- Home

- »

- Next Generation Technologies

- »

-

Power Strip Market Size And Share, Industry Report, 2030GVR Report cover

![Power Strip Market Size, Share & Trends Report]()

Power Strip Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Smart Power Strip, Common Power Strip), By Protection Type (Surge Protection, Fuse-based Protection), By Application (Household, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-496-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Strip Market Summary

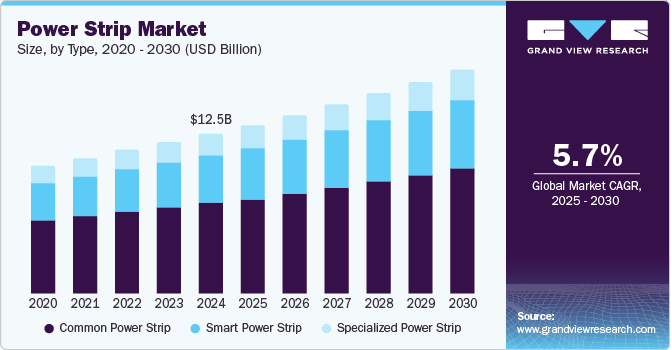

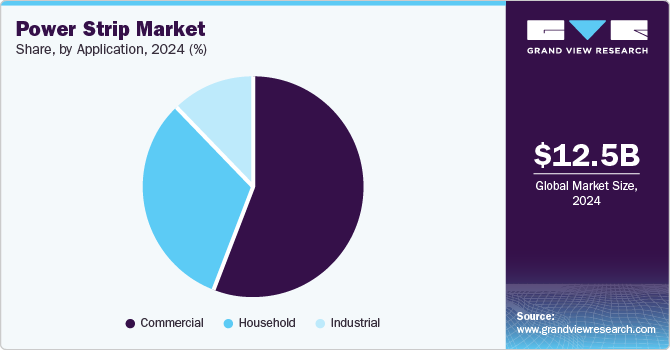

The global power strip market size was estimated at USD 12.5 billion in 2024 and is projected to reach USD 17.5 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. The increasing demand for power management solutions across residential, commercial, and industrial sectors is driving market growth.

Key Market Trends & Insights

- North America dominated the global power strip market with the largest revenue share of 34.3% in 2024.

- By type, the common power strips segment led the market with the largest revenue share of 56.7% in 2024.

- By protection type, the surge protection segment accounted for the largest revenue share in 2024.

- By application, the household sector is expected to register at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 12.5 Billion

- 2030 Projected Market Size: USD 17.5 Billion

- CAGR (2025-2030): 5.7%

- North America: Largest market in 2024

Factors such as the rising adoption of smart home devices, workplace digitization, and expanding infrastructure development contribute to the demand for advanced power strips. Innovations in surge protection and the development of energy-efficient designs further support the market's expansion.

The growing reliance on electronic devices across residential, corporate, and industrial sectors is driving the demand for power strips with surge protection. These devices help safeguard expensive equipment from voltage surges, ensuring uninterrupted functionality. With the growing demand for smart homes, workplaces, and industrial automation, the need for reliable power distribution solutions is increasing. The market demand in the residential sector is predominantly high due to the proliferation of smart devices, home entertainment systems, and advanced kitchen appliances, which require multiple power sources. In addition, manufacturing facilities are incorporating power strips into their infrastructure to support various electronic tools and machinery.

Advancements in power strip technology have led to the development of smart power strips equipped with voice control compatibility, energy monitoring, and remote operation. The rise in disposable income, urbanization, and industrialization in developing economies has contributed to increased adoption of electronic devices, further driving market growth. Companies are introducing innovative solutions to meet evolving consumer needs, such as the features of compatibility with virtual assistants, including Alexa and Google Assistant. However, stringent regulatory requirements across different regions present a challenge for manufacturers. Compliance with international safety standards, such as UL 962A in the U.S. and CSA-C22.2 No. 308 in Canada, necessitates region-specific modifications, limiting global standardization.

Type Insights

Common power strips dominated the power strip industry with a revenue share of 56.7% in 2024. Their widespread use across residential, commercial, and industrial applications is driven by affordability, ease of use, and compatibility with various electronic devices. This segment share can be attributed to the increasing reliance on electronic gadgets, which drives the demand for multiple power outlets in workplaces and households. In addition, their availability in different configurations and with safety features, such as surge protection, has further supported their adoption.

