- Home

- »

- Consumer F&B

- »

-

Powdered Sugar Market Size, Share & Trends Report, 2030GVR Report cover

![Powdered Sugar Market Size, Share & Trends Report]()

Powdered Sugar Market (2024 - 2030) Size, Share & Trends Analysis Report By Nature (Conventional, Organic), By Application (Bakery, Confectionary, Dairy, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-550-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Powdered Sugar Market Size & Trends

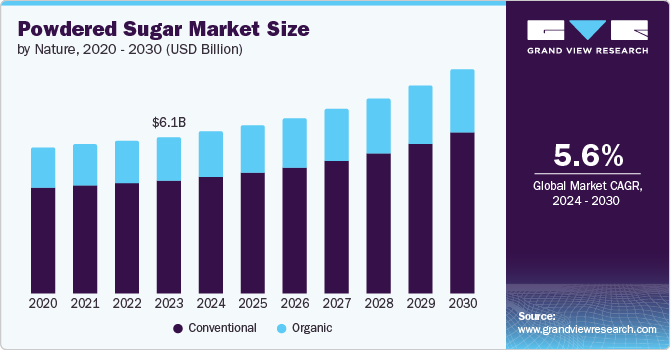

The global powdered sugar market size was valued at USD 6.11 billion in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. The increasing demand for convenience and ready-to-use products in the food and beverage industry proliferates the market. Powdered sugar offers a convenient alternative to granulated sugar, making it easier to dissolve in liquid mixtures and providing a smoother texture in various applications such as baking, confectionery, and beverage production. This convenience factor has contributed to powdered sugar's rising popularity among consumers and food manufacturers.

As consumer demand for baked goods, sweets, and desserts continues to rise globally, the need for powdered sugar as a crucial ingredient in these products has surged. This trend is particularly pronounced in emerging markets where increasing disposable incomes and urbanization drive higher consumption of convenience foods and artisanal baked goods. As lifestyles become busier, consumers seek ready-to-use ingredients that simplify cooking and baking. Powdered sugar, known for its ease of use in various recipes-from frostings to desserts-caters perfectly to this demand. Its ability to dissolve quickly and blend seamlessly into mixtures makes it an ideal choice for home bakers and professional chefs looking for efficiency without sacrificing quality.

Furthermore, the globalization of food culture and the rising popularity of international cuisines have also been instrumental in driving the expansion of the powdered sugar market. With the growing influence of diverse culinary traditions and the increasing consumption of ethnic foods, the demand for powdered sugar as a fundamental ingredient in global recipes has surged. This trend has stimulated powdered sugar consumption in traditional markets and opened new opportunities for market expansion in regions with evolving food preferences and culinary practices.

Nature Insights

The conventional segment dominated the market and accounted for a market revenue share of 72.4% in 2023. Conventional powdered sugar benefits from economies of scale and established production techniques that keep prices relatively low compared to specialty or organic alternatives. Large-scale food manufacturers and producers benefit from affordability as they must manage ingredient costs while maintaining product quality. The ability to offer competitive pricing helps conventional powdered sugar maintain a strong market position, especially in price-sensitive segments and regions.

The organic segment is expected to register the fastest CAGR of 6.2% during the forecast period. The increasing consumer demand for organic and natural products. As awareness of health and environmental issues grows, more consumers seek foods made with organic ingredients, including powdered sugar. This shift is driven by a desire to avoid synthetic chemicals and pesticides, leading to a heightened preference for organic products that are perceived as healthier and more sustainable.

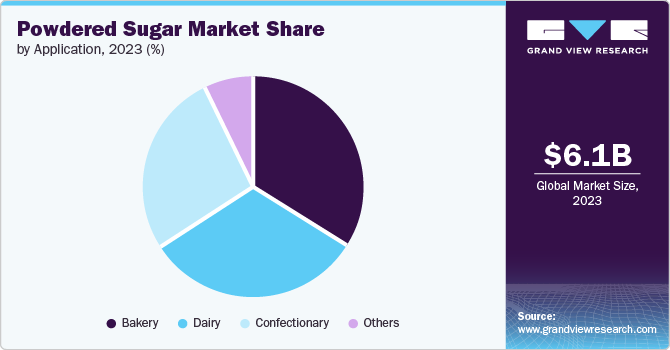

Application Insights

Bakery accounted for the largest market revenue share in 2023. The bakery industry has seen an increase in the variety of products available, from artisanal breads to gourmet desserts. This diversification creates a greater need for specialized ingredients, including powdered sugar, essential for creating smooth frostings, glazes, and decorative toppings. As consumers become more adventurous and seek out unique and high-quality bakery items, the demand for powdered sugar to achieve desired textures and finishes in these diverse products grows accordingly.

The dairy segment is expected to register the fastest CAGR during the forecast period. As consumers globally embrace a variety of dairy offerings such as flavored yogurts, cheese spreads, and creamy desserts, the demand for powdered sugar rises to meet the need for consistent sweetness and texture in these products. Powdered sugar is essential in creating smooth, sweet, and stable formulations in dairy applications, contributing to its growing importance in this segment.

