- Home

- »

- Consumer F&B

- »

-

Powder Dietary Supplements Market, Industry Report, 2030GVR Report cover

![Powder Dietary Supplements Market Size, Share & Trends Report]()

Powder Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredient (Vitamin, Multivitamin, Botanicals, Minerals, Proteins & Amino Acids), By Type, By Application, By End User, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-498-4

- Number of Report Pages: 165

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Powder Dietary Supplements Market Summary

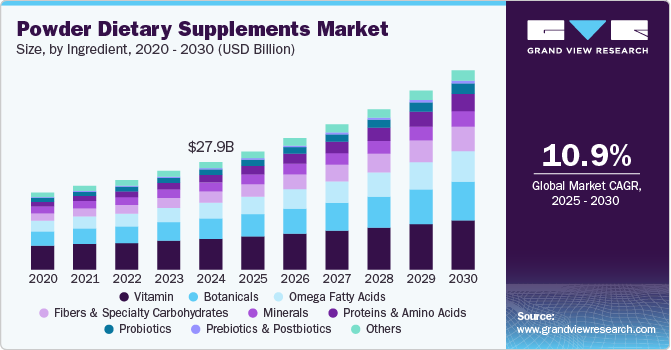

The global powder dietary supplements market size was estimated at USD 27.93 billion in 2024 and is projected to reach USD 51,706.1 million by 2030, growing at a CAGR of 10.9% from 2025 to 2030. A primary driver is the increasing consumer awareness of health and wellness, leading to a proactive approach to nutrition.

Key Market Trends & Insights

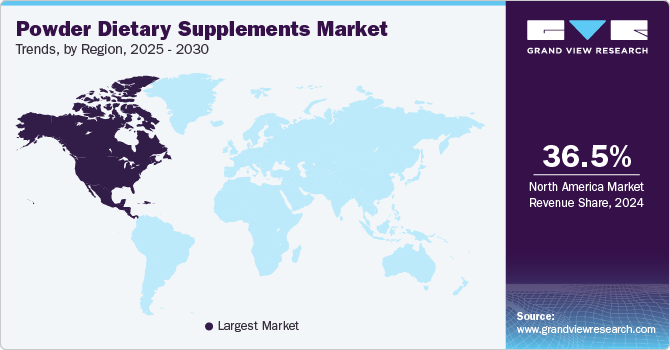

- North America dominated the powder dietary supplements market with a share of 36.50% in 2024.

- The powder dietary supplements market in the U.S. is expected to grow at a CAGR of 9.4% from 2025 to 2030.

- By ingredient, the vitamin supplements segment accounted for a revenue share of 28.7% in 2024.

- By type, the OTC-type powder dietary supplements segment accounted for a revenue share of 75.6% in 2024.

- By application, the energy & weight management application segment accounted for a revenue share of 30.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.93 Billion

- 2030 Projected Market Size: USD 51,706.1 Million

- CAGR (2025-2030): 10.9%

- North America: Largest market in 2024

Powder supplements have higher acceptance among people who are actively seeking convenient and customizable ways to supplement their diets. This extends beyond basic vitamin and mineral supplementation; there's a rising interest in specialized powders catering to specific needs such as sports performance, weight management, and gut health. Moreover, the ease of incorporating powders into various beverages and recipes adds to their appeal, making them a versatile option for busy lifestyles.

Consumers are becoming more discerning about the ingredients they consume, favoring natural, organic, and minimally processed options. This shift is pushing manufacturers to formulate powders with plant-based proteins, adaptogens, and other natural extracts. Additionally, the focus on transparency and sustainability is becoming more prominent, with consumers seeking products with clear sourcing information and eco-friendly packaging, forcing companies to adapt their sourcing and manufacturing practices.

The rise of e-commerce and direct-to-consumer (DTC) brands has also played a crucial role in shaping the market. Online channels provide easy access to a wider range of products and allow consumers to research and compare options before making a purchase. DTC brands can cultivate personal relationships with their customers, often through social media and content marketing, creating a more engaged and loyal consumer base. This accessibility and personalized experience has expanded the market reach significantly, overcoming geographical barriers and empowering niche brands to thrive.

