- Home

- »

- Advanced Interior Materials

- »

-

Precast Concrete Market Size, Share, Industry Report, 2033GVR Report cover

![Precast Concrete Market Size, Share & Trends Report]()

Precast Concrete Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Structural Building Components, Transportation Products), By Application (Residential, Commercial, Infrastructure), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-360-7

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precast Concrete Market Summary

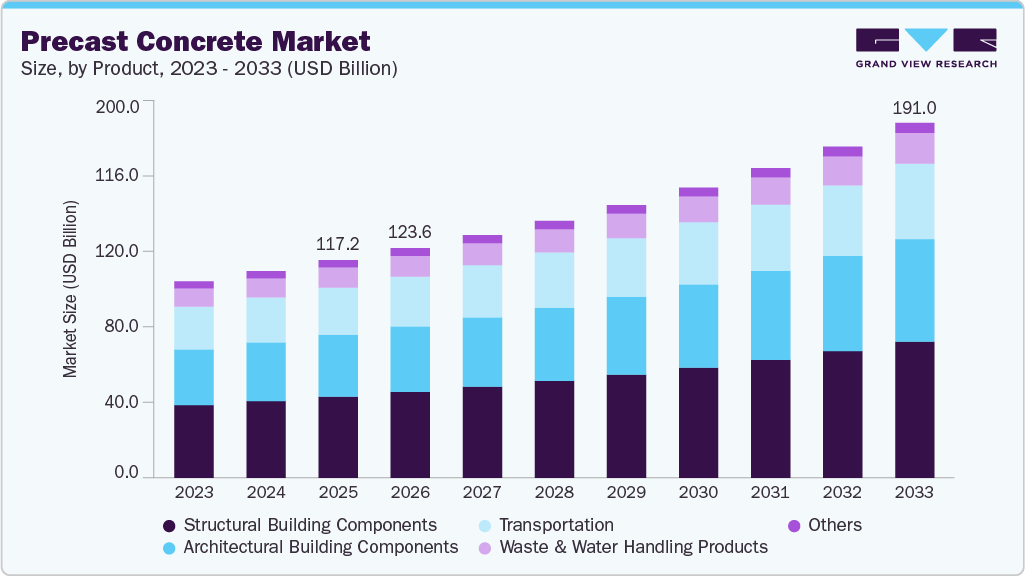

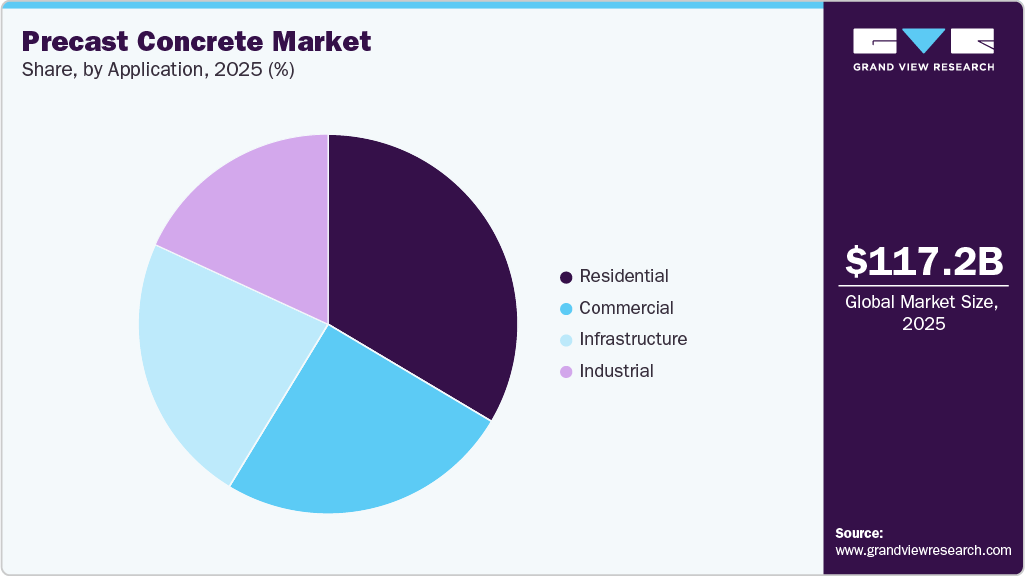

The global precast concrete market size was estimated at USD 117.16 billion in 2025 and is expected to reach USD 191.01 billion by 2033, registering a CAGR of 6.4% from 2026 to 2033. The demand for precast concrete is increasing due to the growing need for faster, cost-efficient, and high-quality construction solutions across residential, commercial, and infrastructure projects.

