Psychedelic Drugs Market Size & Trends

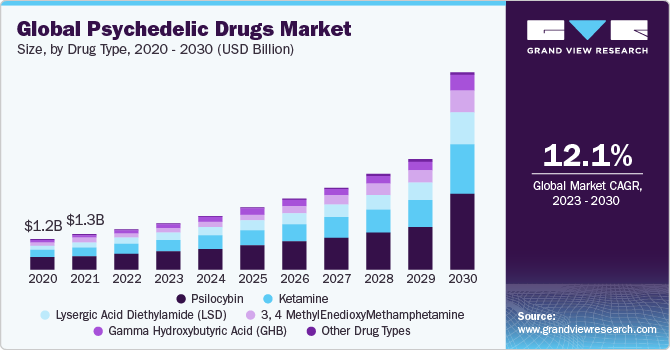

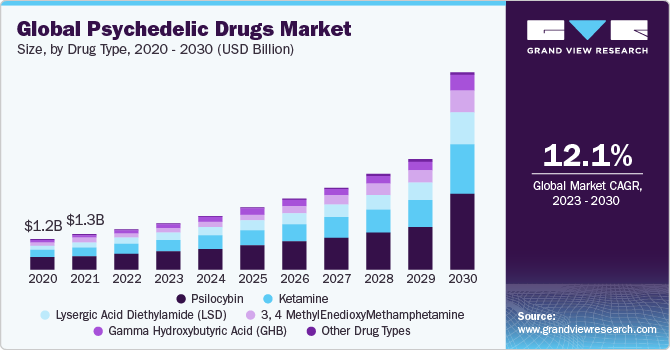

The global psychedelic drugs market size was valued at USD 1,595.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.1% from 2023 to 2030. The increasing awareness of the significance of treating mental health and the growing prevalence of mental health issues are major factors boosting market growth over the forecast period. Furthermore, growing government initiatives associated with mental health is expected to supplement market growth. For instance, in May 2022, the Mental Health Foundation conducted Mental Health Awareness Week to raise awareness about the effects of loneliness on mental health.

The COVID-19 pandemic had a notably positive impact on the psychedelic drugs market. There was an increased prevalence of anxiety and depression among the population owing to the sudden imposition of lockdowns during the pandemic. According to the World Health Organization report, the COVID-19 pandemic triggered a 25% increase in the prevalence of depression and anxiety worldwide. This factor led to an increased demand for psychedelic drugs. Furthermore, many people lost their jobs amid the pandemic, intensifying cases of depression and thus fostering market growth. For instance, as per the Center on Budget and Policy Priorities report, millions of people lost their jobs in the early months of the crisis.

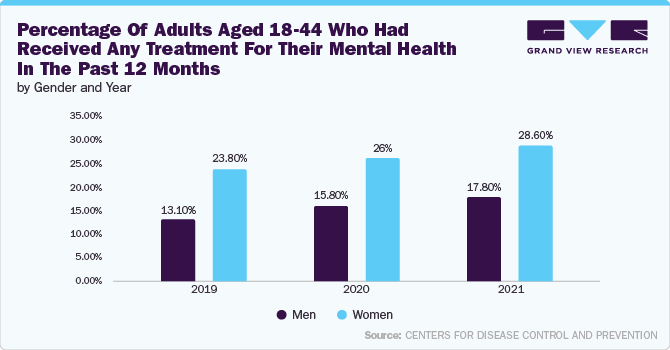

The increasing prevalence of mental health issues is a powerful growth driver for the psychedelic drugs market. For instance, according to the Mental Health Foundation report, in 2022/23, an average of 37.1% of women and 29.9% of men reported high anxiety levels. Similarly, according to the Statistics Canada report, the proportion of Canadians aged 15 years and older with a generalized anxiety disorder doubled from 2012 to 2022, from 2.6% to 5.2%. Mental health disorders such as psychosis, anxiety, panic attacks, and depression require psychedelic drugs for treatment. Thus, the increase in anxiety and other mental disorders is expected to boost the demand for psychedelic drugs.

Drug Type Insights

Based on drug type, the psychedelic drugs market is segmented into Gamma Hydroxybutyric Acid (GHB), Ketamine, Psilocybin, Lysergic Acid Diethylamide (LSD), 3, 4 methylenedioxymethamphetamine, and other drug types. The psilocybin segment dominated the market in 2022. Psilocybin is a naturally occurring compound used to treat various mental health conditions. An increase in product approvals and the establishment of psychedelic drug research centers are expected to drive market growth over the forecast period. For instance, in August 2021, the University of Wisconsin–Madison launched a new research center to coordinate ongoing research and education on psychedelic compounds.

Application Insights

Based on application, the psychedelic drugs market is segmented into treatment-resistant depression, opiate addiction, post-traumatic stress disorder, narcolepsy, panic disorders, and other applications. The treatment-resistant depression segment dominated the market in 2022. Increasing cases of depression across the globe are anticipated to boost market growth. For instance, according to the WHO report published in 2023, an estimated 3.8% of the population experiences depression, including 5% of adults (4% among men and 6% among women), and 5.7% of adults older than 60. Approximately 280 million people worldwide have depression. Such factors are expected to spur market growth.

