- Home

- »

- Medical Devices

- »

-

Precision Medicine Supply Chain Logistics Market Report, 2030GVR Report cover

![Precision Medicine Supply Chain Logistics Market Size, Share & Trends Report]()

Precision Medicine Supply Chain Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Clinical), By Service (Transportation), By Temperature Range, By Application (Oncology, Cardiology), By Product, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-559-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

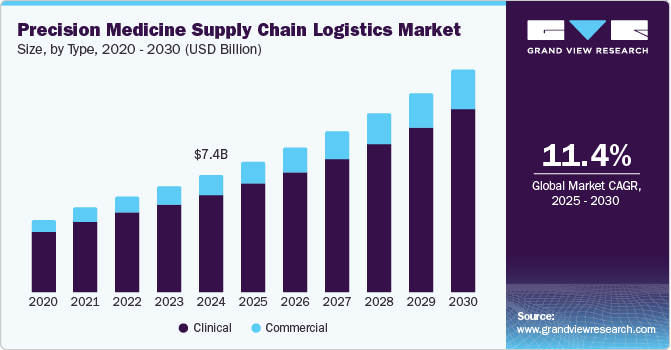

The global precision medicine supply chain logistics market size was estimated at USD 7.42 billion in 2024 and is projected to grow at a CAGR of 11.36% from 2025 to 2030. The growth is mainly due to the rising demand for personalized therapies, the expansion of clinical trials for precision medicine, the increasing prevalence of chronic diseases and genetic disorders, technological advancements in logistics such as AI, blockchain, and IoT, and the rising importance of regulatory compliance and safety standards.

Furthermore, the growing number of clinical trials focused on precision medicine is also driving the market growth. These trials often involve a complex network of biological materials, requiring precise logistics and transport solutions to maintain their integrity. Biopharma companies are conducting more personalized trials for diverse therapeutic areas such as oncology, genetic disorders, and neurology, leading to an increasing demand for customized supply chain solutions. Precision medicine trials require special handling and tracking of samples, and the complexity of these trials requires logistics providers that can manage intricate requirements. Shipping and storing biological samples, such as blood or tissue, at controlled temperatures or under other specific conditions ensures regulatory compliance and optimal trial results. This trend is further fueled by increasing investment in personalized medicine and the rapid expansion of research efforts to develop innovative therapies.

The rising prevalence of chronic diseases and genetic disorders is also one of the factors driving the precision medicine supply chain logistics industry’s growth. Personalized treatments are increasingly being used to manage conditions such as cancer, cardiovascular diseases, diabetes, and rare genetic disorders. This shift toward precision medicine aims to improve treatment efficacy by tailoring therapies to individual genetic profiles. As more patients are diagnosed with chronic conditions that benefit from personalized medicine, the demand for targeted treatments and, consequently, the need for specialized logistics grows. Biologics, immunotherapies, and gene therapies, often used in the treatment of these diseases, require specific handling to maintain their therapeutic efficacy.

Opportunity Analysis

The market presents significant opportunities driven by several evolving trends in the healthcare and logistics sectors. As the demand for personalized therapies and targeted treatments increases, the need for specialized logistics services capable of handling complex and sensitive biological materials, such as gene therapies, biologics, and cell-based treatments, grows rapidly. This creates a lucrative opportunity for logistics providers to offer innovative solutions, such as temperature-controlled transport, real-time tracking, and customized packaging.

In addition, the integration of innovative technologies such as AI, IoT, and blockchain into the supply chain process opens up new opportunities for logistics companies to enhance efficiency, security, and transparency, creating a competitive edge. As regulatory requirements for safe transport and the handling of these products continue to tighten, logistics providers with expertise in navigating complex compliance standards will be in high demand.

