- Home

- »

- Homecare & Decor

- »

-

Railroad Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Railroad Market Size, Share & Trends Report]()

Railroad Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Passenger Rail, Rail Freight), By End Use (Mining, Construction, Agriculture, Others), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-2-68038-075-0

- Number of Report Pages: 42

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Railroad Market Summary

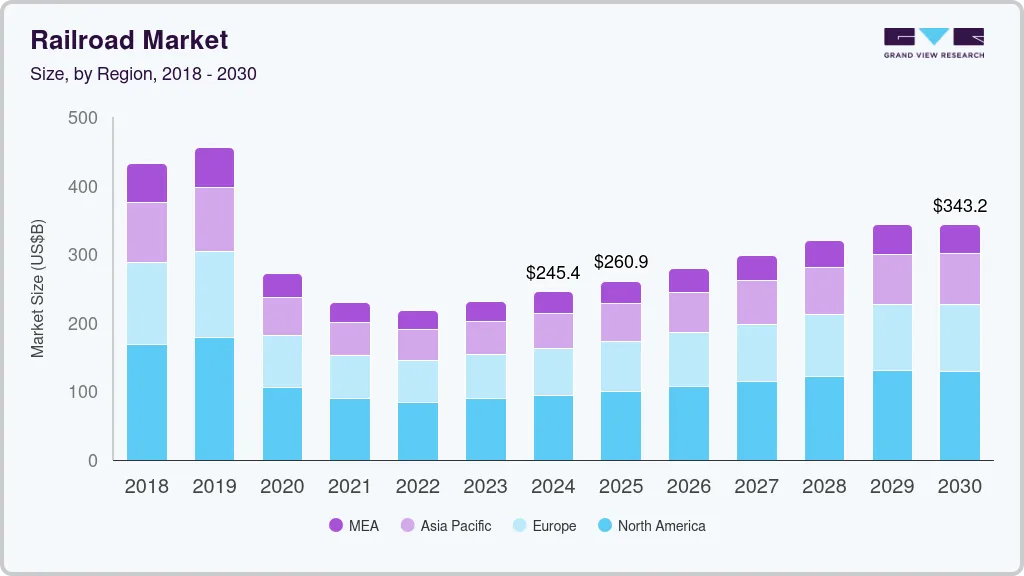

The global railroad market size was estimated at USD 314.84 billion in 2024 and is projected to reach USD 436.35 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The market is likely to be driven by continued investments in railway line projects and the expansion of railroad networks around the world.

Key Market Trends & Insights

- North America held a revenue share of 29.9% in 2024 and is expected to retain its lead throughout the forecast period.

- U.S. is projected to grow at a CAGR of 5.5% from 2025 to 2030.

- By type, passenger rail accounted for a revenue share of 59.0% of the global railroad industry in 2024.

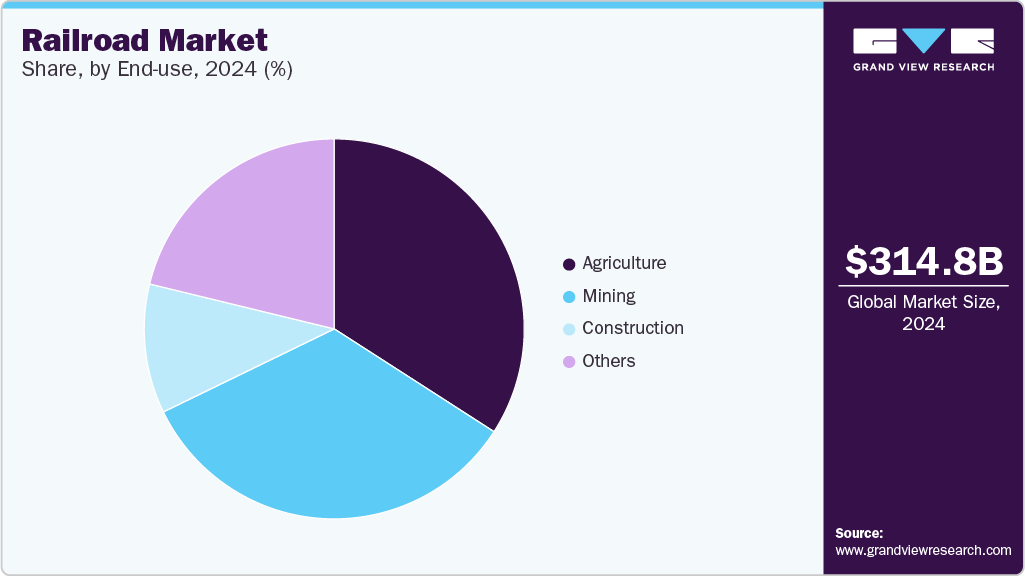

- By end use, the agriculture sector held a revenue share of 34.1 % in 2024.

