- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyvinylidene Chloride Coated Films Market Report, 2033GVR Report cover

![Polyvinylidene Chloride Coated Films Market Size, Share & Trends Report]()

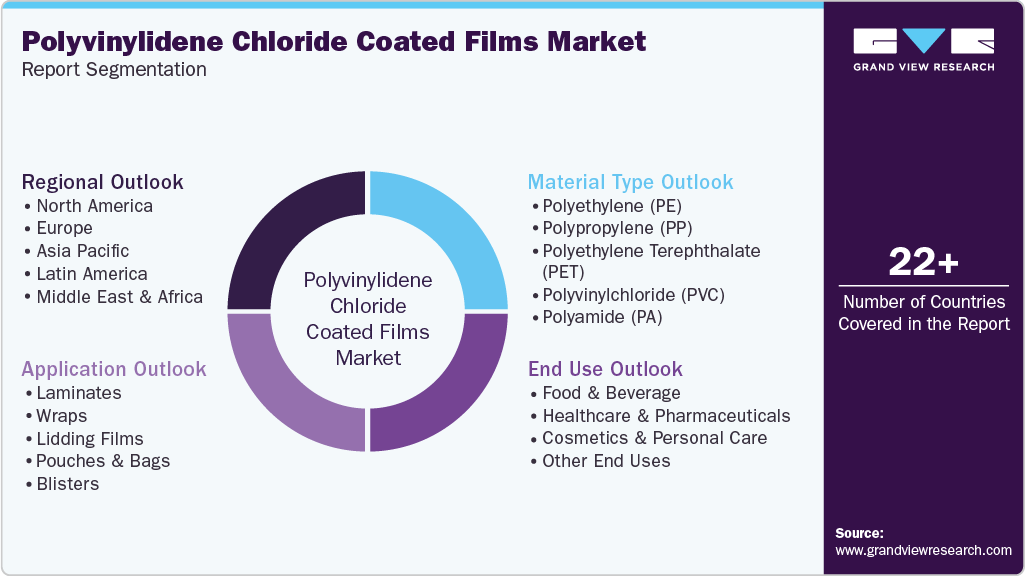

Polyvinylidene Chloride Coated Films Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (PE, PP), By Application (Laminates, Wraps), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-634-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyvinylidene Chloride Coated Films Market Summary

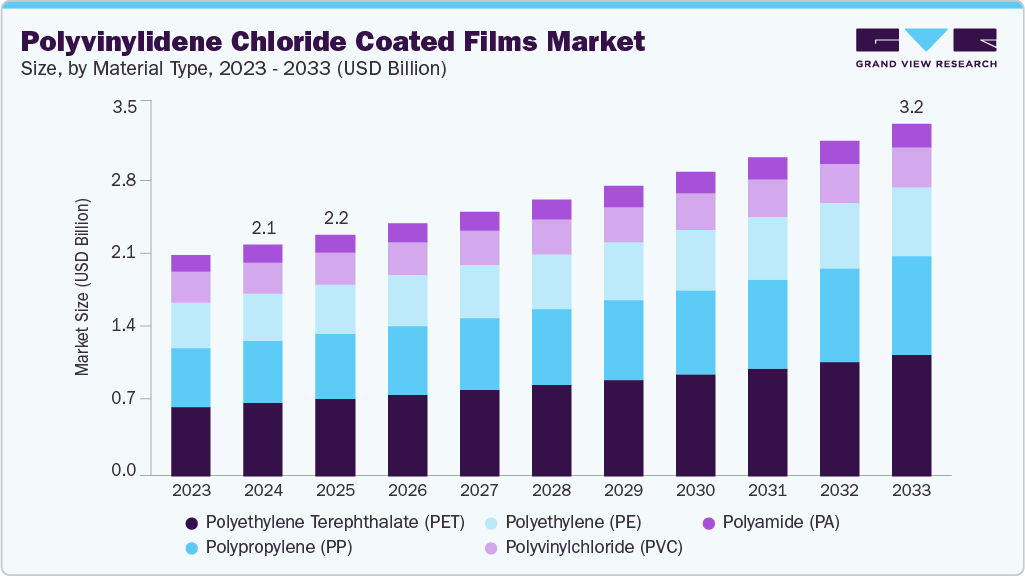

The global polyvinylidene chloride coated films market size was estimated at USD 2.12 billion in 2024 and is projected to reach USD 3.22 billion by 2033, growing at a CAGR of 4.81% from 2025 to 2033. Polyvinylidene chloride (PVDC) coated films are specialized barrier films known for their exceptional resistance to moisture, oxygen, and chemical infiltration.