Key Market Trends & Insights

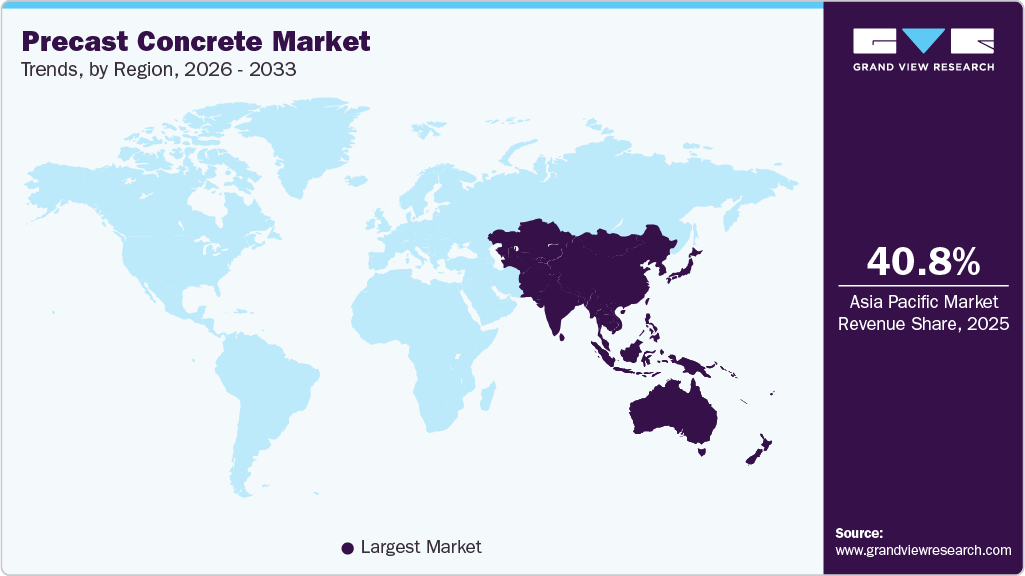

- Asia Pacific dominated the market with the highest revenue share of 40.8% in 2025.

- By product, the structural building components segment is expected to grow at the fastest CAGR of 6.8% over the forecast period.

- By application, the infrastructure segment is expected to grow at the fastest CAGR of 6.9% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 117.16 Billion

- 2033 Projected Market Size: USD 191.01 Billion

- CAGR (2026-2033): 6.4%

- Asia Pacific: Largest market in 2025

Urbanization and population growth are driving the development of large-scale housing and public infrastructure, where precast elements offer speed and consistency. The shift toward modular and prefabricated construction techniques further support market growth. Precast concrete reduces on-site labor requirements and construction timelines, making it attractive for developers facing labor shortages. Improved durability and longer service life also enhance its adoption in critical structures. The ability to maintain quality control in factory environments adds to its reliability.

Key drivers include rapid urban infrastructure development, increasing investments in transportation networks, and rising adoption of industrialized construction methods. Governments and private developers are prioritizing projects that minimize delays and cost overruns, favoring precast solutions. Growth in commercial real estate, data centers, and logistics facilities is boosting demand for standardized structural components. Sustainability goals are also influencing material selection, as precast concrete enables reduced material waste and optimized resource usage. Technological improvements in design flexibility have expanded the application scope. Rising labor costs globally further push builders toward prefabricated alternatives.

The market is witnessing innovation in high-performance concrete mixes, lightweight precast elements, and advanced reinforcement technologies. Digital tools such as Building Information Modeling (BIM) are increasingly integrated with precast design and manufacturing processes. Automation and robotics in precast plants are improving precision and production efficiency. There is a growing demand for customized architectural precast components with enhanced aesthetics. Sustainable innovations, including low-carbon cement and recycled aggregates, are gaining traction. Improved connection systems are expanding structural applications. These trends collectively enhance market competitiveness and application versatility.