Market Size & Forecast

- 2024 Market Size: USD 314.84 Billion

- 2030 Projected Market Size: USD 436.35 Billion

- CAGR (2025-2030): 5.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Several national and international railway projects, particularly in the Asia Pacific, are currently in the planning, development, or building stages, which bodes well for the future growth of the railroad industry. Railcar leasing has become a major trend around the world, and this is predicted to have a favorable impact on railroad transportation. Depending on the nature of the cargo and the use of current technologies in railroad transportation, this mode of transporting goods is not only safer but also more cost-effective. Moreover, advancements in storage facilities, power sources, and transportation timing improvements are likely to create new growth prospects for the railroad industry. Growing use of digital technologies such AI-driven robots and interconnected logistics is expected to fuel the adoption of freight rails for goods transportation. These technologies offer consumers with security and assurance of their goods.

The digitization process is rapidly advancing globally; China Rail Corporation (CRC) is driving the digitization of the freight rail industry. China State Railway Group (CSRG), Sinotrans, and CRRC Corporation are China's major freight rail operators, and they are adopting digital technologies to optimize operations. These operators enhance efficiency, reduce costs, and contribute to China's push for a more sustainable and interconnected logistics system. For instance, China has introduced AI-driven robots in its freight railway sector, representing a significant technological advancement that greatly improves inspection efficiency and accuracy in fault detection. This intelligent system commenced operations in Cangzhou, Hebei Province, and indicates a nationwide initiative by China to modernize its freight transportation through automation and artificial intelligence.

Demand for consumer rails is increasing owing to the rising adoption of public transport instead of private transport. This is mainly attributed to the punctuality, comfort, and convenience offered by the passenger rail. High-speed trains offer a luxury to consumers with comfortable seats, Wi-Fi, and premium food. For instance, the Shinkansen is a trusted and worldwide symbol of Japan’s technological advancement. The trains are also known as Bullet Trains, which are a swift and efficient mode of transport. Tourists visiting Japan are eager to ride the Shinkansen train to experience a high-speed journey. The train is the safest mode of transport in Japan, with zero accidents since its launch. Issues for increasing speed involve minimizing both internal and external noise and vibrations during operation, also enhancing trains to be more energy-efficient, compact, lightweight, and easier to maintain. The Shinkasen saves travel time and is easily accessible. Commuting long distances in a short time is easily possible, so people prefer to stay away from the city center to work and access services. This led to the development of large, dense residential areas outside city centres.

Consumer Survey & Insights

According to the survey of UIC members, the railroad industry has experienced challenges, leading to decreased demand for passenger rail services, influenced by health and safety regulations, a growing emphasis on sustainability, and environmental awareness. Passenger rail companies face difficulties due to changes in passenger behavior, including a drop in travel demand as remote work and virtual meetings become more prevalent. Health and safety regulations are necessary, but they also present barriers to increasing ridership. Experiences differ across regions and modes of travel, and passenger rail traffic has yet to recover fully, particularly in North America and Western Europe. At the same time, the worsening impacts of climate change globally are affecting travel patterns.

Various governments and businesses are establishing ambitious targets to reduce their emissions. As a result, organizations are enhancing their efforts to encourage sustainable travel, with UIC members noting that many corporations are promoting rail travel over air travel where possible. Indian Railways introduced semi-high-speed self-propelled trains equipped with state-of-the-art features such as rapid acceleration, significantly shorter travel time, a top speed of 160 km/h, onboard entertainment options, and a GPS-driven passenger information system. The trains also have automatic sliding doors, retractable steps, zero-discharge vacuum bio-toilets, and CCTV surveillance systems.

