- Home

- »

- Foods, Beverages & Food Ingredients

- »

-

Prebiotics Market Size, Share & Trends, Industry Report 2033GVR Report cover

![Prebiotics Market Size, Share & Trends Report]()

Prebiotics Market (2026 - 2033) Size, Share & Trends Analysis Report By Ingredient (Inulin, Fructo-oligosaccharides, Resistant Starch), By Source (Roots, Grains), By Form (Powder, Liquid), By Functionality, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-089-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Prebiotics Market Summary

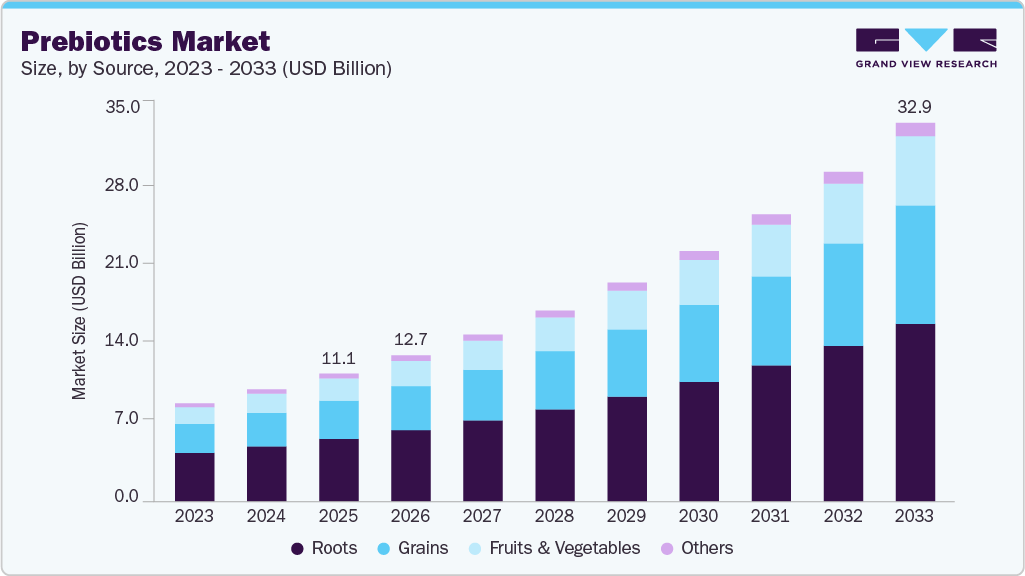

The global prebiotics market size was estimated at USD 11.10 billion in 2025 and is expected to reach USD 32.91 billion by 2033, growing at a CAGR of 14.6% from 2026 to 2033. The market growth is primarily driven by rising consumer awareness of gut health and its connection to overall wellness, including immunity, metabolism, and mental health.

Key Market Trends & Insights

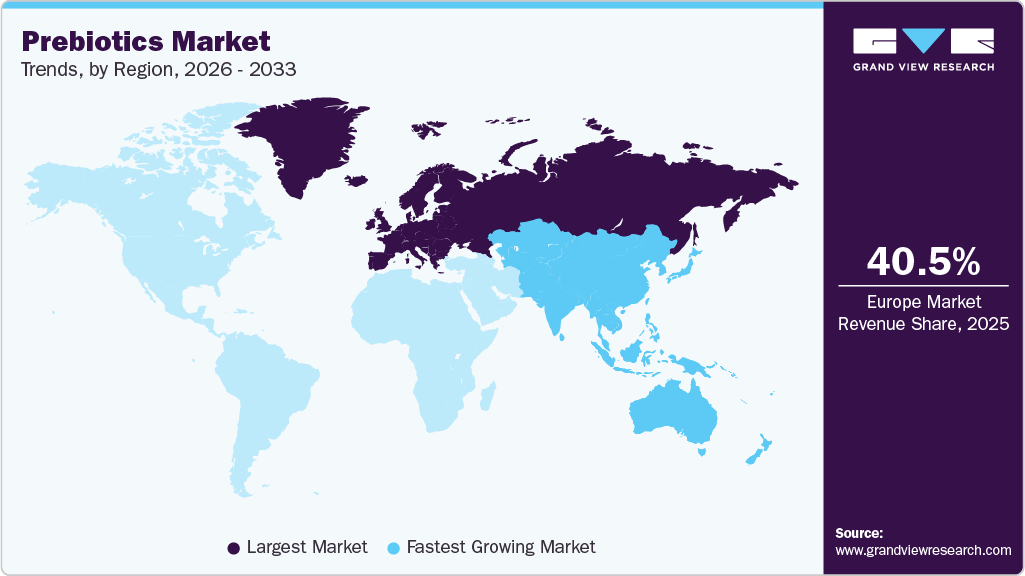

- By region, Europe led the global prebiotics market with a share of 40.5% in 2025.

