Polyglycerol Market Size, Share & Trends Analysis Report By Product (PG-2, 3, 4, 6, 10), By Application (F&B, Pharmaceuticals, Personal Care), By Region (APAC, Europe, MEA, North America), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-026-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Bulk Chemicals

Industry Insights

The global polyglycerol market size was valued at USD 1.91 billion in 2017 and is projected to witness a CAGR of 9.0% over the forecast period. This growth is attributed to increasing demand for additives in the food industry and rapid expansion of the application sectors, such as personal care and pharmaceuticals. Polyglycerol and its esters find applications as thickeners, solubilizers, additives, inert ingredients, and spreading agents. The product is used as an antifogging agent as it complies with the FDA regulations and thus, can be used in various products, such as food and beverage and personal care items.

On the other hand, the global market may witness slow growth due to the fluctuating costs of raw material. The supply-demand gap is often a key reason behind this fluctuation. Other than polyglycerol, glycerol is used in many products, such as alkyd resins, polyether polyols, and epichlorohydrin. Thus, high demand for glycerol in various applications is likely to create a supply-demand gap affecting its prices.

However, growth of the personal care industry will have a positive impact on the global market. Factors, such as rising preference for organic products, demand for anti-aging products, increasing disposable income, and expansion of social networks, are driving the personal care sector. The global beauty and personal care market was valued at USD 455.3 billion in 2017 and it is expected to grow at a CAGR of 5.9% during the forecast period.

Food & beverages is another important end-use sector. The product is widely used in chocolate production. Rising consumption of chocolate is expected to positively affect the market over the forecast period. The global consumption of chocolate in first nine months of 2018 was 3.01 million tons. Pharmaceutical industry is the third major application segment. Increasing investments in the industry by key companies like Novartis and GlaxoSmithKline are expected to further augment the industry growth.

Application Insights

Personal care was the largest application segment in 2017 and accounted for 46.5% of the overall volume share. Increased awareness about health and hygiene is boosting the demand for personal care products, especially in developed regions like North America. For instance, according to L'Oréal 2017 Annual Report, the luxury cosmetics market is driven by the rising population of high-income class.

Food & beverage is the second-largest application sector. Polyglycerol and its derivatives are extensively used in food products. For example, Polyglycerol Polyricinoleate (PGPR) is used as an emulsifier in the production of low-fat spreads. Increasing consumption of emulsifiers in products like peanut butter and frozen desserts is anticipated to boost the demand for PGPR, thereby propelling the segment growth.

Product Insights

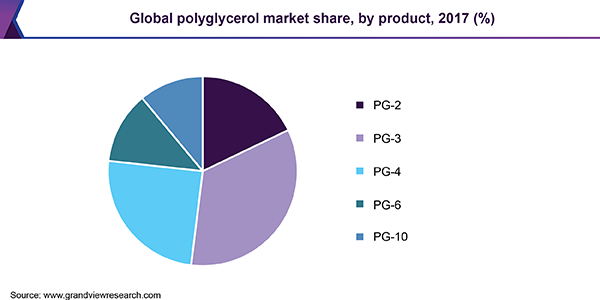

Based on products, the global polyglycerol market is segmented into PG-2, PG-3, PG-4, PG-6, and PG-10. In 2017, PG-3 was the largest product segment and accounted for 34.1% of the overall volume share, owing to its extensive use in food industry as an emulsifying agent. It is highly used in spreads, salad dressings, and chocolates. In personal care sector, esters derived from PG-3 are used as emollients and surfactants in cosmetics & skincare products including lip gloss, foundation, hair conditioners, moisturizers, mascara, and anti-aging serums. Some of the most widely used PG-3 esters are polyglyceryl-3 diisostearate, polyglyceryl-3 stearate, and polyglyceryl-3 ricinoleate.

PG-3 is also used widely in bakery sector, which is an important part of the overall food industry. Bakery segment is flourishing across the globe, especially in Asian countries. China’s bakery sector accounts for approximately 10% of the Chinese F&B industry. PG-4 is another key product and it is used as a non-ionic emulsifier in pharmaceuticals, cosmetics, foods, and industrial applications. Its esters are used as cosmetic and food additives. In cosmetics industry, it is used as a wetting agent, thickener, emollient, and dispersant, which has contributed towards its increasing demand.

Regional Insights

Asia Pacific was the largest segment in 2017 and this trend is expected to continue over the forecast period. I is also projected to be the fastest-growing regional market for polyglycerol on account of growing population, demand for personal care products, and rapid developments in the manufacturing sector. According to the International Trade Administration, in 2016, Asian countries comprised 20% of the U.S. global exports for personal care and cosmetics. Europe is the second-largest segment due to high product demand from the region’s personal care sector coupled with increasing manufacturing activities, pertaining to pharmaceuticals.

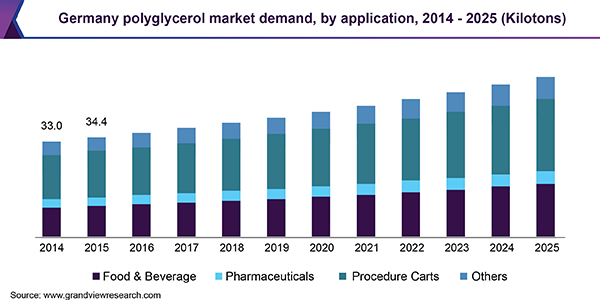

GlaxoSmithKline and Novartis invested in production facility expansion in European countries in 2016 and 2017, respectively. Germany is the largest market in Europe. Heavy investments in the country’s pharmaceutical industry is one of the key factors responsible for this growth. For instance, according to a 2017 report by the European Federation of Pharmaceutical Industries and Association, the pharmaceutical R&D expenditure in Germany accounted for USD 7,466.0 million (€6,216.0 million).

Polyglycerol Market Share Insights

The industry witnesses an intense competition.Some of the key participants include Cargill, Inc.; Sakamoto Yakuhin kogyo Co., Ltd.; Spiga Nord S.p.A.; and The Good Scents Company. Most of these firms are following strategies like R&D activities and new product launch to maintain their industry position. For instance, Cargill, Inc. launched a new sweetener “EverSweet”, a zero calorie sweetener, for a wide range of beverages.

Report Scope

|

Attribute |

Details |

|

Base year for estimation |

2017 |

|

Actual estimates/Historical data |

2014 - 2016 |

|

Forecast period |

2018 - 2025 |

|

Market representation |

Revenue in USD Million, Volume in Kilotons, and CAGR from 2018 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

|

Country scope |

U.S., Germany, U.K., China, India, and Brazil |

|

Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

Segments Covered in the Report

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global polyglycerol market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

PG-2

-

PG-3

-

PG-4

-

PG-6

-

PG-10

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Food & Beverage

-

Pharmaceuticals

-

Personal Care

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."