The ongoing innovation in formulations and delivery systems is a strong demand driver. Companies are constantly researching and developing new ingredient combinations, enhanced flavors, and more convenient packaging formats. This includes the incorporation of innovative ingredients like probiotics, prebiotics, and nootropics, as well as the development of single-serving sachets and pre-mixed powders. These advancements are not only attracting new consumers but also retaining existing ones by offering improved palatability, efficacy, and ease of use, further solidifying the market's upward trajectory.

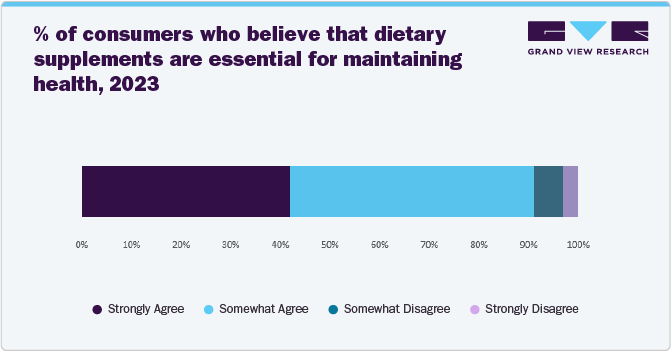

Consumer Surveys & Insights

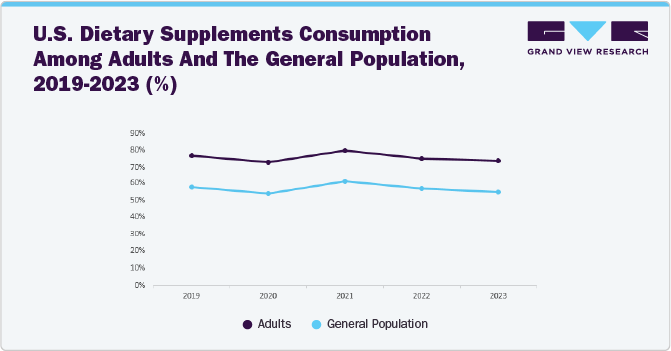

According to the Council for Responsible Nutrition (CRN), overall consumer spending on dietary supplements in the U.S. has shown stability, with median monthly expenditures hovering around USD 48 in 2023 and USD 50 in 2024. Notably, consumers purchasing supplements through healthcare professionals exhibit significantly higher spending patterns, reaching a median monthly outlay of USD 100. Moreover, the CRN 2023 survey revealed that approximately 74% of the U.S. adult population reported taking supplements, while around 55% of the general U.S. population are “regular” users.

Moreover, the 2024 survey conducted by the Council for Responsible Nutrition (CRN) indicates strong market demand for dietary supplements, with approximately 75% of Americans reporting current usage of supplements. This high adoption rate underscores the continued significance of supplements within the health and wellness sector. The sustained consumer interest signifies a robust and reliable business opportunity for companies in this market.

Ingredient Insights

The vitamin supplements accounted for a revenue share of 28.7% in 2024.Consumers are increasingly seeking ways to easily integrate vitamins into their daily routines, and powders provide a versatile option that can be mixed into smoothies, shakes, or even plain water. This preference for personalized nutrition is also driving demand, as individuals can more easily customize their vitamin intake based on their specific needs and deficiencies. Furthermore, the growth is supported by an expanding elderly population more aware of the benefits of daily vitamin intake and a growing focus on overall wellness promoting vitamin supplementation. Demand is not only from older populations, it’s also being fueled by the fitness community who use vitamins to enhance performance as well as boost general health and wellbeing.

The proteins & amino acids supplements are anticipated to witness a growth rate of 15.2% from 2025 to 2030, driven by the escalating interest in sports nutrition and fitness pursuits. As more individuals actively engage in various forms of exercise, the demand for protein supplementation to support muscle growth, repair, and recovery is amplified. Whey protein remains a dominant player due to its high bioavailability, but plant-based proteins such as pea, soy, and rice are continuing to see rapid growth as consumers look for alternatives to animal sources. The understanding of the role of essential amino acids in building muscle and optimizing body function is also contributing to the overall demand. Consumers are being educated on how proteins & amino acids contribute to various aspects of health such as immunity, energy and performance in addition to muscle growth.