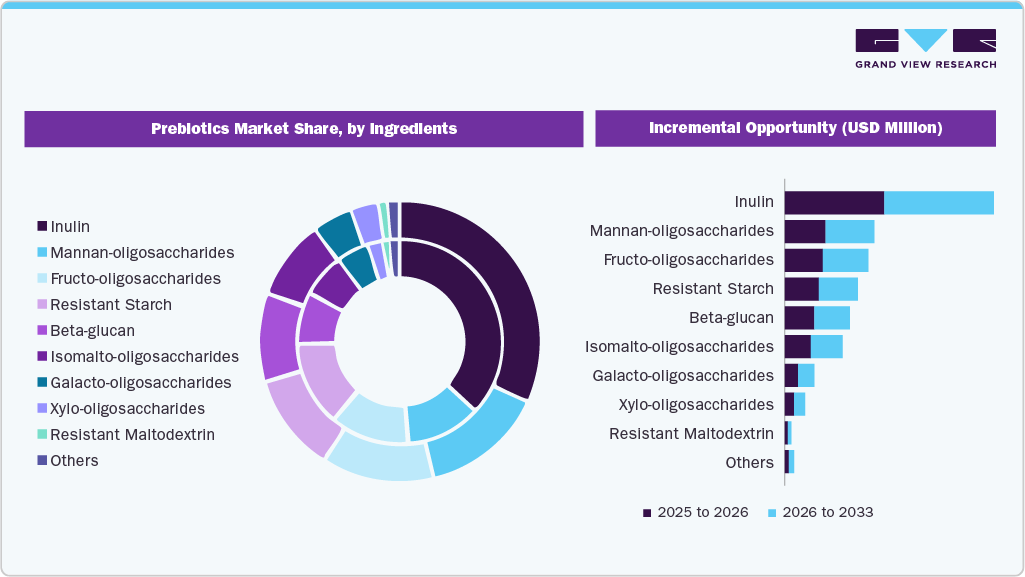

- By ingredients, inulinled the global market with a share of 29.6% in 2025.

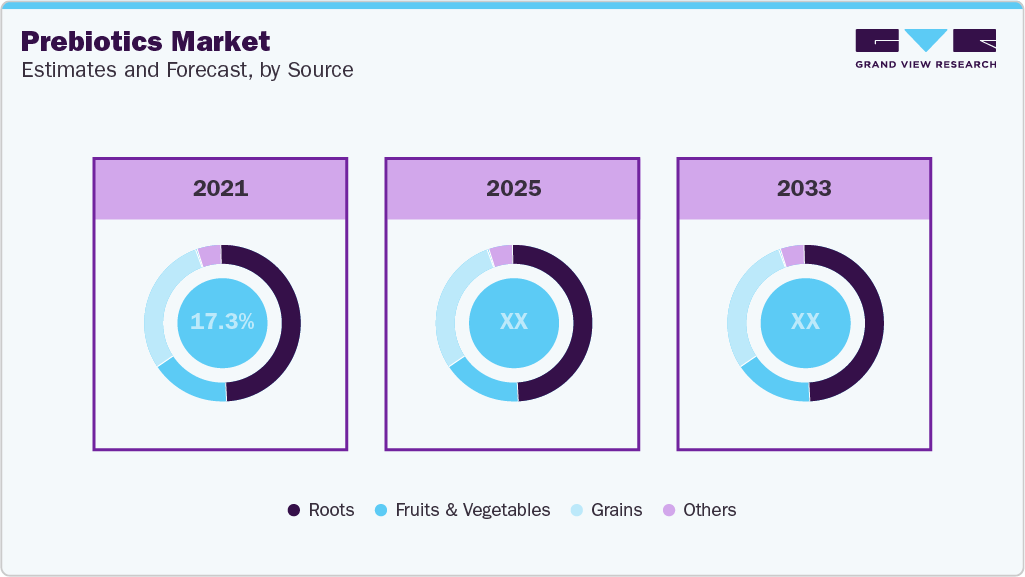

- By source, the roots segment led the market and accounted for a share of 49.0% in 2025.

