- Home

- »

- Electronic Devices

- »

-

Printed Electronics Market Size, Share, Industry Report 2033GVR Report cover

![Printed Electronics Market Size, Share & Trends Report]()

Printed Electronics Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Ink, Substrate), By Technology (Inkjet, Screen, Gravure, Flexographic), By Device (Displays, RFID, Lighting, RFID), By Region, And Segment Forecasts

- Report ID: 978-1-68038-180-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Printed Electronics Market Summary

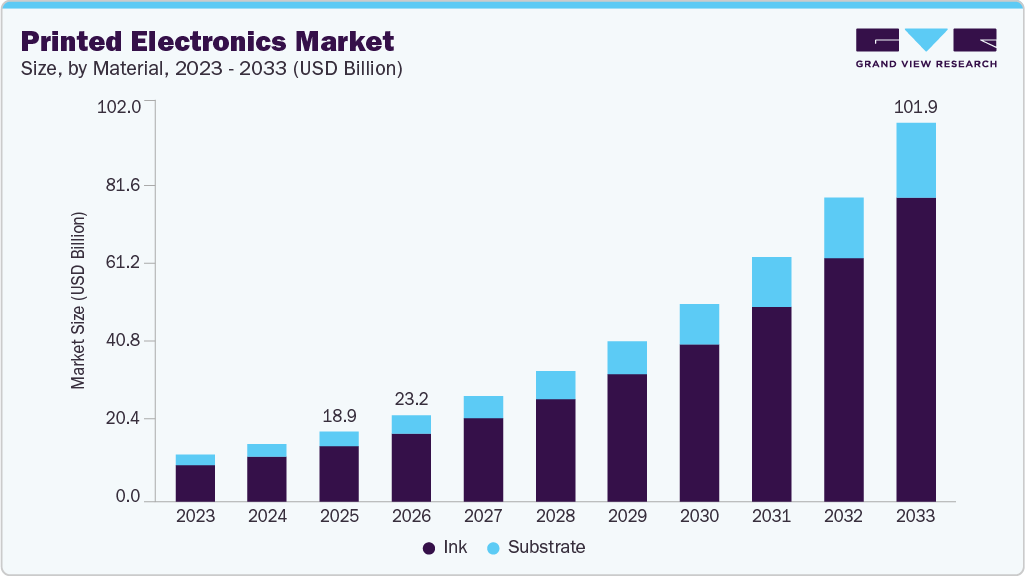

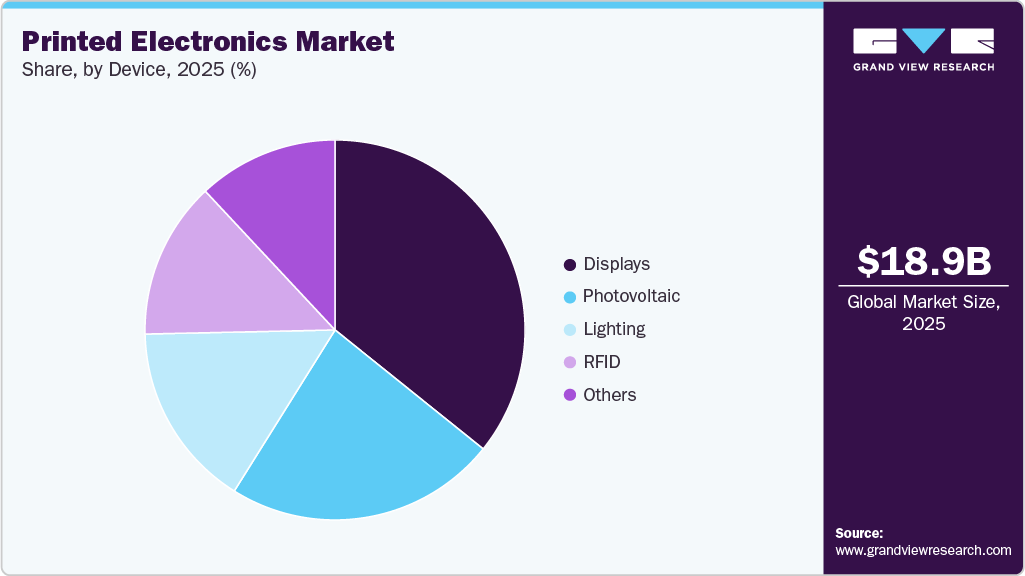

The global printed electronics market size was estimated at USD 18.98 billion in 2025 and is projected to reach USD 101.87 billion by 2033, growing at a CAGR of 23.5% from 2026 to 2033. The market is expanding as industries adopt cost-effective, lightweight, and flexible electronic components for applications in consumer electronics, automotive, healthcare, and smart packaging.

