- Home

- »

- Medical Devices

- »

-

Portable Medical Devices Market Share & Growth Report, 2030GVR Report cover

![Portable Medical Devices Market Size, Share & Trends Report]()

Portable Medical Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Diagnostic, Monitoring, Therapeutics, Smart Wearable Devices), By Application, By Region, And Segment Forecast

- Report ID: GVR-2-68038-488-8

- Number of Report Pages: 208

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Portable Medical Devices Market Summary

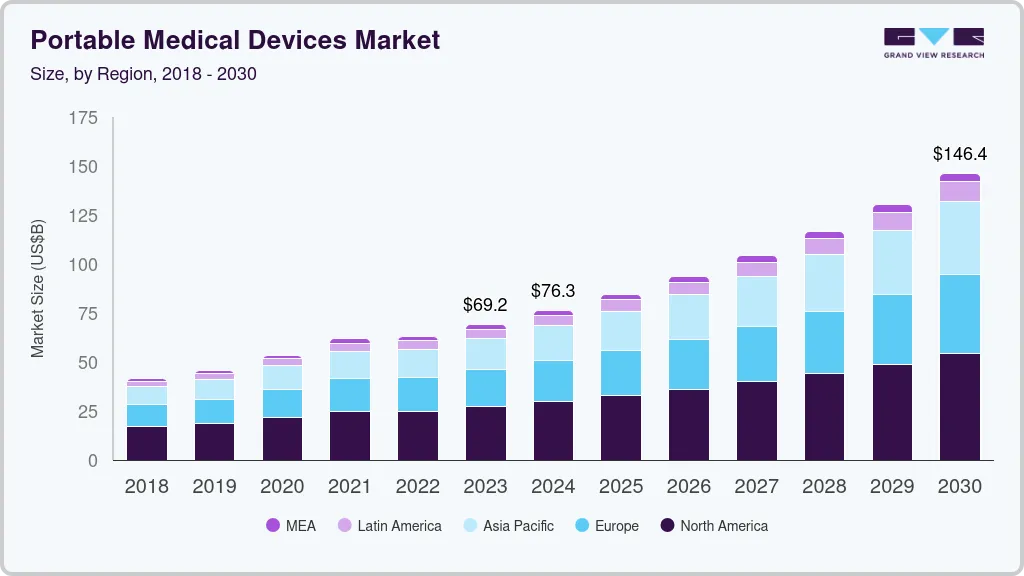

The global portable medical devices market size was estimated at USD 63.0 billion in 2022 and is projected to reach USD 146.4 billion by 2030, growing at a CAGR of 11.3% from 2023 to 2030. An increase in chronic diseases due to changing lifestyles, a preference for home healthcare, and a rise in the geriatric population is anticipated to positively impact the market growth in the coming years.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Europe held the second-largest revenue share of the global market in 2022.

- In terms of product, monitoring devices dominated the market with a share of 48.6% in 2022.

- Smart Wearable Medical Devices is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 63.0 Billion

- 2030 Projected Market Size: USD 146.4 Billion

- CAGR (2023-2030): 11.3%

- North America: Largest market in 2022

Furthermore, the growing demand for wearable electronics and wireless medical devices is among a few key factors for the market growth. Rising awareness among the population regarding the benefits of portable devices and the proliferation of smart technologies is also contributing to the adoption of portable medical devices in hospitals and healthcare settings.

Increasing aging population & the prevalence of chronic diseases globally, and the demand for home-based monitoring equipment are driving market expansion. For instance, according to the American Cancer Society's 2022 annual report, the projected number of new cancer cases in the U.S. was approximately 1.9 million, and over 500,000 people suffered critical illness leading to mortality from cancer in the country. Due to the high projected incidence of cancer and high mortality rate, there will be an increase in the use of health monitoring equipment among the affected population.

The rising emphasis on health & fitness among adults worldwide and the focus of national & regional healthcare agencies on diagnosis & monitoring has significantly contributed to the increase in demand for fitness trackers. Wearables aid in the evaluation of athletes' performances, physiological parameters, and body kinetics. Thus, increasing the adoption of wearables among professional athletes is anticipated to positively impact the market expansion. For instance, a 2021 article by RunRepeat claims that more than 445 million wearable fitness gadgets were sold in 2020, and the pandemic caused a 31% increase in sales.