- By form, powdered prebioticsled the market and accounted for a share of 54.6% in 2025.

- By type, sugar prebioticsled the market and accounted for a share of 70.1% in 2025.

- By functionality, gut healthled the market and accounted for a share of 38.5% in 2025.

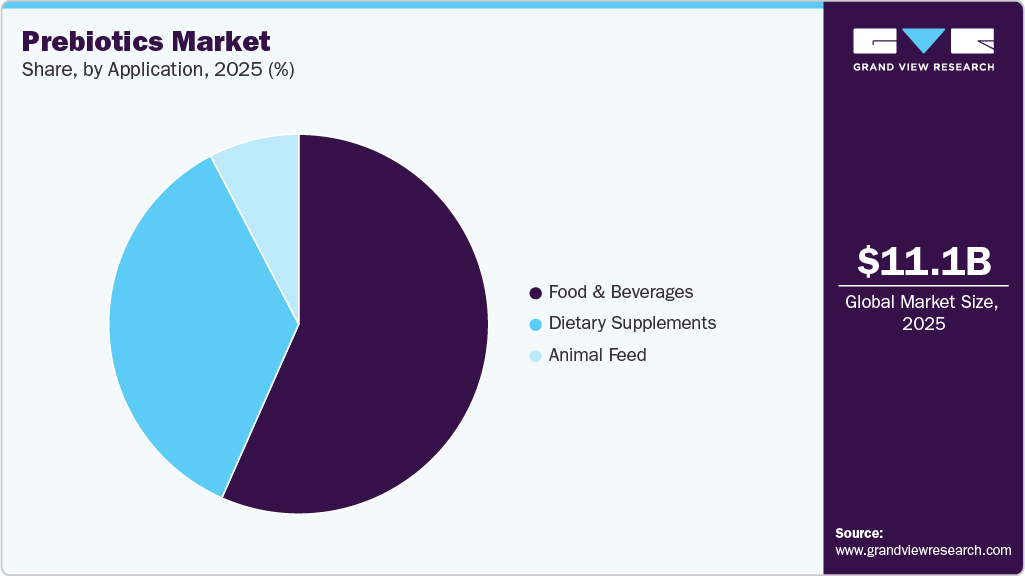

- By application, the food & beverages segment held the largest share of 56.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.10 Billion

- 2033 Projected Market Size: USD 32.91 Billion

- CAGR (2026-2033): 14.6%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

Increasing demand for functional foods and beverages that promote digestive health, coupled with the growing prevalence of lifestyle-related disorders such as obesity and diabetes, has further boosted market expansion.The growing prevalence of gastrointestinal diseases, such as constipation, Irritable Bowel Syndrome (IBS), Gastroesophageal Reflux Disease (GERD), and inflammatory bowel disease, has raised concerns about gut health, thereby supporting the growth of the prebiotics industry. In addition, the rising cultivation and harvesting of prebiotic natural herbs are further projected to drive the growth. The rising investment in research & development (R&D) by companies to develop new ingredients, coupled with the growing acceptance among consumers to pay a premium price for food products that contain prebiotic ingredients, has enabled manufacturers to drive the active health management programs.

This, in turn, will drive the market growth over the forecast period. Prebiotics have a wide range of applications, including as texture enhancers and sweetening agents in the food and beverage industry. The growing concerns with respect to sugar diseases are expected to drive the product growth over the forecast period. In addition, the major prebiotic ingredients, such as inulin and Fructo-Oligosaccharide (FOS), have demand from products that require low-calorie sweetening taste, thus propelling the overall prebiotic sector growth over the forecast period.

Ingredients Insights

The inulin segment led the prebiotics market, accounting for a share of 29.6% in 2025, driven by its wide application, high functional versatility, and proven health benefits. Derived mainly from chicory root, inulin is a natural, plant-based fiber that effectively promotes the growth of beneficial gut bacteria such as bifidobacteria, supporting digestive health and improving nutrient absorption. Its mild sweetness, fat-replacement properties, and ability to enhance texture make it a preferred ingredient in food and beverage formulations, such as dairy products, bakery items, and dietary supplements. Moreover, inulin’s compatibility with clean-label and low-calorie product trends aligns with rising consumer demand for healthier, natural ingredients.