Smart power strips are expected to register the highest CAGR of 6.1% over the forecast period. The increasing integration of IoT-enabled devices, growing adoption of home automation systems, and rising demand for energy-efficient solutions are key factors driving this segment. These power strips offer remote control capabilities, voice assistant compatibility, and energy monitoring features, making them a preferred choice for consumers seeking advanced functionality. For instance, the power strip industry has seen a rise in the adoption of smart power strips equipped with Wi-Fi connectivity and app-based controls, allowing users to manage their devices remotely. With smart homes and connected devices gaining traction, manufacturers are focusing on enhancing the capabilities of smart power strips to cater to evolving consumer needs.

Protection Type Insights

Surge protection dominated the power strip market in 2024 and is expected to register the highest CAGR over the forecast period. The increasing need to safeguard electronic devices from voltage surges resulting from lightning strikes, electrical accidents, and circuit-breaker tripping has driven its widespread adoption across residential, commercial, and industrial applications. Surges can lead to equipment failure, data loss, damage to expensive electronic equipment, and operational disruptions, making surge protection critical. The market has witnessed advancements in surge protection technology, with higher joule ratings and integrated circuit breakers enhancing reliability. For instance, surge-protected power strips with high energy ratings, such as Belkin’s Power Strip Surge Protector with a 3,940-joule energy rating, protect against short circuits, overload, and power fluctuations, further supporting market growth.

Fuse-based protection is expected to experience notable growth over the forecast period. The growing emphasis on electrical safety and adherence to regulatory standards has driven demand for this protection type, providing an added security layer against overcurrent and short circuits. Its adoption has grown in environments where controlled power distribution and circuit protection are essential. Manufacturers are incorporating advanced fuse technologies to improve durability and response time, contributing to the segment’s expansion.

Application Insights

The commercial sector dominated the power strip market with the highest revenue share in 2024. The widespread use of power strips in offices, data centers, retail spaces, and industrial facilities has contributed to the market share. Commercial-grade power strips are designed to withstand demanding environments, offering temperature and weather resistance and built-in surge protection to prevent device damage. Power strips with multiple specialty outlets, such as USB and modem ports, are widely used in corporate offices to support various electronic devices. The power strip industry has seen increasing integration of surge protection and energy management features in commercial-grade products to enhance safety and efficiency. Manufacturers also focus on compliance with UL, ETL, and CSA standards, ensuring durability and reliability. For instance, Falconer Electronics produces commercial power strips with steel fabrication, providing a strong protective casing for enhanced safety.

The household sector is expected to register the highest CAGR over the forecast period. The rising adoption of smart home technologies and the increasing number of electronic devices in residential settings have fueled demand for power strips with advanced safety and convenience features. Hence, consumers opt for power strips with surge protection, USB ports, and smart connectivity to manage energy consumption efficiently. Moreover, manufacturers in the power strip industry are developing compact, multifunctional solutions designed for modern households, supporting the segment’s expansion.

Regional Insights

North America power strip market dominated the global market in 2024 with revenue share of 34.3%. The high adoption of electronic devices across residential, commercial, and industrial sectors drives the region's leadership. Growing demand for energy-efficient power distribution solutions and increasing reliance on surge-protected and smart power strips to safeguard electronic equipment from voltage fluctuations have contributed to market expansion. In addition, stringent safety regulations and compliance standards have influenced manufacturers to develop advanced power strips with enhanced protection features. The local presence of key industry players and the rise in investments in smart home technologies and workplace automation continue to support market growth.

U.S. Power Strip Market Trends

The U.S. power strip market dominated the regional market with a significant revenue share in 2024. The growing number of electronic devices in residential and commercial spaces has increased the demand for reliable power distribution solutions. Businesses and households are opting for surge-protected power strips to safeguard equipment from electrical fluctuations, supporting market expansion. The adoption of smart home systems and automated workspaces has further driven the need for power strips with advanced features, such as energy monitoring and remote access. Moreover, stringent safety regulations and energy efficiency mandates encourage manufacturers to develop innovative power strips with enhanced protective mechanisms. For instance, Belkin, a U.S.-based company headquartered in El Segundo, California, offers surge-protected power strips with high joule ratings and multiple outlets designed to safeguard electronic devices from power surges and spikes, reinforcing the market’s emphasis on safety and reliability.