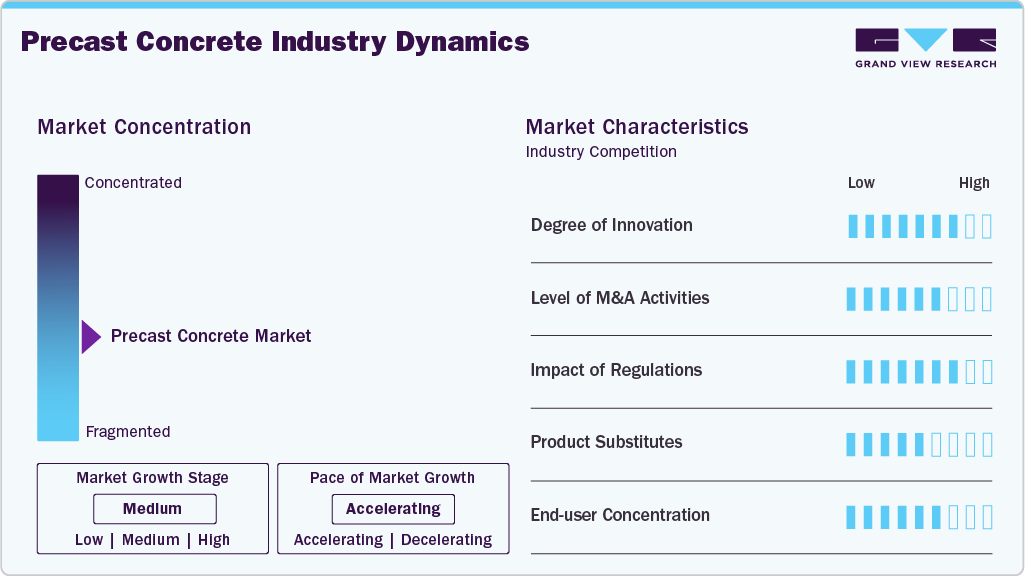

Market Concentration & Characteristics

The precast concrete market exhibits a moderately fragmented structure, comprising a mix of large multinational companies and numerous regional manufacturers. Large companies dominate major infrastructure and commercial projects due to scale, technical expertise, and project execution capabilities. Regional players maintain a strong presence in local residential and small commercial segments. Entry barriers remain moderate, driven by capital investment and technical know-how requirements. Local sourcing advantages support regional competition. Strategic partnerships and capacity expansions are common. Overall, competition remains active with balanced market participation.

The threat of substitutes is moderate, with cast-in-place concrete and steel structures being the primary alternatives. Traditional construction methods offer flexibility but lack the speed and quality consistency of precast solutions. Steel structures compete in high-rise and industrial projects but face cost volatility issues. Pre-engineered buildings serve as substitutes in select applications. However, precast concrete maintains advantages in durability, fire resistance, and lifecycle cost. Hybrid construction approaches are also emerging. Despite substitutes, precast retains strong positioning across multiple end uses.

Product Insights

The structural building components segment dominated with the highest revenue share of 37.3% in 2024 and is expected to be the fastest-growing product type growing at a CAGR of 6.8% from 2026 to 2033. This growth can be attributed to their high demand from construction industry. An increasing number of hotels, malls, and hospitals, coupled with growing industrialization globally, will likely propel demand for structural building components. Rising use of structural building components in affordable housing is anticipated to be a major driver for this segment. Moreover, escalating demand for affordable housing on account of the rapidly growing middle-income population is expected to drive the demand over the forecast period.

Precast concrete walls offer design flexibility and improve profitability, which is projected to propel the demand for precast architectural building components over the forecast period. Expansion of cities will likely result in an increasing number of office buildings, hospitals, schools, shopping centers, apartments, and parking garages. Precast concrete is expected to experience high demand in rail applications due to increasing awareness of its benefits, including high durability, low maintenance costs, and improved track elasticity. In addition, improved ride quality, minimum lifecycle cost, improved geometric retention of rail track, and greater weight, which is important for heavy freight lines and high speed, and environmental friendliness are likely to benefit the industry further.

Application Insights

The infrastructure segment dominated the market with the highest revenue share of 33.1% in 2025. Significant investments in infrastructure and real estate development are offering lucrative growth opportunities for precast concrete. Emphasis on infrastructure and residential needs, particularly in emerging nations, has resulted in a considerable flow of private and government-led investments in these sectors. The precast concrete structures are cast and cured off-site and delivered when required. Thus, they do not need on-site storage space. Moreover, it requires a minimal number of laborers, and installation requires small cranes. Thus, the aforementioned benefits of the product in residential applications are projected to propel the market demand over the forecast period.

Precast walls used in commercial buildings are manufactured off-site, which helps in saving time and space. In addition, the speed and ease of building precast structures promote their application in parking structures. Precast concrete structures are suitable for constructing noise-cancellation walls as their surface is designed to minimize ambient noise caused due to highway traffic or trains. Additionally, the design flexibility offered by concrete makes it suitable for outdoor applications, such as climbing walls, skate parks, and fences. Moreover, infrastructure development programs in emerging economies are likely to further increase product demand. Construction of dams, bridges, flyovers, and other public utility structures is anticipated to accelerate the product demand.