Key Market Trends & Insights

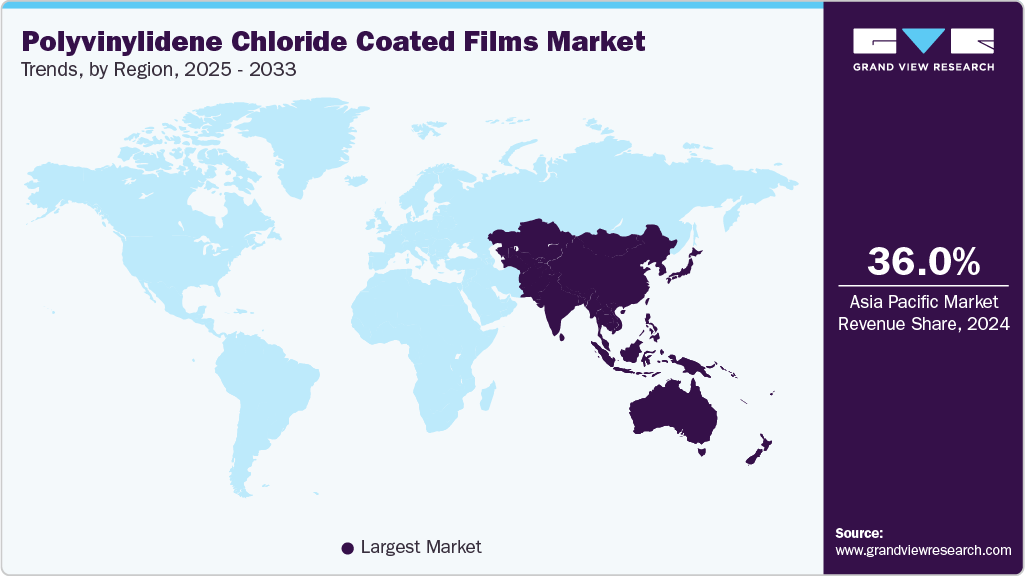

- Asia Pacific accounted for the fastest and largest region with a revenue share of 36.02% in 2024.

- China represents the largest market in the Asia Pacific region with more than 42% of the revenue share.

- Polyethylene terephthalate (PET) dominated the market across the material type in terms of revenue, accounting for a market share of 31.73% in 2024.

- Laminates led the market across the application segmentation in terms of revenue, accounting for a market share of 31.96% in 2024.

