- Home

- »

- Clinical Diagnostics

- »

-

Preimplantation Genetic Testing Market Size Report, 2030GVR Report cover

![Preimplantation Genetic Testing Market Size, Share & Trends Report]()

Preimplantation Genetic Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Procedure, By Product (Reagents & Consumables, Instruments, Software), By Technology, By Application (X-linked Diseases, Embryo Testing), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-854-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Preimplantation Genetic Testing Market Summary

The global preimplantation genetic testing market size was estimated at USD 852.4 million in 2024 and is projected to reach USD 1,282.1 million by 2030, growing at a CAGR of 7.1% from 2025 to 2030. The growing prevalence of single-gene, mitochondrial, and other genetic disorders is expected to drive the demand for preimplantation diagnosis and screening processes.

Key Market Trends & Insights

- The Europe preimplantation genetic testing market dominated the global market in 2024, capturing the largest revenue share at 34.65%.

- Asia Pacific preimplantation genetic testing industry is anticipated to witness the fastest CAGR of 7.4% over the forecast period.

- By product type, the preimplantation genetic diagnosis segment dominated in 2024 and contributed 77.14% of the market share.

- By application, the aneuploidy screening segment dominated in 2024 and contributed 26.0% of the market share.

- By end-use, the hospital segment captured the largest revenue share, accounting for approximately 39.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 852.4 Million

- 2030 Projected Market Size: USD 1,282.1 Million

- CAGR (2025-2030): 7.1%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The Florida Department of Health reports that approximately one in every 33 babies in the U.S. is born with a congenital disability, impacting nearly 120,000 babies each year. With new tests being launched, the demand is expected to grow in the coming years. For instance, in July 2023, Thermo Fisher Scientific Inc. launched two tests based on NGS for preimplantation genetic testing-aneuploidy (PGT-A). Preimplantation Genetic Testing for Aneuploidy (PGT-A) is a widely used method in assisted reproductive technology (ART) to identify embryos with chromosomal abnormalities before transfer. Traditionally, PGT-A involves a biopsy of the developing embryo, typically on day five or six, by creating a small opening in the outer layer and removing a few cells. While effective, this invasive approach poses potential risks to embryo viability and implantation potential.

In recent years, the field has made a pivotal leap forward with the introduction of non-invasive PGT-A (niPGT-A). This breakthrough allows for the analysis of cell-free DNA (cfDNA) that embryos naturally release into the surrounding culture media during growth, eliminating the need for cell biopsy. This approach aims to maintain embryo integrity while still providing valuable genetic insights.

PerkinElmer PG-Seq Rapid Non-Invasive PGT-A Kit, designed specifically for cfDNA collected from embryo culture media. This kit builds upon the company’s earlier PG-Seq biopsy-based solution, offering a significantly faster three-hour sample preparation workflow, less than half the time compared to PG-Seq Kit 2.0. It can detect a range of chromosomal abnormalities, including aneuploidies, unbalanced translocations, and segmental changes. Data from a global collaboration of 15 IVF laboratories show a >90% concordance rate between niPGT-A and traditional PGT-A results, making it a powerful and less invasive option for embryo screening.

Also in July 2023, Thermo Fisher Scientific launched two new NGS-based research tools for preimplantation testing: the Ion ReproSeq PGT-A Kit and the Ion AmpliSeq Polyploidy Kit. Both kits are compatible with the Ion Torrent Genexus Integrated Sequencer, a fully automated platform that streamlines the IVF testing process by integrating templating, sequencing, and data analysis. When used together, these kits enhance diagnostic confidence by adding critical quality control features, including the ability to detect contamination and triploidy in embryos, further strengthening the reliability of PGT-A results.

Earlier, in September 2022, Eurofins Genoma, a leading European diagnostics laboratory, launched its own niPGT-A solution. Eurofins' approach uses cfDNA from the spent culture media and offers a complete genetic profile by capturing signals from both the inner cell mass and the trophectoderm. This ensures more representative data than limited biopsy samples. Eurofins, already recognized for its role in pioneering non-invasive prenatal testing (NIPT) in Italy, sees this launch as a major step in expanding its reproductive genetics portfolio.