The use of precast concrete products in residential construction is popular in European and North American countries. Superior strength, excellent durability, and easy installation process are also projected to promote its application in the residential sector. Increasing middle-income groups in Asia-Pacific region, especially in China and India, are generating huge demand for inexpensive housing. This is one of the key driving forces for residential precast concrete products. Moreover, rise in demand for single-family homes and trends for rapid construction of homes is likely to ascend the demand for precast concrete products.

Regional Insights

The Asia Pacific dominated the global precast concrete market, accounting for the largest revenue share of 40.8% in 2025, driven by extensive urbanization and large-scale infrastructure development. Rapid population growth and government-backed housing programs support strong demand. Industrial and commercial construction activity remains high across major economies. Cost efficiency and faster project execution drive adoption. Local manufacturing capabilities enhance supply chain efficiency. Increasing investments in transport infrastructure further strengthen demand. The region remains the primary growth engine.

China Precast Concrete Market Trends

China leads regional demand driven by massive infrastructure projects and prefabricated building mandates. Government support for industrialized construction significantly benefits the adoption of precast. Urban redevelopment and public housing projects remain key drivers. Large-scale manufacturing facilities ensure supply stability. Technological integration in construction processes is widespread. Sustainability-focused construction policies support advanced precast solutions. China continues to set benchmarks in scale and adoption.

North America Precast Concrete Market Trends

North America shows steady growth supported by infrastructure rehabilitation and commercial construction. Demand is driven by highways, bridges, and institutional buildings. Labor shortages favor precast solutions for faster completion. Adoption is strong in industrial and logistics facilities. Quality and compliance standards drive preference for factory-made components. Technological integration supports design efficiency. The market remains stable with long-term growth potential.

The U.S. precast concrete market benefits from infrastructure renewal initiatives and private construction investment. Demand is strong across transportation, healthcare, and educational buildings. Prefabrication aligns well with cost and timeline constraints. Residential adoption is gradually increasing. Sustainability requirements encourage efficient construction practices. Established industry standards support consistent quality. The U.S. remains a key contributor within North America.

Europe Precast Concrete Market Trends

Europe’s market is driven by sustainable construction practices and stringent building regulations. Demand for energy-efficient and durable building solutions supports precast usage. Infrastructure modernization across transport and public utilities remains a key driver. Adoption of modular construction techniques is expanding. Technological innovation is widely integrated. Environmental compliance strengthens long-term demand. Europe shows balanced growth across segments.

The Germany precast concrete market demonstrates strong adoption due to advanced engineering standards and industrial construction practices. Infrastructure maintenance and residential development support demand. High-quality manufacturing capabilities ensure precision and reliability. Sustainability-focused construction policies drive material efficiency. Modular and prefabricated buildings are increasingly preferred. Technological automation is widely adopted. Germany remains a mature and innovation-driven market.

Central & South America Precast Concrete Market Trends

Central & South America shows growing adoption driven by urban infrastructure development and housing needs. Governments are investing in transportation and public facilities. Cost-effective construction methods support precast demand. Industrial and commercial projects contribute to growth. Local manufacturing capacity is expanding gradually. Market penetration remains moderate but improving. Long-term infrastructure plans support future demand.

Middle East & Africa Precast Concrete Market Trends

The Middle East & Africa market is driven by large-scale infrastructure and commercial construction projects. Rapid urban development and government-led initiatives support precast adoption. Demand is strong in transport, energy, and public buildings. Time-efficient construction methods are highly valued. Climatic durability advantages support material preference. Investments in smart cities boost demand. The region offers strong growth potential.

Key Precast Concrete Insights

The industry exhibits a large number of players providing a range of product varieties leading to intense competitive rivalry. Major players have a strong presence in developed economies like North America, Europe, and some parts of Asia Pacific region, including Australia. High degree of forward and backward integration of dominant players persists in the global industry, which, in turn, has intensified market rivalry and competition, thus making entry of new players difficult.

Key market players are opting for several strategies to enhance their market position and gain a competitive advantage over their competitors. For instance, in January 2021, LafargeHolcim signed an agreement to purchase Firestone Building Products (FSBP), a commercial roofing and building envelope solutions provider based in the United States (US). This acquisition is expected to strengthen LafargeHolcim position in the market.

Key Precast Concrete Companies:

The following are the leading companies in the precast concrete market. These companies collectively hold the largest market share and dictate industry trends.

- Boral Ltd.