Regional Insights

North America powdered sugar market accounted for the largest market revenue share of 36.1% in 2023. North America boasts a thriving bakery industry that includes everything from artisanal bread and pastries to mass-produced confectioneries. This sector's demand for powdered sugar is driven by its essential role in creating frostings, glazes, and sweetened fillings. As commercial and home bakers seek to meet consumer preferences for various baked goods, the need for powdered sugar remains substantial, fueling market growth.

U.S. Powdered Sugar Market Trends

The U.S. powdered sugar market is anticipated to grow significantly over the forecast period. Artisanal bakeries and cupcake shops, such as Magnolia Bakery in New York City, use powdered sugar in their gourmet frostings and glazes. This widespread use across both large and small bakeries underscores the crucial role of powdered sugar in achieving the desired taste and texture in baked goods, supporting its market growth.

Europe Powdered Sugar Market Trends

Europe powdered sugar market was identified as a lucrative region in 2023. Expanding retail and food service channels across Europe have also driven the powdered sugar market. Supermarkets such as Tesco in the UK and Carrefour in France, specialty food stores, and online retailers provide consumers with a wide range of powdered sugar products. Additionally, the growing food service sector, including cafes, restaurants, and patisseries, uses powdered sugar in various menu items, from desserts to beverages.

The UK powdered sugar market is anticipated to grow significantly over the forecast period. The influence of culinary trends and consumer preferences shapes the dynamics of the country's market. As new baking and cooking trends emerge, such as the popularity of specific dessert styles or techniques, the demand for powdered sugar adapts accordingly. For instance, trends like vegan baking or gluten-free recipes may lead to increased use of powdered sugar as a substitute for other sweeteners or as an ingredient in specialized recipes.

Asia Pacific Powdered Sugar Market Trends

Asia Pacific powdered sugar market is anticipated to register the fastest CAGR over the forecast period. The rising population and the increasing disposable income levels in many Asian countries have made premium sweets and dairy products more affordable and accessible to a more extensive consumer base. The growing middle class in the area is fueling the need for Western desserts and pastries containing powdered sugar as a main component. Furthermore, the ever-increasing food processing sector in nations such as India and China are creating fresh prospects for the use of powdered sugar.

China powdered sugar market is anticipated to grow rapidly over the forecast period. As the influence of Western culinary traditions continues to permeate Chinese food culture, the demand for powdered sugar as an essential ingredient in cakes, pastries, and desserts has risen substantially. This trend is further fueled by the growing popularity of baking as a hobby and the emergence of baking as a form of creative expression, leading to heightened demand for powdered sugar among home bakers and culinary enthusiasts.

Key Powdered Sugar Company Insights

Some of the key companies in the powdered sugar market Südzucker United Kingdom Ltd., Tate & Lyle Sugars, Cargill, Inc., and others.

-

Tate & Lyle Sugars'powdered sugar offerings are designed to meet the diverse needs of industrial and retail customers. Known for its fine texture and quick-dissolving properties, the company's powdered sugar is ideal for various applications such as baking, confectionery, and dessert preparation.

-

Imperial Sugar offers powdered sugar that is finely milled to ensure a smooth texture, making it ideal for a wide range of culinary applications. This product is often used in baking and confectionery, where its fine granulation allows it to dissolve quickly and blend seamlessly into recipes. The powdered sugar from Imperial is available in different packaging options, catering to commercial bakers and home cooks alike.

Key Powdered Sugar Companies:

The following are the leading companies in the powdered sugar market. These companies collectively hold the largest market share and dictate industry trends.

- Südzucker United Kingdom Ltd.

- Tate & Lyle Sugars

- Cargill, Inc.

- Imperial Sugar

- Nordic Sugar A/S

- American Crystal Sugar Company

- Domino Foods, Inc.

- Taikoo Sugar Ltd.

- Wholesome Sweeteners, Inc.

- Nanning Sugar Industry Co., Ltd.

Recent Developments

-

In January 2024, Verax announced its entry into the North American sugar market. This strategic move aims to expand its footprint and enhance its operational capabilities within a region with significant demand for powdered sugar products. The company plans to leverage its extensive experience and established supply chain networks to cater to industrial and consumer markets across North America.

Powdered Sugar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.31 billion

Revenue forecast in 2030

USD 8.77 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Südzucker United Kingdom Ltd.; Tate & Lyle Sugars; Cargill; Inc.; Imperial Sugar; Nordic Sugar A/S; American Crystal Sugar Company; Domino Foods; Inc.; Taikoo Sugar Ltd.; Wholesome Sweeteners; Inc.; Nanning Sugar Industry Co.; Ltd.; Nanning Sugar Industry Co.; Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Powdered Sugar Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global powdered sugar market report based on nature, application, and region.

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery

-

Confectionary

-

Dairy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.