- Home

- »

- Communication Services

- »

-

Procurement As A Service Market Size & Share Report, 2033GVR Report cover

![Procurement As A Service Market Size, Share & Trends Report]()

Procurement As A Service Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Strategic Sourcing, Spend Management, Process Management), By Enterprise Size (Large Enterprises, SMEs), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-121-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Procurement As A Service Market Summary

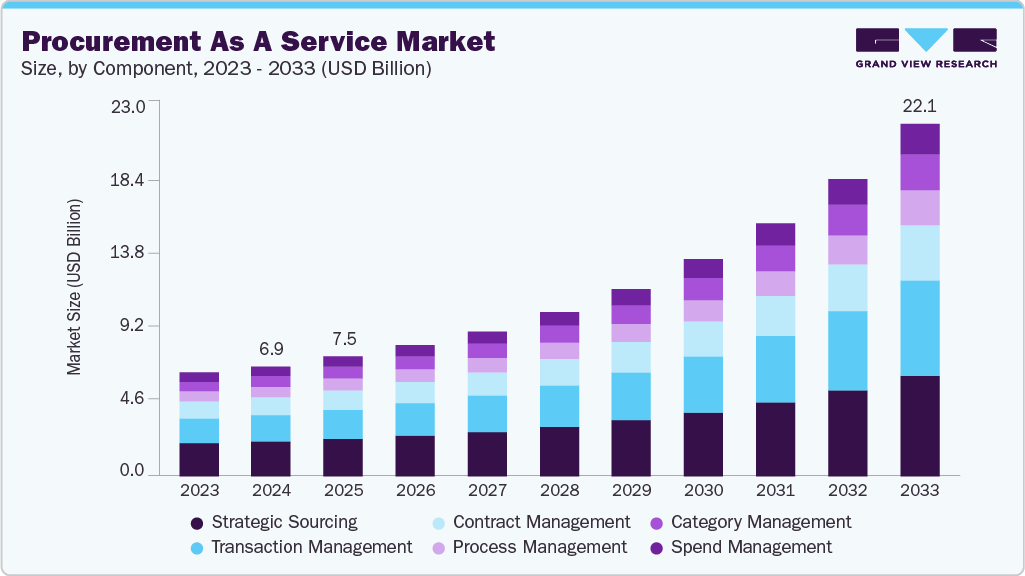

The global procurement as a service market size was estimated at USD 7.43 billion in 2025 and is projected to reach USD 16.48 billion by 2033, growing at a CAGR of 10.8% from 2026 to 2033. This is due to enterprises’ increasing focus on cost optimization, operational efficiency, and strategic sourcing amid volatile macroeconomic conditions.

Key Market Trends & Insights

- North America procurement as a service dominated the global market with the largest revenue share of 44.7% in 2025.

- The procurement as a service industry in the U.S. is expected to grow significantly over the forecast period.

- By component, strategic sourcing led the market and held the largest revenue share of 31.5% in 2025.

- By enterprise size, the large enterprises segment held the dominant position in the market and accounted for the largest revenue share in 2025.

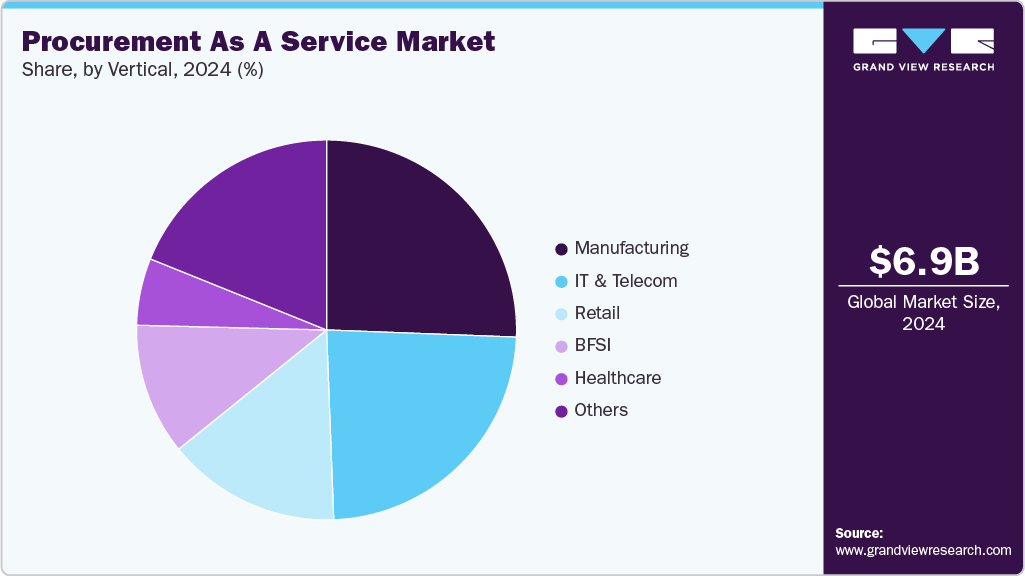

- By vertical, the IT & telecom segment is expected to grow at the fastest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 7.43 Billion