The Isomalto-oligosaccharides (IMOs) segment is anticipated to witness a CAGR of 17.8% from 2026 to 2033.IMOs are known for promoting the growth of beneficial gut bacteria while offering a mild sweetness and low-calorie content, making them an ideal sugar substitute for health-conscious consumers. Their excellent stability under heat and acidic conditions allows easy incorporation into baked goods, dairy products, beverages, and dietary supplements. Additionally, the growing consumer preference for natural, plant-based, and digestive-friendly ingredients, along with the rising incidence of lifestyle diseases such as obesity and diabetes, is driving the adoption of IMOs as a healthier alternative to traditional sweeteners and functional fibers.

Source Insights

The roots segment led the prebiotics industry, accounting for the largest revenue share of 49.0% in 2025. Roots, particularly those of plants like chicory, Jerusalem artichoke, and dandelion, are rich natural sources of inulin and fructo-oligosaccharides (FOS), two of the most widely used and clinically validated prebiotic ingredients. These root-derived prebiotics are highly effective in stimulating the growth of beneficial gut bacteria and improving digestive health. Moreover, roots offer a sustainable, plant-based, and easily extractable source, aligning well with the growing consumer demand for natural and clean-label ingredients. The extensive use of root-based prebiotics in food, beverage, and dietary supplement formulations, combined with their cost-effectiveness and well-established supply chains.

The fruits & vegetables segment is anticipated to witness a CAGR of 15.4% from 2026 to 2033, due to their natural, nutrient-rich composition and strong alignment with the global shift toward clean-label, plant-based, and functional foods. Fruits and vegetables such as bananas, apples, asparagus, onions, and leeks contain naturally occurring fibers, such as pectin, which support gut microbiota health while also providing vitamins, antioxidants, and phytonutrients that enhance overall wellness. As consumers become more health-conscious and seek foods offering multiple benefits beyond basic nutrition, the use of fruit- and vegetable-derived prebiotics has gained traction.

Form Insights

The powdered prebiotics market segment held the largest revenue share of 54.62% in 2025. Powdered prebiotics have a longer shelf life, are easier to store and transport, and can be seamlessly incorporated into various product formulations, including dietary supplements, bakery goods, beverages, and infant nutrition. Their ability to blend uniformly without altering the taste or texture of finished products makes them highly preferred by manufacturers. Additionally, powders offer flexible dosing and formulation advantages in both food and pharmaceutical applications.

Liquid prebiotics are anticipated to witness a CAGR of 14.6% from 2026 to 2033. Liquid prebiotics offer superior solubility and faster absorption, making them ideal for use in health drinks, smoothies, and infant formulas. Additionally, they enable better taste masking and more uniform distribution in formulations, enhancing product quality and consumer appeal. The rising popularity of functional beverages and nutraceutical syrups, along with advancements in liquid formulation technologies, has further fueled their demand. Moreover, the shift toward personalized nutrition and the increasing focus on digestive wellness through daily consumption formats are driving the global adoption of liquid prebiotics.

Functionality Insights

The gut health segment led the prebiotics industry, accounting for the largest revenue share of 38.5%. Prebiotics play a crucial role in promoting the growth of beneficial gut bacteria, improving intestinal balance, and enhancing nutrient absorption, making them essential for overall digestive health. With growing awareness of the gut microbiome’s influence on immunity, metabolism, and even mental well-being, consumers are increasingly prioritizing gut health using functional foods and supplements. Additionally, the rising prevalence of gastrointestinal disorders, unhealthy dietary habits, and antibiotic use has intensified the need for natural gut-supporting ingredients.

Weight management is projected to grow significantly at the fastest CAGR of 15.9% from 2026 to 2033. Prebiotics support weight management by improving gut microbiota composition, enhancing satiety, regulating appetite hormones, and reducing calorie absorption. These natural fibers promote a feeling of fullness, helping to regulate food intake without compromising nutritional value. With the rising prevalence of obesity, diabetes, and metabolic disorders, consumers are increasingly turning to prebiotic-enriched foods and supplements as a natural, science-backed approach to weight control. Additionally, the surge in demand for functional foods, low-calorie diets, and clean-label ingredients, combined with the growing influence of fitness and wellness trends.

Application Insights

The food and beverages application accounted for the largest share of around 56.6% in 2025. Prebiotics are being increasingly incorporated into a wide range of everyday products, including dairy items, cereals, baked goods, beverages, and functional snacks, to enhance digestive health and overall wellness. The growing consumer preference for functional foods that offer added health benefits beyond basic nutrition has significantly boosted demand in this category. Moreover, the rise of clean-label, plant-based, and fortified products has encouraged manufacturers to utilize prebiotics as natural fiber and sugar replacers, thereby improving both nutritional value and taste.