Type Insights

The OTC-type powder dietary supplements accounted for a revenue share of 75.6% in 2024. A significant trend is the increasing consumer awareness of preventative healthcare measures and the desire for convenient, personalized nutrition. This fuels the demand for protein powders, pre-workout formulas, and vitamin/mineral blends that can be easily integrated into daily routines. Furthermore, the rise of fitness and wellness culture, amplified by social media influence, has propelled the popularity of powders that support athletic performance, muscle growth, and weight management. This translates to strong sales across various demographics, from active young adults to older individuals seeking to maintain mobility and overall well-being. We’re also seeing a growth in demand for plant-based and clean-label formulations, reflecting a shift towards natural ingredients, transparency, and sustainability within the consumer base.

The prescribed type of powder dietary supplement is anticipated to witness a growth rate of 11.3% from 2025 to 2030, primarily driven by the increasing recognition of nutritional deficiencies and medical conditions that benefit from targeted supplementation. Medical professionals are more frequently incorporating powder supplements into patient care plans, particularly for individuals with specific dietary restrictions, malabsorption issues, or chronic illnesses. These prescribed supplements are often formulated with higher concentrations of active ingredients and higher safety standards and are specifically tailored to address therapeutic needs, including medical foods or for patients undergoing specific therapies. The aging population and the rise in age-related health issues also contribute to the demand for prescribed powders that support bone health, cognitive function, and overall nutritional status among elderly patients.

Application Insights

The energy & weight management application accounted for a revenue share of 30.2% in 2024. A rising awareness of the link between diet, exercise, and overall well-being fuels the demand for convenient and effective solutions. Consumers are increasingly seeking out powder dietary supplements that can enhance workout performance, boost energy levels without the crash associated with sugary beverages, and support weight loss or maintenance goals. This is further amplified by the trend towards personalized nutrition, with consumers looking for blends tailored to their specific needs and preferences, often prioritizing natural ingredients and clean label formulations. Key trends include the popularity of pre-workout powders, protein-based weight management options, and the use of adaptogens and natural stimulants for sustained energy.

The prenatal powder dietary supplement market is estimated to grow at a CAGR of 15.8% from 2025 to 2030. Expectant mothers are increasingly educated about the importance of essential nutrients like folate, iron, and calcium, and often seek out easy-to-consume powder options to complement their diet and ensure they are meeting their increased nutritional needs. The trend towards preventative healthcare is a strong underlying driver, with many women proactively taking powder dietary supplements before, during, and after pregnancy based on recommendations from healthcare providers and trusted sources. The convenience and ease of incorporation into daily routines are significant factors contributing to the increasing popularity of powder prenatal supplements. Many women experience difficulty swallowing large pills or dislike the taste of chewable vitamins, making powder forms an attractive alternative.

End User Insights

The adult powder dietary supplement accounted for a revenue share of 63.2% in 2024. A strong emphasis on preventative healthcare is driving consumers to proactively seek supplements to support their overall well-being, rather than solely treating ailments. This includes increased interest in powders that support specific health goals such as weight management, improved athletic performance, enhanced immunity, and better digestive health. The demand for adult powder supplements is further amplified by the expanding influence of social media and online communities. Influencers and health professionals readily share information about the benefits of supplements, contributing to greater awareness and acceptance across diverse demographics.

The infant powder dietary supplement market is estimated to grow at a CAGR of 12.4% from 2025 to 2030, driven by the recognition of the crucial role early nutrition plays in a baby's development. Parents are increasingly seeking out supplementary options, particularly those fortified with essential vitamins, minerals, and probiotics, to ensure their infants receive optimal nutrition, especially when breastfeeding is not an option or needs to be supplemented. The demand is also influenced by recommendations from pediatricians and healthcare professionals regarding the need for specific nutrients like vitamin D and iron, which may be lacking in a baby's diet. Concerns about food allergies and sensitivities are also driving the demand for specialized hypoallergenic formulas and supplements made with limited ingredients. Additionally, convenient and easy-to-prepare formats are crucial, making powdered options appealing to busy parents.

