in 2023.

- The U.S. recloser market is anticipated to grow at a CAGR of 5.9% from 2024 to 2030.

- Based on phase, the single-phase dominated the market with a revenue share of 52.6% in 2023.

- Based on control type, the electronics segment dominated the market with a revenue share of 58.4% in 2023.

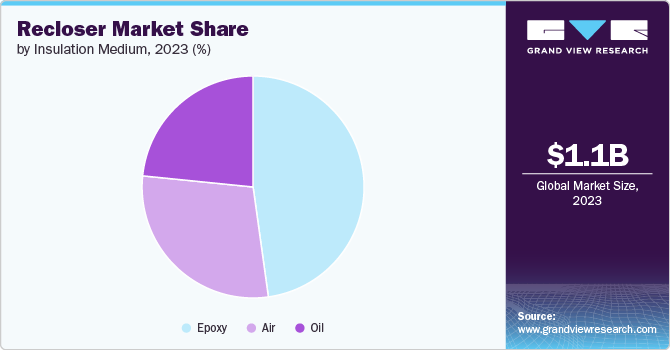

- Based on insulation medium, the epoxy segment accounted for largest revenue share of 47.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.13 Billion

- 2030 Projected Market USD 1.76 Billion

- CAGR (2024-2030): 5.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Moreover, power generation companies are investing heavily in advanced recloser solutions to enhance grid reliability, reduce outage durations, and improve overall operational efficiency. Reclosers automatically close after detecting and isolating faults, are critical in minimizing disruptions and maintaining a continuous power supply, making them indispensable in modern power distribution networks.

The rapid urbanization and industrialization in emerging economies is leading to an increased requirement for robust electrical infrastructure. Countries in Asia-Pacific, Central & South America, and Middle East & Africa are witnessing substantial investments in their power distribution networks to meet the rising electricity demand from residential, commercial, and industrial sectors. This is projected to support the growth of reclosers owing to their reliable power distribution, reduced losses, and resilience of the electrical grid against faults and outages.

Factors further propelling the recloser market include growing adoption of renewable energy sources such as solar, wind, and hydropower. As utilities integrate more renewable energy into their grids, the complexity and variability of power distribution increase, necessitating advanced protection and automation solutions. Reclosers play a crucial role in managing these challenges by providing automated fault detection and isolation, thereby ensuring the stability and reliability of the grid.

Technological advancements and the increasing focus on grid automation are further enhancing the demand for smart reclosers. Modern reclosers equipped with IoT, SCADA (Supervisory Control and Data Acquisition), and advanced communication technologies allow utilities to monitor and control their distribution networks remotely and in real-time. This capability improves fault management and response times; it also enables predictive maintenance and asset management. The integration of these advanced technologies is driving the development of more efficient recloser solutions, thereby fueling market growth.

Phase Insights

The single-phase dominated the market with a revenue share of 52.6% in 2023 and is further expected to grow at a fastest CAGR from 2024 to 2030. Single-phase reclosers are experiencing growth primarily due to their widespread application in residential and rural distribution networks where single-phase power is predominant. Thus, increasing need for reliable power supply in remote areas is driving the demand for single phase reclosers. Their cost-effectiveness and ease of installation also contribute to the increasing segment demand.

The triple-phase power is essential for operating heavy machinery and industrial equipment. Hence, ongoing modernization of urban infrastructure and expansion of industrial activities in regions such as Asia Pacific is increasing the demand for three-phase power distribution solutions. Triple-phase reclosers provide enhanced fault detection and isolation capabilities, improving grid stability and reducing outage durations in complex, high-load environments.

Triple single-phase reclosers can independently manage and isolate faults at each phase, providing more precise control and reducing the impact of faults on the overall network. The mentioned features are ideal in mixed-load environments, such as suburban areas and commercial zones, where varying loads and phases need to be managed efficiently. Additionally, increasing focus on smart grid technologies and the need for more granular control over power distribution are driving the adoption of triple single phase reclosers.

Control Type Insights

Electronics segment dominated the market with a revenue share of 58.4% in 2023 and is further expected to grow at a fastest rate from 2024 to 2030. The growth is attributed to their advanced functionality and integration with smart grid technologies. These reclosers offer precise control, real-time monitoring, and remote operation capabilities, making them ideal for modernizing power distribution networks. Additionally, the increasing focus on renewable energy integration and grid automation is propelling the demand for electronic reclosers, due to their ability to manage the complexities of modern power grids efficiently.

Hydraulic revenue is expected to grow at a CAGR of 4.8% over the forecast period due to their robustness, reliability, and cost-effectiveness. Hydraulics are further favored owing to their mechanical simplicity and ability to operate under harsh environmental conditions without the need for complex electronics. The growing demand for reliable and affordable power distribution solutions in emerging countries such as India, Brazil, and Mexico are driving the adoption of hydraulic reclosers.

Insulation Medium Insights

The epoxy segment accounted for largest revenue share of 47.8% in 2023 and is further expected to grow at a substantial rate over forecast period. Epoxy insulation offers high electrical insulation, thermal stability, and resistance to moisture and UV radiation, making it ideal for harsh climatic conditions. In addition, rising trend towards compact and lightweight electrical equipment in modern power systems favors the use of epoxy, which provides robust insulation without adding significant weight to the overall product.

Air insulated reclosers are gaining traction due to their cost-effectiveness and ease of maintenance. These reclosers are also preferred in applications where environmental concerns and regulations restrict the use of certain insulating mediums. The simplicity of air-insulated designs allows for easier inspection, servicing, and replacement, which minimizes downtime and maintenance costs. These ongoing advancements in air-insulated technology are enhancing their performance and reliability, further driving the market growth. Hence, the segmental revenue is expected to reach USD 0.44 billion by 2030.

