- Home

- »

- Advanced Interior Materials

- »

-

Propeller Shaft Market Size, Share & Growth Report, 2030GVR Report cover

![Propeller Shaft Market Size, Share & Trends Report]()

Propeller Shaft Market (2024 - 2030) Size, Share & Trends Analysis Report By Shaft Type (Single Piece, Multi-piece), By End Use (Automotive, Marine, Aerospace, Industrial Machinery), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-373-7

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Propeller Shaft Market Size & Trends

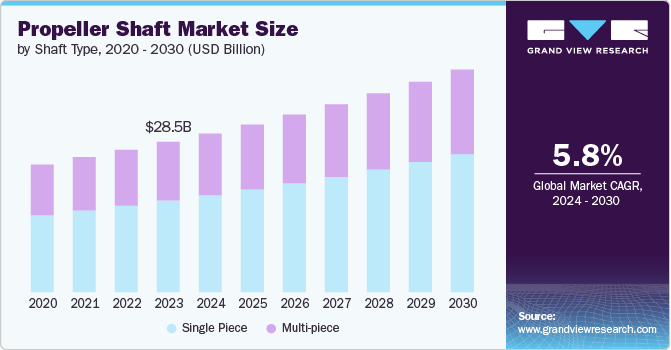

The global propeller shaft market was estimated at USD 28.51 billion in 2023 and is forecasted to grow at a CAGR of 5.8% from 2024 to 2030. This growth is attributed to the growing emphasis on energy efficiency and emissions reduction in the automotive and transportation sectors, encouraging manufacturers to adopt lighter and more efficient components like propeller shafts. In addition, the global push towards sustainable transportation solutions bolsters the demand for propeller shafts that enhance vehicle performance while reducing environmental impact.

Advancements in propeller shaft technology are expected to support the increased demand across various industries. Improved manufacturing techniques, such as using advanced materials like carbon fiber and composites, enable the production of propeller shafts that are lighter, stronger, and more efficient. These advancements not only enhance the performance and durability of propeller shafts but also contribute to greater fuel efficiency and reduced vehicle emissions.

In addition, innovations in design and engineering allow for more compact and integrated systems, which are critical for electric and hybrid vehicles. As the automotive and transportation sectors increasingly prioritize sustainability and efficiency, the demand for technologically advanced propeller shafts capable of meeting these evolving needs is expected to rise significantly, fueling market growth.

Major industry players are focusing on adopting various strategies to gain a competitive edge. They are investing heavily in research and development to innovate new materials and manufacturing techniques that enhance shaft performance while reducing weight and improving efficiency. Moreover, companies are expanding their product portfolios to include customizable and modular shaft solutions catering to diverse vehicle types and specifications. These players also emphasize strategic partnerships and collaborations with automotive OEMs to co-develop advanced drivetrain systems that integrate seamlessly with modern vehicle architectures, including electric and hybrid platforms.

Shaft Type Insights

The market is segmented based on shaft type into single-piece and multi-piece. Among these, single pieces dominated the market with a revenue share of 60.96% in 2023 and are further expected to grow significantly over the forecast period. A single-piece shaft offers various advantages, such as higher reliability, reduced maintenance, and improved vehicle dynamics. These are often made from advanced materials like carbon fiber or high-strength steel and offer better torsional rigidity and lower rotational mass compared to traditional multi-piece designs. This results in smoother power transmission, reduced noise, vibration, and harshness (NVH), and enhanced fuel efficiency. These factors are anticipated to boost the demand for single-piece shafts over the forecast period.

Demand for multi-piece shafts is expected to grow fastest from 2024 to 2030. These are known for their versatility and suitability for various vehicle configurations and applications. Multi-piece shafts also allow for easier assembly and disassembly, making them advantageous in conditions where vehicle repairability is critical, such as in commercial vehicles and heavy-duty applications. They offer flexibility in adapting to different drivetrain layouts and lengths, accommodating diverse vehicle designs and performance requirements. In addition, advancements in manufacturing technologies for multi-piece shafts, such as improved joint designs and materials, enhance their durability and efficiency, further driving their demand in the automotive and industrial sectors.

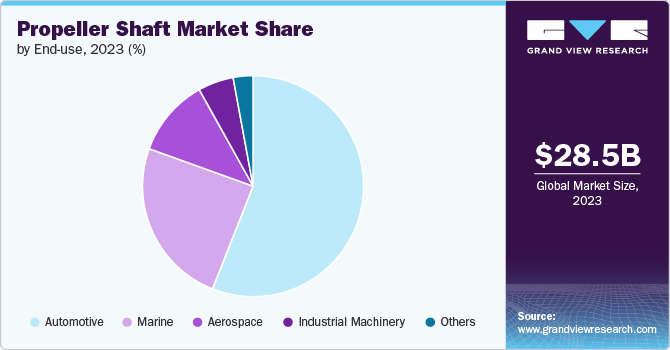

End Use Insights

Based on end use, the market is segmented into automotive, marine, aerospace, and industrial machinery. Automotive end use accounted for the largest revenue share of 55.9% in 2023. With the rise of electric and hybrid vehicles, there's a growing demand for efficient drivetrain components that can transfer power effectively from electric motors to wheels. Propeller shafts play a crucial role by ensuring smooth and reliable power transmission, thereby supporting the expanding market for electric and hybrid vehicles globally. Moreover, the advancements in lightweight materials and manufacturing processes have led to more efficient propeller shafts, which can contribute to improved fuel efficiency and reduced emissions, supporting stringent environmental regulations and consumer demands for sustainable transportation solutions.