Distribution Channel Insights

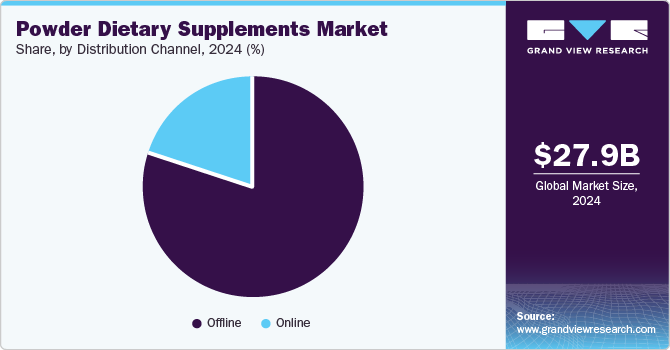

The sales of powder dietary supplements market through offline channels accounted for a revenue share of 79.7% in 2024. Many consumers value the ability to physically see, touch, and even sample products before making a purchase, especially when investing in supplements they intend to incorporate into their regular routines. This tactile experience builds trust and allows shoppers to immediately address any queries with knowledgeable staff. Furthermore, the offline channel benefits from the presence of established brands with strong shelf presence, appealing to consumers seeking tried-and-true products. Convenience is another significant factor, with many consumers opting to pick up supplements during their regular grocery runs or when visiting their local pharmacy for other health needs.

The online segment is estimated to grow at a CAGR of 11.6% from 2024 to 2030. The digital landscape allows consumers to access a vast array of products from a multitude of brands, often from the comfort of their own homes. Moreover, the availability of detailed product information and customer reviews empowers consumers to make informed purchase decisions. Price transparency and the ability to easily compare products from different suppliers also make the online channel highly attractive to budget-conscious consumers. In addition, the 2023 CRN survey reveals a significant market dominance for Amazon in online supplement sales. A substantial 77% of supplement consumers report making purchases through Amazon in the past year. This contrasts sharply with other online retail platforms and direct-to-consumer supplement company websites, which capture only 23% and 22% of consumers, respectively, indicating a strong preference for Amazon as the primary online channel.

Regional Insights

The powder dietary supplements market in North America held over 36.5% of the global revenue in 2024, driven by a strong health and wellness consciousness among consumers. Key trends include increasing demand for plant-based protein powders, driven by both vegans/vegetarians and flexitarians. Sports nutrition remains a major category, with performance-enhancing and muscle-building products seeing consistent sales. Furthermore, supplement companies' aggressive marketing, often leveraging celebrity endorsements and social media influencers, generates significant buzz and product awareness.

U.S. Powder Dietary Supplements Market Trends

The powder dietary supplements market in the U.S. is expected to grow at a CAGR of 9.4% from 2025 to 2030. A strong emphasis on preventative health and self-care drives the demand for a diverse range of supplements, encompassing everything from multivitamins and minerals to specialized formulations for weight management and cognitive enhancement. The market is also highly influenced by consumer education, with readily available information online empowering people to make informed decisions about their supplement choices. The convenience and customization offered by powder supplements align perfectly with the busy American lifestyle. The primary drivers of demand in the U.S. stem from a blend of lifestyle and cultural factors. A high prevalence of obesity and related health conditions fuels the demand for weight management and metabolic support supplements.

Europe Powder Dietary Supplements Market Trends

The powder dietary supplements market in Europe is expected to grow at a CAGR of 10.4% from 2025 to 2030. Consumers are increasingly scrutinizing ingredient lists and seeking out supplements with transparent sourcing and minimal processing. A strong regulatory environment, particularly in the EU, ensures high-quality standards and safety for products entering the market. The market is diverse, with noticeable regional differences in preference for certain ingredients or functionalities. For example, in some Northern European countries, there is a higher demand for products that support immunity, while in Southern Europe, digestive health products are very popular. Key demand drivers in Europe include shifting consumer preferences toward preventative healthcare and a growing awareness of the role of nutrition in overall well-being. The aging European population, with a higher incidence of age-related ailments, is also driving the demand for supplements that support healthy aging.