The dietary supplements segment is anticipated to witness a CAGR of 15.4% from 2025 to 2033. Modern lifestyles, marked by stress and poor dietary habits, have heightened the need for convenient and effective ways to support gut health, digestion, and overall well-being, driving consumers toward prebiotic supplements. These supplements offer precise dosing, ease of consumption, and compatibility with probiotics, making them a popular choice for maintaining a balanced gut microbiome. Additionally, rising awareness of the gut-brain and gut-immune connections has positioned prebiotic supplements as an essential part of daily wellness routines.

Regional Insights

The prebiotics market in North America is projected to grow at a CAGR of 14.5% from 2026 to 2033, driven by growing consumer awareness of gut health, immunity, and overall wellness. Demand is shifting from basic dietary fibers to advanced “precision prebiotics” such as galacto-oligosaccharides and human milk oligosaccharide (HMO) analogues, supported by innovations in fermentation technology and clean-label product development. Food and beverage companies are increasingly incorporating prebiotics into everyday items, such as snacks, yogurts, and functional drinks, to attract health-conscious consumers. For instance, Olipop, a U.S.-based prebiotic soda brand that blends plant-based fibers from chicory root and Jerusalem artichoke to promote digestive health while offering nostalgic soda flavors. The brand’s success reflects the region’s broader trend toward functional, low-sugar, and fiber-enriched beverages positioned as “better-for-you” alternatives.

Europe Prebiotics Market Trends

The Europe prebiotics industry accounted for a revenue share of 40.5% in 2025, driven by increasing consumer interest in digestive wellness, immunity, and sustainable nutrition. European consumers increasingly prefer plant-based, clean-label, and scientifically validated ingredients, aligning with the region’s strict EFSA health-claim regulations. Inulin derived from chicory root remains the most widely used ingredient, while newer oligosaccharides are gaining traction in functional foods, beverages, and infant nutrition. Moreover, the market is broadening beyond human consumption into animal feed applications, reflecting Europe’s sustainability and preventive health priorities. For instance, BENEO, a leading German ingredient supplier, produces inulin and oligofructose from chicory root to support gut health across food and beverage formulations.

Asia Pacific Prebiotics Market Trends

The Asia Pacific prebiotics industry accounted for a revenue share of 29.6% in 2025. As functional foods and dietary supplements gain prominence across key markets such as China, Japan, South Korea, and Australia, prebiotics are being incorporated into everyday products, expanding their accessibility beyond specialized health formats. Ageing populations, rising disposable incomes, and growing interest in immunity and digestive wellness further reinforce this trend. Advancements in ingredient manufacturing and strong e-commerce penetration across APAC have improved product availability and accelerated consumer adoption.

Central & South America Prebiotics Market Trends

The Central & South America prebiotics industry is expected to grow at a CAGR of 15.0% from 2026 to 2033. A shift in diet patterns and the rise of non-communicable diseases (obesity, cardiovascular issues) in the region are prompting consumers and manufacturers to seek healthier, fortified food and beverage options that often include prebiotics. Food manufacturers are reformulating products to meet “clean-label” and wellness trends, incorporating prebiotics (such as inulin and fructo-oligosaccharides) into dairy, infant nutrition, dietary supplements, and fortified foods.

Middle East & Africa Prebiotics Market Trends

The Middle East & Africa prebiotics industry is expected to grow at a CAGR of 13.2% from 2026 to 2033. Demand for prebiotics in the Middle East & Africa is rising as consumers increasingly prioritize digestive wellness and preventive health. Growing awareness of the link between gut health, immunity, and overall wellbeing has encouraged a shift toward functional nutrition, with prebiotic ingredients gaining prominence in daily diets. This trend is reinforced by the expanding availability of fortified foods, beverages, and dietary supplements across regional retail channels, making prebiotic-enriched products more accessible to mainstream consumers.

Key Prebiotics Company Insights

Leading players in the prebiotics market include Abbott Laboratories, BENEO GmbH, Yakult Honsha Co., Ltd. The global market remains highly competitive, with leading players expanding their distribution networks across both online and offline channels to improve consumer accessibility. Companies are increasingly investing in product innovation, advanced extraction technologies, and formulation diversity to meet the evolving needs of consumers and address their health concerns. Market growth is further fueled by rising demand for premium and specialized prebiotic products, the global focus on digestive wellness, and the integration of prebiotics into a broader range of functional foods, beverages, and dietary supplements across the health and wellness industry.