Supporting these advancements is Esco Medical’s MIRI Time-Lapse Incubator, a key enabler of niPGT. This advanced incubator offers continuous time-lapse monitoring and controls environmental factors like temperature and pH using its specialized CultureCoin® dish. It allows embryologists to closely track morphokinetic development, enhancing embryo selection while maintaining ideal conditions for cfDNA analysis.

As infertility affects an estimated 17.5% of the global adult population (WHO, 2023), demand for safer, more accessible IVF solutions continues to rise. Non-invasive PGT-A offers a promising alternative to traditional methods, prioritizing both embryo viability and patient comfort, while opening new doors for broader clinical adoption in reproductive health.

Drivers, Opportunities & Restraints

The rising incidence of genetic diseases has fueled the demand for preimplantation genetic testing (PGT). With the increasing prevalence of genetic disorders, PGT has become crucial in IVF procedures. This testing helps identify and prevent the transfer of genetic abnormalities, enhancing the likelihood of successful pregnancies. Innovations like PGT-A and monogenic diseases (PGT-M) have further improved outcomes, reducing miscarriage rates and the risk of hereditary conditions. Consequently, the adoption of PGT is expected to grow, driven by its benefits in detecting and managing disorders effectively.

The increasing rate of infertility has significantly contributed to the rising demand for PGT in assisted reproductive technologies (ART). Infertility affects millions worldwide, with factors such as delayed childbearing, lifestyle changes, environmental influences, and underlying health conditions playing pivotal roles. As more couples seek solutions for infertility, in vitro fertilization (IVF) has emerged as a prominent method to achieve pregnancy. Within IVF, PGT plays a crucial role by ensuring the selection of genetically healthy embryos for implantation, thereby enhancing the chances of a successful pregnancy.

Preimplantation genetic testing, including PGT-A and PGT-M, helps identify chromosomal abnormalities and specific genetic disorders in embryos before implantation. This not only increases the likelihood of a successful pregnancy but also reduces the risk of miscarriage and genetic disorders in offspring. The ability of PGT to screen for genomic issues before pregnancy offers reassurance to couples facing infertility, providing them with better outcomes and fewer cycles needed to achieve pregnancy. Moreover, advancements in testing technologies have improved the accuracy and reliability of PGT, further driving its adoption. As infertility rates continue to rise, the utilization of PGT in ART is expected to grow, offering hope and solutions to those struggling with infertility.

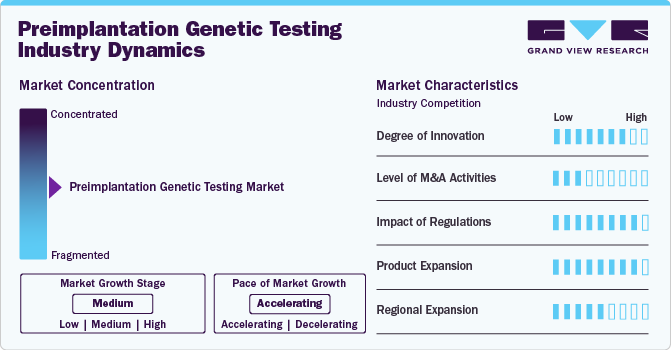

Market Concentration & Characteristics

The preimplantation genetic testing market has seen significant innovation, including advancements like PGT-A and PGT-M. These innovations improve accuracy, reduce risks, and enhance pregnancy success rates, driving market growth and offering better outcomes for individuals facing genetic and fertility challenges.

The market is characterized by the leading players with moderate levels of product launches and merger and acquisition (M&A) activity. Companies are consolidating to leverage advanced technologies, expand their market reach, and enhance their service offerings, driving growth and innovation within the industry and improving outcomes for patients seeking genetic and fertility solutions.