Powder dietary supplements market in Germany is matured due to the country’s economy leading in Europe. German consumers have a reputation for being discerning, favoring high-quality products with a strong emphasis on science-backed benefits and natural ingredients. The market is heavily influenced by the country's robust healthcare system and a strong consumer awareness of preventative health and well-being. There is a notable demand for vitamins and minerals, especially in powder form, due to their versatility, ease of use and ability to be easily incorporated into homemade protein shakes, smoothies and other meals. Moreover, German consumers are highly conscious of product safety and transparency, making compliance with EU regulations essential for market success. Consumers often seek out products with clear labeling and certifications, indicating a commitment to quality which pushes brands to keep up rigorous standards.

Asia Pacific Powder Dietary Supplements Market Trends

The powder dietary supplements market in the Asia Pacific is set to grow at a CAGR of about 12.3% from 2025 to 2030, driven by a large and increasingly health-conscious population. Key trends include strong growth in demand for traditional Chinese medicine (TCM) derived supplements, botanical ingredients and immunity-boosting products. The market is incredibly diverse, with regional nuances and variations in consumer preferences across different countries. The rise of e-commerce platforms has played a significant role in expanding the accessibility of various powder supplement brands throughout the region, making products much easier to purchase. Moreover, rising disposable incomes and urbanization have led to lifestyle changes and an increased focus on health and wellness. Besides, the growing middle-class population is increasingly focused on preventative health and willing to invest in supplements to enhance and maintain their well-being.

Japan powder dietary supplements market is mature and well-established with a strong focus on product quality, safety, and efficacy. Japanese consumers place the highest value on scientifically researched and evidence-based products. The population is relatively health conscious, with preventative care being a key consideration for many, and have a preference for brands with long-standing reputations. The market shows strong demand for collagen peptide supplements that promote skin health and anti-aging, as well as various vitamins and minerals in powder form. Moreover, the demand in Japan is primarily driven by its aging population, with a strong focus on longevity and maintaining an active lifestyle into later years. Japanese consumers have a strong cultural emphasis on health and beauty, boosting the demand for products that promote skin elasticity and vitality. Additionally, the working population, facing demanding schedules and long hours, is increasingly reliant on supplements to help manage stress and maintain overall health. The market is highly regulated with strict government oversight, making product quality assurance a crucial factor for success.

The powder dietary supplements market in the Australian & New Zealand is set to grow at a CAGR of about 10.2% from 2025 to 2030. Consumers there tend to be well-informed and demand transparency in sourcing and manufacturing processes. The market is competitive, with both local and international brands vying for market share with a range of products from sports nutrition to general health and wellness. A strong outdoor culture and an active lifestyle contribute to the demand for supplements that support performance and recovery. Moreover, the availability of supplements through multiple channels, such as health food stores, pharmacies and online retailers is increasing access.

Key Powder Dietary Supplements Company Insights

Key companies including Amway Corp., Nestle Health Science, Abbott, Bayer AG, Glanbia plc, Nature's Way Brands, LLC, Oziva, Herbalife Nutrition Ltd., NOW Foods, Haleon group of companies, Otsuka Pharmaceutical and Jarrow Formulas hold significant positions due to their extensive product portfolios, established distribution networks, and strong brand recognition. However, the market is also witnessing the rise of smaller, agile companies focusing on niche categories such as plant-based proteins, specific health condition support, and personalized nutrition. Strategies employed by these companies to gain and maintain a competitive edge include continuous new product launches catering to evolving consumer demands and health trends, strategic mergers and acquisitions to expand product offerings and market reach, aggressive geographical expansion into emerging markets, and a significant push to strengthen their online presence through e-commerce channels and direct-to-consumer models. These actions reflect the industry's pursuit of innovation, market penetration, and adaptability to changing consumer preferences within the highly competitive dietary supplement landscape.

Key Powder Dietary Supplements Companies:

The following are the leading companies in the powder dietary supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Amway Corp.

