- Home

- »

- Animal Feed and Feed Additives

- »

-

Poultry Feed Market Size, Share, Industry Report, 2030GVR Report cover

![Poultry Feed Market Size, Share & Trends Report]()

Poultry Feed Market (2023 - 2030) Size, Share & Trends Analysis Report By Livestock (Layers, Broilers, Turkeys), By Additives (Antibiotics, Vitamins, Amino Acid, Feed Enzymes, Feed Acidifiers), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-680-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Poultry Feed Market Summary

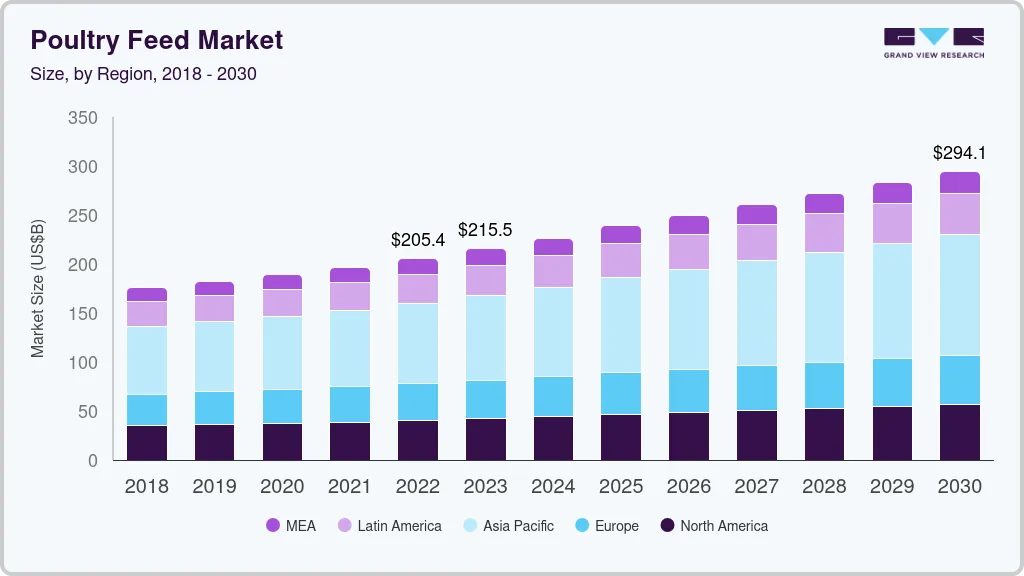

The global poultry feed market size was estimated at USD 205,422.1 million in 2022 and is projected to reach USD 294,071.8 million by 2030, growing at a CAGR of 4.6% from 2023 to 2030. The demand can primarily be attributed to the increasing poultry farming to cater to the rising demand for chicken meat and eggs globally.

Key Market Trends & Insights

- Asia Pacific was the largest in 2018 with a market volume share of 34.8%.

- By livestock, the broilers segment dominated the market with over 65% share in terms of both volume and revenue.

- By additive, the amino acid segment emerged as the largest segment in terms of both volume and revenue in 2018.

Market Size & Forecast

- 2022 Market Size: USD 205,422.1 Million

- 2030 Projected Market Size: USD 294,071.8 Million

- CAGR (2023-2030): 4.6%

- Asia Pacific: Largest market in 2018

Poultry is considered as one of the most economical sources of protein owing to which poultry products such as egg and meat are consistently witnessing growth in demand. According to the United States Department of Agriculture (USDA), the global production of chicken meat, with a growth of 2%, is likely to reach 97.8 million tons in 2019.

Demand for poultry products heavily depends upon the population and income factor. Packaged poultry feed is expected to witness higher growth rates as compared to traditional poultry feed, which, in turn, is anticipated to provide new opportunities for industry participants.

Quality and the price of feed products emerged as one of the most significant factors in this market owing to which suppliers are playing a critical role in the poultry feed industry. To keep the prices in manageable proportion, poultry feed producers are likely to increase their presence in raw material production, which is further projected to change the procurement strategies in the market.

The industry is highly competitive owing to the presence of numerous market players striving to manufacture products suitable for use in multiple applications. High competition in the market is pushing manufacturers to produce innovative products. The competition in the market is particularly intense among big players such as Cargill, Archer Daniels, Midland, Kemin Industries, and Lallemand, Inc.

Livestock Insights

Broilers segment, with over 65% market share in terms of both volume and revenue, emerged as the largest segment in 2018. Increasing demand for chicken meat owing to protein content emerged as a significant driving factor for the segment growth. Broilers are specifically raised for meat production.

Increasing demand for chicken meat owing to the presence of protein-rich content at low cost is triggering the growth of broilers farming. Proper nutrition is one of the most important factors in broilers farming. Broiler requires 13 vitamins, one essential fatty acid, 13 amino acids, 14-16 minerals, and a source of energy for balanced nutrition.