Regulation significantly impacts the preimplantation genetic testing industry, ensuring safety, efficacy, and ethical standards. Stringent regulatory frameworks guide the development and implementation of testing procedures, fostering trust among patients and practitioners. However, navigating complex regulations can also pose challenges for market entry and innovation, influencing the pace of technological advancements.

In the market for preimplantation genetic testing, product substitutes include traditional prenatal diagnostic methods such as amniocentesis and chorionic villus sampling (CVS). Unlike PGT, these methods test for genetic disorders after pregnancy has been established, potentially leading to difficult decisions if abnormalities are found. These substitutes offer alternative diagnostic options but do not provide the early intervention benefits of PGT.

The end user concentration factor is crucial for any manufacturer in the market space. The end user concentration is primarily high among fertility clinics, specialized reproductive health centers, and hospitals with advanced IVF facilities. These institutions adopt PGT to enhance pregnancy success rates and reduce genetic risks. Additionally, couples with a history of genetic disorders or infertility issues represent a significant portion of the end user demographic, driving the demand for these advanced diagnostic services.

Procedure Insights

The preimplantation genetic diagnosis segment dominated in 2024 and contributed 77.14% of the market share. Growing awareness among healthcare professionals and consumers about genetic testing for specific gene mutations is a key driver of the segment's growth. The increasing incidence of single-gene diseases and translocation cases, coupled with the effective implementation of NGS technology for genetic testing by market players, further propels this growth. PGD services enable the examination of embryos to identify specific gene mutations, helping to reduce the incidence of these diseases in newborns.

Conversely, PGS services focus on detecting chromosomal abnormalities in embryos. These services are recommended for couples of advanced reproductive age, those undergoing multiple IVF cycles, and those with a history of recurrent pregnancy loss. The PGS services segment is expected to experience significant growth during the forecast period due to rising demand and continuous advancements in IVF procedures. Additionally, the high number of IVF procedures conducted in well-equipped laboratories enhances the quality of PGS services, thereby driving further growth.

Product Insights

The reagents and consumables segment dominated the preimplantation genetic testing market and contributed 50.0% of the market share in 2024. The rising adoption of PGT in the IVF process is boosting the demand for reagents and consumables. Annually, more than 3.0 million IVF cycles are performed worldwide, resulting in over 700,000 deliveries using IVF. Additionally, the growing use of advanced testing technologies such as next-generation sequencing, polymerase chain reaction, and fluorescent in situ hybridization is expected to drive segment growth.

In 2024, the instruments segment held the second-largest share of the preimplantation genetic testing industry. Market players are actively developing novel testing instruments that provide high-accuracy results. Furthermore, the increasing number of hospitals and clinics offering IVF services is anticipated to increase the demand for advanced instruments to perform PGT on-site.

Technology Insights

The Polymerase Chain Reaction (PCR) segment dominated the preimplantation genetic testing industry and contributed 39.6% to the market share in 2024. High market penetration, cost-effectiveness, and the high accuracy of PCR tests are key factors supporting the segment's significant market share. PCR increases the likelihood of producing a large number of copies of a specific genome segment, enhancing the detection of chromosomal abnormalities. This technology is both specific and sensitive, making it suitable for various types of genetic diagnoses.

Next-generation sequencing (NGS) is projected to grow at the fastest CAGR during the forecast period. NGS tests offer superior accuracy compared to other methods and can sequence large amounts of DNA in a shorter time. Additionally, technological advancements have broadened the capabilities of NGS, enabling the detection of many more chromosomal abnormalities.

Application Insights

The aneuploidy screening segment dominated in 2024 and contributed 26.0% of the market share. Aneuploidy screening plays a crucial role in assessing embryo quality during IVF procedures. The growing adoption of aneuploidy screening and the introduction of new products are expected to propel segment growth. For instance, in June 2024, NxGen MDx launched the Fetal RhD test. The test works on their existing Non-Invasive Prenatal Screen platform. NxGen MDx's Non-Invasive Prenatal Screening (NIPS) assesses for common chromosomal abnormalities like Down syndrome (trisomy 21), trisomy 18, and trisomy 13, offering expanded options for aneuploidy and microdeletions detection as well.

