- Home

- »

- Healthcare IT

- »

-

Pregnancy Tracking And Postpartum Care Apps Market Report, 2030GVR Report cover

![Pregnancy Tracking And Postpartum Care Apps Market Size, Share & Trends Report]()

Pregnancy Tracking And Postpartum Care Apps Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Pre-partum, Post-partum), By Device (Smartphones, Tablets, Others), By Platform, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-004-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pregnancy Tracking And Postpartum Care Apps Market Summary

The global pregnancy tracking and postpartum care apps market size was estimated at USD 217.3 million in 2022 and is projected to reach USD 874.8 million by 2030, growing at a CAGR of 19.1% from 2023 to 2030. The rapidly growing health consciousness amongst females, proactive development of women’s health technology solutions, rise in digital literacy coupled with improved internet connectivity, and the emergence of femtech entrepreneurial ventures are boosting the market growth.

Key Market Trends & Insights

- North America dominated the global pregnancy tracking and postpartum care apps market with the largest revenue share of 37.9% in 2022.

- Asia Pacific is anticipated to register the fastest growth rate over the forecast period.

- By application, the pre-partum segment led the market with the largest revenue share of 59.9% in 2022.

- By device, the smartphones segment led the market with the largest revenue share of 67.2% in 2022.

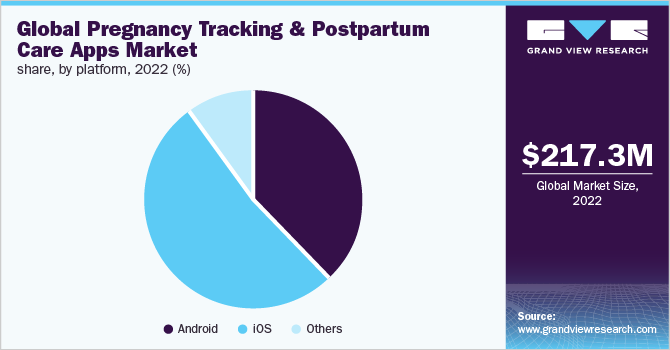

- By platform, the android segment is expected to register at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 217.3 Million

- 2030 Projected Market Size: USD 874.8 Million

- CAGR (2023-2030): 19.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

As per a FemTech Revolution article published in 2020, digital women's health startups witnessed a significant surge of 105% in funding & investments in 2020, while there were approximately 50 new femtech firms founded in 2020-21.

The growing awareness of digital healthcare followed by the essential needs of pregnant women is supporting market innovation. Innovators are utilizing various mobile platforms to deliver quality women’s health solutions, which would help them track their health & well-being, receive informational content on multiple health issues, and obtain answers to medical inquiries. Well-established companies in the women’s health market are offering pregnancy care management and fetal & infant development solutions coupled with educational content verified by renowned healthcare professionals. These companies focus on enhancing user engagement and generating awareness through their product/application offerings.

Mobile applications for smartphones have made life easier by making it convenient to monitor women’s health during and after pregnancy. With the easy availability of technologically advanced devices and increasing adoption of smartphones, innovators have started investing to make the most of the current situation of the industry, by focusing on delivering quality women’s health solutions through various mobile platforms, which would help pregnant women track their symptoms, record fetal development, avail educational content, network with other pregnant women, track contraction patterns, and avail other pre-partum and post-partum care services. Moreover, advancements in internet connectivity have significantly boosted the adoption of telehealth and telemedicine services in multiple verticals of healthcare. Key players in the market are rapidly integrating advanced telehealth solutions and offering users virtual care solutions for pregnancy care management.

Health apps catering to women’s health have been gaining popularity in recent years. Various studies supporting their benefits, increasing awareness, and the rising penetration of health apps in various geographies, are some of the factors boosting adoption. An increasing number of applications catering to specific issues of women, such as fertility, pregnancy tracking & post-partum care, and fitness & nutrition has led to a rise in the number of users of such apps around the world. Moreover, apps available in the market are constantly upgrading or newer apps are being launched, which provide a detailed analysis of the user’s health. The perception of women regarding pregnancy tracking and post-partum care apps is changing due to constant research demonstrating their use and growing awareness regarding these applications in+ the healthcare community & patients. For instance, according to a 2019 study published in Frontiers, apps supporting infant feeding practices and early prevention of childhood obesity were quite common in pregnant women.

The global female population is increasingly becoming aware and health conscious, which is driving the demand for innovative digital solutions catering to their unmet health needs. Public awareness, the emergence of entrepreneurial startups addressing women’s health, growing funding & recognition, and the normalizing of women’s health issues are boosting the industry. Early movers addressing these prominent white spaces could focus on developing solutions to serve underserved communities in emerging economies & low-income countries.

