- Home

- »

- Next Generation Technologies

- »

-

Portable Lithium Power Station Market, Industry Report 2030GVR Report cover

![Portable Lithium Power Station Market Size, Share & Trends Report]()

Portable Lithium Power Station Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Direct Power, Solar Power), By Capacity, By Sales Channel, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-382-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

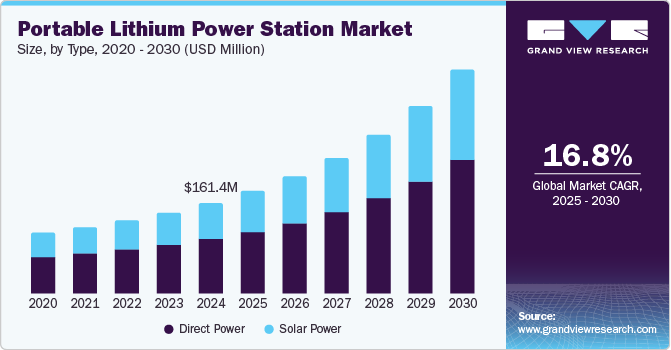

The global portable lithium power station market size was valued at USD 161.4 million in 2024 and is projected to grow at a CAGR of 16.8% from 2025 to 2030. The growth of the portable lithium power station market can be attributed to the increasing use of electronic devices, a shift towards renewable energy solutions, and a heightened need for reliable backup power sources due to frequent outages and natural disasters. These factors collectively create a robust environment for market expansion, indicating a promising outlook for the industry in the coming years.

The increasing reliance on electronic devices, such as smartphones, laptops, and other smart gadgets, is leading to market expansion. As these devices become more integral to daily life, the demand for reliable, portable power sources has surged. Portable lithium power stations offer a convenient solution, allowing users to charge multiple devices simultaneously, which is particularly beneficial during outdoor activities or emergencies when traditional power sources may not be available.

Moreover, many portable lithium power stations can be charged using solar energy, making them an attractive option for environmentally conscious consumers. This trend aligns with global efforts to reduce carbon emissions and transition to cleaner energy sources. The increased investment in renewable energy infrastructure, particularly in regions with unreliable electricity supply, further propels the demand for portable power solutions. For instance, according to the International Energy Agency (IEA), global energy investment is projected to exceed USD 3 trillion in 2024, with USD 2 trillion dedicated to clean energy technologies and infrastructure.

Type Insights

The direct power segment dominated the market with a revenue share of 60.5% in 2024. Direct power options provide immediate access to electricity, making them particularly considerable for users who require quick charging capabilities for their devices during outdoor activities or emergencies. In addition, the simplicity of plug and play functionality allows users to connect their devices directly to the power station without needing specialized knowledge or equipment. As lifestyles become increasingly mobile, the demand for direct power solutions is expected to continue rising, especially among outdoor enthusiasts, travelers, and individuals in regions with unreliable electricity.

The solar power segment is projected to grow at the highest CAGR during the forecast period. As consumers and businesses seek eco-friendly alternatives, portable lithium power stations that incorporate solar charging capabilities are becoming more popular. The advancements in solar technology have made solar panels more efficient and compact, allowing for faster charging times and improved energy conversion rates. Furthermore, government incentives and subsidies aimed at promoting renewable energy adoption are encouraging consumers to invest in solar-powered solutions.

Capacity Insights

The less than 500 WH segment dominated the market with the highest share in 2024, primarily due to its suitability for personal use and small-scale applications. These compact units are ideal for outdoor enthusiasts, campers, and travelers who need lightweight and portable energy solutions for small devices such as smartphones, tablets, and laptops. Their affordability and convenience make them a preferred choice among consumers looking for practical power sources for short trips or emergencies.

The 1,000 WH to 1,499 WH segment is expected to grow at the highest CAGR over the forecast period. This growth reflects a rising demand for higher capacity power stations that can support more substantial energy needs, such as powering appliances during extended outages or outdoor events. As consumers become more reliant on technology often bringing multiple devices on trips or requiring backup power for essential home appliances the need for larger capacity units becomes evident. These power stations can handle everything from refrigerators to medical equipment during emergencies, making them indispensable for families preparing for potential power disruptions.

Sales Channel Insights

The e-commerce segment dominated the market with the highest revenue share in 2024. The convenience of online shopping has made it easier for consumers to access a wide range of portable lithium power stations from various brands. E-commerce platforms provide detailed product information, customer reviews, and competitive pricing, which enhance consumer confidence in purchasing these products online. For instance, according to a report by ESW, 95% of consumers consult customer reviews before making a purchase, underscoring the importance of product ratings in e-commerce. Furthermore, online retailers often offer exclusive deals and promotions that are not available in physical stores, attracting price-sensitive customers.

