- Home

- »

- Advanced Interior Materials

- »

-

Powder Fire Suppression Systems Market Size Report, 2030GVR Report cover

![Powder Fire Suppression Systems Market Size, Share & Trends Report]()

Powder Fire Suppression Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Residential, Commercial, Industrial), By Region (North America, Europe, Asia Pacific), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-036-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

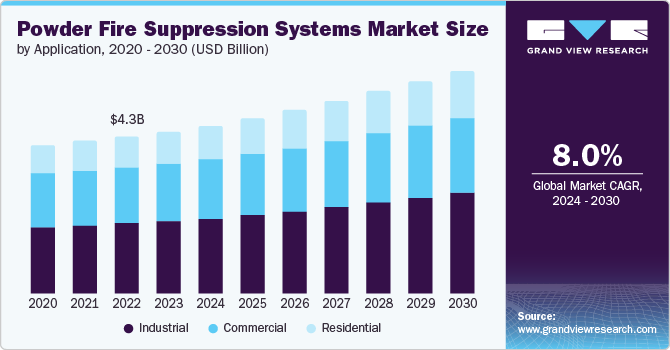

The global powder fire suppression systems market size was estimated at USD 4,490.4 million in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. The rising importance of fire safety products and growing emphasis by the government and regulatory agencies to improve fire safety standards is acting as a driver for the market growth. This push towards the usage of powder fire suppression systems by regulatory agencies is part of a broader initiative to enhance fire safety protocols, reflecting a commitment to safeguarding infrastructure, assets, and, most importantly, lives from the devastating impacts of fires.

The market has been growing in the U.S. due to the established regulatory framework in the country that governs high consumer awareness and higher implementation of fire safety precautions in residential, commercial, and industrial premises. In addition, the U.S. government is actively working to provide support to domestic businesses to purchase powder fire suppression systems.

For instance, in January 2022, the U.S. government introduced America Creating Opportunities for Manufacturing, Pre-Eminence in Technology, and Economic Strength (COMPETES) Act. Through this legislation, the government focuses on developing the supply chain, enhancing the workforce, and growing domestic manufacturing. The market growth is significantly driven by the rising population across the world. The growing population is creating a housing crisis in various metro cities. As a solution, high-rise building construction projects are rapidly increasing.

This demands better fire safety regulations for high-rise buildings, which is likely to propel the industry growth over the forecast period. Furthermore, the expansion of the commercial sector is also driving the growth of the overall industry. National Fire Protection Association (NFPA) standard 10 states that commercial places should install/provide portable fire extinguishers for the protection of cooking appliances that use combustible cooking media and other combustible substances. Such implementation of stringent regulations is anticipated to drive industry growth.

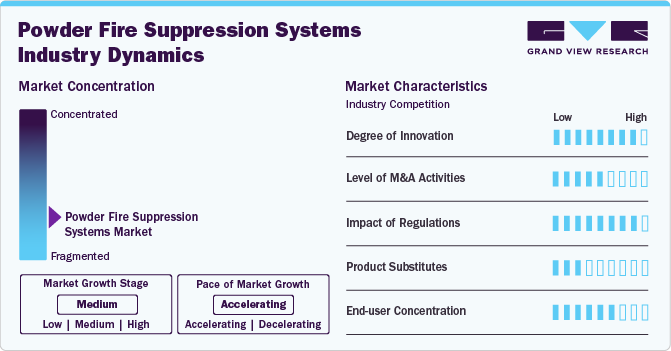

Industry Dynamics

Industry growth stage is medium, and pace is accelerating. The industry is characterized by a high degree of innovation due to rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global Industry.

For instance, in March 2022, Johnson Controls acquired Powertec Pumps Ltd. to strengthen its fire suppression unit business line. The acquisition helped JC to provide elevated customer service in the fire suppression sector

The industry is also characterized by a high degree of product innovation and incorporation of new technologies to optimize the system effectiveness, which results in the development of high-quality powder fire suppression systems.

The industry is majorly ruled by various certifications, regulations, and standards enforced by multiple organizations, such as the OSHA (Occupational Safety and Health Administration) and the governments of respective countries. For example, OSHA 29 Code of Federal Regulations (CFR) 1910.157 standards aim to minimize employee exposure to hazardous situations involving fire and to provide fire protection equipment.

The industry is slightly fragmented, with a few major players such as Johnson Controls, Carrier, and Reliable Fire & Security dominating the Industry and some smaller companies competing in space. Due to the growing urbanization and expansion of the manufacturing sector, new entrants are looking for more significant opportunities in the global industry for powder fire suppression systems.