In 2024, the HLA typing segment accounted for the second-largest market share. The use of PGT for embryo HLA typing, particularly for applications in stem cell therapy and related fields, significantly contributed to the segment's growth. This approach enhances the success of hematopoietic stem cell transplantation by utilizing genetically matched donors, which has been shown to improve survival rates compared to using unrelated donors.

End-use Insights

In 2024, the hospital segment captured the largest revenue share, accounting for approximately 39.3%. Factors driving this growth include high patient volume, enhanced healthcare infrastructure, and the availability of IVF services in both public and private hospitals. Couples seeking fertility treatments often choose hospitals due to their advanced technological capabilities. Additionally, increased research activities in hospitals are anticipated to boost testing rates within these settings. Looking ahead, the hospital segment is projected to exhibit the fastest growth in the coming years.

Fertility centers are expected to emerge as the most lucrative of all over the forecast period. Fertility centers are lucrative end users of PGT due to several key reasons. These centers specialize in assisted reproductive technologies, offering PGT to enhance the success rates of IVF procedures by selecting genetically healthy embryos. PGT helps mitigate the risk of genetic disorders in newborns, thereby increasing the confidence and satisfaction of patients. Additionally, fertility centers attract patients seeking advanced reproductive care, driving demand for PGT services. Their focus on cutting-edge technology and specialized expertise in reproductive health positions them as pivotal players in the market, contributing to the profitability and growth of PGT services.

Regional Insights

The Europe preimplantation genetic testing market dominated the global market in 2024, capturing the largest revenue share at 34.65%. The rising number of IVF procedures fuels this leadership due to increasing late pregnancies. Liberal regulations in several European countries regarding aneuploidy screening, coupled with the presence of robust market players and service providers, are expected to open up new avenues for growth in the European PGT market. Europe's strong position in the PGT market is further bolstered by favorable regulatory environments for aneuploidy screening and the presence of established market players and service providers. The region's healthcare infrastructure supports advanced reproductive technologies, including PGT, attracting patients seeking reliable fertility treatments. The increasing trend towards IVF procedures among older demographics underscores Europe's pivotal role, driven by demographic shifts and technological advancements. These factors collectively contribute to Europe's dominant revenue share and its potential for continued growth.

UK Preimplantation Genetic Testing Market Trends

The UK preimplantation genetic testing market is expected to witness significant growth over the forecast period. Supportive government policies and funding, along with a growing preference for personalized medicine and improved IVF success rates, also contribute to the market's growth.

The preimplantation genetic testing market in Germany is expected to grow over the forecast period. Improved public knowledge about genetic disorders and the benefits of PGT has encouraged more couples to opt for genetic testing.

North America Preimplantation Genetic Testing Market Trends

North America preimplantation genetic testing industry is expected to witness growth over the forecast period, due to the rising prevalence of various disorders. The increasing number of labs offering PGT, rising awareness, and high incidence of hereditary disorders and other diseases, such as PCOS and chlamydia, are other factors contributing to the regional growth.

U.S. Preimplantation Genetic Testing Market Trends

The preimplantation genetic testing (PGT) industry in the U.S. is growing due to increased awareness of hereditary disorders, advancements in reproductive technology, rising infertility rates, and a growing preference for personalized medicine. Additionally, supportive regulations and higher demand for in-vitro fertilization (IVF) procedures contribute to market expansion.