The brick and mortar segment is expected to grow at a significant CAGR over the forecast period. Physical retail stores offer consumers the opportunity to see and test portable lithium power stations firsthand before making a purchase. This tactile experience can influence buying decisions, especially for customers who prefer to assess product quality and features directly. Retailers often provide knowledgeable staff who can offer personalized recommendations based on individual needs and preferences.

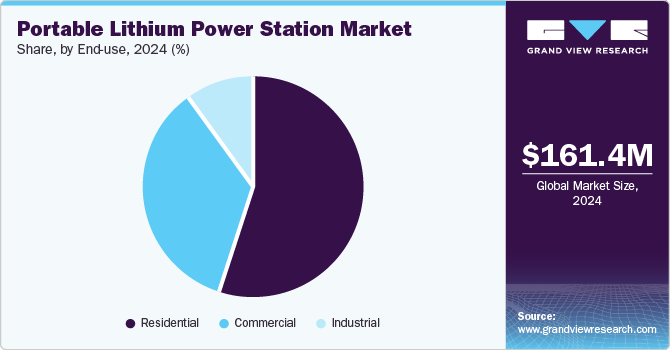

End Use Insights

The residential segment dominated the market with the highest revenue share in 2024, as homeowners seek reliable backup power solutions for everyday use and emergencies. The increasing adoption of smart home technology has heightened awareness of energy management systems that integrate seamlessly with portable lithium power stations. Homeowners are looking for ways to ensure that their essential devices remain powered during outages. In addition, as utility rates fluctuate and concerns about grid reliability grow, many households view these portable units as valuable investments that enhance energy independence and resilience.

The industrial segment is projected to grow at the fastest CAGR during the forecast period, as businesses look for efficient energy solutions to support operations while reducing reliance on traditional energy sources. Industries such as construction and telecommunications require reliable backup systems that can operate equipment during outages or in remote locations where grid access is limited. Portable lithium power stations provide flexibility by allowing companies to deploy energy solutions tailored to specific project needs without investing heavily in permanent infrastructure.

Application Insights

The emergency power segment dominated the market with the highest share in 2024 due to increasing concerns about power reliability amid natural disasters and outages. Consumers are investing in portable lithium power stations as essential tools for emergency preparedness, ensuring they can maintain access to electricity during critical situations when traditional power sources may fail. Events such as hurricanes, wildfires, and winter storms have heightened awareness of the need for backup systems that can provide reliable energy during crises.

The off-grid segment is projected to grow at the fastest CAGR during the forecast period. Portable lithium power stations provide an effective solution for off-grid living, outdoor activities such as camping or RVing, and emergency situations where conventional power sources are unavailable. As more individuals seek sustainable living options away from urban centers whether through tiny homes or eco-friendly retreats the need for efficient off-grid energy solutions becomes paramount. For instance, Schneider Electric has introduced the OffGrid portable power station, which can be charged via electrical outlets or solar panels, making it versatile for various energy needs.

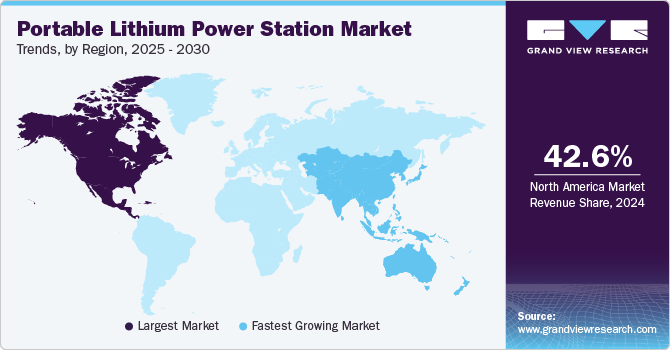

Regional Insights

The North America portable lithium power station market dominated the global market with a revenue share of 42.6% in 2024, primarily due to advanced technological infrastructure and high consumer awareness. The region's strong outdoor recreation culture drives demand for portable power solutions as consumers seek reliable energy sources for camping and other activities. In addition, frequent power outages and a growing emphasis on emergency preparedness have prompted both residential and commercial users to invest in these devices. The robust e-commerce landscape further facilitates access to a wide range of products, enhancing market growth in this region.

U.S. Portable Lithium Power Station Market Trends

The U.S. portable lithium power station industry dominated the regional portable lithium power station industry in 2024. As more individuals engage in outdoor activities such as camping and hiking, the need for portable power stations that can charge various electronic devices has surged. In addition, the growing emphasis on renewable energy sources, particularly solar-powered units, aligns with the nation's sustainability goals, making these products increasingly advantageous. Moreover, companies such as Goal Zero and Jackery have seen significant increases in demand for their portable power stations, which are designed to provide reliable energy solutions for outdoor enthusiasts while also being compatible with solar charging systems.

