- Home

- »

- Next Generation Technologies

- »

-

Global Real-Time Payments Market Size & Trend Report 2030GVR Report cover

![Real-Time Payments Market Size, Share & Trends Report]()

Real-Time Payments Market (2023 - 2030) Size, Share & Trends Analysis Report By Enterprise Size (Large, SME), By Payment Type (P2B, P2P), By End-use Industry, By Component, By Deployment, And Segment Forecasts

- Report ID: GVR-3-68038-059-0

- Number of Report Pages: 144

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Real-Time Payments Market Summary

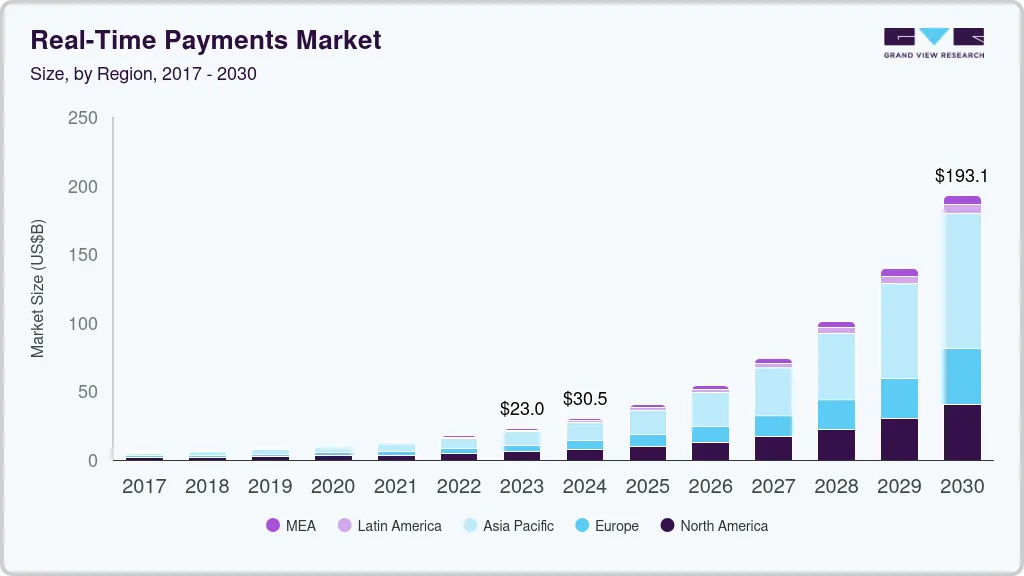

The global real-time payments market size was valued at USD 17.57 billion in 2022 and is projected to reach USD 198.08 billion by 2030, growing at a CAGR of 35.5% from 2023 to 2030. The global real-time payments transactions volume was valued at over USD 100 billion in 2022. The global real-time payments transactions volume was valued at over USD 100 billion in 2022.

Key Market Trends & Insights

- Asia Pacific dominated the market in 2022 and accounted for the maximum share of around 41.0%.

- North America is expected to witness a steady growth rate over the forecast period.

- By payment type, the P2B segment dominated the market in 2022 and accounted for a 64.0% share of the global revenue.

- By component, the solutions segment dominated the market in 2022 and accounted for a share of over 76.0%.

- By deployment, the on-premise segment dominated the market in 2022 and accounted for a share of more than 60.0%.

Market Size & Forecast

- 2022 Market Size: USD 17.57 Billion

- 2030 Projected Market Size: USD 198.08 Billion

- CAGR (2023-2030): 35.5%

- Asia Pacific: Largest market in 2022

The market growth can be attributed to the high proliferation of smartphones and the adoption of cloud-based solutions for faster payments. In addition, the increasing demand from customers for quicker payment settlements and growing investments from financial institutes and governments to boost the adoption of real-time payment solutions are expected to accelerate the market growth. The incorporation of innovative technologies, such as Artificial Intelligence (AI) and IoT, in digital payment platforms, is also expected to contribute to the demand for real-time payment solutions.