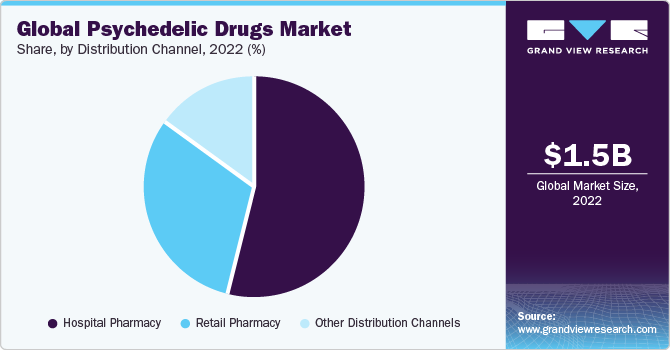

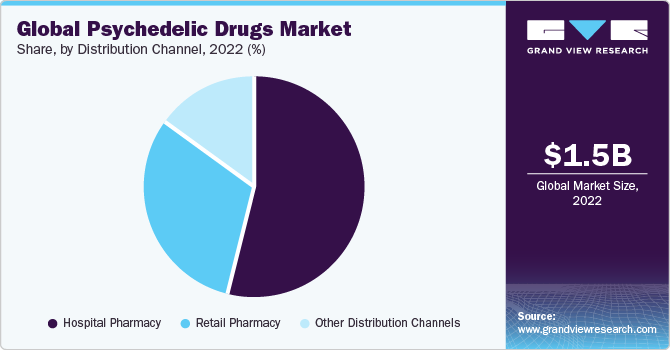

Distribution Channel Insights

Based on distribution channels, the psychedelic drugs market is segmented into hospital pharmacies, retail pharmacies, and other distribution channels. The hospital pharmacy segment is expected to witness robust growth, primarily fueled by the increasing awareness and acceptance of psychedelic drugs for mental health treatment. Furthermore, an increase in the number of patients seeking mental health treatment in hospitals is expected to supplement the segment's growth. Moreover, the collaboration between pharmacists, researchers, and healthcare professionals fosters an environment conducive to integrating psychedelic treatments into mainstream medical practices, thereby fostering market growth.

Regional Insights

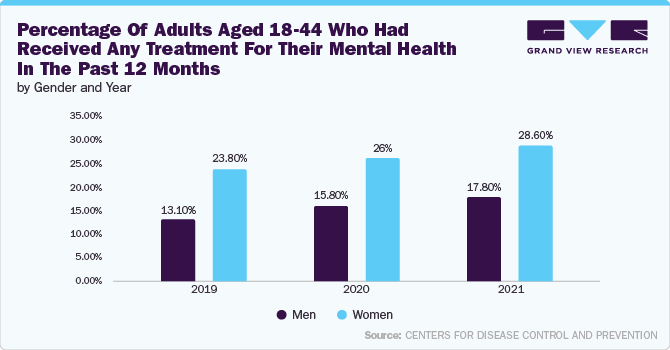

North America dominated the market in 2022. Rising awareness of mental health and the prevalence of mental disorders in the region have increased the demand for psychedelic drugs-based diagnostics. For instance, according to the Mental Health America (MHA) report in 2022, 19.86% of adults experienced a mental illness, equivalent to nearly 50 million Americans. Moreover, the region’s well-established research ecosystem and healthcare infrastructure provide a favorable environment for adopting and developing psychedelic drugs. Additionally, the growing acceptance of psychedelic drugs by mental health professionals and the medical community has strengthened their integration into treatment protocols, further accelerating demand. Substantial investments and collaborations within the pharmaceutical and biotech sectors are propelling research and development, aiming to harness the potential of psychedelic drugs for novel therapies.

Key Companies & Market Share Insights

Prominent players in the market include Jazz Pharmaceuticals, NeonMind BioSciences, Cybin Corp., Pfizer Inc., Numinus, Mind Medicine, PharmaTher Holdings Ltd, NRx Pharmaceuticals Inc., Seelos Therapeutics, Havn Life, Revive Therapeutics, and Usona Institute. These industry leaders remain dedicated to continuous innovation through new product development, strategic M&A activities, and forming key alliances, all aimed at exploring fresh avenues in the market. Some of the instances of such initiatives include:

-

In September 2023, Cybin Inc. announced a strategic collaboration with Fluence, a leading organization in psychedelic therapy continuing education. This collaboration is designed to support the scaling of the EMBARK training program for the CYB003 phase 3 trial.

-

In October 2022, Numinus Wellness Inc., a prominent mental health care company, initiated a groundbreaking program offering Ketamine for the treatment of chronic and serious medical illnesses. This pioneering program was initially rolled out in Numinus' clinics located in Utah, British Columbia, and Quebec.