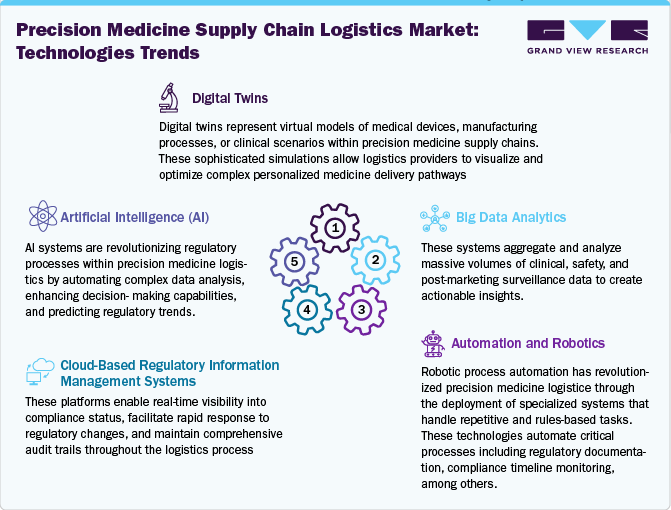

Technological Advancements

Technological innovation has transformed the precision medicine supply chain logistics market through complementary and integrated platforms that address the unique challenges of personalized medicine distribution. Digital twins, big data analytics, automation systems, cloud-based regulatory platforms, and artificial intelligence solutions work together to create proper supply chain ecosystems capable of maintaining product integrity, ensuring regulatory compliance, and delivering life-saving treatments precisely to the patients.

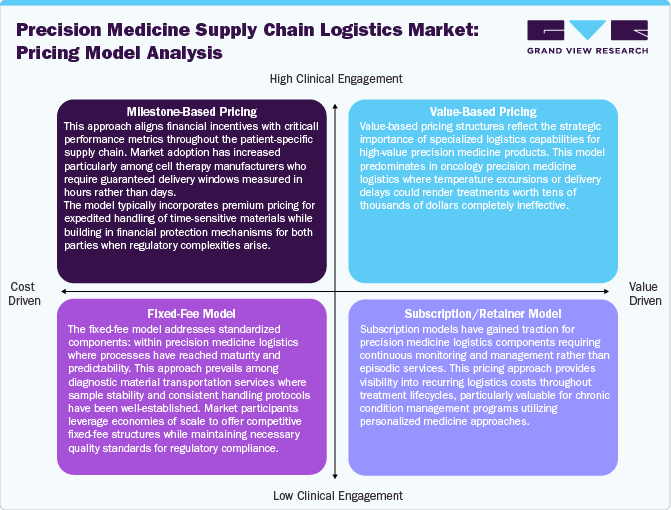

Pricing Analysis

The precision medicine supply chain logistics industry employs four distinct pricing strategies tailored to the unique demands of personalized healthcare delivery. Milestone-based pricing links payments to regulatory achievements, benefiting companies managing complex product registrations across multiple jurisdictions. Value-based pricing reflects the strategic importance of specialized logistics capabilities for high-value treatments where quality directly impacts therapeutic outcomes. Fixed-fee models provide budgetary certainty for standardized, repeatable logistics activities, particularly appealing to organizations with mature product portfolios.

Subscription models deliver continuous compliance support through recurring payment structures, enabling ongoing access to specialized expertise without project-based interactions. Market leaders increasingly blend these approaches to create customized pricing solutions that address the complex requirements of different precision medicine applications.

Market Concentration & Characteristics

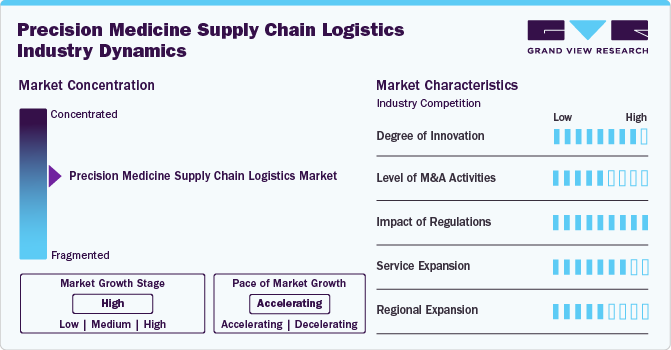

The market is experiencing high innovation, particularly in the areas of cold chain logistics, real-time tracking technologies, and AI-powered predictive analytics. These innovations enable better management of time-sensitive deliveries, improving the accuracy of shipments, and ensuring the integrity of temperature-sensitive products.

Companies are increasingly engaging in mergers and acquisitions to expand their service offerings, integrate advanced technologies, and strengthen their global supply chains. This trend is largely driven by the need for comprehensive logistics solutions to support the growing demand for personalized medicine and biologics.

Service expansion is a key trend, with logistics providers diversifying into specialized services such as temperature-controlled transportation, customized packaging solutions, and advanced warehousing facilities. The expanding need for precision medicine logistics led companies to offer more integrated solutions to meet the unique demands of personalized medicine supply chains.

Many regional expansions are taking place, especially in emerging markets such as Asia Pacific, Latin America, and the Middle East. These regions are witnessing increasing investments in healthcare infrastructure, fueling the demand for efficient and specialized logistics services for precision medicine.

