- Home

- »

- Medical Devices

- »

-

Pulmonary Stents Market Size, Share & Growth Report, 2030GVR Report cover

![Pulmonary Stents Market Size, Share & Trends Report]()

Pulmonary Stents Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Self-expandable, Balloon-expandable), By Material (Metal, Silicon, Hybrid), By Type (Tracheobronchial Stents, Laryngeal Stents), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-163-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pulmonary Stents Market Summary

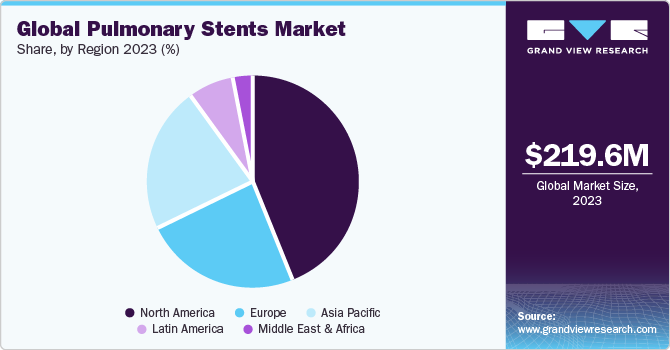

The global pulmonary stents market size was estimated at USD 219.60 million in 2023 and is expected to reach USD 306.09 million by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The increasing prevalence of respiratory diseases is a major factor behind market growth.

Key Market Trends & Insights

- North America held the largest revenue share of 43.69% in 2023.

- The U.S. accounted for the largest market share in North America in 2023.

- By product, the balloon-expandable stents segment accounted for the largest revenue share of 53.40% in 2023.

- By material, the metal segment accounted for the largest revenue share of 58.89% in 2023.

- By type, the tracheobronchial stents segment accounted for the largest revenue share of 72.12% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 219.60 Million

- 2030 Projected Market Size: USD 306.09 Million

- CAGR (2024-2030): 4.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

According to the Global Initiative for Asthma - GINA article of September 2022, an estimated 200 million people have COPD, of which 3.2 million people die each year. The growing geriatric population and healthcare awareness, increasing minimally invasive procedures, and new stent technology advancements are expected to drive market growth in the forecast period.

Lung cancer is a major public health concern in the U.S., and its rising incidence and mortality rates are driving the market growth of pulmonary stents. According to the American Cancer Society estimates, there were 238,340 new lung cancer cases in the U.S. in 2023. The majority of lung cancer diagnoses occur in individuals aged 65 and older, with a very small proportion of cases affecting those under 45. Lung cancer remains a significant public health concern, particularly in older people. The average age at diagnosis is 70 years, and this disease stands as the leading cause of cancer-related deaths in the U.S., accounting for one in five cancer fatalities. Each year, more individuals succumb to lung cancer than the combined total of breast, colon, and prostate cancer deaths.

The pulmonary stents industry is witnessing significant growth due to advancements in new stent technology, particularly in the areas of 3D-printed self-expanding stents (3DPSS), biodegradable stents (BS), and drug-eluting stents (DES). According to the NCBI article published in November 2023, these innovations offer several advantages over traditional stents, including improved patient outcomes, reduced complication rates, and enhanced quality of life.

3DPSS is a promising new technology that provides a more customized patient fit. These stents are created by printing a 3D model of the patient's airway, ensuring a precise fit that optimizes stent performance and reduces the risk of complications. 3DPSS has demonstrated effectiveness in treating complex airway diseases, offering improved symptom relief and enhanced quality of life for patients. BS offers a unique solution by gradually dissolving over time, eliminating the need for removal procedures. This eliminates the associated risks and discomfort of stent removal, reducing healthcare costs and improving patient satisfaction. DES are coated with medication, typically an anti-proliferative drug, that is slowly released into the airway over time. This helps to prevent restenosis (narrowing of the airway again after stenting), a common complication with traditional stents.

Market Concentration & Characteristics

The market is growing with innovation, showcasing a continuous stream of new ideas and advanced approaches. These stents have become quite popular because of their minimal invasiveness and the relief they offer with reduced pain. Companies are investing in inventive technologies and procedures to meet the growing demand, staying on the cutting edge of progress in this field. Moreover, market players, such as Bess Medizintechnik GmbH, Boston Scientific Corporation, Cook Group, and E. Benson Hood Laboratories Inc., are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Moreover, companies are actively investing substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. This may result in increasing the cost of developing novel pulmonary stent technologies. Pulmonary stents keep narrowed airways open in the lungs. While pulmonary stents are an effective treatment option, several product substitutes can be considered in certain cases.

Pulmonary stents offer a minimally invasive approach to treating airway obstructions, minimizing the risk of surgery-related complications. Alternative procedures like bronchial thermoplasty (BT) and endoscopic laser resection (ELR), while minimally invasive, require specialized expertise and equipment. Tracheal resection with anastomosis (TRA) and tracheostomy are surgical procedures that involve more extensive incisions and carry a higher risk of complications.