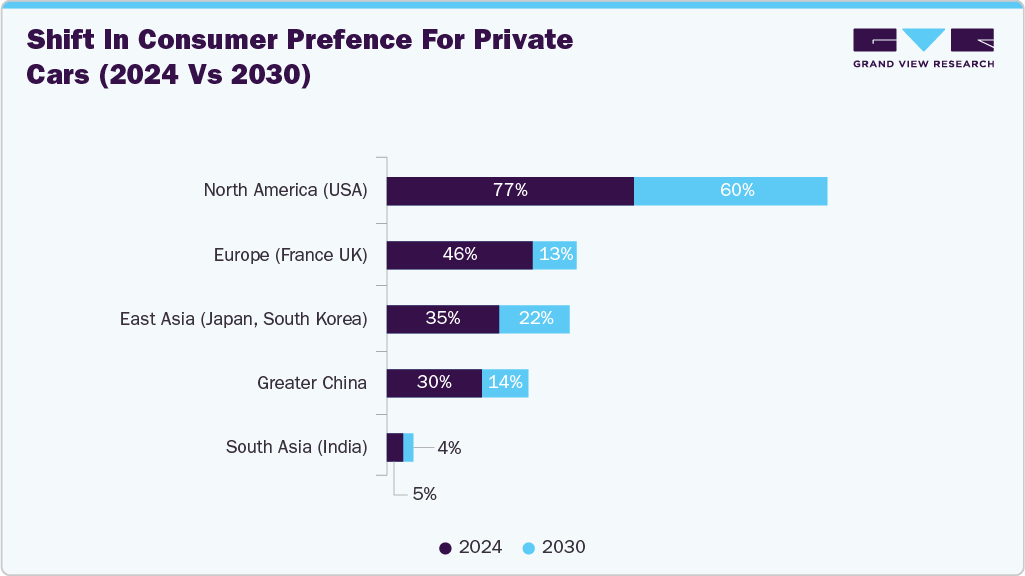

In recent years, consumers have become more conscious of environmental issues associated with different modes of transportation. Resultantly, the overall private car usage is expected to decrease by 20% to 70% in the next ten years, with variations across the regions. This reeducation is likely to be replaced by higher adoption of railway and other sustainable modes of transportation.

Consumer preferences are steadily shifting towards more sustainable, safe, quick, robust modes of transportation. This can be identified from the growing adoption of public modes of transportation over private cars. North America maintains a strong lead in a shift away from private cars, suggesting sustained investment in rail infrastructure and technological advancements. Other key regions such as Europe, East Asia, and Greater China display moderate yet stable expansion, reflecting ongoing development, innovation in high-speed rail, and a growing emphasis on sustainable transport solutions.

Type Insights

Passenger rail accounted for a revenue share of 59.0% of the global railroad industry in 2024. The segment is projected to witness growth over the coming years as the tourism industry picks up speed, thanks to inexpensive passenger train fares. Furthermore, increased investments in the expansion of passenger railroad networks and the introduction of newer and faster trains, like bullet trains and metros, are likely to propel segment growth. The passenger rail segment is also expected to grow fastest in the forecast period.

Rail freight demand is expected to grow at a CAGR of 5.2% from 2025 to 2030. This is mainly due to the lower rail freight rates and the safety of goods as compared to other modes. Furthermore, the railroad network's strong connection facilitates the transportation of commodities in remote places that are otherwise impossible to reach by air. Even though global trade and cargo volumes were affected by the pandemic, the railroad industry is expected to recover over the projection period as freight and shipping volumes return to pre-pandemic levels.

End Use Insights

The agriculture sector held a revenue share of 34.1 % in 2024. Stable and efficient railroad service is especially crucial for the agriculture industry. Rail transportation is essentially the only cost-effective shipping option available for low-value, bulk commodities in rural areas far from sea transit and end markets. These factors have driven the agriculture railroad segment in the past. In India, the robust Indian railway network connects small farmers from the remotest parts of the country to the mainstream market, where they can sell their agricultural produce.

The mining sector is expected to grow at a CAGR of 5.8% over the forecast period to overtake the agriculture segment in terms of market size by 2030. Monorail systems are being increasingly employed in coal and ore mines because of their efficiency and cheap running costs. Monorail systems are quickly becoming essential components in all mining projects where transportation systems have been optimized and where road and rail transportation can be combined. Looking to capitalize on the opportunities in freight, the Indian Railways has been mapping mining districts across the country to connect them with the railroad network.

Regional Insights

The railroad market in North America held a revenue share of 29.9% in 2024 and is expected to retain its lead throughout the forecast period. Freight rail is a pillar of the American economy, according to the Association of American Railroads, and the U.S. is home to a world-class freight rail network. The growth of freight rail in the country can be linked to continued investments in the enhancement of equipment, infrastructure, and technology. Passenger railroad services in the region are driven by rising consumer demand, increased passenger safety measures, and technological as well as operational advancements.

U.S. Railroad Market Trends

The railroad market in the U.S. is projected to grow at a CAGR of 5.5% from 2025 to 2030, owing to several key factors. These include increased investments in rail infrastructure, rising demand for efficient freight transportation, and advancements in rail technology. Additionally, the emphasis on sustainable and eco-friendly transportation solutions is driving the adoption of rail over other modes. The growth is further supported by government initiatives aimed at modernizing the rail network and improving connectivity across regions.