Type Insights

The clinical segment captured the highest revenue share of the precision medicine supply chain logistics industry in 2024. The growth of the segment is due to the growing number of cell and gene therapy clinical trials worldwide. The increasing complexity of early-stage research, coupled with stringent regulatory requirements, is driving demand for specialized logistics solutions to support trial site distribution, sample collection, and real-time temperature monitoring.

The commercial segment is projected to experience the fastest CAGR over the forecast period, due to the increasing number of regulatory approvals and market launches of personalized therapies. As more treatments transition from clinical trials to commercialization, the demand for specialized logistics services is rising to ensure seamless global distribution.

Service Insights

The transportation segment dominated the market with the largest revenue share in 2024. The segment growth can be attributed to the increasing demand for time-sensitive and temperature-controlled deliveries. As personalized medicine and biologics continue to grow, the need for specialized transportation solutions, such as cold chain logistics, is accelerating the market revenue stream. The growth is also fueled by advancements in logistics technologies, ensuring faster, more secure deliveries across global supply chains.

The warehousing segment is projected to witness a lucrative CAGR during the forecast period. The growth of the segment is mainly attributed toincreasing demand for specialized storage solutions required for precision medicine and biologics. As personalized treatments become more widespread, the need for secure, temperature-controlled storage facilities, such as cold chain warehouses, is growing. Innovations in inventory management, including automation and real-time tracking, are further enhancing the efficiency and scalability of warehousing operations.

Temperature Range Insights

The ambient storage segment dominated the market in 2024, driven by the rising adoption of temperature-stable biologics and oral targeted therapies. Unlike cold chain or ultra-cold chain logistics, ambient storage offers greater operational flexibility, reduced costs, and ease of use. This makes it particularly suitable for the growing volume of precision medicine products that do not require refrigeration. The segment growth is further accelerated by increasing demand for oral oncology drugs that retain efficacy at room temperature. Advancements in robust packaging technologies and real-time temperature monitoring have strengthened ambient supply chain logistics demand. In addition, emerging markets are increasingly adopting ambient storage solutions due to infrastructure feasibility and cost-efficiency.

The refrigerated storage segment is projected to witness the fastest CAGR from 2025 to 2030. The growth is driven due to the growing demand for temperature-sensitive products, particularly in the field of precision medicine. As personalized treatments and therapies become more prevalent, the need for precise storage solutions to maintain the integrity of biological samples, vaccines, and other temperature-sensitive products increases, thereby witnessing lucrative segment growth potential in the near future.

Application Insights

The oncology segment dominated the market in 2024. The growth can be attributed to the rapid advancements in cancer treatments and the increasing global prevalence of cancer. This dominance is primarily attributed to the significant rise in targeted therapies, immunotherapies, and personalized treatment options. According to the data published by the American Cancer Society (ACS) in 2024, the U.S. is expected to report over 2 million cases of cancer in 2024. Thus, the growing cases of cancer are driving the adoption of advanced therapies, including immunotherapy and personalized medicine, which is fostering further growth in the oncology treatment market.

The neurology segment is projected to grow at a lucrative CAGR during the forecast period. The growth of the segment is driven by the rising prevalence of neurological disorders such as Alzheimer's, Parkinson's, and multiple sclerosis. The aging population, coupled with advancements in diagnostic technologies like neuroimaging and molecular diagnostics, is further boosting segmental growth.

Product Insights

The Cell & Gene Therapies (CGT) segment dominated the market with a revenue share in 2024. The growth of the market segment is mainly driven by breakthroughs in the development of personalized medicine, increased investment in research and development, and advancements in gene editing technologies like CRISPR. The ability of cell and gene therapies to address previously untreatable diseases, such as certain types of cancer, genetic disorders, and autoimmune conditions, is a major driver of market expansion.

The nucleic acid therapies segment is projected to grow at a lucrative CAGR during the forecast period. The growth is due to the increasing demand for these advanced therapies. Growing demand for specialized logistics solutions for nucleic acid therapies to minimize the unique challenges associated with these treatments. These therapies require stringent temperature controls, rapid distribution, and precise tracking to maintain their integrity and efficacy. The logistics sector must adapt by investing in advanced cold chain technologies, real-time monitoring systems, and flexible distribution networks to meet the rising demands of the nucleic acid therapeutics market.

