- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyethylene Terephthalate Films Market Size Report, 2030GVR Report cover

![Polyethylene Terephthalate Films Market Size, Share & Trends Report]()

Polyethylene Terephthalate Films Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Conventional PET Films, Shrink PET Films, Isotropic PET Films), By End Use (Food & Beverage, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-382-2

- Number of Report Pages: 172

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyethylene Terephthalate Films Market Summary

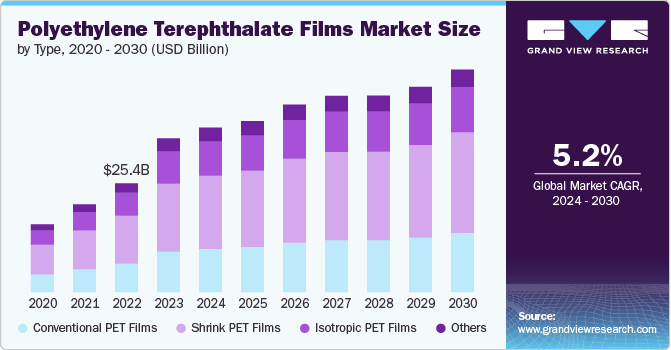

The global polyethylene terephthalate films market size was estimated at USD 35.97 billion in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030. PET films are commonly utilized in food and beverage packaging owing to their superior moisture and gas barrier qualities.

Key Market Trends & Insights

- North America dominated the global polyethylene terephthalate films market with the largest revenue share in 2023.

- The polyethylene terephthalate films market in the U.S led the North America market and held the largest revenue share in 2023.

- By type, the shrink PET films segment led the market, holding the largest revenue share of 44.32% in 2023.

- By end use, the electrical & electronics segment is expected to grow at the fastest CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 37.97 Billion

- 2030 Projected Market Size: USD 52.08 Billion

- CAGR (2024-2030): 5.2%

- North America: Largest market in 2023

The growing customer desire for easy and lightweight packaging solutions is driving up the demand for polyethylene terephthalate (PET) films.

One of the prominent trend in the Polyethylene terephthalate (PET) films market is the emerging popularity and increasing adoption of packaged food & beverages. PET shrink films are used to package food products such as muffins, cookies, candies, and other confectionery items. These films are also being utilized as primary packaging that comes into direct touch with the food. Moreover, the increasing manufacture of electronic gadgets such as smartphones, tablets, and wearable technologies drives up demand for high-quality PET films.

Drivers, Opportunities & Restraints

The growth of various industries, such as packaging, electronics, and cosmetics, fuels the demand for PET films. As these industries expand globally, the need for high-quality and consistent PET for manufacturing essential products such as packaging materials and components rises, contributing to the increased demand for PET Films.

The market is expected to witness various opportunities over the forecast period. Additionally, population growth and urbanization contribute significantly to the demand for PET films. The rising global population, particularly in developing regions, leads to increased consumption of products that utilize PET films. Globalization and international trade play a key role in the demand for PET films. With the interconnectedness of economies, the demand for PET films is influenced by global supply chains and trade agreements.

The Polyethylene terephthalate (PET) films market is growing at a rapid rate, however the market faced various challenges. The increasing demand for ecologically friendly packaging solutions is pushing the development and use of biodegradable and compostable films. This is expected to restrain the market growth in the coming years.

Type Insights & Trends

Based on type, shrink PET Films segment dominated the market with the revenue share of 44.32% in 2023. Shrink PET films are frequently used for consumer product labeling as they are less expensive than rigid packaging options, employing less material and lowering shipping costs due to their lightweight nature. Shrink wrap is commonly used for shipping and storing products and to protect vehicles like boats, cars, and helicopters from damage during storage and shipment.

Conventional PET Films is another significant category which is expected to grow significantly over the forecast period. Traditional PET films are commonly utilized in food and beverage packaging due to their excellent barrier qualities and visual appeal. Furthermore, PET films are employed in blister packaging for pharmaceuticals and consumer items to provide visibility and protection.

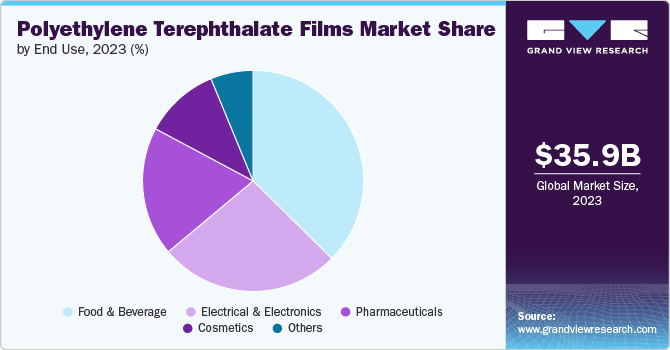

End Use Insights & Trends

Based on end use, food & beverage segment led the market with the revenue share of 37.39% in 2023. PET Films plastic resistant to extreme environmental conditions and does not degrade under high temperatures, keeping the integrity of products such as cosmetics and food and beverages. Furthermore, the low cost and high printability of plastic make it a profitable packaging materials.

