- Home

- »

- Next Generation Technologies

- »

-

Precision Harvesting Market Size, Industry Report, 2030GVR Report cover

![Precision Harvesting Market Size, Share & Trends Report]()

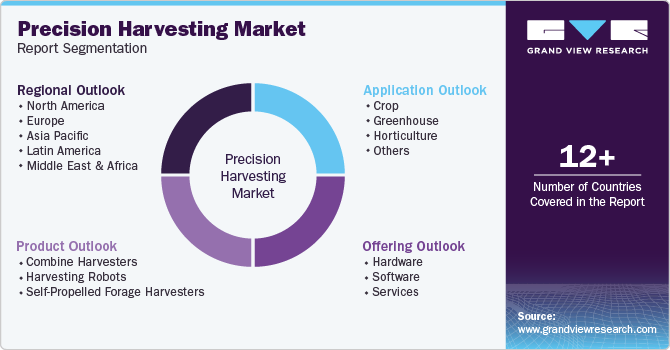

Precision Harvesting Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Crop, Greenhouse, Horticulture), By Product (Combine Harvesters, Harvesting Robots, Self-Propelled Forage Harvesters), By Offering, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-414-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Harvesting Market Summary

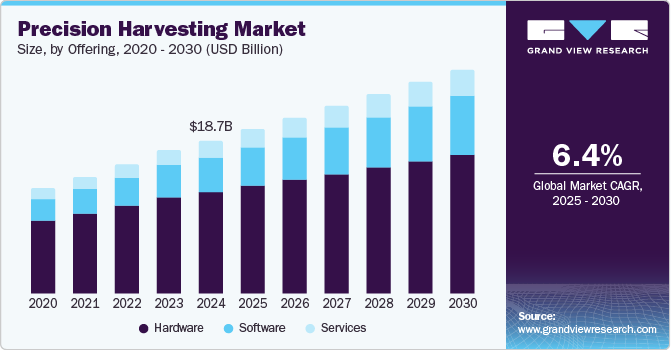

The global precision harvesting market size was valued at USD 18.68 billion in 2024 and is anticipated to reach USD 27.41 billion by 2030, growing at a CAGR of 6.4% from 2025 to 2030. This growth can be attributed to the increasing adoption of harvesting robots and autonomous combine harvesters, which address labor shortages in agriculture.

Key Market Trends & Insights

- The North America precision harvesting market dominated the global market with a revenue share of 43.6% in 2024.

- The U.S. precision harvesting market dominated the regional market in 2024.

- By product, the combine harvesters segment dominated the market in 2024.

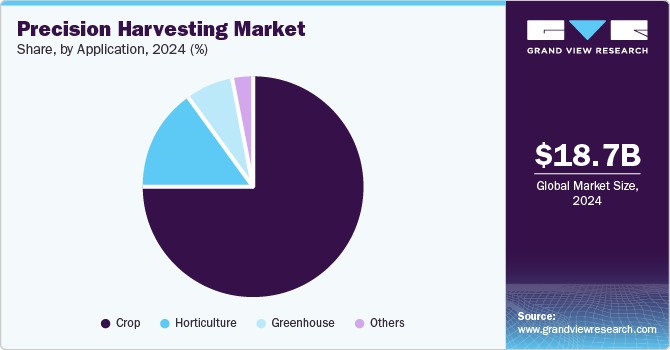

- By application, the crop segment dominated the market with a 75.5% share in 2024.

- By offering, the hardware segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.68 Billion

- 2030 Projected Market Size: USD 27.41 Billion

- CAGR (2025-2030): 6.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These technologies improve operational efficiency, enable precise harvesting techniques, and reduce wastage, leading to higher crop yields. The rising demand for high crop yields due to population growth and food security concerns drives the precision harvesting industry. To meet these demands, farmers are increasingly turning to advanced technologies. Moreover, precision harvesting solutions help optimize processes, improving crop quality and profitability. With urbanization intensifying pressure on agricultural systems, the need for efficient solutions becomes even more critical.

Furthermore, technological advancements and innovations such as GPS systems, yield monitoring sensors, and automated machinery transform traditional farming into more efficient, data-driven operations. These technologies enhance accuracy and enable real-time crop health monitoring, leading to higher yields. As these innovations become more accessible and affordable, their adoption is expected to rise.

Ultimately, the convergence of agricultural mechanization, labor efficiency, and technological innovation presents a promising future for the market. Manufacturers heavily invest in research and development to create solutions that meet market demands while promoting sustainable practices. Moreover, the ongoing integration of IoT and data analytics into farming is set to redefine productivity, ensuring the continued relevance of precision harvesting technologies.