- 2033 Projected Market Size: USD 16.48 Billion

- CAGR (2026-2033): 10.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Organizations across industries are under sustained pressure to reduce procurement spend, improve supplier negotiations, and enhance compliance, while managing complex, globalized supply chains. By outsourcing procurement functions to specialized service providers, enterprises gain access to standardized processes, category expertise, and scalable operating models without the fixed costs associated with in-house procurement teams, making PaaS particularly attractive to mid-sized enterprises and cost-conscious large organizations.Moreover, the rising complexity of supplier ecosystems and the need for risk mitigation and resilience contribute to the growth of the procurement as a service industry. Geopolitical tensions, trade policy changes, supply disruptions, and sustainability mandates have exposed vulnerabilities in traditional procurement models. PaaS providers offer advanced supplier risk management, multi-vendor sourcing strategies, and real-time visibility across procurement workflows, enabling organizations to respond more effectively to disruptions. This is increasingly critical for industries such as manufacturing, BFSI, healthcare, and energy, where supply continuity and regulatory compliance are business-critical.

The accelerated adoption of digital procurement technologies is also fueling market growth. PaaS offerings are increasingly bundled with cloud-based platforms, AI-driven spend analytics, robotic process automation (RPA), and contract lifecycle management tools. These technologies enable data-driven decision-making, demand forecasting, and automated transactional procurement, improving cycle times and reducing errors. Enterprises lacking internal digital procurement capabilities are turning to PaaS providers to rapidly modernize procurement operations without significant upfront technology investments.

According to the Hackett Group’s April 2025 survey findings, procurement players expect AI to transform procurement roles is relevant to the Procurement as a Service (PaaS) market, as it highlights accelerating demand for AI-enabled, automated, and data-driven procurement capabilities. The insight reflects the technology expectations driving enterprises to adopt PaaS models, where service providers deliver advanced AI, analytics, and automation that many organizations cannot efficiently build in-house. This trend is reinforced by 2024 adoption patterns, where nearly half of procurement teams piloted generative AI, achieving up to 10% gains in productivity, quality, and cost savings, alongside growing use of embedded AI tools within procurement platforms, strengthening demand for technology-enabled, service-led procurement models.

Component Insights

The strategic sourcing segment dominated the market and accounted for the revenue share of 31.5% in 2025, driven by enterprises’ need to achieve sustainable cost optimization while managing increasingly complex and globalized supplier ecosystems. Organizations are under continuous pressure to reduce procurement spend without compromising quality, continuity, or compliance. Strategic sourcing providers leverage advanced spend analytics, supplier benchmarking, and category management expertise to identify savings opportunities beyond tactical price negotiations, such as demand rationalization, total cost of ownership optimization, and long-term supplier consolidation.

The transaction management segment is anticipated to grow at the highest CAGR during the forecast period, driven by enterprises’ growing need to streamline high-volume, repetitive procurement activities while reducing operational costs. Organizations across industries manage large numbers of purchase requisitions, purchase orders, goods receipt notes, and invoice processing tasks on a daily basis. Handling these activities in-house often leads to inefficiencies, manual errors, and higher administrative overhead. By outsourcing transaction management to specialized PaaS providers, enterprises can standardize processes, improve cycle times, and achieve predictable cost structures, making this segment particularly attractive for large enterprises and shared services environments.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for the largest revenue share in 2025, driven by the scale and complexity of procurement operations inherent to multinational and diversified organizations. Large enterprises manage extensive supplier networks, high procurement spend, and multi-category sourcing across regions, which increases the need for standardized, efficient, and compliant procurement processes. PaaS enables these organizations to centralize procurement governance while maintaining operational flexibility at the business-unit level. By leveraging external procurement expertise and established service delivery models, large enterprises can reduce process fragmentation, enhance spend visibility, and achieve greater control over enterprise-wide procurement activities.

The small & medium enterprises segment is expected to grow at a significant CAGR during the forecast period, driven by the need to access professional procurement capabilities without the cost and complexity of building in-house teams. SMEs typically operate with limited procurement expertise, fragmented processes, and lower bargaining power with suppliers. PaaS providers enable SMEs to leverage standardized procurement processes, category expertise, and supplier networks that would otherwise be difficult to develop internally. This allows SMEs to improve sourcing efficiency, ensure policy compliance, and achieve better pricing and terms, making PaaS an attractive model for enhancing procurement maturity.

