- Home

- »

- Automotive & Transportation

- »

-

Rear-view Mirror Market Size, Share & Trends Report, 2030GVR Report cover

![Rear-view Mirror Market Size, Share & Trends Report]()

Rear-view Mirror Market (2023 - 2030) Size, Share & Trends Analysis Report, By Feature Type ( Auto-Dimming, Automatic Folding), By Mounting Location, By Product Type, By Type, By Vehicle Type (Passenger Car, Commercial Vehicle), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-196-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rear-view Mirror Market Size & Trends

The global rear-view mirror market size was valued at USD 9.02 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% over the forecast period from 2023 to 2030. Countries worldwide have witnessed a setback due to the COVID-19 pandemic, negatively impacting automobile production. The aftermath of the initial lockdowns implemented in March 2020 resulted in supply chain disruptions, with several production facilities coming to a halt. However, starting in 2022, automotive production is expected to witness a recovery. The growing demand for enhanced safety, comfort, and convenience in automobiles, especially in developing and mature economies, is anticipated to drive market growth over the forecast period.

Concerns about passenger and driver protection against accidents are expected to favor product adoption. Changes in vehicle design over the years, such as the introduction of oversized back headrests for vehicle and passenger safety, are expected to contribute to an increased demand for advanced mirrors as their visibility is not affected by design changes in the vehicle. This has encouraged several manufacturers in the industry to introduce smart mirrors in vehicles to offer better visual clarity while preserving the intended benefit and function.

Smart rear-view mirrors include a full-screen monitor for clear visibility, with the potential to switch freely between the two modes, such as camera and mirror. For instance, Nissan has developed a Multi-sensor system with rear camera control and an image-processing program that eliminates or dramatically reduces glare in the rear field caused by trailing cars’ headlights and taillights. The camera also helps the driver understand the traffic conditions.

Other factors, such as increasing awareness about shared connectivity and mobility, rising demand for autonomous vehicles, automatic parking, and an inclination toward comfort and safety, are expected to drive demand over the forecast period. Additionally, increasing sales of ultra-luxurious, high-end, and mid-end cars are expected to favor the global demand for rear-view mirrors.

The COVID-19 pandemic has affected passenger and commercial vehicle sales, subsequently impacting demand. Europe continues to lead market growth, a trend expected to continue over the next few years; however, the adoption rate has declined due to a recent dip in automotive sales in the region. The regional market is expected to see mixed recovery cycles owing to economic stimulus packages and local restrictions.

Feature Type Insights

The heating function segment accounted for the largest revenue share of over 49.3%, due to its extensive usage in cold weather. The rear-view mirror market can be segmented based on feature type into auto-dimming, blind spot detection, power control, automatic folding, heating function, and others. These features enhance the vehicle’s electrification and safety. The camera, integrated with the rear-view mirror, notifies the driver with a warning while parking or lane changing.

The blind-spot detection segment is projected to register the fastest CAGR of 4.9% over the forecast period. This growth can be attributed to continuously strengthening vehicle safety standards and growing awareness about vehicle safety. Moreover, factors like the increasing demand for premium vehicles and the introduction of stringent government programs regarding vehicle safety are expected to drive segmental growth over the forecast period.

Vehicle Type Insights

The passenger cars segment dominated the market with the highest revenue share of 76.0% in 2022 and is expected to witness the fastest CAGR of 4.2% over the forecast period. Passenger vehicles include all personal use transport vehicles, such as SUVs, luxury vehicles, and sedans, and are commonly designed to accommodate up to five individuals. The segment is estimated to expand at the highest CAGR during the forecast period, owing to the increasing global vehicle fleet and vehicle per capita. Passenger cars occupied the majority share of over 71% of total vehicle production in 2020. According to European Automobile Manufacturers' Association (ACEA), vehicles per capita were recorded at 569 vehicles per 1,000 inhabitants in Europe in 2019. Besides, emerging economies such as China and India are expected to increase market growth over the forecast period further.

The commercial vehicle segment is expected to witness significant growth of CAGR over the forecast period. Commercial vehicles include Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs). The adoption of commercial vehicles is expected to increase over the next eight years owing to sustained economic activities, increased spending on the infrastructure sector, increased e-commerce and mining activities, and lower interest rates on commercial vehicles.