Product Insights

The combine harvesters segment dominated the market in 2024. This growth is driven by the increasing demand for efficient agricultural machinery that enhances productivity and reduces labor costs. In addition, the widespread adoption of versatile wheel-type combine harvesters, effective in various field conditions, has further solidified this segment's position. With farmers seeking innovative solutions to maximize yields, the combine harvesters segment is expected to maintain its strong presence in the precision harvesting industry in the coming years.

The harvesting robots segment is anticipated to witness the highest CAGR during the forecast period. This growth can be attributed to the rapid advancements in autonomous technology and the increasing demand for automation in agriculture. With labor shortages becoming more pronounced, harvesting robots offer efficient solutions that enhance productivity and reduce reliance on manual labor. In addition, the growing emphasis on sustainable farming practices fuels the adoption of these technologies, as they contribute to improved crop management and reduced environmental impact.

Application Insights

The crop segment dominated the market with a 75.5% share in 2024. This dominance is due to the rising demand for efficient harvesting solutions in agriculture, with farmers increasingly adopting precision harvesting technologies to enhance productivity and improve crop yields. Moreover, the trend toward sustainable farming practices further supports the growth of this segment. Hence, the crop segment is expected to continue leading the market in the forecast years.

The greenhouse segment is anticipated to witness the highest CAGR during the forecast period. This growth can be attributed to the increasing adoption of smart greenhouse technologies, which enhance efficiency and optimize plant growth through automation and data analytics. With sustainable agriculture practices gaining traction, the demand for controlled environment agriculture is expected to rise significantly. In addition, innovations in IoT and AI technology are transforming greenhouse operations, further contributing to the segment's rapid expansion and driving market growth.

Offering Insights

The hardware segment held the largest market share in 2024. This growth is attributable to the increasing use of advanced agricultural machinery and equipment to improve operational efficiency. The growing adoption of precision farming technologies has accelerated the demand for hardware solutions supporting automation and data analytics. In addition, ongoing advancements in hardware design are reshaping farming practices and playing a key role in expanding the precision harvesting industry.

The hardware segment is further segmented into automation & control system, sensing devices, and others. The automation and control system segment held the largest market share in 2024. This dominance is due to the increasing need for efficient agricultural practices that enhance productivity and reduce resource waste. In addition, automation and control systems use advanced technologies such as sensors, drones, and data analytics, allowing farmers to optimize irrigation, fertilization, and pest management. With the agriculture sector facing labor shortages and rising food demand, these systems play a crucial role in modernizing farming operations. Therefore, the segment is expected to continue leading the market in the study period.

The sensing devices segment is anticipated to witness the highest CAGR during the forecast period. This growth can be attributed to the increasing adoption of advanced agricultural technologies that enhance productivity and efficiency. Sensing devices provide real-time data on critical factors such as soil moisture, temperature, and crop health, enabling farmers to make informed decisions. With the growing demand for sustainable farming practices, these devices are crucial in optimizing resource use and improving crop yields. Hence, the sensing devices segment is expected to become a key growth driver.

The software segment is anticipated to witness the highest CAGR during the forecast period. This growth is expected to be driven by the increasing need for data-driven agricultural decision-making, with farmers seeking to enhance productivity and efficiency. The adoption of farm management software enables farmers to analyze real-time data related to crop health, soil conditions, and weather patterns, facilitating informed agricultural practices. Furthermore, the growing emphasis on sustainable farming methods encourages the integration of advanced software solutions that optimize resource management and reduce environmental impact.

Regional Insights

The North America precision harvesting market dominated the global market with a revenue share of 43.6% in 2024. This growth can be attributed to the early adoption of advanced agricultural technologies and significant investments in research and development. The region benefits from a robust technological infrastructure and supportive government policies that encourage innovation in farming practices. In addition, the increasing demand for efficient and sustainable agricultural solutions further strengthens the region's position in the precision harvesting sector. Consequently, North America is expected to maintain its dominance in the forecast years.

U.S. Precision Harvesting Market Trends

The U.S. precision harvesting market dominated the regional market in 2024. This dominance can be attributed to advanced agricultural practices, significant technological investments, and favorable government policies. In addition, the presence of large-scale farms, a robust research ecosystem, and access to cutting-edge machinery further enable efficient precision harvesting. With increasing emphasis on sustainable farming and the growing demand for improved crop yields, the U.S. is expected to maintain its leading position in the regional precision harvesting industry in the coming years.