Digitization has resulted in the increased adoption of real-time payment solutions. Governments across the globe are taking initiatives to promote digital payments with an aim to increase the number of digital transactions in their respective countries. For instance, in December 2019, the Japanese government announced plans to carry out the Cashless Japan initiative to double the number of digital transactions by 2025. The continuous rollout of 5G network and high-speed broadband services worldwide bodes well for the market growth. Governments globally are investing in 5G infrastructure and subsidies to accelerate the adoption of digital payments.

For instance, in July 2020, the U.K. government announced an investment of USD 237.4 million in the 5G Testbeds and Trials program (5GTT), which aims to explore new ways to boost business growth in the country. In December 2019, the Federal Communication Commission announced plans to launch a USD 9 billion 5G subsidy program for rural America. Numerous fintech companies across the globe are developing real-time payment solutions to enable corporate clients to send payment requests to bank clients using mobile apps and websites. For instance, JPMorgan Chase & Co. announced the launch of Request for Pay, which enables corporate clients to send a payment request to 57 million retail clients using their mobile app and website.

The demand for real-time payment solutions has particularly increased in the wake of the COVID-19 outbreak. A myriad of unexpected issues, such as payment systems that involve physical touch, have prompted merchants and consumers to consider contactless payment solutions, such as smartphone-based apps designed to make contactless and real-time payments. According to the global report of ACI Worldwide, Inc., a software company, more than 70.3 billion real-time payment transactions were processed globally in 2020, and a surge of 41% for real-time payments was observed during the COVID-19 pandemic.

Payment Type Insights

The P2B segment dominated the market in 2022 and accounted for a 64.0% share of the global revenue. P2B payments refer to monetary transactions between customers and businesses. The unabated growth of mobile commerce and e-commerce is a key factor driving the growth of the segment. According to the statistics provided by Oberlo, a computer software company, mobile commerce sales were projected to reach USD 3.56 trillion in 2021, which was approximately 22.3% higher than the sales reported in 2020.

The P2P segment is anticipated to register the highest growth rate over the forecast period. Various cross-border payment companies are making efforts to develop real-time P2P payment solutions by striking strategic partnerships with banks and financial service providers. For instance, in February 2021, MoneyGram International, a cross-border payment service provider, and Visa, a payment technology company, announced the launch of a real-time Peer-to-Peer (P2P) payment solution in Vietnam through Visa Direct. The solution enables customers from the U.S., U.K., and 18 other European countries to transfer money to Vietnam quickly using Visa Direct.

Component Insights

The solutions segment dominated the market in 2022 and accounted for a share of over 76.0% of the global revenue. The segment has been further divided into the payment gateway, payment processing, security & fraud management. Merchants across the globe are partnering with payment gateway service providers to expand their businesses in other regions. Merchants manage a large volume of transactions, which has propelled the integration of gateway systems into their sales channels. For instance, in November 2020, Shopify, an e-commerce company, announced its partnership with Alibaba Group Holding Ltd., an Alipay payment gateway provider.

The company’s payment gateway enables Shopify merchants to seamlessly accept payments in China. Advancements in technologies coupled with the rapid growth of the e-commerce sector are driving the need for payment security and fraud management solutions. Companies across the globe are making efforts to develop innovative solutions to detect and mitigate fraud activities. For instance, in February 2021, ClearSale LLC, a fraud detection solution provider, announced the launch of an e-commerce podcast, Gateway to E-Commerce, to discuss the trends and challenges associated with frauds across the e-commerce platform during the pandemic.

Deployment Insights

The on-premise segment dominated the market in 2022 and accounted for a share of more than 60.0% of the global revenue. Numerous companies across the globe are striking partnerships with payment technology companies to deliver on-premise real-time payment solutions. For instance, in October 2020, ACI Worldwide, a software company that provides real-time payment solutions, announced its partnership with Mastercard, a payment technology company, to offer a wide range of real-time payment solutions supporting on-premise software for the central bank, government, and system operator owned platforms.