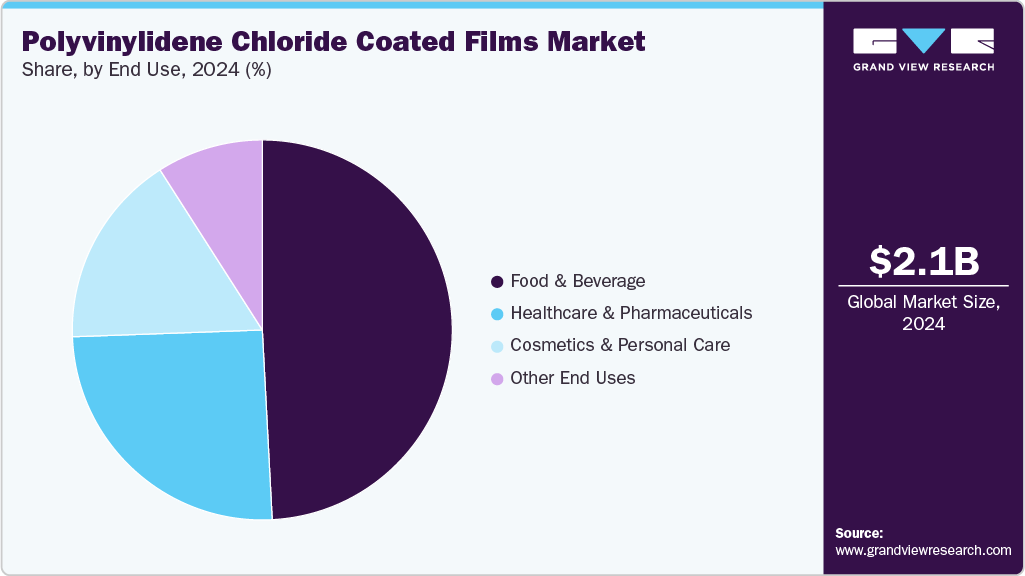

- Food & beverage dominated the polyvinylidene chloride coated films market across end-use in terms of revenue, accounting for a market share of 49.17% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.12 Billion

- 2033 Projected Market Size: USD 3.22 Billion

- CAGR (2025-2033): 4.81%

- Asia Pacific: Largest market in 2024

These films are commonly used in applications requiring high shelf-life and protection, especially in food packaging, pharmaceutical blister packs, and personal care packaging. The coating enhances the performance of base materials such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), transforming them into high-barrier substrates.

The growth of emerging markets, where rising disposable incomes and urbanization are fueling the need for processed and packaged goods, is expected to boost the product demand. Simultaneously, the global surge in demand for convenient, ready-to-eat foods and the expansion of cold chain logistics systems have created favorable conditions for PVDC-coated packaging solutions.

Drivers, Opportunities & Restraints

The key growth driver of the PVDC-coated films market is the increasing demand for high-performance packaging materials in the food and pharmaceutical industries. Consumers and regulatory bodies are placing more emphasis on the safety and shelf life of consumables. PVDC coatings provide an excellent oxygen and moisture barrier, which helps prevent spoilage and extends product usability.

Innovations in sustainable alternatives and smart packaging are growing opportunities in the market. Companies are investing in research to develop recyclable or biodegradable alternatives to PVDC, such as chlorine-free coatings and bio-based polymers, to meet increasing environmental and regulatory requirements. The integration of smart packaging features, including freshness indicators and antimicrobial coatings, presents new avenues for PVDC-coated films in premium product categories.

However, the non-recyclability and chlorine content of PVDC raise environmental concerns. As sustainability becomes a core focus across industries, PVDC is under scrutiny for its disposal challenges and lack of compatibility with existing recycling streams. Regulatory bodies and large FMCG companies are increasingly looking for recyclable mono-material alternatives.

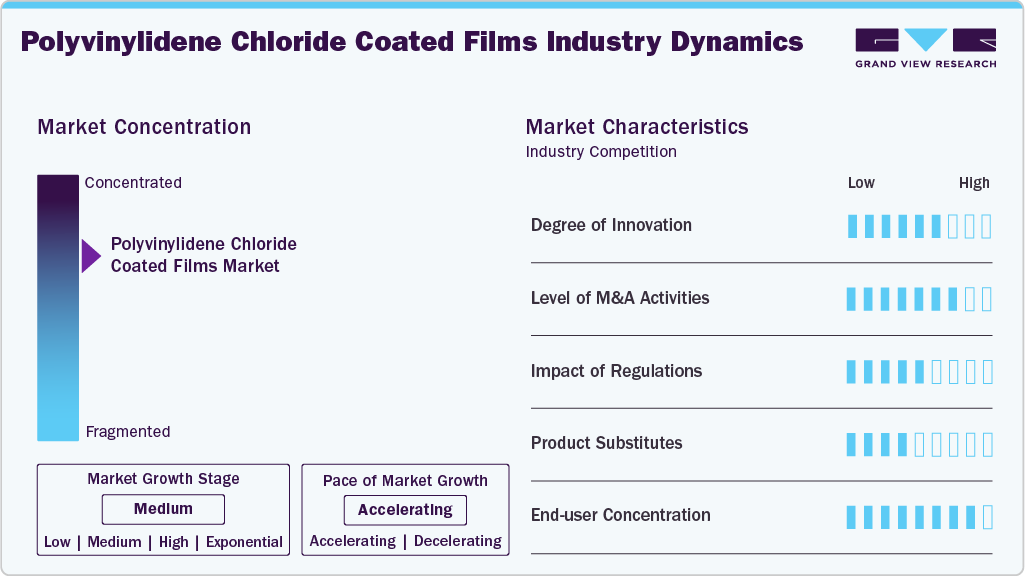

Market Concentration & Characteristics

The polyvinylidene chloride coated films market is in a medium growth stage, and the pace is accelerating. The market exhibits moderately concentrated conditions, with a few large players dominating due to their advanced coating technologies, global supply chains, and diversified portfolios. Companies such as Mondi Group plc., Kureha Corporation, Jindal Poly Films Limited, and Cosmo Films Ltd hold significant market share by offering customized PVDC-coated film solutions across regions and industries.