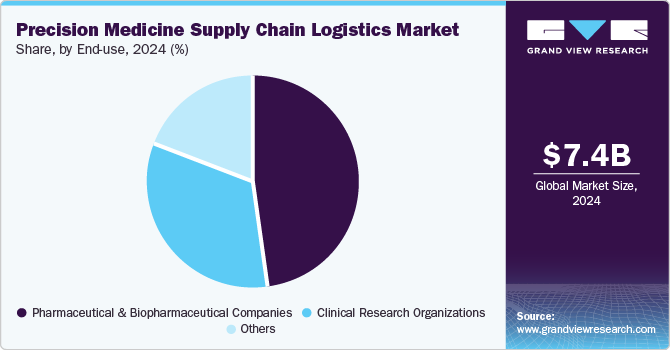

End-use Insights

The pharmaceutical and biopharmaceutical companies segment dominated the market in 2024. The growth of the segment is due to the increasing focus on personalized therapies, including cell and gene therapies, mRNA-based treatments, and other high-value biologics. These companies rely heavily on specialized logistics partners to manage temperature-sensitive transportation, real-time tracking, and regulatory-compliant distribution networks. As the pipeline of precision medicine candidates continues to expand, biopharma firms are increasingly outsourcing logistics operations to ensure quality, scalability, and timely delivery of patient-specific therapies.

The clinical research organizations segment is projected to witness the fastest CAGR during the forecast period. The growth of the segment is mainly due to the rising demand for outsourced manufacturing of complex biologics, cell and gene therapies, and personalized medicines. As these therapies require stringent cold chain handling and rapid turnaround times, the clinical research organizations are increasingly partnering with specialized logistics providers to ensure compliant, end-to-end delivery solutions.

Regional Insights

North America precision medicine supply chain logistics industry accounted for the largest revenue share of 38.04% in 2024, due to its advanced healthcare infrastructure and established cold chain networks that support the complex demands of precision medicine logistics. The region benefits from a high concentration of precision medicine developers, especially in the field of cell and gene therapies, driving increased demand for specialized transportation, real-time monitoring, and ultra-cold storage solutions.

U.S. Precision Medicine Supply Chain Logistics Market Trends

The growth of the precision medicine supply chain logistics industry in the U.S. is driven by the country’s highly developed regulatory landscape, such as the U.S. Food and Drug Administration (FDA), Good Distribution Practice (GDP), and Good Manufacturing Practice (GMP) that mandates strict cold chain compliance. In addition, rising pharmaceutical exports and increased outsourcing of logistics operations to specialized providers are further accelerating the market growth.

Europe Precision Medicine Supply Chain Logistics Market Trends

The precision medicine supply chain logistics industry in Europeis experiencing growth. The region has seen rising investments in GDP-compliant cold storage facilities and last-mile delivery solutions that support sensitive and high-value therapies. The European Medicines Agency (EMA) enforces strict compliance guidelines, encouraging logistics providers to adopt real-time temperature monitoring systems and proactive risk mitigation strategies.

The precision medicine supply chain logistics market in the UK held a significant share in 2024. The country’s market growth is supported by a strong pharmaceutical supply chain and high demand for cold chain logistics due to an active biotech and vaccine sector. The impact of Brexit has added complexity to cross-border movement, making cold chain efficiency and traceability even more critical.

The France precision medicine supply chain logistics market is driven due to the growing biologics and vaccine production sector, with government-backed pharmaceutical manufacturing and R&D initiatives increasing the need for specialized logistics infrastructure.

The precision medicine supply chain logistics market in Germany is anticipated to grow due to a strong biopharma base and expanding CGT clinical trials. The country’s well-developed cold chain infrastructure, combined with EU regulatory standards, is aiding sustained investment in precision logistics.

Asia Pacific Precision Medicine Supply Chain Logistics Market Trends

The Asia Pacific precision medicine supply chain logistics industry is projected to grow at the fastest CAGR over the forecast period. The rise in pharmaceutical manufacturing, vaccine exports, and increasing demand for biologics and CGT support market growth. The region is witnessing large-scale investment in temperature-controlled warehouses, IoT-based tracking systems, and express cold chain transportation tailored for personalized therapies.

The precision medicine supply chain logistics market in China is expected to grow over the forecast period. The country’s growth is due to the rapid development of cold storage and refrigerated transport infrastructure to meet the rising demand for high-precision treatments. Government regulations are also tightening around pharmaceutical cold chain compliance, further boosting investment in GDP-certified logistics.