Europe Precision Harvesting Market Trends

The Europe precision harvesting market held a significant market share in 2024. This strong position can be attributed to the increasing adoption of advanced agricultural technologies and innovative farming practices across the region. In addition, European farmers are increasingly focused on improving efficiency and sustainability, which drives demand for precision harvesting solutions. Moreover, supportive government initiatives and funding programs to enhance agricultural productivity further contribute to growth. Hence, Europe is expected to witness sustained growth during the study period.

Asia Pacific Precision Harvesting Market Trends

The Asia Pacific precision harvesting market is anticipated to witness the highest CAGR during the forecast period. This growth can be attributed to the increasing urbanization and a growing population, which are driving food consumption in the region. In addition, technological advancements and the shift toward sustainable agriculture encourage the adoption of precision harvesting solutions. Moreover, financial incentives and training programs are being introduced to support farmers in adopting modern agricultural practices. Therefore, the Asia Pacific region is expected to experience significant expansion in the precision harvesting sector in the coming years.

The China precision harvesting market dominated the regional market in 2024. This growth is due to significant investments in advanced agricultural technologies and a growing emphasis on improving farming efficiency. The country benefits from large-scale farming operations and the widespread adoption of innovative harvesting solutions, which enable high productivity levels. In addition, technological advancements in automation and data analytics enhance the precision and efficiency of harvesting processes. Hence, China is expected to maintain its dominance in the regional precision harvesting industry in the forecast years.

Key Precision Harvesting Company Insights

Some key companies in the precision harvesting market are Deere & Company, AGCO Corporation, KUBOTA Corporation, Raven Industries, Inc., and CLAAS KGaA mbH. These organizations are focusing on expanding their customer base and gaining a competitive edge in the market. To achieve this, key players are actively pursuing several strategic initiatives, such as mergers and acquisitions, as well as forming partnerships with other leading companies. By leveraging these strategies, they aim to enhance their capabilities in providing data-driven insights, improving operational efficiency, and driving innovation in the precision harvesting market.

-

Deere & Company is a global leader in agricultural, construction, and forestry machinery. It offers advanced precision farming and harvesting technologies such as GPS-guided equipment, automated combine adjustments, and yield mapping. In addition, the John Deere operations center enables data-driven decision-making. Moreover, investments in research and development drive innovation in autonomous machinery and sustainable farming solutions.

-

AGCO Corporation designs and manufactures agricultural equipment under brands such as Fendt and Massey Ferguson. Its Fuse Smart Farming platform delivers precision farming and harvesting tools, including automated systems and telemetry solutions. AGCO is focused on innovation and sustainability to provide tailored solutions for modern agricultural needs.

Key Precision Harvesting Companies:

The following are the leading companies in the precision harvesting market. These companies collectively hold the largest market share and dictate industry trends.

- Deere & Company

- AGCO Corporation

- KUBOTA Corporation

- Raven Industries, Inc.

- CLAAS KGaA mbH

- Ag Leader Technology

- TeeJet Technologies

- TOPCON CORPORATION

- DICKEY-john

- CNH Industrial N.V.

Recent Developments

-

In August 2024, CNH Industrial N.V. partnered with CropX to launch an API connection for sustainable precision farming. This integration enables seamless data transfer from CNH machinery to the CropX system, improving data visualization and supporting variable-rate applications. As a result, this initiative empowers farmers to make data-driven decisions, enhancing productivity and sustainability.

-

In April 2024, AGCO Corporation launched PTx, a new precision agriculture brand combining Precision Planting technologies and PTx Trimble. The initiative aims to accelerate agricultural technology transformation by offering advanced, compatible solutions through specialized dealers and partnerships with more than 100 OEMs. It focuses on improving operational efficiency and boosting yields for farmers worldwide.

Precision Harvesting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.09 billion

Revenue forecast in 2030

USD 27.41 billion

Growth Rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, offering, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Deere & Company; AGCO Corporation; KUBOTA Corporation; Raven Industries, Inc.; CLAAS KGaA mbH; Ag Leader Technology; TeeJet Technologies; TOPCON CORPORATION; DICKEY-john; CNH Industrial N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Harvesting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global precision harvesting market report based on application, product, offering, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Crop

-

Greenhouse

-

Horticulture

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Combine Harvesters

-

Harvesting Robots

-

Self-Propelled Forage Harvesters

-

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Automation & Control System

-

Sensing Devices

-

Others

-

-

Software

-

Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.