Environmental and food safety regulations significantly influence the PVDC-coated films market. Regulatory bodies in regions such as the European Union are actively pushing for sustainable packaging practices, including targets for recyclability. PVDC, being a chlorine-containing polymer, is increasingly discouraged in certain flexible packaging applications due to the formation of hydrochloric acid during incineration and complications in mechanical recycling.

The growing focus on circular economy principles has brought viable substitutes to the forefront. Ethylene Vinyl Alcohol (EVOH) is one of the leading alternatives among acrylic-coated films and biodegradable polymers. EVOH offers comparable oxygen barrier properties with the added benefit of being recyclable in multi-layer structures under some recycling protocols. Metallized films also offer good barrier performance and are more widely accepted in recycling streams. These alternatives are increasingly preferred in food packaging applications where PVDC’s chlorine content is seen as a disadvantage.

The demand for PVDC-coated films is heavily concentrated among a few core industries, with the food and pharmaceutical sectors accounting for the majority of market volume. The food industry, in particular, uses PVDC-coated films in laminates, pouches, lidding films, and wraps to extend the shelf life of perishable goods and to ensure moisture and aroma protection. With rising global demand for packaged, frozen, and ready-to-eat foods, this segment continues to be a primary consumer of PVDC coatings.

Material Type Insights

Polyethylene terephthalate (PET) dominated the market across the material type in terms of revenue, accounting for a market share of 31.73% in 2024. It serves as a base film for PVDC coatings owing to its dimensional stability, strength, and high clarity. PVDC-coated PET films are particularly suited for lidding films, blister packs, and retort packaging. Though more expensive than PE or PP, the superior temperature resistance and printability of PET make it ideal for high-end applications in food and healthcare packaging.

PE-based PVDC-coated films are anticipated to grow at a significant CAGR of 4.18% through the forecast period. Polyethylene is widely used due to its excellent flexibility, low cost, and compatibility with PVDC coatings. When combined with PVDC, these films offer enhanced moisture and gas barrier properties, making them suitable for primary packaging in food and personal care products.

Polypropylene (PP) is a favored substrate for PVDC coatings due to its high clarity, mechanical strength, and superior moisture barrier properties. PVDC-coated PP films are predominantly used in food packaging, especially for snack foods and dry goods, where barrier integrity is critical.

Polyvinylchloride (PVC) is most commonly used with PVDC in pharmaceutical blister packaging, where its rigidity and formability are valuable for creating protective cavities. When coated with PVDC, PVC offers excellent moisture and oxygen barriers, essential for sensitive drug formulations. However, PVC’s chlorine content, combined with that of PVDC, raises significant environmental and regulatory concerns, pushing manufacturers to seek more sustainable alternatives in regions with strict plastic regulations.

Application Insights

Laminates led the market across the application segmentation in terms of revenue, accounting for a market share of 31.96% in 2024. They are widely used in laminate structures to combine the strength of base films with the high barrier properties of PVDC. These laminates are extensively applied in food and medical packaging to ensure long shelf life and protection against moisture and oxygen ingress.

The wraps segment is expected to expand at a substantial CAGR of 5.26% through the forecast period. It serves as high-barrier packaging for items like meat, cheese, and bakery products. These wraps preserve freshness, reduce contamination risk, and minimize food waste by extending shelf life. The clarity and cling properties of PVDC films make them especially valuable for retail display packaging, though environmental concerns about film disposability are driving innovation in recyclable alternatives.

PVDC-coated lidding films are used primarily in ready-meal trays, yogurt containers, and blister packaging, offering secure seals and excellent barrier protection. Their strong adhesion and ability to withstand sterilization processes make them ideal for both food and medical applications.