- LafargeHolcim

- Gulf Precast Concrete Co. LLC

- Olson Precast Company

- CEMEX S.A.B. de C.V

- Forterra Pipe and Precast LLC

- Tindall Corporation

- Spancrete

- Elementbau Osthessen GmbH & Co., ELO KG

- GÜlermak A.S.

- STECS

- LAING O’Rourke

- Larsen & Toubro Ltd.

Recent Developments

-

In July 2025, Boral opened a new state-of-the-art precast manufacturing facility at Emu Plains (Sydney) to supply segments for the Western Harbour Tunnel project, expanding production capacity and supporting major infrastructure delivery.

-

In January 2024, LafargeHolcim completed three European acquisitions, Artepref S.A. in Spain, W.A.T.T. Recycling in Greece, and Eco-Readymix Ltd in the UK, expanding its Solutions & Products business as an important part of its precast and modular construction strategy.

Precast Concrete Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 123.59 billion

Revenue forecast in 2033

USD 191.01 billion

Growth rate

CAGR of 6.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Poland; Czech Republic; Croatia; China; India; Japan; Singapore; South Korea; Brazil; Saudi Arabia; Israel

Key companies profiled

Boral Ltd.; LafargeHolcim; Gulf Precast Concrete Co. LLC; Olson Precast Company; CEMEX S.A.B. de C.V; Forterra Pipe and Precast LLC; Tindall Corporation; Spancrete; Elementbau Osthessen GmbH & Co., ELO KG; GÜlermak A.S.; STECS; LAING O’Rourke; Larsen & Toubro Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precast Concrete Market Report Segmentation

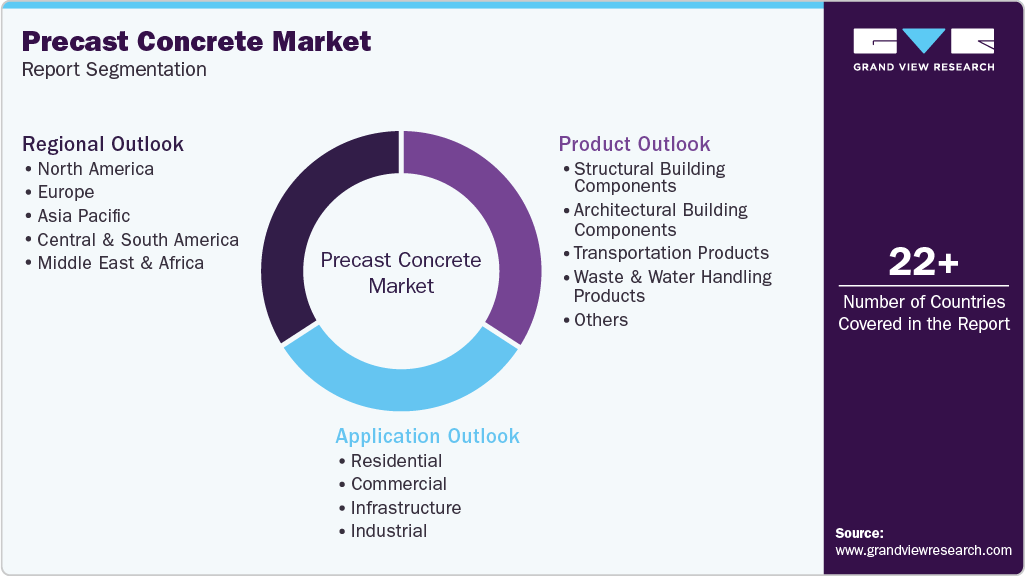

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global precast concrete market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Structural Building Components

-

Architectural Building Components

-

Transportation Products

-

Waste & Water Handling Products

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

Infrastructure

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Poland

-

Czech Republic

-

Croatia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global precast concrete market size was estimated at USD 117.16 billion in 2025 and is expected to reach USD 123.59 billion in 2026.

b. The global precast concrete market is expected to grow at a compound annual growth rate of 6.4% from 2026 to 2033 to reach USD 191.01 billion by 2033.

b. Structural building components dominated the Precast Concrete market with a share of 37.3% in 2025 due to the superior characteristics such as high strength, high durability, and faster installation.

b. Some of the key players operating in the precast concrete market include Boral Limited, LafargeHolcim, Gulf Precast Concrete Co. LLC, Olson Precast Company, CEMEX S.A.B. de C.V, Forterra Pipe and Precast LLC, and Tindall Corporation.

b. The key factors that are driving the precast concrete market due to increasing commercial and residential construction projects across major regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.