The electrical & electronics segment is expected to grow at a rapid CAGR over the forecast period. Increasing adoption of Internet of Things (IoT) devices and smart home technologies is driving the growth of the electrical & electronics segment. Growing population, rapid urbanization, and industrialization in developed and developing economies have accelerated the use of plastics, driving market expansion. The existence of a huge number of participants will increase competition among players. These investments in new technologies and developed equipment are resulting in a broad competitive landscape in the plastic market for electrical appliances.

Regional Insights

The North America region has a well-established infrastructure and culture that promotes technological innovation, leading to increased adoption of advanced materials, including thermally conductive plastics, in various industries. The shale gas boom in North America has transformed polyethylene market in the region. The abundant and easy availability of cost-effective feedstocks derived from shale gas, particularly ethane, has given polyethylene producers based in North America a significant competitive advantage. Additionally, the availability of low-cost raw materials enhances the position of the region as a key player in global polyethylene production.

U.S. Polyethylene Terephthalate (PET) Films Market Trends

The U.S. market dominated the North American PET Films market is expected to grow at a significant rate in the coming years. The integration of advanced technologies for extracting and processing shale gas further enhances the efficiency and competitiveness of the petrochemicals industry in the country.

Asia Pacific Polyethylene Terephthalate (PET) Films Market Trends

Asia Pacific dominated global Polyethylene terephthalate (PET) films market and accounted for largest revenue share of over 34% in 2023. The manufacturing prowess and position of the region contribute to the demand for PET Films. The manufacturing industry across the region develops electronics, appliances, food & beverage, etc. increasingly demands polyethylene for component production, as well as packaging manufacturing. The availability of polyethylene as a versatile raw material supports the manufacturing industry, thereby leading to the growth of this market in the country.

Europe Polyethylene Terephthalate (PET) Films Market Trends

The Polyethylene terephthalate (PET) films market in Europe is experiencing significant growth due to several key drivers. The manufacturing industry of the region significantly influences the demand for PET Films in the country. The use of this material in the construction industry, as well as in industrial production, also contributes to the demand for polyethylene in the country.

Key Polyethylene Terephthalate Films Company Insights

The polyethylene terephthalate (PET) films market is highly competitive, with several key players dominating the landscape. Major companies include Bleher Folientechnik GmbH , Shenzhen KHJ Technology Co., Ltd ., Jiangsu Yuxing Film Technology Company, Nuroll SpA., Qingdao Kingchuan Packaging, and Mitsubishi Chemical Group. The Polyethylene terephthalate (PET) films market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Polyethylene Terephthalate Films Companies:

The following are the leading companies in the polyethylene terephthalate films market. These companies collectively hold the largest market share and dictate industry trends.

- Bleher Folientechnik GmbH

- Shenzhen KHJ Technology Co., Ltd

- Jiangsu Yuxing Film Technology Company

- Nuroll SpA.

- Qingdao Kingchuan Packaging

- Mitsubishi Chemical Group

- GLS Group

- Polyplex

- TORAY INDUSTRIES, INC.

- COVINIL S.A.

Recent Developments

-

In September 2023, Mengniu's announced the launch of all-PE yogurt pouch made with Dow's INNATE TF-BOPE resins, which aid to maintain the packaging's beauty and productivity.The newly created all-PE packaging is for the dairy sector since it integrates previous hard-to-recycle packaging into closed-loop recycling processes using responsible and mechanical recycling technologies, providing consumers with more sustainable packaging options.

-

In December 2022, Toray Industries, Inc. announced the development of a polyethylene terephthalate (PET) film. This film offers application and adhesion for water-based and solvent-free coatings.It is suitable for water-based paints and has good adherence to films once dry.

Polyethylene Terephthalate Films Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.51 billion

Revenue forecast in 2030

USD 52.08 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; The Netherlands; Belgium; China; India; Japan; South Korea; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Bleher Folientechnik GmbH; Shenzhen KHJ Technology Co., Ltd.; Jiangsu Yuxing Film Technology Company; Nuroll SpA.; Qingdao Kingchuan Packaging; Mitsubishi Chemical Group; GLS Group; Polyplex; TORAY INDUSTRIES, INC.; COVINIL S.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyethylene Terephthalate Films Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global polyethylene terephthalate films market report on the basis of type, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Conventional PET Films

-

Shrink PET Films

-

Isotropic PET Films

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Electrical & Electronics

-

Pharmaceuticals

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

The Netherlands

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polyethylene terephthalate (PET) films market size was valued at USD 35.97 billion in 2023.

b. The global polyethylene terephthalate (PET) films market is expected to grow at a CAGR of 5.2% from 2024 to 2030.

b. Shrink PET films segment dominated the market with a revenue share of over 44% in 2023.

b. Key players operating in the PET films market include Bleher Folientechnik GmbH , Shenzhen KHJ Technology Co., Ltd ., Jiangsu Yuxing Film Technology Company, Nuroll SpA., Qingdao Kingchuan Packaging, and Mitsubishi Chemical Group.

b. PET films are commonly utilized in food and beverage packaging owing to their superior moisture and gas barrier qualities. The growing customer desire for easy and lightweight packaging solutions is driving up the demand for Polyethylene Terephthalate (PET) films.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.