PVDC-coated films in pouches and bags combine lightweight packaging with high barrier functionality, making them suitable for powdered foods, pet foods, cosmetics, and pharmaceuticals. These flexible formats offer ease of storage, handling, and resealing, aligning with modern consumer preferences for convenience.

End Use Insights

Food & beverage dominated the polyvinylidene chloride coated films market across end-use in terms of revenue, accounting for a market share of 49.17% in 2024. It is driven by the need for long-lasting, safe, and visually appealing packaging. These films are used across diverse applications from vacuum-sealed meats to snack packs and dairy lids, ensuring protection from oxygen, aroma loss, and moisture.

The healthcare & pharmaceuticals segment is projected to witness the fastest CAGR of 5.80% over the forecast period. PVDC-coated films are a mainstay in pharmaceutical packaging, particularly in blister packs, due to their exceptional ability to shield sensitive drugs from environmental degradation. The demand is bolstered by growing global pharmaceutical consumption, aging populations, and stricter regulations for drug safety.

In cosmetics and personal care, PVDC-coated films are used for sachets, sample pouches, and product wraps, where shelf appeal and barrier properties are critical. These films protect formulations from moisture and oxidation while maintaining fragrance integrity. As the sector shifts toward premium and sustainable packaging, PVDC-coated solutions are used selectively, often in combination with decorative printing and functional formats for single-use or travel packaging.

Regional Insights

Asia Pacific accounted for the fastest and largest region with a revenue share of 36.02% in 2024. Rapid industrialization, urbanization, and a growing middle-class population are driving demand for packaged food, pharmaceuticals, and personal care products. Countries like China, India, Japan, and South Korea are investing in modern packaging technologies and expanding their domestic converting capacities. In addition, foreign investments and favorable manufacturing costs make the region a central hub for PVDC-coated film production and export.

China represents the largest market in the Asia Pacific region with more than 42% of the revenue share, due to its massive food processing, pharmaceutical, and packaging infrastructure. The government’s push for advanced healthcare and food safety standards has further driven the adoption of high-barrier materials such as PVDC. However, rising environmental awareness and regulatory pressure are also compelling Chinese manufacturers to develop alternative coatings and improve recyclability.

India polyvinylidene chloride coated films market is fueled by increasing consumer demand for packaged and processed foods, rising pharmaceutical exports, and expanding personal care sectors. Government initiatives such as “Make in India” and improvements in cold chain logistics have boosted demand for advanced barrier packaging. While domestic manufacturing capacity is growing, India still relies on imports for certain grades of high-performance PVDC-coated films.

North America Polyvinylidene Chloride Coated Films Market Trends

North America’s mature packaging industry, strict quality standards, and emphasis on shelf-life optimization continue to support steady demand. However, environmental and sustainability regulations are pushing brands and converters to explore recyclable and chlorine-free barrier alternatives. Despite this, PVDC remains entrenched in applications where performance and regulatory approval are non-negotiable.

The U.S. market is a leader in pharmaceutical and food-grade PVDC-coated film consumption, with well-established infrastructure and strict FDA regulations governing packaging materials. Nevertheless, growing sustainability concerns have prompted major retailers and FMCG brands to reassess material choices, gradually phasing out PVDC in favor of recyclable solutions, especially in consumer-facing products. Yet, due to unmatched barrier performance, PVDC remains widely used in critical pharmaceutical applications.

Europe Polyvinylidene Chloride Coated Films Market Trends

Europe is a mature market for PVDC-coated films, but is undergoing significant transition due to stringent environmental regulations and the EU’s circular economy directives. Countries like France, Germany, and the UK are leading the shift toward mono-material structures and recyclable high-barrier films. However, PVDC remains essential in applications where other materials fail to meet technical requirements or regulatory approvals.

Germany's polyvinylidene chloride coated films market have a strong base of pharmaceutical, food processing, and specialty film manufacturers that depend on high-performance barrier films. However, Germany is also at the forefront of environmental innovation, with stringent recycling laws and strong industry commitments to reducing plastic waste. As a result, PVDC use is increasingly restricted to critical applications like pharmaceutical blisters and high-barrier food packs.