Key Market Trends & Insights

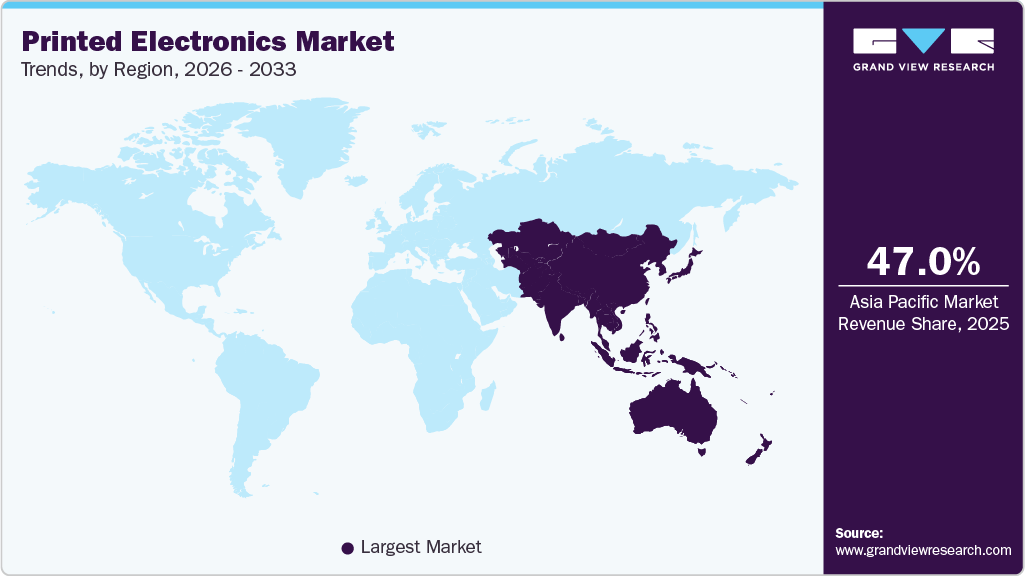

- The Asia Pacific printed electronics market held the largest revenue share of 47.0% in 2025.

- The U.S. printed electronics industry’s growth is driven by the rising demand for flexible electronics and ongoing innovation across consumer, healthcare, automotive, and packaging applications.

- By material, the ink segment held the largest revenue share of 78.8% in 2025.

- By technology, the screen segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 18.98 Billion

- 2033 Projected Market Size: USD 101.87 Billion

- CAGR (2026-2033): 23.5%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

The estimated escalation of the technology is attributed to its ability to be incorporated in a variety of dynamic application areas, such as the Internet of Things (IoT) and consumer electronics. The increasing penetration of IoT is providing several growth opportunities, widening the scope of printed electronics applications across the sector. In addition, the rising demand for advanced OLED displays and printed RFID devices is paving the way for increasing the adoption of the technology owing to its low production cost, higher efficiency, and low power consumption.

Printed electronics has been a significant research arena, focusing on continuous upgrades and improvements to enhance the existing abilities and explore more applications across various fields. Increased investments in R&D by various associations, organizations, and manufacturers over the last few decades have led to several benchmarking innovations and developments in this technology. The end-product manufacturers majorly include the producers of consumer electronics, such as IoT devices, smartphones, display devices, and other communication devices.

The manufacturers implement the technology into various products based on the necessity and supply to the distributors or retailers for sales purposes. The prominent players in the industry are focusing on mergers and acquisitions, as well as distribution partnerships, to establish a foothold in the emerging regional market. For instance, in November 2024, Henkel, Covestro, and Quad Industries announced a partnership to advance printed electronics for medical wearables, combining their expertise to accelerate customer developments and promote innovative stretchable electronic solutions for healthcare applications.