The growing healthcare demands of the women population across the globe are driving tech developers to develop applications that can majorly foster feelings of self-awareness, self-assessment, and empowerment. According to 2021 Pulsar TRAC estimates, approximately 61.4% of the health tech developers are developing digital health applications to address women’s health issues. Technological advancement is the core of the digital women’s healthcare market, evolving on the foundation of electronic medical records, analytics, mobile applications, AI, and cloud computing technologies.

The COVID-19 pandemic had a positive impact on the market. Women’s digital health solutions witnessed significant spikes in the adoption rate and recorded a dramatic rise in the number of users. Female communities across the globe were using femtech applications in maintaining a healthy lifestyle and well-being. For instance, a study was published in the Maternal and Child Health Journal in 2021, which analyzed the impact of COVID-19 on pregnancy distress and the utilization as well as the adoption of mobile apps by pregnant women during the pandemic. As per the results, around 77.9% of respondents reported using pregnancy-related mobile apps during the pandemic. This signifies that digital health technologies for women gained traction during the pandemic.

Application Insights

In 2022, pre-partum application segment dominated the market and accounted for the largest revenue share of 59.9%. Growing health consciousness and awareness towards available digital health technologies amongst the female population is driving the market growth. App developers are offering social networking features, pregnancy tracking, product/service recommendations, fetal development tracking, fitness & exercise regime recommendations, and educational content. Among all the prevalent health issues faced by females, maternal mortality is a rapidly growing concern across the globe, especially in emerging and underdeveloped economies.

According to Bill & Melinda Gates Foundation in 2020, the maternal mortality rate was recorded at 152 per 100,000 live births across the globe. Due to the high maternal mortality rate, mobile application developers are innovating pregnancy tracking and postpartum care applications, which provide verified medical content to pregnant mothers and offer virtual care solutions. For example, Bonzun offers virtual midwife solutions through telemedicine & teleconsultation services to pregnant mothers. Similarly, Ovia Health’s Ovia Pregnancy and Glow Inc.’s Nurture offer personalized solutions to monitor fetal development and provide emergency healthcare professional contact.

As women can now plan their pregnancy via digital tools, they can also monitor their pregnancy phases. The women’s health technology has not only limited itself to reproductive health but has also ventured into pregnancy monitoring that helped pregnant women to track their own health and their fetus’ health in real time.

On the other hand, post-partum care application is anticipated to register the fastest growth rate over the forecast period. The growing prevalence of post-partum depression amongst females is driving the demand for this application. As per Translational Psychiatry estimates, in October 2021, the prevalence of post-partum depression amongst the global female population was 17.22%. The increasing demand for postpartum apps is attracting investment from individuals and investors. In March 2019, Babyscripts received an investment of USD 500,000 from Inova Health System. Babyscripts provides a mobile app for assisting women with postpartum and prenatal care, along with remote monitoring technology.

Device Insights

In 2022, smartphones dominated the market and accounted for the largest revenue share of 67.2%. This significant dominance is attributable to the rapidly rising penetration of smartphones across the globe. As per BankMyCell.com estimates, in November 2022, there are over 6.64 billion smartphone users across the globe accounting for approximately 83.3% of the world’s population, and is expected to reach 7.33 billion users by 2025. In the U.S. the smartphone penetration in the female population is 75% in 2022. Evolving technology in the industry coupled with growing health consciousness amongst the female population is driving the adoption rate of smartphones to monitor & track pregnancy and avail post-partum care.

On the other hand, the others segment is anticipated to register the fastest growth rate over the forecast period. According to Pew Research Center, in June 2019, around 21% of individuals in the U.S. use a wearable device. Furthermore, 31% of respondents belonging to the household income group of USD 75,000 or above per year owned wearable devices, which dramatically dwindles down to a mere 12% of users belonging to the household income group of USD 30,000 or less per year. The increasing prevalence of women’s health issues and growing health consciousness among female users are driving the adoption of wearables. Mobile phone integration, longer battery life, and wireless connectivity are some of the key features that users seek in wearable devices. Gamification, predictive analytics, and cloud synchronization are some of the significant innovations in wearable technology.

Platform Insights

In 2022, the iOS platform segment dominated the market and accounted for the largest revenue share of 52.4% owing to the growing adoption rate of iOS devices in recent years. According to Demand Sage estimates in 2022, approximately 2.2 billion iPhone units were sold and there are over 1.2 billion iPhone users globally. Pregnancy tracking and post-partum care apps developed for iOS devices are capable of providing contraction tracker, symptom tracker, fetal & infant development tracker, social networking of pregnant females, and informational content. Some of the key applications developed in this segment for iOS devices are Pregnancy+, Ovia Pregnancy Tracker, Glow Nurture Pregnancy, Hello Belly Pregnancy Tracker, Move Your Bump, and Baby2Body.