In 2018, layers segment, with approximately 30% volume share, emerged as the second-largest segment in the global poultry feed market. Layers are primarily reared for egg production. Increasing population across the globe is creating a high demand for food and energy sources, which is increasing the production of layer globally.

Increasing per capita egg consumption and growth in the global population are the major demand drivers for the growth of the layers segment. The U.S., Mexico, and Canada emerged as significant markets owing to the higher ratio of egg consumption, presence of various raw materials for feed, and consumer’s preference for poultry products.

Additive Insights

Amino acid segment emerged as the largest segment in terms of both volume and revenue in 2018 and is estimated to witness a remarkable growth rate over the coming years. The amino acid is considered as one of the most important sources of protein and, therefore, highly required in poultry nutrition. Due to high protein content, amino acid helps reduce the inclusion level of soybean meal in a monogastric animal’s diet.

Vitamins are a group of organic compounds required in small quantities for feed. Vitamins are used to regulate normal body functions, reproduction, and growth, which makes them an important additive. They can be broadly categorized into two different groups, namely water-soluble and fat-soluble vitamins.

Ethoxyquin is one of the majorly used synthetic antioxidants. It is also one of the economic antioxidants and has high preservative capabilities owing to which it is used in canned pet foods. However, the demand for such antioxidant has decreased in the recent past owing to negative consumer perceptions and side effects regarding synthetic antioxidants.

Regional Insights

Asia Pacific was the largest in 2018 with a market volume share of 34.8%. The presence of a huge population and increasing disposable incomes are likely to trigger the market growth at the fastest rate in Asia Pacific. Asia Pacific led by emerging economies such as China, India, and Malaysia has a competitive edge over other regions on account of the abundant availability of low-cost labor and agricultural land. The region is likely to advance at the fastest rate, in terms of both volume and revenue, over the forecast period owing to the huge population and increasing disposable incomes of consumers.

In the U.S., nearly thirty-five companies (federally inspected) are engaged in raising and processing of chicken. These companies are vertically integrated throughout the poultry value chain, which helps them ensure the quality of the product. The European poultry feed industry is driven by innovation and highly regulated.

Also, conventionally, the European market has been highly regulated in terms of human health and well-being as well as the environment. This results in regular changes in the guidelines for feed additives in terms of bans and restrictions. Increasing broiler production in Europe and consumers’ preference for poultry products owing to their economic prices in comparison to other substitutes are likely to develop the market across the region over the forecast period. Spain emerged as a major demand driver for the European market.

Key Companies & Market Share Insights

Royal DSM N.V.; Alltech Inc.; Novus International Inc.; Evonik Industries; Kent Nutrition Group, Inc.; and BASF are some of the companies present in the industry. Poultry feed manufacturers aim to achieve optimum business growth and establish a strong market position through the implementation of various strategies such as acquisitions, joint ventures, production capacity expansions, new product launches, promotion of key product brands, and significant investments in the research & development.

Emerging regional players or new entrants, especially in developing countries, are likely to have increased opportunities to enter the market. Rising establishment of government initiatives and ascending foreign investments in the developing agricultural sector, mainly in China and India, are expected to boost the market growth over the forecast period.

Poultry Feed Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 215,487.8 billion

Revenue forecast in 2030

USD 294,071.8 million

Growth Rate

CAGR of 4.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2014 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Livestock, additives, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, Japan, Indonesia, Vietnam, Brazil, Argentina, South Africa

Key companies profiled

Royal DSM N.V.; Alltech Inc.; Novus International Inc.; Evonik Industries; Kent Nutrition Group, Inc.; and BASF.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global poultry feed market report on the basis of livestock, additives, and region:

-

Livestock Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Layers

-

Broilers

-

Turkeys

-

Others

-

-

Additives Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Antibiotics

-

Vitamins

-

Antioxidants

-

Amino Acid

-

Feed Enzymes

-

Feed Acidifiers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global poultry feed market size was estimated at USD 182.1 billion in 2019 and is expected to reach USD 189.0 billion in 2020.

b. The global poultry feed market is expected to grow at a compound annual growth rate of 4.5% from 2019 to 2025 to reach USD 238.9 billion by 2025.

b. Asia Pacific dominated the poultry feed market with a share of 36.7% in 2019. This is attributable to rising poultry farming to cater to the rising demand for chicken meat and eggs globally.

b. Some key players operating in the poultry feed market include Royal DSM N.V.; Alltech Inc.; Novus International Inc.; Evonik Industries; Kent Nutrition Group, Inc.; and BASF.

b. Key factors that are driving the market growth include increasing demand for eggs and poultry meat as poultry is considered as one of the most economical sources of protein.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.