The pandemic resulted in a significant demand for remote monitoring and patient engagement solutions, and manufacturers are increasingly focusing on expanding production to meet the growing need for portable monitoring devices. These devices play a significant role in combating COVID-19 infection and monitoring patients. For instance, the demand for monitoring devices, such as blood pressure monitors and temperature monitoring devices has drastically increased during the first phase of the COVID-19 pandemic in 2020, as there were critical parameters to be looked at for identifying the presence of the virus.

In addition, healthcare companies responded swiftly to the COVID-19 outbreak by offering a significant number of medical equipment for remote patient monitoring. For instance, in April 2020, the U.S. Food and Drug Administration (U.S. FDA) granted Abbott and Dexcom permission to deploy continuous glucose monitoring devices in hospitals in order to decrease contact with patients and remotely manage their health. Moreover, the pandemic has had a positive impact on the companies' sales due to the increased sales volume of the devices across countries worldwide. For instance, Koninklijke Philips N.V.’s connected care business segment generated a revenue of USD 6,834.0 million in 2020, an increase of 19.1% compared to 2019. Thus, the increased awareness among the population facilitated the strong adoption of the devices during COVID-19.

Product Insights

Monitoring devices dominated the market with a share of 48.6% in 2022. This can be attributed to the growing adoption in healthcare centers. Technological advancements, advantages such as mobility and compact design, and new product approvals are some other factors driving the market. For instance, in August 2020, Fitbit released the Fitbit Sense smartwatch, which, among other features, included the first-of-its-kind electrodermal activity sensor for stress management.

The Diagnostics segment held the second-largest market share in terms of revenue in 2022 owing to the increasing adoption of X-ray, CT scans, handheld ultrasound systems, and endoscopes among other systems in healthcare settings. Development of smaller, technologically advanced imaging platforms and subsequent product approvals are some other factors boosting the market. For instance, in July 2022, Fujifilm Europe introduced an innovative & portable hybrid C-arm and practical X-ray machine. The FDR cross-device is intended to deliver excellent fluoroscopic and static X-ray pictures during surgical treatment and additional medical procedures.

The smart wearable devices segment is expected to witness the fastest CAGR in the forecast period. This can be attributed to the rising demand for fitness and wristbands for long-term continuous health monitoring. Focus on preventive healthcare and the growing adoption of technologically advanced products are also expected to contribute to the growth of the portable medical devices market.

Application Insights

The other application segment which consists of oncology, musculoskeletal, thoracic, vascular, and metabolic applications, accounted for the largest market share in terms of revenue in 2022. The growing prevalence of cancer coupled with rising usage of diagnostic imaging and image-guided therapy systems is one of the key factors attributed to this growth. Moreover, the rising prevalence of diabetes and the adoption of advanced therapeutics is also contributing to the segment growth.

Cardiology held the second most prominent position in the market. This can be attributed to technological advancements and new product development in cardiology. Furthermore, technologies available in clinical settings, such as heart rate and rhythm monitors and blood pressure monitors, are now directly available to consumers, which is expected to boost demand for these products.

Gynecology is expected to register the maximum growth during the forecast period. The segment growth can be attributed to growing prevalence of gynecological disorders, such as Polycystic Ovary Syndrome (PCOS), endometriosis, uterine fibroids, and adenomyosis. As per an article published in the BMC Women's Health in July 2022, in China, dysmenorrhea was the most prevalent gynecological disorder with a prevalence of around 45.96%, followed by 19.04% of PCOS, 14.23% of uterine fibroids, 13.20% of spontaneous abortion, 11.16% of ovarian dysfunction, and around 4.09% of endometriosis.

Regional Insights

North America dominated the market with a share of 39.7% in 2022. Major factors contributing to the growth of this region include high penetration of diagnostic, therapeutic, and monitoring portable medical devices for disease management. A rising burden of chronic diseases and a growing geriatric population are also driving the market. According to the CDC, in July 2022, 12.1 million people in the U.S. were expected to have (AFib) atrial fibrillation by the year 2030. Therefore, the growing prevalence of AFib is anticipated to boost market growth, as patients with this condition require constant monitoring.