The cloud segment is anticipated to register the fastest growth rate over the forecast period. The increasing adoption of mobile-based payment solutions across the globe is driving the growth of this segment. Moreover, numerous fintech companies are enhancing their cross-border payment platforms through integration with cloud-based platforms to provide a better customer experience to the customers. For instance, in March 2021, Banking Circle, a financial infrastructure provider, announced the enhancement of its cross-border payment platform through its integration with Microsoft Azure, a cloud platform, to provide real-time payment insights to clients.

Enterprise Size Insights

On the basis of enterprise size, the global market has been bifurcated into large and Small- and Medium-sized Enterprises (SMEs). The large enterprises size segment dominated the market in 2022 and accounted for the maximum share of more than 65% of the global revenue. A number of businesses are making investments in real-time payment solutions to provide efficient payment processing. In addition, the rising demand for such solutions across large-scale retail stores to offer efficient and quick payment processing to customers is expected to propel the growth of this segment.

On the other hand, the SMEs enterprise size segment is anticipated to register the fastest growth rate over the forecast period. A number of SMEs across the world are transitioning from traditional paper-based invoicing to digital invoicing. In addition, these enterprises are expected to widely adopt cost-saving technologies, such as cloud-based services, to grow in the industry. All these factors are expected to support the growth of the SMEs segment over the forecast period.

End-use Industry Insights

The retail & e-commerce segment dominated the market in 2022 and accounted for a share of more than 35% of the global revenue. The increasing demand for instant payment settlement from retailers and merchants has accelerated the adoption of real-time payment solutions in this segment. These solutions provide a competitive edge to retailers by offering them an efficient and affordable mode of payment. The growing preference for mobile-based shopping across the globe is also emerging as a major driver for the growth of this segment. The segment is projected to expand further at the fastest CAGR from 2022 to 2030.

The Banking, Financial Services, and Insurance (BFSI) end-use industry segment is anticipated to register the second-fastest growth rate over the forecast period. Banks across the globe are launching real-time payment solutions to enhance customer experiences. For instance, in November 2020, the Brazil Central Bank announced the launch of Pix, an instant payment platform for citizens, government, and private sector entities in Brazil. This instant payment system offers consumers and companies across Brazil greater flexibility to make money transfers 24/7.

Regional Insights

Asia Pacific dominated the market in 2022 and accounted for the maximum share of around 41.0% of the global revenue. The regional market is projected to expand further at the fastest CAGR over the forecast period. The growing adoption of real-time payment solutions by large-scale as well as small- & medium-scale enterprises in Asia Pacific is expected to drive the regional market growth. A number of enterprises across the Asia Pacific region are focusing on digitizing their business operations, which, in turn, is expected to boost the demand for real-time payment solutions.

North America is expected to witness a steady growth rate over the forecast period. The region is home to several prominent players in the global market. The growing number of immigrants in North American countries, such as the U.S. and Canada, is expected to increase the number of cross-border disbursements, which, in turn, is estimated to support the market growth in these countries. Continued digitization and rapid economic development are some of the other key factors expected to propel the growth of the North America regional market.

Key Companies & Market Share Insights

The market is highly fragmented. Prominent market players are pursuing various strategies, such as strategic joint ventures and partnership agreements, product innovations, research & development initiatives, geographical expansions, and mergers & acquisitions, to strengthen their foothold in the industry. They are particularly focusing on providing cloud-based or on-premise solutions to large enterprises to enable efficient and effective money transfers in real-time. Vendors are also focusing on expanding their product offerings to enhance customer experience.