Oil insulated reclosers are expected to grow at a CAGR of 5.7% over 2024 to 2030 owing to their reliability and durability. The robust dielectric properties of oil insulation make it suitable for high-voltage applications and harsh environmental conditions. The ability of oil to dissipate heat effectively and provide excellent arc-quenching capabilities enhances the operational efficiency and safety of reclosers. The established benefits of oil-insulated reclosers contribute to their sustained demand and market growth.

Regional Insights

In 2023, North America recloser market accounted for the revenue share of 22.3% and is further expected to grow at a significant rate over forecast period. The ongoing efforts to modernize aging grid infrastructure and enhance the reliability of power distribution networks are driving the market growth. Moreover, stringent regulatory standards aimed at reducing outages and enhancing grid resilience further boost the demand for technologically advanced reclosers across the region.

U.S. Recloser Market Trends

The U.S. recloser market is anticipated to grow at a CAGR of 5.9% from 2024 to 2030 due to federal and state-level initiatives promoting grid modernization and resilience. Furthermore, increasing deployment of renewable energy sources drive the adoption of advanced recloser solutions. The need to enhance the reliability and efficiency of power distribution, reduce outage durations, and manage the complexities of integrating distributed energy resources (DERs) are key factors propelling the product demand in the country.

Europe Recloser Market Trends

Countries within the European Union are investing heavily in smart grid projects to improve the efficiency and reliability of their power distribution networks. Additionally, European Green Deal and other regulatory frameworks promoting the transition to clean energy sources are driving the need for advanced reclosers capable of managing the intermittent nature of renewables. The need for enhanced grid resilience and reliability to cope with aging infrastructure supports the growing demand for reclosers in Europe.

Asia Pacific Recloser Market Trends

Asia Pacific accounted for the largest and fastest growing market with a CAGR of 6.0% over the forecast period due to the region's expanding power infrastructure and increasing electricity demand from urbanization and industrialization. Countries such as China, India, and South Korea are heavily investing in their electrical grids to support economic growth and development. The integration of renewable energy sources, driven by ambitious government targets, further necessitates the deployment of advanced recloser systems to maintain grid stability.

Key Recloser Company Insights

Some key players operating in the market are ABB, Eaton., Siemens, Hubbell., and G&W Electric.:

-

ABB is a manufacturer of power and automation technologies. The company offers a comprehensive range of products and solutions, including advanced reclosers for power distribution networks. ABB's reclosers are known for their reliability, advanced control systems, and integration with smart grid technologies, helping utilities enhance grid resilience and efficiency.

-

Eaton. provides energy-efficient solutions, including a wide range of reclosers for electrical distribution. Eaton's reclosers are designed to improve grid reliability and performance, featuring advanced protection, control, and communication capabilities to support modern smart grid applications.

NOJA Power Switchgear Pty Ltd, ENTEC Electric & Electronic, Tavrida Electric, and ARTECHE. are some emerging participants in the market.

-

Tavrida Electric specializes in innovative electrical switchgear solutions, including vacuum circuit reclosers that are recognized for their high reliability and advanced technology. The company focuses on developing compact, maintenance-free reclosers with superior performance, catering to utilities and industrial customers worldwide.

-

Arteche is one of the prominent players in the electrical equipment sector, offering a variety of products including reclosers designed for reliable fault detection and isolation. Arteche's reclosers are known for their robust design, advanced control features, and adaptability to various grid configurations, supporting utilities in maintaining efficient and resilient power distribution systems.

Key Recloser Companies:

The following are the leading companies in the recloser market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Eaton.

- Schneider Electric

- Siemens

- Hubbell

- G&W Electric

- NOJA Power Switchgear Pty Ltd

- ENTEC Electric & Electronic

- Tavrida Electric

- ARTECHE

- BRUSH

- General Electric Company

Recent Developments

-

In March 2024, NOJA Power Switchgear Pvt Ltd announced the expansion of their Brisbane headquarters to include a new Distribution Centre Facility. The strategy is expected to provide company a 50% increase in manufacturing floorspace, allowing the organization to meet growing demand for the Australian made NOJA Power switchgear products.

-

In February 2022, G&W Electric announced the launch of its Viper-HV Recloser which supports faster overcurrent protection through fault isolation and automatic restoration for temporary faults on overhead sub-transmission lines.

Recloser Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.20 billion

Revenue forecast in 2030

USD 1.76 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Phase, control type, insulation medium, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

ABB; Eaton; Schneider Electric; Siemens; Hubbell.; G&W Electric; NOJA Power Switchgear Pty Ltd; ENTEC Electric & Electronic; Tavrida Electric; ARTECHE.; BRUSH; General Electric Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recloser Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global recloser market report based on the phase, control type, insulation medium, and region:

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Three-phase

-

Single-phase

-

Triple Single-phase

-

-

Control Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic

-

Hydraulic

-

-

Insulation Medium Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil

-

Air

-

Epoxy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

- Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global recloser market size was estimated at USD 1.13 billion in 2023 and is expected to reach USD 1.20 billion in 2024.

b. The global recloser market is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030 to reach USD 1.76 billion by 2030

b. Single-phase recloser accounted for largest revenue share of 52.6% in 2023 owing to due to their widespread application in residential and rural distribution networks.

b. Some key players operating in the recloser market include ABB, Eaton., Schneider Electric, Siemens, Hubbell., and G&W Electric.

b. The key factors that are driving the recloser market growth are increasing demand for reliable and efficient power distribution systems and rising global emphasis on grid modernization and smart grid technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.