Material Insights

The ink segment led the printed electronics industry, accounting for the largest revenue share of 78.8% in 2025, as it provides the essential conductive, dielectric, and functional properties needed to create circuits, sensors, displays, and antennas on flexible substrates. Inks continue to dominate due to ongoing advancements in formulations, particularly those incorporating silver, carbon, and emerging graphene-based options, which offer improved conductivity, lower costs, and better compatibility with high-volume printing techniques, such as screen and inkjet processes. This strength supports broader adoption across consumer electronics, automotive, and healthcare applications, where demand for lightweight, bendable, and energy-efficient components drives steady growth in the overall market.

Moreover, this continuous innovation in high-performance ink materials is prompting key manufacturers to introduce advanced products to meet rising application requirements. For instance, in September 2024, NovaCentrix launched its Metalon Ultra ink line, starting with Metalon HPS-U11, which offers advanced silver nanoparticle formulations for high-precision printed electronics applications. This supports domestic manufacturing and enables fine-line printing across various sectors, including solar, displays, and medical devices.

The substrate segment is expected to register the fastest CAGR from 2026 to 2033. Printed electronics also extensively use flexible substrates. It lowers the cost of production and allows the fabrication of mechanically flexible circuits. The inkjet and screen-printing typically imprint rigid substrates like glass and silicon. In contrast, the mass-printing methods use flexible foil and paper. Polyethylene Terephthalate (PET) is the most commonly used material for substrates due to its low cost and high temperature stability.

Technology Insights

The screen segment accounted for the largest revenue share of the printed electronics market in 2025. This dominance is valued for its ability to deposit thick, uniform layers of conductive and functional inks on flexible substrates, which makes it ideal for producing sensors, displays, RFID tags, and membrane switches in high volumes. The market is driven by its cost-effectiveness, scalability, and compatibility with a wide range of materials. At the same time, it continues to show the fastest projected growth through 2033 as demand rises for lightweight, bendable electronics in automotive, healthcare, and consumer devices.

The inkjet segment is expected to grow at the fastest CAGR from 2026 to 2033. This technology drives cost savings through minimal material waste and high-precision patterning, fostering innovation across industries such as healthcare and consumer electronics, where adaptability and rapid prototyping are crucial. Furthermore, the adoption of advanced inkjet systems continues to accelerate as manufacturers seek scalable, sustainable, and high-resolution printing solutions. For instance, in August 2024, Elephantech launched its ELP04 industrial inkjet platform, which delivers faster and more resource-efficient printed electronics production, enabling manufacturers to create high-precision PCBs and components using metal nanoinks without conventional photolithography or etching processes.

Device Insights

The displays segment accounted for the largest share of the printed electronics market in 2025. This dominance stems from the technology's ability to produce cost-efficient, customizable panels with superior bendability and energy efficiency, meeting the growing demand for innovative products such as foldable smartphones and curved vehicle displays. For instance, in May 2025, Samsung Display showcased the advanced display R&D segment at Display Week in the U.S., presenting EL-QD and OLEDoS prototypes, sensor-integrated OLED technologies, and innovative form factors to establish its leadership in next-generation printed and flexible electronics.

The RFID segment is expected to register the fastest growth during the forecast period in the global printed electronics market, driven by its ability to deliver cost-effective, flexible solutions that seamlessly integrate into everyday applications, such as supply chain tracking and smart inventory management. These printed RFID tags, leveraging advanced ink formulations and roll-to-roll production techniques, offer unparalleled scalability and adaptability, enabling businesses to enhance operational efficiency without the rigidity of traditional silicon-based alternatives. This surge is particularly evident in sectors such as retail and logistics, where the demand for real-time visibility drives innovation and adoption.

Regional Insights

Asia Pacific printed electronics market accounted for the largest share of 47.0% in 2025, driven by its position as the world's leading hub for consumer electronics manufacturing and the rapid adoption of flexible, lightweight technologies in devices such as smartphones, wearables, and displays. Countries like China, Japan, South Korea, and Taiwan are at the forefront, supported by substantial investments in research and development, government initiatives that promote innovation, and a growing demand for cost-effective solutions in IoT applications, smart packaging, and automotive components.