Vertical Insights

The manufacturing segment dominated the market and accounted for the largest revenue share in 2025, driven by the inherent complexity and scale of procurement requirements across direct and indirect spend categories. Manufacturing organizations rely on a wide range of raw materials, components, capital equipment, and maintenance, repair, and operations (MRO) supplies to sustain continuous production. Managing this diverse supplier base while ensuring cost efficiency, quality, and on-time availability places significant strain on internal procurement functions. PaaS providers support manufacturers by standardizing procurement processes, improving spend visibility, and optimizing supplier management, thereby directly improving production efficiency and cost control.

The IT & telecom segment is expected to grow at a significant CAGR over the forecast period, driven by the rapid pace of technological change and the resulting complexity of procurement requirements. Organizations in this vertical must continuously source hardware, software, cloud services, network equipment, and specialized IT services while managing short product lifecycles and frequent technology upgrades. This dynamic environment increases the need for structured sourcing, vendor rationalization, and contract management. PaaS providers enable IT and telecom companies to manage multi-vendor ecosystems efficiently, standardize procurement processes, and maintain cost control across rapidly evolving technology categories.

Regional Insights

North America dominated the global market with the largest revenue share of 44.7% in 2025, driven by the growing focus on operational efficiency and digital transformation across industries. Organizations are increasingly outsourcing procurement functions to streamline costs, enhance compliance, and gain access to advanced analytics and automation tools.

U.S. Procurement As A Service Market Trends

The procurement as a service market in the U.S. is expected to grow significantly at a CAGR of 10.8% from 2026 to 2033, due to the demand for strategic sourcing and supplier risk management in complex, multi-tier supply chains. Enterprises are prioritizing spend optimization, regulatory compliance, and visibility into supplier performance, leveraging PaaS providers to address these challenges while reducing operational overhead.

Europe Procurement As A Service Market Trends

The procurement as a service market in Europe is anticipated to register considerable growth from 2026 to 2033 due to stringent regulatory compliance requirements and sustainability initiatives. Enterprises are seeking procurement services that ensure adherence to ESG standards, environmental regulations, and ethical sourcing practices. PaaS providers offering sustainable procurement solutions, carbon footprint tracking, and regulatory compliance support are gaining traction in this region.

The UK procurement as a service market is expected to grow rapidly in the coming years, owing the adoption of cost optimization and digital procurement frameworks among SMEs and large enterprises.

The Germany procurement as a service market held a substantial market share in 2025 due to the manufacturing and industrial sectors’ need for precision, efficiency, and integration of procurement with Industry 4.0 initiatives. Enterprises are outsourcing procurement to leverage specialized sourcing expertise, optimize MRO and raw material spend, and integrate automated workflows with production planning, enabling cost savings and operational reliability.

Asia Pacific Procurement As A Service Market Trends

Asia Pacific procurement as a service held a significant share in the global market in 2025, due to rapid industrialization and the expansion of global supply chains. Enterprises are adopting outsourced procurement to manage high transaction volumes, multi-supplier networks, and localized sourcing challenges while leveraging digital tools to improve procurement visibility and operational efficiency across diverse markets.

The Japan procurement as a service market is expected to grow rapidly in the coming years, driven by enterprises’ emphasis on supply chain resilience and risk mitigation. Companies are increasingly turning to procurement service providers to manage supplier diversification, reduce dependency on single-source suppliers, and implement automated transaction management systems that support high-quality, consistent operations.

The China procurement as a service market held a substantial market share in 2025, due to the rapid adoption of e-procurement platforms and the need for integrated digital procurement solutions. Enterprises are seeking services that combine advanced analytics, AI-driven sourcing recommendations, and seamless procure-to-pay workflows to optimize procurement spend, improve supplier collaboration, and scale operations in line with fast-growing domestic and export markets.

Key Procurement As A Service Market Company Insights

Key players operating in the procurement as a service industry are Accenture, Genpact, GEP, IBM Corporation, WNS (Holdings) Limited, and Infosys Limited. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In November 2025, Accenture joined forces with Essity and Microsoft in a strategic collaboration aimed at accelerating the deployment of AI agents across Essity’s global operations. The multi-year partnership will leverage Accenture’s expertise to help Essity unlock efficiencies, enhance agility, and drive growth. The collaboration aims to focus on optimizing procurement and finance functions, where cross-functional teams will test and refine AI-driven solutions.