Marine is anticipated to grow at the fastest rate over the forecast period. Propeller shafts are important components in marine propulsion systems, transmitting power from engines to propellers efficiently and reliably. As maritime transportation continues to grow, particularly in sectors such as shipping, fishing, and tourism, there is a subsequent need for robust and durable propeller shafts capable of withstanding harsh marine environments and operating conditions.

Regional Insights

North America dominated the propeller shaft market with a revenue share of 23.62% in 2023. The region is strongly pushing towards electric and hybrid vehicles, driven by stringent government emissions regulations and rising consumer preferences for fuel-efficient transportation options. Propeller shafts are important in these vehicles to transfer power from electric motors to wheels effectively, thereby supporting the expanding market for electric and hybrid drivetrains in the region.

U.S. Propeller Shaft Market Trends

The propeller shaft market in the U.S. is growing at a CAGR of 6.0% over the forecast period. The country has a robust automotive manufacturing base, with OEMs continuously investing in research and development to enhance vehicle performance and reduce environmental impact. This investment includes advancements in the lightweight materials and manufacturing processes for propeller shafts, which are crucial for achieving higher fuel efficiency and meeting regulatory standards.

Europe Propeller Shaft Market Trends

Europe propeller shaft market is growing at a CAGR of 5.6% from 2024 - 2030. The region has been at the forefront of promoting sustainable transportation solutions, leading to an increased adoption of electric and hybrid vehicles across major automotive markets. Propeller shafts play a critical role in these vehicles by optimizing power transmission efficiency and supporting the transition toward cleaner mobility options. These factors are likely to support the market growth over the coming years.

Asia Pacific Propeller Shaft Market Trends

The Propeller Shaft market in Asia Pacific is expected to grow at the highest CAGR over the forecast period. Asia Pacific is home to some of the largest automotive markets globally, including China, Japan, India, and South Korea. Rapid urbanization and rising disposable incomes drive increased vehicle ownership and production. With the rising vehicle production, the consumption of propeller shafts is further expected to increase, thereby boosting the market growth.

Key Propeller Shaft Company Insights

Some key players operating in the market include GKN Automotive Limited and Dana Limited.

-

GKN Automotive Limited is a leader in manufacturing driveline components and advanced ePowertrain technologies. The company offers various solutions under eDrive Systems, all-wheel & 4-wheel drive systems, and sideshafts & propshafts. It also provides aftermarket products and services to its customers. GKN Automotive Limited has 5 production sites and 2 remanufacturing sites spread across 6 countries.

-

Dana Limited, established in 1904 and headquartered in the U.S., is a leading designer and manufacturer of energy-management solutions and highly efficient propulsion systems for light vehicles, commercial vehicles, off-highway vehicles, and aftermarkets.

RSB Group and General Propeller Company are some of the emerging participants in the market.

-

General Propeller Company is a leading boat shaft producer and distributor to various boat manufacturers, including Correct Craft-Nautique, Hunter, Sea Ray, and Regal. The company has a vast product portfolio that includes propellers, seals for inboard shafts, inboard shafts/couplings, marine hardware, and propeller pullers.

-

RSB Group is an India-based manufacturer and distributor of aggregates and systems for passenger cars, farm equipment, construction equipment, and commercial vehicles. The company offers its products in the automotive, non-automotive, and aftermarket segments. Its product line includes propeller shafts, rear axles, suspension systems, gearboxes, front axles, bevel gearboxes, transmission components, planetary gearboxes, and others.

Key Propeller Shaft Companies:

The following are the leading companies in the propeller shaft market. These companies collectively hold the largest market share and dictate industry trends.

- GKN Automotive Limited

- Dana Limited

- RSB Group

- General Propeller Company

- Meritor, Inc.

- BRACEWELL MARINE GROUP

- Marine Techq

- Quality Pacific Manufacturing, Inc.

- Collins Aerospace

- Wheel Movers

Recent Developments

-

In April 2023, RSB Group announced the inauguration of its 13th state-of-the-art facility for manufacturing propeller shafts in Sri City, Andhra Pradesh. The 64,000-square-foot factory has high-end facilities expected to meet stringent quality requirements. This initiative will also allow the company to cater to customers in southern India.

Propeller Shaft Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.13 billion

Revenue forecast in 2030

USD 42.27 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Shaft type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

GKN Automotive Limited; Dana Limited; RSB Group; General Propeller Company; Meritor, Inc.; BRACEWELL MARINE GROUP; Marine Techq; Quality Pacific Manufacturing, Inc.; Collins Aerospace; Wheel Movers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Propeller Shaft Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global propeller shaft market based on shaft type, end use, and region:

-

Shaft Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Piece

-

Multi-piece

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Marine

-

Aerospace

-

Industrial Machinery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global propeller shaft market size was estimated at USD 28.51 billion in 2023 and is expected to reach USD 30.13 billion in 2024.

b. The global propeller shaft market is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030 to reach USD 42.27 billion by 2030.

b. Automotive segment accounted for the largest revenue share of over 56.0% in 2023. With the rise of electric and hybrid vehicles, there's a growing demand for efficient drivetrain components that can transfer power effectively from electric motors to wheels. Propeller shafts play a crucial role in this by ensuring smooth and reliable power transmission, thereby supporting the expanding market for electric and hybrid vehicles globally.

b. Some key players operating in the propeller shaft market include GKN Automotive Limited, Dana Limited, RSB Group, General Propeller Company, Meritor, Inc., BRACEWELL MARINE GROUP, Marine Techq, Quality Pacific Manufacturing, Inc., Collins Aerospace, Wheel Movers.

b. The key factors that are driving the market growth are the growing emphasis on energy efficiency and emissions reduction in the automotive and transportation sectors, encouraging manufacturers to adopt lighter and more efficient components like propeller shafts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.