Europe held the second-largest revenue share of the global market. The UK, France, Germany, Italy, and Spain are the main markets in this region. Increasing geriatric population in developed countries, such as the UK, Germany, Italy, & France, and the presence of high unmet needs in Eastern Europe are some of the factors anticipated to drive growth over the forecast period.

Asia Pacific, on the other hand, is expected to attain a significant CAGR in the forecast period. Rise in the geriatric population, the growing prevalence of diabetes, escalating incidences of heart diseases, and an increase in disposable income along with the adoption of smart wearables are attributed to the regional market growth.

Key Companies & Market Share Insights

The portable medical devices market is highly fragmented owing to the presence of several manufacturers that provide handheld and mobile medical devices. Market players are undertaking strategic initiatives, such as product launches, partnerships, and acquisitions, to strengthen their presence. For instance, in March 2021, GE Healthcare launched Venue Fit, a portable and intelligent point-of-care ultrasound solution. This expanded the company’s portfolio. In April 2020, OMRON Corporation made a strategic alliance with AliveCor, which will combine Omron’s blood pressure devices with AliveCor’s ECG technology to promote remote patient care. Some of the prominent players in the global portable medical devices market include:

-

General Electric Company

-

OMRON Corporation

-

VYAIRE

-

Samsung

-

Koninklijke Philips N.V.

-

Medtronic

-

F. Hoffmann-La Roche Ltd

-

Nox Medical

Portable Medical Devices Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 69.2 billion

The revenue forecast in 2030

USD 146.4 billion

Growth rate

CAGR of 11.30% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Country scope

U.S.; Canada; Germany; U.K.; Spain; France; Italy; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand; South Korea; New Zealand; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia and Kuwait

Key companies profiled

General Electric Company; OMRON Corporation; VYAIRE; Samsung; Koninklijke Philips N.V.; Medtronic; F. Hoffmann-La Roche Ltd; and Nox Medical

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Portable Medical Devices Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global portable medical devices market based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Imaging

-

CT

-

X-ray

-

Ultrasound

-

Endoscope

-

-

Therapeutics

-

Insulin Pump

-

Nebulizer

-

Oxygen Concentrator

-

Image-guided Therapy Systems

-

-

Monitoring Devices

-

Cardiac Monitoring

-

Holter Monitors

-

Resting ECG System

-

Stress ECG Monitors

-

Event Monitoring Systems

-

ECG Management Systems

-

-

Neuromonitoring

-

EEG Machines

-

EMG Machines

-

ICP Monitors

-

MEG Machines

-

Cerebral Oximeters

-

-

Respiratory Monitoring

-

Capnographs

-

Spirometers

-

Peak Flow Meters

-

-

Fetal Monitoring

-

Neonatal Monitoring

-

Hemodynamic Monitoring Systems

-

Vital Sign Monitors

-

-

Smart Wearable Medical Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Gynecology

-

Cardiology

-

Gastrointestinal

-

Urology

-

Neurology

-

Respiratory

-

Orthopedics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The monitoring devices segment dominated the market for portable medical devices and accounted for the largest revenue share of 48.6% in 2022. This is attributable to technological advances, new product approvals, and benefits, such as compact design & portability.

b. The other application segment dominated the market for portable medical devices and accounted for the largest revenue share of 34.2% in 2022. This is attributable to increasing cancer prevalence and the rising use of imaging & image-guided treatment systems.

b. The portable medical devices market is expected to grow at a CAGR of 11.30% from 2023 to 2030 to reach USD 146.4 billion by 2030.

b. The global portable medical devices market size was estimated at USD 63.0 billion in 2022 and is expected to reach USD 69.2 billion in 2023.

b. North America dominated the portable medical devices market and accounted for the largest revenue share of 39.7% in 2022.

b. Some key players operating in the portable medical devices market include Koninklijke Philips N.V, General Electric Company, Medtronic, OMRON Corporation, Samsung, and F. Hoffmann-La Roche Ltd.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.