Japan precision medicine supply chain logistics market is expected to witness significant growth over the forecast period. The country’s growth is due to advanced regulatory compliance, demand for regenerative medicine, and a highly developed cold chain. The country features robotic cold storage, AI-driven logistics systems, and RFID-based tracking, making it one of the most advanced markets for precision medicine logistics.

The precision medicine supply chain logistics market in India is projected to register considerable growth over the forecast period, due to the increasing government support. The government’s "Make in India" initiative is accelerating the development of domestic cold chain infrastructure.

Latin America Precision Medicine Supply Chain Logistics Market Trends

The Latin America precision medicine supply chain logistics industry is projected to grow over the forecast period. The growth in the region is due to increasing pharmaceutical imports and expanding healthcare access. Countries like Brazil are leading investments in cold storage and refrigerated transportation. Challenges such as infrastructure gaps, regulatory variations, and high logistics costs are pushing providers to adopt cost-effective, region-specific cold chain strategies.

The precision medicine supply chain logistics market in Brazil is expected to grow over the forecast period. The country has a rapidly expanding biologics and vaccine distribution network, necessitating better cold chain storage and compliance-driven logistics solutions. Regulatory reforms and increased pharmaceutical trade agreements are enhancing international logistics operations.

Key Precision Medicine Supply Chain Logistics Company Insights

Key players operating in the precision medicine supply chain logistics market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Key strategies include geographic expansions, strategic partnerships, service innovation, and acquisitions aimed at strengthening regulatory expertise and global reach. These efforts support the compliance needs of pharmaceutical, biotechnology, and medical device companies and drive overall market growth by improving service delivery across diverse regulatory environments.

Key Precision Medicine Supply Chain Logistics Companies:

The following are the leading companies in the precision medicine supply chain logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Almac Group

- Catalent, Inc

- Parexel International

- IQVIA

- Thermo Fisher Scientific

- DHL

- FedEx

- UPS Healthcare

- GXO Logistics

- Marken

Recent Developments

-

In March 2025, DHL announced the acquisition of Cryopdpto enhance its services in the life sciences and healthcare sector. Cryopdp specializes in shipping, storage, and packaging for pharmaceutical and biotech companies. This move aims to strengthen DHL's supply chain services.

-

In June 2024, DHL announced the expansion of its specialized logistics services for the life sciences and healthcare sector in France through a long-term strategic partnership with Sanofi. The collaboration includes warehousing, inventory management, picking and packing, and order fulfillment across three key sites in France.

Precision Medicine Supply Chain Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.24 billion

Revenue forecast in 2030

USD 14.12 billion

Growth rate

CAGR of 11.36% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, temperature range, application, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Japan; China; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Almac Group; Catalent, Inc.; Parexel International; IQVIA; Thermo Fisher Scientific; DHL; FedEx; UPS Healthcare; GXO Logistics; Marken

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Medicine Supply Chain Logistics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the precision medicine supply chain logistics market report based on type, service, temperature range, application, product, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical

-

Commercial

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Air Freight

-

Sea Freight

-

Overland

-

-

Warehousing

-

Sourcing & Procurement

-

Others

-

-

Temperature Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ambient Storage

-

Refrigerated Storage

-

Ultra-Low Temperature Storage

-

Cryogenic Storage

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Cardiology

-

Neurology

-

Infectious Diseases

-

Rare Diseases

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cell & Gene Therapies (CGT)

-

Monoclonal Antibodies

-

Nucleic Acid Therapies

-

Vaccines

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Clinical Research Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global precision medicine supply chain logistics market size was estimated at USD 7.42 billion in 2024 and is expected to reach USD 8.24 billion in 2025.

b. The global precision medicine supply chain logistics market is expected to grow at a compound annual growth rate of 11.36% from 2025 to 2030 to reach USD 14.12 billion by 2030.

b. North America dominated the precision medicine supply chain logistics market with a share of 38.1% in 2024. This is attributable due to its advanced healthcare infrastructure and established cold chain networks that support the complex demands of precision medicine logistics.

b. Some key players operating in the precision medicine supply chain logistics market include Almac Group, Catalent, Inc, Parexel International, IQVIA, Thermo Fisher Scientific, DHL, FedEx, UPS Healthcare, GXO Logistics, Marken

b. Key factors that are driving the market growth include growing demand for personalized therapies, the expansion of clinical trials for precision medicine, the increasing prevalence of chronic diseases and genetic disorders, technological advancements in logistics such as AI, blockchain, and IoT, and the rising importance of regulatory compliance and safety standards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.