Asia Pacific Preimplantation Genetic Testing Market Trends

Asia Pacific preimplantation genetic testing industry is anticipated to witness the fastest CAGR of 7.4% over the forecast period. Advancements in reproductive technology and the growing accessibility to healthcare also contribute to the rising popularity of PGT in the region. China and Japan are major countries in the region that continue to create advancements in reproductive health, along with other healthcare disciplines. The high adoption rate of IVF translates into increased usage of PGT in this region, and increasing awareness levels among people are expected to boost revenue generation in the regional market. Moreover, emerging economies such as China & India, and the presence of regulatory bodies to monitor challenges associated with reproductive health, are expected to encourage the adoption of these services in this region in the near future.

The preimplantation genetic testing market in China is expected to grow over the forecast period due to the high burden of genetic diseases in China. With a large population and significant incidence of hereditary disorders, there is heightened demand for PGT to screen embryos and select those free of genetic mutations, thereby increasing chances of healthy births and reducing disease transmission.

The Japan preimplantation genetic testing market is expected to grow over the forecast period due the technological advancements and increased awareness. Innovations in genetic testing technologies enhance accuracy and reliability, while heightened public awareness encourages more couples to opt for PGT as part of assisted reproductive treatments, thus fostering market expansion.

Latin America Preimplantation Genetic Testing Market Trends

The Latin America preimplantation genetic testing industry is expected to grow substantially over the forecast period. Awareness is playing a pivotal role in driving the growth of the PGT market. As awareness of genetic disorders increases across the region, more individuals and couples are seeking proactive measures to mitigate risks during family planning.

The preimplantation genetic testing market in Brazil is expected to grow substantially over the forecast period. The entry of new providers and technologies into the Brazilian market for Preimplantation Genetic Testing (PGT) is instrumental in driving its growth. These new entrants bring advanced genomic technologies and methodologies that enhance accuracy and expand the range of conditions screened.

MEA Preimplantation Genetic Testing Market Trends

The MEA preimplantation genetic testing industry is estimated to grow significantly over the forecast period, due to the rising awareness of PGT, the importance of screening & diagnosis of genetic disorders, and a positive change in the perception and attitude regarding hereditary diseases.

The UAE preimplantation genetic testing market is growing. Social acceptance plays a pivotal role in the UAE. As attitudes towards advanced medical technologies and hereditary health evolve positively, there is increasing acceptance of PGT as a viable option for family planning among Emiratis and expatriates alike. This cultural shift is supported by a progressive healthcare infrastructure that promotes innovation and patient empowerment.

The preimplantation genetic testing market in Kuwait is expected to witness growth over the forecast period, driven by technological advancements. Advancements in hereditary testing technologies enhance the accuracy, reliability, and efficiency of PGT procedures, thereby improving outcomes for couples undergoing assisted reproductive treatments.

Key Preimplantation Genetic Testing Company Insights

Some of the key players operating in the market include Quest Diagnostics Incorporated; Natera, Inc.; and Illumina. Inc.

-

Illumina, Inc. primarily operates within the life sciences and biotechnology vertical. The company specializes in sequencing and genomics, providing advanced tools and technologies that enable researchers & professionals to analyze and decode DNA with exceptional accuracy & efficiency. Illumina’s innovations have broad applications in various industries, including healthcare, agriculture, and scientific research. It is a leading player in genomics and driving advancements in personalized medicine, genetic discovery, and more.

-

Quest Diagnostics Incorporated is a publicly owned medical diagnostics company that provides clinical testing services, such as gene-based & esoteric testing, routine testing, and drug-of-abuse testing. Its service portfolio includes anatomic pathology services & related services to healthcare providers, risk assessment services for life insurers, and others, as well as central laboratory testing for clinical trials. It has geographical presence in Mexico, India, Ireland, and the UK. Several international diagnostic laboratories, hospitals, and clinics are partners with the company.

GenEmbryomics, Color Health, Inc., and EasyDNA are some of the emerging companies in the preimplantation genetic testing (PGT) market.

-

Color Health, Inc. operates in healthcare technology and genomics verticals. The company delivers healthcare solutions that focus on genetics and genomics. Color Health also offers genetic testing and counseling services, leveraging the power of genetic information to provide insights into individuals’ health risks, including hereditary conditions and cancer predispositions.