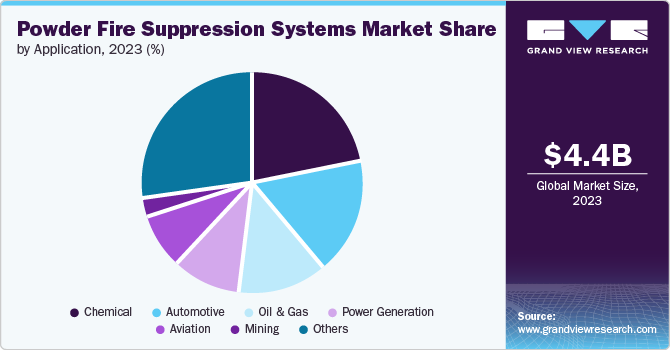

Application Insights

Based on application, the industrial segment led the market with the largest revenue share of 44.8% in 2023. The industrial segment consists of powder fire suppression systems used in manufacturing facilities, data hosting centers, warehouses & storage buildings, etc. These places are more prone to fire than yards. Moreover, fire protection laws and regulations are more developed and highly implemented compared to the residential and commercial sectors. For instance, according to the Occupational Safety and Health Administration (OSHA) standard, portable fire extinguishers must be placed within a travel distance of 75 feet in industrial units.

The residential segment is anticipated to witness at the fastest CAGR of 5.6% over the forecast period. The rising population and growing housing sector are expected to significantly fuel the demand for powder fire suppression systems over the forecast period. Moreover, the rising awareness related to fire safety protocols meant for residential applications among end-users across the world is expected to fuel the product demand in residential buildings. For instance, in November 2022, the Federation of European Fire Officers (FEU) and the European Fire Safety Alliance launched an EU-wide awareness program.

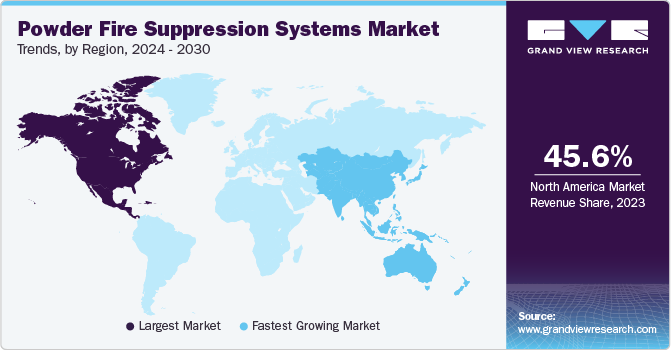

Regional Insights

North America dominated the powder fire suppression systems market with the revenue share of 45.6% in 2023. This market is characterized by substantial growth in the data, automotive, mining, textile, and chemical industries. Furthermore, the rising multi-family housing projects and growing high-rise building construction are anticipated to fuel the market growth.

U.S. Powder Fire Suppression Systems Market Trends

The powder fire suppression systems market in U.S. accounted for more than 80.0% of the North America in 2023. The market is driven by the expansion of industrial sectors such as energy and electricity, manufacturing, and oil and gas, which involve a high risk of fire, as the utilization of resources such as coal, crude oil, petroleum, and flammable gases remains high in these industries.

Europe Powder Fire Suppression Systems Market Trends

The powder fire suppression systems market in Europe is anticipated to grow at the fastest CAGR during the forecast period. The implementation of strict fire safety regulations across Europe is expected to increase the usage of powder fire suppression systems in the region's construction industry. Moreover, the growing emphasis on improving the overall fire safety standards of buildings in Europe is projected to drive the market in the coming years.

The Germany powder fire suppression systems market accounted for the revenue share of more than 28.0% of Europe in 2023. The national Model Building Code in Germany mandates that fire protection features be included in the building design process from the beginning. In addition, Proof of fire protection is required for all structures in Germany with floors more than 7 meters. Such construction standards and regulations are likely to drive the market growth.

The powder fire suppression systems market in UK is expected to grow at a significant CAGR during the forecast period. Imposition of stringent regulations by the Government of the UK that mandate the installation of these systems in commercial buildings such as offices, schools, hotels, restaurants, cafes, museums, sports arenas, shopping malls, and hospitals is acting as a driver for the market.

Asia Pacific Powder Fire Suppression Systems Market Trends

The powder fire suppression systems market in Asia Pacific is anticipated to witness at the fastest CAGR over the forecast period. As the increasing number of fire accidents has compelled the ruling governments of Asia Pacific to lay down fire safety norms, which mandate the usage of powder fire suppression systems in commercial facilities such as offices, schools, hospitals, hotels, and others, to reduce the losses of lives due to the outbreak of fire.

The China powder fire suppression systems market accounted for the revenue share of over 28.0% of Asia Pacific in 2023. The Chinese government has been offering incentives to promote the manufacturing sector and the subsequent easing of FDI norms. Hence, the expansion of the manufacturing sector is driving the industrial construction in the country. Rising research & development investments by oil & gas companies in China and the growing demand for increasing LNG/CNG/gas production are expected to contribute to the market growth over the forecast period.

The powder fire suppression systems market in India is anticipated to grow at the fastest CAGR over the forecast period. India's economy is progressing rapidly owing to the launch of the “Make in India” program and the ongoing infrastructural development projects in the country. Moreover, due to high investment in industries such as automotive, power, nuclear, construction, and oil and gas, India is likely to contribute a major portion of the global demand for powder fire suppression systems in coming years.

Central & South America Powder Fire Suppression Systems Market Trends

The powder fire suppression systems market in Central & South America is expected to witness at a significant CAGR during the forecast period, owing to the increasing mining production and coupled up with the adoption of powder fire suppression systems in the region.