Latin America Polyvinylidene Chloride Coated Films Market Trends

Latin America presents a growing market for PVDC-coated films, particularly in Brazil, Mexico, and Argentina, where the food and pharmaceutical packaging sectors are expanding. In addition, rising consumer demand for packaged and hygienic products, along with improvements in retail infrastructure and healthcare access, is creating favorable conditions for market growth.

Middle East & Africa Polyvinylidene Chloride Coated Films Market Trends

The Middle East & Africa are emerging markets for PVDC-coated films, with growth largely driven by increasing urbanization, expansion in food retail, and rising pharmaceutical imports. The GCC countries, along with South Africa and Egypt, are investing in local packaging production to reduce dependency on imports.

Saudi Arabia polyvinylidene chloride coated films market is driven by growing focus on localizing pharmaceutical production under its Vision 2030 strategy. In addition, the country’s expanding food processing sector supports further consumption of PVDC-coated laminates and wraps.

Key Polyvinylidene Chloride Coated Films Company Insights

The PVDC-coated films market is fragmented yet dominated by several specialized, global players leveraging advanced technologies and extensive distribution networks. Broader market leadership includes major firms such as Mondi Group, Jindal Poly Films, Cosmo Films, Bilcare, Klöckner Pentaplast, Innovia Films, and Perlen Packaging, which compete through R&D, geographic expansion, and tailored product portfolios.

Key Polyvinylidene Chloride Coated Films Companies:

The following are the leading companies in the polyvinylidene chloride coated films market. These companies collectively hold the largest market share and dictate industry trends.

- Mondi Group plc.

- Kureha Corporation

- Jindal Poly Films Limited

- Cosmo Films Ltd

- Bilcare Limited

- Glenroy, Inc.

- Vibac Group S.p.A.

- Innovia Films

- Polinas Corporate

- Klöckner Pentaplast

Recent Developments

-

In January 2024, Kureha Corporation announced a JPY 10.00 billion (~ USD 70.0 million) investment in R&D focused on next-generation PVDC materials. The initiative aims to improve the sustainability profile of PVDC by developing thinner coatings with enhanced barrier performance and better compatibility with recycling infrastructure.

-

In October 2023, Solvay introduced Diofan Ultra736, a next-generation PVDC coating designed specifically for pharmaceutical blister films that delivers ultra-high water‑vapor barrier protection while remaining thermally formable. As an aqueous, fluorine-free dispersion compliant with direct pharmaceutical contact, it also maintains a strong oxygen barrier, transparency, and chemical resistance, allowing packaging producers to design thinner, lighter structures without sacrificing performance.

Polyvinylidene Chloride Coated Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.21 billion

Revenue forecast in 2033

USD 3.22 billion

Growth rate

CAGR of 4.81% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Mondi Group plc.; Kureha Corporation; Jindal Poly Films Limited; Cosmo Films Ltd; Bilcare Limited; Glenroy, Inc.; Vibac Group S.p.A.; Innovia Films; Polinas Corporate; Klöckner Pentaplast

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyvinylidene Chloride Coated Films Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the polyvinylidene chloride coated films market report on the basis of material type, application, end use, and region:

-

Material Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Polyvinylchloride (PVC)

-

Polyamide (PA)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Laminates

-

Wraps

-

Lidding Films

-

Pouches & Bags

-

Blisters

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Healthcare & Pharmaceuticals

-

Cosmetics & Personal Care

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polyvinylidene chloride coated films market size was estimated at USD 2.12 billion in 2024 and is expected to reach USD 2.21 billion in 2025.

b. The global polyvinylidene chloride coated films market is expected to grow at a compound annual growth rate of 4.81% from 2025 to 2033 to reach USD 3.22 billion by 2033.

b. Polyethylene terephthalate (PET) dominated the polyvinylidene chloride coated films market with a share of 31.73% in 2024, as it serves as a base film for PVDC coatings owing to its dimensional stability, strength, and high clarity.

b. Some key players operating in the polyvinylidene chloride coated films market include Mondi Group plc., Kureha Corporation, Jindal Poly Films Limited, Cosmo Films Ltd, Bilcare Limited, Glenroy, Inc., Vibac Group S.p.A., Innovia Films, Polinas Corporate, and Klöckner Pentaplast.

b. Key factors that are driving the polyvinylidene chloride coated films market growth include increasing demand for high-performance packaging materials in the food and pharmaceutical industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.