The printed electronics market in China held a dominant share in 2025, driven by the country's dominant position in consumer electronics manufacturing and strong government support for advanced technologies. With a robust supply chain and significant investments in research and development, China leads the production of flexible displays, sensors, and conductive inks for applications in wearables, smart packaging, and automotive components. This leadership has encouraged major display manufacturers to showcase cutting-edge innovations and accelerate the commercialization of flexible printed electronics. For instance, in May 2023, TCL CSOT showcased over 30 advanced display products at SID Display Week in China, including the world’s first 65-inch 8K ink-jet printed flexible OLED. The launch highlighted innovations across OLED, Mini LED, Micro LED, and medical and automotive displays, emphasizing high-resolution, flexible printed electronics technology.

The Japan printed electronics market is expected to register the fastest CAGR from 2026 to 2033, driven by the country's leadership in advanced manufacturing and innovation in flexible and lightweight components. As of late 2025, the sector benefits from robust demand in consumer electronics, automotive displays, and wearable devices, where printed technologies enable cost-effective production of sensors, OLED panels, and RFID tags. Moreover, ongoing investments in R&D and collaborations among major firms are expected the boost market growth. This growth reflects a broader shift toward sustainable, low-power solutions that align well with national priorities in energy efficiency and high-tech exports.

North America Printed Electronics Market Trends

North America is anticipated to register significant growth from 2026 to 2033. This growth is driven by strong demand for flexible, lightweight, and cost-effective solutions across key sectors, including automotive, healthcare, and consumer electronics. Companies in the region are benefiting from ongoing investments in flexible hybrid electronics, wearable sensors, and smart packaging, which enable innovative applications like in-vehicle displays and medical monitoring tools. This momentum has encouraged major industry players to increase their regional commitments and accelerate the deployment of technology. For instance, in June 2024, Komori expanded its U.S. printed electronics initiative, appointing Doug Schardt to lead sales of printed electronics in North America. The company strengthened its investment after establishing Japan’s PE development center, targeting market growth and addressing supply-chain challenges with alternative manufacturing technologies.

U.S. Printed Electronics Market Trends

The U.S. printed electronics industry continues to expand steadily, driven by ongoing innovations in flexible and lightweight components that serve key sectors, including consumer devices, automotive systems, healthcare monitoring tools, and smart packaging solutions. Companies push forward with better conductive inks and printing methods to cut costs while boosting performance and sustainability, making these technologies more practical for everyday business needs. This progress has encouraged leading firms to form strategic alliances that further enhance production capabilities and technology reach. For instance, in April 2025, Ynvisible announced a global partnership with CCL Design, expanding manufacturing capacity across Asia, Europe, and the U.S. The agreement enabled scalable production of printed e-paper displays and broadened market access, accelerating adoption within the global printed electronics sector.

Europe Printed Electronics Market Trends

The printed electronics industry in Europe is anticipated to register significant growth from 2026 to 2033, fueled by innovations in flexible and lightweight components that are reshaping industries from automotive to healthcare. As manufacturers pivot toward sustainable, cost-effective solutions, the sector benefits from robust EU funding aimed at bolstering domestic production and reducing reliance on imports, particularly in sensor technologies and smart displays. Germany's leadership in integrating these electronics into electric vehicles and industrial automation exemplifies the region's forward momentum, even as global supply chain pressures introduce measured caution. According to a survey conducted by OE-A (Organic and Printed Electronics Association) in 2025, 77% of OE-A members anticipate growth this year, signaling steady optimism amid evolving demands for eco-friendly innovations. This perspective has encouraged companies across the region to intensify collaboration and accelerate commercialization efforts to meet rising market expectations.

The printed electronics market in Germany accounted for the largest share in 2025, driven by its strong industrial base, advanced research capabilities, and leadership in key applications, including automotive sensors, flexible displays, and smart packaging. The country benefits from major players like BASF and Henkel, as well as emerging innovators, alongside supportive government initiatives and clusters that foster innovation in conductive materials and printing technologies. This dynamic environment has prompted companies to actively demonstrate their latest technologies and strengthen industry partnerships. For instance, in February 2024, Covestro showcased smart film solutions in Germany’s one of the leading international exhibition and conference for Flexible, Organic, and Printed Electronics, LOPEC 2024, highlighting polycarbonate and TPU substrates for healthcare, automotive, and consumer electronics. The company emphasized collaboration-driven innovation and its role as an integrator supporting advanced flexible electronics manufacturing.