Europe Power Strip Market Trends

Europe power strip market is expanding due to the growing demand for efficient power distribution solutions across residential, commercial, and industrial sectors. The increasing adoption of smart home technologies and the rising number of household electronic devices drive the need for advanced power strips with surge protection and energy-saving features. In commercial spaces, workplaces and data centers require reliable power management solutions, contributing to market growth. In addition, stringent safety regulations and energy efficiency standards in countries such as Germany, the UK, and France encourage the adoption of high-quality power strips. The presence of key manufacturers and ongoing product innovations impel regional market growth.

Asia Pacific Power Strip Market Trends

The Asia Pacific power strip market is expected to grow at the highest CAGR of 7.1% over the forecast period. Rapid urbanization, increasing electricity consumption, and the expanding use of electronic devices in residential and commercial settings are key factors driving market growth. The rising adoption of smart home technologies and energy-efficient solutions has increased demand for advanced power strips with surge protection and remote-control capabilities. Government initiatives promoting electrical safety standards and the growing presence of local manufacturers offering cost-effective solutions are also shaping the market landscape. With technological advancements and increasing awareness about device protection, the region is witnessing a shift toward high-performance power strips designed to meet diverse consumer needs.

The China power strip market dominated the Asia Pacific market in 2024. The country's expanding infrastructure, growing industrial sector, and increasing reliance on electronic devices in residential and commercial spaces have contributed to market growth. Rising awareness of electrical safety and the need for energy-efficient power solutions have driven the demand for advanced power strips with surge protection and smart functionalities. Government policies promoting domestic manufacturing and technological advancements in power management solutions have further supported market expansion. The presence of key local manufacturers offering a wide range of cost-effective and premium power strips has strengthened China's position in the industry.

Middle East & Africa Power Strip Market Trends

The Middle East & Africa power strip market is driven by rising electricity consumption, expanding commercial infrastructure, and increasing demand for surge-protected and energy-efficient solutions. Improvements in electrical safety standards and the growing adoption of smart power strips equipped with remote control and energy monitoring features further support market expansion. In addition, initiatives promoting industrial and residential electrification enhance the demand for advanced power strips. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are witnessing infrastructure modernization, which drives the adoption of high-performance power strips across various applications.

Key Power Strip Company Insights

Some of the key companies operating in the power strip industry are General Electric Company; Belkin; and Leviton Manufacturing Co., Inc. These companies are expanding their market presence by launching new products, collaborating, and adopting various other strategies.

-

General Electric Company is a multinational conglomerate with a strong presence in the power solutions sector. The company offers a range of electrical and energy management products, such as surge protectors and power strips, designed for residential, commercial, and industrial applications. It is focused on innovation and safety and employs advanced technologies to enhance power distribution and protection.

-

Belkin is a key player in the power strip market, offering surge protectors and power strips designed for home and office environments. The company focuses on safety and reliability, integrating features such as high-joule-rated surge protection, USB charging ports, and connected equipment warranty. Through continuous innovation and a commitment to enhanced power management, Belkin focuses on supporting efficient and secure connectivity for modern electronic devices.

Key Power Strip Companies:

The following are the leading companies in the power strip market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric Company

- Belkin

- Leviton Manufacturing Co., Inc.

- Schneider Electric

- Legrand

- Koninklijke Philips N.V.,

- Siemens

- ABB

- Panasonic corporation

- Cyber Power Systems, Inc.

- Delixi Electric

- Falconer Electronics

Recent Developments

-

In June 2024, Belkin launched its latest surge protector range in Australia, featuring models with up to 1,800 joules of surge protection and dual USB-C Power Delivery ports providing up to 30W of shared power. These surge protectors have a connected equipment warranty, ensuring enhanced protection for electronic devices.

-

In October 2024, Schneider Electric introduced the Schneider OffGrid-a portable power station designed for outdoor and emergency use. The device supports solar panel recharging for enhanced sustainability by featuring multiple charging options, including USB-A, USB-C, AC sockets, DC ports, and wireless charging. Constructed from 60% post-consumer recycled plastic, it also includes an eco-mode auto-shutdown feature to optimize power usage.

Power Strip Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.3 billion

Revenue forecast in 2030

USD 17.5 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, protection type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

General Electric Company; Belkin; Leviton Manufacturing Co., Inc.; Schneider Electric; Legrand; Koninklijke Philips N.V.; Siemens; ABB; Panasonic Corporation; Cyber Power Systems, Inc.; Delixi Electric; Falconer Electronics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Strip Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global power strip market report based on type, protection type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Power Strip

-

Common Power Strip

-

Specialized Power Strip

-

-

Protection Type (Revenue, USD Million, 2018 - 2030)

-

Surge Protection

-

Fuse-based Protection

-

Others

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.