Regional Insights

North America held the largest revenue share of 43.69% in 2023 due to high prevalence of asthma in the region. According to the Asthma and Allergy Foundation of America, asthma, a chronic respiratory condition that affects the airways, poses a significant public health challenge. With more than 27 million individuals affected in the U.S. alone, asthma represents a substantial growth driver for the North American market. Asthma is more widespread in female adults as compared to male adults, with an estimated 10.8% of females affected compared to 6.5% of males. This gender gap necessitates gender-specific treatment strategies and interventions.

The U.S. accounted for the largest market share in North America in 2023. The U.S. faces a significant burden of chronic obstructive pulmonary disease (COPD), according to the CDC, 16 million adults are affected, and a substantial number are unaware of their condition. This widespread prevalence, particularly among women, combined with the unmet needs in managing severe airway obstructions, has emerged as a key driver for the growth of the U.S. pulmonary stents industry.

Asia Pacific region is expected to grow at the fastest rate during the forecast period. Surge in patient numbers and the increasing presence of prominent healthcare providers in swiftly developing economies like India and China create opportunities for expansion. According to the WHO, in November 2023, China had a significant burden of chronic obstructive pulmonary disease (COPD), with an estimated 100 million individuals affected, representing nearly 25% of global COPD cases.

China has implemented a comprehensive nationwide intervention to strengthen COPD care in primary healthcare settings to address this pressing health concern. Key initiatives include screening for high-risk individuals and enhancing the utilization of lung function tests through a national program. These efforts, spearheaded by the Chinese government, have substantially bolstered the capacity for COPD screening and management in primary care facilities.

Japan’s healthcare system is witnessing a transition in service portfolio from nursing care to preventive care in disease management because of rising healthcare expenditure. According to the GSK news in September 2023, Japan has significant stride in public health by approving Arexvy, the first respiratory syncytial virus (RSV) vaccine for older adults. This approval can potentially safeguard around 43.5 million Japanese people aged 60 and over.

Product Insights

The balloon-expandable stents segment accounted for the largest revenue share of 53.40% in 2023. Balloon angioplasty (BA) has long been established as the primary intervention for pulmonary artery stenosis (PAS) in pediatric cases. Despite its efficacy, a notable subset of lesions proves resistant to conventional BA methods. In addressing this challenge, ultra-high pressure (UHP) balloons have emerged as a promising alternative.

A recent study, published on NCBI in January 2023, conducted a retrospective analysis of data from 28 children who underwent 37 UHP BA procedures for PAS. Success in this context was defined as achieving a post-procedure gradient of less than 25 mmHg across the stenotic area. The findings revealed a remarkable success rate of 78.4% for ultra-high pressure balloon angioplasty (UHP BA) in effectively treating pulmonary artery stenosis (PAS) among children with congenital heart defects (CHD).

Self-expandable stents are anticipated to witness the fastest market growth over the forecast period. Self-expandable metallic stents (SEMS) emerge as a secure and effective therapeutic choice for obstructive atelectasis, demonstrating a high rate of technical success and promising clinical outcomes. In a 2020 NCBI article, the study aimed to appraise the safety and efficacy of SEMS in addressing obstructive atelectasis and evaluate the predictive value of preoperative computed tomography (CT) enhancement for successful lung re-expansion post-SEMS placement.

The analysis encompassed data from 35 patients (29 males and 6 females) with obstructive atelectasis who underwent SEMS placement between February 2012 and March 2018. The technical success rate for SEMS placement reached 97.1%, while the clinical success rate stood at 82.9%. Notably, 29 patients (82.9%) experienced complete resolution of atelectasis, and 6 patients (17.1%) exhibited partial resolution.

Material Insights

The metal segment accounted for the largest revenue share of 58.89% in 2023. Bare metal and drug-eluting stents find primary application in addressing narrowed arteries, particularly in the coronary arteries of the heart. While both stents maintain open arteries and enhance blood flow, they operate through distinct mechanisms. As per the National Heart, Lung, and Blood Institute, Drug-eluting stents (DES) are the predominant choice for coronary artery interventions. These stents feature a coating of medication that is gradually released into the artery, aiming to prevent restenosis, the reappearance of narrowing post-stenting. Various types of DES incorporate diverse medications, each possessing unique properties and applications in clinical contexts.

The Silicon segment is estimated to register the fastest CAGR over the forecast period. According to the NCBI article published in April 2023, a recent meta-analysis examined the efficacy of silicone stents in treating benign airway obstructions. This comprehensive analysis, which included data from eight studies involving 395 patients, revealed promising outcomes for silicone stents. The curative rate, defined as the proportion of patients with stents removed without symptomatic restenosis within one year, exceeded 40%.

The stability rate was comparable, measuring the proportion of patients who maintained stable stent placement. Consequently, the "effective rate," encompassing curative and stability rates, surpassed 75%. Regarding complications, the migration rate was 25%, with a granulation rate of 15.7%. Remarkably, no evidence of publication bias was detected. These findings underscore the potential of silicone stents as an effective and durable treatment option for benign airway obstructions.