The UK printed electronics market is poised for significant growth from 2026 to 2033, fueled by strong demand for flexible and wearable technologies in healthcare monitoring devices, smart packaging, and consumer electronics. This surge is supported by ongoing investments in research and development, as well as collaborative efforts between universities and innovative firms, positioning the UK as a leading force in adopting advanced applications, such as sensors and displays. As the European market continues to benefit from broader trends toward lightweight and cost-effective electronic solutions, the country’s dynamic progress underscores its pivotal role in shaping the continent's printed electronics landscape.

Key Printed Electronics Company Insights

Key players operating in the printed electronics industry include Ynvisible Interactive Inc.; DuPont; and Optomec, Inc. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In October 2024, Henkel and Teca-Print, a manufacturer of high-precision pad printing machines, announced a strategic partnership to advance pad printing solutions for printed electronics. The collaboration provided seamless product recommendations, joint trials, and feasibility studies, spanning R&D to production, with a focus on applications in antennas, digital healthcare, 3D electronics, and smart mobility.

-

In May 2024, Komori Corporation and Yamagata University signed a comprehensive collaboration agreement to advance next-generation printed electronics. The partnership combined Yamagata University's materials expertise with Komori's printing technology, expanding from prior R&D in organic EL electrodes and flexible hybrid electronics to commercialization, human resource development, and facility sharing in Japan's leading printed electronics market.

-

In 2024, LITEON+ Technology and Japanese startup Elephantech signed an MOU to advance sustainable innovation in the printed electronics sector. The partnership integrated Elephantech's low-carbon Pure Additive method into LITEON's production of backlit keyboard modules for major laptop brands, targeting enhanced efficiency and reduced environmental impact in the Asia-Pacific region.

Key Printed Electronics Companies:

The following are the leading companies in the printed electronics market. These companies collectively hold the largest market share and dictate industry trends.

- Agfa-Gevaert Group

- BASF

- Canatu

- DuPont

- E INK HOLDINGS INC.

- Elephantech Inc.

- KURZ

- LG DISPLAY CO., LTD.

- Molex, LLC

- NovaCentrix

- Optomec, Inc.

- Ynvisible Interactive Inc.

Printed Electronics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 23.23 billion

Revenue forecast in 2033

USD 101.87 billion

Growth rate

CAGR of 23.5% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Material, technology, device, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

LG DISPLAY CO., LTD.; DuPont; BASF; Molex, LLC; E INK HOLDINGS INC.; NovaCentrix; Agfa-Gevaert Group; KURZ; Optomec, Inc.; Ynvisible Interactive Inc.; Elephantech Inc.; Canatu

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Technology and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Printed Electronics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the printed electronics market report based on material, technology, device, and region:

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Ink

-

Substrate

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Inkjet

-

Screen

-

Gravure

-

Flexographic

-

-

Device Outlook (Revenue, USD Billion, 2021 - 2033)

-

Displays

-

Photovoltaic

-

Lighting

-

RFID

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global printed electronics market size was estimated at USD 18.98 billion in 2025 and is expected to reach USD 23.22 million in 2026.

b. The global printed electronics market is expected to grow at a compound annual growth rate of 23.5% from 2026 to 2033 to reach USD 101.87 billion by 2033.

b. The ink segment dominated the printed electronics market in 2025 due to the high demand for conductive, flexible, and functional inks essential for fabricating sensors, displays, and wearable electronic devices, enabling cost-effective and scalable production of advanced printed electronic components.

b. Some key players operating in the market include LG DISPLAY CO., LTD., DuPont, BASF, Molex, LLC, E INK HOLDINGS INC., NovaCentrix, Agfa-Gevaert Group, KURZ, Optomec, Inc., Ynvisible Interactive Inc., Elephantech Inc., Canatu and others.

b. Factors such as the growing demand for flexible, low-cost, and lightweight electronic components, advancements in conductive and functional inks, and the rising adoption of wearable devices, smart packaging, and IoT applications play a key role in accelerating the printed electronics market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.