-

In October 2025, Capgemini completed its acquisition of WNS, creating a global leader in Agentic AI-powered Intelligent Operations and significantly enhancing its global procurement and outsourcing capabilities. The acquisition strengthens Capgemini’s ability to deliver end-to-end digital procurement solutions, leveraging AI and data-driven automation to optimize sourcing, supplier management, and spend analytics. With an expanded global footprint, enhanced technology platforms, and advanced analytics capabilities, Capgemini is positioned to provide scalable, intelligent procurement services to multinational enterprises, reinforcing its leadership in the Procurement as a Service market and the broader intelligent operations landscape.

Key Procurement As A Service Companies:

The following key companies have been profiled for this study on the procurement as a service market.

- Accenture

- Aegis Components

- Capgemini

- Genpact

- GEP

- HCL Technologies Limited

- Infosys Limited

- IBM Corporation

- TATA Consultancy Services Limited

- Wipro

- WNS (Holdings) Limited

Procurement As A Service Market Report Scope

Report Attribute

Details

Market size in 2026

USD 8.05 billion

Revenue forecast in 2033

USD 16.48 billion

Growth rate

CAGR of 10.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, Enterprise Size, Vertical, and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Accenture; Aegis Components; Capgemini; Genpact; GEP; HCL Technologies Limited; Infosys Limited; IBM Corporation; TATA Consultancy Services Limited; Wipro; WNS (Holdings) Limited

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

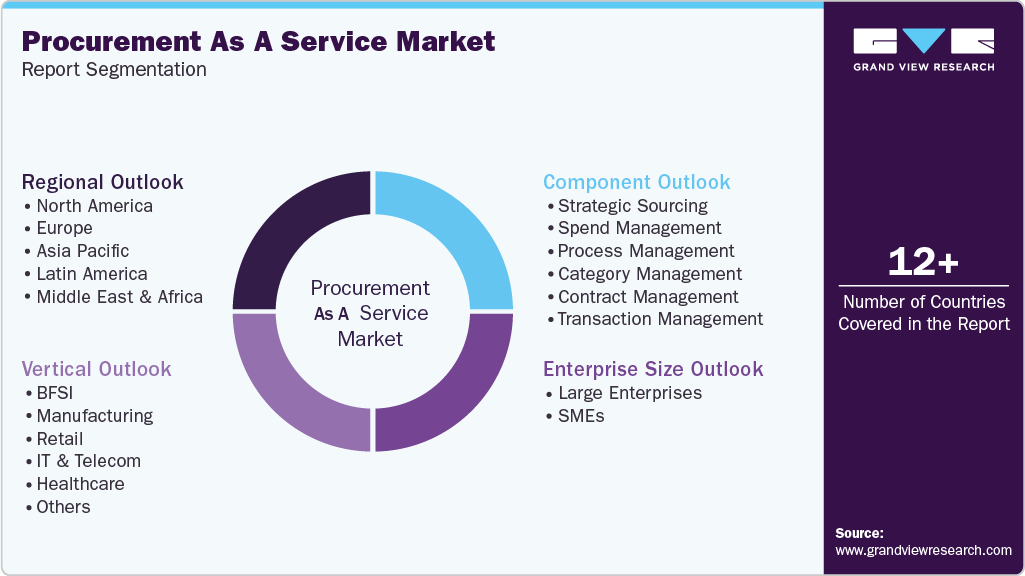

Global Procurement As A Service Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the procurement as a service market report based on component, enterprise size, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Strategic Sourcing

-

Spend Management

-

Process Management

-

Category Management

-

Contract Management

-

Transaction Management

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Manufacturing

-

Retail

-

IT & Telecom

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the global market with the largest revenue share of 44.7% in 2025, driven by the growing focus on operational efficiency and digital transformation across industries.

b. Some key players operating in the procurement as a service market include Accenture, Aegis Components, Capgemini, Genpact, GEP, HCL Technologies Limited, Infosys Limited, IBM Corporation, TATA Consultancy Services Limited, Wipro, and WNS (Holdings) Limited

b. Key factors driving the procurement as a service market growth include enterprises’ increasing focus on cost optimization, operational efficiency, and strategic sourcing amid volatile macroeconomic conditions. Organizations across industries are under sustained pressure to reduce procurement spend, improve supplier negotiations, and enhance compliance, while managing complex, globalized supply chains.

b. The global procurement as a service market size was estimated at 7.43 billion in 2025 and is expected to reach USD 8.05 billion in 2026.

b. The global procurement as a service market is expected to grow at a compound annual growth rate of 10.8% from 2026 to 2033 to reach USD 16.48 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.