-

EasyDNA primarily operates in genetic testing and diagnostics. The company offers various DNA testing services to individuals and organizations. Its services cover diverse areas, including paternity testing, ancestry & genealogy analysis, health & wellness insights, and forensic DNA testing. EasyDNA provides accessible and user-friendly testing solutions, enabling individuals to gain access to their genetic heritage, family relationships, and potential health-related factors.

Key Preimplantation Genetic Testing Companies:

The following are the leading companies in the preimplantation genetic testing market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics Incorporated

- Natera, Inc.

- COOPER SURGICAL, INC.

- Genea Pty Limited.

- Invitae Corporation

- Laboratory Corporation of America Holdings

- Thermo Fisher Scientific Inc.

- Bioarray S.L.

- Illumina, Inc.

- Igenomix

- RGI

- F. Hoffmann-La Roche Ltd

Recent Developments

-

In January 2024, Orchid Health announced the launch of the first commercially available whole genome sequencing service for specific diseases in preimplantation embryos.

-

In July 2023, Thermo Fisher Scientific Inc. introduced two new NGS-based research tools designed for PGT-A. These tools are specifically intended for use in in vitro fertilization (IVF) and intracytoplasmic sperm injection (ICSI) procedures. The Ion ReproSeq PGT-A Kit and Ion AmpliSeq Polyploidy Kit mark the debut of research-use reproductive health assays on the Ion Torrent Genexus Integrated Sequencer.

-

In December 2023, Progenesis inaugurated its Genetic Laboratory in New Delhi and an AI & Bioinformatics Data Centre in Chennai. The event drew health experts, highlighting Progenesis's commitment to genetic solutions, particularly in the field of in vitro fertilization (IVF).

Preimplantation Genetic Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 909.11 million

Revenue forecast in 2030

USD 1.28 billion

Growth rate

CAGR of 7.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure, product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Quest Diagnostics Incorporated; Natera, Inc.; COOPER SURGICAL, INC.; Genea Pty Limited.; Invitae Corporation; Laboratory Corporation of America Holdings; Thermo Fisher Scientific Inc.; Bioarray S.L., Illumina, Inc.; Igenomix, RGI; F. Hoffmann-La Roche Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Preimplantation Genetic Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global preimplantation genetic testing market report based on procedure, product, technology, application, end-use, and region:

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Preimplantation Genetic Screening

-

Preimplantation Genetic Diagnosis

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents and Consumables

-

Instruments

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Next Generation Sequencing (NGS)

-

Polymerase Chain Reaction (PCR)

-

Fluorescent In-Situ Hybridization (FISH)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chromosomal Abnormalities

-

X-linked Diseases

-

Embryo Testing

-

Aneuploidy Screening

- HLA Typing

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Fertility Centers

-

Hospitals

-

Diagnostic Centers

-

Research Centers and Academic Labs

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global preimplantation genetic testing market size was estimated at USD 852.35 million in 2024 and is expected to reach USD 909.11 million in 2025.

b. The global preimplantation genetic testing market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2030, reaching USD 1.28 billion by 2030.

b. Aneuploidy screening dominated the preimplantation genetic testing market with a revenue share of 26.0% in 2024 and is projected to grow at the fastest rate over the forecast period. The aneuploidy screening is mostly used to determine embryo quality in IVF.

b. Some key players operating in the preimplantation genetic testing market include Illumina Inc.; Thermo Fisher Scientific, Inc.; Natera, Inc.; Bioarray S.L.; Good Start Genetics, Inc.; Laboratory Corporation of America Holdings; California Pacific Medical Center; Quest Diagnostics Incorporated; Reproductive Health Science Ltd.; CooperSurgical, Inc.; Genea Limited; F. Hoffmann-La Roche AG; and CombiMatrix.

b. Key factors that are driving the market growth include worldwide increase in number of IVF cycles and integration of preimplantation genetic testing in IVF procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.