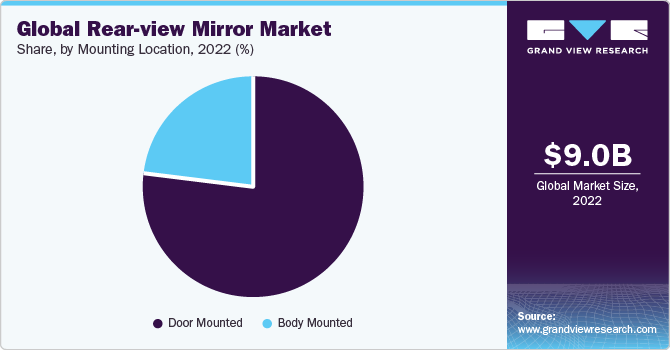

Mounting Location Insights

The door mounted segment dominated the market with the highest revenue share of 76.9% in 2022 and is expected to witness the fastest CAGR of 4.2% over the forecast period, owing to the rising sales of commercial vehicles. Door-mounted mirrors are also side or wing mirrors and are largely used in luxury cars. The positioning allows the driver to adjust the mirror to visibility. The popularity of door-mounted products is also attributed to the aerodynamic design and low replacement cost. The segment is expected to witness a healthy CAGR over the forecast period owing to the rising sales of commercial vehicles.

The body mounted segment is expected to witness significant growth of CAGR over the forecast period. Body-mounted mirrors are used in commercial vehicles where drivers must constantly track trailing vehicles. The demand in the body-mounted segment also increases in commercial vehicles as heavy commercial vehicles such as trucks or goods carriers do not have interior rear-view mirrors.

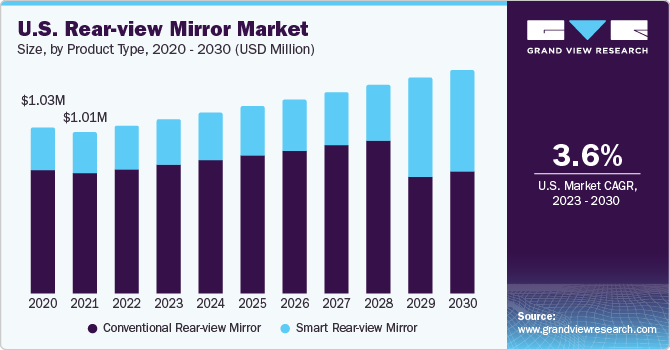

Product Type Insights

The smart rear-view mirror segment held the largest market share of 74.6% in 2022. These products have an in-built camera, enabling the driver to switch between a traditional rear-view mirror and an LCD monitor screen. These mirrors help enhance visibility in bad weather conditions or if the view is blocked due to tall cargo and commercial vehicles. Furthermore, these are available in various shapes and sizes and help improve automotive aerodynamics, enhancing fuel efficiency and drivability. The segment is expected to grow over the forecast period due to increasing technological awareness and the growing digitization of automotive parts.

The conventional rear-view mirror segment accounted for the fastest CAGR of 18.8%. The demand is increasing in commercial vehicles owing to their benefits, such as reduced blind spots and increased visibility. Conventional mirrors offer an enhanced left- and right-side view of heavy commercial vehicles.

Type Insights

The exterior mirror segment accounted for the largest share of around 75.2% of the market in 2022 and is estimated to register the fastest CAGR of 4.3% over the forecast period. Exterior mirrors work as a replacement for side-view mirrors and offer help in lane changing and parking. Moreover, they also help avoid traffic accidents, driving fatigue, and traffic violations. The products are largely used in heavy trucks and are efficient in any weather condition, assisting the driver while changing lanes or parking.

The interior mirror segment is estimated to register a significant CAGR over the forecast period. Auto-Dimming interior rear-view mirrors are in increasing demand in various vehicles as they improve driving safety by eliminating glare. The increasing sales of high-end premium vehicles and other passenger vehicles, such as SUVs globally, are expected to drive the demand for interior rear-view mirrors over the forecast period. Moreover, the segment is also expected to grow over the forecasted period due to increasing sales and demand for passenger vehicles.

Regional Insights

Asia Pacific dominated the market with the largest revenue share of 51.9% in 2022. The region is expected to register the fastest CAGR of 4.5% over the forecast period owing to the increasing production of vehicles in India, China, and Japan. The region was responsible for over half of the total global production of vehicles in 2020. Furthermore, the increase in demand for luxury vehicles in India and the availability of new purchases and automotive parts replacements is also expected to drive regional market growth by 2030.

Europe is expected to grow at a significant CAGR during the forecast period, owing to the presence of prominent luxury car manufacturers such as AUDI, BMW, Porsche, and Volkswagen. The increased production volume in the region post-COVID-19 lockdown is expected to increase the demand for rear-view mirrors in the upcoming years.