For instance, in June 2021, Mastercard Incorporated announced the launch of PayPort+, a next-generation real-time payment gateway service, to provide payment service providers and financial institutions with flexible access to the U.K.’s real-time payment infrastructure. The PayPort+ solution is powered by Vocalink, a Mastercard company, and Form3, a technology partner. Some of the prominent players in the global real-time payments market include:

-

ACI Worldwide, Inc.

-

Fidelity National Information Services, Inc. (FIS Inc.)

-

Finastra

-

Fiserv, Inc.

-

Mastercard, Inc.

-

Montran Corp.

-

PayPal Holdings, Inc.

-

Temenos AG

-

Visa Inc.

-

Volante Technologies Inc.

-

Wirecard AG

-

Worldpay, Inc.

Real-Time Payments Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 23.02 billion

Revenue forecast in 2030

USD 193.08 billion

Growth rate

CAGR of 35.5% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Payment type, component, deployment, enterprise size, end use industry, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Sweden; Denmark; Switzerland; China; India; Japan; Singapore; Brazil; Argentina

Key companies profiled

ACI Worldwide, Inc.; Mastercard Inc.; Finastra; Visa Inc.; PayPal Holdings, Inc.; Fiserv, Inc.; Fidelity National Information Services, Inc. (FIS Inc.); Wirecard AG; Worldpay, Inc.; Temenos AG; Montran Corporation; Volante Technologies Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThe report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global real-time payments market report based on payment type, component, deployment, enterprise size, end-use industry, and region:

-

Payment Type Outlook (Revenue, USD Million, 2017 - 2030)

-

P2B

-

B2B

-

P2P

-

Others

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solutions

-

Payment Gateway

-

Payment Processing

-

Security & Fraud Management

-

Advisory Services

-

Integration & Implementation Services

-

Managed Services

-

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017- 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Industry Outlook (Revenue, USD Million, 2017- 2030)

-

Retail & E-commerce

-

BFSI

-

IT & Telecom

-

Travel & Tourism

-

Government

-

Healthcare

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Sweden

-

Denmark

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

-

South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global real-time payments market size was estimated at USD 17.57 billion in 2022 and is expected to reach USD 23.02 billion in 2023.

b. The global real-time payments market is expected to grow at a compound annual growth rate of 35.5% from 2023 to 2030 to reach USD 193.08 billion by 2030.

b. Asia Pacific dominated the real-time payments market with a share of 41.1% in 2022. This is attributable to the increasing usage of smartphones in emerging economies and favorable government initiatives related to digital transactions.

b. Some key players operating in the real-time payments market include ACI Worldwide, Inc.; Mastercard Incorporated; Finastra; Nets A/S; Worldline; Capgemini SE; Visa, Inc.; PayPal Holdings, Inc.; Fiserv, Inc.; Icon Solutions Ltd.; Temenos AG; FIS, Inc.; Montran Corporation; Worldpay, LLC; Wirecard AG; and Volante Technologies, Inc.

b. Key factors that are driving the market growth include rising usage of smartphones worldwide and growing demand for quick clearings and settlements of money transfers among consumers and merchants.

b. In August 2020, Google announced the extension of its partnership with banks in the U.S., including BMO Harris, Coastal Community Bank, and First Independent Bank. Similar partnerships have envisaged the establishment of digital bank accounts through Google Pay.

b. The COVID-19 pandemic is likely to drive the growth of the real-time payments market over the forecast period as individuals increasingly prefer contactless payment methods as part of the efforts to arrest the spread of coronavirus.

b. The P2B segment accounted for the highest revenue share of more than 64.0% in 2022 as it is a preferred way of monetary transactions between customers and businesses.

b. The P2P segment is set to lead the real-time payments market over the forecast period as several banking organizations and financial service providers are entering into strategic partnerships with third-party payment service solution providers.

b. The solutions segment accounted for a share of more than 76.0% of the overall real-time payments market revenue in 2022and has been further segmented into payment processing, payment gateway, and security & fraud management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.