Key Prebiotics Companies:

The following are the leading companies in the prebiotics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- BENEO GmbH

- Bright Food (Group) Corp. Ltd.

- Cargill Inc.

- Kraft Foods Group, Inc.

- Cosucra Groupe Warcoing SA

- The Kraft Heinz Company

- Friesland Campina

- Jarrow Formulas, Inc.

- Parmalat S.p.A

- Roquette Frères

- Royal Cosun

- Yakult Honsha Co., Ltd.

Recent Developments

-

In August 2025, Activia (a brand of Danone) launched a new product in Canada called Activia EXPERT, which combines prebiotics and prebiotic fibre in one yoghurt. It is positioned for “gut health-conscious” consumers, featuring more than 1 billion CFU of Bifidobacterium lactis per serving, 2.5 g of inulin (a prebiotic) per serving, and a reformulated profile with higher protein and reduced sugar.

-

In January 2025, A new clinical trial was launched by Hebrew SeniorLife’s Hinda & Arthur Marcus Institute for Aging Research, exploring whether a synbiotic - a combination of prebiotics and probiotics - developed by Solarea Bio (specifically the supplement Bondia/SBD111) can support bone health in women aged 60 and above. The study, named “STARS,” is designed as a randomized, double-masked, placebo-controlled trial lasting 18 months, and will also examine how diet, inflammation, and the gut microbiome contribute to age-related bone loss.

-

In March 2024, Beech‑Nut Nutrition Company announced the launch of seven innovative baby and toddler food products, including organic yogurt-and-fruit jars and smoothie pouches enriched with prebiotics, as well as snack lines like waffles and fruit/vegetable chews, designed to cater to parents seeking wholesome, convenient, and gut-health-supporting options for young children.

Prebiotics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 12.68 billion

Revenue forecast in 2033

USD 32.91 billion

Growth rate

CAGR of 14.6% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, source, form, functionality, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Key companies profiled

Abbott Laboratories; BENEO GmbH; Bright Food (Group) Corp. Ltd.; Cargill Inc.; Kraft Foods Group, Inc.; Cosucra Groupe Warcoing SA; The Kraft Heinz Company; Friesland Campina; Jarrow Formulas, Inc.; Parmalat S.p.A; Roquette Frères; Royal Cosun; Yakult Honsha Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prebiotics Market Report Segmentation

This report forecasts revenue & volume growth at the global, regional & country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global prebiotics market report based on ingredient, source, form, functionality, application, and region:

-

Ingredient Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Inulin

-

Fructo-oligosaccharides

-

Mannan-oligosaccharides

-

Galacto-oligosaccharides

-

Xylo-oligosaccharides

-

Isomalto-oligosaccharides

-

Resistant Starch

-

Resistant Maltodextrin

-

Beta-glucan

-

Others

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Roots

-

Fruits & Vegetables

-

Grains

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Powder/Crystal

-

Liquid

-

-

Functionality Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Gut Health

-

Cardiovascular Health

-

Bone Health

-

Immunity

-

Weight Management

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Dairy Products

-

Infant Foods

-

Cereals

-

Beverage

-

Meat Products

-

Others

-

-

Dietary Supplements

-

Food Supplements

-

Nutritional Supplements

-

Specialty Supplements

-

-

Animal Feed

-

Poultry

-

Swine

-

Cattle

-

Aquaculture

-

Pet Food

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The key market player in the prebiotics market includes Abbott Laboratories, BENEO GmbH, Bright Food (Group) Corporation Limited, Cargill Incorporated, Kraft Foods Group, Inc., Cosucra Groupe Warcoing SA, The Kraft Heinz Company, FrieslandCampina, Jarrow Formulas, Inc, Parmalat S.p.A, Roquette Frères, Royal Cosun, and Yakult Honsha Co., Ltd.

b. Key factors that are driving the prebiotics market growth include the growing use of prebiotics in the dairy industry due to its health benefits. In addition, growing technological advancements in developing inulin and oligosaccharides are likely to replace sugar that is anticipated to drive the market over the forecast period.

b. The global prebiotics market was estimated at USD 9.72 billion in 2024 and is expected to reach USD USD 11.10 billion in 2025.

b. The global prebiotics market is expected to grow at a compound annual growth rate of 14.6% from 2025 to 2033 to reach USD 32.91 billion by 2033.

b. Europe led the market with a share of 40.77% in 2024. The European prebiotics market is experiencing strong growth, driven by increasing consumer interest in digestive wellness, immunity, and sustainable nutrition.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.