Brazil powder fire suppression systems market is likely to dominate the regional market share and remained at over 40.0%. The country’s increasing mineral production is likely to increase market demand for powder fire suppression systems owing to regulations which state that the installation of fire suppression technology is a must in the mining industry.

Middle East & Africa Powder Fire Suppression Systems Market Trends

The powder fire sup The pression systems market in Middle East and Africa is expected to witness at the fastest CAGR over the forecast period. According to the International Monetary Fund, strong government expenditure in GCC is expected to increase the expenditure on the construction of hospitals, leisure projects, and schools, which, in turn, is, expected to propel the market growth in the region

The Saudi Arabia powder fire suppression systems market dominated the regional market. The oil & gas industry in Saudi Arabia generated a considerable part of the market as a result of sustained investments in hydrocarbon exploration and capacity expansion of refineries.

Key Powder Fire Suppression Systems Company Insights

Some of the key players operating in the global market include Johnson Controls, Carrier, Amerex Corporaton, and Buckeye Fire Equipment Company.

-

Carrier Global operates through its main fire safety brands namely Autronautica, Det-Tronics, Edwards, Kidde, Marioff, Badger, and Kidde Fire Systems. These brands provides a range of products from industrial fire extinguishers, smoke and carbon dioxide (CO2) detectors water mist suppression systems, clean agent suppression systems and fire alarm signals and systems to certified hazardous-area fire and gas safety systems

-

Johnson Controls offers its safety products through its divisions (brands) named Tyco, Ansul, Chemguard, Skum, Rapid Response, Sabo Foam, Hygood, Grinnell, SprinkCAD, PyroChem, and Williams Fire

Fireaway Inc., NAFFCO FZCO, and SIEX 2001 S.L. are some of the emerging market participants in the market.

-

NAFFCO is a firefighting equipment, fire alarms and suppression systems manufacturer and supplier based out of The Middle East. It specializes in providing services related to fire protection engineering

-

Fireaway is a manufacturer of fire suppression products. It provides thermal units, manual units, and electrical units to protect people, property, and business assets. The company caters to multiple industries, such as transportation, mining, power utilities, marine, wind, and the telecommunications industry

Key Powder Fire Suppression Systems Companies:

The following are the leading companies in the powder fire suppression systems market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson Controls

- Carrier

- Reliable Fire & Security

- Koorsen Fire & Security

- Gielle Group

- Afex Fire Suppression Systems

- American Fire Technologies

- Fireaway Inc.

- Buckeye Fire

- Amerex Corporation

- AKRONEX International Fire Engineering Inc.

- SIEX

- Hochiki Corporation

- NAFFCO FZCO

- Halma plc

Recent Developments

-

In February 2024, AFEX Fire Suppression Systems, experts in creating and producing fire safety solutions for heavy-duty vehicles, declared its formal venture into the Asia-Pacific region. This strategic move is expected to enable the company to meet the growing need for high-quality fire suppression systems in the region

-

In June 2022, Zenova PLC, a fire safety and heat management solutions provider based in the U.K., appointed a sub-distribution partner in Saudi Arabia through a distribution agreement with Ethmaar Investment Company. The company aims to increase its market presence in Saudi Arabia by providing thermal insulation and fire protection products

-

In March 2021, Gielle Industries secured a contract to provide support for fire-fighting vehicles at European institution facilities in Luxembourg for a duration of five years. This partnership is expected to enhance the company's footprint in Germany in the near future

Powder Fire Suppression Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4,650.7 million

Revenue forecast in 2030

USD 6.17 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018- 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; UK; Spain; Italy; China; India; Japan; South Korea; Australia; Argentina; Brazil; Saudi Arabia; South Africa, Israel

Key companies profiled

Johnson Controls, Carrier; Reliable Fire & Security; Koorsen Fire & Security; Gielle Group; Afex Fire Suppression Systems; American Fire Technologies; Fireaway Inc.; Buckeye Fire; Amerex Corporation; AKRONEX International Fire Engineering Inc.; SIEX, Hochiki Corporation; NAFFCO FZCO; Halma plc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Powder Fire Suppression Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global powder fire suppression systems market report based on application, and region.

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Automotive

-

Paint Booths

-

Inflammable Liquid Storage

-

Others

-

-

Chemical

-

Oil & Gas

-

Power Generation

-

Aviation

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Israel

-

-

Frequently Asked Questions About This Report

b. The powder fire suppression systems market size was estimated at USD 4,490.4 million in 2023 and is expected to be USD 4,650.7 million in 2024.

b. The powder fire suppression systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 6.17 billion by 2030.

b. North America region dominated the market and accounted for 45.6% share in 2023, which is attributed to its wide application in end use industries and high product awareness among the masses.

b. Some of the key players operating in the powder fire suppression systems market include Johnson Controls, Carrier, Hochiki Corporation, NAFFCO FZCO, Halma plc, Koorsen Fire & Security, etc.

b. Key factors driving the powder fire suppression systems market is rising industrial manufacturing, growing residential/high rise buildings, and stringent laws and regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.