Europe Railroad Market Trends

The railroad market in Europe accounted for over 21% revenue share of the global railroad industry in 2024. This is driven by Europe's commitment to sustainable transportation, leading to significant investments in modernizing and expanding rail networks across the continent. Initiatives like the Trans-European Transport Network (TEN-T) aim to enhance cross-border connectivity, while the development of high-speed rail networks in countries such as France, Spain, and Germany further boosts market growth. Additionally, the adoption of digital technologies and smart rail infrastructure is improving operational efficiency and passenger experience, contributing to the market's expansion.

Asia Pacific Railroad Market Trends

The railroad market in Asia Pacific is expected to grow at a CAGR of 6.2% from 2025 to 2030 due to increased government investments in new railroad construction and the high reliance of the population on rail transport. For example, Timetric's Construction Intelligence Center (CIC) shows that the Asia Pacific leads the world in railroad investment. It is also the world's largest transport infrastructure market, with PwC forecasting annual spending of about USD 900 billion by 2025. Apart from this, increased imports and exports from Asian countries are predicted to boost the railroad industry growth.

Key Railroad Company Insights

The market includes both international and domestic participants who focus on strategies such as innovation, mergers and acquisitions, and investments in technology, infrastructure, and expansions to enhance their position in the market. Some prominent companies in this market are Central Japan Railway Company, SNCF Group, OAO RZD (Russian Railways), Indian Railways, and BNSF Railway.

-

Central Japan Railway Company (JR Central) is a major railway operator in Japan, best known for its operation of the Shinkansen, or Bullet Train, which connects key cities like Tokyo, Nagoya, and Osaka. Established in 1987 after the privatization of Japan National Railways (JNR), JR Central is headquartered in Nagoya. The company is a leader in high-speed rail technology, renowned for its commitment to safety, punctuality, and innovation. It also operates conventional rail services and is involved in various real estate and retail businesses, contributing significantly to Japan's transportation infrastructure and economy.

-

SNCF (Société Nationale des Chemins de fer Français) is the national railway company of France, responsible for operating the majority of the country’s rail services, including high-speed trains like the TGV (Train à Grande Vitesse). Established in 1938, SNCF is a state-owned company that is crucial in France’s transportation infrastructure. It operates a wide range of services, from regional and intercity trains to international connections, and is known for its commitment to innovation, punctuality, and sustainability in rail transport. SNCF is also involved in logistics, freight services, and urban transport solutions, focusing on reducing the environmental impact of its operations.

Key Railroad Companies:

The following are the leading companies in the railroad market. These companies collectively hold the largest market share and dictate industry trends.

- Central Japan Railway Company

- SNCF Group

- Union Pacific Corporation

- OAO RZD (Russian Railways)

- BNSF Railway

- Indian Railways

- Deutsche Bahn

- JSC Russian Railways

- CSX Corporation

- Canadian Pacific Railway

Recent Developments

-

In March 2025, The USA board approved the Canadian National and Iowa Northern merger. The deal strengthens logistics and opens new opportunities for clients. Iowa Northern connects its railway network with Canadian National in Iowa. Waterloo and Cedar Rapids stations now provide seamless cargo delivery to clients. Link:

-

In May 2024,Spanish-based Rail manufacturer Danobat a leader in the design and development of advanced manufacturing solutions, strengthens its position in the North American rail market with the acquisition of the American company Delta Wheel Truing Solutions.

Railroad Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 334.20 billion

Revenue forecast in 2030

USD 436.35 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Actuals

2018 - 2024

Forecast

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; India; China; Japan; Australia; Indonesia; Brazil; UAE; Saudi Arabia

Key companies profiled

Central Japan Railway Company; SNCF; Union Pacific Corporation;OAO RZD (Russian Railways); BNSF Railways; Indian Railways; Deutsche Bahn; JSC Russian Railways; CSX Corporation; Canadian Pacific Railway

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Railroad Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the railroad market on the basis of type, end-use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rail Freight

-

Passenger Rail

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mining

-

Construction

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global railroad market was estimated at USD 314.84 billion in 2024 and is expected to reach USD 334.20 billion in 2025.

b. The global railroad market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 436.35 billion by 2030.

b. North America held a revenue market share of 29.2% in 2024 and is expected to retain its lead throughout the forecast period. Freight rail is a pillar of the American economy, according to the Association of American Railroads, and the U.S. is home to a world-class freight rail network.

b. Some of the key players operating in the railroads market include Procter & Gamble; The Estée Lauder Companies Inc.; Mama Earth; Unilever; The Clorox Company; Honest Co.; The Body Shop; L’Oréal; FOM London Skincare; Bloomtown.

b. Key factors that are driving the railroad market growth include increasing investments by the governments in various countries to improve the railway infrastructure & build new lines and the growing tourism industry in the Asia Pacific and European countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.