Key Companies & Market Share Insights

The key players in 2020 include Gentex Corporation, Continental AG, Valeo, Magna International, Inc., and Murakami Corporation. Most of these companies focus on offering technologically-driven and advanced products to strengthen their hold on the market. Companies are also undertaking strategic initiatives such as regional expansions, acquisitions, mergers, and collaborations to grow in the market. Organic growth remains the key strategy for the overall industry, focusing on product launches to develop new and innovative products and expand product offerings. For instance, in November 2020, Magna International, Inc. announced the launch of its next-generation camera-based driver assistance system, the Magna Gen5 “one-box.” It is a Mobileye EyeQ5-based system with a forward-facing camera system and related software in a single unit.

Key Rear-view Mirror Companies:

- Continental AG

- Murakami Corporation

- VALEO

- TOKAIRIKA,CO, LTD.

- SL Corporation.

- Ishizaki Holdings

- GENTEX CORPORATION

- Ficosa Internacional SA

- Magna International Inc.

- Mitsuba Corp.

Recent Developments

-

In September 2022, Motherson, an automotive components manufacturer, acquired ICHIKOH INDUSTRIES, LTD mirror business. As a subsidiary of Valeo SE, Ichikoh Industries primarily serves Japanese OEMs. This strategic acquisition marks Motherson's entry into the Japanese market and brings three manufacturing plants in Japan and China. By acquiring Ichikoh Industries' mirror business, Motherson gains access to expertise and intellectual property. The deal includes the transfer of 260 patents, further strengthening Motherson's technological capabilities and innovation potential.

-

In August 2022, Audi India, a division of AUDI AG launched its latest addition, the new Q3, which showcases several noteworthy technological advancements. These additions not only enhance driver safety but also contribute to improved comfort and convenience. Alongside these features, the new Q3 boasts several enhancements that enhance the driving experience. Audi's commitment to incorporating cutting-edge technologies into the Q3 demonstrates its dedication to providing advanced features and a premium driving experience to its customers.

-

In March 2022, Ford Motor Company announced its plans to introduce three all-electric passenger vehicles in Europe by the conclusion of 2024. Ford's commitment to expanding its electric vehicle lineup in Europe reflects its strategic focus on sustainable mobility and meeting the growing demand for electric vehicles in the market. By introducing three new all-electric models, the company aims to offer customers a wider range of choices when it comes to electric mobility solutions.

-

In January 2022, General Motors (GM) made a strategic declaration of allocating more than USD 4 billion towards enhancing its electric vehicle manufacturing capacity within two Michigan-based factories. GM established a collaborative alliance with LG Energy Solution as a pivotal component of this strategic initiative, outlining a blueprint for a cutting-edge USD 2.5 billion battery facility in Lansing. This financial commitment by GM serves as a tangible testament to its dedication to the electric vehicle market, underscoring its aspirations to fortify its production prowess within this burgeoning industry.

Rear-view Mirror Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.40 billion

Revenue forecast 2030

USD 12.46 billion

Growth rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Feature type, mounting location, product type, type, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Continental AG; Murakami Corporation; VALEO; TOKAIRIKA, CO; LTD.; SL Corporation.; Ishizaki Holdings; GENTEX CORPORATION; Ficosa Internacional SA; Magna International Inc.; Mitsuba Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rear-view Mirror Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global rear-view mirror marketbased on feature type, mounting location, product type, type, vehicle type, and region:

-

Feature Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Auto-Dimming

-

Blind Spot Detection

-

Power Control

-

Automatic Folding

-

Heating Function

-

Others

-

-

Mounting Location Outlook (Revenue in USD Million, 2017 - 2030)

-

Door Mounted

-

Body Mounted

-

-

Product Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Smart Rear-View Mirror

-

Conventional Rear-View Mirror

-

-

Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Exterior Mirror

-

Interior Mirror

-

-

Vehicle Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Passenger Car

-

Commercial Vehicles

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific dominated the rear-view mirror market with a share of 51.88% in 2022. This is attributable to the increased production of vehicles in India, China, and Japan.

b. Some key players operating in the rear-view mirror market include Continental AG, Valeo, Magna International, Inc., Gentex Corporation, Ficosa Corporation, MITSUBA Corporation, and Murakami Corporation.

b. Key factors that are driving the rear-view mirror market growth include stringent vehicle safety standards and a steady rise in the demand for autonomous and premium vehicles worldwide.

b. The rear-view mirror market size was estimated at USD 9.03 billion in 2022 and is expected to reach USD 9.40 billion in 2023.

b. The rear-view mirror market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 12.46 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.