On the other hand, the Android platform segment is anticipated to register the fastest growth rate over the forecast period. Pregnancy tracking and pre-partum & post-partum care management applications for Android-run smartphones are gaining popularity over the past years. The rising penetration of smartphones and improving internet connectivity are the key driving forces responsible for the lucrative growth of the Android platform segment. According to Business of Apps estimates, in 2022 there are over 2.5 billion Android users in 190 countries globally.

Regional Insights

In 2022, North America accounted for the largest revenue share of 37.9% in the market. Widespread healthcare digitalization coupled with rising smartphone ownership rates and enhanced internet coverage is driving the demand for women’s health-related smart solutions. As per BankMyCell.com estimates, in 2019, there were approximately 288 million active smartphone users in North America. Rising healthcare spending and the increasing need for improved pregnancy tracking and post-partum care management are among the factors responsible for the growth of the North American market. Increasing per capita expenditure on healthcare is another factor likely to drive the market.

According to CDC National Center for Health Statistics, the per capita national health expenditure was about USD 12,530 in 2020. In addition, favorable government initiatives and increasing healthcare IT spending & advancing digital health infrastructure are among the factors driving the market growth.

On the other hand, Asia Pacific is anticipated to register the fastest growth rate over the forecast period. Growing demand for effective health technology, advancing digital infrastructure, increasing healthcare IT expenditure, and rising smartphone penetration is responsible for the Asia Pacific market growth. As per BankMyCell.com estimates, in 2019, there were approximately 1.7 billion active smartphone users in Asia Pacific. Government authorities are undertaking initiatives to promote the development of digital health solutions in the region by supporting 4G & 5G network infrastructure development and planning digital health technology roadmaps to attract private stakeholders. The market growth is further supported by the rising incidence of pregnancy-related complications in women. In addition, rising disposable income and growing R&D activities in this region are among the factors expected to have a positive impact on market growth.

Key Companies & Market Share Insights

The pregnancy tracking and postpartum care apps market is fragmented in nature with renowned market names such as Glow & Ovia and several femtech entrepreneurial ventures serving different women’s health needs. Rising demand to cater to unmet women’s health needs is boosting key participants to focus on their product development strategies and develop innovative digital solutions. Application developers are focusing on enhancing user engagement by incorporating user-friendly and super-intuitive interfaces in their apps’ algorithms.

In addition, established players are developing their apps in multiple languages to expand their clientele across the globe. For instance, Flo Health Inc. launched Flo a menstrual and pregnancy tracking app in 22 languages. The app allows users to track pregnancies and monitor fetal development and offers personalized daily informational content. Furthermore, companies are venturing into developing solutions addressing post-partum depression. Some of the prominent players in the global pregnancy tracking and postpartum care apps market include:

-

Contraction Timer

-

Ovia

-

Glow Nurture

-

Hypnobirthing: Calm Birth

-

Baby2Body

-

Hello Baby

-

Pregnancy Tracker

-

Baby Bump

-

Pregnancy +

Pregnancy Tracking And Postpartum Care Apps Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 257.6 million

Revenue forecast in 2030

USD 874.8 million

Growth rate

CAGR of 19.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, device, platform, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Russia; Denmark; Finland; Iceland; Norway; Sweden; Japan; China; India; Australia; South Korea; Singapore; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Contraction Tracker; Ovia; Glow Nurture; Hypnobirthing: Calm Birth; Baby2Body; Hello Baby; Pregnancy Tracker; Baby Bump; Pregnancy+

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pregnancy Tracking And Postpartum Care Apps Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global pregnancy tracking and postpartum care apps market report based on application, device, platform, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Pre-partum

-

Post-partum

-

-

Device Outlook (Revenue, USD Million, 2017 - 2030)

-

Smartphones

-

Tablets

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Android

-

iOS

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Finland

-

Iceland

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pregnancy tracking and postpartum care apps market size was estimated at USD 217.3 million in 2022 and is expected to reach USD 257.6 million in 2023.

b. The global pregnancy tracking and postpartum care apps market is expected to grow at a compound annual growth rate of 19.1% from 2023 to 2030 to reach USD 874.8 million by 2030.

b. North America dominated the pregnancy tracking and postpartum care apps market with a share of 37.9% in 2022. Widespread healthcare digitalization coupled with rising smartphone ownership rates and enhanced internet coverage is driving the demand for women’s health-related smart solutions.

b. Some key players operating in the pregnancy tracking and postpartum care apps market include Contraction Tracker; Ovia; Glow Nurture; Hypnobirthing: Calm Birth; Baby2Body; Hello Baby; Pregnancy Tracker; Baby Bump and Pregnancy+.

b. Key factors that are driving the market growth include increasing health consciousness amongst females, proactively developing women’s health technology solutions, rising digital literacy coupled with improved internet connectivity, and emergence of femtech entrepreneurial ventures is boosting the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.