Type Insights

The tracheobronchial stents segment accounted for the largest revenue share of 72.12% in 2023. Tracheobronchial Stents are used primarily for COVID-19 patients. According to the NCBI article published in September 2021, tracheobronchial stent placement, a relatively safe and effective treatment for tracheobronchial stenosis, typically involves silicone stent insertion under general anesthesia with positive-pressure ventilation using rigid bronchoscopy.

Moreover, extracorporeal membrane oxygenation (ECMO) is a valuable technique for maintaining oxygenation and adequate ventilation while concurrently removing carbon dioxide. While traditionally considered a relative contraindication for patients with advanced malignancy due to poor outcomes despite ECMO support, ECMO remains a viable option for high-risk asphyxiation patients who prove difficult to manage under conventional ventilation during tracheal stent placement.

The laryngeal stents segment is anticipated to grow at the fastest rate during the forecast period. According to the NCBI article published in October 2022, a novel, cost-effective stent option for pediatric laryngotracheal reconstruction (LTR) has emerged as a refashioned Foley catheter. This prospective clinical study evaluated the efficacy and safety of these stents in treating laryngotracheal stenosis (LTS) in children up to 8 years of age.

The study enrolled 31 pediatric patients with LTS, encompassing 17 males and 14 females with an average age of 3.45 years. Subglottic stenosis was the most prevalent cause of LTS, accounting for 74.2% of the cases. The mean stenting duration was 40.5 days. Remarkably, decannulation was achieved in 96.8% of the patients. The stents were well-tolerated, with no reported complications such as stent migration, excessive granulation tissue, intractable aspiration, or pressure necrosis.

Key Companies & Market Share Insights

Boston Scientific; Cook Group; ENDO-FLEX GmbH, and Bess medizintechnik GmbH are some of the dominant players operating in the pulmonary stents market.

-

Boston Scientific is a unit to tackle healthcare challenges, impacting over 100 countries. Their mission is to reduce costs, boost efficiency, and broaden healthcare access.

-

Cook Group has been working since 1963 to develop ways to avoid open surgery. They use devices, materials, and therapies to help healthcare systems deliver better results more efficiently.

-

ENDO-FLEX GmbH for more than 30 years and has provided a wide range of flexible endoscopic products, including devices, instruments, and implants.

Merit Medical System; Olympus Corporation, and Standard Sci Tech Inc. are some of the emerging market players functioning in pulmonary stents market.

-

Merit Medical Systems, Inc. for over [30] years, specializing in crafting, producing, and distributing unique disposable medical devices.

-

Taewoong Medical has emerged as a global leader in the medical industry, with its products reaching over 75 countries worldwide.

Key Pulmonary Stents Companies:

- Bess medizintechnik GmbH

- Boston Scientific Corporation

- Cook Group

- E. Benson Hood Laboratories Inc.

- Efer Endoscopy

- Endo-Flex GmbH

- Merit Medical Systems Inc.

- Micro-Tech (Nanjing) Co. Ltd

- Standard Sci Tech Inc.

- Olympus Corporation

Recent Developments

-

In January 2022, Cook group has secured Breakthrough Device designation from the U.S. Food and Drug Administration (FDA) for a novel drug-eluting stent intended for use in below-the-knee (BTK) procedures.

-

In February 2022, Micro-Tech Endoscopy unveiled the self-increasing tracheobronchial nitinol y-stent. Specifically designed to address malignant tumors at the tracheobronchial carina, the Y-shaped tracheal stent system offers a flexible and adaptable solution for effective treatment.

-

In June 2022, Boston Scientific Corporation acquired a 64% majority investment in M.I.Tech Co., Ltd., a Korean medical device manufacturer, through a deal with Synergy Innovation Co., Ltd. M.I.Tech specializes in HANAROSTEN technology, self-expanding metal stents, crafting non-vascular for endoscopic and urologic procedures.

Pulmonary Stents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 229.61 million

Revenue forecast in 2030

USD 306.09 million

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, material, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Bess medizintechnik GmbH; Boston Scientific Corporation; Cook Group; E. Benson Hood Laboratories Inc.; Efer Endoscopy; Endo-Flex GmbH; Merit Medical Systems Inc.; Micro-Tech (Nanjing) Co. Ltd; Standard Sci Tech Inc.; Olympus Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pulmonary Stents Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pulmonary stents market report based on product, material, type and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-expandable Stents

-

Balloon-expandable Stents

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Silicon

-

Hybrid

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tracheobronchial Stents

-

Laryngeal Stents

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pulmonary stents market size was estimated at USD 219.60 million in 2023 and is expected to reach USD 229.61 million in 2024.

b. The global pulmonary stents market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 306.09 million by 2030.

b. In 2023, North America held the largest pulmonary stents market, with a revenue share of 43.69%. The region's advanced healthcare infrastructure, increasing awareness about oral health, and a growing aging population contribute to the market's dominance.

b. Some key market players are Boston Scientific, Cook Group, ENDO-FLEX GmbH, E. Benson Hood Laboratories Inc., and Efer Endoscopy.

b. The increasing prevalence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD) and lung cancer, is a major driving force behind the expansion of the pulmonary stents market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.