Europe Portable Lithium Power Station Market Trends

Europe portable lithium power station industry is witnessing significant growth driven by the high prevalence of tourism and outdoor activities, which creates a strong demand for reliable power sources for travelers and outdoor enthusiasts. The region's commitment to renewable energy adoption is also driving interest in solar-compatible power stations. For instance, on July 14, 2021, the European Commission proposed to amend the Renewable Energy Directive, aiming to increase the target for renewable energy sources in the EU's overall energy mix from 32% to at least 40% by 2030.

Asia Pacific Portable Lithium Power Station Market Trends

The Asia Pacific portable lithium power station market is expected to grow at the highest CAGR during the forecast period owing to rapidly evolving, fueled by increasing urbanization and a growing middle class that demands reliable energy solutions for both personal and professional use. The region is experiencing a surge in outdoor recreational activities, leading to heightened interest in portable power stations that can support electronic devices during camping trips or outdoor events. In addition, countries such as China and India are investing heavily in renewable energy infrastructure, promoting the adoption of solar-powered portable units.

China is rapidly establishing itself as a leader in the portable lithium power station industry, driven by extensive investments in renewable energy infrastructure and a strong commitment to sustainability. The country has become the world's largest solar and wind energy producer, with significant capacity additions in recent years. This growth is supported by government initiatives to increase the share of non-fossil fuels in the energy mix, reduce reliance on coal, and enhance energy efficiency.

Key Portable Lithium Power Station Company Insights

The portable lithium power station industry is characterized by the presence of several key players that significantly influence its dynamics. Companies such as Jackery Inc. and EcoFlow are at the forefront, known for their innovative designs and high-capacity products that cater to both recreational and emergency power needs. Other notable companies include Bluetti Power, which focuses on solar-compatible power stations, and Goal Zero, recognized for its durable and efficient portable power products tailored for outdoor adventures.

-

EcoFlow specializes in innovative and eco-friendly energy solutions. The company offers high-capacity portable power stations and solar generators designed for home backup, outdoor activities, and emergencies. Their flagship DELTA series is known for rapid charging capabilities and versatile output options, allowing users to power multiple devices simultaneously.

-

Goal Zero is recognized for its reliable solar-powered products. The company offers a range of portable power stations, particularly the Yeti series, which is favored for its user-friendly design and efficient performance. Goal Zero’s products are ideal for outdoor enthusiasts and emergency preparedness, providing dependable energy solutions for camping, tailgating, and home backup during outages.

Key Portable Lithium Power Station Companies:

The following are the leading companies in the portable lithium power station market. These companies collectively hold the largest market share and dictate industry trends.

- AIMTOM

- Allpowers

- Westinghouse Electric Corporation

- Shenzhen Enyuda Technology Co., Ltd. (Aeiusny)

- Portable Power Technology Ltd.

- Bluetti Power

- EcoFlow Technology Inc.

- EGO POWER+

- Goal Zero

- Jackery Inc.

- Lion Energy

- Li Power (Shenzhen) Technology Co., Ltd.

- Midland Radio Corporation

- Nexpow LLC

- Blackfire, Inc.

Recent Development

-

In September 2024, EcoFlow Technology Inc. unveiled four new portable power station series at IFA, including the EcoFlow Technology Inc. DELTA Pro 3 Solar Home Battery System. This system features the innovative X-Core 3.0 architecture, achieving 5-star certification for safe and fast charging, allowing a full charge in just 56 minutes.

Portable Lithium Power Station Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 182.3 million

Revenue forecast in 2030

USD 396.4 million

Growth rate

CAGR of 16.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, capacity, sales channel, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Netherlands, Ireland, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia.

Key companies profiled

AIMTOM; Allpowers ; Westinghouse Electric Corporation; Shenzhen Enyuda Technology Co., Ltd. (Aeiusny); Portable Power Technology Ltd.; Bluetti Power; EcoFlow Technology Inc.; EGO POWER+; Goal Zero; Jackery Inc.; Lion Energy; Li Power (Shenzhen) Technology Co., Ltd.; Midland Radio Corporation; Nexpow LLC; Blackfire, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Portable Lithium Power Station Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global portable lithium power station market report based on type, capacity, application, sales channel, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Power

-

Solar Power

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less Than 500 WH

-

500 WH to 999 WH

-

1,000 WH to 1,499 WH

-

1,500 WH and Above

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Brick And Mortar

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Emergency Power

-

Off-Grid

-

Automotive

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.