- Nestle Health Science

- Abbott

- Bayer AG

- Glanbia plc

- Nature's Way Brands, LLC

- OZiva

- Herbalife Nutrition Ltd.

- NOW Foods

- Haleon group of companies

- Otsuka Pharmaceutical

- Jarrow Formulas

Recent Developments

-

In May 2024, Vector Consumer, a UK-based company, strategically expanded its reach in the health and wellness market by acquiring Dose & Co, a New Zealand firm specializing in powder collagen supplements. This acquisition not only adds a well-regarded brand to Vector Consumer's existing product offerings but also taps into Dose & Co's established presence and innovation in the collagen supplement space. This move signals Vector Consumer's commitment to growth and its ambition to become a significant player in the increasingly popular category of nutritional supplements, specifically targeting consumers interested in beauty and wellbeing.

-

In December 2023, Centrum expanded its product line in India by introducing multivitamin and protein powders. This move signifies a strategic effort to cater to the growing health and wellness consciousness among Indian consumers. By combining the benefits of both multivitamins and protein, Centrum aims to offer a convenient and comprehensive solution for individuals seeking to improve their nutritional intake and overall well-being.

Powder Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 30,794.2 million

Revenue forecast in 2030

USD 51,706.1 million

Growth rate (Revenue)

CAGR of 10.9% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, type, application, end-user, distribution channel, ingredient-application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, U.K., Germany, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Philippines, Thailand, Vietnam, Malaysia, Singapore, Indonesia, Brazil, Peru, Chile, Argentina, Colombia, South Africa, Saudi Arabia, and UAE

Key companies profiled

Amway Corp.; Nestle Health Science; Abbott; Bayer AG; Glanbia plc; Nature's Way Brands, LLC; Oziva; Herbalife Nutrition Ltd.; NOW Foods; Haleon group of companies; Otsuka Pharmaceutical; and Jarrow Formulas

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Powder Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global powder dietary supplements market report based on ingredient, type, application, end user, distribution channel, ingredient- application, and region:

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

-

Ingredient-Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

Multivitamin

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Vitamin A

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Vitamin B

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Vitamin C

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Vitamin D

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Vitamin K

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Vitamin E

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

-

Botanicals

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Minerals

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

Calcium

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Potassium

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Magnesium

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Iron

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Zinc

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Others

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

- Others

-

-

-

Proteins & Amino Acids

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

Collagen

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Others

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

-

Fibers & Specialty Carbohydrates

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Omega Fatty Acids

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Probiotics

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Prebiotics & Postbiotics

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Others

-

Energy & Weight Management

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

Philippines

-

Thailand

-

Vietnam

-

Malaysia

-

Singapore

-

Indonesia

-

-

Central & South America

-

Brazil

-

Peru

-

Chile

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global powder dietary supplements market was estimated at USD 27.93 billion in 2024 and is expected to reach USD 30.79 billion in 2025.

b. The powder dietary supplements market is expected to grow at a compound annual growth rate of 10.9% from 2025 to 2030 to reach USD 51.71 billion by 2030.

b. North America dominated the powder dietary supplements market with a share of 36.50% in 2024, driven by the increasing consumer awareness of health and wellness, leading to a greater emphasis on preventative care and self-management of health conditions. This has translated into a surge in demand for protein powders, particularly among fitness enthusiasts and athletes, as well as plant-based options catering to vegan and vegetarian populations. Furthermore, the convenience and versatility of powder formats are appealing to busy lifestyles.

b. Some of the key market players in the powder dietary supplements market are Amway Corp., Nestle Health Science, Abbott, Bayer AG, Glanbia plc, Nature's Way Brands, LLC, Oziva, Herbalife Nutrition Ltd., NOW Foods, Haleon group of companies, Otsuka Pharmaceutical and Jarrow Formulas.

b. The powder dietary supplements market has experienced significant growth in recent years, driven by the increase in obesity and the aging population, particularly in developed countries, as both adults and older individuals often seek supplements to address age-related and weight-related health concerns. Moreover, the ease of use and versatility of powder formats, which can be easily mixed into smoothies, shakes, or even water, make them particularly appealing to busy lifestyles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.